Trump Marks Social Security’s 90th Anniversary by Spreading Misinformation

President Trump spreads misinformation at White House press conference (Washington Post)

Social Security turned 90 this week, a milestone that should have been celebrated with reverence. However, the Trump administration marked the occasion by perpetuating misleading claims about its handling of the program. From manipulating statistics to spreading untruths about immigrants, this administration is playing a cynical game with one of America’s most cherished federal programs.

While signing a proclamation for Social Security’s 90th anniversary, Trump made several astounding statements. He said that Social Security was “going to die very shortly,” but that his new SSA chief, Frank Bisignano, had effectively saved the program by instituting draconian cuts to the agency’s staff and resources, which have hobbled customer service and obstructed Americans’ access to their earned benefits. Trump also uttered this completely false, mini-word salad: “In 4 or 5 years (Social Security) is going to go bust, but not any more it’s not.” (See below the actual truth about Social Security’s finances.)

The President, who has promised ‘not to touch’ Social Security, once again demonstrated his ignorance about how the program really works. The program is not “going to die” in 4 or 5 years. Furthermore, alleged cost-savings by the Social Security Administration have nothing to do with whether the program itself remains financially healthy. Not only did Trump make blatant misstatements about the facts surrounding Social Security, he used the anniversary as an opportunity to scapegoat undocumented workers (who actually pay into the system, but cannot collect benefits).

As our president, Max Richtman, reminds us, “We wish we could simply celebrate, but the 90-year history of Social Security shows that we must always defend the program from those who would privatize or outright eliminate it.” Richtman emphasizes, “Social Security is part of the fabric of American life and must be preserved for the future.” (We commemorated the 90th anniversary with the release of our new documentary, “Social Security: 90 Years Strong,” which is streaming on multiple platforms.)

Manipulating Metrics to Rewrite Reality

At the forefront of the administration’s disinformation campaign is Social Security Commissioner Frank Bisignano, who joined President Trump in the Oval Office to tout what they called a “miraculous” turnaround at the Social Security Administration (SSA). Citing supposed improvements like reduced call wait times and streamlined customer service, they painted a rosy picture that crumbles under scrutiny.

For instance, Trump claimed that call wait times had reached an “all-time high” of 42 minutes during the Biden administration but had dramatically improved since his return to office. The truth? By the end of 2024, under Biden-appointed Commissioner Martin O’Malley, wait times on SSA’s 1-800 number had already dropped below 13 minutes, accompanied by a 30-year low in the disability claims backlog and a 6% productivity increase across the agency (Government Exec). These achievements were the result of funding from the Inflation Reduction Act and innovative reforms implemented long before Trump re-entered the White House.

Under Bisignano, however, the very calculation of call wait times has been redefined to artificially inflate performance. Kathleen Romig, director of Social Security policy at the Center on Budget and Policy Priorities, exposed this manipulation, explaining that the new metrics exclude the time callers who use the callback feature wait for a response.

“They say that the stat is the ‘average speed to answer,’ but that includes the average speed to speak to a human being and the average speed to a self-service option,” Romig said. “As soon as you’ve pressed ‘3’ for whatever service, you have stopped waiting for the purposes of [Bisignano’s] stat, and none of the rest of it counts” (Government Exec).

This statistical sleight of hand isn’t just misleading—it’s a breach of public trust. Social Security is the bedrock of retirement income and disability support for millions of Americans. Misrepresenting its operations does a disservice to the very people the SSA is supposed to serve.

“I think that when the president of the United States and his leadership team repeatedly lie about the biggest program in the federal government and the most important program for older people in this country, over and over again… it undermines trust in the program and undermines support for the program.” – Kathleen Romig, Center on Budget and Policy Priorities

Cherry-Picking Data

The administration didn’t stop at manipulating customer service metrics—it also peddled false claims about waste and fraud. Trump and Bisignano boasted that “nearly 275,000 illegal aliens” had been kicked off Social Security, another statement that wilts under scrutiny.

Romig pointed out that this claim likely conflates several unrelated issues, including legal immigrants losing their status and Musk-era bureaucratic errors where thousands of legitimate Social Security beneficiaries were falsely flagged as deceased.

“Most immigrants cannot collect Social Security benefits—short of becoming a permanent resident or citizen—but they still contribute to the program’s trust fund through payroll taxes,” Romig explained (Government Exec). By undercutting immigrant workers’ contributions, Trump’s policies have, in fact, “accelerated the depletion date of the trust fund” by reducing its revenue base.

Social Security is not Going Broke

To truly take stock of Social Security’s situation at 90, we must look squarely at the looming challenges—and how the Trump administration’s choices have made matters worse, not better. Social Security’s combined trust disability and retirement trust fund will become depleted in 2034, absent any preventative action from Congress. After that, only 81% of benefits will be payable, which the latest trustees’ report attributes in part to recent legislative changes (AP via Washington Post). But the program is not “going broke” or “dying.”

A key aggravating factor is the Trump administration’s Unfair, Ugly Bill. While Trump has repeated that his law “will eliminate taxes on federal Social Security benefits,” the reality is far different. As Brendan Duke of the Center on Budget and Policy Priorities explained, the new law only adds a temporary tax deduction for people 65 and over. It does not eliminate or mitigate taxes on Social Security benefits. More urgently, Duke warned, “The new tax law signed by Trump in July will accelerate the insolvency of Social Security” (AP).

Meanwhile, the program serves nearly 69 million Americans today—a number expected to rise to 82 million by Social Security’s 100th anniversary. AARP CEO Myechia Minter-Jordan rightly insisted: “As we look ahead to the next 90 years of Social Security, it’s critical that it remains strong for generations to come.” Yet Trump has not proposed a real, long-term solution to shore up the program, instead defaulting to misdirection and political theater.

Staffing cuts have further threatened the Social Security Administration’s ability to serve the public. According to the Associated Press, “the agency cut more than 7,000 from its workforce this year as part of the Department of Government Efficiency’s effort to reduce the size of the government.” These brutal reductions have led unions and advocacy organizations to sue over concerns about service quality and privacy.

The Privatization Mirage

The specter of Social Security privatization has returned, even as Americans have consistently rejected such plans in the past. (George W. Bush tried and failed to privatize the program in 2005.) Treasury Secretary Scott Bessent said out loud that a provision of the Unfair, Ugly Bill creating special savings account for children was a “backdoor for privatizing Social Security.” Trump’s nominee to head the Bureau of Labor of Statistics, E.J. Antoni, told a radio station in Texas last December that Social Security was a “Ponzi scheme” and should be “sunsetted” for future generations.

Glenn Hubbard, a top economist in the George W. Bush administration, reflected a common elite view: “We will have to make a choice. If you want Social Security benefits to look like they are today, we’re going to have to raise everyone’s taxes a lot. And if that’s what people want, you pay the high price and you move on.”

