Honoring America’s Grandparents

**** This is an update of a previous blog post ****

As we celebrate Grandparents Day 2022, we recognize seniors as a positive force in society. The pandemic only strengthened that role, even as it took a heavy toll on seniors themselves. To that extent, their stepped-up participation as caregivers was nothing short of heroic.

Even before the pandemic, grandparents were taking on greater responsibility for raising grandchildren. According to Kiplinger, the number of children in their grandparents’ care doubled from 1970 to 2010. In 2019, some 2.5 million grandparents were responsible for raising their grandkids. And those are only the ones who did so ‘officially.’

During the pandemic, working parents lacking sufficient child-care have turned to grandparents to help out with the children. Grandparents have admirably stepped in to do everything from babysitting to home schooling to preparing meals for the family.

“Whether students are learning at school or at home, or are not yet school age, more grandparents have jumped into daily caregiver roles. Many are happily working without pay, for the love of family, while others have accepted offers of money from their frazzled, eternally grateful adult children.” – WTTG-TV, Washington, D.C.

During the height of the pandemic, Bill and Mary Hill of Phoenix, Arizona took care of their 8 year-old grandson five days a week, and supervised his homeschooling, because the child’s parents were required to show up for work in person.

“At first it was like, we’d love to be a part of this and get to see our grandson more, really get to know him a little better,” Mary said. “At the same time, we were going, `Oh my gosh.’ We knew it would change our lives and it has. It’s much busier.” – Mary Hill, Phoenix, AZ via Fox5 D.C.

There are two-way benefits in these arrangements. Grandchildren and parents get much-needed extra help – and seniors’ mental and physical health is often strengthened through social stimulation and enhanced activity.

Some of the extra help that seniors provide their families may not have been possible without their earned benefits – Social Security and Medicare. The basic financial and health security that these programs provide give seniors the flexibility and peace of mind to contribute to their families and communities.

Jeanne Trimble of Northern Virginia told the Wall Street Journal that her Social Security benefits made it possible for her to retire and care for her son’s two young children during the pandemic.

“My son and daughter-in-law were reluctant to put the kids in daycare and were struggling to keep up with their own work schedules. I’m 64 and was planning to retire in two years but my husband and I consulted with our bank and figured out that with Social Security, I could retire early to help out.” – Jeanne Trimble, Northern Virginia, in the Wall St. Journal

Helping out with grandchildren is only one of the many ways that seniors aid their communities. The Front Royal, VA Royal Examiner published a list of the myriad contributions that older Americans make to society, including:

- As caregivers for an ailing spouse, with responsibilities ranging from managing household tasks to offering emotional support and providing medical care.

- As babysitters for their grandchildren, whose parents are productive members of the workforce.

- As organizers for events hosted by religious groups and other types of community-based organizations, which often struggle to attract younger participants.

- As donators of time and money to charities, foundations, and non-profit organizations that support members of the community.

- As mentors for the next generation, passing on family legacies, a lifetime of experience, and a career’s worth of knowledge.

- As part of a support system for other seniors, such as by planning activities at their seniors’ residence or running errands for someone with reduced mobility.

One specialist in senior services summed it up nicely:

“Seniors are able to devote the required time and effort to see projects through from start to finish. Seniors realize their needs can be intergenerational and what benefits them will also benefit the rest of society.” – Mickey Balas, Seniors Navigator

Southern California senior Cliff Adcock volunteered for Meals on Wheels

This is what we mean when we say that seniors contribute so much to our lives and communities. The reason we repeat it often is that some in government and the private sector suggest that seniors receive too much help, or can afford to sacrifice some of their hard-earned, already modest benefits for the cause of fiscal austerity. We say, if anything, Social Security and Medicare must be strengthened and expanded. As seniors continue to give back so much, we must always look out for them in return.

Over the Counter Hearing Aids Could Be a Winner for Seniors

The Food and Drug Administration has issued a final rule establishing a new category of over-the-counter hearing aids. This will allow people with ‘mild to moderate’ hearing loss to buy hearing aids directly from stores or online retailers. Consumers will not need an exam, prescription or a fitting by an audiologist. The rule should make hearing aids affordable for seniors on fixed incomes who may not be able to afford the high cost of prescription devices – which run in the thousands of dollars per pair. (Traditional Medicare does not yet cover these costs.)

