Way back in 1983, the Koch-seeded Cato Institute published a paper entitled, “Achieving A Leninist Strategy,” which mapped out a right-wing scheme to undermine Social Security by dividing the generations. The strategy was: convince young people that Social Security is a bad deal for them, because they have to pay into it while an undeserving older generation collects benefits. This, in turn, would weaken public support for the program, as the L.A. Times’ Michael Hiltzik explained:

“The authors… were anguished over President Reagan’s failure to exploit Social Security’s 1982 fiscal crisis to privatize the program. They concluded that the reason was the program’s strong support among the powerful voting bloc of seniors, compounded by the indifference of younger voters. The answer, they concluded, was to undermine confidence in Social Security among the young.’” – Michael Hiltzik, L.A. Times

It’s not that the conservative/libertarian movement suddenly cared about the welfare of young adults. Then, as now, they simply did not believe in social insurance, because they do not believe that the federal government has a legitimate role in providing basic financial and health security to working Americans. The conservative movement fundamentally opposes Social Security and Medicare as we know them — unless the programs are privatized so that Wall Street and Corporate America can get their hands on that money. (It has partially worked where Medicare is concerned, in the form of Medicare Advantage.)

Forty years after the CATO Institute paper, this strategy is still very much in effect. The New York Times ran not one – but two – conservative opinion pieces in the past week, attempting to convince readers that Social Security is unfair to younger adults.

The first opinion piece (the one we will address here), “For the Good of the Country, Older Americans Should Work More and Take Less,” was written by Craig Seuerle (76) of the Urban-Brookings Tax Policy Center and Glenn Kramon (70), Assistant Managing Editor of the New York Times. Apparently speaking for all seniors, these two presumably well-compensated white collar professionals write, “We are consuming an ever larger share of our economy’s resources through programs like Social Security and Medicare, leaving younger Americans to foot growing bills for their parents’ and grandparents’ retirements.”

Their solution for this “problem” is not surprising: raise the retirement age for Social Security and do not allow people in their early 60’s to claim early. “Those in late middle age will need to work longer as they live longer,” they glibly proclaim. Medicare, which the authors say “discourages work after 64” must be “re-designed.” Translation: the eligibility age should be raised and benefits cut.

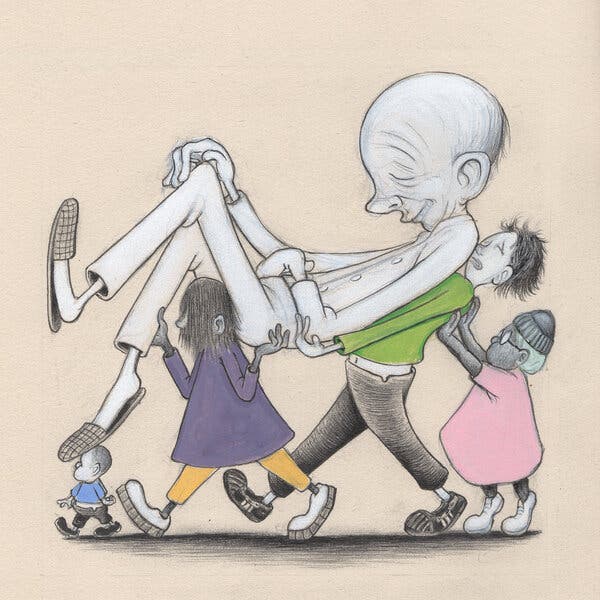

The blatantly ageist artwork accompanying the NY Times op-ed

Their justification for slashing Americans’ social insurance programs beyond recognition is that seniors, on average, are too prosperous and consume too much to need Social Security and Medicare as they exist today. Besides, people are living so much longer these days; they should work for a living in their 60s instead of collecting Social Security or getting health care from Medicare. Younger people, the authors say, shouldn’t have to foot the bill for seniors’ retirement.