Others, like Rachel Greszler of the right-wing Heritage Foundation, advocate for “partial and optional privatization” and cutting benefits, but such ideas would undermine Social Security’s fundamental nature as a social insurance program.

Meanwhile, several Democratic members of Congress have put forward legislation to shore up the program’s finances by demanding that the wealthy begin paying their fair share in Social Security contributions — eschewing benefit cuts as punitive for current and future beneficiaries. We have endorsed many of these bills and continue to support them.

Honoring the Legacy of Social Security

The 90th anniversary of Social Security should have been a moment purely to honor the program that has lifted millions of Americans out of poverty. Instead, Trump used it as an excuse to propagate misinformation designed to score political points. The truth matters, especially when it comes to an institution as vital and enduring as Social Security.

Our job is to continue to advocate — from the halls of Congress to town halls across the country — for Social Security. The people’s job is to continue letting their voices be heard loud and clear, as we saw in this spring’s “Hands Off Social Security” protests. When the public pushes back, the Trump administration takes notice, reversing some of the most egregious policies at the Social Security Administration. We must remain vigilant if Social Security is to survive intact.

FDR’s Secretary of Labor, Frances Perkins, who was a prime mover in the creation of the program in 1935, said it best: “Social security is so firmly embedded in the American psychology today that no politician, no political party, could possibly destroy this act and still maintain our democratic system.”

Watch our new documentary, “Social Security: 90 Years Strong” here. View the 3-minute trailer here.

Medicare Turned 60! Here’s Why We Can’t Simply Celebrate

This blog post is an expanded version of an op-ed published in Common Dreams.

Like Sarah Jessica Parker, Chris Rock, and Brooke Shields, Medicare has turned 60 years old. President Lyndon B. Johnson signed the program into law on July 30, 1965, giving seniors a guarantee of health coverage that never existed before. Prior to Medicare’s enactment, it was nearly impossible for older people to obtain health insurance, as they were considered a ‘bad risk.’

Medicare provides universal coverage to Americans over 65 years of age. (Ironically, Medicare would not yet be old enough to qualify for itself.) The law created Medicare Part A as a national hospital insurance program. Part B is a voluntary program for doctor visits and other medical services. Medicare Part C is another name for the privatized, for-profit version of the program called “Medicare Advantage.” And Part D is the prescription drug program enacted in 2003.

The Hospital Insurance portion is funded through workers’ payroll contributions. At the signing ceremony in Independence, MO, LBJ said: “Through this new law, every citizen will be able, in their productive years when they are earning, to insure themselves against the ravages of illness in old age.”

Lyndon Johnson paid tribute to former President Harry S. Truman, presenting him with the very first Medicare card. It was Truman who, 20 years earlier, had proposed a form of universal medical coverage for the American people.

LBJ quoted Truman’s remarks from the 1940s:

“Millions of our citizens do not now have a full measure of opportunity to achieve and to enjoy good health. Millions do not now have protection or security against the economic effects of sickness. And the time has now arrived for action to help them attain that opportunity and to help them get that protection.” – President Harry S. Truman

It turned out that the time had not yet arrived. Truman’s proposal failed to gain traction during a time of retrenchment from the expansions of the New Deal, and opposition from the Republican majority on Capitol Hill which he famously labeled the “do-nothing Congress.”

President Johnson’s determination to enact his Great Society agenda and sheer political muscle – not to mention solid Democratic control of Congress – pushed Medicare (and its sister program, Medicaid) into being. LBJ was known for his intense style of political arm-twisting, known as “the Johnson Treatment.” Once he latched onto a goal, he was unlikely to let it go.

Naturally, Medicare faced fierce opposition from conservatives. None other than Ronald Reagan made the ludicrous prediction that if Medicare were enacted, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” Sixty years later, we are no less “free” because of Medicare. In fact, having guaranteed health care makes seniors and people with disabilities (and their families) much more free – from disease, from worry, and financial ruin.

Today, 68 million people rely on Medicare for health coverage, including 12 million who are dually eligible for Medicare and Medicaid. Medicare isn’t perfect: The for-profit Medicare Advantage (Part C) program is extremely problematic (see below). The Medicare Part A trust fund will become depleted in 2033 if Congress fails to take action to strengthen it. Traditional Medicare still doesn’t cover basic hearing, vision, and dental care — which we have been pushing for many years. But most concerning of all — President Trump and his party have spent this 60th anniversary year actively undermining both Medicare and Medicaid.

Some 68 million seniors and people with disabilities rely on Medicare for health coverage

The “Unfair, Ugly” bill that Trump signed earlier this month slashed nearly $1 trillion from Medicaid, which will strip health coverage from an estimated 10 to 16 million lower-income Americans. The new law — projected to add more than $3 trillion to the national debt — could trigger cuts to Medicare down the road.

Meanwhile, the Trump administration is recklessly taking steps to privatize the entire Medicare program. It has announced a pilot project to involve private companies in conducting prior authorizations for care (now an infamous aspect of the for-profit Medicare Advantage program) in traditional Medicare. The administration, under HHS Secretary Robert F. Kennedy, Jr. and CMS Director Mehmet Oz, also has announced a plan to automatically enroll new Medicare beneficiaries in the for-profit Medicare Advantage (MA) program — a huge gift to the multi-billion dollar insurance industry at the expense of patients.

The problems with Medicare Advantage are now legendary. Enrollees are basically put into HMO’s run by insurance giants like Aetna, Humana, and United HealthCare, with limited networks of providers. Unreasonable denials of care are rampant. Patients who become disenchanted with MA plans often find it impossible to switch to traditional Medicare. Meanwhile, MA Insurers have been overcharging the government for their services and ripping off taxpayers. (Several of these insurance companies are currently under investigation.)

Joe Namath pitches for-profit Medicare Advantage plans in tv ads by insurance industry

We are watching to see if the Trump administration, which talks a good game about lowering prescription medication costs while simultaneously doing favors for Big Pharma, will honor the provisions of President Biden’s Inflation Reduction Act, which made myriad patient-friendly reforms to the Part D drug program — including out of pocket caps for beneficiaries and the ability of the government to negotiate prices with the industry.

The bottom line is: Let’s please not allow President Trump and congressional Republicans to shred one of the greatest legacies of LBJ’s Great Society. We and our fellow advocacy groups are pushing back — and so is the general public. But we don’t want to be fighting this same battle every time Medicare (and Medicaid) mark an anniversary — when we should be purely celebrating.

Want to hear more about the condition of Medicare and Medicaid under the Trump administration? Listen to our podcast here.

Did you know we are on BlueSky now? Follow us here!

Associated Press Flubs Social Security Trustees Story

We blogged earlier this week about the inaccuracy of media reports about Social Security’s financial future. Some mainstream media journalists seemed to rely on old tropes when covering the recent Social Security trustees report. A prime example: a news story from the Associated Press (AP) with the alarmist headline, Medicare and Social Security go-broke dates pushed up.

