Conservatives Won’t Stop Dividing the Generations over Social Security, Medicare

Americans of all ages face a crushing affordability crisis. Rather than blame the billionaire class and their political servants – or wealth inequality in general – conservatives have continued trying to pit the generations against each other.

Look no further than this week’s misleading op-ed in the Los Angeles Times,The Financial Engine Behind Millennial and Gen Z Malaise. This is only the latest in a gaggle of mainstream media pieces blaming younger adults’ economic struggles on older people – otherwise known as the “greedy geezer” myth.

These screeds barely ever mention that the rising cost of college tuition, mounting student debt, and unaffordable housing could be mitigated by more progressive federal policies that favor everyday people instead of financial elites. See: almost every other Western-style democracy. Instead, it’s all supposedly older people’s fault.

“Medicare programs are paying for golf balls, greens fees, social club memberships, horseback riding lessons, and pet food,” writes columnist Veronique de Rugy of the right-leaning Mercatus Center at George Mason University.

In reality, Medicare covers medically necessary services like doctor visits, hospital stays, and preventive care… not luxury goods. Far from living in luxury, most seniors are reliant on Social Security to cover some or all of their living expenses. In fact, without Social Security, some 40% of seniors would fall into poverty!

Conservative think tanks are trying awfully hard to divide the generations

The Mercatus-authored piece also mirrors Koch-funded groups like the American Enterprise Institute (AEI) by claiming that retirees are receiving “37% more in Social Security benefits than they paid in (payroll) taxes.”

This statement completely ignores the true nature of Social Security. It was never designed to be an investment program or to generate profits for contributors, nor was it designed to pay out only as much as a worker contributed.

“Social Security is social insurance and like any insurance program, it spreads risk among those who contribute. If you have home insurance, you don’t expect to get your premiums back if your house doesn’t burn down, but you do expect to collect much more than you contributed if disaster strikes.” – Maria Freese, NCPSSM senior Social Security policy expert

With Social Security, you contribute during your working years so you have a source of income if you become disabled, your family is protected if you die, and you can maintain some level of standard of living if you are fortunate enough to enjoy a long life. Once you qualify for benefits, they last as long as you live – benefits don’t stop at an arbitrary number tied to your contributions.

What’s more, Social Security benefits are progressively structured — meaning lower-income seniors receive higher proportional benefits than their wealthier counterparts.

Meanwhile, the op-ed makes the claim that Social Security is the “biggest driver of our government debt.” This is another conservative trope. Social Security is self-funded and does not contribute to debt. (The program also is legally barred from borrowing money.) As conservative hero Ronald Reagan himself said, “Social Security has nothing to do with the deficit.”

President Reagan acknowledged that Social Security does not contribute to the federal debt

In fact, the biggest driver of federal debt is ‘tax expenditures’ — windfalls for the wealthy like the Trump/GOP tax cuts, which added some $3 trillion in red ink. Conservatives don’t seem to mind debt if it’s driven by tax breaks for the rich.

The L.A. Times piece also misleads readers with a “gotcha,” using the basic economic reality that Americans generally are worth more at the end of their lives than they are at the beginning or middle:

“American heads of households younger than 35 now have a median net worth of about $39,000 and an average net worth of more than $183,000`. Those over age 75 have a median net worth of roughly $335,000 and an average net worth exceeding $1.6 million.” – Veronique de Rugy, L.A. Times

Typically, Americans have built up wealth over their lifetimes as they save for retirement or pay off their home mortgages. And until recently, each generation tended to be wealthier than the ones before it. However, thanks to regressive economic policies, that trend has now been reversed.

Conservative narratives seem designed to pave the way for benefit cuts and privatization of Social Security. Although the Times op-ed does not explicitly mention means testing Social Security and Medicare – which would fundamentally alter these programs – the author strongly hints at it:

“Treating every elderly person, no matter how well-off, as a member of a protected class entitled to increasingly unaffordable benefits will eventually destroy a system that progressives in particular cherish.” – Veronique de Rugy, L.A. Times

These social insurance programs are earned benefits based (in part) on lifetime payroll contributions. They are not a ‘handout’ to seniors, people with disabilities, or their families. Implementing means-testing breaks this decades-long compact with workers, and would disproportionately target modest earners making $50,000-$70,000 annually.

This is all part of a broader, well-funded effort to turn generations against each other and soften the ground for degrading Social Security and Medicare. Framing seniors as “greedy geezers” living large on “boomer luxury communism” is designed to distract from the real culprits behind our affordability crisis.

