Seven Falsehoods in Senator Mike Lee’s Social Security Post

Earlier this week, Senator Mike Lee (R-UT) posted an extensive – and patently ridiculous – diatribe against Social Security on X (formerly Twitter). The thread is full of falsehoods and misleading assertions about America’s most popular social insurance program, including its origins. Senator Lee incorporates many tired myths that the political right propagates to undermine a successful government program they can’t stand – simply because it is a successful government program.

In her book, “The Truth About Social Security,” social insurance expert and advocate Nancy Altman writes that “today’s discussions of Social Security are replete with revisionist history. Some of today’s revisionist statements are ‘zombie lies’… that refuse to die.”

The motive of these revisionist attacks is clear: to undermine public faith in Social Security so conservatives can cut or privatize it. According to Newsweek, a video has resurfaced from 2010 involving Senator Lee in which he said his intentions were to “phase out” Social Security altogether.

Never mind that Social Security is largely beloved by the American public or that it keeps seniors, people with disabilities, and their families from falling into poverty. Of course, Senator Lee focuses exclusively on the retirement portion while neglecting to mention that the program covers Americans of all ages in the event of the disability or death of a family breadwinner.

Making matters worse, Senator Lee’s post was amplified by the billionaire owner of X and Trump crony, Elon Musk. With Musk’s assist, Lee’s propaganda received some 40 million views on X. The right-wing misinformation machine that helped elect Donald Trump is now targeting Americans’ cherished earned benefits.

Here are 7 claims in Senator Lee’s X post that don’t pass the sniff test, followed by – gasp! – the actual FACTS:

#1

Lee: In 1935, the American people were sold a bill of goods. They were told, “Pay into this system, and it’ll be YOUR money for retirement.” Sounds great, right?

FACT: The American people were not “sold a bill of goods” in any way. President Franklin D. Roosevelt, who signed the program into law in 1935, made clear that Social Security was a social insurance program to help “protect against the hazards and vicissitudes of life.” (In 1934, FDR said that the aim of Social Security was “furthering the security of the citizen and his family through social insurance.”)

Workers pay into the program in exchange for benefits upon retirement, disability, or the death of a family breadwinner — similar to the way customers pay private insurance premiums and receive payouts when something they are insured against occurs (a house fire, a car accident, etc.). The Roosevelt administration never characterized Social Security as a personal savings account, though that is a common misunderstanding perpetuated by Social Security opponents like Senator Lee.

In distorting the nature and intent of Social Security, revisionists like Lee “seek to expunge the far-sighted and noble vision of Social Security’s founders, President Roosevelt and those around him,” writes Altman.

#2

Lee: First of all, this money doesn’t sit in a nice, individual account with your name on it. No, it goes into a huge account called the “Social Security Trust Fund.”

FACT: Again, Social Security was not designed or promoted as an individual savings account. This can be a bit confusing because Americans do receive Social Security numbers to track their income and calculate benefits. Senator Lee and others exploit this confusion to undermine Social Security itself.

Benefits are calculated according to lifetime wages and are designed to be “progressive.” In other words, lower-income retirees receive a larger proportion of their former work income in benefits than higher-earners do. Benefits are also adjusted for inflation, so that, most years, retirees receive a boost in their monthly Social Security payments.

It is no secret that surplus payroll contributions from workers go into a Social Security trust fund, which is invested in government bonds and repaid with interest — which helps to pay future benefits. That is simply how the system works.

#3

Lee: Here’s the kicker—the government routinely raids this fund. Yes, you heard that right. They take “your money” and use it for whatever the current Congress deems “necessary.”

FACT: This is another bogus claim that Social Security’s opponents perpetuate. The Social Security trust fund (currently valued at $2.8 trillion) is invested in treasury bonds backed by the full faith and credit of the U.S. government. Those bonds are repaid with interest, like any others. As our president and CEO regularly points out, if you had $2.8 trillion, you probably would not hide it under your mattress; you would invest it in safe securities.

Like the revenue from other government-issued bonds, Congress may spend that money how it sees fit (the military, roads, bridges, etc.). This is no different than bonds held by Wall Street mutual funds or foreign governments. However, Congress is not allowed to “raid” the Social Security trust fund itself — and has not done so. The assets in the trust fund belong solely to Social Security and can only be used to pay benefits and the cost of administering the program. Politicians are not stealing from it.

#4

Lee: If you had put the same amount into literally ANYTHING else—a mutual fund, real estate, even a savings account—you’d be better off by the time you reached retirement age, even if the government kept some of it!

FACT: While it’s true that investments in commodities and other markets can sometimes pay off, they are not reliable. The markets can be lucrative, but they also are volatile. And if the timing isn’t right, you could lose all or most of your retirement funds. Just ask the millions of people who were all set to retire in 2008 and saw their 401K’s and other investments evaporate.

Once again, Social Security is not an investment fund. It is a collective social insurance program that pays out promised benefits. In its nearly 90 years of existence, Social Security has never missed a payment to beneficiaries, through recessions, wars, and natural disasters. Even COVID was not able to disrupt the payment of promised Social Security benefits.

#5

Lee: Let’s talk about how this system is set up to fail. The demographic shift? More retirees, fewer workers. It’s almost fair to compare it to a Ponzi scheme that’s running out of new investors.

FACT: Lee does not explain how a system “set up to fail” has worked so well for almost a century. As for the “demographic shift” of “more retirees and fewer workers,” the historic Social Security reforms of 1983 already anticipated the swell in retirees that would occur when the Baby Boomers reached their senior years, and the coinciding trend toward lower birthrates. That is why the 1983 reforms were put in place — to keep Social Security financially strong well into the 21st century.

What the 1983 reformers did not anticipate (but perhaps should have) was the growing inequality in income that has plagued the country in the past 40 years, depriving Social Security of anticipated revenue. Four decades ago, 90% of the nation’s total wages were subject to Social Security payroll taxes. Today, that figure has sunk closer to 80% as the rich have gotten richer and most other Americans’ wages have stagnated. The solution is to adjust the payroll wage cap (now set at $176,100 for 2025) so that higher earners once again contribute their fair share — providing Social Security with billions of dollars in much-needed revenue.

