Tester Opponent’s Ad Full of Falsehoods on Social Security

The campaign of Montana GOP Senate candidate Tim Sheehy stooped to new lows in a recent ad. In less than 30 seconds, the Koch-funded, billionaire-backed campaign unveiled a series of baseless claims about incumbent Senator Jon Tester’s record on Social Security. Terry Minnow, chair of the Montana seniors’ group Big Sky 55+, excoriated the Sheehy campaign in an open letter published in a local newspaper, demanding that the ad be taken off the air:

“The gross misrepresentations put forth in your ad play political games with (Montana seniors’) livelihoods and their sense of well-being. It is reckless and irresponsible to distress and scare Montanans with patently false information that will bring them anxiety, worry and sleepless nights.” – Terry Minnow, Chair, Big Sky 55+

Let’s take a closer look at the falsehoods in Sheehy’s ad, and where the two candidates really land on Social Security.

Falsehood #1: Jon Tester and other Democrats have “raided” the Social Security trust fund

There are no facts to back up this claim. The trust fund is invested in special U.S. Treasury notes which are repaid to Social Security with interest— just like other government bonds. The trust fund serves a designated purpose, and can only be used to pay for Social Security benefits and administrative costs. Contrary to the popular myth, no one is “raiding” the trust fund or “stealing” from it.

Falsehood #2: Jon Tester supported huge cuts to Social Security

Jon Tester has never supported “huge cuts” to Social Security. He earned a 100% rating on our legislative scorecard two congressional sessions in a row. Lawmakers only receive a 100% rating by consistently supporting Social Security. “I will always defend Medicare and Social Security with all I’ve got,” says Senator Tester. This is why we formally endorsed him in June.

Falsehood #3: Tim Sheehy opposes cuts to Social Security and Medicare

While Jon Tester has always opposed Republican proposals to “sunset” Social Security, Tim Sheehy can’t say the same. Sheehy told a conservative radio host that he agreed with a “mandatory sunset clause in every bill,” leaving Social Security benefits to the whims of politicians year after year. Sheehy, who was endorsed by Donald Trump, has shown he will align with the most extreme members of Congress. Florida Senator Rick Scott, the architect of a plan to sunset Social Security, has endorsed Sheehy and even spent time in Bozeman this summer speaking at his campaign events.

Sheehy has supported GOP efforts to make the Trump tax cuts permanent. This would add nearly $2 trillion to the federal debt. Some Republicans set their sights on Social Security and Medicare to make up the difference. Sheehy himself admits that making the Trump tax cuts permanent could jeopardize Social Security.

NCPSSM president Max Richtman endorses Jon Tester (R) and House candidate Monica Tranel (L) as seniors’ champions in Big Fork, MT

We are hopeful that Montana voters who care about Social Security will see through the falsehoods — and familiarize themselves with where the two candidates truly stand. This past June, NCPSSM President and CEO Max Richtman traveled to Big Fork, Montana to deliver our PAC’s endorsement of Senator Tester. The Senator has received similar endorsements from other seniors’ advocates as well, while Tim Sheehy peddles misinformation on these issues.

Check out this Facebook video from a real Montana Voter! It’s a lot more honest than Sheehy’s ad.

Dems, Republicans Spar on Social Security at Senate Hearing

Senate Budget Committee Chairman Sheldon Whitehouse (D-RI)

Senate Budget Committee chairman Sheldon Whitehouse (D-RI) and his colleagues welcomed two panels of witnesses to a hearing on Capitol Hill on September 10th to discuss the future of Social Security. The star witness was Social Security Administration (SSA) Commissioner Martin O’Malley, who took command of the agency in late 2023 pledging to improve customer service.

Democrats at the hearing criticized the House Republican Study Committee 2025 spending plan that would gut Social Security if implemented, cutting benefits for 3 out of 4 Americans. Democratic committee members reiterated their commitment not only to maintaining the solvency of the program’s trust fund (which is projected to become depleted in 2035 without Congressional action), but expanding benefits. Senator Whitehouse expressed frustration with Republicans for failing to support Democratic bills to strengthen the program, while offering no legislation of their own.

