Hopes that Senate Would Mitigate Medicaid & SNAP Cuts Have Been Dashed

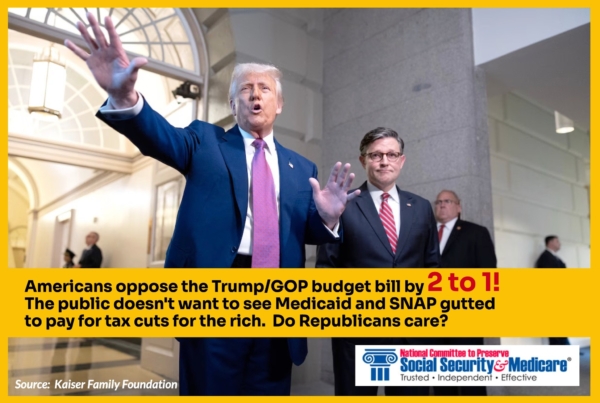

(Getty Images)

By Anne Montgomery, Senior Health Policy Expert

Seniors’ advocates who analyzed the reconciliation bill narrowly approved by the House of Representatives in May hoped that the U.S. Senate would temper unaffordable tax cuts for the wealthy — and avoid slashing Medicaid and SNAP. Those hopes have been dashed by Senate Republicans on the Finance and Agriculture Committees, who propose to end Medicaid and SNAP as we know them – as lifelines for millions of Americans across the country who need reliable access to basic health care and food to survive.

As Common Dreams so aptly put it in their news headline this week, “

“We’re watching in real time as Senate Republicans line up to gut healthcare for millions of Americans in order to pay for tax cuts for themselves, their wealthy donors, and big businesses.” – Common Dreams, 6/17/25

Although the Congressional Budget Office has yet to announce an estimate of the Senate bill’s funding reductions through 2034, most anticipate it will carve $1 trillion or so out of current federal funding for the two programs and use this as a partial offset for tax cuts that will benefit high-wealth individuals and businesses.

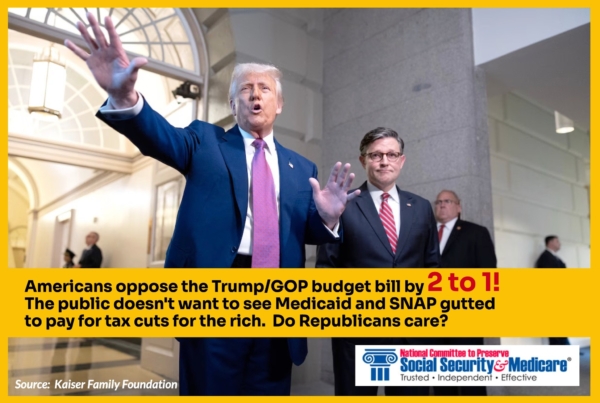

Senate Republicans are ploughing ahead with this devastating legislation despite the fact that new polling shows Americans oppose it by a margin of 2 to 1, among those who knew about the bill’s provisions.

If Congress shoves this bill forward into law, states will become quickly impoverished as the health care system begins to collapse. Hospitals will not be able to provide care to millions of newly uninsured people who come to emergency rooms with no source of coverage. Nursing homes will not be able to field sufficient staff to provide decent care to older adults. Seniors and people with disabilities will be unable to get care in the place of their choosing.

Republicans are using fake arguments that Medicaid and SNAP are somehow wasteful and inefficient. But health care providers – doctors, hospitals, nurses, and other skilled practitioners – know otherwise. Medicaid payments for their services are already modest, in some cases lower than the actual cost of care. For families, the SNAP payments they use to buy groceries are hardly luxurious, averaging $726 per month (in Virginia, for example) for a family with two kids. That’s $181 per week.

Low-income adults between the ages 50 to 64 will be devastated by the House and Senate bills. Many are family caregivers, who are helping out their adult children with child care or providing support for older loved ones.

For the first time ever, these caregivers aged 50-64, who are not yet eligible for Medicare, would be subject to rigid work requirements in order to continue receiving health care and food assistance. The results are predictable: many of them will go without health care coverage themselves, and will be at risk of hunger.

