Don’t Claim Social Security Early Because of Trump & Musk

Many Americans nearing retirement age are understandably nervous about the future of Social Security under the Trump/Musk regime. More people are claiming benefits early to hedge their bets against potential cuts or disruptions. First-time benefit claims jumped from roughly 500,000 in March of 2024 to 580,000 this year. These early filers are right to be concerned.

The Trump administration, largely via Elon Musk’s DOGE operation, is slashing the workforce and closing offices at the Social Security Administration, which delivers earned benefits for 73 million people. According to the Wall Street Journal, more than 75% of U.S. adults are worried “a great deal or a fair amount” about Social Security, “a 13-year high.”

The Trump/Musk team has announced drastic policy changes creating administrative hurdles for seniors and people with disabilities. Field offices have closed; wait times on the 1-800 phone line have ballooned again; and the agency’s website has crashed several times since Trump took office. The administration even announced that it was reclassifying some legal immigrants as “dead,” so that they cannot use their Social Security numbers or collect benefits.

But while it is understandable that some people are rushing to claim Social Security benefits early, this isn’t necessarily the best strategy. For many years, we have encouraged people to delay claiming benefits as long as they can afford to. We even ran a public education campaign in 2018 called Delay & Gain about this very topic.

Full retirement age is now 67. That’s when you can collect your full retirement benefit. You can file for Social Security as early as 62, but every year you claim early triggers an 8% lifetime benefit cut. Conversely, if you wait to claim until age 70, your lifetime benefit is higher than claiming at full retirement age.

“Cutting your benefits by claiming early so that your future benefits won’t be cut is kind of like ‘self-deporting.’ In an attempt to protect yourself, you may make things worse,” said Dan Adcock, our Director of Government Relations and Policy.

It’s a risky proposition to claim early and take the hit in lifetime benefits — out of the very reasonable worry that Trump’s presidency threatens the integrity of the Social Security system. While Trump and Musk can throw sand in the gears of the Social Security Administration, it would take an act of Congress to cut statutory benefits. Any legislation changing Social Security requires at least 60 votes in the Senate, which is a hard number to reach in today’s politically divided environment.

Trump & Musk’s interference with Social Security has drawn protests across the country

This is not to say that some congressional Republicans wouldn’t love to cut benefits, even if they don’t admit that what they propose are, in fact, benefit cuts. GOP proposals include raising the retirement age to 69 or 70, means testing Social Security, and reducing annual Cost of Living Adjustments (COLAs). But they still would need 60 votes in the Senate.

We do not take Trump’s promise “not to touch” Social Security very seriously, but so far he has not endorsed any congressional proposals to actually cut benefits. He has, however, pushed to eliminate taxes on benefits, which would accelerate the projection depletion of the Social Security trust fund reserves.

What to do, then, if you are nervous about Social Security during the second Trump era? We recently posted some tips for protecting your benefits & data, from our senior Social Security expert, Maria Freese:

1. Create a Personal My Social Security account on SSA’s website

With a My Social Security account, you will be less reliant on the telephone or local field offices to transact business with SSA.

2. Acquire and Save Your Earnings Record

If you have My Social Security account, you have access to your earnings records through SSA. We recommend you download all of your records to your personal computer and make a printed copy, which you save in a secure location.

3. Regularly Review Your Financial Transactions & Track Your Credit History

Regularly checking your accounts and credit history is a good habit to follow at any time, but especially now with so much personal financial information held by SSA at risk of exposure through DOGE activities.

4. Verify Your Identity with SSA in Person

Verifying your identity in advance, when you are not under time pressure and while field offices remain open, could serve as a legitimate back-up option if creating a My Social Security account is not possible.

For most people, taking these commonsense actions is the best way to protect yourself during this time of upheaval. Pre-emptively cutting your own lifetime benefits by claiming early is likely to do more harm than good.

“Claim benefits when it is best for you financially — not because you are afraid of the negative impact of Trump and Musk’s attack on the SSA,” says Freese. “Don’t let Donald Trump and the richest man in the world force you into a poorer retirement.”

Trump Wants to Reclassify Social Security Staffers as Political Appointees

The Trump administration is again targeting the Social Security Administration (SSA) with changes that could undermine its mission. President Trump seeks to replace career civil servants at federal agencies (including SSA) with politically loyal appointees, using a classification known as “Schedule F.” This reclassification is designed to boost the president’s control over career federal staffers by removing their civil service protections and making them easier to fire.

This reckless move by the Trump Administration threatens to sideline professionals whose expertise ensures millions of Americans get the benefits they depend on. Schedule F isn’t just a bureaucratic tweak; it’s a power play that jeopardizes the foundation of one of the country’s most trusted institutions.