“Here’s what I think the plan is for Republicans: Run out the clock until insolvency. Then, when there is a crisis, try to get Democrats into a back room, where Republicans can secretly negotiate benefit cuts, and then bring them out to the public under cover of bipartisanship. That won’t work.” – Senator Sheldon Whitehouse (D-RI)

If that isn’t the plan, Senator Whitehouse challenged Republicans to introduce Social Security legislation — which they haven’t done since 2016. (That bill would have cut benefits by more than 30%). Democrats say that their goal is clear: maintain the financial health of Social Security without cutting benefits — mainly by demanding that high earners begin paying their fair share in payroll contributions. (This is why we a have endorsed Democrats up and down the ballot, including Kamala Harris.)

Senator Ron Wyden (D-OR)

“The ultra wealthy are avoiding nearly $2 Trillion in taxes every 10 years. That is enough to keep Social Security whole until the end of this century.” – Senator Ron Wyden (D-OR)

The nation’s nearly 70 million Social Security beneficiaries not only deserve an expanded and strengthened program; they rightly expect proper customer service from the Social Security Administration. Commissioner O’Malley touted the agency’s achievements since he took office, including cutting wait times on the 1-800 phone line and making the process of recovering benefit overpayments less painful for seniors, despite underfunding by the U.S. Congress, resulting in a 50-year low in SSA staffing

“We have now reduced wait times on the 1-800 number by 50%… We have now cleared more cases every week for 12 weeks in a row and have reduced the (appeals backlog for disability claims) to a 30-year low. (But) these recent gains will be short-lived without your immediate attention and support.” – Social Security Administration Commissioner Martin O’Malley, 9/11/24

NCPSSM’s senior Social Security expert, Maria Freese, praised O’Malley’s advocacy for better SSA funding::

With 10,000 Americans turning 65 each day, it’s critical that SSA receive adequate funds each year during the appropriations process. Commissioner O’Malley did a masterful job of explaining the negative consequences that would result if the agency continues to be underfunded. ” – Maria Freese, NCPSSM Senior Policy Advisor

Even so, the commissioner pointed out that a majority of Americans hold favorable views of SSA, especially compared to other parts of the federal government.

O’Malley engaged in a spirited back and forth with Sen. Ron Johnson (R-WI), who did not conceal his disdain for Social Security, calling it a “paternalistic” program with “forced” participation. In 2022, Johnson proposed that Social Security be downgraded from a ‘mandatory’ to a ‘voluntary’ spending program. At this week’s hearing, he advocated raising the retirement age. Like other proponents of this idea, Johnson uses the canard that Americans are “living longer” and shouldn’t be able to collect benefits until age 69 or 70.

Commissioner O’Malley reminded the Senator that many socioeconomically challenged groups face lower life expectancies — and that people in physically demanding jobs may not be able to continue working until their late 60s. (Raising the retirement age would be a huge lifetime benefit cut.)

Social Security Administration Commissioner Martin O’Malley

The second panel of witnesses featured Rebecca Vallas, who recently became CEO of the National Academy of Social Insurance. She stressed importance of Social Security benefits to millions of Americans while expressing optimism in legislators’ ability to address looming solvency issues:

“Social Security isn’t just a government program, and it isn’t just a math problem that needs to be solved. It’s a reflection of our shared values as Americans and a commitment that we make to each other. The reason there’s so much bipartisan support and love for this program is that we feel this not just financially, but spiritually” – Ms. Rebecca D. Vallas, CEO of the National Academy of Social Insurance

Several Democrats in the House and Senate have introduced legislation that would strengthen and expand Social Security, but few of these bills have come up for a vote.

Earlier this week, Sen. Brian Schatz (D-HI) introduced a bill endorsed by NCPSSM. Our president and CEO Max Richtman said the legislation will “enhance Social Security for current beneficiaries and future generations.” Democratic Senators Whitehouse and Sanders along with Rep. John Larson and (several others in the House) have introduced their own legislation to improve Social Security without cutting benefits. Some of these bills would expand benefits across the board. Democrats have called on GOP lawmakers to support these commonsense measures, but, as this week’s hearing demonstrates, there is little consensus between the two parties as of now – and perhaps little in sight.