GOP Senators Face Key Test on Health Care Affordability

Sen. Bernie Moreno (R-OH) is one of the bipartisan ‘gang’ of Senators working on an ACA tax credit compromise

Last week, the House of Representatives took a bold step towards averting huge increases in Americans’ health care premiums, passing a bill that would extend the Affordable Care Act (ACA) tax credits for three years. The measure succeeded thanks to YES votes from all House Democrats and 17 House Republicans, who openly defied GOP Speaker Mike Johnson.

In a press statement, NCPSSM Max Richtman applauded the House vote:::

“Kudos to members of the U.S. House for bucking Republican leadership and voting to extend crucial ACA tax credits… The House legislation would especially bring relief to older Americans, who are not yet eligible for Medicare and are subject to higher premiums than younger people.” – Max Richtman, President and CEO, National Committee to Preserve Social Security & Medicare

The legislation now heads to the Senate. Republican Senate Majority Leader John Thune has positioned the House bill to be “dead on arrival,” but signaled openness to a compromise under certain strictures. (Let’s not forget that Senate Republicans killed ACA tax credits once already.) Meanwhile, President Trump has indicated that he will veto any “clean extension” that comes to his desk.

Anne Montgomery, Senior Health Policy Expert with NCPSSM, explained that ACA subsidies are indispensable for millions of Americans, especially older ones who are not yet eligible for Medicare (aka “near seniors.”) Without the extended tax credits, many near seniors will be priced out of the ACA marketplace entirely.

“Taking away these tax credits essentially shuts people out of coverage at older ages. In less healthy (often red) states, premiums without extended tax credits could be 10 to 20 times higher,” said Montgomery.

A bi-partisan ‘gang’ of senators reportedly is working on a compromise bill that may offer a two-year extension of ACA tax credits, with new income caps and other restrictions.

Some Republicans continue to push their preferred alternative, enhanced Health Savings Accounts (HSAs). Republican Senators Cassidy (LA) and Crapo (ID) have led the charge with legislation that would put HSAs at the forefront, and replace ACA subsidies with block grants to states. The plan would unravel the ACA’s affordability framework and allow insurers to charge older adults even more than they already do.

“The Cassidy–Crapo bill walks away from what the ACA set out to do and the financial help people need for affordable coverage. Democrats will have to decide whether that compromise is good policy or, frankly, a piece of junk.” – Anne Montgomery, Senior Health Policy Expert, National Committee to Preserve Social Security & Medicare

Montgomery says that the benefit of simply enhancing HSA accounts would be minimal compared to extending the ACA tax credits. However, she says NCPSSM would support a balanced agreement that modestly expands the use of HSAs, as long as it preserves the integrity of the Affordable Care Act exchanges, the tax credit structure, and the principle of affordability for older adults.

Older adults who are not yet eligible for Medicare may not be able to afford ACA premiums if Congress doesn’t act immediately

“There’s a big difference between allowing for more HSA products – and dismantling the Affordable Care Act exchange system,” noted Montgomery.

Time is critical now. Many ACA enrollees already have received notices of significantly higher premiums for the new year. Any reasonable legislation at this point would have to re-open the ACA enrollment period to allow people to sign up for plans with affordable premiums.

NCPSSM President Richtman warns lawmakers not to let the ACA tax credits expire, thrusting millions of Americans into a health care affordability crisis. He says that Republicans’ failure to cooperate will come back to haunt them in November’s mid-terms.

“We will help remind voters who had the backs of Americans struggling to keep up with soaring health care premiums — and who didn’t,” said Richtman.

**********************************************************************************************************

Read the Senate Finance Committee Democrats’ takedown of HSAs here.

Listen to our podcast with Florida Rep. Debbie Wasserman Schultz on ACA tax credits & Trump Medicaid cuts here.

Trump & DOGE Wreaked Havoc at SSA, New Reporting Confirms

As the year ends, new reporting confirms that customer service at the Social Security Administration (SSA) has tanked since Trump took office last January – despite the administration’s claims to the contrary. A new investigative report by the Washington Post — based on a thorough analysis of agency data and interviews — reveals that “long-strained customer services have become worse by many key measures.”

Commissioner Frank Bisignano has issued glowing — but bogus — reports touting ‘improvements’ at SSA, but basic common sense says that the scorched-earth tactics the agency implemented after Trump & DOGE took over could only have degraded service.

“Thousands of employees were fired or quit and hasty policy changes and reassignments left inexperienced staff to handle the aftermath,” write Post correspondents Lisa Rein, Meryl Kornfield, and Hannah Natanson. (SSA slashed its workforce at a time when staffing already was at a 50-year low, with 10,000 baby boomers hitting age 65 every day.)