We asked our director of government relations and policy, Dan Adcock, to correct some of the inaccuracies in the AP piece…

Dan Adcock: Let’s start with the headline. It’s completely misleading. Neither program is “going broke.” In the case of Social Security, the combined trust fund is projected to become depleted in 2034 if Congress takes no action, at which time the system still could pay 81% of benefits. Social Security itself is not going broke or bankrupt. The only way that could happen is if we had 100% unemployment and no one was paying into the program.

AP: Social Security’s trust funds — which cover old age and disability recipients — will be unable to pay full benefits beginning in 2034, instead of last year’s estimate of 2035.

Adcock: The reporter omits that that Social Security also pays benefits to spouses and survivors (upon the death of a family breadwinner), including millions of children. Social Security is a retirement program for sure — but it is also so much more than that.

AP: The trustees say the latest findings show the urgency of needed changes to the programs, but… lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.

Adcock: This is a media trope that insists no one in Washington is thinking about Social Security’s future — or willing to take action. In fact, both parties have proposed solutions to ‘fix’ Social Security. The problem is that the Republicans focus exclusively on cutting benefits. Democrats have put forward proposals to bring more revenue into the program by demanding that the wealthy contribute their fair share. Opinion polling suggests that the public favors the approach of raising revenue rather than cutting benefits, regardless of party affiliation.

AP: President Donald Trump and other Republicans have vowed not to make any cuts to Medicare or Social Security, even as they seek to shrink the federal government’s expenditures.

Adcock: Those vows to protect Social Security have turned out to be quite hollow. The House Republican Study Committee has proposed cuts to Social Security (including raising the retirement age) in its budget blueprints. House and Senate Republicans have favored a fiscal commission that could fast-track cuts to the program through Congress. But more immediately, Trump unleashed Elon Musk & DOGE to wreak havoc on the Social Security Administration. The result has been severe cuts in staffing, mounting difficulty for customers accessing their benefits, multiple website crashes, and people being wrongly declared dead and having their benefits cut off. While these are not benefit cuts per se, they represent unprecedented interference in the delivery of Social Security — and break the President’s promise “not to touch” it.

AP: The report states that the Social Security Social Security Fairness Act (SSFA), enacted in January, which repealed the Windfall Elimination and Government Pension Offset provisions of the Social Security Act and increased Social Security benefit levels for some workers, had an impact on the depletion date of SSA’s trust funds.

Dan Adcock: The beneficiaries of the SSFA were not just “some workers.” They’re public sector employees like teachers, firefighters, and police officers who were denied full Social Security benefits until the Social Security Fairness Act was passed last year. The impact on the depletion date of the trust funds was only six months.

AP: Congressional Budget Office reporting has stated that the biggest drivers of debt rising in relation to GDP are increasing interest costs and spending for Medicare and Social Security. An aging population drives those numbers.

Dan Adcock: According to the nonpartisan Center for Budget and Policy Priorities, the biggest driver of the debt is TAX EXPENDITURES, including Trump’s huge tax cuts for the wealthy and big corporations. Social Security and Medicare Part A are completely self-funded by workers’ payroll contributions and DO NOT CONTRIBUTE to the debt. As Ronald Reagan said, “Social Security has nothing to do with the deficit.”

Many of the inaccuracies in the AP story reinforce, wittingly or not, the conservative narrative that Social Security is going broke and must be cut in order to survive. That can undermine public support for the program and pave the way for benefit reductions and privatization. We urge the mainstream media not to default to this narrative and at the least balance its coverage, which would acknowledge that some of our leaders in Washington have positive ideas for strengthening Social Security without cutting benefits — with the public squarely behind them.

Visit our website to view some common Social Security Myths!

Some of the Media Bungle Social Security Trustees Report

It’d be swell if more of the mainstream media would accurately report the financial status of Social Security. Unfortunately, much of the coverage is influenced by conservative propaganda rather than actual facts. Predictably, some of the reporting on the recently released Social Security trustees report is less journalistic than alarmist and simplistic.

As Los Angeles Times columnist Michael Hiltzik observes, “The annual report of the trustees provides yearly opportunities for misunderstandings by politicians, the media, and the general public about the health of (Social Security). This year is no exception,”

A quick review of the headlines following the release of the 2025 trustees report bears this out:

Social Security is set to dry up even sooner than expected – Forbes

Social Security Is Running Out of Money – Newsweek

Social Security go-broke date pushed up – Associated Press

Social Security Could Be Bankrupt By 2033 – iHeart Radio

For the record: Social Security is not drying up, running out of money, going broke, or facing bankruptcy. What the trustees reported is that, absent any action by Congress, the reserves in Social Security’s combined trust fund will become depleted by 2034 — a year earlier than was projected in the previous report. At that point, the program still could pay 81% of benefits. No one wants to see seniors suffer a 19% benefit cut, but that outcome is far from inevitable.

Let’s be clear: the only way that Social Security itself could go ‘bankrupt’ is if we had 100% unemployment and no one was paying into the program. Barring that unlikely event, Social Security still will have plenty of money. (There currently is a $2.7 trillion surplus in the trust fund.)

The trust fund’s projected depletion date has vacillated between 2033 and 2035 for several years now. The date moving up one year in the latest report is no cause for panic; but you’d never know that from the coverage.

Not all of the news media is bungling the story. Some of the reporting actually is fair and responsible. But the inaccurate coverage feeds directly into the conservative narrative that Social Security is on a path to oblivion — and that the only way to ‘save’ it is by cutting benefits or privatizing the program.

“We have a generational opportunity and a moral obligation to address the solvency and unsustainability of these programs,” insisted Rep. Jody Arrington (R-TX), Chair of the House Budget Committee. (Note: neither the trustees nor the program’s chief actuary has said that Social Security is “unsustainable.”)

The libertarian Cato Institute’s Romina Boccia called the 2025 report “bleak,” warning that “The program is barreling toward insolvency — and fast.” (Note: the trust fund will become insolvent if no action is taken to prevent it, but the program itself will remain solvent. The trust fund and the Social Security program are not the same thing.)

The second bogus claim in the media narrative is that ‘no one in Washington is taking the projected shortfall seriously or doing anything about it.’

“Lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.” – Associated Press, 6/18/25

In fact, both parties have proposed fixes for Social Security. Republicans have put forth plans to raise the retirement age (a huge benefit cut!), means test benefits (another cut), and implement a more miserly COLA formula (yes, an additional cut!) — on top of their ongoing calls to privatize the program. These proposals ask current or future seniors to bear the costs (and the risk, in the case of privatization) of ‘saving’ Social Security.

Democrats — including Rep. John Larson (D-CT), Senator Richard Blumenthal (D-CT), Senator Elizabeth Warren (D-MA), and Sen. Sheldon Whitehouse (D-RI) — have introduced legislation to bring more revenue into Social Security by asking the wealthy to contribute their fair share — with no benefit cuts. We fully embrace this approach.