Harris, Dems Promise to Protect Seniors’ Earned Benefits at Convention

Along with powerful speakers from across the Democratic party (and even some Republicans), heartfelt personal testimonials, and a music-infused roll call, Social Security and Medicare played a prominent role during this week’s convention in Chicago. Democrats hammered home the message that Kamala Harris will protect senior’s earned benefits while Donald Trump and Project 2025 pose a clear threat to Social Security and Medicare (despite Trump’s mixed-messages on the subject).

“We’re not going back” became the rallying cry at the convention, which Harris employed in her acceptance speech to warn voters that a second Trump administration would undermine Americans’ retirement and health security::::

“We are not going back to when Donald Trump tried to cut Social Security and Medicare. We are not going back to when he tried to get rid of the Affordable Care Act.” – Kamala Harris, 8/22/24

During his presidency, Trump submitted White House budgets that included billions of dollars in cuts to Social Security and Medicare. He tried unsuccessfully to repeal the Affordable Care Act. He suspended the Social Security payroll tax and hoped it would be “terminated.” This year, he said he was “open” to “cutting entitlements” and proposes to eliminate the tax on Social Security benefits which helps to fund the program.

By contrast, Harris pledged in her speech to “protect Social Security and Medicare” — a salient promise that squarely aligns with public opinion. In recent polling, some 80% of Americans across party lines do not want to see Social Security and Medicare cut. In fact, majorities want to see Social Security expanded by having the wealthy contribute their fair share.

Other VIP speakers reinforced Harris’ promise throughout the week:::

“As President, Kamala will fight to lower the cost of health care and eldercare for EVERY family.” – Gov. Gretchen Whitmer (D-MI)

“For workers striving for a secure retirement, Kamala will fight for you.” – Gov. Roy Cooper (D-NC)

“I had two incredible grandparents who stepped in and raised me. When I work to protect Medicare and social security, I do it with a personal knowledge of what those big programs meant in small but deeply meaningful ways to our family.” – Senator Tammy Baldwin (D-IL)