Demonstrators in Baltimore protest DOGE interference at Social Security Administration (AP Photo)

Elon Musk and DOGE swept into SSA last winter, seizing Americans’ personal Social Security data and disrupting agency operations as part of a phony hunt for ‘fraud.’ (Never mind that actual Social Security fraud is statistically quite low.) Musk and Trump’s claims that 150 year-olds somehow collect benefits were part of this charade.

The 73 million people who depend on Social Security have paid the price. “Exaggerated claims of fraud have led to new roadblocks for elderly beneficiaries, disabled people and legal immigrants, who are now required to complete some transactions in person or online rather than by phone.”

Meanwhile, a New York Times report published just before Christmas revealed that DOGE’s crusade to cut government “waste, fraud, and abuse” was a sham.

“The group did not do what Mr. Musk said it would: reduce federal spending by $1 trillion before October. On DOGE’s watch, federal spending did not go down at all. It went up,” according to the Times report.

Musk quit DOGE last summer but left a toxic legacy

DOGE’s assault on the Social Security Administration exposed that the true goal was not to fight waste, but to dismantle crucial functions of the federal government that oligarchs like Trump and Musk find bothersome, such as a social safety net.

As Government Exec reported in September, Musk’s DOGE brats were “a bunch of people who didn’t know what they were doing, with ideas of how government should run — thinking it should work like a McDonald’s or a bank — screaming all the time.”

“The shock troops of DOGE were the advance guard in perhaps the most dramatic transformation of the U.S. government since the New Deal. And despite the highly public departure of DOGE’s leader, Elon Musk, that campaign continues today.” – Government Exec, 9/8/25

After Musk returned to the private sector last summer, subsequent news reports indicated that DOGE may have finally ceased operations. But soon after, Forbes reported that rumors of DOGE’s death may have been exaggerated. “DOGE isn’t dead—it’s been absorbed into the bloodstream of the government, federal employees say.”

Seniors and advocates can take heart that public pressure forced SSA and DOGE to walk back some of their more egregious proposals, but Trump’s campaign to destroy the workings of the federal government continues — with grave implications not only for the Social Security Administration, but for the Medicare and Medicaid programs as well. If recent reporting proves anything, it’s that the fight against Trump’s effort to rend the social safety net will continue into 2026.

*******************************************************

Listen to our podcast interview with former Social Security Commissioner Martin O’Malley here.

Listen to our podcast interview with SSA whistleblower Laura Haltzel here.

Watch our documentary about the history of Social Security here.

Thanks, Cato, But Let’s Not “Re-Imagine” Social Security (It’s Been Working for 90 Years)

What do you get when a libertarian think tank publishes a book proposing to radically change Social Security in collaboration mostly with other right-leaning organizations? You get something like “Re-imagining Social Security,” authored by the CATO Institute’s Ivane Nachkebia and Romina Boccia (who more than once has called the program a ‘legal Ponzi scheme’). Not surprisingly, to these authors, “re-imagining” the program that some 70 million Americans depend on for financial security essentially means altering the program beyond recognition and cutting benefits for future retirees. To which we say: better not to let their imaginations run away with our earned benefits.

The libertarian Cato Institute (which never met a federal program it liked) appears to be on a crusade to undermine the existing Social Security program. Just this week, Boccia published a post in Cato’s ‘Debt Dispatch’ blog, claiming that Social Security “operates on the Robin Hood principle in reverse.” This is, pardon the expression, quite rich coming from a think tank whose funders include the Koch network and mega-corporations like Google, Facebook, Philip Morris, the American Petroleum Institute and Chevron.

Here’s what we call “reverse Robin Hood”: a right-leaning think tank funded by financial elites striving to compromise future seniors’ earned benefits. The book and blog post are simply the latest fusillade in a decades-long campaign to discredit Social Security, arguably one of the greatest legacies of that conservative bogeyman: FDR’s New Deal. (See more about this below, including Cato’s 1983 screed, “Achieving a Leninist Strategy.”)

We do give Nachkebia and Boccia credit for raising a serious issue: the very real financial challenges facing Social Security. The program’s trustees project that the Social Security trust fund reserves will become depleted in the early 2030s – unless Congress takes pre-emptive action. The authors are simply wrong about the cause and the cure.

NCPSSM President Max Richtman (center) debates author Romina Boccia (left) about Social Security policy at a 2024 forum

The book’s first mistake is ascribing the predicted shortfall purely to ‘demographic’ changes in American society (older people becoming a bigger chunk of the population while birthrates decline), which the 1983 Social Security reforms already anticipated and addressed with a mix of revenue enhancements and benefit cuts. That is why Social Security’s full retirement age has been gradually increased from 65 to 67.