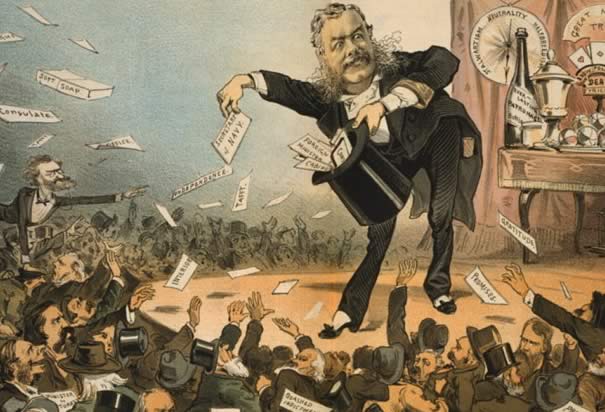

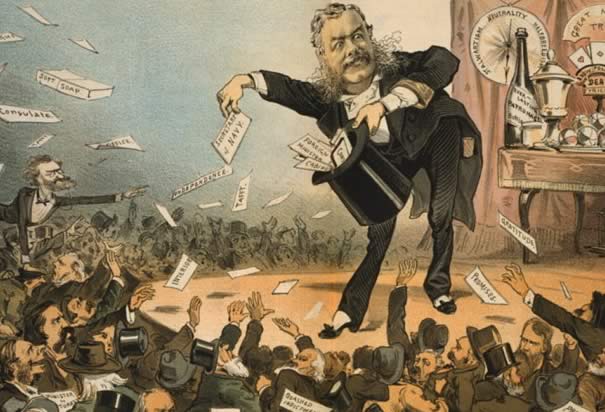

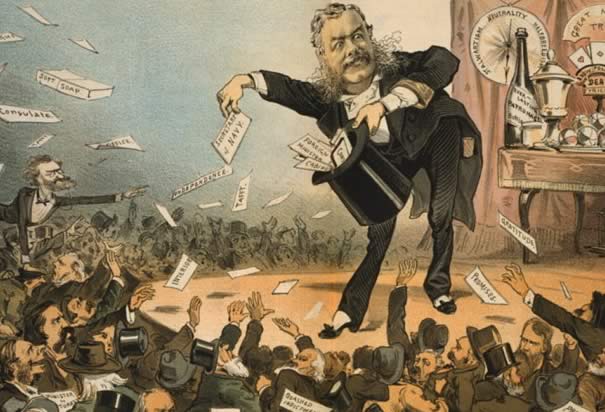

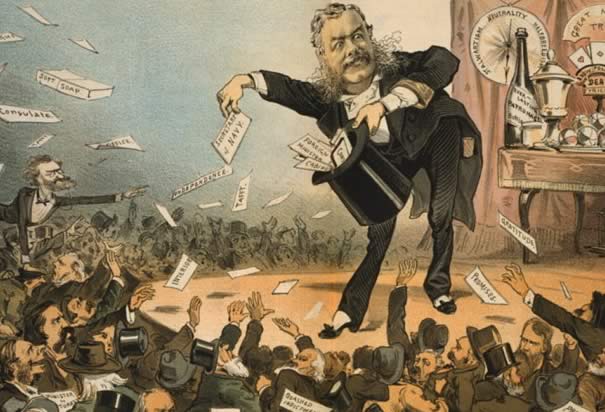

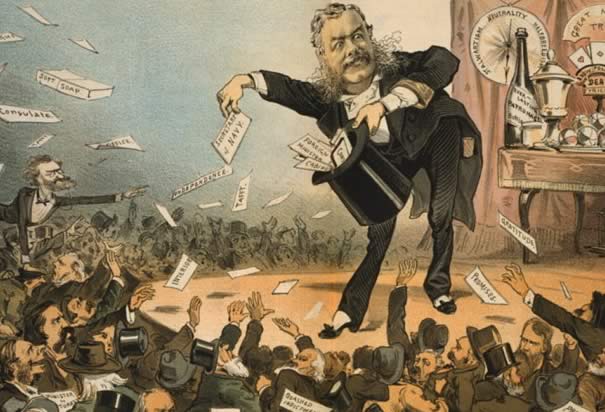

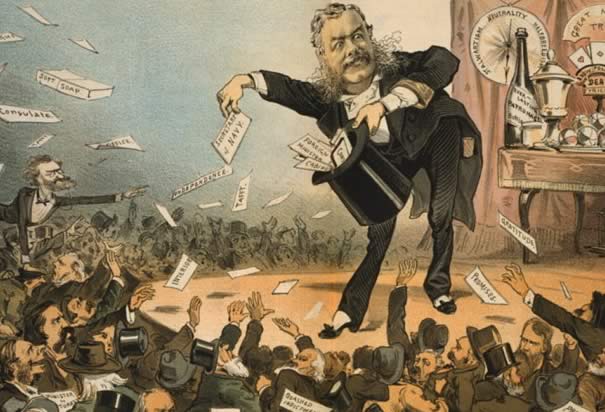

Schedule F is a throwback to the patronage system that the U.S. did away with in the late 19th century. Back then, federal jobs were handed out based on political loyalty, not expertise. According to an ally of the National Committee to Preserve Social Security and Medicare who was a longtime SSA employee:::

“MAGA doesn’t trust professional staff. They want loyal staff, and that is what Schedule F is all about. It’s about populating the federal service with people who are incompetent and unqualified, but loyal like a Labrador.”

At the SSA, professionalism has been key to its success for decades. But with Schedule F, that’s at risk. The same ally pointed out the inconsistency of classifying SSA employees as Schedule F workers. “The supposed criterion for inclusion in Schedule F is that you are in a policy-making role—that historically is the primary defining criterion for classification in the Senior Executive Service (SES).” This undermines the intent behind differentiating policy-making roles from operational ones and risks muddying the waters even further.

What Does This Mean for SSA Employees?

The potential scope of Schedule F at the SSA is staggering. Critics say it could sweep up everyone from Social Security field office employees to mid-level program analysts, even though their work has nothing to do with making policy. “Field office employees enforce and apply policy and statute; they don’t make it,” said the former longtime SSA employee. “Asserting they’re policy makers is like saying police officers are legislators.”

Acting Social Security Commissioner Leland Dudek, who admittedly receives his marching orders from the White House and Elon Musk’s DOGE, seems intent on broad reclassification of the workforce. “Leland Dudek wants it to apply to most SSA employees…but I guess he is simply a literal puppet,” the former SSA staffer observed.

This shift raises big concerns about competence and integrity. Schedule F opens the door for politically connected appointees who may lack the skills to handle complex tasks that directly impact the lives of beneficiaries. NCPSSM’s ally didn’t mince words about the type of people Trump wants to bring in. “Imagine filling federal service with Pete Hegseth and Linda McMahon and RFK Jr. wannabees,” he said.

The U.S. got rid of the patronage system in the 19th century. Trump wants to bring it back.

Impacts on Beneficiaries and the Public

When you think about the logistical and technical challenges involved in running Social Security, it’s clear just how damaging Schedule F could be. The SSA manages benefits for 73 million Americans, relying on skilled employees to ensure payments are accurate and timely. Politicizing these jobs could lead to significant delays, errors, or wrongful denials of benefits that could devastate vulnerable populations.

The impacts of Schedule F extend to the public’s trust in the SSA. Already struggling with staffing shortages and office closures induced by the interference of Trump, Musk and DOGE, the last thing the agency needs is more instability. Critics argue that politicizing the workforce will make things worse, putting additional strain on both employees and beneficiaries.

Dudek himself has come under harsh criticism for his ‘leadership’ at the agency. “All this stuff is way outside his wheelhouse. I sense he comes in every morning and gets his script written by the Heritage Foundation (author of the notorious Project 2025),” the ally commented. Under Dudek’s tenure, SSA has put in place (and, in some cases, has later been compelled to reverse) several policies that appear to be part of an agenda to ‘prove’ that federal programs like Social Security are inefficient and rife with ‘fraud.’ Trump and Musk have spread lies about alleged fraud, all of which have been thoroughly discredited. Yet, they persist to “reform” SSA in ways that are interfering with the efficient delivery of benefits.

The agency’s workforce is being slashed by at least 10,000 jobs at a time when staffing already was at a 50-year low. Social Security claimants have complained that it’s even harder to obtain assistance on SSA’s telephone line, on the website, or at the shrinking number of field offices. The agency’s website has crashed several times in the past month, preventing beneficiaries from accessing their accounts.

The Trump agenda truly has nothing to do with government efficiency— and everything to do with an ideological crusade to shrink the federal government, consequences be damned.

Trump Hands Big Pharma a Gift, Undermines Seniors

President Trump has signed a sweeping executive order that dilutes Medicare’s ability to negotiate prescription drug prices. Though the White House touts it as a measure to reduce healthcare costs, closer analysis reveals that the real beneficiaries are pharmaceutical companies—not seniors who rely on Medicare for prescription drug coverage.

This move significantly erodes key elements of the Inflation Reduction Act (IRA), a landmark achievement under President Biden which empowered Medicare to directly negotiate drug prices with pharmaceutical companies. Namely, Medicare now will have to wait 13 years until any brand-name drug hits the market before that medication is eligible for price negotiation.

Trump’s executive order mandates Health and Human Services Secretary Robert F. Kennedy Jr. to work with Congress toward revamping Medicare’s price negotiation rules. For Big Pharma, it’s a long-awaited victory. According to Reuters, the order specifically targets the timeline for when drugs become eligible for negotiations, a point of contention for the pharmaceutical industry since the IRA was passed in 2022. This delay aligns with the industry’s lobbying goals to preserve their profits for as long as possible, at the expense of seniors struggling to manage the skyrocketing costs of prescription drugs.