“For millions of Americans, hearing aids and the doctor’s visit to get them prescribed are too expensive. In the executive order I issued last year to increase competition in key industries and lower costs, I called on the FDA to finally make hearing aids available over the counter. Today, the FDA is doing just that.” – President Biden, 8/16/22

President Biden’s executive order required the FDA to allow hearing aids to be sold over the counter and gave the agency 120 days to accomplish it. Congress passed legislation in 2017 empowering the FDA to create a category of OTC hearing aids, but it was not fully implemented until now. “Consumers could see OTC hearing aids available in traditional retail and drug stores as soon as mid-October when the rule takes effect,” says the FDA.

The National Committee to Preserve Social Security and Medicare has long advocated for over-the-counter hearing aids, especially because hearing care is so crucial to seniors’ overall health.

“As someone who suffers from hearing loss, I understand what this means for seniors’ health – and their pocketbooks. While we hope that Medicare will eventually cover hearing aids, the new rule allowing OTC hearing aids is a common sense, compassionate measure that will improve seniors’ access to quality devices.” – Max Richtman, President of the National Committee to Preserve Social Security and Medicare

Prescription hearing aids can cost as much as $2,500 each (or $5,000 a pair). The hefty price tag can be a severe strain for seniors living on fixed incomes, especially since Medicare does not cover hearing aids. That’s why some 70% of Americans between age 65 and 84 with hearing loss are not using hearing aids. They simply cannot afford to.

The new generation of OTC hearing aids will retail for a fraction of the prescription price:

“By opening the market to OTC aids, manufacturers of consumer electronics — from giants such as Apple and Samsung to small startups — could enter the hearing aid space and sell directly to consumers… [at a retail price] between $150 and 299.” – The Hill Newspaper

Imagine being able to buy high-quality hearing aids at your local pharmacy or grocery store for as little as $150, bypassing the time-consuming and expensive process of acquiring them from an audiologist. Of course, those with more serious hearing impairment will and should continue to seek prescription hearing aids through a specialist.

This is not just a matter of personal cost. It’s a public health issue. Hearing loss is a gateway to other potential medical problems – including fatigue, stress, depression and memory loss. Access to affordable, high-quality OTC hearing aids means that millions of seniors will likely be able to hear better and stay healthier.

Finally, Some Accountability for Medicare Advantage Ads

**** This is an update to a previously published post ****

The makers of those misleading ads for Medicare Advantage (MA) starring celebrities like Joe Namath, Jimmy Walker, and William Shatner may finally be held to account. The Centers for Medicare and Medicaid Services (CMS) has issued new rules clamping down on the ads after receiving a flood of consumer complaints. As Mark Miller writes in yesterday’s Retirement Revised blog, “Brokers will be subject to tougher disclose rules, but most significantly, Medicare will hold insurers responsible for what their marketing agents say in ads.”

The celebrity-driven ads blur the line between privately-run Medicare Advantage (Medicare Part C) and the traditional, publicly-administered Medicare program. Joe Namath and Company make it sound as though “Medicare Part C” is the Medicare program. Viewers may have no idea that there is a public option for “traditional Medicare,” which is solely focused on patient care rather than private profit. The ads also contain misleading invitations for consumers to call the Medicare Advantage plan’s toll free-number and find out how to “add money back into your Social Security check.” Earlier this week, the Wall Street Journal reported:

“The aggressive sales efforts by marketers are the result of billions invested by private-equity firms, financial-services companies and stock-market investors into virtual call centers, internet-based lead-origination firms and other marketing businesses over the past several years.” – Wall Street Journal, 8/31/22

The government’s new rules are aimed at marketers that sell MA policies for insurance companies. Insurers will be held accountable for what marketers claim in the ads. The bottom line: MA marketers “will need to disclose more to their customers,” according to the Journal. The new rules are not aimed at the celebrities who appear in the ads, but William Shatner of Star Trek fame promised, “We’ll change things so it satisfies everybody and eliminates the confusion.”

