“Social Security was our lifeline” says Richmond Mayor at NCPSSM/AARP Town Hall

The importance of Social Security to the Black Community could not have been clearer in Richmond, VA on Tuesday — at the National Committee’s first town hall of a new public education campaign, “Social Security: Here Today, Here Tomorrow.” The town hall was sponsored by AARP Virginia.

Watch a recorded video stream of the entire Richmond event here.

Some 80 Richmond residents and AARP volunteers filled the Black History Museum & Cultural Center for an evening of Social Security-themed games and a public forum/Q&A. Representatives of the Social Security Administration (SSA) and the office of U.S. Rep. Rob Wittman were on hand to answer questions about attendees’ earned benefits.

The town hall was moderated by WTVR-TV (CBS 6) anchor, Reba Hollingsworth, with panelists including former Social Security Commissioner Carolyn Colvin, NCPSSM President & CEO Max Ricthman, and financial advisor Brandon Byerson.

Social Security Plinko — a fun way to learn about a program of special importance to Black Americans

Richmond Mayor Levar Stoney opened the public forum with an impassioned testimonial about being raised by his grandmother, who was a Social Security beneficiary. “Black individuals rely more on Social Security than other demographics, and my grandmother’s story is a great example of that,” Stoney said. “It truly was our lifeline.” Without Social Security, some 50% of Black Americans would be living in poverty.

Mayor Levar Stoney kicks-off the Richmond town hall, 6/27/23

Commissioner Colvin, who ran the Social Security program during the Obama administration, explained that Black workers especially depend on Social Security because of historically lower wages and dwindling employer-provided pensions. “If you’re dealing with struggling to put food on the table and pay your bills or to deal with health issues, you don’t have money to save towards your retirement,” Colvin said.

National Committee President Max Richtman focused on busting Social Security myths that can undermine public support for the program. “Social Security is not going bankrupt. It will be there for future generations if Congress takes responsible action. And politicians are not ‘stealing from Social Security,’ Richtman pointed out.

He also debunked conservative propaganda that Social Security is a bad deal for younger adults — not only because they will need their retirement benefits even more than current seniors do – but because the average 27 year-old with a spouse and two children already has more than $800,000 worth of insurance coverage from Social Security.

“People think of Social Security as only being for seniors, but let’s remember that it provides life, disability, spousal and survivor’s insurance for Americans of all ages — including millions of children,” said Richtman.

NCPSSM President Max Richtman & Fmr. Social Security Commissioner Carolyn Colvin

The “Social Security: Here Today, Here Tomorrow” campaign is focused on near retirees (people who are not yet eligible for Social Security but will be soon.) As the Richmond-Times Dispatch reported, attendee Michele Rodrigues came to the event to learn more about Social Security before she becomes eligible for benefits:::

Rodrigues got set back financially after losing her job. She said she wants to be ready for a decision on claiming Social Security before she turns 62, the earliest age one can collect retirement benefits. “It’s critical for my retirement,” Rodrigues said. – Gabriela DeCamargo Goncalves, Richmond Times Dispatch, 6/29/23

The public education campaign rolls onward with town halls this summer and early fall in Philadelphia, PA (7/26/23), Lansing, MI (8/28/23), Milwaukee, WI (September TBD), and Las Vegas, NV (October TBD). Visit www.socialsecurityheretoday.org for registration information. Those unable to attend the free town halls in person will be able to watch live video streams of the events.

“We look forward to taking the campaign to these other cities, spreading the word that Social Security is crucial for all Americans — and that it’s so important for workers to understand the program before they become eligible,” says Richtman. “Most of all, we want them to know that Social Security remains strong, and that with action from Congress to enhance the program’s finances and improve benefits, it definitely will be there for them when they need it.”

Watch the “Social Security: Here Today, Here Tomorrow” video here.

NCPSSM Launches New, National Social Security Campaign with AARP

The National Committee to Preserve Social Security and Medicare is launching a new public education campaign — sponsored by AARP — to correct misinformation about Social Security and emphasize the program’s value to American workers, especially to communities of color. The campaign, “Social Security: Here Today, Here Tomorrow,” will debunk myths and give workers the facts about their vital earned benefits. The campaign includes a series of public town halls across the U.S. between June and October, 2023, featuring prominent Social Security experts and advocates, Social Security officials, and financial advisors. The first town hall is Tuesday, June 27th, in Richmond, VA. The Richmond panel of experts includes former Acting Social Security Commissioner, Carolyn Colvin.

“There is a ‘doom and gloom’ narrative about Social Security today. ‘The program is going bankrupt.’ ‘It won’t be there for future generations.’ ‘Politicians are stealing from Social Security.’ None of that is true. We want the public to understand that Social Security is there for them today — and it will be there for them tomorrow. And not just in retirement, but in case of disability, the death of a family breadwinner, or the retirement of a spouse. That’s what this campaign is all about.” – Max Richtman, NCPSSM President and CEO

Social Security is a financial lifeline to millions of American seniors, but it is especially crucial to the Black community. Black Americans traditionally rely on Social Security for monthly income more than other groups do, due to wage and job discrimination, diminishing employer-provided pensions, and challenges in saving for retirement.