Senator Lee falsely compares Social Security to a “Ponzi scheme.” (So have Donald Trump and other influential Republicans.). A Ponzi scheme is a criminal enterprise where investors are swindled out of promised returns. Social Security is an inter-generational compact which has worked remarkably well for nearly 90 years and never missed a payment.

#6

Lee: Remember, this isn’t just about retirement. It’s about independence, about controlling your own destiny. With Social Security, you control nothing.

FACT: This is probably the most absurd argument in Senator Lee’s post. Conservatives typically portray any government program that they don’t like (usually social programs, no matter how beneficial or successful) as compromising Americans’ freedom. Ronald Reagan famously warned against the passage of Medicare, saying, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.’

Of course, the opposite is true. Programs like Social Security and Medicare help to liberate seniors (and people with disabilities and their families) from fear of losing health coverage or falling into poverty. People who have baseline financial and health security are freer and more independent to live the way they wish, not less free.

To say that “you control nothing” with Social Security is patently ridiculous. Social Security provides you and your family with guaranteed retirement, disability, spousal, and survivor benefits. Participating in Social Security does not prevent you from investing in 401Ks, IRAs, real estate, or any other markets, or simply putting money in a savings account. More than half of the American workforce currently participates in an employer-sponsored retirement plan. These people are not prevented from doing that by Social Security. In fact, Social Security was once envisioned as part of a “three-legged stool” of retirement savings, pensions, and Social Security benefits. Unfortunately, Americans are having trouble saving for retirement because of growing income inequality and rising living costs, and few employers provide pensions anymore. That is an argument for expanding – not privatizing or cutting – Social Security.

#7

Lee: Social Security is government dependency at its worst.

FACT: Only in the fantasy world of the political right is Social Security “government dependency.” Social Security is not and has never been a welfare program. Americans contribute to it during the course of their working lives in return for promised benefits. It was designed that way on purpose; so that it would not be a government handout. Americans feel ownership of Social Security. That’s why when Senator Lee and others on the right float ideas to cut or privatize Social Security, seniors respond, “Hands off of Social Security. That’s our money. We paid for it!”

**********************************

2025 Medicare Premium Hike Nothing New, Part of Larger Trend

Medicare beneficiaries will be paying a higher premium for Part B insurance in 2025. Unfortunately, this is nothing new. Medicare premiums have been rising every year for decades now. The 2025 increase, though, is receiving an unusual amount of attention, probably because of the media’s hyper-focus on inflation in general.

Part B premiums will rise 2.7% (or $10.50 per month) for the average beneficiary. This exceeds the 2025 Social Security COLA of 2.5% (which also is not unusual). While seniors on fixed incomes already grappling with higher costs clearly won’t be happy paying an extra $10.50 per month for Medicare, the increase is in keeping with years past and part of a trend.

Health insurance premiums in general have been climbing, driven in part by soaring health care costs. The median increase in private marketplace premiums will be 7% in 2025, while premiums for employer-sponsored plans are expected to rise nine percent. The website Stretch Dollar attributes the spike in premiums to several factors, including:

*Higher labor costs in the health care sector.

*Hospital market consolidation gives insurance companies less negotiating power.

*The growing popularity of expensive specialty drugs like GLP-1 weight loss drugs and new gene therapies.

We don’t need to feel too sorry for the nation’s insurance behemoths, though. Unlike some other Western countries, profit motive is baked into our health coverage system. “All told, America’s biggest health insurers raked in more than $41 billion in profit in 2022,” reported the Penn Capital-Star — a “staggering sum of money” surpassing the GDP of some countries.

Annual premium hikes are to be expected given rising costs and massive inefficiencies in the U.S. health care system. In fact, Axios characterized ours as “one of the most inefficient health care systems among (the world’s) high-income countries.” Axios blames this, in part, on increased intervention in health care decisions by insurance companies (the ‘managed care’ model). “Administrative requirements that insurers sign off on care before it’s delivered… cost time and money.”

Unfortunately, this is the entire modus operandi of Medicare Advantage (MA), the privatized version of Medicare. MA insurers impose “prior authorizations” before patients can get certain treatments and procedures recommended by their doctors, often denying care that the publicly-administered “traditional Medicare” routinely covers. The built-in profit motive of M.A. plans (who receive fixed payments from Medicare for each patient) incentivizes insurers to pay out less for patient care.

The traditional Medicare program is far from perfect, but it is far more efficient at delivering care because it has no profit motive. In fact, traditional Medicare is one of the most efficiently administered health insurance programs. Traditional Medicare’s administrative costs are a scant two percent, while private insurance companies spend some 12-18% of their revenue on overhead.