Medicare Advantage plans have come under growing scrutiny for a number of questionable practices that undermine patient care and overcharge taxpayers. Last June, the Washington Post reported about a whistle-blower from a Medicare Advantage outfit in California who is working with federal investigators looking at alleged, widespread malfeasance on the part of MA plans. According to the Post:

“The Justice Department is pursuing civil lawsuits against multiple companies that participate in the privatized system, from huge insurers to prestigious nonprofit hospital systems, alleging they have cheated the system for unfair profit.” – Washington Post, 6/5/22

Investigators are probing allegations that some MA plans are billing the Medicare program for patient care based on “outdated or irrelevant” diagnoses, in order to make more money. These include conditions like heart disease, depression, obesity, and cancer that patients had already surmounted — or that they never had in the first place. Critics say that in addition to overcharging the government for care for these patients, MA plans billing for outdated or false diagnoses could stigmatize patients “who were improperly deemed obese, malnourished or mentally ill.”

“The point of larding the medical records with outdated and irrelevant diagnoses such as cancer and stroke — often without the knowledge of the patients themselves — was not providing better care, according to a lawsuit from the Justice Department; (it was to make higher profits).” – Washington Post, 6/5/22

Some Medicare Advantage plans have long been accused of “upcoding,” which means “submitting bills for more severe and expensive diagnoses or procedures than (were) diagnosed or performed,” according to the National Center for Biotechnology Information. Plain and simple, this is a form of fraud. The victim is the Medicare program — and the workers, taxpayers, and enrollees who fund it.

The irony is that Medicare Advantage plans, which began during the George W. Bush administration, were supposed to save the Medicare program money. Instead, these privately-run, for-profit plans are “costing taxpayers more money to run than traditional fee-for-service Medicare,” notes the Washington Post.

According to MedPAC, a government watchdog panel, the federal government incurred $12 billion in “excess payments” to Medicare Advantage plans in 2020. MedPAC projected the figure will swell to $16 billion next year.

Meanwhile, the HHS Inspector General’s office issued a report in April, showing that some MA plans are denying “medically necessary” claims and pre-authorizations that should be covered under Medicare rules. Again, the motive seems to be squeezing more money out of the federal government at the expense of patient care.

“The Inspector General’s report explains that because the Centers for Medicare and Medicaid Services (CMS) pays Medicare Advantage plans a flat fee regardless of the amount they spend on care, they have a ‘potential incentive…to deny beneficiary access to services and deny payments to providers in an attempt to increase profits.’” – Common Dreams, 6/8/22

Despite the mounting evidence of wrongdoing on the part of some MA plans, Medicare Advantage continues to grow in popularity. MA is on the brink of capturing more than half of the Medicare market, which up to now has been dominated by traditional Medicare. This is thanks, in so small part, to the torrent of television ads featuring celebrity pitchmen, promising lower premiums and free benefits like gym memberships and rides to the doctor’s office.

The ads, of course, do not mention that MA plans offer limited networks of providers – or that medically necessary claims and pre-approvals may be denied so the plans can make more money. Nor do Joe Namath and Jimmy Walker tell viewers that some plans are over-billing the government for false or outdated diagnoses, and without patients’ knowledge.

Instead of being held truly accountable, Medicare Advantage plans are being rewarded with an 8.5% revenue increase from the federal government for 2023. Since this privatized version of Medicare was created, for-profit companies have gained increasing influence in the care of one of our most vulnerable populations – the elderly. It is welcome news that the Justice Department and HHS Inspector General’s office are intensifying their scrutiny of Medicare Advantage. At stake is nothing less than billions in taxpayer dollars and the wellbeing of millions of America’s seniors.