“This change could lead to higher Medicare prescription drug spending, higher prices, and potentially higher Medicare Part D premiums.” – Kaiser Family Foundation, April 17, 2025

Breaking Down the Delays

Under President Biden’s IRA, Medicare could negotiate prices for conventional ‘small-molecule’ drugs after nine years on the market, and for complex biologics after thirteen years. Trump’s executive order proposes extending the negotiation eligibility for small-molecule drugs by an additional four years, creating parity with biosimilars. While this might sound like a minor adjustment, in reality, it gifts Big Pharma a four-year buffer to maintain exorbitant prices on some of the most widely used medications.

“Drugmakers have opposed the IRA’s time frame for negotiation eligibility, arguing it stifles innovation,” Reuters notes. But what does this delay mean for Medicare recipients? For four extra years, Medicare and its beneficiaries will be stuck paying unaffordable prices for essential drugs that could have otherwise been negotiated for lower costs.

Biden’s first round of negotiations under the IRA achieved price cuts of as much as 79% on ten high-cost drugs. These reforms were projected to yield significant savings for Medicare recipients. Trump’s policy reverses course, depriving seniors of immediate access to more affordable treatments while cushioning Big Pharma’s profits.

“The main action that Trump proposed this week is ripped from drug industry talking points. Despite vowing to lower drug prices, the administration concedes explicitly that this particular proposal will actually raise them.” – The American Prospect, 4/16/25

A Gift to Big Pharma, Wrapped in Pseudo-Reform

To deflect from the pro-pharma nature of the order, the Trump administration is branding it as part of broader “healthcare savings” and offering other token measures. The order encourages the FDA to streamline approval processes for generic and biosimilar medications, which are cheaper alternatives to branded drugs. It also allows states to apply for drug importation programs to buy medications from nations like Canada.

These gestures are not new; they have been proposed in previous administrations, including under Biden, and their benefits are dubious at best. For instance, only one state, Florida, has successfully gained FDA approval to import drugs from Canada. Meanwhile, the financial relief promised by generic drugs often takes years to materialize due to industry legal challenges and other hurdles.

Meanwhile, the pharmaceutical companies’ profits remain untouched as they continue charging exorbitant prices for existing drugs. Worse, as Common Dreams points out, Trump’s executive order was an “outright cave to Big Pharma” designed to “delay implementation of price negotiation reform under the guise of market-friendly tweaks.”

Medicare will now have to wait 13 years after a conventional drug hits the market to negotiate its price with Big Pharma

Seniors Are Paying the Price

This policy reversal comes at the worst possible time for seniors, who already face steep out-of-pocket expenses for healthcare. According to Reuters, Trump’s administration also looks to standardize Medicare payment rates across different healthcare facilities, under the pretext of “cost alignment.” While this sounds like it could create savings, healthcare advocates warn that these policies typically shift costs onto individuals, penalizing the very people Medicare is supposed to protect.

Such policies emanate from a Republican playbook that often positions market mechanisms over direct government action in healthcare reform. But when the market in question is controlled by pharmaceutical monopolies, the results are predictable. Prices rise, inequalities deepen, and seniors bear the brunt.

**** For more on the threat the Trump Administration poses to Medicare and Medicaid, listen to the newest episode of our podcast, with special guest Fred Riccardi, President of the Medicare Rights Center. ****

Protesters Across USA Tell Trump & Musk: “Hands off Social Security!”

From Anchorage, Alaska to the National Mall in Washington, D.C., millions of protesters turned out on Saturday for nationwide “Hands Off” demonstrations against the Trump administration’s reckless handling of Social Security, Medicare, Medicaid and a host of other federal programs.

These protests weren’t the usual political rallies. They were deeply personal, driven by countless stories of concern about programs that Americans depend on. Whether emanating from retirees in Florida or students in Nebraska, the message was loud and clear: Don’t mess with our nation’s social insurance programs!

Roger Broom, a 66-year-old from Ohio, shared the fear many feel while holding a sign at his local rally in Columbus. “They can’t talk about cutting Social Security like it’s just budget trimming,” he said. “This is money I’ve earned after working all my life. Without it, I’m done.”

Why now?

The uproar comes from public frustration with the Trump administration’s plans to slash federal spending (and staff) — abetted by Elon Musk and his Department of Government Efficiency (DOGE) — under the phony banner of rooting out ‘waste, fraud, and abuse.’ Their main target so far has been the Social Security Administration – including massive layoffs, planned closures of field offices, and new limitations on phone service.

Because of Trump/Musk/DOGE interference, SSA’s website has already crashed multiple times, preventing beneficiaries from accessing their accounts.

“Even when the site is back online, many customers have not been able to sign in to their accounts — or have logged in only to find information missing. For others, access to the system has been slow, requiring repeated tries to get in.” – Washington Post, 4/7/25

Former SSA Commissioner Martin O’Malley warned that benefit payments could be disrupted because of Trump/Musk/DOGE meddling with Social Security systems.

***Listen to our new podcast interview with Commissioner O’Malley here, in which he warns that Musk is out to “destroy” Social Security.***

Ground Zero in D.C.

The National Mall in Washington, D.C., was one of the largest gathering spots of the day. Hand-painted signs read, “Stability for Seniors” and “Social Security Is Earned, Not a Handout.” One group chanted, “Hey ho, Trump’s gotta go!” While exact crowd estimates are not available, there likely were tens of thousands of protesters in D.C., if not more, of diverse ages and backgrounds.

NCPSSM’s own Government Relations and Policy Director Dan Adcock attended the protest in Washington. “The whole event was a good balm for the firehose of bad news coming out of this administration on a daily basis,” Adcock says. “People really needed it.”

NCPSSM’s Dan Adcock at the National Mall

Adcock and the other protesters heard rousing speeches from members of Congress. Standing on a stage near the Washington Monument, Rep. Jamie Raskin (D-MD) said, “Social Security is a promise made from one generation to another. Breaking that promise is breaking America!”

Al and Bev Mirmelstein drove all the way from Charlottesville, VA to attend the D.C. protest. The Mirmlesteins say they have not been to many protests, but felt they had to participate. “We’ve been quiet too long,” Bev confessed, holding a sign reading, “Don’t Rob Our Future.” Her husband Al said, “They’re putting a target on all of us.”

Medicare and Medicaid Under Fire

Protesters sounded the alarm over the Trump administration’s threats to Medicare and Medicaid, too. The Department of Health and Human Services (HHS), led by Secretary Robert F. Kennedy, Jr., (which oversees Medicare & Medicaid) has announced the elimination of 10,000 jobs in the federal health care workforce, while House Republicans have maneuvered to cut nearly $1 trillion from Medicaid.

“I’m terrified for my mom,” said Archer Moran, who attended a rally in Florida near Trump’s golf course. He explained that his mother, a Medicaid recipient, would struggle to survive without her health coverage. “They call them cuts. It’s taking away someone’s lifeline. Lives are literally at risk here.”

Small Towns, Big Audiences

The protests extended from the coasts to the Midwest. In Omaha, Nebraska, nearly a thousand people gathered in Memorial Park. Chants of “Protect what’s ours!” could be heard along Dodge Street, while passing cars honked in solidarity. Protester Jean Zinnen brought her 15-year-old granddaughter to the Omaha demonstration. “She needs to see this is an example of showing up for what matters,” Zinnen said, as she clutched a sign reading, “Our Rights, Our Fight.”