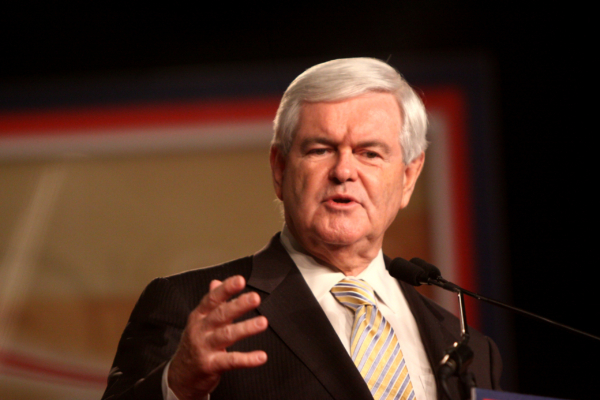

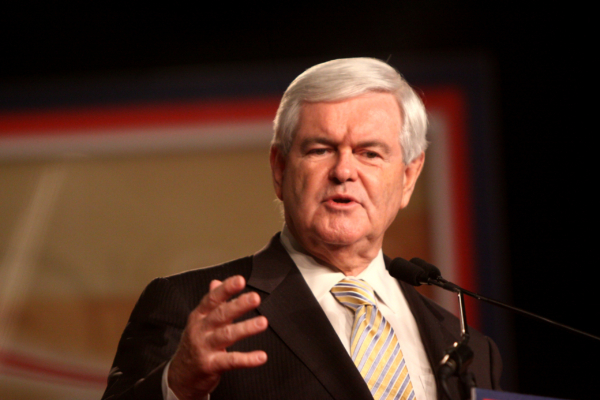

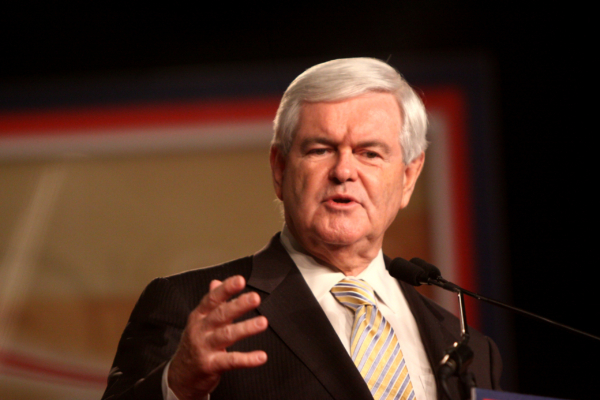

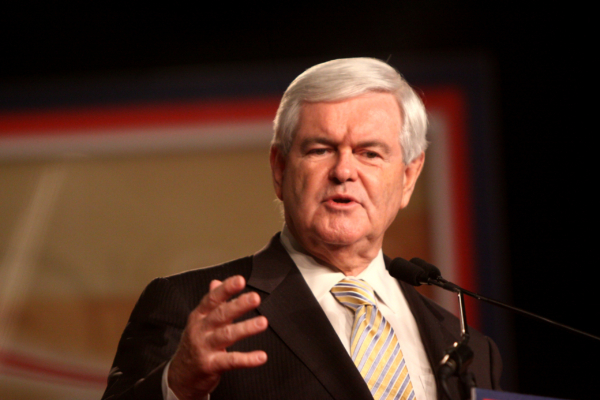

Fmr. House Speaker Newt Gingrich once said traditional Medicare would “wither on the vine.”

This is not to say that traditional Medicare can’t be improved. The same trends in health care costs that buffet the private markets affect Medicare as well. The Obama and Biden administrations attempted to cut Medicare’s costs without compromising patient care. In fact, the Inflation Reduction Act of 2022 is expected to save the program $6 billion by 2026 by lowering prescription drug costs. This and other Democratic proposals to cut Medicare costs — and increase revenue — will now languish in a second Trump administration with a Republican-controlled Congress.

In fact, the Republican agenda (as laid out in Project 2025) is to undermine traditional Medicare by steering seniors toward for-profit Medicare Advantage plans. If successful, they will have realized Newt Gingrich’s dream of leaving traditional Medicare to “wither on the vine.” Seniors do not deserve that.

Despite the increase in annual premiums, Medicare remains one of the most popular federal programs. According to Kaiser Family Foundation, 90% percent of Medicare beneficiaries rate their coverage positively, including half who say it is “excellent.” We and other advocates will continue to fight for a thriving Medicare program that prioritizes patients over profits.

Our senior health policy expert, Anne Montgomery, explains the choices confronting seniors during this year’s Medicare open enrollment season on the “Your Earned This” podcast. Listen here.

WEP & GPO Repeal Passes House: A Bi-partisan Victory for Public Sector Workers & Their Families

The U.S. House voted Tuesday night to repeal two highly unpopular provisions of Social Security law — the WEP (Windfall Elimination Provision) and GPO (Government Pension Offset). These provisions, enacted more than 40 years ago, prevent millions of public sector employees and their families from collecting Social Security benefits. The Social Security Fairness Act, introduced by Rep. Garrett Graves (R-LA) and Rep. Abigail Spanberger (D-VA), would revoke WEP and GPO if passed by the Senate and signed by the president.

NCPSSM has long supported repeal of these provisions and lauded the 327 to 75 House vote. Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare, said in a statement:

“Tuesday night’s House vote was a bipartisan victory for public sector employees and their families, who, like all Americans, deserve to collect the benefits they have earned. We urge the U.S. Senate to join the House in approving this bill”. – NCPSSM president and CEO Max Richtman, 11/12/24

In a statement released after their bill prevailed in the House, Reps. Spanberger and Graves referred to the WEP and GPO provisions as “theft” of public employees’ benefits:

“By passing the Social Security Fairness Act, a bipartisan majority of the U.S. House of Representatives showed up for the millions of Americans — police officers, teachers, firefighters, and other local and state public servants — who worked a second job to make ends meet or began a second career to support their families after retiring from public service. – Reps. Abigail Spanberger & Garrett Graves, 11/12/24

Though the bill provides welcome relief to public sector workers, it is not ‘paid for’; the bill includes no new revenue or cuts to cover the cost of expanding benefits. In 2022, Social Security’s chief actuary estimated that the Social Security Fairness act would cost the program some $146 billion. Meanwhile, the Congressional Budget Office analysis of the legislation projected that it would expedite the depletion of the Social Security trust fund reserves by a relatively negligible six months.

Hill-watchers say that the bill’s proponents are pushing Senate Majority Leader Charles Schumer to attach the legislation to a larger, must-pass bill. Proponents reportedly are hoping to avoid the Social Security Fairness Act coming to the Senate floor as a free-standing bill, as it then would be subject to (potentially harmful) amendments.

While NCPSSM endorses the bill, we support the more comprehensive Social Security improvements offered in Rep. John Larson’s Social Security 2100 Act, which includes repeal of WEP and GPO along with increased revenue to cover the costs.

Unions representing public sector employees – from teachers to firefighters – hailed the House passage of the Social Security Fairness Act as a major win for their members. International Association of Firefighters (IAFF) General President Edward A. Kelly said in a statement following the vote, “Now it’s time for Senators to step up and send this bill to the President’s desk.”

Watch Rep. Larson’s impassioned speech about his Social Security 2100 Act on the House floor earlier this week.