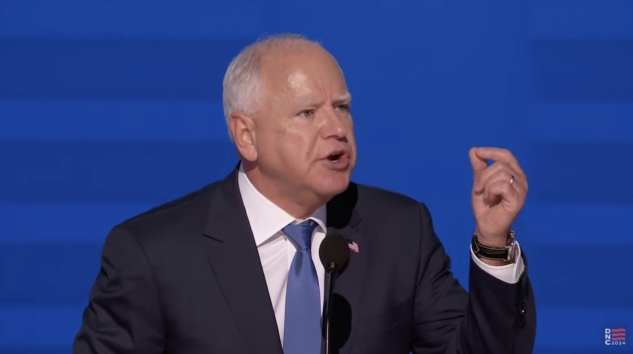

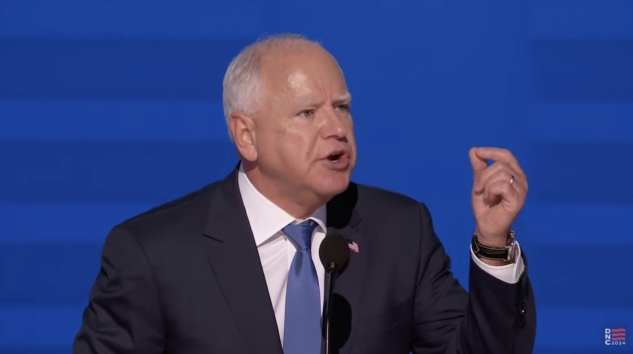

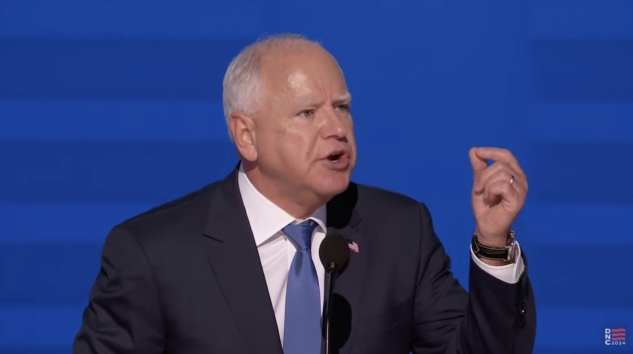

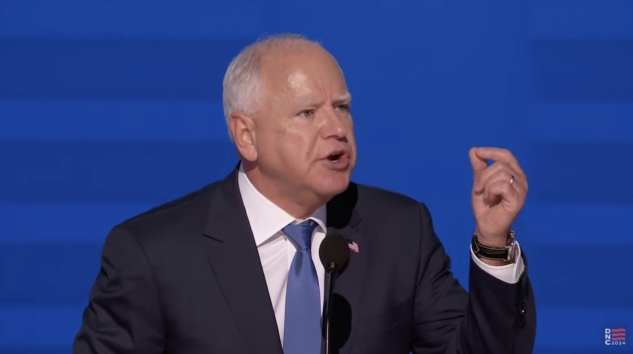

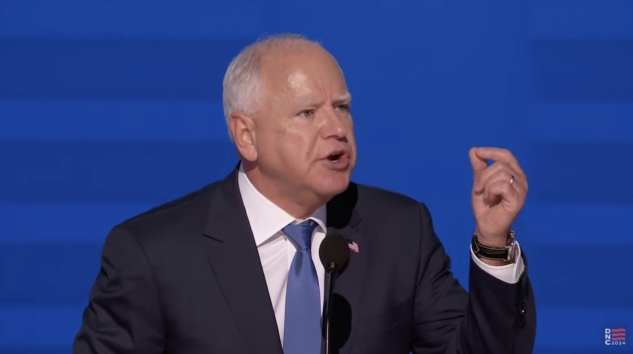

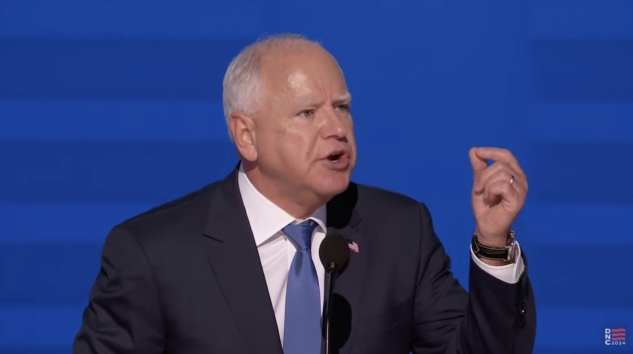

Vice presidential nominee Tim Walz offered his own testimonial about Social Security. His father died of lung cancer when Walz was 19, leaving the family with a “a mountain of medical debt” — but Social Security kept them from falling into poverty. In his acceptance speech Wednesday night, Walz said simply, “Thank God for Social Security survivor benefits!”

The National Committee to Preserve Social Security and Medicare was represented at the convention by political director Luke Warren, director of government relations and policy Dan Adcock, and president/CEO Max Richtman — who was selected to serve on the Democratic Platform Committee.

“This obviously was a historic convention and it was exciting to be there. I think that what’s remarkable is that Social Security and Medicare, which we have been telling Democrats for years are winning issues, were very much in the mix,” says Dan Adcock, who has attended every Democratic convention since 2004. “In past conventions, seniors’ programs were hardly mentioned at all. But this time, they were prominent in the speeches of both Kamala Harris and Tim Walz.”

