Why GOP Medicaid Work Requirements Are Such an Awful Idea

The House Republicans’ debt ceiling bill includes drastic cuts to federal programs that seniors and other vulnerable Americans rely on. But it also imposes work requirements on lower income people who receive health coverage through Medicaid. Under the GOP plan, Medicaid patients would have to work at least 80 hours per month or lose their coverage. We spoke to the National Committee’s senior health policy expert, Anne Montgomery, about why this is such a bad idea.

Q: Why is imposing work requirements on Medicaid patients such a harmful idea?

Q: Why is imposing work requirements on Medicaid patients such a harmful idea?

A: It’s harmful because regardless of whether or not you’re working, everyone needs ongoing access to health care. Medicaid is a health insurance program for lower-income Americans, not a work program. It makes no sense to deny medical coverage to people by requiring them to prove to state bureaucrats that they are working. If you need care, you should be able to get it. To condition one upon the other makes no sense.

Q: Why shouldn’t Medicaid beneficiaries have to work in order to keep their benefits?

A: There are many people who may not be able to work due to chronic health conditions or disabilities. Or they may be taking care of loved ones who are sick. There are others who, because of the ‘gig economy,’ may be in and out of work and have trouble finding steady employment. Turnover is particularly high (and work hours inconsistent) in the service and retail sectors. Under the Republican proposal, if you don’t have consistent work, you may lose your health coverage.

Q: Couldn’t some of these workers simply apply for disability insurance?

A: It’s not as simple as snapping your fingers, and you’re on disability. First of all, only 40% of people who apply for Social Security Disability Insurance (SSDI) actually are approved for benefits. Secondly, why would you want people to go onto disability insurance if the aim is to encourage work?

Q: With these work requirements comes a lot of new ‘red tape.’ How might this be an obstacle to people trying to keep their Medicaid coverage?

A: Yes. Not only would you have to be working – or find work – in order to keep your health coverage, you would have to meet strict documentation requirements, which involves additional red tape and paperwork. In pilot programs for Medicaid work requirements, people have lost coverage because of confusion rather than not working. Medicaid beneficiaries should work when they can, but we shouldn’t yank their health care from under them if they can’t work at a particular time.

Q: Would Medicaid work requirements seriously increase the number of Americans working?

There is no evidence that Medicaid work requirements actually would boost employment. In states which have experimented with work requirements, that certainly isn’t the case. In Arkansas, for instance, 17,000 patients lost Medicaid coverage for failing to meet the requirements. An analysis found that “Medicaid beneficiaries had not started working more or earning more money as a result of the policy.”

Q: What is the real agenda behind Medicaid work requirements?

Conservatives have long opposed Medicaid as “just another welfare program” and a “waste of taxpayer dollars,” while in reality it is a crucial part of our health care system that pays for coverage for tens of millions of lower-income Americans — and the hospitals, doctors and nursing homes who care for them. In fact, according to the Centers for Medicare and Medicaid (CMS), more than 92 million Americans were enrolled in Medicaid and CHIP (in the 50 states and the District of Columbia that reported enrollment data for December 2022). The GOP was especially upset by Medicaid expansion under the Affordable Care Act (though many red states now have expanded their Medicaid programs under the ACA). Imposing work requirements is a way to drastically reduce the number of Americans on Medicaid rolls, with no regard for the impact on patients’ health.

Q: The Republicans’ work requirement proposals come at a particularly fraught time, as federal COVID emergency measures come to an end, right?

A: That’s right. Under the Public Health Emergency (PHE) state Medicaid programs were required to keep people continuously enrolled in exchange for additional federal funding. With the PHE phaseout that begin this month, millions of Americans will now have to go through a “redetermination” of their eligibility for Medicaid coverage for the first time in 3 years. Imposing work requirements at the same time that many are already losing access to Medicaid coverage is punitive and unnecessary. Republicans are effectively using this process as an opening to slash federal spending on a constituency that they believe doesn’t have a lot of political power.

Ohio Forum Focuses on Cutting Vs. Expanding Social Security

National Committee president and CEO Max Richtman brought the organization’s message of expanding and strengthening Social Security to Ohio today. He participated in a forum in Sandusky, OH, co-sponsored by the local nonprofit, Serving Our Seniors. The forum, entitled, The Future of Social Security Retirement Income, was attended by more than two hundred citizens, mostly seniors who are already collecting benefits. [WATCH THE FORUM HERE.]