How to begin untangling this disingenuous argument? First of all, while it’s true that some groups of Americans are living longer, other demographics aren’t. Longevity in 21st century America largely depends on socioeconomic status. For example, according to Kaiser Family Foundation, life expectancy for Black Americans was only 70.8 years compared to 76.4 years for white people.

The authors insist that people in their 60s should simply work longer. But they omit the fact that, while white collar professionals like themselves may be able to work through their 60s, many workers in physically-demanding jobs cannot. Not to mention: where are all these jobs for workers in their 60s? Many people in this age group face layoffs and job discrimination that make it difficult to continue holding a job.

Simply put, the Times piece is self-serving and misleading. Journalist Robert Kuttner debunked the authors’ claims quite tidily in the American Prospect:

The core fallacy in these arguments is the use of averages. On average, the elderly are richer, but that average includes Warren Buffett and the guy bagging groceries at your local supermarket because he can’t afford to retire.

On average, older homeowners have benefited from the run-up in housing values, but older renters spend more and more of their incomes on housing.

On average, older Americans are living longer and working longer. But affluent Americans tend to live longer than poorer ones. And well-off professionals tend to work well past retirement age because they love their work, while poorer Americans work at crappy jobs because they need the income. – Robert Kuttner, American Prospect, 10/31/23

In other words, not everyone is as comfortable as Seuerle and Kramon. The seniors that we meet tell us that they depend on every dollar of their Social Security benefits to pay the bills — and sometimes they still come up short and have to choose between essentials like rent and groceries. Social Security is especially crucial to communities of color. Some 50% of Black Americans would be living in poverty without Social Security.

Ditto with Medicare. We have heard poignant stories from seniors across the demographic spectrum who say they would not be alive without the life-saving medical care they received through Medicare.

And what about those younger adults who are supposedly so burdened by contributing a small percentage of their income to Social Security and Medicare so that they can collect benefits when they’re older? It’s likely that younger people would be much better off if their student debts were forgiven, if college were affordable, and if young families had affordable daycare. Most younger workers would probably rather have those things than compromise their future Social Security benefits.

Of course, most conservatives oppose those improvements for younger Americans, because they likely would require federal spending. The right’s default solution is always to cut benefits – in this case Social Security and Medicare.

Responding to the Times opinion piece, Dean Baker of the Center for Economic and Policy Research (CEPR) argues that growing wealth inequality – fostered by 40 years of Reaganomics – is far more burdensome to young Americans than paying Social Security and Medicare payroll taxes:

“In short, we have made a series of policy decisions that have led to a massive upward redistribution of income in the last half-century. The impact of this upward redistribution on the income of young workers dwarfs the impact of demographics. Unfortunately, our news outlets seem more interested in highlighting the demographic (young vs. old) issue than the causes of inequality.” – Dean Baker, CEPR, 10/29/23

Unfortunately, the conservative propaganda has been partially working. Young people still may support the Social Security program, but their confidence in it has been undermined by the ‘gloom and doom’ scenario that the right promulgates. As our President and CEO Max Richtman points out, some younger adults believe they are more likely to see a U.F.O. or Bigfoot than to receive a Social Security check when they retire.

In fact, younger adults are already covered by Social Security, though they may not realize it. For example, a 27 year-old with a spouse and two children has some $2 million worth of life and disability insurance from Social Security. The perpetrators of the ‘generational divide’ propaganda never seem to mention that. Nor do they mention that the average Millennial is on track to receive about $1 million in lifetime benefits.

In a 2021 poll, more than 60% of Millennials said that Social Security “should be enough to help me live comfortably in retirement.” That’s a good sign. NCPSSM and other advocates will continue to spread the word that Social Security is ‘a good deal’ for today’s younger adults and tomorrow’s retirees. For 88 years, it has worked as an inter-generational compact to provide workers with basic financial security. Let’s not allow well-funded and well-off conservatives to ‘divide and conquer’ the generations in order to kill or privatize two of our nation’s most effective and popular programs, Social Security and Medicare.