There may be a lack of bipartisan consensus on the proper path, but to say that Congress is ‘kicking the can down the road’ is an oversimplification. These simple narratives are easier to fall back on for reporters facing deadlines, but they are grossly misleading — and can undermine public faith in Social Security. Of course, Congress should act, but there still is time before this becomes a full-blown crisis.

We’ll blog again later in the week with an analysis of a recent news story by the Associated Press, which (typically) mischaracterizes the implications of the trustees report. Stay tuned!

Hopes that Senate Would Mitigate Medicaid & SNAP Cuts Have Been Dashed

(Getty Images)

By Anne Montgomery, Senior Health Policy Expert

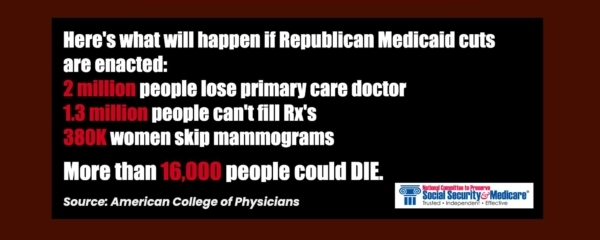

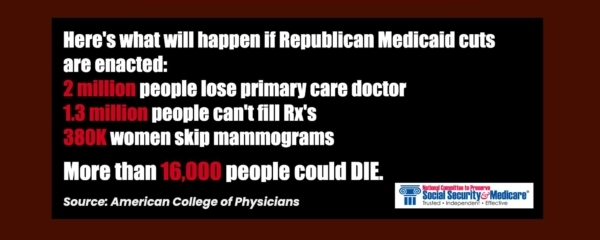

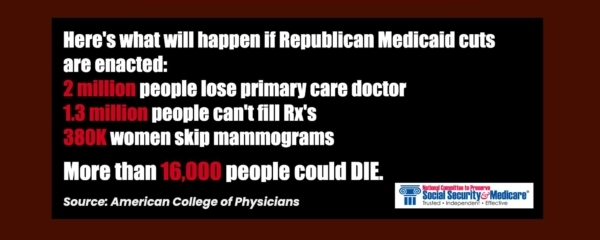

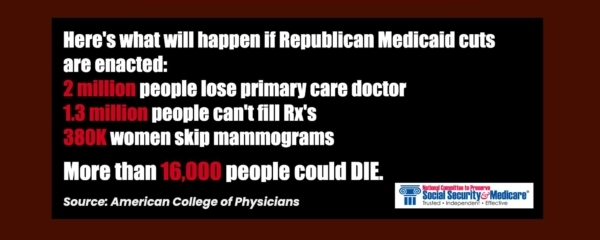

Seniors’ advocates who analyzed the reconciliation bill narrowly approved by the House of Representatives in May hoped that the U.S. Senate would temper unaffordable tax cuts for the wealthy — and avoid slashing Medicaid and SNAP. Those hopes have been dashed by Senate Republicans on the Finance and Agriculture Committees, who propose to end Medicaid and SNAP as we know them – as lifelines for millions of Americans across the country who need reliable access to basic health care and food to survive.

As Common Dreams so aptly put it in their news headline this week, “

“We’re watching in real time as Senate Republicans line up to gut healthcare for millions of Americans in order to pay for tax cuts for themselves, their wealthy donors, and big businesses.” – Common Dreams, 6/17/25

Although the Congressional Budget Office has yet to announce an estimate of the Senate bill’s funding reductions through 2034, most anticipate it will carve $1 trillion or so out of current federal funding for the two programs and use this as a partial offset for tax cuts that will benefit high-wealth individuals and businesses.

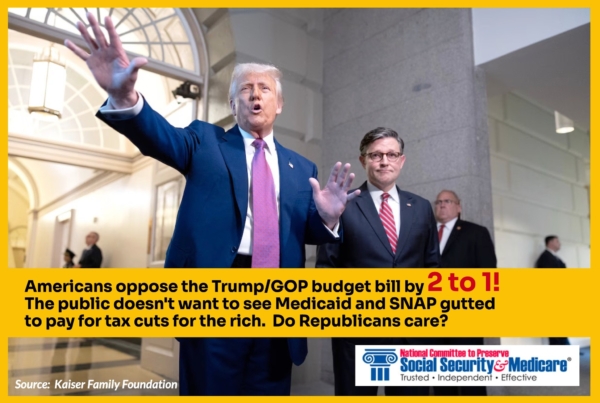

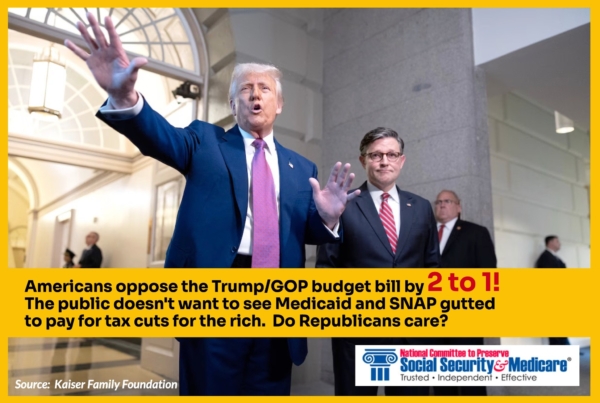

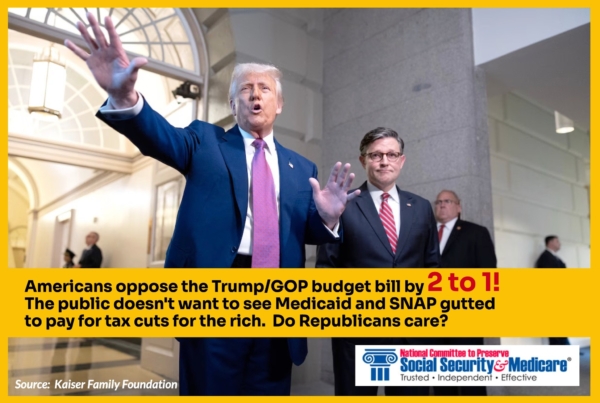

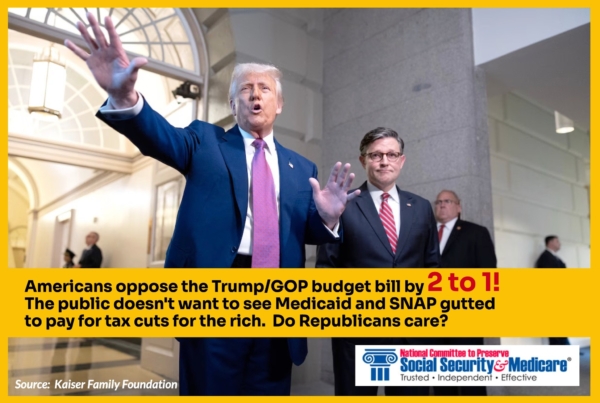

Senate Republicans are ploughing ahead with this devastating legislation despite the fact that new polling shows Americans oppose it by a margin of 2 to 1, among those who knew about the bill’s provisions.