Richtman appeared alongside Rep. Marcy Kaptur (D-OH), a champion for seniors who represents the Sandusky area in the U.S. Congress. (Rep. Kaptur earned 100% on the National Committee’s most recent legislative scorecard.) The forum was moderated by Sue Daugherty, executive director of Serving Our Seniors, and also included a representative of the conservative/libertarian Cato institute, Romina Boccia. According to the site, Influence Watch, the Cato Institute “has received funding from a number of right-of-center organizations, including the Charles G. Koch Charitable Foundation.”

“This forum isn’t about politics of it. It’s all about informing all of us of the realities of it. How will we, as a nation, sustain these important programs? That’s the big question and our panel crosses across the spectrum of politics.” – Sue Daugherty, moderator and CEO, Serving Our Seniors

The forum featured lively exchanges between audience members and panelists, with Richtman advocating for revenue-side solutions to Social Security’s financial challenges. (The combined trust fund is projected to become depleted in 2034, absent Congressional action.)

Boccia urged the kind of reform championed by conservatives, including reducing benefits for future generations of retirees, at least partially privatizing the program, and the creation of a special commission to propose Social Security reforms (presumably along the lines of the Simpson-Bowles commission in the 2010s). That commission’s recommendations, including some benefit cuts, were never adopted.

Richtman made clear NCPSSM’s opposition to the kinds of solutions offered by Boccia, especially benefit cuts for future retirees, who will rely on Social Security even more than today’s seniors do.

“Our message is that Congress needs to act. If there’s no action, that’s not acceptable because there would be automatic cuts in 2034. What we favor is bringing more revenue by having the wealthy begin paying their fair share. And in exchange for contributing more, higher earners should realize higher benefits than they do now. It’s important to maintain that fundamental principle of Social Security.” – Max Richtman, NCPSSM President & CEO

Richtman endorsed legislation from Senator Bernie Sanders and Rep. John Larson (who soon will be re-introducing his Social Security 2100 Act), both of which would bring more revenue into Social Security by adjusting the payroll wage cap – and in Sanders’ case – using investment taxes to help shore up the program. Both Sanders’ and Larson’s bills also would boost benefits across-the-board, in addition to targeted increases for the most financially vulnerable seniors.