Student Calvin Snyder explained why he felt compelled to protest. “Decisions being made (in Washington) that impact the future this badly shouldn’t be met with quiet acceptance,” said Snyder. “It’s not just anger for self-interest. This is for everyone relying on these programs to live.”

Hundreds of people protested, not only in major cities, but in small towns like Sylva, North Carolina, marching through newly blooming spring neighborhoods in solidarity with demonstrators across the country.

Providence, RI

What’s Next?

The protests delivered a loud and defiant message to those in charge, while remaining peaceful. When asked about the protests, President Trump offered a rambling, incoherent response:

“A lot of them were there because what we witnessed was a terrible thing. And we’ve seen it over the years. You know that better than anyone who would know it. And I know it… I think it’s a shame, a disgrace, and it has to stop.”

In addition to the nonsensical gobbledygook, Trump and his administration have promoted the lie that Social Security is rife with fraud, and the myth that “Democrats” are promoting illegal immigration by enticing migrants with Social Security benefits. Not only is this a discredited conspiracy theory, but undocumented workers are legally barred from collecting Social Security (though many pay into the system, increasing Social Security’s revenues).

Organizers of Saturday’s protests insist they weren’t just a one-day event. For many protesters, this was part of an ongoing campaign to resist the Trump administration. Whether at town halls, in the voting booth, or on the streets, resistors don’t appear ready to back down. “This isn’t something people are going to forget,” said Omaha protester Susan Calef.

“The positive energy of these protests reminds people that there are millions of Americans who feel the same way they do,” says NCPSSM’s Dan Adcock. “As long as we hold rallies like these, organize, and vote, we can reverse the awful things that are going on right now.”

Sources:

https://edition.cnn.com/2025/04/05/us/hands-off-protests-trump-musk/index.html

https://www.aljazeera.com/news/2025/4/5/hands-off-protesters-rally-across-us-to-oppose-trumps-policies

https://www.npr.org/2025/04/05/nx-s1-5353388/hands-off-protests-washington-dc

https://www.politico.com/news/2025/04/05/hands-off-protests-trump-us-00274352

https://nebraskaexaminer.com/2025/04/06/thousands-in-memorial-park-protest-federal-actions-as-part-of-national-han

Martin O’Malley Makes the Case Against Trump, Musk & DOGE on Our Podcast

This week’s “You Earned This” podcast features a special VIP guest: former Maryland Governor and Social Security Commissioner Martin O’Malley. It’s a conversation that everyone who cares about the future of Social Security should hear. O’Malley, who led the Social Security Administration (SSA) during the final year of Joe Biden’s presidency, conveys a clear message: Social Security is under attack, and the consequences for millions of Americans couldn’t be more dire.

O’Malley doesn’t mince words when reflecting on the state of the SSA under what he terms the “co-presidency” of Donald Trump and Elon Musk. “It breaks my heart to see the way that Musk and Trump are just taking a meat cleaver to this agency and kneecapping its ability to serve the public,” he said during our interview. “It’s not fair. It’s not right. People need to wake up to the very real threat that this poses to their earned benefits.”

2024: A Year of Progress

O’Malley described his year at the SSA as one of the most rewarding periods of his life. Tasked with leading an agency that had been chronically underfunded, he sought to rally the workforce that delivers Americans’ retirement and disability benefits. Years of congressional budget neglect had reduced SSA staffing to a 50-year low, while the demand for services was at an all-time high.

O’Malley took pride in working with SSA’s dedicated employees, who, despite these challenges, had a shared mission to serve the public. Together, they focused on addressing severe customer service backlogs, improving fraud prevention, and ensuring benefits were delivered on time. His team implemented critical changes, including improved data sharing with suspect banking institutions to combat fraud. Under O’Malley’s leadership, SSA reduced wait times on the agency’s 1-800 phone line from 40 minutes to twelve minutes, and shrank the delays for Social Security Disability Insurance hearings, among other improvements.

“I hadn’t felt that fully engaged in work since my time as mayor of Baltimore,” O’Malley said. “Watching the agency turn around, even on a very leaky battleship — even as we coped with inadequate resources and decades of neglect — was well worth doing.”

But the gains O’Malley and his team worked so hard to achieve were quickly undone.

The Sabotage of Social Security

According to O’Malley, the reversal began almost immediately after Trump took office. Under the new administration, the SSA announced severe staffing cuts, including mass firings. Entire offices, including those dedicated to improving customer service and promoting equal opportunity, were illegally purged. “Carrots and sticks” were used to incentivize early retirement, creating a hostile work environment that alienated the dedicated public servants O’Malley once led.

“Trump, Musk, and DOGE have really (abused) a group of people that I came to love very quickly. The workers believed in a shared mission, that what they’re doing matters so much to so many. That’s the only reason people hung in there through all of the tough years,” O’Malley lamented.

After the induced early retirements and firings, “people saw their colleagues hugging each other goodbye. There were tears… and cardboard boxes on top of hoods of cars,” O’Malley explained. “SSA leadership essentially said, ‘Hey, joyous news! Everybody who feels compelled to leave the agency: quit now without letting the door hit your backside on the way out.’”

O’Malley estimates that the reductions in staffing will ultimately result in 10,000 SSA jobs disappearing — a 20% cut. The consequence, he says, will be a depleted, overburdened workforce unable to meet the demands of an aging population, at a time when 10,000 Baby Boomers reach retirement age every day. This systematic gutting of the already SSA has exacerbated wait times on phone lines and at field offices, caused website crashes, and increased frustration for the everyday Americans who depend on these vital services.

Musk’s Ideology of Brutal Efficiency

O’Malley doesn’t hold back on what he sees as the Trump administration’s true intentions:

“Elon Musk wants to destroy Social Security. It doesn’t fit with his worldview. He thinks people that are elderly, people who are disabled are, by their very nature, wasteful.”

Musk has publicly derided empathy as a weakness, a philosophy that seems to underpin his approach to governance. O’Malley pointed out that Musk views Social Security beneficiaries as “inefficiencies” or, worse, “dispensable.”

“The ‘waste’ that Musk is talking about are people who are elderly and can’t work, people who are disabled and can’t work, children who lose parents,” O’Malley explained. “That’s why he wants to go after a program that he thinks subsidizes people who supposedly are ‘a drain on the system.’”

Musk’s fake hunt for waste and fraud is hypocritical, O’Malley noted, given the billionaire’s reliance on federal contracts worth $8 million per day. Yet instead of safeguarding Social Security, Musk has partnered with Trump to undermine a program that keeps seniors from falling into poverty.

Trump & Musk’s Falsehoods

O’Malley also called out Trump and Musk for spreading disinformation about Social Security, including absurd claims about rampant fraud:

“Donald Trump stands up in his non-state of the union address and implies there are 360-year-olds collecting Social Security, people who presumably came here for the founding of Jamestown or Plymouth. Totally untrue.”

O’Malley re-iterated a darkly funny, but apt remark he made at a Social Security hearing on Capitol Hill on Tuesday. “The zombie apocalypse is not real. There aren’t millions of people wandering all around the cities of America with checks spewing out of their cadaverous pockets.”