“Like all Americans, the Black community pays into Social Security with every paycheck — and deserves to know that the government will keep its promise to provide baseline financial security when they encounter what President Franklin Roosevelt called ‘the hazards and vicissitudes’ of life.” – Max Richtman

At the “Social Security: Here Today, Here Tomorrow” town halls, attendees will enjoy themed games and refreshments, followed by a panel discussion with national and local experts, including Q&A. Representatives of the Social Security Administration and/or congressional district offices have been invited to answer attendees’ questions about their own Social Security benefits.

Here is a schedule of the town halls. Admission is free. Reservations are required.

Richmond, VA, June 27, 2023 at the Black History & Cultural Center of Virginia

Philadelphia, PA, July 26, 2023 at Center In The Park

Lansing, MI, August 28, 2023 at AARP Michigan Office (To be televised later on WLAJ-TV/ABC)

Milwaukee, WI, September, 2023 (date & location TBA)

Las Vegas, NV, October, 2023 (date & location TBA)\

You can watch s a 2-minute video about the campaign here.

For more information, visit the campaign website, www.socialsecurityheretoday.org.

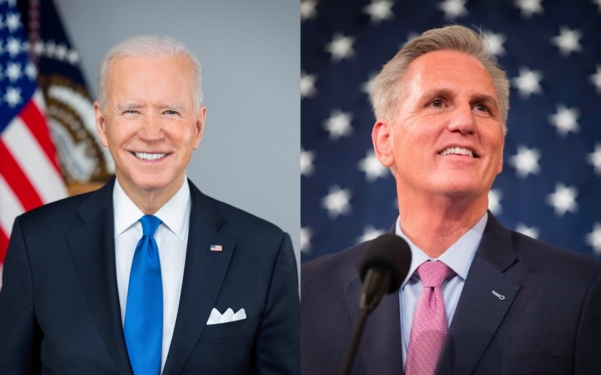

Biden-McCarthy Debt Ceiling Deal Averts Disruption of Social Security, Medicare

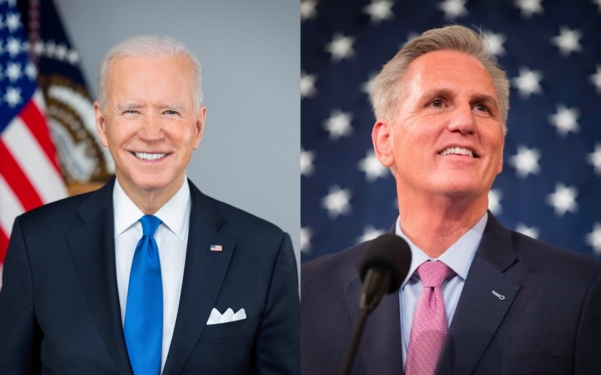

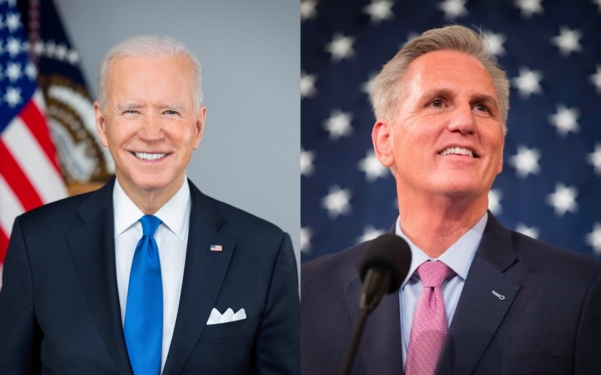

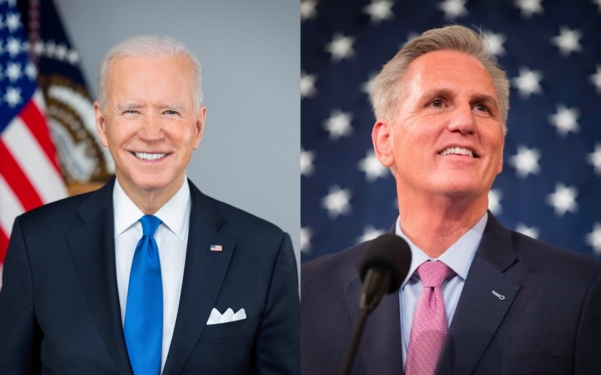

Amid all the static surrounding the debt ceiling deal that President Biden and Speaker McCarthy struck over the weekend, this much is certain: the deal is better for American seniors than a federal default. “The agreement represents a compromise, which means no one got everything they wanted,” said President Biden on Monday. “But that’s the responsibility of governing.” Many observers feel that the President and his party — and the American people — came out ahead.

“(The debt ceiling deal is) a win for Democrats, who sought to avoid having another debt limit showdown ahead of next year’s election. And they protected many programs that Republicans sought to slash.” – The Hill, 5/28/23

“Based on what we’ve learned about the Biden-McCarthy agreement so far, it looks to me as though Republicans got relatively less of what they wanted, while Democrats got relatively more.” – Eugene Robinson, Washington Post, 5/29/23

The alternative to this deal, a default on U.S. government debts, would not only have caused economic catastrophe; it would have disrupted the Social Security payments that millions of American seniors rely on to cover basic living expenses. Medicare payments likely also would be impacted by a default.