To say all of this is cruel is an understatement. It will also damage the broader economy, which would be saddled with an additional five TRILLION dollars of debt. This means that interest payments on the debt that all taxpayers must pay will soar.

The National Committee to Preserve Social Security and Medicare sees this as a clarion call to stop what has been called “the largest transfer of wealth from the poor to the rich in U.S. history.” We urge you to raise your voices — as frequently as you can. Write letters and emails. Make appointments with staffers working for your Representative and the Senators in your state. Show up at rallies and share your story, or your neighbor’s story. Go to town halls. Elect those who show they care about YOU, not just getting rich and plunging the nation into fiscal chaos.

**************************************************************************************************************************************

LISTEN TO ANNE MONTGOMERY ON OUR PODCAST, WHERE SHE TALKS ABOUT THE DISADVANTAGES OF MEDICARE ADVANTAGE here.

Trump/DOGE Actions Fuel Surge in Social Security Claims

More Americans are suddenly filing for Social Security earlier than planned — and it isn’t necessarily because they’re eager to retire. Interference in the Social Security system by Trump, Musk and DOGE has triggered a wave of public panic about the future of the program. For many, it’s created a sense of urgency to claim benefits before any other harmful changes are made. The recent feuding between Trump and Musk — entertaining, disturbing, and inevitable as it is — does not undo their craven efforts to undermine public faith in Social Security. Unfortunately, it’s working.

According to CBS News, early Social Security claims have surged by 17% this year compared to the same period in 2024. If this trend continues, annual filings are on track to reach 4 million. This spike comes amid the slashing of workforce and resources at the Social Security Administration under the guise of ‘efficiency’ — along with Trump and Musk’s lies about the program (like the one about long-dead people supposedly receiving benefits). Trump’s SSA has even declared living people dead, forcing them to go to a field office in person to be officially ‘resurrected.’

Americans are Worried

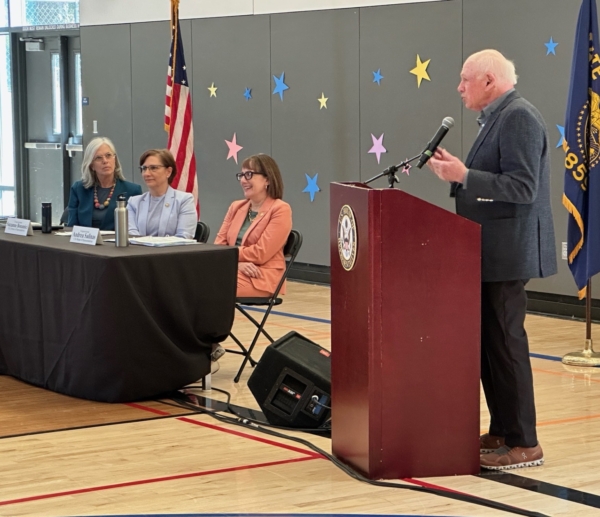

Many retirees are worried that these confusing, chaotic changes at SSA could impact their benefits. NCPSSM President and CEO Max Richtman has spoken at congressional town halls across the country, where constituents are voicing their concerns loudly and clearly. Richtman notes that attendees often ask if they should file for Social Security early to ensure they receive benefits before further disruptions affect the system.

Understandable as those concerns are, Richtman cautions against filing out of fear. At a recent town hall he explained, “It’s reasonable to be worried, but claiming benefits early may hurt you in the long run. We normally encourage workers to wait till full retirement age or beyond, because the longer you wait (up to age 70), the higher your lifetime benefit will be.”

Conversely, workers who claim before full retirement age take a 7% hit in lifetime benefits for every year they file early. “Those who can wait to claim benefits often end up in a much better financial position over the long term,” Richtman says.

Customer Service at SSA is Suffering

Trump, Musk, and DOGE-instigated cutbacks at the Social Security Administration have disrupted customer service, fueling public concern about their benefits. Long waits, busy signals, and ongoing issues with new AI-powered customer service systems have further complicated operations. CNET called SSA’s customer service bots “maddeningly bad” – answering questions in non-sequiturs and refusing to connect callers to live agents. (See the AI bot talking in circles to an MSNBC anchor here.) Meanwhile, SSA’s website has crashed multiple times since DOGE’s tech bros invaded the agency.