The truth, O’Malley explained, is that fraud within Social Security is extraordinarily rare, despite Trump and Musk’s bogus claims. Musk alleged that 40% of the calls on SSA’s phone line are fraudsters. In truth, says O’Malley, for every 3,100 calls taken by SSA’s call center, only one results in a successful attempt at direct deposit fraud. That’s about .0007%! Of course, ideally there would be zero fraud. In fact, new policies implemented during O’Malley’s tenure targeted improper payments. Unfortunately, those reforms likely are out the window now.

Undermining Public Confidence in Social Security

O’Malley expressed his belief that Trump and Musk aim to erode public confidence in Social Security as a prelude to dismantling it entirely. “I have come to the conclusion that Trump and Musk actually want to sour the public against the SSA. And they do that by destroying its ability to provide customer service for people who work their whole lives for these benefits,” he explained.

By making it harder for Americans to access their benefits and by spreading false narratives of ‘waste, fraud, and abuse,’ they hope to sway public opinion against the program. Once that confidence is eroded, the ultimate goal is clear: cut, privatize, and even raid Social Security for cash.

“I could even imagine a sinister scenario,” O’Malley speculated, “where they say, ‘Hey, Social Security is broken. It was always going to go broke and it doesn’t work. So we’re going to have to liquidate the trust fund.” If that were to happen, the $2.7 trillion in the trust fund could be misdirected for unrelated purposes — including a permanent tax cut for the wealthy and big corporations.

O’Malley speaks at a Save Our Social Security rally in Florida last month

A Call to Action

Social Security isn’t a government handout. It’s an earned benefit that keeps seniors and people with disabilities financially afloat. It’s a contract between generations, ensuring workers who pay into the system today can claim benefits upon retirement, disability, or the death of a family breadwinner.

As O’Malley pointed out, the vast majority of Americans support expanding Social Security, not weakening it. “80% of Americans believe Social Security should be strengthened and made better,” he said. But maintaining that support requires action. “Members of Congress need to hear directly from the people,” O’Malley urged. “Americans see the threat and they want them to ‘stop the steal’ of their Social Security benefits.”

Since leaving his post at SSA, O’Malley has been traveling the country to advocate for Social Security and to speak out against the DOGE squad’s interference in the program. He has already delivered two speeches in Florida, warning seniors of what’s at stake, and is heading to Oklahoma next. While he may no longer be Social Security Commissioner, Martin O’Malley remains fiercely devoted to defending the agency he led — and the 73 million people who depend on it.

***********************

LISTEN TO GOV. O’MALLEY’S PODCAST INTERVIEW here.

READ OUR EXCLUSIVE INTERVIEW WITH SSA WHISTLEBLOWER LAURA HALTZEL here.

Don’t Claim Social Security Early Because of Trump & Musk

Many Americans nearing retirement age are understandably nervous about the future of Social Security under the Trump/Musk regime. More people are claiming benefits early to hedge their bets against potential cuts or disruptions. First-time benefit claims jumped from roughly 500,000 in March of 2024 to 580,000 this year. These early filers are right to be concerned.

The Trump administration, largely via Elon Musk’s DOGE operation, is slashing the workforce and closing offices at the Social Security Administration, which delivers earned benefits for 73 million people. According to the Wall Street Journal, more than 75% of U.S. adults are worried “a great deal or a fair amount” about Social Security, “a 13-year high.”

The Trump/Musk team has announced drastic policy changes creating administrative hurdles for seniors and people with disabilities. Field offices have closed; wait times on the 1-800 phone line have ballooned again; and the agency’s website has crashed several times since Trump took office. The administration even announced that it was reclassifying some legal immigrants as “dead,” so that they cannot use their Social Security numbers or collect benefits.

But while it is understandable that some people are rushing to claim Social Security benefits early, this isn’t necessarily the best strategy. For many years, we have encouraged people to delay claiming benefits as long as they can afford to. We even ran a public education campaign in 2018 called Delay & Gain about this very topic.

Full retirement age is now 67. That’s when you can collect your full retirement benefit. You can file for Social Security as early as 62, but every year you claim early triggers an 8% lifetime benefit cut. Conversely, if you wait to claim until age 70, your lifetime benefit is higher than claiming at full retirement age.

“Cutting your benefits by claiming early so that your future benefits won’t be cut is kind of like ‘self-deporting.’ In an attempt to protect yourself, you may make things worse,” said Dan Adcock, our Director of Government Relations and Policy.

It’s a risky proposition to claim early and take the hit in lifetime benefits — out of the very reasonable worry that Trump’s presidency threatens the integrity of the Social Security system. While Trump and Musk can throw sand in the gears of the Social Security Administration, it would take an act of Congress to cut statutory benefits. Any legislation changing Social Security requires at least 60 votes in the Senate, which is a hard number to reach in today’s politically divided environment.

Trump & Musk’s interference with Social Security has drawn protests across the country

This is not to say that some congressional Republicans wouldn’t love to cut benefits, even if they don’t admit that what they propose are, in fact, benefit cuts. GOP proposals include raising the retirement age to 69 or 70, means testing Social Security, and reducing annual Cost of Living Adjustments (COLAs). But they still would need 60 votes in the Senate.

We do not take Trump’s promise “not to touch” Social Security very seriously, but so far he has not endorsed any congressional proposals to actually cut benefits. He has, however, pushed to eliminate taxes on benefits, which would accelerate the projection depletion of the Social Security trust fund reserves.

What to do, then, if you are nervous about Social Security during the second Trump era? We recently posted some tips for protecting your benefits & data, from our senior Social Security expert, Maria Freese:

1. Create a Personal My Social Security account on SSA’s website

With a My Social Security account, you will be less reliant on the telephone or local field offices to transact business with SSA.

2. Acquire and Save Your Earnings Record

If you have My Social Security account, you have access to your earnings records through SSA. We recommend you download all of your records to your personal computer and make a printed copy, which you save in a secure location.

3. Regularly Review Your Financial Transactions & Track Your Credit History

Regularly checking your accounts and credit history is a good habit to follow at any time, but especially now with so much personal financial information held by SSA at risk of exposure through DOGE activities.

4. Verify Your Identity with SSA in Person

Verifying your identity in advance, when you are not under time pressure and while field offices remain open, could serve as a legitimate back-up option if creating a My Social Security account is not possible.

For most people, taking these commonsense actions is the best way to protect yourself during this time of upheaval. Pre-emptively cutting your own lifetime benefits by claiming early is likely to do more harm than good.

“Claim benefits when it is best for you financially — not because you are afraid of the negative impact of Trump and Musk’s attack on the SSA,” says Freese. “Don’t let Donald Trump and the richest man in the world force you into a poorer retirement.”

Trump Wants to Reclassify Social Security Staffers as Political Appointees

The Trump administration is again targeting the Social Security Administration (SSA) with changes that could undermine its mission. President Trump seeks to replace career civil servants at federal agencies (including SSA) with politically loyal appointees, using a classification known as “Schedule F.” This reclassification is designed to boost the president’s control over career federal staffers by removing their civil service protections and making them easier to fire.

This reckless move by the Trump Administration threatens to sideline professionals whose expertise ensures millions of Americans get the benefits they depend on. Schedule F isn’t just a bureaucratic tweak; it’s a power play that jeopardizes the foundation of one of the country’s most trusted institutions.