The deal’s 2-year freeze on “non-defense discretionary spending” may affect the Social Security Administration’s (SSA) operating budget, though the exact impact isn’t yet clear. SSA has been chronically underfunded since the Tea Party-fomented fiscal crisis in 2011. The spending cap in this deal means that SSA won’t have the funds needed to improve customer service. However, the deal will have nowhere near the devastating impact of the 23% across-the-board spending cuts in the House GOP’s original debt ceiling bill. The same holds true for Older Americans Act programs (including nutrition and home heating assistance), which could have been slashed by the Republicans’ House-passed legislation.

“President Joe Biden has saved us from the political terrorism of MAGAnomics with… (a) debt ceiling deal that must be passed. House Speaker Kevin McCarthy, who was willing to sacrifice education, veterans benefits, and public safety in the interest of his own power, now has the onus to secure support for this deal from his caucus.” – Center for American Progress, 5/27/23

McCarthy has begun trying to whip his caucus to support the bill in the face of opposition from the party’s extreme MAGA wing. On Tuesday afternoon, the blow-it-all-up House Freedom Caucus declared its opposition to the deal, preferring to see the country edge perilously closer to default instead. It was this same Freedom Caucus crowd that insisted McCarthy refuse to bring a clean debt limit bill to the floor in the first place — in exchange for their support during his campaign to become Speaker.

Progressive Democrats in the House expressed concerns about the deal, largely centering on work requirements for federal food assistance (SNAP) beneficiaries aged 50-54 with no legal dependents. (The SNAP work requirement in the deal would sunset in 2030.) The deal includes new work requirement exemptions for SNAP recipients who are homeless or veterans.

The Democratic leadership in the House expects Speaker McCarthy to produce as many Republican votes in favor of the deal as he can, with Democrats presumably filling in the necessary votes to pass a bill. The odds of the deal passing the House depends on how many Democratic Progressives and House Freedom Caucus members vote against the compromise.

At the end of last week, Treasury Secretary Janet Yellen warned that, without Congressional action to raise the debt ceiling, the nation would run out of money to pay its bills on time by June 5. That gives lawmakers only a handful of legislative days to enact the Biden-McCarthy deal. “We strongly encourage both chambers (of Congress) to enact the deal and send it to the President’s desk,” said OMB Director Shalanda Young at a press conference late Tuesday afternoon.

Default Could Be Devastating to Seniors on Fixed Incomes

As the country nears a projected federal default date as early as June 1, experts and advocates are warning that seniors’ benefits could be in jeopardy. A default would mean that the government will not be able to meet its financial obligations, resulting in delays for vital programs like Social Security and Medicare.

Here’s what Rae Hartley Beck of Forbes had to say on Monday:

“It’s never a good thing when politicians use the full faith and credit of the United States as a bargaining chip. But for the one in five Americans who receive a monthly check from Social Security, the current political standoff in our nation’s capital is nothing short of ominous.” – Rae Hartley Beck, Forbes, 5/15/23

The pressure on House Republicans and the Biden White House to reach a deal has never been higher. Social Security expert Alicia Munnell weighed in on the subject in MarketWatch:

“The fact that some 13 million people have virtually no other source of income, a body of research suggests that timing is very important for cash strapped low-income households.” – attribution, Alicia Munnell, Center for Retirement Research at Boston University, 5/15/23

The National Committee to Preserve Social Security and Medicare has been issuing similar warnings for seniors to prepare for the worst, ever since Speaker McCarthy began a dangerous game of “chicken” by threatening not to lift the debt ceiling without massive concessions on spending.

Our director of government relations and policy, Dan Adcock, told NBC News:

“Seniors should be prepared if they’re financially able… so they have enough to tide them over. But millions of beneficiaries have no financial room to maneuver” – Dan Adcock to NBC News, 5/13/23

Adcock noted that about 40% of Social Security recipients, which include Americans who are disabled and those who are widowed, receive 90% of their income from Social Security. That equates to nearly 27 million people.

Meanwhile, our senior financial security expert, Maria Freese also warned CNBC, “With a default, there may be no money to send Social Security checks out.”

Mary Johnson, policy analyst with the Senior Citizens League, a nonpartisan advocacy group, said to NBC News, “the longer we wait and get close to default, the greater the risk to Social Security benefits being held up and delayed, or not paid in full.”

The National Committee has laid the blame for the debt crisis squarely on House Republicans’ shoulders. Not only would a default be disastrous for seniors on fixed incomes; McCarthy’s debt ceiling bill would slash funding for the Social Security Administration and several programs under the Older Americans Act that disadvantaged seniors rely on every day.

Our president and CEO Max Richtman sent a letter to Congress detailing the impacts of the House GOP bill on seniors:

“Speaker McCarthy’s debt ceiling bill would result in dramatic cuts to a wide range of programs essential to the health and well-being of our nation’s seniors.” – NCPSSM President Max Richtman, letter to U.S. Congress, 4/25/23

The impasse hangs politics over the heads of 65 million Americans who receive benefits through the Social Security program and the 63 million beneficiaries who receive health care through Medicare. The most vulnerable of America’s seniors are facing the most risk at an unprecedented scale.