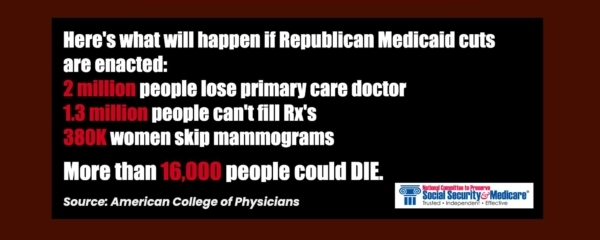

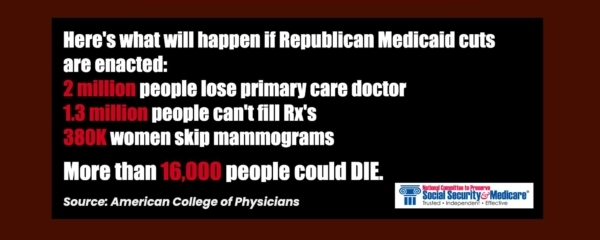

If Congress shoves this bill forward into law, states will become quickly impoverished as the health care system begins to collapse. Hospitals will not be able to provide care to millions of newly uninsured people who come to emergency rooms with no source of coverage. Nursing homes will not be able to field sufficient staff to provide decent care to older adults. Seniors and people with disabilities will be unable to get care in the place of their choosing.

Republicans are using fake arguments that Medicaid and SNAP are somehow wasteful and inefficient. But health care providers – doctors, hospitals, nurses, and other skilled practitioners – know otherwise. Medicaid payments for their services are already modest, in some cases lower than the actual cost of care. For families, the SNAP payments they use to buy groceries are hardly luxurious, averaging $726 per month (in Virginia, for example) for a family with two kids. That’s $181 per week.

Low-income adults between the ages 50 to 64 will be devastated by the House and Senate bills. Many are family caregivers, who are helping out their adult children with child care or providing support for older loved ones.

For the first time ever, these caregivers aged 50-64, who are not yet eligible for Medicare, would be subject to rigid work requirements in order to continue receiving health care and food assistance. The results are predictable: many of them will go without health care coverage themselves, and will be at risk of hunger.

To say all of this is cruel is an understatement. It will also damage the broader economy, which would be saddled with an additional five TRILLION dollars of debt. This means that interest payments on the debt that all taxpayers must pay will soar.

The National Committee to Preserve Social Security and Medicare sees this as a clarion call to stop what has been called “the largest transfer of wealth from the poor to the rich in U.S. history.” We urge you to raise your voices — as frequently as you can. Write letters and emails. Make appointments with staffers working for your Representative and the Senators in your state. Show up at rallies and share your story, or your neighbor’s story. Go to town halls. Elect those who show they care about YOU, not just getting rich and plunging the nation into fiscal chaos.

**************************************************************************************************************************************

LISTEN TO ANNE MONTGOMERY ON OUR PODCAST, WHERE SHE TALKS ABOUT THE DISADVANTAGES OF MEDICARE ADVANTAGE here.

Trump Marks Social Security’s 90th Anniversary by Spreading Misinformation

President Trump spreads misinformation at White House press conference (Washington Post)

Social Security turned 90 this week, a milestone that should have been celebrated with reverence. However, the Trump administration marked the occasion by perpetuating misleading claims about its handling of the program. From manipulating statistics to spreading untruths about immigrants, this administration is playing a cynical game with one of America’s most cherished federal programs.

While signing a proclamation for Social Security’s 90th anniversary, Trump made several astounding statements. He said that Social Security was “going to die very shortly,” but that his new SSA chief, Frank Bisignano, had effectively saved the program by instituting draconian cuts to the agency’s staff and resources, which have hobbled customer service and obstructed Americans’ access to their earned benefits. Trump also uttered this completely false, mini-word salad: “In 4 or 5 years (Social Security) is going to go bust, but not any more it’s not.” (See below the actual truth about Social Security’s finances.)

The President, who has promised ‘not to touch’ Social Security, once again demonstrated his ignorance about how the program really works. The program is not “going to die” in 4 or 5 years. Furthermore, alleged cost-savings by the Social Security Administration have nothing to do with whether the program itself remains financially healthy. Not only did Trump make blatant misstatements about the facts surrounding Social Security, he used the anniversary as an opportunity to scapegoat undocumented workers (who actually pay into the system, but cannot collect benefits).

As our president, Max Richtman, reminds us, “We wish we could simply celebrate, but the 90-year history of Social Security shows that we must always defend the program from those who would privatize or outright eliminate it.” Richtman emphasizes, “Social Security is part of the fabric of American life and must be preserved for the future.” (We commemorated the 90th anniversary with the release of our new documentary, “Social Security: 90 Years Strong,” which is streaming on multiple platforms.)

Manipulating Metrics to Rewrite Reality

At the forefront of the administration’s disinformation campaign is Social Security Commissioner Frank Bisignano, who joined President Trump in the Oval Office to tout what they called a “miraculous” turnaround at the Social Security Administration (SSA). Citing supposed improvements like reduced call wait times and streamlined customer service, they painted a rosy picture that crumbles under scrutiny.

For instance, Trump claimed that call wait times had reached an “all-time high” of 42 minutes during the Biden administration but had dramatically improved since his return to office. The truth? By the end of 2024, under Biden-appointed Commissioner Martin O’Malley, wait times on SSA’s 1-800 number had already dropped below 13 minutes, accompanied by a 30-year low in the disability claims backlog and a 6% productivity increase across the agency (Government Exec). These achievements were the result of funding from the Inflation Reduction Act and innovative reforms implemented long before Trump re-entered the White House.

Under Bisignano, however, the very calculation of call wait times has been redefined to artificially inflate performance. Kathleen Romig, director of Social Security policy at the Center on Budget and Policy Priorities, exposed this manipulation, explaining that the new metrics exclude the time callers who use the callback feature wait for a response.

“They say that the stat is the ‘average speed to answer,’ but that includes the average speed to speak to a human being and the average speed to a self-service option,” Romig said. “As soon as you’ve pressed ‘3’ for whatever service, you have stopped waiting for the purposes of [Bisignano’s] stat, and none of the rest of it counts” (Government Exec).

This statistical sleight of hand isn’t just misleading—it’s a breach of public trust. Social Security is the bedrock of retirement income and disability support for millions of Americans. Misrepresenting its operations does a disservice to the very people the SSA is supposed to serve.

“I think that when the president of the United States and his leadership team repeatedly lie about the biggest program in the federal government and the most important program for older people in this country, over and over again… it undermines trust in the program and undermines support for the program.” – Kathleen Romig, Center on Budget and Policy Priorities

Cherry-Picking Data

The administration didn’t stop at manipulating customer service metrics—it also peddled false claims about waste and fraud. Trump and Bisignano boasted that “nearly 275,000 illegal aliens” had been kicked off Social Security, another statement that wilts under scrutiny.