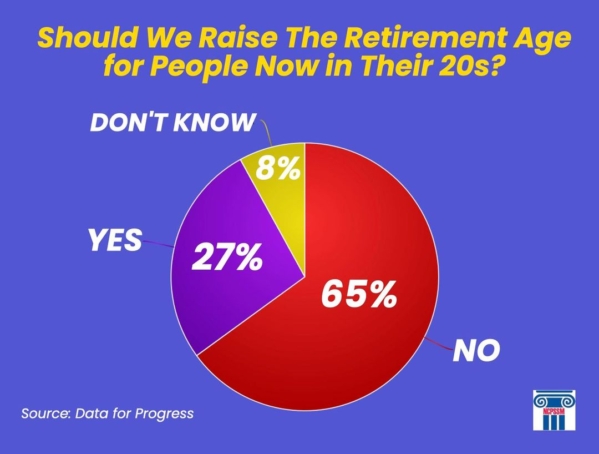

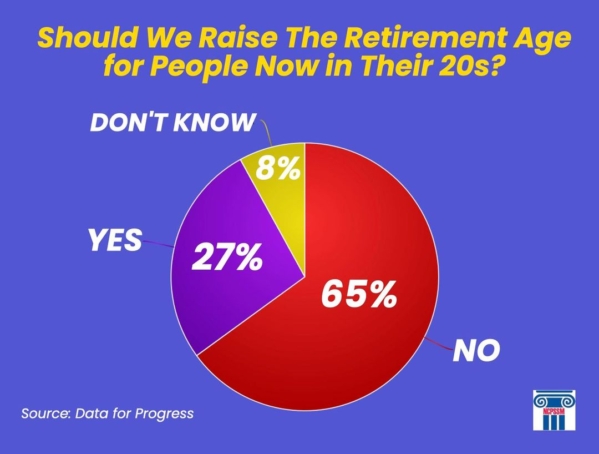

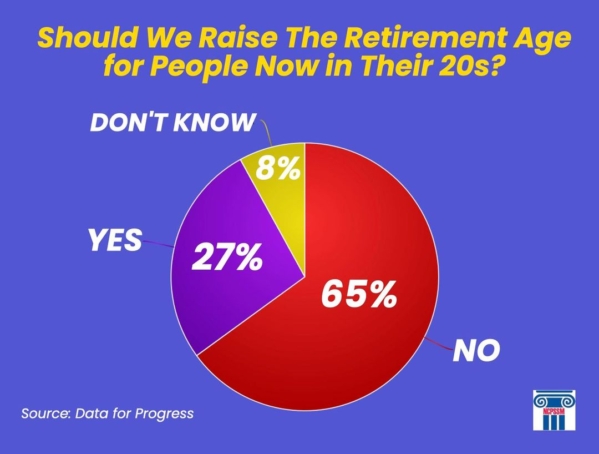

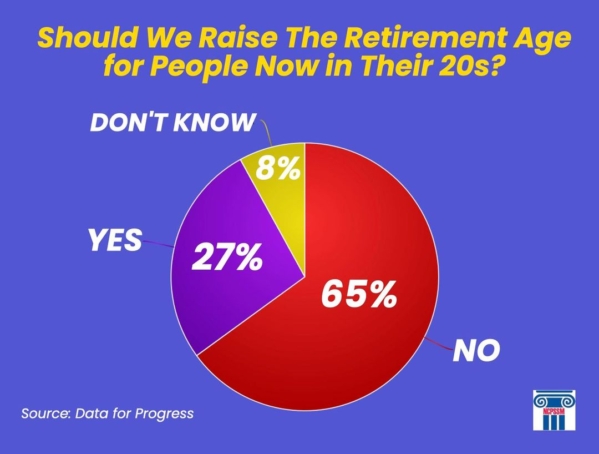

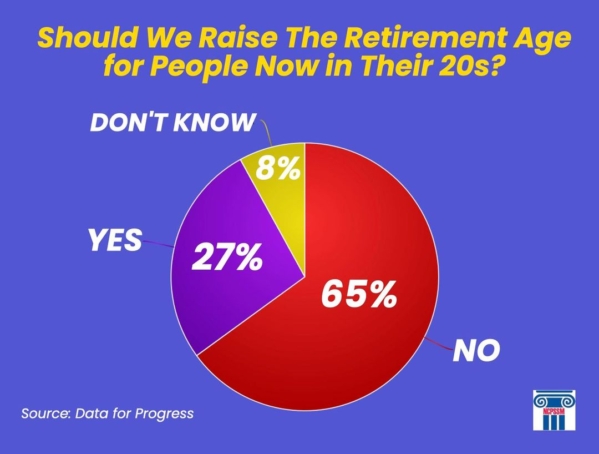

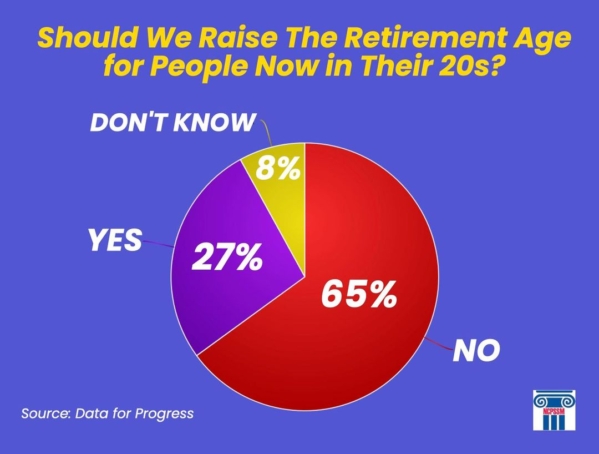

According to Richtman, most of the audience at the forum seemed to support the push to expand and strengthen Social Security, rather than cutting benefits or privatizing the program. Polling bears this out. A recent Data for Progress poll indicates that a majority of voters across party lines oppose raising the retirement age for today’s younger adults – a prominent GOP proposal of late. Other polling shows significant bipartisan support for expanding benefits by having the wealthy contribute more. (Earnings over $160,200 are not currently subject to Social Security payroll taxes.)

Republicans have generally rejected revenue-based solutions, insisting that “entitlements” need to be “reformed” or “looked at” (in other words, cut) in order to reduce federal debt, even though Social Security is self-funded and does not contribute a penny of red ink. The Sandusky Register newspaper reported that, despite the Cato Institute’s presence at the forum, other conservatives did not accept invitations to participate, including freshman Senator J.D. Vance (R-OH) and the DC-based Heritage Foundation.

NCPSSM-Endorsed Candidate Wins Wisconsin Supreme Court Race

The National Committee-endorsed candidate in the pivotal Wisconsin State Supreme Court race prevailed in yesterday’s elections. Judge Janet Protasiewicz bested her opponent, Daniel Kelly, by 10 points on Tuesday, changing the complexion of the court. Liberals will now be in the majority for the first time in some fifteen years.