The National Committee to Preserve Social Security and Medicare stands with President Biden in his willingness to discuss the budget and deficits with Republicans, but we also support his strong opposition to the GOP holding the economy (and seniors’ earned benefits) hostage.

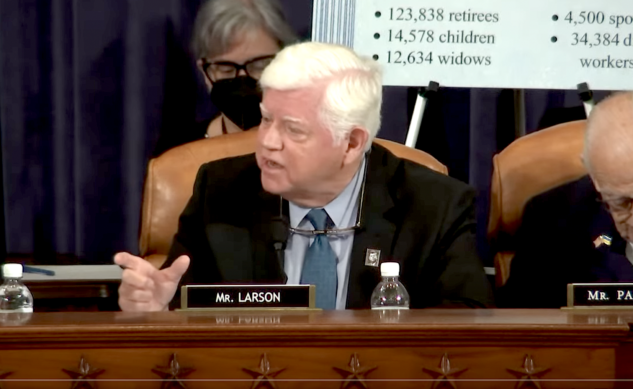

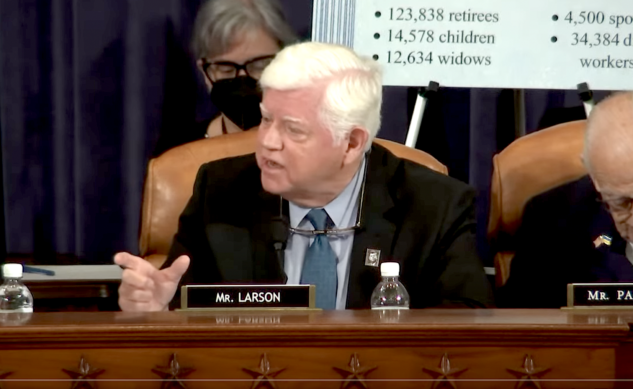

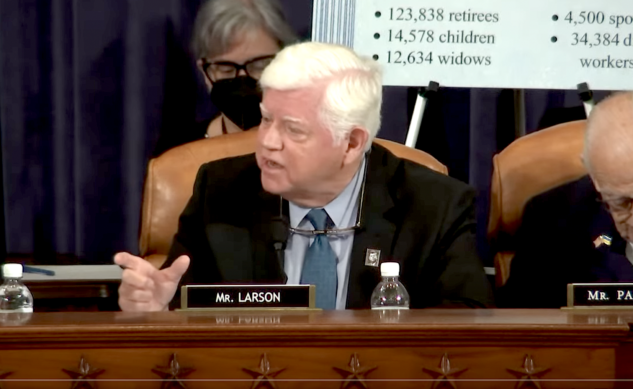

Democrats Push for Strengthening Social Security in First Hearing of New Congress

The first hearing of the new Congress on Social Security saw Republicans claiming that they simply want information about the program’s status, while Democrats insisted that it’s time to boost Social Security — and pushed back on GOP proposals to cut benefits.

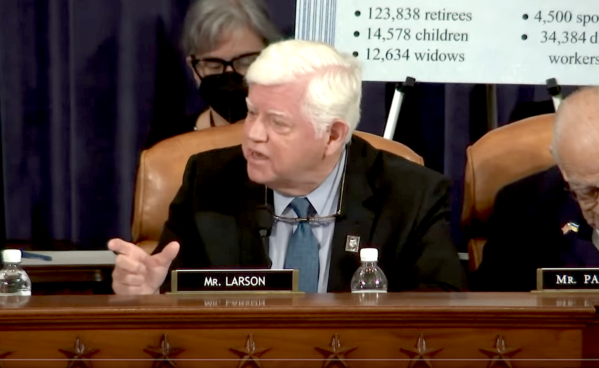

“Today, we are faced with the fierce urgency of now. Five million Americans receive below-poverty level (Social Security) checks from their government because Congress has not enhanced benefits in more than 50 years,” said Rep. John Larson (D-CT), ranking member and former chairman of the House Ways and Means Social Security Subcommittee. “We need to protect and enhance this vital program, not cut it!”

In written testimony, NCPSSM President and CEO Max Richtman reminded subcommittee members that “Social Security is more than just a safety net program. It is an earned benefit that provides families with insurance to help cover the loss of income if their primary breadwinner dies, becomes disabled or retires.”

The subcommittee, chaired by Rep. Drew Ferguson (R-GA), heard from three expert witnesses: Stephen Goss (Chief Actuary at the Social Security Administration); Barry Huston (Analyst at the Congressional Research Service); and Dr. Phillip Swagel (Director of the Congressional Budget Office). Republicans pressed each witness for demographic and financial data about Social Security in the wake of the latest Trustees report projecting that the program’s combined trust fund will become depleted in 2034, absent Congressional action.

In his testimony, Chief Actuary Goss pointed out that the depletion date hasn’t really fluctuated much in the past decade or so. “The projected date has been 2033 to 2035 for the past twelve years,” he said. “We’re simply getting closer to the date.”