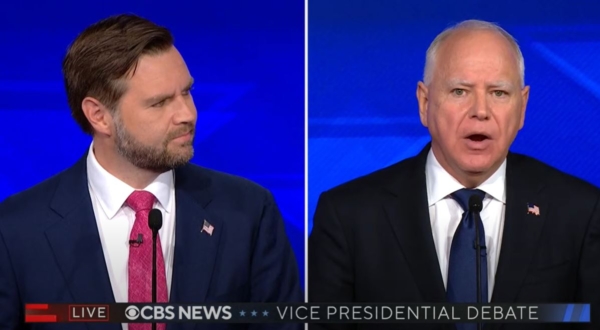

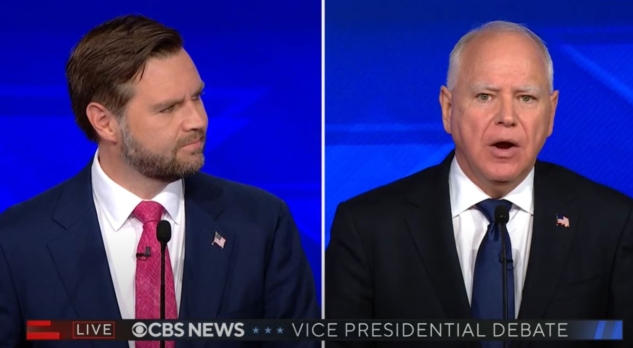

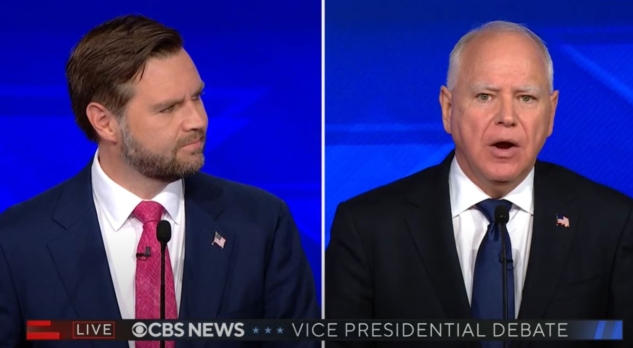

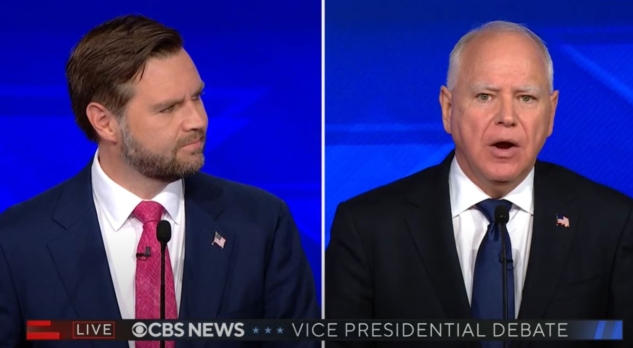

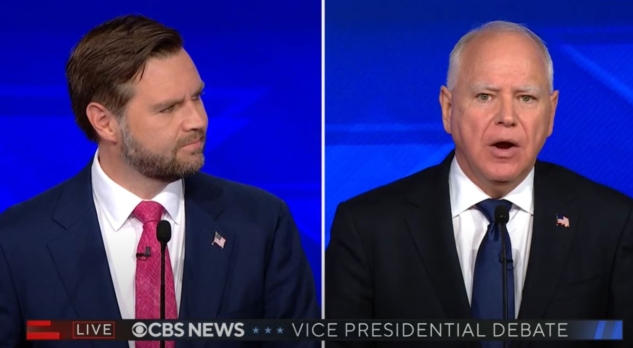

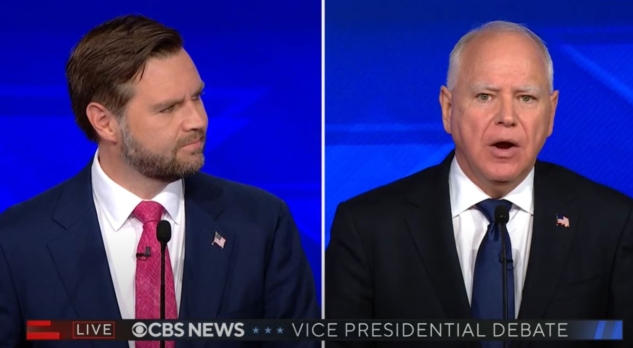

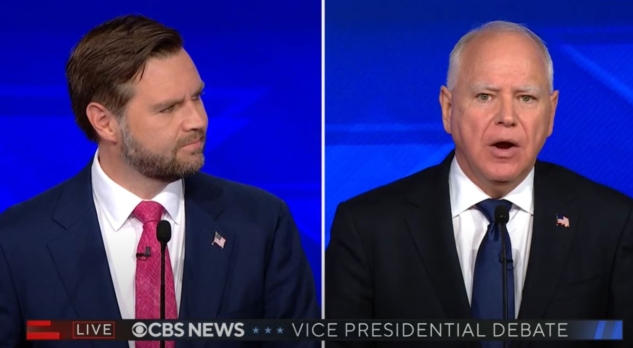

In Debate, Walz Reassures Seniors the Democratic Ticket Has Their Backs

The National Committee to Preserve Social Security and Medicare released this statement at the end of Tuesday’s vice presidential debate:::

Tim Walz was the only one in tonight’s vice presidential debate who sought to reassure older Americans about their health security and medical costs. He touted the Biden-Harris’ administration’s successes in reducing seniors’ prescription drug costs through the Inflation Reduction Act. He noted that the administration “negotiated drug prices with Medicare” for the first time in history.

J.D. Vance was silent on this issue, because Donald Trump has never seriously confronted Big Pharma on behalf of seniors or anyone else.

Walz reaffirmed that Kamala Harris will “protect and enhance” the Affordable Care Act (ACA), which benefits both near seniors and Medicare beneficiaries. He reminded the audience that Donald Trump tried to repeal the ACA and would have succeeded were it not for one no vote by Senator John McCain.