Romig pointed out that this claim likely conflates several unrelated issues, including legal immigrants losing their status and Musk-era bureaucratic errors where thousands of legitimate Social Security beneficiaries were falsely flagged as deceased.

“Most immigrants cannot collect Social Security benefits—short of becoming a permanent resident or citizen—but they still contribute to the program’s trust fund through payroll taxes,” Romig explained (Government Exec). By undercutting immigrant workers’ contributions, Trump’s policies have, in fact, “accelerated the depletion date of the trust fund” by reducing its revenue base.

Social Security is not Going Broke

To truly take stock of Social Security’s situation at 90, we must look squarely at the looming challenges—and how the Trump administration’s choices have made matters worse, not better. Social Security’s combined trust disability and retirement trust fund will become depleted in 2034, absent any preventative action from Congress. After that, only 81% of benefits will be payable, which the latest trustees’ report attributes in part to recent legislative changes (AP via Washington Post). But the program is not “going broke” or “dying.”

A key aggravating factor is the Trump administration’s Unfair, Ugly Bill. While Trump has repeated that his law “will eliminate taxes on federal Social Security benefits,” the reality is far different. As Brendan Duke of the Center on Budget and Policy Priorities explained, the new law only adds a temporary tax deduction for people 65 and over. It does not eliminate or mitigate taxes on Social Security benefits. More urgently, Duke warned, “The new tax law signed by Trump in July will accelerate the insolvency of Social Security” (AP).

Meanwhile, the program serves nearly 69 million Americans today—a number expected to rise to 82 million by Social Security’s 100th anniversary. AARP CEO Myechia Minter-Jordan rightly insisted: “As we look ahead to the next 90 years of Social Security, it’s critical that it remains strong for generations to come.” Yet Trump has not proposed a real, long-term solution to shore up the program, instead defaulting to misdirection and political theater.

Staffing cuts have further threatened the Social Security Administration’s ability to serve the public. According to the Associated Press, “the agency cut more than 7,000 from its workforce this year as part of the Department of Government Efficiency’s effort to reduce the size of the government.” These brutal reductions have led unions and advocacy organizations to sue over concerns about service quality and privacy.

The Privatization Mirage

The specter of Social Security privatization has returned, even as Americans have consistently rejected such plans in the past. (George W. Bush tried and failed to privatize the program in 2005.) Treasury Secretary Scott Bessent said out loud that a provision of the Unfair, Ugly Bill creating special savings account for children was a “backdoor for privatizing Social Security.” Trump’s nominee to head the Bureau of Labor of Statistics, E.J. Antoni, told a radio station in Texas last December that Social Security was a “Ponzi scheme” and should be “sunsetted” for future generations.

Glenn Hubbard, a top economist in the George W. Bush administration, reflected a common elite view: “We will have to make a choice. If you want Social Security benefits to look like they are today, we’re going to have to raise everyone’s taxes a lot. And if that’s what people want, you pay the high price and you move on.”

Others, like Rachel Greszler of the right-wing Heritage Foundation, advocate for “partial and optional privatization” and cutting benefits, but such ideas would undermine Social Security’s fundamental nature as a social insurance program.

Meanwhile, several Democratic members of Congress have put forward legislation to shore up the program’s finances by demanding that the wealthy begin paying their fair share in Social Security contributions — eschewing benefit cuts as punitive for current and future beneficiaries. We have endorsed many of these bills and continue to support them.

Honoring the Legacy of Social Security

The 90th anniversary of Social Security should have been a moment purely to honor the program that has lifted millions of Americans out of poverty. Instead, Trump used it as an excuse to propagate misinformation designed to score political points. The truth matters, especially when it comes to an institution as vital and enduring as Social Security.

Our job is to continue to advocate — from the halls of Congress to town halls across the country — for Social Security. The people’s job is to continue letting their voices be heard loud and clear, as we saw in this spring’s “Hands Off Social Security” protests. When the public pushes back, the Trump administration takes notice, reversing some of the most egregious policies at the Social Security Administration. We must remain vigilant if Social Security is to survive intact.

FDR’s Secretary of Labor, Frances Perkins, who was a prime mover in the creation of the program in 1935, said it best: “Social security is so firmly embedded in the American psychology today that no politician, no political party, could possibly destroy this act and still maintain our democratic system.”

Watch our new documentary, “Social Security: 90 Years Strong” here. View the 3-minute trailer here.

Medicare Turned 60! Here’s Why We Can’t Simply Celebrate

This blog post is an expanded version of an op-ed published in Common Dreams.

Like Sarah Jessica Parker, Chris Rock, and Brooke Shields, Medicare has turned 60 years old. President Lyndon B. Johnson signed the program into law on July 30, 1965, giving seniors a guarantee of health coverage that never existed before. Prior to Medicare’s enactment, it was nearly impossible for older people to obtain health insurance, as they were considered a ‘bad risk.’

Medicare provides universal coverage to Americans over 65 years of age. (Ironically, Medicare would not yet be old enough to qualify for itself.) The law created Medicare Part A as a national hospital insurance program. Part B is a voluntary program for doctor visits and other medical services. Medicare Part C is another name for the privatized, for-profit version of the program called “Medicare Advantage.” And Part D is the prescription drug program enacted in 2003.

The Hospital Insurance portion is funded through workers’ payroll contributions. At the signing ceremony in Independence, MO, LBJ said: “Through this new law, every citizen will be able, in their productive years when they are earning, to insure themselves against the ravages of illness in old age.”

Lyndon Johnson paid tribute to former President Harry S. Truman, presenting him with the very first Medicare card. It was Truman who, 20 years earlier, had proposed a form of universal medical coverage for the American people.

LBJ quoted Truman’s remarks from the 1940s:

“Millions of our citizens do not now have a full measure of opportunity to achieve and to enjoy good health. Millions do not now have protection or security against the economic effects of sickness. And the time has now arrived for action to help them attain that opportunity and to help them get that protection.” – President Harry S. Truman

It turned out that the time had not yet arrived. Truman’s proposal failed to gain traction during a time of retrenchment from the expansions of the New Deal, and opposition from the Republican majority on Capitol Hill which he famously labeled the “do-nothing Congress.”

President Johnson’s determination to enact his Great Society agenda and sheer political muscle – not to mention solid Democratic control of Congress – pushed Medicare (and its sister program, Medicaid) into being. LBJ was known for his intense style of political arm-twisting, known as “the Johnson Treatment.” Once he latched onto a goal, he was unlikely to let it go.

Naturally, Medicare faced fierce opposition from conservatives. None other than Ronald Reagan made the ludicrous prediction that if Medicare were enacted, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” Sixty years later, we are no less “free” because of Medicare. In fact, having guaranteed health care makes seniors and people with disabilities (and their families) much more free – from disease, from worry, and financial ruin.