NCPSSM’s political action committee (PAC) does not usually weigh into state political races, but made an exception with Protasiewicz because of the stakes for seniors – both directly and indirectly – in this election. Protasiewicz’s opponent, Judge Daniel Kelly, had characterized Social Security as “involuntary servitude” by taxpayers to benefit those whom he described as “people who have chosen to retire without sufficient assets to support themselves.”

“Unlike Judge Kelly, we are confident that Janet Protasiewicz values the dignity and independence of retirees in Wisconsin who have worked hard, paid their taxes and played by the rules,” said Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

“Voter rights — including the rights of older Wisconsinites to vote for pro-senior candidates — won yesterday in Wisconsin,” said NCPSSM PAC director, Dan Adcock. “As a justice on the Wisconsin Supreme Court, Janet Protasiewicz will protect democracy by ensuring free and fair elections are held in the Badger state. Congratulations to her for an impressive victory!” – Dan Adcock, NCPSSM PAC Director

The Wisconsin Supreme Court election was dubbed the most high-stakes race of 2023. Protasiewicz’s victory will help determine the future of gerrymandered legislative maps drawn by Republicans – and voting rights issues in a pivotal state heading into the 2024 presidential elections. These electoral issues have the potential to affect policy on the national level, including the future of Social Security, Medicare, and Medicaid – all three of which are under attack by Republicans.

“Free and fair elections are the only way older Wisconsinites have a fighting chance to elect candidates that value the earned economic and health security they receive through Social Security and Medicare. Without the check on the state legislature and governor that Judge Protasiewicz will provide as a Supreme Court Justice, the deck would have been stacked against older voters.” – Max Richtman

Protasiewicz, who pulled off an impressive state-wide win, told a “jubilant” crowd in Milwaukee last night, “Our state is taking a step forward to a better and brighter future where our rights and freedoms will be protected.” In true MAGA fashion, her opponent refused to concede graciously after Protasiewicz became the projected winner, characterizing her “an unworthy opponent.” As the New York Times reported, Daniel Kelly called his rival’s campaign “truly beneath contempt.”

“Today’s results mean two very important and special things,” Judge Protasiewicz said. “First, it means that Wisconsin voters have made their voices heard. They have chosen to reject partisan extremism in this state. And second, it means our democracy will always prevail.”

Social Security is Not Going Bankrupt, But Needs to be Strengthened

In their report released on Friday, the Social Security Trustees projected that the program’s combined trust fund will remain solvent until 2034 – one year earlier than previously projected. At that time, the program still would be able to pay 80% of benefits. As of the end of 2022, the trust fund had $2.83 trillion in reserves.

“Contrary to conservative claims, Social Security is not ‘going bankrupt’; the program will always be able to pay benefits because of ongoing contributions from workers and employers. In fact, this is yet another Trustees report showing that Social Security remains strong in the face of turmoil in the rest of the economy. Its projected insolvency date has stayed roughly the same even after a global pandemic and recent economic upheavals.” – Max Richtman, NCPSSM President and CEO

Congress can strengthen the program’s finances by bringing more revenue into Social Security. We support legislation introduced by Senator Bernie Sanders to keep the trust fund solvent for the rest of this century while expanding benefits. We also support Rep. John Larson’s Social Security 2100 Act, which the congressman plans to re-introduce this Spring. Both bills would adjust the Social Security payroll wage cap so that higher-income earners begin contributing their fair share.

Republican proposals to “reform” Social Security are the wrong kind of action. The TRUST Act would put the future of Social Security in the hands of a special committee that could provide members of Congress with political cover for cutting benefits. The 2022 House Republican Study Committee budget blueprint calls for raising the retirement age to nearly 70, a huge lifetime benefit cut. Ditto for the Cassidy-King proposal taking shape in the Senate, which also would gamble future retirees’ benefits on Wall Street – a truly dangerous idea.

Many Republicans insist that they won’t cut benefits for today’s retirees — only for future beneficiaries. But Gen Z and Millennials will need their Social Security benefits even more than current retirees do, thanks to chronically flat wages, disappearing pensions, and mounting student debt, among other factors.

“President Biden and congressional Democrats see Social Security as a house that needs renovations and an addition built. Republicans want to knock down the entire house or, at the very least, weaken the foundation — if not today, then in decades to come. Today’s Trustees report is not an excuse to cut Social Security; it’s a reminder that the program needs to be strengthened and expanded without asking seniors, people with disabilities and survivors to bear the cost.” – Max Richtman

Senators’ “Bipartisan” Social Security Plan Would Slash Benefits

The National Committee to Preserve Social Security and Medicare has sent an urgent letter to Senators Bill Cassidy (R-LA) and Angus King (I-ME) expressing deep concern over a Social Security proposal reportedly taking shape under their names. The Cassidy-King plan would put Social Security on a slippery slope toward privatization — and ultimately cut benefits for future beneficiaries.