Now Is Not the Time to Turn Our Backs on Seniors

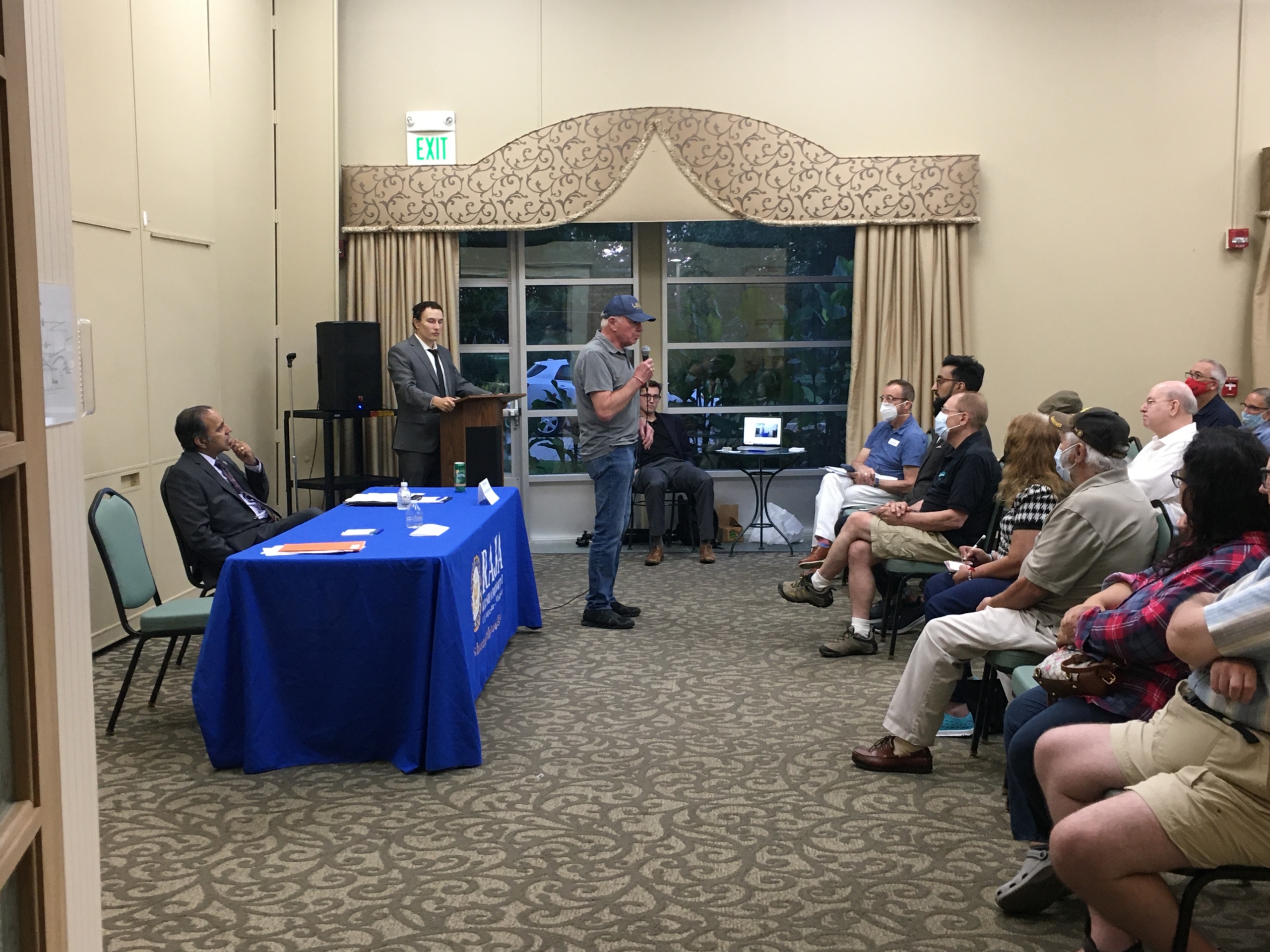

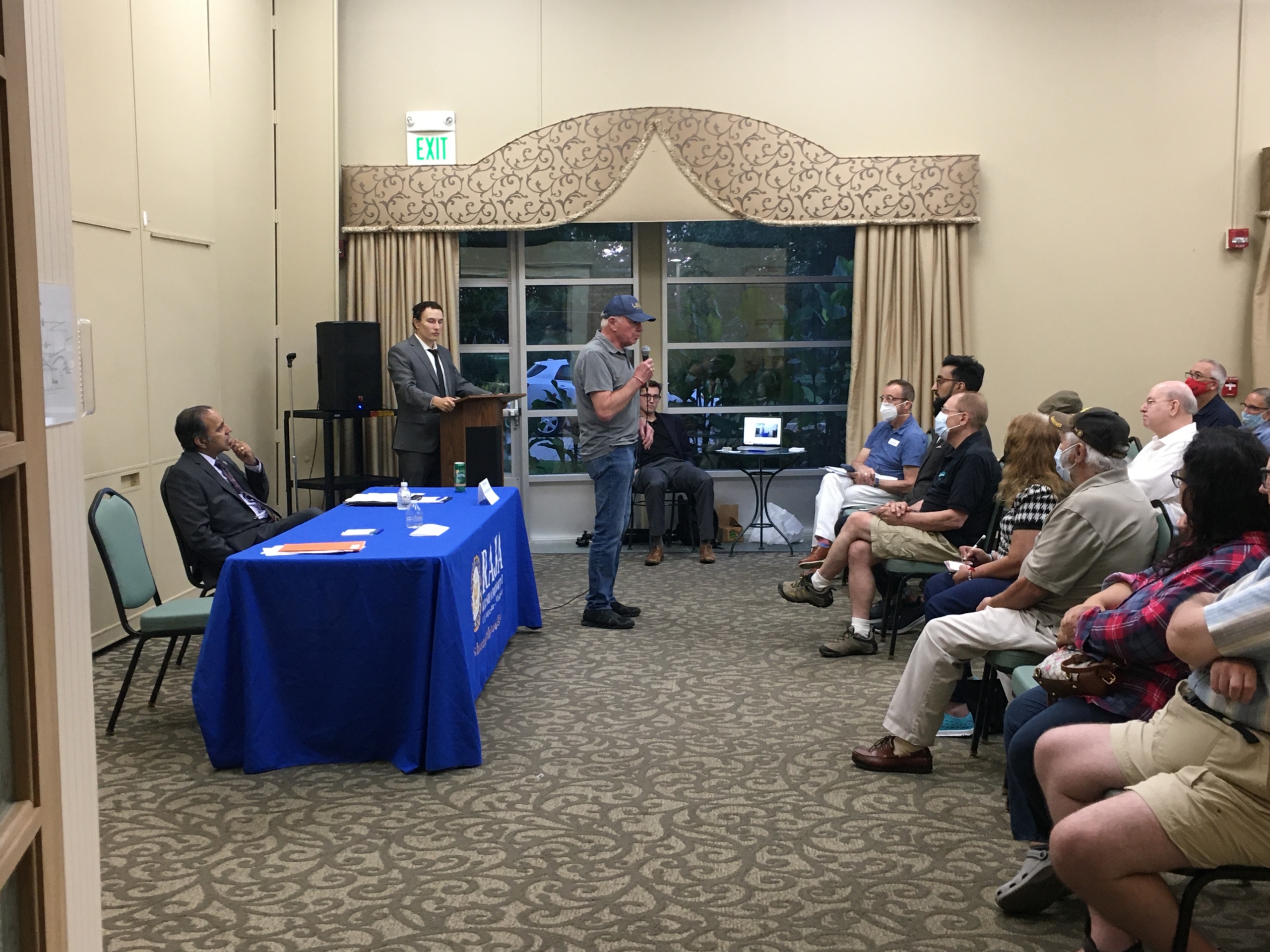

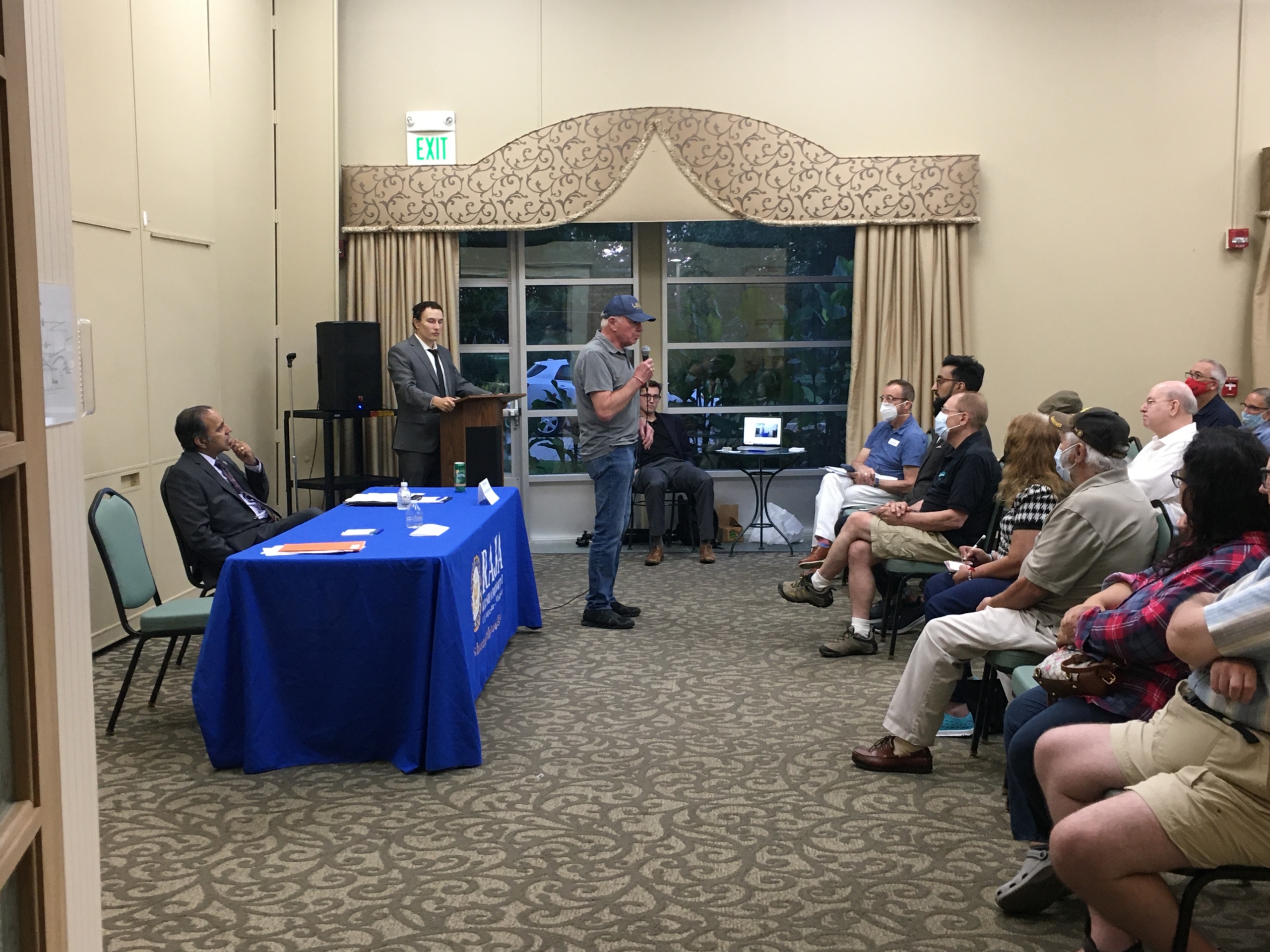

“Now is not the time to turn our backs on seniors by cutting Social Security and Medicare!” declared Congressman Raja Krishnamoorthi (D-IL), kicking off a town hall in his home district with National Committee President and CEO Max Richtman on August 29th. Held in Des Plaines, Illinois before an audience of constituents, the event was entitled, “Keeping Our Promises to Seniors.”

During the hour-long town hall, Richtman and Rep. Krishnamoorthi pledged to continue working together to expand and strengthen Social Security and Medicare — and fight any attempts to cut or privatize them. “We