NCPSSM’s Dan Adcock & Max Richtman in Chicago

NCPSSM President and CEO Max Richtman spoke at the DNC Seniors’ Council meeting in Chicago on Wednesday, echoing Harris’ commitment to improving Social Security’s finances by adjusting the payroll wage cap that currently exempts wages above $168,600, depriving the program of much-needed revenue:

“Kamala Harris and Tim Walz support extending the solvency of Social Security’s trust fund — and boosting Social Security benefits. They also believe the wealthy should pay their fair share in Social Security payroll contributions.” – Max Richtman, 8/21/24

Richtman pointed out that seniors are an important voting bloc who reliably show up at the polls. An Emerson College survey released on Thursday show Harris gaining ground over Trump among older Baby Boomers and the Silent Generation. According to Newsweek, “The majority of voters over 70 support Harris over Trump, 51% to 48%. (This) represents a major breakthrough for Harris.”

“Close elections can turn on how the largest and most dependable age group votes. Seniors know – or should know — that Democrats will go to the mat for them,” Richtman told the Seniors’ Council.

Social Security Celebrates 89 Years of Keeping Seniors Financially Secure

Social Security turns 89 years old today. That’s nearly nine decades of providing baseline financial security to America’s retirees and their families — and since 1956, to people with disabilities. Today, 67 million people — or 1 in 5 U.S. residents — receive Social Security benefits. And in all these years, Social Security has never missed a payment. Not once.

When President Franklin D. Roosevelt signed Social Security into law on August 14, 1935, about half of the nation’s seniors lived in poverty. Many were living in actual poor houses. (As of 2021, only 8 percent of people over 65 fell beneath the poverty line.) “We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life,” FDR declared at the signing ceremony in 1935. “But we have tried to frame a law which will give some measure of protection to the average citizen and to his family… against poverty-ridden old age.”

That “measure of protection” is modest, but crucial. The average Social Security check for retirees is about $1,900 per month… or $22,800 per year. If you talk to seniors on fixed incomes, as I do when I’m traveling around the country speaking about Social Security, they will tell you that their earned benefits are a financial lifeline. “It’s a sizable chunk of my income,” a beneficiary in Milwaukee told us. “It’s my livelihood,” said a retiree in Richmond. Another senior put it simply: “Thank God for Social Security.”

Social Security not only provides retirement benefits; it serves as insurance for eligible workers and their families. In fact, the average 27 year-old worker with a family already has the equivalent of some $2 million in life and disability insurance from Social Security. This simple truth betrays the claims of politicians and pundits who claim that the program somehow is unfair to younger Americans paying into it. In fact, Social Security truly is intergenerational. It is there for workers today — and when they retire.

Social Security’s impact goes beyond workers and retirees. The program provides economic stimulus for the entire nation. Thanks to the ‘multiplier effect,’ every dollar of Social Security benefits produces $2 in economic stimulus. That adds up to more than $1.6 trillion in stimulus as benefits are spent and generate economic activity in every state. Social Security also acts as an automatic economic stabilizer because benefits are paid even during economic downturns.

The program has its challenges. The Social Security Trustees project that reserves in the combined retirement and disability trust fund will become depleted by 2035 if Congress doesn’t take pre-emptive action. Contrary to popular belief, this is not because of the increasing ratio of retirees collecting benefits to workers paying into the program. The lawmakers behind the 1983 Social Security reforms had already anticipated that, which is why they increased revenue and raised the retirement age to 67 for anyone born in 1960 or later.

The primary reason for the current projected shortfall is growing income inequality. The 1983 reformers did not anticipate the widening gap between higher earners and everyone else who contributes to Social Security through payroll taxes. Those payroll taxes are capped at a certain level of income, also known as the “tax max.” (The current cap is $168,600 in annual wages.) Back in the early 1980s, the Social Security “tax maximum” captured 90 percent of Americans’ earnings. With the rich getting richer and middle-class income stagnating, that figure has decreased to only 82 percent today. More and more high earners were “maxing out,” depriving the system of much-needed revenue.

The system can be restored to financial health by adjusting the payroll wage cap so that the wealthy begin paying their fair share. We support Representative John Larson’s (D-Conn.) Social Security 2100 Act, which re-imposes payroll taxes at $400,000 in wages — and for the first time would include some of high-earners’ investment income. (We have endorsed similar legislation from Senator Bernie Sanders (D-Vt.), Senator Sheldon Whitehouse (D-R.I.), Rep. Jan Schakowsky (D-Ill.), Rep. Brendan Boyle (D-Penn.)