The Cassidy-King plan attempts to address the projected shortfall in the Social Security trust fund by borrowing $1.5 trillion to invest on Wall Street (modeled on the concept of a “sovereign wealth fund”) — in hopes it would yield sufficient returns to pay back the loans and still have enough money left over to cover any future gap in Social Security funding. But this funding scheme really is a trojan horse for benefit cuts that reportedly are at the core of the Cassidy-King proposal.

“The so-called ‘sovereign wealth fund’ in the Cassidy-King proposal is an illusion – a smokescreen to promote a deal that is too good to be true. Workers who represent the heart of the middle class, along with some of the most vulnerable among us, will bear the brunt of the inevitable benefit cuts from this plan.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

Although details of the Cassidy-King proposal have not been made fully public, the news site Semafor reported that the plan includes raising the full retirement age to “around 70” — a massive lifetime benefit cut for future retirees — and changing the formula that Social Security uses to determine monthly benefits, another potential blow to all but the lowest-income beneficiaries.

Although it’s true that over long periods of time, markets can produce higher rates of return than the guaranteed Treasury bonds in which the trust fund is currently invested, the amount of time it has taken the markets to recover from downturns in the past has stretched as long as thirty years. In fact, the Dow has spent almost 70 out of the last 100 years recovering from downturns.

“For the math to add up, a plan like Cassidy-King would ultimately have to cut benefits. Otherwise, we’re talking about ‘magic money’ from ephemeral Wall Street returns that may not materialize. Any claims by the plan’s authors or supporters in Congress that Cassidy-King would not cut benefits for future retirees are not credible.” – Max Richtman

The Cassidy-King plan, which has attracted some bipartisan support on Capitol Hill, is yet another conservative scheme to “save” Social Security by changing the fundamentals of the program itself — a program which is enormously popular and has provided seniors with financial security for more than 80 years. Most every Republican proposal ultimately would lead to benefit cuts – if not for today’s beneficiaries, then for their children and grandchildren. Democrats, including Sen. Bernie Sanders and Rep. John Larson, have introduced legislation that would keep the Social Security trust fund solvent and expand, not cut, benefits for the growing share of Americans who depend on the program for all or most of their retirement income. These bills achieve this by asking the wealthy to pay their fair share of taxes to fund Social Security.

“We have endorsed the Sanders and Larson bills, while urging members of Congress who truly want to strengthen Social Security to reject legislation that would alter its fundamental nature, cut benefits, or privatize the program. Because so many seniors are highly dependent on their earned benefits to pay their bills, they are unwilling to risk their monthly checks on the mirage of a Wall Street paved with gold.” – Max Richtman

Read our in-depth analysis of the Cassidy-King plan here.

Why GOP Medicaid Work Requirements Are Such an Awful Idea

The House Republicans’ debt ceiling bill includes drastic cuts to federal programs that seniors and other vulnerable Americans rely on. But it also imposes work requirements on lower income people who receive health coverage through Medicaid. Under the GOP plan, Medicaid patients would have to work at least 80 hours per month or lose their coverage. We spoke to the National Committee’s senior health policy expert, Anne Montgomery, about why this is such a bad idea.

A: It’s harmful because regardless of whether or not you’re working, everyone needs ongoing access to health care. Medicaid is a health insurance program for lower-income Americans, not a work program. It makes no sense to deny medical coverage to people by requiring them to prove to state bureaucrats that they are working. If you need care, you should be able to get it. To condition one upon the other makes no sense.

Q: Why shouldn’t Medicaid beneficiaries have to work in order to keep their benefits?

A: There are many people who may not be able to work due to chronic health conditions or disabilities. Or they may be taking care of loved ones who are sick. There are others who, because of the ‘gig economy,’ may be in and out of work and have trouble finding steady employment. Turnover is particularly high (and work hours inconsistent) in the service and retail sectors. Under the Republican proposal, if you don’t have consistent work, you may lose your health coverage.

Q: Couldn’t some of these workers simply apply for disability insurance?

A: It’s not as simple as snapping your fingers, and you’re on disability. First of all, only 40% of people who apply for Social Security Disability Insurance (SSDI) actually are approved for benefits. Secondly, why would you want people to go onto disability insurance if the aim is to encourage work?

Q: With these work requirements comes a lot of new ‘red tape.’ How might this be an obstacle to people trying to keep their Medicaid coverage?