have to protect Social Security and Medicare. That’s our promise… and in America, we keep our promises,” said the Congressman.

Richtman and Krishnamoorthi lauded the Democrats’ recently enacted Inflation Reduction Act, which empowers Medicare to negotiate prescription drug prices and caps beneficiaries’ out-of-pocket costs for medications, among other measures to alleviate seniors’ costs at the pharmacy counter.

“Medicare is going to be able to negotiate the prices of some of the most expensive drugs. And the $2,000 yearly cap in Medicare Part D is going to help a lot of seniors who have been spending a fortune on very costly treatments. We worked on this for a long time and finally got it through the Congress.” – Max Richtman at Rep. Krishnamoorthi’s town hall, 8/29/22

Richtman praised Rep. Krishnamoorthi for “taking on Big Pharma” and contributing to this landmark legislation as a member of the House Committee on Oversight and Reform. “This new law may be a bitter pill for the drug industry. But it will provide relief to millions of seniors,” Richtman said.

Prescription drugs were not the only things on constituents’ minds at the town hall. Participants asked questions about the controversial Medicare Advantage (MA) program — the privately-run alternative to traditional Medicare. MA plans, which are run by big insurance companies, are undergoing increased (some would say, overdue) scrutiny for questionable practices, including overbilling the Medicare program and denying reasonable care to patients.