Making matters even worse, Ill-advised policies (mandated by the Trump administration) have put up unnecessary roadblocks for customers simply trying to access their Social Security accounts or make changes to their information. Supposed ‘anti-fraud’ measures on the 1-800 phone lines are causing more claimants to travel to understaffed Social Security field offices for help.

The Center on Budget and Policy Priorities reports that SSA’s restrictive, new policies will require claimants to make nearly 2 million additional trips to understaffed Social Security field offices every year. Imposing this burden on seniors and people with disabilities is further proof of the administration’s indifference to the people who rely on this program as a financial lifeline.

Public Pushback

Americans are alarmed by these changes and are making their voices heard. Protests under the banner “Hands Off Social Security” have gained traction nationwide. Congressional town halls around the country are drawing standing-room-only crowds. Max Richtman is encouraged by these grassroots efforts, comparing them to the successful public campaign that halted George W. Bush’s plans to privatize Social Security in 2005. “We can stop bad things from happening if people continue to make their voices heard.”

NCPSSM CEO Max Richtman speaks at Social Security town hall in Oregon (April, 2025)

Town halls across the country are drawing packed audiences worried about Social Security

As evidence, Richtman points out that SSA has walked back some of its more egregious, new policies in the face of public blowback. Earlier this spring, the agency announced that claimants could no longer verify their identities via the 1-800 phone line because of ‘fraud,’ even though actual telephone fraud in the program is about .001% of total benefits paid. When the advocacy community and the grassroots movement pushed back in a very public way, the SSA loosened the new policy so that not every senior would have to travel to a crowded field office or go online to verify ID.

Social Security has been a lifeline for seniors for nearly 90 years. The Trump/Musk/DOGE changes to the system are dangerous and unnecessary. (Musk even called Social Security a Ponzi scheme.) “This program works and has stood the test of time,” Richtman says. “We must ensure it continues to do so for decades to come” by maintaining public pressure on President Trump and his acolytes at the Social Security Administration.

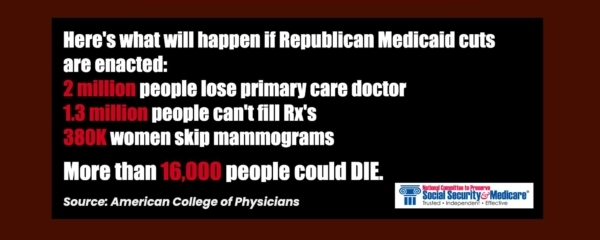

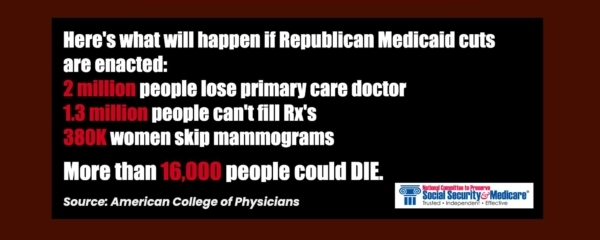

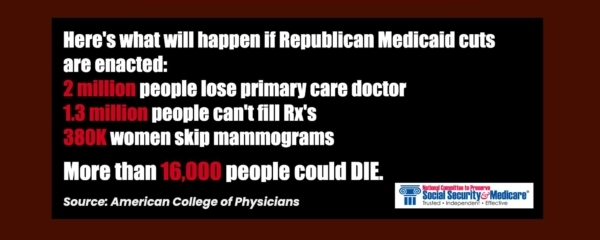

The Devastating Consequences of GOP Medicaid Cuts

House Republicans have taken another major step toward gutting the Medicaid program to pay for tax cuts largely benefitting their wealthy donors. On May 14, the GOP-controlled House Committee on Energy and Commerce approved budget legislation that slashes Medicaid funding by a jaw-dropping $717 billion over the next decade.