Schedule F is a throwback to the patronage system that the U.S. did away with in the late 19th century. Back then, federal jobs were handed out based on political loyalty, not expertise. According to an ally of the National Committee to Preserve Social Security and Medicare who was a longtime SSA employee:::

“MAGA doesn’t trust professional staff. They want loyal staff, and that is what Schedule F is all about. It’s about populating the federal service with people who are incompetent and unqualified, but loyal like a Labrador.”

At the SSA, professionalism has been key to its success for decades. But with Schedule F, that’s at risk. The same ally pointed out the inconsistency of classifying SSA employees as Schedule F workers. “The supposed criterion for inclusion in Schedule F is that you are in a policy-making role—that historically is the primary defining criterion for classification in the Senior Executive Service (SES).” This undermines the intent behind differentiating policy-making roles from operational ones and risks muddying the waters even further.

What Does This Mean for SSA Employees?

The potential scope of Schedule F at the SSA is staggering. Critics say it could sweep up everyone from Social Security field office employees to mid-level program analysts, even though their work has nothing to do with making policy. “Field office employees enforce and apply policy and statute; they don’t make it,” said the former longtime SSA employee. “Asserting they’re policy makers is like saying police officers are legislators.”

Acting Social Security Commissioner Leland Dudek, who admittedly receives his marching orders from the White House and Elon Musk’s DOGE, seems intent on broad reclassification of the workforce. “Leland Dudek wants it to apply to most SSA employees…but I guess he is simply a literal puppet,” the former SSA staffer observed.

This shift raises big concerns about competence and integrity. Schedule F opens the door for politically connected appointees who may lack the skills to handle complex tasks that directly impact the lives of beneficiaries. NCPSSM’s ally didn’t mince words about the type of people Trump wants to bring in. “Imagine filling federal service with Pete Hegseth and Linda McMahon and RFK Jr. wannabees,” he said.

The U.S. got rid of the patronage system in the 19th century. Trump wants to bring it back.

Impacts on Beneficiaries and the Public

When you think about the logistical and technical challenges involved in running Social Security, it’s clear just how damaging Schedule F could be. The SSA manages benefits for 73 million Americans, relying on skilled employees to ensure payments are accurate and timely. Politicizing these jobs could lead to significant delays, errors, or wrongful denials of benefits that could devastate vulnerable populations.

The impacts of Schedule F extend to the public’s trust in the SSA. Already struggling with staffing shortages and office closures induced by the interference of Trump, Musk and DOGE, the last thing the agency needs is more instability. Critics argue that politicizing the workforce will make things worse, putting additional strain on both employees and beneficiaries.

Dudek himself has come under harsh criticism for his ‘leadership’ at the agency. “All this stuff is way outside his wheelhouse. I sense he comes in every morning and gets his script written by the Heritage Foundation (author of the notorious Project 2025),” the ally commented. Under Dudek’s tenure, SSA has put in place (and, in some cases, has later been compelled to reverse) several policies that appear to be part of an agenda to ‘prove’ that federal programs like Social Security are inefficient and rife with ‘fraud.’ Trump and Musk have spread lies about alleged fraud, all of which have been thoroughly discredited. Yet, they persist to “reform” SSA in ways that are interfering with the efficient delivery of benefits.

The agency’s workforce is being slashed by at least 10,000 jobs at a time when staffing already was at a 50-year low. Social Security claimants have complained that it’s even harder to obtain assistance on SSA’s telephone line, on the website, or at the shrinking number of field offices. The agency’s website has crashed several times in the past month, preventing beneficiaries from accessing their accounts.

The Trump agenda truly has nothing to do with government efficiency— and everything to do with an ideological crusade to shrink the federal government, consequences be damned.

Trump Hands Big Pharma a Gift, Undermines Seniors

President Trump has signed a sweeping executive order that dilutes Medicare’s ability to negotiate prescription drug prices. Though the White House touts it as a measure to reduce healthcare costs, closer analysis reveals that the real beneficiaries are pharmaceutical companies—not seniors who rely on Medicare for prescription drug coverage.

This move significantly erodes key elements of the Inflation Reduction Act (IRA), a landmark achievement under President Biden which empowered Medicare to directly negotiate drug prices with pharmaceutical companies. Namely, Medicare now will have to wait 13 years until any brand-name drug hits the market before that medication is eligible for price negotiation.

Trump’s executive order mandates Health and Human Services Secretary Robert F. Kennedy Jr. to work with Congress toward revamping Medicare’s price negotiation rules. For Big Pharma, it’s a long-awaited victory. According to Reuters, the order specifically targets the timeline for when drugs become eligible for negotiations, a point of contention for the pharmaceutical industry since the IRA was passed in 2022. This delay aligns with the industry’s lobbying goals to preserve their profits for as long as possible, at the expense of seniors struggling to manage the skyrocketing costs of prescription drugs.

“This change could lead to higher Medicare prescription drug spending, higher prices, and potentially higher Medicare Part D premiums.” – Kaiser Family Foundation, April 17, 2025

Breaking Down the Delays

Under President Biden’s IRA, Medicare could negotiate prices for conventional ‘small-molecule’ drugs after nine years on the market, and for complex biologics after thirteen years. Trump’s executive order proposes extending the negotiation eligibility for small-molecule drugs by an additional four years, creating parity with biosimilars. While this might sound like a minor adjustment, in reality, it gifts Big Pharma a four-year buffer to maintain exorbitant prices on some of the most widely used medications.

“Drugmakers have opposed the IRA’s time frame for negotiation eligibility, arguing it stifles innovation,” Reuters notes. But what does this delay mean for Medicare recipients? For four extra years, Medicare and its beneficiaries will be stuck paying unaffordable prices for essential drugs that could have otherwise been negotiated for lower costs.

Biden’s first round of negotiations under the IRA achieved price cuts of as much as 79% on ten high-cost drugs. These reforms were projected to yield significant savings for Medicare recipients. Trump’s policy reverses course, depriving seniors of immediate access to more affordable treatments while cushioning Big Pharma’s profits.

“The main action that Trump proposed this week is ripped from drug industry talking points. Despite vowing to lower drug prices, the administration concedes explicitly that this particular proposal will actually raise them.” – The American Prospect, 4/16/25

A Gift to Big Pharma, Wrapped in Pseudo-Reform

To deflect from the pro-pharma nature of the order, the Trump administration is branding it as part of broader “healthcare savings” and offering other token measures. The order encourages the FDA to streamline approval processes for generic and biosimilar medications, which are cheaper alternatives to branded drugs. It also allows states to apply for drug importation programs to buy medications from nations like Canada.

These gestures are not new; they have been proposed in previous administrations, including under Biden, and their benefits are dubious at best. For instance, only one state, Florida, has successfully gained FDA approval to import drugs from Canada. Meanwhile, the financial relief promised by generic drugs often takes years to materialize due to industry legal challenges and other hurdles.

Meanwhile, the pharmaceutical companies’ profits remain untouched as they continue charging exorbitant prices for existing drugs. Worse, as Common Dreams points out, Trump’s executive order was an “outright cave to Big Pharma” designed to “delay implementation of price negotiation reform under the guise of market-friendly tweaks.”

Medicare will now have to wait 13 years after a conventional drug hits the market to negotiate its price with Big Pharma

Seniors Are Paying the Price

This policy reversal comes at the worst possible time for seniors, who already face steep out-of-pocket expenses for healthcare. According to Reuters, Trump’s administration also looks to standardize Medicare payment rates across different healthcare facilities, under the pretext of “cost alignment.” While this sounds like it could create savings, healthcare advocates warn that these policies typically shift costs onto individuals, penalizing the very people Medicare is supposed to protect.