The authors ignore the current culprit – rising wealth inequality – which has been depriving Social Security of much-needed revenue for years. After all, we’re living in an age when Elon Musk, Jeff Bezos, and Mark Zuckerberg own more wealth than the bottom 50% of American society. Four decades ago, Social Security payroll taxes captured about 90% of all wages. Today, that figure has slipped to about 80%, as the wage and wealth gap widens (and higher earners make more of their money from investment income).

In 2026, annual wages exceeding $184,500 will not be subject to Social Security payroll taxes. Under this system, Musk, Bezos, and Zuckerberg will finish contributing to Social Security shortly after the ball drops in Times Square in January, while most of us pay into the program for the entire year.

The most painless and equitable fix to this problem would be to adjust – or outright eliminate – the payroll wage cap, in addition to folding-in some of wealthier earners’ non-wage income. Of course, the “Reimagining” authors do not favor this solution, because right-of-center groups do not want the wealthy to pay higher taxes for any reason. (Cato Institute and the Heritage Foundation, one of the book’s contributors, championed Trump’s 2025 massive tax giveaway for the wealthy, funded by more than $1 trillion in Medicaid and food assistance cuts. Talk about ‘Reverse Robin Hood!’)

The public appears to feel quite differently. Americans say they are willing to pay more for Social Security if it means the program will survive and thrive well into the 21st century. A survey published in 2025 by the National Academy of Social Insurance (NASI) found that a majority of Americans support eliminating the payroll wage cap on income over $400,000. Further, according to NASI, “Americans across all groups, including a majority of Republicans, say they are willing to contribute more by gradually increasing the payroll tax rate to strengthen the program’s finances.”

The right-leaning Cato Institute is funded by financial elites, including the Koch Network and Big Oil

On the other hand, the survey found that, given a “broad set of options to address Social Security’s financing gap,” Americans strongly reject benefit reductions. The public’s wishes do not seem to resonate with Cato’s authors, who advocate, among other measures:

- Raising the retirement age again

- Transitioning to a flat-benefit structure

- Indexing initial benefits to prices instead of wages

- Cutting the annual Cost-of-Living Adjustment (COLA)

Make no mistake: these proposals would cut benefits and turn Social Security into a welfare program instead of social insurance for everyone, which it was designed to be. The authors claim to have the interests of today’s younger adults in mind. Never mind that tomorrow’s seniors will rely even more on Social Security than current seniors do, thanks to the disappearance of employer-provided pensions, rising wealth inequality, and the soaring costs of everything from college tuition to medical care — making it harder for younger adults to save for retirement. (Today, only about 50% of workers have a retirement plan.)

It’s probably not a coincidence that, more than 40 years before the publication of “Reimagining Social Security,” CATO issued a white paper entitled, “Achieving A Leninist Strategy” (1983), which mapped out a scheme to undermine public support for Social Security by dividing the generations. The strategy was: convince young people that Social Security is a bad deal, making it easier to chip away at the program that many on the right have opposed since the very beginning. (1936 Republican presidential candidate Alf Landon called Social Security “a fraud on the working man.”) Some conservatives would love to see Social Security privatized so that workers’ hard-earned contributions could be funneled to Wall Street.

1936 GOP presidential candidate Alf Landon called Social Security “a fraud on the working man.”

Boccia and Nachkebia take a slightly different tack. Their core claim is that the U.S. retirement benefit system is overly generous compared to other Western nations. They analyze retirement benefits in Canada, New Zealand, Germany and Sweden and find them to be less fulsome than ours, as if to say, “These other countries don’t feel the need to support seniors on the same level as Social Security does here. Maybe we are doing too much.”

What the authors don’t mention is that these four social democracies provide more overall services and supports to their people than we do – including universal health care[1]. They also offer subsidies (for housing, transportation, heating/cooling assistance, etc.) that lower the cost of living[2]. Sweden and Germany have free college tuition, which can significantly reduce the debt burden faced by young workers. With these fundamental supports, seniors in other Western nations do not necessarily need the level of retirement benefits that Social Security provides here.

At the same time, let’s bear in mind that Social Security benefits are relatively modest. Next year’s estimated average annual retirement benefit is $24,852, only nine thousand dollars above the federal poverty line. Without Social Security, 22 million adults and dependent children would fall into poverty. Before Franklin D. Roosevelt signed Social Security into law 90 years ago, many seniors literally lived in poorhouses.

FDR wanted workers to have a “moral right” to collect Social Security (Wikimedia Commons)

The design of Social Security (which Cato is attempting to undermine) was very much intentional. It is social insurance. Everyone contributes and everyone benefits. From the beginning, FDR insisted that Social Security be earned through workers’ payroll contributions “so as to give the contributors a legal, moral, and political right to collect their (benefits).” The book’s prescriptions would upend the program’s founding principle.