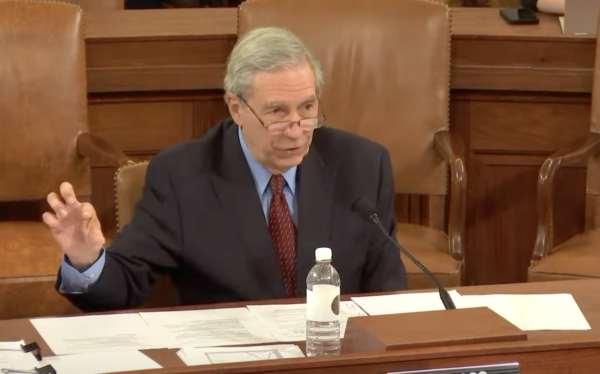

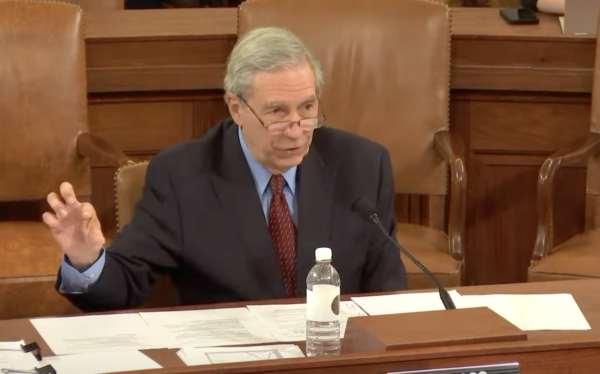

Chief Actuary Stephen Goss says trust fund insolvency date hasn’t really changed much in 12 years

Congressional Republicans have seized on the trust fund’s insolvency date to advocate “reforms” to Social Security that ultimately would cut benefits – including raising the retirement age to 70, means testing, and adopting a more miserly COLA formula.

“The House Republican Study Committee proposed to raise the retirement age to 70 years old, reduce benefits for anyone earning over $60,000 a year, and privatize Social Security,” said Rep. Linda Sanchez (D-CA). She accused Republicans of “trying to cut hard-earned benefits for working class families” and labeled GOP proposals for Social Security “reheated leftovers that keep making their way to the table.”

Subcommittee member Rep. Bill Pascrell (D-NJ) criticized Republican Senator Ron Johnson (R-WI) for calling Social Security a “Ponzi scheme.” The congressman offered a passionate defense of Social Security, saying that the program “has kept the American dream within sight for generations of families. And we know there are a lot of families who subsist on Social Security alone.”

Chairman Ferguson offered Rep. Pascrell the assurance that “the Senator from Wisconsin (Ron Johnson) will not be taking a vote on this subcommittee.” He promised that Republicans seek a “bipartisan approach,” adding, “I would like to put your minds at ease: you won’t have to worry about voting on the Republican Study Committee plan on this subcommittee.”

Democrats, including Rep. Larson in the House and Bernie Sanders in the Senate, have offered legislation to strengthen Social Security’s finances and expand benefits – by asking the wealthy to contribute their fair share. Both Larson’s and Sanders’ bills would adjust the payroll wage cap to raise more revenue from high income earners. Under current law, wages above $160,200 are not subject to Social Security taxes.

Rep. Linda Sanchez: GOP proposals are “reheated leftovers that keep making their way to the table.”

Chief Actuary Goss’ testimony seemed to bolster the case for raising the payroll wage cap. He said that the percentage of wages captured by the payroll tax dropped from 90% in the early 80s to roughly 82% by the year 2000, “knocking down revenue we would have been getting.” Goss attributed this gap to rising income inequality, with those near or above the “payroll tax maximum” earning increasingly higher wages during the past four decades than those below.

With nearly half of retirees depending on Social Security for all of their income, and many teetering on the brink of poverty even with their monthly benefit checks, the stakes could not be higher. “Social Security is a promise,” said Rep. Pascrell. “So, whatever changes we’re going to make, we better get it right.”

**** Watch the full Social Security Subcommittee hearing here ****

“Social Security was our lifeline” says Richmond Mayor at NCPSSM/AARP Town Hall

The importance of Social Security to the Black Community could not have been clearer in Richmond, VA on Tuesday — at the National Committee’s first town hall of a new public education campaign, “Social Security: Here Today, Here Tomorrow.” The town hall was sponsored by AARP Virginia.

Watch a recorded video stream of the entire Richmond event here.

Some 80 Richmond residents and AARP volunteers filled the Black History Museum & Cultural Center for an evening of Social Security-themed games and a public forum/Q&A. Representatives of the Social Security Administration (SSA) and the office of U.S. Rep. Rob Wittman were on hand to answer questions about attendees’ earned benefits.

The town hall was moderated by WTVR-TV (CBS 6) anchor, Reba Hollingsworth, with panelists including former Social Security Commissioner Carolyn Colvin, NCPSSM President & CEO Max Ricthman, and financial advisor Brandon Byerson.

Social Security Plinko — a fun way to learn about a program of special importance to Black Americans

Richmond Mayor Levar Stoney opened the public forum with an impassioned testimonial about being raised by his grandmother, who was a Social Security beneficiary. “Black individuals rely more on Social Security than other demographics, and my grandmother’s story is a great example of that,” Stoney said. “It truly was our lifeline.” Without Social Security, some 50% of Black Americans would be living in poverty.