A: Yes. Not only would you have to be working – or find work – in order to keep your health coverage, you would have to meet strict documentation requirements, which involves additional red tape and paperwork. In pilot programs for Medicaid work requirements, people have lost coverage because of confusion rather than not working. Medicaid beneficiaries should work when they can, but we shouldn’t yank their health care from under them if they can’t work at a particular time.

Q: Would Medicaid work requirements seriously increase the number of Americans working?

There is no evidence that Medicaid work requirements actually would boost employment. In states which have experimented with work requirements, that certainly isn’t the case. In Arkansas, for instance, 17,000 patients lost Medicaid coverage for failing to meet the requirements. An analysis found that “Medicaid beneficiaries had not started working more or earning more money as a result of the policy.”

Q: What is the real agenda behind Medicaid work requirements?

Conservatives have long opposed Medicaid as “just another welfare program” and a “waste of taxpayer dollars,” while in reality it is a crucial part of our health care system that pays for coverage for tens of millions of lower-income Americans — and the hospitals, doctors and nursing homes who care for them. In fact, according to the Centers for Medicare and Medicaid (CMS), more than 92 million Americans were enrolled in Medicaid and CHIP (in the 50 states and the District of Columbia that reported enrollment data for December 2022). The GOP was especially upset by Medicaid expansion under the Affordable Care Act (though many red states now have expanded their Medicaid programs under the ACA). Imposing work requirements is a way to drastically reduce the number of Americans on Medicaid rolls, with no regard for the impact on patients’ health.

Q: The Republicans’ work requirement proposals come at a particularly fraught time, as federal COVID emergency measures come to an end, right?

A: That’s right. Under the Public Health Emergency (PHE) state Medicaid programs were required to keep people continuously enrolled in exchange for additional federal funding. With the PHE phaseout that begin this month, millions of Americans will now have to go through a “redetermination” of their eligibility for Medicaid coverage for the first time in 3 years. Imposing work requirements at the same time that many are already losing access to Medicaid coverage is punitive and unnecessary. Republicans are effectively using this process as an opening to slash federal spending on a constituency that they believe doesn’t have a lot of political power.

Ohio Forum Focuses on Cutting Vs. Expanding Social Security

National Committee president and CEO Max Richtman brought the organization’s message of expanding and strengthening Social Security to Ohio today. He participated in a forum in Sandusky, OH, co-sponsored by the local nonprofit, Serving Our Seniors. The forum, entitled, The Future of Social Security Retirement Income, was attended by more than two hundred citizens, mostly seniors who are already collecting benefits. [WATCH THE FORUM HERE.]

Richtman appeared alongside Rep. Marcy Kaptur (D-OH), a champion for seniors who represents the Sandusky area in the U.S. Congress. (Rep. Kaptur earned 100% on the National Committee’s most recent legislative scorecard.) The forum was moderated by Sue Daugherty, executive director of Serving Our Seniors, and also included a representative of the conservative/libertarian Cato institute, Romina Boccia. According to the site, Influence Watch, the Cato Institute “has received funding from a number of right-of-center organizations, including the Charles G. Koch Charitable Foundation.”

“This forum isn’t about politics of it. It’s all about informing all of us of the realities of it. How will we, as a nation, sustain these important programs? That’s the big question and our panel crosses across the spectrum of politics.” – Sue Daugherty, moderator and CEO, Serving Our Seniors

The forum featured lively exchanges between audience members and panelists, with Richtman advocating for revenue-side solutions to Social Security’s financial challenges. (The combined trust fund is projected to become depleted in 2034, absent Congressional action.)

Boccia urged the kind of reform championed by conservatives, including reducing benefits for future generations of retirees, at least partially privatizing the program, and the creation of a special commission to propose Social Security reforms (presumably along the lines of the Simpson-Bowles commission in the 2010s). That commission’s recommendations, including some benefit cuts, were never adopted.

Richtman made clear NCPSSM’s opposition to the kinds of solutions offered by Boccia, especially benefit cuts for future retirees, who will rely on Social Security even more than today’s seniors do.

“Our message is that Congress needs to act. If there’s no action, that’s not acceptable because there would be automatic cuts in 2034. What we favor is bringing more revenue by having the wealthy begin paying their fair share. And in exchange for contributing more, higher earners should realize higher benefits than they do now. It’s important to maintain that fundamental principle of Social Security.” – Max Richtman, NCPSSM President & CEO

Richtman endorsed legislation from Senator Bernie Sanders and Rep. John Larson (who soon will be re-introducing his Social Security 2100 Act), both of which would bring more revenue into Social Security by adjusting the payroll wage cap – and in Sanders’ case – using investment taxes to help shore up the program. Both Sanders’ and Larson’s bills also would boost benefits across-the-board, in addition to targeted increases for the most financially vulnerable seniors.