Today, 68 million people rely on Medicare for health coverage, including 12 million who are dually eligible for Medicare and Medicaid. Medicare isn’t perfect: The for-profit Medicare Advantage (Part C) program is extremely problematic (see below). The Medicare Part A trust fund will become depleted in 2033 if Congress fails to take action to strengthen it. Traditional Medicare still doesn’t cover basic hearing, vision, and dental care — which we have been pushing for many years. But most concerning of all — President Trump and his party have spent this 60th anniversary year actively undermining both Medicare and Medicaid.

Some 68 million seniors and people with disabilities rely on Medicare for health coverage

The “Unfair, Ugly” bill that Trump signed earlier this month slashed nearly $1 trillion from Medicaid, which will strip health coverage from an estimated 10 to 16 million lower-income Americans. The new law — projected to add more than $3 trillion to the national debt — could trigger cuts to Medicare down the road.

Meanwhile, the Trump administration is recklessly taking steps to privatize the entire Medicare program. It has announced a pilot project to involve private companies in conducting prior authorizations for care (now an infamous aspect of the for-profit Medicare Advantage program) in traditional Medicare. The administration, under HHS Secretary Robert F. Kennedy, Jr. and CMS Director Mehmet Oz, also has announced a plan to automatically enroll new Medicare beneficiaries in the for-profit Medicare Advantage (MA) program — a huge gift to the multi-billion dollar insurance industry at the expense of patients.

The problems with Medicare Advantage are now legendary. Enrollees are basically put into HMO’s run by insurance giants like Aetna, Humana, and United HealthCare, with limited networks of providers. Unreasonable denials of care are rampant. Patients who become disenchanted with MA plans often find it impossible to switch to traditional Medicare. Meanwhile, MA Insurers have been overcharging the government for their services and ripping off taxpayers. (Several of these insurance companies are currently under investigation.)

Joe Namath pitches for-profit Medicare Advantage plans in tv ads by insurance industry

We are watching to see if the Trump administration, which talks a good game about lowering prescription medication costs while simultaneously doing favors for Big Pharma, will honor the provisions of President Biden’s Inflation Reduction Act, which made myriad patient-friendly reforms to the Part D drug program — including out of pocket caps for beneficiaries and the ability of the government to negotiate prices with the industry.

The bottom line is: Let’s please not allow President Trump and congressional Republicans to shred one of the greatest legacies of LBJ’s Great Society. We and our fellow advocacy groups are pushing back — and so is the general public. But we don’t want to be fighting this same battle every time Medicare (and Medicaid) mark an anniversary — when we should be purely celebrating.

Want to hear more about the condition of Medicare and Medicaid under the Trump administration? Listen to our podcast here.

Did you know we are on BlueSky now? Follow us here!

Associated Press Flubs Social Security Trustees Story

We blogged earlier this week about the inaccuracy of media reports about Social Security’s financial future. Some mainstream media journalists seemed to rely on old tropes when covering the recent Social Security trustees report. A prime example: a news story from the Associated Press (AP) with the alarmist headline, Medicare and Social Security go-broke dates pushed up.

We asked our director of government relations and policy, Dan Adcock, to correct some of the inaccuracies in the AP piece…

Dan Adcock: Let’s start with the headline. It’s completely misleading. Neither program is “going broke.” In the case of Social Security, the combined trust fund is projected to become depleted in 2034 if Congress takes no action, at which time the system still could pay 81% of benefits. Social Security itself is not going broke or bankrupt. The only way that could happen is if we had 100% unemployment and no one was paying into the program.

AP: Social Security’s trust funds — which cover old age and disability recipients — will be unable to pay full benefits beginning in 2034, instead of last year’s estimate of 2035.

Adcock: The reporter omits that that Social Security also pays benefits to spouses and survivors (upon the death of a family breadwinner), including millions of children. Social Security is a retirement program for sure — but it is also so much more than that.

AP: The trustees say the latest findings show the urgency of needed changes to the programs, but… lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.

Adcock: This is a media trope that insists no one in Washington is thinking about Social Security’s future — or willing to take action. In fact, both parties have proposed solutions to ‘fix’ Social Security. The problem is that the Republicans focus exclusively on cutting benefits. Democrats have put forward proposals to bring more revenue into the program by demanding that the wealthy contribute their fair share. Opinion polling suggests that the public favors the approach of raising revenue rather than cutting benefits, regardless of party affiliation.

AP: President Donald Trump and other Republicans have vowed not to make any cuts to Medicare or Social Security, even as they seek to shrink the federal government’s expenditures.

Adcock: Those vows to protect Social Security have turned out to be quite hollow. The House Republican Study Committee has proposed cuts to Social Security (including raising the retirement age) in its budget blueprints. House and Senate Republicans have favored a fiscal commission that could fast-track cuts to the program through Congress. But more immediately, Trump unleashed Elon Musk & DOGE to wreak havoc on the Social Security Administration. The result has been severe cuts in staffing, mounting difficulty for customers accessing their benefits, multiple website crashes, and people being wrongly declared dead and having their benefits cut off. While these are not benefit cuts per se, they represent unprecedented interference in the delivery of Social Security — and break the President’s promise “not to touch” it.

AP: The report states that the Social Security Social Security Fairness Act (SSFA), enacted in January, which repealed the Windfall Elimination and Government Pension Offset provisions of the Social Security Act and increased Social Security benefit levels for some workers, had an impact on the depletion date of SSA’s trust funds.

Dan Adcock: The beneficiaries of the SSFA were not just “some workers.” They’re public sector employees like teachers, firefighters, and police officers who were denied full Social Security benefits until the Social Security Fairness Act was passed last year. The impact on the depletion date of the trust funds was only six months.

AP: Congressional Budget Office reporting has stated that the biggest drivers of debt rising in relation to GDP are increasing interest costs and spending for Medicare and Social Security. An aging population drives those numbers.

Dan Adcock: According to the nonpartisan Center for Budget and Policy Priorities, the biggest driver of the debt is TAX EXPENDITURES, including Trump’s huge tax cuts for the wealthy and big corporations. Social Security and Medicare Part A are completely self-funded by workers’ payroll contributions and DO NOT CONTRIBUTE to the debt. As Ronald Reagan said, “Social Security has nothing to do with the deficit.”

Many of the inaccuracies in the AP story reinforce, wittingly or not, the conservative narrative that Social Security is going broke and must be cut in order to survive. That can undermine public support for the program and pave the way for benefit reductions and privatization. We urge the mainstream media not to default to this narrative and at the least balance its coverage, which would acknowledge that some of our leaders in Washington have positive ideas for strengthening Social Security without cutting benefits — with the public squarely behind them.

Visit our website to view some common Social Security Myths!