Such policies emanate from a Republican playbook that often positions market mechanisms over direct government action in healthcare reform. But when the market in question is controlled by pharmaceutical monopolies, the results are predictable. Prices rise, inequalities deepen, and seniors bear the brunt.

**** For more on the threat the Trump Administration poses to Medicare and Medicaid, listen to the newest episode of our podcast, with special guest Fred Riccardi, President of the Medicare Rights Center. ****

Protesters Across USA Tell Trump & Musk: “Hands off Social Security!”

From Anchorage, Alaska to the National Mall in Washington, D.C., millions of protesters turned out on Saturday for nationwide “Hands Off” demonstrations against the Trump administration’s reckless handling of Social Security, Medicare, Medicaid and a host of other federal programs.

These protests weren’t the usual political rallies. They were deeply personal, driven by countless stories of concern about programs that Americans depend on. Whether emanating from retirees in Florida or students in Nebraska, the message was loud and clear: Don’t mess with our nation’s social insurance programs!

Roger Broom, a 66-year-old from Ohio, shared the fear many feel while holding a sign at his local rally in Columbus. “They can’t talk about cutting Social Security like it’s just budget trimming,” he said. “This is money I’ve earned after working all my life. Without it, I’m done.”

Why now?

The uproar comes from public frustration with the Trump administration’s plans to slash federal spending (and staff) — abetted by Elon Musk and his Department of Government Efficiency (DOGE) — under the phony banner of rooting out ‘waste, fraud, and abuse.’ Their main target so far has been the Social Security Administration – including massive layoffs, planned closures of field offices, and new limitations on phone service.

Because of Trump/Musk/DOGE interference, SSA’s website has already crashed multiple times, preventing beneficiaries from accessing their accounts.

“Even when the site is back online, many customers have not been able to sign in to their accounts — or have logged in only to find information missing. For others, access to the system has been slow, requiring repeated tries to get in.” – Washington Post, 4/7/25

Former SSA Commissioner Martin O’Malley warned that benefit payments could be disrupted because of Trump/Musk/DOGE meddling with Social Security systems.

***Listen to our new podcast interview with Commissioner O’Malley here, in which he warns that Musk is out to “destroy” Social Security.***

Ground Zero in D.C.

The National Mall in Washington, D.C., was one of the largest gathering spots of the day. Hand-painted signs read, “Stability for Seniors” and “Social Security Is Earned, Not a Handout.” One group chanted, “Hey ho, Trump’s gotta go!” While exact crowd estimates are not available, there likely were tens of thousands of protesters in D.C., if not more, of diverse ages and backgrounds.

NCPSSM’s own Government Relations and Policy Director Dan Adcock attended the protest in Washington. “The whole event was a good balm for the firehose of bad news coming out of this administration on a daily basis,” Adcock says. “People really needed it.”

NCPSSM’s Dan Adcock at the National Mall

Adcock and the other protesters heard rousing speeches from members of Congress. Standing on a stage near the Washington Monument, Rep. Jamie Raskin (D-MD) said, “Social Security is a promise made from one generation to another. Breaking that promise is breaking America!”

Al and Bev Mirmelstein drove all the way from Charlottesville, VA to attend the D.C. protest. The Mirmlesteins say they have not been to many protests, but felt they had to participate. “We’ve been quiet too long,” Bev confessed, holding a sign reading, “Don’t Rob Our Future.” Her husband Al said, “They’re putting a target on all of us.”

Medicare and Medicaid Under Fire

Protesters sounded the alarm over the Trump administration’s threats to Medicare and Medicaid, too. The Department of Health and Human Services (HHS), led by Secretary Robert F. Kennedy, Jr., (which oversees Medicare & Medicaid) has announced the elimination of 10,000 jobs in the federal health care workforce, while House Republicans have maneuvered to cut nearly $1 trillion from Medicaid.

“I’m terrified for my mom,” said Archer Moran, who attended a rally in Florida near Trump’s golf course. He explained that his mother, a Medicaid recipient, would struggle to survive without her health coverage. “They call them cuts. It’s taking away someone’s lifeline. Lives are literally at risk here.”

Small Towns, Big Audiences

The protests extended from the coasts to the Midwest. In Omaha, Nebraska, nearly a thousand people gathered in Memorial Park. Chants of “Protect what’s ours!” could be heard along Dodge Street, while passing cars honked in solidarity. Protester Jean Zinnen brought her 15-year-old granddaughter to the Omaha demonstration. “She needs to see this is an example of showing up for what matters,” Zinnen said, as she clutched a sign reading, “Our Rights, Our Fight.”

Student Calvin Snyder explained why he felt compelled to protest. “Decisions being made (in Washington) that impact the future this badly shouldn’t be met with quiet acceptance,” said Snyder. “It’s not just anger for self-interest. This is for everyone relying on these programs to live.”

Hundreds of people protested, not only in major cities, but in small towns like Sylva, North Carolina, marching through newly blooming spring neighborhoods in solidarity with demonstrators across the country.

Providence, RI

What’s Next?

The protests delivered a loud and defiant message to those in charge, while remaining peaceful. When asked about the protests, President Trump offered a rambling, incoherent response:

“A lot of them were there because what we witnessed was a terrible thing. And we’ve seen it over the years. You know that better than anyone who would know it. And I know it… I think it’s a shame, a disgrace, and it has to stop.”

In addition to the nonsensical gobbledygook, Trump and his administration have promoted the lie that Social Security is rife with fraud, and the myth that “Democrats” are promoting illegal immigration by enticing migrants with Social Security benefits. Not only is this a discredited conspiracy theory, but undocumented workers are legally barred from collecting Social Security (though many pay into the system, increasing Social Security’s revenues).

Organizers of Saturday’s protests insist they weren’t just a one-day event. For many protesters, this was part of an ongoing campaign to resist the Trump administration. Whether at town halls, in the voting booth, or on the streets, resistors don’t appear ready to back down. “This isn’t something people are going to forget,” said Omaha protester Susan Calef.

“The positive energy of these protests reminds people that there are millions of Americans who feel the same way they do,” says NCPSSM’s Dan Adcock. “As long as we hold rallies like these, organize, and vote, we can reverse the awful things that are going on right now.”

Sources:

https://edition.cnn.com/2025/04/05/us/hands-off-protests-trump-musk/index.html

https://www.aljazeera.com/news/2025/4/5/hands-off-protesters-rally-across-us-to-oppose-trumps-policies

https://www.npr.org/2025/04/05/nx-s1-5353388/hands-off-protests-washington-dc

https://www.politico.com/news/2025/04/05/hands-off-protests-trump-us-00274352

https://nebraskaexaminer.com/2025/04/06/thousands-in-memorial-park-protest-federal-actions-as-part-of-national-han

Martin O’Malley Makes the Case Against Trump, Musk & DOGE on Our Podcast

This week’s “You Earned This” podcast features a special VIP guest: former Maryland Governor and Social Security Commissioner Martin O’Malley. It’s a conversation that everyone who cares about the future of Social Security should hear. O’Malley, who led the Social Security Administration (SSA) during the final year of Joe Biden’s presidency, conveys a clear message: Social Security is under attack, and the consequences for millions of Americans couldn’t be more dire.