J.D. Vance defended Trump for having nothing but “concepts of a (health care) plan” — and tried to claim that the former president defended the Affordable Care Act when in truth he tried to rip health coverage from millions of Americans.

Little was said or asked about Social Security during the debate, but Vance did mention that his own grandmother benefited from Social Security. Unfortunately, his running mate, Donald Trump, cannot be trusted to preserve seniors’ earned benefits. He once called Social Security a “Ponzi Scheme”; he tried to cut Social Security as president; and earlier this year he said that he’s “open” to “cutting entitlements.”

Tim Walz truly understands the value of Social Security. He has talked about how Social Security kept his family out of poverty when his father passed away when Walz was 19 years old. He and Kamala Harris have consistently pledged to protect Social Security and Medicare from cuts.

The GOP vice presidential candidate did nothing to reassure seniors that a Trump-Vance administration will defend their financial and health security. The record, the facts, and the promises of the Democratic ticket reinforce that Kamala Harris and Tim Walz have the backs of everyday Americans, the middle class, and our nation’s roughly 60 million seniors. – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

Tester Opponent’s Ad Full of Falsehoods on Social Security

The campaign of Montana GOP Senate candidate Tim Sheehy stooped to new lows in a recent ad. In less than 30 seconds, the Koch-funded, billionaire-backed campaign unveiled a series of baseless claims about incumbent Senator Jon Tester’s record on Social Security. Terry Minnow, chair of the Montana seniors’ group Big Sky 55+, excoriated the Sheehy campaign in an open letter published in a local newspaper, demanding that the ad be taken off the air:

“The gross misrepresentations put forth in your ad play political games with (Montana seniors’) livelihoods and their sense of well-being. It is reckless and irresponsible to distress and scare Montanans with patently false information that will bring them anxiety, worry and sleepless nights.” – Terry Minnow, Chair, Big Sky 55+

Let’s take a closer look at the falsehoods in Sheehy’s ad, and where the two candidates really land on Social Security.

Falsehood #1: Jon Tester and other Democrats have “raided” the Social Security trust fund

There are no facts to back up this claim. The trust fund is invested in special U.S. Treasury notes which are repaid to Social Security with interest— just like other government bonds. The trust fund serves a designated purpose, and can only be used to pay for Social Security benefits and administrative costs. Contrary to the popular myth, no one is “raiding” the trust fund or “stealing” from it.

Falsehood #2: Jon Tester supported huge cuts to Social Security

Jon Tester has never supported “huge cuts” to Social Security. He earned a 100% rating on our legislative scorecard two congressional sessions in a row. Lawmakers only receive a 100% rating by consistently supporting Social Security. “I will always defend Medicare and Social Security with all I’ve got,” says Senator Tester. This is why we formally endorsed him in June.

Falsehood #3: Tim Sheehy opposes cuts to Social Security and Medicare

While Jon Tester has always opposed Republican proposals to “sunset” Social Security, Tim Sheehy can’t say the same. Sheehy told a conservative radio host that he agreed with a “mandatory sunset clause in every bill,” leaving Social Security benefits to the whims of politicians year after year. Sheehy, who was endorsed by Donald Trump, has shown he will align with the most extreme members of Congress. Florida Senator Rick Scott, the architect of a plan to sunset Social Security, has endorsed Sheehy and even spent time in Bozeman this summer speaking at his campaign events.

Sheehy has supported GOP efforts to make the Trump tax cuts permanent. This would add nearly $2 trillion to the federal debt. Some Republicans set their sights on Social Security and Medicare to make up the difference. Sheehy himself admits that making the Trump tax cuts permanent could jeopardize Social Security.

NCPSSM president Max Richtman endorses Jon Tester (R) and House candidate Monica Tranel (L) as seniors’ champions in Big Fork, MT

We are hopeful that Montana voters who care about Social Security will see through the falsehoods — and familiarize themselves with where the two candidates truly stand. This past June, NCPSSM President and CEO Max Richtman traveled to Big Fork, Montana to deliver our PAC’s endorsement of Senator Tester. The Senator has received similar endorsements from other seniors’ advocates as well, while Tim Sheehy peddles misinformation on these issues.

Check out this Facebook video from a real Montana Voter! It’s a lot more honest than Sheehy’s ad.

Seven Falsehoods in Senator Mike Lee’s Social Security Post

Earlier this week, Senator Mike Lee (R-UT) posted an extensive – and patently ridiculous – diatribe against Social Security on X (formerly Twitter). The thread is full of falsehoods and misleading assertions about America’s most popular social insurance program, including its origins. Senator Lee incorporates many tired myths that the political right propagates to undermine a successful government program they can’t stand – simply because it is a successful government program.

In her book, “The Truth About Social Security,” social insurance expert and advocate Nancy Altman writes that “today’s discussions of Social Security are replete with revisionist history. Some of today’s revisionist statements are ‘zombie lies’… that refuse to die.”

The motive of these revisionist attacks is clear: to undermine public faith in Social Security so conservatives can cut or privatize it. According to Newsweek, a video has resurfaced from 2010 involving Senator Lee in which he said his intentions were to “phase out” Social Security altogether.

Never mind that Social Security is largely beloved by the American public or that it keeps seniors, people with disabilities, and their families from falling into poverty. Of course, Senator Lee focuses exclusively on the retirement portion while neglecting to mention that the program covers Americans of all ages in the event of the disability or death of a family breadwinner.

Making matters worse, Senator Lee’s post was amplified by the billionaire owner of X and Trump crony, Elon Musk. With Musk’s assist, Lee’s propaganda received some 40 million views on X. The right-wing misinformation machine that helped elect Donald Trump is now targeting Americans’ cherished earned benefits.

Here are 7 claims in Senator Lee’s X post that don’t pass the sniff test, followed by – gasp! – the actual FACTS:

#1

Lee: In 1935, the American people were sold a bill of goods. They were told, “Pay into this system, and it’ll be YOUR money for retirement.” Sounds great, right?