Some of the Media Bungle Social Security Trustees Report

It’d be swell if more of the mainstream media would accurately report the financial status of Social Security. Unfortunately, much of the coverage is influenced by conservative propaganda rather than actual facts. Predictably, some of the reporting on the recently released Social Security trustees report is less journalistic than alarmist and simplistic.

As Los Angeles Times columnist Michael Hiltzik observes, “The annual report of the trustees provides yearly opportunities for misunderstandings by politicians, the media, and the general public about the health of (Social Security). This year is no exception,”

A quick review of the headlines following the release of the 2025 trustees report bears this out:

Social Security is set to dry up even sooner than expected – Forbes

Social Security Is Running Out of Money – Newsweek

Social Security go-broke date pushed up – Associated Press

Social Security Could Be Bankrupt By 2033 – iHeart Radio

For the record: Social Security is not drying up, running out of money, going broke, or facing bankruptcy. What the trustees reported is that, absent any action by Congress, the reserves in Social Security’s combined trust fund will become depleted by 2034 — a year earlier than was projected in the previous report. At that point, the program still could pay 81% of benefits. No one wants to see seniors suffer a 19% benefit cut, but that outcome is far from inevitable.

Let’s be clear: the only way that Social Security itself could go ‘bankrupt’ is if we had 100% unemployment and no one was paying into the program. Barring that unlikely event, Social Security still will have plenty of money. (There currently is a $2.7 trillion surplus in the trust fund.)

The trust fund’s projected depletion date has vacillated between 2033 and 2035 for several years now. The date moving up one year in the latest report is no cause for panic; but you’d never know that from the coverage.

Not all of the news media is bungling the story. Some of the reporting actually is fair and responsible. But the inaccurate coverage feeds directly into the conservative narrative that Social Security is on a path to oblivion — and that the only way to ‘save’ it is by cutting benefits or privatizing the program.

“We have a generational opportunity and a moral obligation to address the solvency and unsustainability of these programs,” insisted Rep. Jody Arrington (R-TX), Chair of the House Budget Committee. (Note: neither the trustees nor the program’s chief actuary has said that Social Security is “unsustainable.”)

The libertarian Cato Institute’s Romina Boccia called the 2025 report “bleak,” warning that “The program is barreling toward insolvency — and fast.” (Note: the trust fund will become insolvent if no action is taken to prevent it, but the program itself will remain solvent. The trust fund and the Social Security program are not the same thing.)

The second bogus claim in the media narrative is that ‘no one in Washington is taking the projected shortfall seriously or doing anything about it.’

“Lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.” – Associated Press, 6/18/25

In fact, both parties have proposed fixes for Social Security. Republicans have put forth plans to raise the retirement age (a huge benefit cut!), means test benefits (another cut), and implement a more miserly COLA formula (yes, an additional cut!) — on top of their ongoing calls to privatize the program. These proposals ask current or future seniors to bear the costs (and the risk, in the case of privatization) of ‘saving’ Social Security.

Democrats — including Rep. John Larson (D-CT), Senator Richard Blumenthal (D-CT), Senator Elizabeth Warren (D-MA), and Sen. Sheldon Whitehouse (D-RI) — have introduced legislation to bring more revenue into Social Security by asking the wealthy to contribute their fair share — with no benefit cuts. We fully embrace this approach.

There may be a lack of bipartisan consensus on the proper path, but to say that Congress is ‘kicking the can down the road’ is an oversimplification. These simple narratives are easier to fall back on for reporters facing deadlines, but they are grossly misleading — and can undermine public faith in Social Security. Of course, Congress should act, but there still is time before this becomes a full-blown crisis.

We’ll blog again later in the week with an analysis of a recent news story by the Associated Press, which (typically) mischaracterizes the implications of the trustees report. Stay tuned!

Hopes that Senate Would Mitigate Medicaid & SNAP Cuts Have Been Dashed

(Getty Images)

By Anne Montgomery, Senior Health Policy Expert

Seniors’ advocates who analyzed the reconciliation bill narrowly approved by the House of Representatives in May hoped that the U.S. Senate would temper unaffordable tax cuts for the wealthy — and avoid slashing Medicaid and SNAP. Those hopes have been dashed by Senate Republicans on the Finance and Agriculture Committees, who propose to end Medicaid and SNAP as we know them – as lifelines for millions of Americans across the country who need reliable access to basic health care and food to survive.

As Common Dreams so aptly put it in their news headline this week, “

“We’re watching in real time as Senate Republicans line up to gut healthcare for millions of Americans in order to pay for tax cuts for themselves, their wealthy donors, and big businesses.” – Common Dreams, 6/17/25

Although the Congressional Budget Office has yet to announce an estimate of the Senate bill’s funding reductions through 2034, most anticipate it will carve $1 trillion or so out of current federal funding for the two programs and use this as a partial offset for tax cuts that will benefit high-wealth individuals and businesses.

Senate Republicans are ploughing ahead with this devastating legislation despite the fact that new polling shows Americans oppose it by a margin of 2 to 1, among those who knew about the bill’s provisions.

If Congress shoves this bill forward into law, states will become quickly impoverished as the health care system begins to collapse. Hospitals will not be able to provide care to millions of newly uninsured people who come to emergency rooms with no source of coverage. Nursing homes will not be able to field sufficient staff to provide decent care to older adults. Seniors and people with disabilities will be unable to get care in the place of their choosing.

Republicans are using fake arguments that Medicaid and SNAP are somehow wasteful and inefficient. But health care providers – doctors, hospitals, nurses, and other skilled practitioners – know otherwise. Medicaid payments for their services are already modest, in some cases lower than the actual cost of care. For families, the SNAP payments they use to buy groceries are hardly luxurious, averaging $726 per month (in Virginia, for example) for a family with two kids. That’s $181 per week.

Low-income adults between the ages 50 to 64 will be devastated by the House and Senate bills. Many are family caregivers, who are helping out their adult children with child care or providing support for older loved ones.

For the first time ever, these caregivers aged 50-64, who are not yet eligible for Medicare, would be subject to rigid work requirements in order to continue receiving health care and food assistance. The results are predictable: many of them will go without health care coverage themselves, and will be at risk of hunger.

To say all of this is cruel is an understatement. It will also damage the broader economy, which would be saddled with an additional five TRILLION dollars of debt. This means that interest payments on the debt that all taxpayers must pay will soar.

The National Committee to Preserve Social Security and Medicare sees this as a clarion call to stop what has been called “the largest transfer of wealth from the poor to the rich in U.S. history.” We urge you to raise your voices — as frequently as you can. Write letters and emails. Make appointments with staffers working for your Representative and the Senators in your state. Show up at rallies and share your story, or your neighbor’s story. Go to town halls. Elect those who show they care about YOU, not just getting rich and plunging the nation into fiscal chaos.

**************************************************************************************************************************************

LISTEN TO ANNE MONTGOMERY ON OUR PODCAST, WHERE SHE TALKS ABOUT THE DISADVANTAGES OF MEDICARE ADVANTAGE here.