The Congressional Budget Office (CBO) estimates that the Republican budget could strip health coverage from at least 13.7 million people. “Republicans are cutting them adrift, with no place else to turn for medical care except perhaps the emergency room,” says NCPSSM President Max Richtman, who labeled it “the most massive cut in Medicaid’s 60-year history.”

Richtman emphasizes that, “with coverage ripped from millions of Americans, the health care system itself could collapse. Republicans may claim that these cuts are aimed at ‘waste, fraud, and abuse,’ but there isn’t anywhere near $717 billion worth of it in today’s Medicaid system.

The Center for American Progress called it “…the largest transfer of wealth from the poor to the rich in U.S. history.”

States Cannot Pick Up the Slack

States don’t have the resources to close the gaps in Medicaid funding. With federal payments slashed, they will face impossible choices. Forecasts provide little reassurance. Nearly 40% of economists polled by the National Association of Business Economics believe there’s a greater than 50% chance of a recession in the next year. If that happens, state tax revenues will shrink just as Medicaid needs spike. Even if the economy holds up, states will likely be forced to cut eligibility and benefits to cope with these federal cuts.

Cuts to Medicaid Will Undermine the Health Care Provider Infrastructure

Medicaid isn’t just a healthcare safety net. It’s a key driver of the economy, accounting for 18% of national healthcare spending. Reducing this massive investment impacts everyone, not just Medicaid beneficiaries. Republicans have proposed no alternate programs have to fill these gaps.

A joint study from the Urban Institute and the Robert Wood Johnson Foundation revealed that if Republicans defund Medicaid expansion under the Affordable Care Act, hospitals alone would lose $32 billion in revenue while absorbing $6.3 billion in unpaid care costs.

Prescription drug spending would drop by $20.9 billion, other health services (like home care) by $20.7 billion, and physician office revenue by $6.4 billion. These aren’t abstract numbers; they represent a threat to providers and patients alike.

Cutting Medicaid Could Mean the End of Optional Home and Community-Based Services

“The GOP cuts,” says Richtman, “would hit seniors especially hard,” as Medicaid pays for 60% of long-term care services and supports. Worse yet, a population deprived of basic health care will ultimately be sicker and cost taxpayers more in the long run.”

Approximately 700,000 Americans are currently on waiting lists for Medicaid Home and Community-Based Services (HCBS). These services allow seniors to maintain their independence, stay in their homes, and receive essential supports such as transportation and caregiver respite. Medicaid HCBS helps older adults avoid institutional settings like nursing homes.

The current 4.5 million HCBS recipients would see their coverage evaporate under the proposed Republican cuts. For many older Americans, their only option would be nursing home care, which is often more expensive and less desirable. As Richtman says, “Older Americans have made it clear they want to age in their homes with dignity.”

Trump & House Speaker Mike Johnson. Americans can blame these two for “the largest transfer of wealth from the poor to the rich in U.S. history.”

Requiring Mature Americans to Work for Medicaid Eligibility

The legislation proposes raising work requirements for Medicaid eligibility to include people up to age 65. This change is wildly unrealistic given the barriers older Americans face in the workforce. AARP data shows that nearly two-thirds of workers aged 55-64 believe their age prevents them from finding jobs. Employers are less likely to hire older workers. Economic downturns make these issues worse, as older employees are often the first to be laid off.

Work requirements already proved disastrous in New Hampshire and Arkansas, where implementation led to significant drops in Medicaid enrollment. A Kaiser Family Foundation analysis projected that work requirements could cause 5 million Americans to lose coverage.

“These cuts are not ‘pennywise,’ but they’re definitely ‘pound foolish,’” says Richtman. “This proposal is about barriers, not solutions… It punishes older workers for being unemployed in a system rigged against them.”

The Bottom Line

The devastating effects of this bill can’t be understated. Slashing Medicaid’s budget would lead to massive job losses in healthcare, worsen chronic illnesses, and force millions into poverty or homelessness. This isn’t just about money; it’s about lives. Or, as Richtman puts it, “There are two deficits in GOP-controlled Washington today… the budget deficit and an apparent deficit of empathy on the part of many Republicans.”