According to Richtman, most of the audience at the forum seemed to support the push to expand and strengthen Social Security, rather than cutting benefits or privatizing the program. Polling bears this out. A recent Data for Progress poll indicates that a majority of voters across party lines oppose raising the retirement age for today’s younger adults – a prominent GOP proposal of late. Other polling shows significant bipartisan support for expanding benefits by having the wealthy contribute more. (Earnings over $160,200 are not currently subject to Social Security payroll taxes.)

Republicans have generally rejected revenue-based solutions, insisting that “entitlements” need to be “reformed” or “looked at” (in other words, cut) in order to reduce federal debt, even though Social Security is self-funded and does not contribute a penny of red ink. The Sandusky Register newspaper reported that, despite the Cato Institute’s presence at the forum, other conservatives did not accept invitations to participate, including freshman Senator J.D. Vance (R-OH) and the DC-based Heritage Foundation.

NCPSSM-Endorsed Candidate Wins Wisconsin Supreme Court Race

The National Committee-endorsed candidate in the pivotal Wisconsin State Supreme Court race prevailed in yesterday’s elections. Judge Janet Protasiewicz bested her opponent, Daniel Kelly, by 10 points on Tuesday, changing the complexion of the court. Liberals will now be in the majority for the first time in some fifteen years.

NCPSSM’s political action committee (PAC) does not usually weigh into state political races, but made an exception with Protasiewicz because of the stakes for seniors – both directly and indirectly – in this election. Protasiewicz’s opponent, Judge Daniel Kelly, had characterized Social Security as “involuntary servitude” by taxpayers to benefit those whom he described as “people who have chosen to retire without sufficient assets to support themselves.”

“Unlike Judge Kelly, we are confident that Janet Protasiewicz values the dignity and independence of retirees in Wisconsin who have worked hard, paid their taxes and played by the rules,” said Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

“Voter rights — including the rights of older Wisconsinites to vote for pro-senior candidates — won yesterday in Wisconsin,” said NCPSSM PAC director, Dan Adcock. “As a justice on the Wisconsin Supreme Court, Janet Protasiewicz will protect democracy by ensuring free and fair elections are held in the Badger state. Congratulations to her for an impressive victory!” – Dan Adcock, NCPSSM PAC Director

The Wisconsin Supreme Court election was dubbed the most high-stakes race of 2023. Protasiewicz’s victory will help determine the future of gerrymandered legislative maps drawn by Republicans – and voting rights issues in a pivotal state heading into the 2024 presidential elections. These electoral issues have the potential to affect policy on the national level, including the future of Social Security, Medicare, and Medicaid – all three of which are under attack by Republicans.

“Free and fair elections are the only way older Wisconsinites have a fighting chance to elect candidates that value the earned economic and health security they receive through Social Security and Medicare. Without the check on the state legislature and governor that Judge Protasiewicz will provide as a Supreme Court Justice, the deck would have been stacked against older voters.” – Max Richtman

Protasiewicz, who pulled off an impressive state-wide win, told a “jubilant” crowd in Milwaukee last night, “Our state is taking a step forward to a better and brighter future where our rights and freedoms will be protected.” In true MAGA fashion, her opponent refused to concede graciously after Protasiewicz became the projected winner, characterizing her “an unworthy opponent.” As the New York Times reported, Daniel Kelly called his rival’s campaign “truly beneath contempt.”

“Today’s results mean two very important and special things,” Judge Protasiewicz said. “First, it means that Wisconsin voters have made their voices heard. They have chosen to reject partisan extremism in this state. And second, it means our democracy will always prevail.”

Social Security is Not Going Bankrupt, But Needs to be Strengthened

In their report released on Friday, the Social Security Trustees projected that the program’s combined trust fund will remain solvent until 2034 – one year earlier than previously projected. At that time, the program still would be able to pay 80% of benefits. As of the end of 2022, the trust fund had $2.83 trillion in reserves.

“Contrary to conservative claims, Social Security is not ‘going bankrupt’; the program will always be able to pay benefits because of ongoing contributions from workers and employers. In fact, this is yet another Trustees report showing that Social Security remains strong in the face of turmoil in the rest of the economy. Its projected insolvency date has stayed roughly the same even after a global pandemic and recent economic upheavals.” – Max Richtman, NCPSSM President and CEO

Congress can strengthen the program’s finances by bringing more revenue into Social Security. We support legislation introduced by Senator Bernie Sanders to keep the trust fund solvent for the rest of this century while expanding benefits. We also support Rep. John Larson’s Social Security 2100 Act, which the congressman plans to re-introduce this Spring. Both bills would adjust the Social Security payroll wage cap so that higher-income earners begin contributing their fair share.