“The HHS Inspector General’s report that showed that many MA beneficiaries were denied coverage even though it should have been approved under Medicare rules. Why? Because MA is a business. Insurance companies want to make money. Their priority is profit. If they can make more money by denying services, they’ll do that.” – Max Richtman, 8/29/22

Richtman told the town hall audience that Senator Ron Wyden, Chairman of the Senate Finance Committee, has launched an inquiry into questionable Medicare Advantage practices. Sen. Wyden recently sent letters to 15 state insurance commissioners and state health insurance assistance programs requesting data related to “deceptive marketing practices.” The Centers for Medicare and Medicaid Services (CMS) says it received more than twice the number of complaints from seniors regarding Medicare Advantage plans in 2021 than it did in 2020.

“I have heard alarming reports that MA health plans… and their contractors are engaging in aggressive sales practices that take advantage of vulnerable seniors and people with disabilities.” – Senator Ron Wyden’s letter to MA insurers and state insurance commissioners

Medicare Advantage plans spend millions of dollars on sometimes misleading television ads featuring celebrities like Joe Namath and Jimmy Walker. “Joe Namath was a great quarterback,” said Richtman, “But I’m tired of watching him and other famous people pitching Medicare Advantage when the ads don’t tell the whole story.”

Richtman and Rep. Krishnamoorthi also addressed Democratic efforts to expand and strengthen Social Security. Richtman cited Rep. John Larson’s Social Security 2100: A Sacred Trust bill, which would “bring in more revenue, extend solvency, and improve benefits… by changing the cap on wages subject to payroll taxes so the wealthy pay their fair share.” The National Committee has endorsed the Social Security 2100 legislation and Congressman Krishnamoorthi is one of the bill’s cosponsors in the U.S. House. (The bill is awaiting a vote in committee and on the House floor.)

Rep. Raja Krishnamoorthi (D-IL) and NCPSSM President Max Ricthman

Congressman Krishnamoorthi receives a 100% rating on the National Committee’s legislative scorecard, reflecting his votes on crucial issues affecting seniors. He told town hall attendees that both of his parents receive Social Security and Medicare benefits and were “happy” that he had received a perfect score from the National Committee, adding, “If my parents are happy, I’m happy.”

NCPSSM President and House Members Team-Up to Tout New Prescription Drug Pricing Measures