FACT: The American people were not “sold a bill of goods” in any way. President Franklin D. Roosevelt, who signed the program into law in 1935, made clear that Social Security was a social insurance program to help “protect against the hazards and vicissitudes of life.” (In 1934, FDR said that the aim of Social Security was “furthering the security of the citizen and his family through social insurance.”)

Workers pay into the program in exchange for benefits upon retirement, disability, or the death of a family breadwinner — similar to the way customers pay private insurance premiums and receive payouts when something they are insured against occurs (a house fire, a car accident, etc.). The Roosevelt administration never characterized Social Security as a personal savings account, though that is a common misunderstanding perpetuated by Social Security opponents like Senator Lee.

In distorting the nature and intent of Social Security, revisionists like Lee “seek to expunge the far-sighted and noble vision of Social Security’s founders, President Roosevelt and those around him,” writes Altman.

#2

Lee: First of all, this money doesn’t sit in a nice, individual account with your name on it. No, it goes into a huge account called the “Social Security Trust Fund.”

FACT: Again, Social Security was not designed or promoted as an individual savings account. This can be a bit confusing because Americans do receive Social Security numbers to track their income and calculate benefits. Senator Lee and others exploit this confusion to undermine Social Security itself.

Benefits are calculated according to lifetime wages and are designed to be “progressive.” In other words, lower-income retirees receive a larger proportion of their former work income in benefits than higher-earners do. Benefits are also adjusted for inflation, so that, most years, retirees receive a boost in their monthly Social Security payments.

It is no secret that surplus payroll contributions from workers go into a Social Security trust fund, which is invested in government bonds and repaid with interest — which helps to pay future benefits. That is simply how the system works.

#3

Lee: Here’s the kicker—the government routinely raids this fund. Yes, you heard that right. They take “your money” and use it for whatever the current Congress deems “necessary.”

FACT: This is another bogus claim that Social Security’s opponents perpetuate. The Social Security trust fund (currently valued at $2.8 trillion) is invested in treasury bonds backed by the full faith and credit of the U.S. government. Those bonds are repaid with interest, like any others. As our president and CEO regularly points out, if you had $2.8 trillion, you probably would not hide it under your mattress; you would invest it in safe securities.

Like the revenue from other government-issued bonds, Congress may spend that money how it sees fit (the military, roads, bridges, etc.). This is no different than bonds held by Wall Street mutual funds or foreign governments. However, Congress is not allowed to “raid” the Social Security trust fund itself — and has not done so. The assets in the trust fund belong solely to Social Security and can only be used to pay benefits and the cost of administering the program. Politicians are not stealing from it.

#4

Lee: If you had put the same amount into literally ANYTHING else—a mutual fund, real estate, even a savings account—you’d be better off by the time you reached retirement age, even if the government kept some of it!

FACT: While it’s true that investments in commodities and other markets can sometimes pay off, they are not reliable. The markets can be lucrative, but they also are volatile. And if the timing isn’t right, you could lose all or most of your retirement funds. Just ask the millions of people who were all set to retire in 2008 and saw their 401K’s and other investments evaporate.

Once again, Social Security is not an investment fund. It is a collective social insurance program that pays out promised benefits. In its nearly 90 years of existence, Social Security has never missed a payment to beneficiaries, through recessions, wars, and natural disasters. Even COVID was not able to disrupt the payment of promised Social Security benefits.

#5

Lee: Let’s talk about how this system is set up to fail. The demographic shift? More retirees, fewer workers. It’s almost fair to compare it to a Ponzi scheme that’s running out of new investors.

FACT: Lee does not explain how a system “set up to fail” has worked so well for almost a century. As for the “demographic shift” of “more retirees and fewer workers,” the historic Social Security reforms of 1983 already anticipated the swell in retirees that would occur when the Baby Boomers reached their senior years, and the coinciding trend toward lower birthrates. That is why the 1983 reforms were put in place — to keep Social Security financially strong well into the 21st century.

What the 1983 reformers did not anticipate (but perhaps should have) was the growing inequality in income that has plagued the country in the past 40 years, depriving Social Security of anticipated revenue. Four decades ago, 90% of the nation’s total wages were subject to Social Security payroll taxes. Today, that figure has sunk closer to 80% as the rich have gotten richer and most other Americans’ wages have stagnated. The solution is to adjust the payroll wage cap (now set at $176,100 for 2025) so that higher earners once again contribute their fair share — providing Social Security with billions of dollars in much-needed revenue.

Senator Lee falsely compares Social Security to a “Ponzi scheme.” (So have Donald Trump and other influential Republicans.). A Ponzi scheme is a criminal enterprise where investors are swindled out of promised returns. Social Security is an inter-generational compact which has worked remarkably well for nearly 90 years and never missed a payment.

#6

Lee: Remember, this isn’t just about retirement. It’s about independence, about controlling your own destiny. With Social Security, you control nothing.

FACT: This is probably the most absurd argument in Senator Lee’s post. Conservatives typically portray any government program that they don’t like (usually social programs, no matter how beneficial or successful) as compromising Americans’ freedom. Ronald Reagan famously warned against the passage of Medicare, saying, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.’

Of course, the opposite is true. Programs like Social Security and Medicare help to liberate seniors (and people with disabilities and their families) from fear of losing health coverage or falling into poverty. People who have baseline financial and health security are freer and more independent to live the way they wish, not less free.

To say that “you control nothing” with Social Security is patently ridiculous. Social Security provides you and your family with guaranteed retirement, disability, spousal, and survivor benefits. Participating in Social Security does not prevent you from investing in 401Ks, IRAs, real estate, or any other markets, or simply putting money in a savings account. More than half of the American workforce currently participates in an employer-sponsored retirement plan. These people are not prevented from doing that by Social Security. In fact, Social Security was once envisioned as part of a “three-legged stool” of retirement savings, pensions, and Social Security benefits. Unfortunately, Americans are having trouble saving for retirement because of growing income inequality and rising living costs, and few employers provide pensions anymore. That is an argument for expanding – not privatizing or cutting – Social Security.

#7

Lee: Social Security is government dependency at its worst.