Republican proposals to “reform” Social Security are the wrong kind of action. The TRUST Act would put the future of Social Security in the hands of a special committee that could provide members of Congress with political cover for cutting benefits. The 2022 House Republican Study Committee budget blueprint calls for raising the retirement age to nearly 70, a huge lifetime benefit cut. Ditto for the Cassidy-King proposal taking shape in the Senate, which also would gamble future retirees’ benefits on Wall Street – a truly dangerous idea.

Many Republicans insist that they won’t cut benefits for today’s retirees — only for future beneficiaries. But Gen Z and Millennials will need their Social Security benefits even more than current retirees do, thanks to chronically flat wages, disappearing pensions, and mounting student debt, among other factors.

“President Biden and congressional Democrats see Social Security as a house that needs renovations and an addition built. Republicans want to knock down the entire house or, at the very least, weaken the foundation — if not today, then in decades to come. Today’s Trustees report is not an excuse to cut Social Security; it’s a reminder that the program needs to be strengthened and expanded without asking seniors, people with disabilities and survivors to bear the cost.” – Max Richtman

Senators’ “Bipartisan” Social Security Plan Would Slash Benefits

The National Committee to Preserve Social Security and Medicare has sent an urgent letter to Senators Bill Cassidy (R-LA) and Angus King (I-ME) expressing deep concern over a Social Security proposal reportedly taking shape under their names. The Cassidy-King plan would put Social Security on a slippery slope toward privatization — and ultimately cut benefits for future beneficiaries.

The Cassidy-King plan attempts to address the projected shortfall in the Social Security trust fund by borrowing $1.5 trillion to invest on Wall Street (modeled on the concept of a “sovereign wealth fund”) — in hopes it would yield sufficient returns to pay back the loans and still have enough money left over to cover any future gap in Social Security funding. But this funding scheme really is a trojan horse for benefit cuts that reportedly are at the core of the Cassidy-King proposal.

“The so-called ‘sovereign wealth fund’ in the Cassidy-King proposal is an illusion – a smokescreen to promote a deal that is too good to be true. Workers who represent the heart of the middle class, along with some of the most vulnerable among us, will bear the brunt of the inevitable benefit cuts from this plan.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

Although details of the Cassidy-King proposal have not been made fully public, the news site Semafor reported that the plan includes raising the full retirement age to “around 70” — a massive lifetime benefit cut for future retirees — and changing the formula that Social Security uses to determine monthly benefits, another potential blow to all but the lowest-income beneficiaries.

Although it’s true that over long periods of time, markets can produce higher rates of return than the guaranteed Treasury bonds in which the trust fund is currently invested, the amount of time it has taken the markets to recover from downturns in the past has stretched as long as thirty years. In fact, the Dow has spent almost 70 out of the last 100 years recovering from downturns.

“For the math to add up, a plan like Cassidy-King would ultimately have to cut benefits. Otherwise, we’re talking about ‘magic money’ from ephemeral Wall Street returns that may not materialize. Any claims by the plan’s authors or supporters in Congress that Cassidy-King would not cut benefits for future retirees are not credible.” – Max Richtman

The Cassidy-King plan, which has attracted some bipartisan support on Capitol Hill, is yet another conservative scheme to “save” Social Security by changing the fundamentals of the program itself — a program which is enormously popular and has provided seniors with financial security for more than 80 years. Most every Republican proposal ultimately would lead to benefit cuts – if not for today’s beneficiaries, then for their children and grandchildren. Democrats, including Sen. Bernie Sanders and Rep. John Larson, have introduced legislation that would keep the Social Security trust fund solvent and expand, not cut, benefits for the growing share of Americans who depend on the program for all or most of their retirement income. These bills achieve this by asking the wealthy to pay their fair share of taxes to fund Social Security.

“We have endorsed the Sanders and Larson bills, while urging members of Congress who truly want to strengthen Social Security to reject legislation that would alter its fundamental nature, cut benefits, or privatize the program. Because so many seniors are highly dependent on their earned benefits to pay their bills, they are unwilling to risk their monthly checks on the mirage of a Wall Street paved with gold.” – Max Richtman

Read our in-depth analysis of the Cassidy-King plan here.