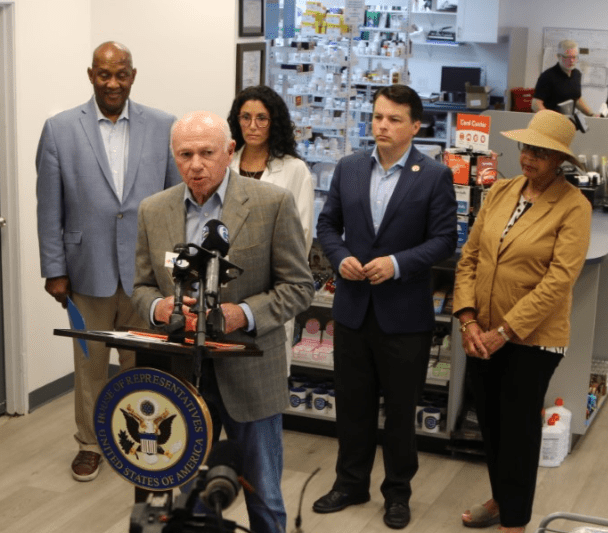

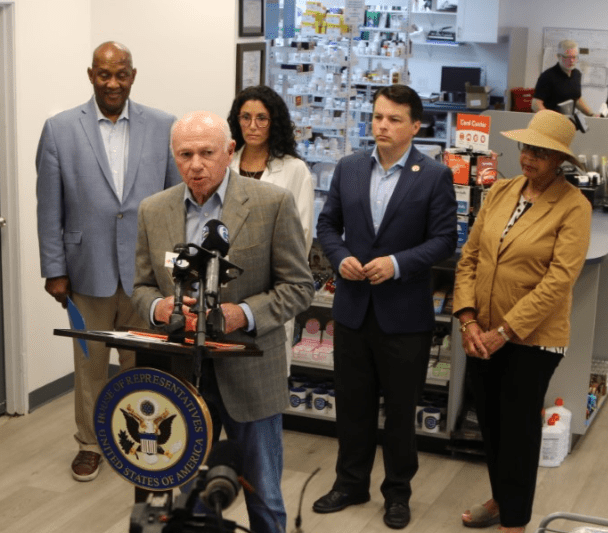

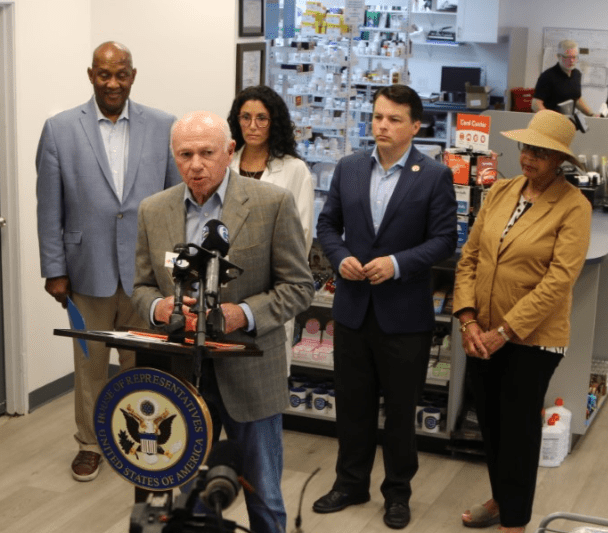

NCPSSM President and CEO Max Richtman joined two Pennsylvania congressmen in announcing that seniors will benefit from the just-enacted Inflation Reduction Act. Richtman appeared last week at Circle Pharmacy in Philadelphia with representatives Brendan Boyle (D-PA) and Dwight Evans (D-PA), two seniors champions who voted for the new legislation that includes significant measures to lower prescription drug prices. The event was covered by NBC 10, WCAU-TV in Philadelphia.

The Inflation Reduction Act allows Medicare to negotiate drug prices with Big Pharma, a measure that is expected to save the program $288 billion over ten years – and lead to savings at the pharmacy counter for tens of millions of seniors and, eventually, all Americans. Negotiations will begin for ten of the highest cost drugs in Medicare. Negotiated prices will take effect beginning in 2026.

Speaking in front of the Circle Pharmacy counter, Richtman said:

“We would have liked to have more drugs covered, sooner, but the good thing is in this legislation, the drugs that are subject to negotiation are the costliest, so at least we’re going to get at the heart of the problem.” – Max Richtman, NCPSSM President and CEO, 8/18/22

Congressman Boyle, a member of the House Ways and Means Social Security subcommittee, called the Inflation Reduction Act “one of the most significant pieces of legislation that I will have had the opportunity to vote on.” Rep. Evans, a member of the House Ways and Means Health subcommittee said, “This law makes a difference for hundreds of thousands of Pennsylvanians.”

Gwendolyn O’Neal, who co-owns the independent Circle Pharmacy, encounters seniors who cannot afford their prescription medications on a regular basis. “It’s hard. We want them to have the medicine they need to live,” she said.

“(The current prescription drug pricing system) makes it difficult for people. They sometimes have to choose between medicine and groceries or paying the rent. Often, their copays are very high and they get frustrated because they have to make that choice.” – Gwendolyn O’Neal, co-owner, Circle Pharmacy, Philadelphia, PA, 8/18/22

The new law also includes two other landmark reforms: a $2,000 annual out-of-pocket limit on drug costs for patients in Medicare Part D — and a $35 monthly cap on insulin costs for beneficiaries. President Biden signed the Inflation Reduction Act into law on August 16th, calling it a “godsend” for American families.

On August 19th, Max Richtman sent a congratulatory letter to President Biden for keeping his campaign promise to take action to lower prescription drug prices.

“The National Committee thanks you for your persistent efforts that led to the enactment of this landmark law. We look forward to working with you and your administration to advance legislation that will make further improvements in health care coverage, affordability and access for all Americans.” – Max Richtman letter to President Biden, 8/19/22

Richtman encourages other members of Congress who supported the new law to hold similar events to get the word out in advance of November’s mid-term elections, when advocates hope seniors will vote for the party that is demonstrably working to alleviate the pain of high health care costs.