O’Malley doesn’t mince words when reflecting on the state of the SSA under what he terms the “co-presidency” of Donald Trump and Elon Musk. “It breaks my heart to see the way that Musk and Trump are just taking a meat cleaver to this agency and kneecapping its ability to serve the public,” he said during our interview. “It’s not fair. It’s not right. People need to wake up to the very real threat that this poses to their earned benefits.”

2024: A Year of Progress

O’Malley described his year at the SSA as one of the most rewarding periods of his life. Tasked with leading an agency that had been chronically underfunded, he sought to rally the workforce that delivers Americans’ retirement and disability benefits. Years of congressional budget neglect had reduced SSA staffing to a 50-year low, while the demand for services was at an all-time high.

O’Malley took pride in working with SSA’s dedicated employees, who, despite these challenges, had a shared mission to serve the public. Together, they focused on addressing severe customer service backlogs, improving fraud prevention, and ensuring benefits were delivered on time. His team implemented critical changes, including improved data sharing with suspect banking institutions to combat fraud. Under O’Malley’s leadership, SSA reduced wait times on the agency’s 1-800 phone line from 40 minutes to twelve minutes, and shrank the delays for Social Security Disability Insurance hearings, among other improvements.

“I hadn’t felt that fully engaged in work since my time as mayor of Baltimore,” O’Malley said. “Watching the agency turn around, even on a very leaky battleship — even as we coped with inadequate resources and decades of neglect — was well worth doing.”

But the gains O’Malley and his team worked so hard to achieve were quickly undone.

The Sabotage of Social Security

According to O’Malley, the reversal began almost immediately after Trump took office. Under the new administration, the SSA announced severe staffing cuts, including mass firings. Entire offices, including those dedicated to improving customer service and promoting equal opportunity, were illegally purged. “Carrots and sticks” were used to incentivize early retirement, creating a hostile work environment that alienated the dedicated public servants O’Malley once led.

“Trump, Musk, and DOGE have really (abused) a group of people that I came to love very quickly. The workers believed in a shared mission, that what they’re doing matters so much to so many. That’s the only reason people hung in there through all of the tough years,” O’Malley lamented.

After the induced early retirements and firings, “people saw their colleagues hugging each other goodbye. There were tears… and cardboard boxes on top of hoods of cars,” O’Malley explained. “SSA leadership essentially said, ‘Hey, joyous news! Everybody who feels compelled to leave the agency: quit now without letting the door hit your backside on the way out.’”

O’Malley estimates that the reductions in staffing will ultimately result in 10,000 SSA jobs disappearing — a 20% cut. The consequence, he says, will be a depleted, overburdened workforce unable to meet the demands of an aging population, at a time when 10,000 Baby Boomers reach retirement age every day. This systematic gutting of the already SSA has exacerbated wait times on phone lines and at field offices, caused website crashes, and increased frustration for the everyday Americans who depend on these vital services.

Musk’s Ideology of Brutal Efficiency

O’Malley doesn’t hold back on what he sees as the Trump administration’s true intentions:

“Elon Musk wants to destroy Social Security. It doesn’t fit with his worldview. He thinks people that are elderly, people who are disabled are, by their very nature, wasteful.”

Musk has publicly derided empathy as a weakness, a philosophy that seems to underpin his approach to governance. O’Malley pointed out that Musk views Social Security beneficiaries as “inefficiencies” or, worse, “dispensable.”

“The ‘waste’ that Musk is talking about are people who are elderly and can’t work, people who are disabled and can’t work, children who lose parents,” O’Malley explained. “That’s why he wants to go after a program that he thinks subsidizes people who supposedly are ‘a drain on the system.’”

Musk’s fake hunt for waste and fraud is hypocritical, O’Malley noted, given the billionaire’s reliance on federal contracts worth $8 million per day. Yet instead of safeguarding Social Security, Musk has partnered with Trump to undermine a program that keeps seniors from falling into poverty.

Trump & Musk’s Falsehoods

O’Malley also called out Trump and Musk for spreading disinformation about Social Security, including absurd claims about rampant fraud:

“Donald Trump stands up in his non-state of the union address and implies there are 360-year-olds collecting Social Security, people who presumably came here for the founding of Jamestown or Plymouth. Totally untrue.”

O’Malley re-iterated a darkly funny, but apt remark he made at a Social Security hearing on Capitol Hill on Tuesday. “The zombie apocalypse is not real. There aren’t millions of people wandering all around the cities of America with checks spewing out of their cadaverous pockets.”

The truth, O’Malley explained, is that fraud within Social Security is extraordinarily rare, despite Trump and Musk’s bogus claims. Musk alleged that 40% of the calls on SSA’s phone line are fraudsters. In truth, says O’Malley, for every 3,100 calls taken by SSA’s call center, only one results in a successful attempt at direct deposit fraud. That’s about .0007%! Of course, ideally there would be zero fraud. In fact, new policies implemented during O’Malley’s tenure targeted improper payments. Unfortunately, those reforms likely are out the window now.

Undermining Public Confidence in Social Security

O’Malley expressed his belief that Trump and Musk aim to erode public confidence in Social Security as a prelude to dismantling it entirely. “I have come to the conclusion that Trump and Musk actually want to sour the public against the SSA. And they do that by destroying its ability to provide customer service for people who work their whole lives for these benefits,” he explained.

By making it harder for Americans to access their benefits and by spreading false narratives of ‘waste, fraud, and abuse,’ they hope to sway public opinion against the program. Once that confidence is eroded, the ultimate goal is clear: cut, privatize, and even raid Social Security for cash.

“I could even imagine a sinister scenario,” O’Malley speculated, “where they say, ‘Hey, Social Security is broken. It was always going to go broke and it doesn’t work. So we’re going to have to liquidate the trust fund.” If that were to happen, the $2.7 trillion in the trust fund could be misdirected for unrelated purposes — including a permanent tax cut for the wealthy and big corporations.

O’Malley speaks at a Save Our Social Security rally in Florida last month

A Call to Action

Social Security isn’t a government handout. It’s an earned benefit that keeps seniors and people with disabilities financially afloat. It’s a contract between generations, ensuring workers who pay into the system today can claim benefits upon retirement, disability, or the death of a family breadwinner.

As O’Malley pointed out, the vast majority of Americans support expanding Social Security, not weakening it. “80% of Americans believe Social Security should be strengthened and made better,” he said. But maintaining that support requires action. “Members of Congress need to hear directly from the people,” O’Malley urged. “Americans see the threat and they want them to ‘stop the steal’ of their Social Security benefits.”

Since leaving his post at SSA, O’Malley has been traveling the country to advocate for Social Security and to speak out against the DOGE squad’s interference in the program. He has already delivered two speeches in Florida, warning seniors of what’s at stake, and is heading to Oklahoma next. While he may no longer be Social Security Commissioner, Martin O’Malley remains fiercely devoted to defending the agency he led — and the 73 million people who depend on it.

***********************

LISTEN TO GOV. O’MALLEY’S PODCAST INTERVIEW here.

READ OUR EXCLUSIVE INTERVIEW WITH SSA WHISTLEBLOWER LAURA HALTZEL here.