News and Updates

LOUISE OF “HARRY & LOUISE” ADS WARNS TRUMP PUTS

SOCIAL SECURITY, SENIORS AT RISK

The American actress is speaking out against President Trump’s handling of Social Security. In a new video released by the National Committee to Preserve Social Security and Medicare, Ms. Goddard — who appeared in a series of famous tv ads opposing the Clinton health care plan in the early 1990s — says Trump is endangering seniors’ earned benefits.

Can Trump or Biden fix Social Security?

Trump and Biden briefly talked Social Security during the debate — but they have more work to do.

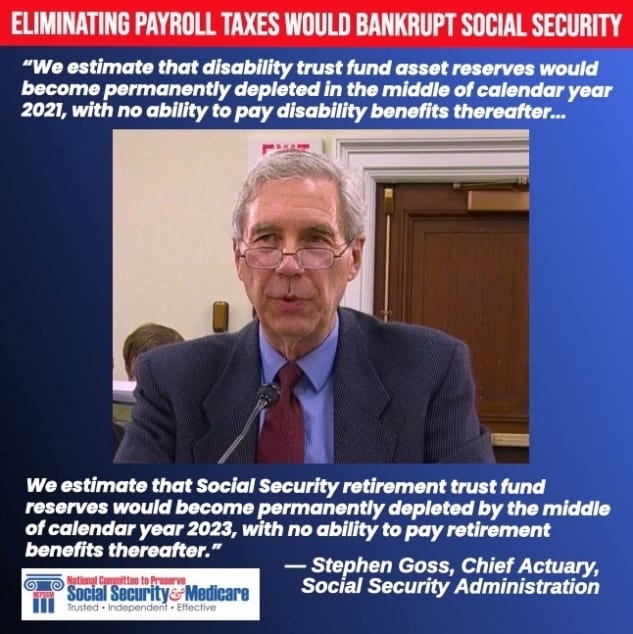

Trump can’t be trusted to protect Social Security

“A businessman capable of gross financial negligence would do the same thing to Social Security if given a second term in the White House… as he bankrupts the program and leaves working people and retirees out in the cold,” writes National Committee President Max Richtman in a new op-ed.