Eleanor Roosevelt was a key figure in several of the most important social reform movements of the twentieth century: the Progressive movement, the New Deal, and the Women’s Movement. We believe that if she were alive today, Eleanor would be leading efforts to achieve parity in Social Security benefits, along with fighting for income equality, and caregiver credits in Social Security for women who leave the workforce to raise a family or care for their aging relatives. “Eleanor’s Hope” focuses on communicating, educating and advocating on these and other critical women’s issues. Read More…About Eleanor’s Hope

Eleanor Roosevelt was a key figure in several of the most important social reform movements of the twentieth century: the Progressive movement, the New Deal, and the Women’s Movement. We believe that if she were alive today, Eleanor would be leading efforts to achieve parity in Social Security benefits, along with fighting for income equality, and caregiver credits in Social Security for women who leave the workforce to raise a family or care for their aging relatives. “Eleanor’s Hope” focuses on communicating, educating and advocating on these and other critical women’s issues. Read More…About Eleanor’s Hope

A Conversation about Women’s Retirement Inequities

with NCPSSM Policy Advisor Maria Freese

“We are still confronting what we refer to as ‘mommy channels,’ where women are steered into jobs with less pay, little job security, and few benefits such as health care coverage or access to retirement plans.”

50 Years of Financial Progress for Women

50 Years of Financial Progress for Women How Unpredictable Schedules Widen the Gender Pay Gap

How Unpredictable Schedules Widen the Gender Pay Gap

As VP Kamala Harris Can Be a Powerful Voice for Women’s Retirement Security

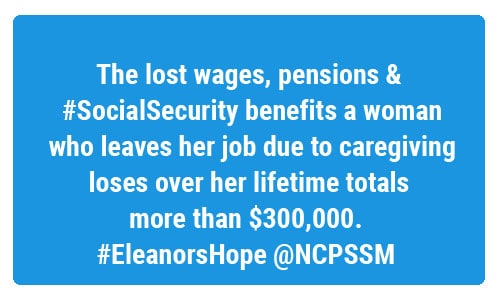

As VP Kamala Harris Can Be a Powerful Voice for Women’s Retirement Security Equal Pay Day Brings Home Long-term Costs of Pay Inequality

Equal Pay Day Brings Home Long-term Costs of Pay Inequality

Poorer, Older and Sicker: The Challenges Facing America’s Senior Women

Poorer, Older and Sicker: The Challenges Facing America’s Senior Women

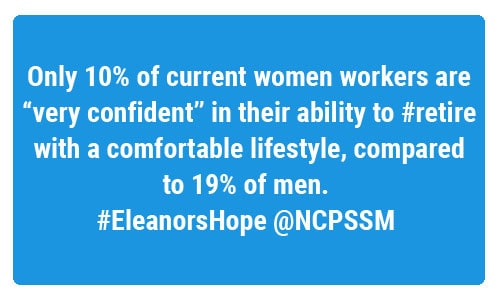

America’s Gender Pay Gap Lasts a Lifetime

America’s Gender Pay Gap Lasts a Lifetime