Don’t Claim Social Security Early Because of Trump & Musk

Many Americans nearing retirement age are understandably nervous about the future of Social Security under the Trump/Musk regime. More people are claiming benefits early to hedge their bets against potential cuts or disruptions. First-time benefit claims jumped from roughly 500,000 in March of 2024 to 580,000 this year. These early filers are right to be concerned.

The Trump administration, largely via Elon Musk’s DOGE operation, is slashing the workforce and closing offices at the Social Security Administration, which delivers earned benefits for 73 million people. According to the Wall Street Journal, more than 75% of U.S. adults are worried “a great deal or a fair amount” about Social Security, “a 13-year high.”

The Trump/Musk team has announced drastic policy changes creating administrative hurdles for seniors and people with disabilities. Field offices have closed; wait times on the 1-800 phone line have ballooned again; and the agency’s website has crashed several times since Trump took office. The administration even announced that it was reclassifying some legal immigrants as “dead,” so that they cannot use their Social Security numbers or collect benefits.

But while it is understandable that some people are rushing to claim Social Security benefits early, this isn’t necessarily the best strategy. For many years, we have encouraged people to delay claiming benefits as long as they can afford to. We even ran a public education campaign in 2018 called Delay & Gain about this very topic.

Full retirement age is now 67. That’s when you can collect your full retirement benefit. You can file for Social Security as early as 62, but every year you claim early triggers an 8% lifetime benefit cut. Conversely, if you wait to claim until age 70, your lifetime benefit is higher than claiming at full retirement age.

“Cutting your benefits by claiming early so that your future benefits won’t be cut is kind of like ‘self-deporting.’ In an attempt to protect yourself, you may make things worse,” said Dan Adcock, our Director of Government Relations and Policy.

It’s a risky proposition to claim early and take the hit in lifetime benefits — out of the very reasonable worry that Trump’s presidency threatens the integrity of the Social Security system. While Trump and Musk can throw sand in the gears of the Social Security Administration, it would take an act of Congress to cut statutory benefits. Any legislation changing Social Security requires at least 60 votes in the Senate, which is a hard number to reach in today’s politically divided environment.

Trump & Musk’s interference with Social Security has drawn protests across the country

This is not to say that some congressional Republicans wouldn’t love to cut benefits, even if they don’t admit that what they propose are, in fact, benefit cuts. GOP proposals include raising the retirement age to 69 or 70, means testing Social Security, and reducing annual Cost of Living Adjustments (COLAs). But they still would need 60 votes in the Senate.

We do not take Trump’s promise “not to touch” Social Security very seriously, but so far he has not endorsed any congressional proposals to actually cut benefits. He has, however, pushed to eliminate taxes on benefits, which would accelerate the projection depletion of the Social Security trust fund reserves.

What to do, then, if you are nervous about Social Security during the second Trump era? We recently posted some tips for protecting your benefits & data, from our senior Social Security expert, Maria Freese:

1. Create a Personal My Social Security account on SSA’s website

With a My Social Security account, you will be less reliant on the telephone or local field offices to transact business with SSA.

2. Acquire and Save Your Earnings Record

If you have My Social Security account, you have access to your earnings records through SSA. We recommend you download all of your records to your personal computer and make a printed copy, which you save in a secure location.

3. Regularly Review Your Financial Transactions & Track Your Credit History

Regularly checking your accounts and credit history is a good habit to follow at any time, but especially now with so much personal financial information held by SSA at risk of exposure through DOGE activities.

4. Verify Your Identity with SSA in Person

Verifying your identity in advance, when you are not under time pressure and while field offices remain open, could serve as a legitimate back-up option if creating a My Social Security account is not possible.

For most people, taking these commonsense actions is the best way to protect yourself during this time of upheaval. Pre-emptively cutting your own lifetime benefits by claiming early is likely to do more harm than good.

“Claim benefits when it is best for you financially — not because you are afraid of the negative impact of Trump and Musk’s attack on the SSA,” says Freese. “Don’t let Donald Trump and the richest man in the world force you into a poorer retirement.”

Trump Wants to Reclassify Social Security Staffers as Political Appointees

The Trump administration is again targeting the Social Security Administration (SSA) with changes that could undermine its mission. President Trump seeks to replace career civil servants at federal agencies (including SSA) with politically loyal appointees, using a classification known as “Schedule F.” This reclassification is designed to boost the president’s control over career federal staffers by removing their civil service protections and making them easier to fire.