Mayor Levar Stoney kicks-off the Richmond town hall, 6/27/23

Commissioner Colvin, who ran the Social Security program during the Obama administration, explained that Black workers especially depend on Social Security because of historically lower wages and dwindling employer-provided pensions. “If you’re dealing with struggling to put food on the table and pay your bills or to deal with health issues, you don’t have money to save towards your retirement,” Colvin said.

National Committee President Max Richtman focused on busting Social Security myths that can undermine public support for the program. “Social Security is not going bankrupt. It will be there for future generations if Congress takes responsible action. And politicians are not ‘stealing from Social Security,’ Richtman pointed out.

He also debunked conservative propaganda that Social Security is a bad deal for younger adults — not only because they will need their retirement benefits even more than current seniors do – but because the average 27 year-old with a spouse and two children already has more than $800,000 worth of insurance coverage from Social Security.

“People think of Social Security as only being for seniors, but let’s remember that it provides life, disability, spousal and survivor’s insurance for Americans of all ages — including millions of children,” said Richtman.

NCPSSM President Max Richtman & Fmr. Social Security Commissioner Carolyn Colvin

The “Social Security: Here Today, Here Tomorrow” campaign is focused on near retirees (people who are not yet eligible for Social Security but will be soon.) As the Richmond-Times Dispatch reported, attendee Michele Rodrigues came to the event to learn more about Social Security before she becomes eligible for benefits:::

Rodrigues got set back financially after losing her job. She said she wants to be ready for a decision on claiming Social Security before she turns 62, the earliest age one can collect retirement benefits. “It’s critical for my retirement,” Rodrigues said. – Gabriela DeCamargo Goncalves, Richmond Times Dispatch, 6/29/23

The public education campaign rolls onward with town halls this summer and early fall in Philadelphia, PA (7/26/23), Lansing, MI (8/28/23), Milwaukee, WI (September TBD), and Las Vegas, NV (October TBD). Visit www.socialsecurityheretoday.org for registration information. Those unable to attend the free town halls in person will be able to watch live video streams of the events.

“We look forward to taking the campaign to these other cities, spreading the word that Social Security is crucial for all Americans — and that it’s so important for workers to understand the program before they become eligible,” says Richtman. “Most of all, we want them to know that Social Security remains strong, and that with action from Congress to enhance the program’s finances and improve benefits, it definitely will be there for them when they need it.”

Watch the “Social Security: Here Today, Here Tomorrow” video here.

NCPSSM Launches New, National Social Security Campaign with AARP

The National Committee to Preserve Social Security and Medicare is launching a new public education campaign — sponsored by AARP — to correct misinformation about Social Security and emphasize the program’s value to American workers, especially to communities of color. The campaign, “Social Security: Here Today, Here Tomorrow,” will debunk myths and give workers the facts about their vital earned benefits. The campaign includes a series of public town halls across the U.S. between June and October, 2023, featuring prominent Social Security experts and advocates, Social Security officials, and financial advisors. The first town hall is Tuesday, June 27th, in Richmond, VA. The Richmond panel of experts includes former Acting Social Security Commissioner, Carolyn Colvin.

“There is a ‘doom and gloom’ narrative about Social Security today. ‘The program is going bankrupt.’ ‘It won’t be there for future generations.’ ‘Politicians are stealing from Social Security.’ None of that is true. We want the public to understand that Social Security is there for them today — and it will be there for them tomorrow. And not just in retirement, but in case of disability, the death of a family breadwinner, or the retirement of a spouse. That’s what this campaign is all about.” – Max Richtman, NCPSSM President and CEO

Social Security is a financial lifeline to millions of American seniors, but it is especially crucial to the Black community. Black Americans traditionally rely on Social Security for monthly income more than other groups do, due to wage and job discrimination, diminishing employer-provided pensions, and challenges in saving for retirement.

“Like all Americans, the Black community pays into Social Security with every paycheck — and deserves to know that the government will keep its promise to provide baseline financial security when they encounter what President Franklin Roosevelt called ‘the hazards and vicissitudes’ of life.” – Max Richtman

At the “Social Security: Here Today, Here Tomorrow” town halls, attendees will enjoy themed games and refreshments, followed by a panel discussion with national and local experts, including Q&A. Representatives of the Social Security Administration and/or congressional district offices have been invited to answer attendees’ questions about their own Social Security benefits.

Here is a schedule of the town halls. Admission is free. Reservations are required.

Richmond, VA, June 27, 2023 at the Black History & Cultural Center of Virginia

Philadelphia, PA, July 26, 2023 at Center In The Park

Lansing, MI, August 28, 2023 at AARP Michigan Office (To be televised later on WLAJ-TV/ABC)

Milwaukee, WI, September, 2023 (date & location TBA)

Las Vegas, NV, October, 2023 (date & location TBA)\

You can watch s a 2-minute video about the campaign here.

For more information, visit the campaign website, www.socialsecurityheretoday.org.