FACT: Only in the fantasy world of the political right is Social Security “government dependency.” Social Security is not and has never been a welfare program. Americans contribute to it during the course of their working lives in return for promised benefits. It was designed that way on purpose; so that it would not be a government handout. Americans feel ownership of Social Security. That’s why when Senator Lee and others on the right float ideas to cut or privatize Social Security, seniors respond, “Hands off of Social Security. That’s our money. We paid for it!”

**********************************

2025 Medicare Premium Hike Nothing New, Part of Larger Trend

Medicare beneficiaries will be paying a higher premium for Part B insurance in 2025. Unfortunately, this is nothing new. Medicare premiums have been rising every year for decades now. The 2025 increase, though, is receiving an unusual amount of attention, probably because of the media’s hyper-focus on inflation in general.

Part B premiums will rise 2.7% (or $10.50 per month) for the average beneficiary. This exceeds the 2025 Social Security COLA of 2.5% (which also is not unusual). While seniors on fixed incomes already grappling with higher costs clearly won’t be happy paying an extra $10.50 per month for Medicare, the increase is in keeping with years past and part of a trend.

Health insurance premiums in general have been climbing, driven in part by soaring health care costs. The median increase in private marketplace premiums will be 7% in 2025, while premiums for employer-sponsored plans are expected to rise nine percent. The website Stretch Dollar attributes the spike in premiums to several factors, including:

*Higher labor costs in the health care sector.

*Hospital market consolidation gives insurance companies less negotiating power.

*The growing popularity of expensive specialty drugs like GLP-1 weight loss drugs and new gene therapies.

We don’t need to feel too sorry for the nation’s insurance behemoths, though. Unlike some other Western countries, profit motive is baked into our health coverage system. “All told, America’s biggest health insurers raked in more than $41 billion in profit in 2022,” reported the Penn Capital-Star — a “staggering sum of money” surpassing the GDP of some countries.

Annual premium hikes are to be expected given rising costs and massive inefficiencies in the U.S. health care system. In fact, Axios characterized ours as “one of the most inefficient health care systems among (the world’s) high-income countries.” Axios blames this, in part, on increased intervention in health care decisions by insurance companies (the ‘managed care’ model). “Administrative requirements that insurers sign off on care before it’s delivered… cost time and money.”

Unfortunately, this is the entire modus operandi of Medicare Advantage (MA), the privatized version of Medicare. MA insurers impose “prior authorizations” before patients can get certain treatments and procedures recommended by their doctors, often denying care that the publicly-administered “traditional Medicare” routinely covers. The built-in profit motive of M.A. plans (who receive fixed payments from Medicare for each patient) incentivizes insurers to pay out less for patient care.

The traditional Medicare program is far from perfect, but it is far more efficient at delivering care because it has no profit motive. In fact, traditional Medicare is one of the most efficiently administered health insurance programs. Traditional Medicare’s administrative costs are a scant two percent, while private insurance companies spend some 12-18% of their revenue on overhead.

Fmr. House Speaker Newt Gingrich once said traditional Medicare would “wither on the vine.”

This is not to say that traditional Medicare can’t be improved. The same trends in health care costs that buffet the private markets affect Medicare as well. The Obama and Biden administrations attempted to cut Medicare’s costs without compromising patient care. In fact, the Inflation Reduction Act of 2022 is expected to save the program $6 billion by 2026 by lowering prescription drug costs. This and other Democratic proposals to cut Medicare costs — and increase revenue — will now languish in a second Trump administration with a Republican-controlled Congress.

In fact, the Republican agenda (as laid out in Project 2025) is to undermine traditional Medicare by steering seniors toward for-profit Medicare Advantage plans. If successful, they will have realized Newt Gingrich’s dream of leaving traditional Medicare to “wither on the vine.” Seniors do not deserve that.

Despite the increase in annual premiums, Medicare remains one of the most popular federal programs. According to Kaiser Family Foundation, 90% percent of Medicare beneficiaries rate their coverage positively, including half who say it is “excellent.” We and other advocates will continue to fight for a thriving Medicare program that prioritizes patients over profits.

Our senior health policy expert, Anne Montgomery, explains the choices confronting seniors during this year’s Medicare open enrollment season on the “Your Earned This” podcast. Listen here.

WEP & GPO Repeal Passes House: A Bi-partisan Victory for Public Sector Workers & Their Families

The U.S. House voted Tuesday night to repeal two highly unpopular provisions of Social Security law — the WEP (Windfall Elimination Provision) and GPO (Government Pension Offset). These provisions, enacted more than 40 years ago, prevent millions of public sector employees and their families from collecting Social Security benefits. The Social Security Fairness Act, introduced by Rep. Garrett Graves (R-LA) and Rep. Abigail Spanberger (D-VA), would revoke WEP and GPO if passed by the Senate and signed by the president.

NCPSSM has long supported repeal of these provisions and lauded the 327 to 75 House vote. Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare, said in a statement:

“Tuesday night’s House vote was a bipartisan victory for public sector employees and their families, who, like all Americans, deserve to collect the benefits they have earned. We urge the U.S. Senate to join the House in approving this bill”. – NCPSSM president and CEO Max Richtman, 11/12/24

In a statement released after their bill prevailed in the House, Reps. Spanberger and Graves referred to the WEP and GPO provisions as “theft” of public employees’ benefits:

“By passing the Social Security Fairness Act, a bipartisan majority of the U.S. House of Representatives showed up for the millions of Americans — police officers, teachers, firefighters, and other local and state public servants — who worked a second job to make ends meet or began a second career to support their families after retiring from public service. – Reps. Abigail Spanberger & Garrett Graves, 11/12/24

Though the bill provides welcome relief to public sector workers, it is not ‘paid for’; the bill includes no new revenue or cuts to cover the cost of expanding benefits. In 2022, Social Security’s chief actuary estimated that the Social Security Fairness act would cost the program some $146 billion. Meanwhile, the Congressional Budget Office analysis of the legislation projected that it would expedite the depletion of the Social Security trust fund reserves by a relatively negligible six months.