This reckless move by the Trump Administration threatens to sideline professionals whose expertise ensures millions of Americans get the benefits they depend on. Schedule F isn’t just a bureaucratic tweak; it’s a power play that jeopardizes the foundation of one of the country’s most trusted institutions.

Schedule F is a throwback to the patronage system that the U.S. did away with in the late 19th century. Back then, federal jobs were handed out based on political loyalty, not expertise. According to an ally of the National Committee to Preserve Social Security and Medicare who was a longtime SSA employee:::

“MAGA doesn’t trust professional staff. They want loyal staff, and that is what Schedule F is all about. It’s about populating the federal service with people who are incompetent and unqualified, but loyal like a Labrador.”

At the SSA, professionalism has been key to its success for decades. But with Schedule F, that’s at risk. The same ally pointed out the inconsistency of classifying SSA employees as Schedule F workers. “The supposed criterion for inclusion in Schedule F is that you are in a policy-making role—that historically is the primary defining criterion for classification in the Senior Executive Service (SES).” This undermines the intent behind differentiating policy-making roles from operational ones and risks muddying the waters even further.

What Does This Mean for SSA Employees?

The potential scope of Schedule F at the SSA is staggering. Critics say it could sweep up everyone from Social Security field office employees to mid-level program analysts, even though their work has nothing to do with making policy. “Field office employees enforce and apply policy and statute; they don’t make it,” said the former longtime SSA employee. “Asserting they’re policy makers is like saying police officers are legislators.”

Acting Social Security Commissioner Leland Dudek, who admittedly receives his marching orders from the White House and Elon Musk’s DOGE, seems intent on broad reclassification of the workforce. “Leland Dudek wants it to apply to most SSA employees…but I guess he is simply a literal puppet,” the former SSA staffer observed.

This shift raises big concerns about competence and integrity. Schedule F opens the door for politically connected appointees who may lack the skills to handle complex tasks that directly impact the lives of beneficiaries. NCPSSM’s ally didn’t mince words about the type of people Trump wants to bring in. “Imagine filling federal service with Pete Hegseth and Linda McMahon and RFK Jr. wannabees,” he said.

The U.S. got rid of the patronage system in the 19th century. Trump wants to bring it back.

Impacts on Beneficiaries and the Public

When you think about the logistical and technical challenges involved in running Social Security, it’s clear just how damaging Schedule F could be. The SSA manages benefits for 73 million Americans, relying on skilled employees to ensure payments are accurate and timely. Politicizing these jobs could lead to significant delays, errors, or wrongful denials of benefits that could devastate vulnerable populations.

The impacts of Schedule F extend to the public’s trust in the SSA. Already struggling with staffing shortages and office closures induced by the interference of Trump, Musk and DOGE, the last thing the agency needs is more instability. Critics argue that politicizing the workforce will make things worse, putting additional strain on both employees and beneficiaries.

Dudek himself has come under harsh criticism for his ‘leadership’ at the agency. “All this stuff is way outside his wheelhouse. I sense he comes in every morning and gets his script written by the Heritage Foundation (author of the notorious Project 2025),” the ally commented. Under Dudek’s tenure, SSA has put in place (and, in some cases, has later been compelled to reverse) several policies that appear to be part of an agenda to ‘prove’ that federal programs like Social Security are inefficient and rife with ‘fraud.’ Trump and Musk have spread lies about alleged fraud, all of which have been thoroughly discredited. Yet, they persist to “reform” SSA in ways that are interfering with the efficient delivery of benefits.

The agency’s workforce is being slashed by at least 10,000 jobs at a time when staffing already was at a 50-year low. Social Security claimants have complained that it’s even harder to obtain assistance on SSA’s telephone line, on the website, or at the shrinking number of field offices. The agency’s website has crashed several times in the past month, preventing beneficiaries from accessing their accounts.

The Trump agenda truly has nothing to do with government efficiency— and everything to do with an ideological crusade to shrink the federal government, consequences be damned.