Biden-McCarthy Debt Ceiling Deal Averts Disruption of Social Security, Medicare

Amid all the static surrounding the debt ceiling deal that President Biden and Speaker McCarthy struck over the weekend, this much is certain: the deal is better for American seniors than a federal default. “The agreement represents a compromise, which means no one got everything they wanted,” said President Biden on Monday. “But that’s the responsibility of governing.” Many observers feel that the President and his party — and the American people — came out ahead.

“(The debt ceiling deal is) a win for Democrats, who sought to avoid having another debt limit showdown ahead of next year’s election. And they protected many programs that Republicans sought to slash.” – The Hill, 5/28/23

“Based on what we’ve learned about the Biden-McCarthy agreement so far, it looks to me as though Republicans got relatively less of what they wanted, while Democrats got relatively more.” – Eugene Robinson, Washington Post, 5/29/23

The alternative to this deal, a default on U.S. government debts, would not only have caused economic catastrophe; it would have disrupted the Social Security payments that millions of American seniors rely on to cover basic living expenses. Medicare payments likely also would be impacted by a default.

The deal’s 2-year freeze on “non-defense discretionary spending” may affect the Social Security Administration’s (SSA) operating budget, though the exact impact isn’t yet clear. SSA has been chronically underfunded since the Tea Party-fomented fiscal crisis in 2011. The spending cap in this deal means that SSA won’t have the funds needed to improve customer service. However, the deal will have nowhere near the devastating impact of the 23% across-the-board spending cuts in the House GOP’s original debt ceiling bill. The same holds true for Older Americans Act programs (including nutrition and home heating assistance), which could have been slashed by the Republicans’ House-passed legislation.

“President Joe Biden has saved us from the political terrorism of MAGAnomics with… (a) debt ceiling deal that must be passed. House Speaker Kevin McCarthy, who was willing to sacrifice education, veterans benefits, and public safety in the interest of his own power, now has the onus to secure support for this deal from his caucus.” – Center for American Progress, 5/27/23

McCarthy has begun trying to whip his caucus to support the bill in the face of opposition from the party’s extreme MAGA wing. On Tuesday afternoon, the blow-it-all-up House Freedom Caucus declared its opposition to the deal, preferring to see the country edge perilously closer to default instead. It was this same Freedom Caucus crowd that insisted McCarthy refuse to bring a clean debt limit bill to the floor in the first place — in exchange for their support during his campaign to become Speaker.

Progressive Democrats in the House expressed concerns about the deal, largely centering on work requirements for federal food assistance (SNAP) beneficiaries aged 50-54 with no legal dependents. (The SNAP work requirement in the deal would sunset in 2030.) The deal includes new work requirement exemptions for SNAP recipients who are homeless or veterans.

The Democratic leadership in the House expects Speaker McCarthy to produce as many Republican votes in favor of the deal as he can, with Democrats presumably filling in the necessary votes to pass a bill. The odds of the deal passing the House depends on how many Democratic Progressives and House Freedom Caucus members vote against the compromise.

At the end of last week, Treasury Secretary Janet Yellen warned that, without Congressional action to raise the debt ceiling, the nation would run out of money to pay its bills on time by June 5. That gives lawmakers only a handful of legislative days to enact the Biden-McCarthy deal. “We strongly encourage both chambers (of Congress) to enact the deal and send it to the President’s desk,” said OMB Director Shalanda Young at a press conference late Tuesday afternoon.

Default Could Be Devastating to Seniors on Fixed Incomes

As the country nears a projected federal default date as early as June 1, experts and advocates are warning that seniors’ benefits could be in jeopardy. A default would mean that the government will not be able to meet its financial obligations, resulting in delays for vital programs like Social Security and Medicare.

Here’s what Rae Hartley Beck of Forbes had to say on Monday:

“It’s never a good thing when politicians use the full faith and credit of the United States as a bargaining chip. But for the one in five Americans who receive a monthly check from Social Security, the current political standoff in our nation’s capital is nothing short of ominous.” – Rae Hartley Beck, Forbes, 5/15/23

The pressure on House Republicans and the Biden White House to reach a deal has never been higher. Social Security expert Alicia Munnell weighed in on the subject in MarketWatch:

“The fact that some 13 million people have virtually no other source of income, a body of research suggests that timing is very important for cash strapped low-income households.” – attribution, Alicia Munnell, Center for Retirement Research at Boston University, 5/15/23

The National Committee to Preserve Social Security and Medicare has been issuing similar warnings for seniors to prepare for the worst, ever since Speaker McCarthy began a dangerous game of “chicken” by threatening not to lift the debt ceiling without massive concessions on spending.

Our director of government relations and policy, Dan Adcock, told NBC News:

“Seniors should be prepared if they’re financially able… so they have enough to tide them over. But millions of beneficiaries have no financial room to maneuver” – Dan Adcock to NBC News, 5/13/23

Adcock noted that about 40% of Social Security recipients, which include Americans who are disabled and those who are widowed, receive 90% of their income from Social Security. That equates to nearly 27 million people.

Meanwhile, our senior financial security expert, Maria Freese also warned CNBC, “With a default, there may be no money to send Social Security checks out.”

Mary Johnson, policy analyst with the Senior Citizens League, a nonpartisan advocacy group, said to NBC News, “the longer we wait and get close to default, the greater the risk to Social Security benefits being held up and delayed, or not paid in full.”