While it might be in the interest of some of the book’s contributors — including the American Enterprise Institute, the Mercatus Center, and the Heritage Foundation (authors of the notorious Project 2025) — and their donors to shrink Social Security in the name of ‘saving it,’ we’re hard pressed to think of anyone else who would truly benefit. Instead of “Reimagining Social Security,” we prefer to imagine a future where the program that has worked so well for 90 years is strengthened and preserved as an earned benefit, just as FDR intended.

[1] The Commonwealth Fund, “International Health Care System Profiles”, https://www.commonwealthfund.org/international-health-policy-center/system-profiles

[2] Government of Canada, “Benefits”, https://www.canada.ca/en/services/benefits.html; KiwiEducation, “Social Benefits in New Zealand”, https://kiwieducation.com/nz/lifehack/social-benefits-in-new-zealand/; Facts About Germany, “Strong Welfare State”, https://www.tatsachen-ueber-deutschland.de/en/germany-glance/strong-welfare-state; Forsakringskassan, “Social Insurance in Sweden”, https://www.forsakringskassan.se/english/moving-to-working-studying-or-newly-arrived-in-sweden/social-insurance-in-sweden

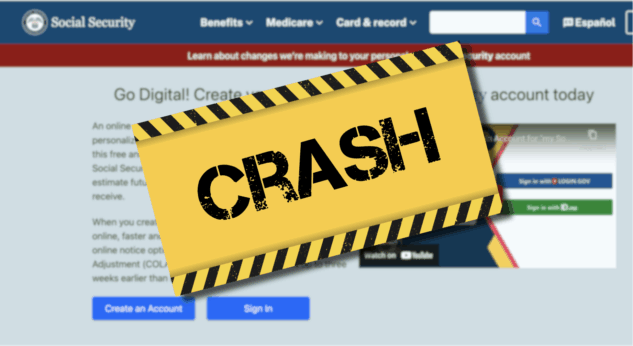

Latest Social Security Website Crash a Symptom of Trump/DOGE Mismanagement

Seniors trying to access their earned benefit information hit a snag when the Social Security Administration’s (SSA) website crashed on Wednesday morning. These sorts of incidents have unfortunately become commonplace since the Trump administration took over, as DOGE’s crusade at SSA has left the agency in chaos.

“We continue to get reports of glitches on SSA’s website. It looks like this was one of them,” said NCPSSM President and CEO, Max Richtman.

At around 10 AM on Wednesday, My Social Security users faced “Online Service Not Available” errors. Advocates questioned whether the outage stemmed from SSA’s June login overhaul, which mandated Login.gov and ID.me as the sole sign-in options and scrapped traditional Social Security usernames and passwords. (Under new Trump administration rules, beneficiaries are no longer able to verify their identity over the phone.)

Thanks to Trump, Commissioner Frank Bisignano, and DOGE, staffing at SSA sits at historic lows, as the administration continues to force out experienced civil servants (including knowledgeable IT staff) in favor of a “technology agenda” better suited for the private sector, not an agency intended to serve the public. As a result, the website crashed five times in the month of March, and again during this latest incident. (Let’s not even get started on the AI bots that SSA has deployed to answer customer phone calls, which CNET called “maddening.”)

Trump’s Social Security Commissioner Frank Bisignano has presided over reckless cuts at SSA (AP Images)

Nancy Altman, President of Social Security Works, pointed out how Trump/DOGE cutbacks make tech outages “far more likely.” She told ThinkAdvisor, “This is especially concerning because Social Security leadership wants to reduce visitors to field offices by half, telling people to go online instead.”

“SSA is not a tech company to be gutted and sold to private equity. It is an agency that up until this year had nobly served the public, despite gross underfunding from Congress. On behalf of all Social Security beneficiaries, we lament the decline in service at SSA.” – Max Richtman, President and CEO, NCPSSM

SSA Commissioner Frank Bisignano has tried to disguise these reckless cuts as part of his “technology agenda,” using sketchy stats to cover up the fact that the administration has done nothing but kneecap the agency’s ability to function.

In an April edition of our podcast, former SSA Commissioner Martin O’Malley excoriated Trump and DOGE for taking a “meat cleaver” to what had been an improving agency under the Biden administration, despite chronic underfunding from Congress.

*************************************************************************************

Read our fact sheet on how seniors can protect themselves from chaos at SSA here

Read our fact check on Commissioner Frank Bisignano, aka “The Frankster” here

Listen to our “You Earned This” podcast here