Hill-watchers say that the bill’s proponents are pushing Senate Majority Leader Charles Schumer to attach the legislation to a larger, must-pass bill. Proponents reportedly are hoping to avoid the Social Security Fairness Act coming to the Senate floor as a free-standing bill, as it then would be subject to (potentially harmful) amendments.

While NCPSSM endorses the bill, we support the more comprehensive Social Security improvements offered in Rep. John Larson’s Social Security 2100 Act, which includes repeal of WEP and GPO along with increased revenue to cover the costs.

Unions representing public sector employees – from teachers to firefighters – hailed the House passage of the Social Security Fairness Act as a major win for their members. International Association of Firefighters (IAFF) General President Edward A. Kelly said in a statement following the vote, “Now it’s time for Senators to step up and send this bill to the President’s desk.”

Watch Rep. Larson’s impassioned speech about his Social Security 2100 Act on the House floor earlier this week.

In Debate, Walz Reassures Seniors the Democratic Ticket Has Their Backs

The National Committee to Preserve Social Security and Medicare released this statement at the end of Tuesday’s vice presidential debate:::

Tim Walz was the only one in tonight’s vice presidential debate who sought to reassure older Americans about their health security and medical costs. He touted the Biden-Harris’ administration’s successes in reducing seniors’ prescription drug costs through the Inflation Reduction Act. He noted that the administration “negotiated drug prices with Medicare” for the first time in history.

J.D. Vance was silent on this issue, because Donald Trump has never seriously confronted Big Pharma on behalf of seniors or anyone else.

Walz reaffirmed that Kamala Harris will “protect and enhance” the Affordable Care Act (ACA), which benefits both near seniors and Medicare beneficiaries. He reminded the audience that Donald Trump tried to repeal the ACA and would have succeeded were it not for one no vote by Senator John McCain.

J.D. Vance defended Trump for having nothing but “concepts of a (health care) plan” — and tried to claim that the former president defended the Affordable Care Act when in truth he tried to rip health coverage from millions of Americans.

Little was said or asked about Social Security during the debate, but Vance did mention that his own grandmother benefited from Social Security. Unfortunately, his running mate, Donald Trump, cannot be trusted to preserve seniors’ earned benefits. He once called Social Security a “Ponzi Scheme”; he tried to cut Social Security as president; and earlier this year he said that he’s “open” to “cutting entitlements.”

Tim Walz truly understands the value of Social Security. He has talked about how Social Security kept his family out of poverty when his father passed away when Walz was 19 years old. He and Kamala Harris have consistently pledged to protect Social Security and Medicare from cuts.

The GOP vice presidential candidate did nothing to reassure seniors that a Trump-Vance administration will defend their financial and health security. The record, the facts, and the promises of the Democratic ticket reinforce that Kamala Harris and Tim Walz have the backs of everyday Americans, the middle class, and our nation’s roughly 60 million seniors. – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

Tester Opponent’s Ad Full of Falsehoods on Social Security

The campaign of Montana GOP Senate candidate Tim Sheehy stooped to new lows in a recent ad. In less than 30 seconds, the Koch-funded, billionaire-backed campaign unveiled a series of baseless claims about incumbent Senator Jon Tester’s record on Social Security. Terry Minnow, chair of the Montana seniors’ group Big Sky 55+, excoriated the Sheehy campaign in an open letter published in a local newspaper, demanding that the ad be taken off the air:

“The gross misrepresentations put forth in your ad play political games with (Montana seniors’) livelihoods and their sense of well-being. It is reckless and irresponsible to distress and scare Montanans with patently false information that will bring them anxiety, worry and sleepless nights.” – Terry Minnow, Chair, Big Sky 55+

Let’s take a closer look at the falsehoods in Sheehy’s ad, and where the two candidates really land on Social Security.

Falsehood #1: Jon Tester and other Democrats have “raided” the Social Security trust fund

There are no facts to back up this claim. The trust fund is invested in special U.S. Treasury notes which are repaid to Social Security with interest— just like other government bonds. The trust fund serves a designated purpose, and can only be used to pay for Social Security benefits and administrative costs. Contrary to the popular myth, no one is “raiding” the trust fund or “stealing” from it.

Falsehood #2: Jon Tester supported huge cuts to Social Security

Jon Tester has never supported “huge cuts” to Social Security. He earned a 100% rating on our legislative scorecard two congressional sessions in a row. Lawmakers only receive a 100% rating by consistently supporting Social Security. “I will always defend Medicare and Social Security with all I’ve got,” says Senator Tester. This is why we formally endorsed him in June.

Falsehood #3: Tim Sheehy opposes cuts to Social Security and Medicare

While Jon Tester has always opposed Republican proposals to “sunset” Social Security, Tim Sheehy can’t say the same. Sheehy told a conservative radio host that he agreed with a “mandatory sunset clause in every bill,” leaving Social Security benefits to the whims of politicians year after year. Sheehy, who was endorsed by Donald Trump, has shown he will align with the most extreme members of Congress. Florida Senator Rick Scott, the architect of a plan to sunset Social Security, has endorsed Sheehy and even spent time in Bozeman this summer speaking at his campaign events.

Sheehy has supported GOP efforts to make the Trump tax cuts permanent. This would add nearly $2 trillion to the federal debt. Some Republicans set their sights on Social Security and Medicare to make up the difference. Sheehy himself admits that making the Trump tax cuts permanent could jeopardize Social Security.

NCPSSM president Max Richtman endorses Jon Tester (R) and House candidate Monica Tranel (L) as seniors’ champions in Big Fork, MT

We are hopeful that Montana voters who care about Social Security will see through the falsehoods — and familiarize themselves with where the two candidates truly stand. This past June, NCPSSM President and CEO Max Richtman traveled to Big Fork, Montana to deliver our PAC’s endorsement of Senator Tester. The Senator has received similar endorsements from other seniors’ advocates as well, while Tim Sheehy peddles misinformation on these issues.

Check out this Facebook video from a real Montana Voter! It’s a lot more honest than Sheehy’s ad.