The National Committee has laid the blame for the debt crisis squarely on House Republicans’ shoulders. Not only would a default be disastrous for seniors on fixed incomes; McCarthy’s debt ceiling bill would slash funding for the Social Security Administration and several programs under the Older Americans Act that disadvantaged seniors rely on every day.

Our president and CEO Max Richtman sent a letter to Congress detailing the impacts of the House GOP bill on seniors:

“Speaker McCarthy’s debt ceiling bill would result in dramatic cuts to a wide range of programs essential to the health and well-being of our nation’s seniors.” – NCPSSM President Max Richtman, letter to U.S. Congress, 4/25/23

The impasse hangs politics over the heads of 65 million Americans who receive benefits through the Social Security program and the 63 million beneficiaries who receive health care through Medicare. The most vulnerable of America’s seniors are facing the most risk at an unprecedented scale.

The National Committee to Preserve Social Security and Medicare stands with President Biden in his willingness to discuss the budget and deficits with Republicans, but we also support his strong opposition to the GOP holding the economy (and seniors’ earned benefits) hostage.

Democrats Push for Strengthening Social Security in First Hearing of New Congress

The first hearing of the new Congress on Social Security saw Republicans claiming that they simply want information about the program’s status, while Democrats insisted that it’s time to boost Social Security — and pushed back on GOP proposals to cut benefits.

“Today, we are faced with the fierce urgency of now. Five million Americans receive below-poverty level (Social Security) checks from their government because Congress has not enhanced benefits in more than 50 years,” said Rep. John Larson (D-CT), ranking member and former chairman of the House Ways and Means Social Security Subcommittee. “We need to protect and enhance this vital program, not cut it!”

In written testimony, NCPSSM President and CEO Max Richtman reminded subcommittee members that “Social Security is more than just a safety net program. It is an earned benefit that provides families with insurance to help cover the loss of income if their primary breadwinner dies, becomes disabled or retires.”

The subcommittee, chaired by Rep. Drew Ferguson (R-GA), heard from three expert witnesses: Stephen Goss (Chief Actuary at the Social Security Administration); Barry Huston (Analyst at the Congressional Research Service); and Dr. Phillip Swagel (Director of the Congressional Budget Office). Republicans pressed each witness for demographic and financial data about Social Security in the wake of the latest Trustees report projecting that the program’s combined trust fund will become depleted in 2034, absent Congressional action.

In his testimony, Chief Actuary Goss pointed out that the depletion date hasn’t really fluctuated much in the past decade or so. “The projected date has been 2033 to 2035 for the past twelve years,” he said. “We’re simply getting closer to the date.”

Chief Actuary Stephen Goss says trust fund insolvency date hasn’t really changed much in 12 years

Congressional Republicans have seized on the trust fund’s insolvency date to advocate “reforms” to Social Security that ultimately would cut benefits – including raising the retirement age to 70, means testing, and adopting a more miserly COLA formula.

“The House Republican Study Committee proposed to raise the retirement age to 70 years old, reduce benefits for anyone earning over $60,000 a year, and privatize Social Security,” said Rep. Linda Sanchez (D-CA). She accused Republicans of “trying to cut hard-earned benefits for working class families” and labeled GOP proposals for Social Security “reheated leftovers that keep making their way to the table.”

Subcommittee member Rep. Bill Pascrell (D-NJ) criticized Republican Senator Ron Johnson (R-WI) for calling Social Security a “Ponzi scheme.” The congressman offered a passionate defense of Social Security, saying that the program “has kept the American dream within sight for generations of families. And we know there are a lot of families who subsist on Social Security alone.”

Chairman Ferguson offered Rep. Pascrell the assurance that “the Senator from Wisconsin (Ron Johnson) will not be taking a vote on this subcommittee.” He promised that Republicans seek a “bipartisan approach,” adding, “I would like to put your minds at ease: you won’t have to worry about voting on the Republican Study Committee plan on this subcommittee.”

Democrats, including Rep. Larson in the House and Bernie Sanders in the Senate, have offered legislation to strengthen Social Security’s finances and expand benefits – by asking the wealthy to contribute their fair share. Both Larson’s and Sanders’ bills would adjust the payroll wage cap to raise more revenue from high income earners. Under current law, wages above $160,200 are not subject to Social Security taxes.

Rep. Linda Sanchez: GOP proposals are “reheated leftovers that keep making their way to the table.”

Chief Actuary Goss’ testimony seemed to bolster the case for raising the payroll wage cap. He said that the percentage of wages captured by the payroll tax dropped from 90% in the early 80s to roughly 82% by the year 2000, “knocking down revenue we would have been getting.” Goss attributed this gap to rising income inequality, with those near or above the “payroll tax maximum” earning increasingly higher wages during the past four decades than those below.

With nearly half of retirees depending on Social Security for all of their income, and many teetering on the brink of poverty even with their monthly benefit checks, the stakes could not be higher. “Social Security is a promise,” said Rep. Pascrell. “So, whatever changes we’re going to make, we better get it right.”

**** Watch the full Social Security Subcommittee hearing here ****