Rep. Larson’s bill not only would extend the solvency of the trust fund; it would expand benefits across the board — and provide especially vulnerable groups of beneficiaries with targeted benefit increases.

Some on Capitol Hill reject any measures to increase revenue, and insist that Social Security must be “reformed,” which is code for cutting benefits. We reject benefit cuts as unnecessary and harmful to current and future retirees. These include raising the retirement age to 69 or 70, means-testing benefits, adopting a more miserly COLA formula, or privatizing Social Security.

We push back when conservatives say benefits must be cut to address the federal debt. Social Security is self-funded and does not contribute to the debt. In fact, according to the Center on Budget and Policy Priorities, the number one driver of debt is tax giveaways to the wealthy and profitable corporations, such as the Trump tax cuts of 2017, which some lawmakers now want to make permanent.

Some proponents of cutting Social Security claim they won’t touch benefits for today’s seniors, but that future generations will have to count on less from the program. We say that our children and grandchildren will rely on Social Security even more than current seniors do — because of the disappearance of employer-provided pensions, mounting student debt, and rising income inequality making it harder to save for retirement. Younger workers will need every dollar of their promised retirement benefits, if not more.

This 89th anniversary year for Social Security is also a crucial one for the program, because the future of Social Security hinges, in part, on the results of the 2024 elections. Most politicians claim to support Social Security. We urge voters to look beyond the rhetoric and assess what candidates for federal office truly propose for Social Security. Those who advocate cutting benefits (by raising the retirement age or by other means), either for today’s retirees or tomorrow’s, do not have seniors’ true interests in mind. Candidates who want to strengthen and expand Social Security are the ones looking out for workers’ financial security — and honoring the legacy of Franklin D. Roosevelt, who said 89 years ago that the Social Security Act was “a cornerstone in a structure which is being built but is by no means complete.”

Our Fact Checker Says FactCheck.Org Missed the Bigger Picture on Trump, Social Security & Medicare

Our Director of Government Relations & Policy, Dan Adcock

Late last month, FactCheck.org published an article titled ‘FactChecking Vice President Kamala Harris’ which included misleading claims on the two presidential candidates and their stances on Social Security and Medicare. The Heritage Foundation, a right-wing think tank, and other groups like it, have taken positions that would seriously undermine the nation’s most popular social insurance programs. Donald Trump has tried to distance himself from Heritage Foundation’s Project 2025 policy blueprint, but the people behind it undoubtedly would play an influential role in a second Trump Administration. We chatted with our Government Relations and Policy Director, Dan Adcock, about some of the missing context in the FactCheck.org article — and the bigger picture on Social Security and Medicare in 2024.

Q: The FactCheck piece quotes Donald Trump claiming he would “get rid of the waste and fraud” and “save (Social Security and Medicare) without cuts.” Why should America’s seniors believe that “getting rid of waste and fraud” isn’t just a fancy way of saying “cutting benefits?”

A: Trump’s previous public statements make it clear that he’s open to the idea of making cuts. He said on CNBC that cutting “entitlements” would be easy. Then, of course, he walked that back. In one of his books he compared Social Security to a “Ponzi scheme.” It’s clear that he doesn’t really care about Social Security. On one hand, he’s said that he won’t cut benefits… and that’s great. But as president, his budgets proposed to cut Social Security Disability Insurance by billions of dollars. He also proposed getting rid of the Social Security payroll tax — which finances the program itself. Without the Social Security payroll tax, there would be no Social Security.

Q: The FactCheck article makes the claim,“In his four years as president, Trump did not propose cutting Social Security’s retirement benefits.” Is this misleading? If so, how?

A: This is definitely misleading wording from FactCheck. To imply that disability insurance can be isolated from retirement insurance is hogwash. It’s all the same program. Workers pay for both retirement and disability insurance together with every paycheck. We are currently part of efforts, both legislatively and in the press, to make it clear that it is in fact a single program, and that cutting any component of Social Security would mean tearing the whole thing down.

Q: Trump denies that Project 2025, authored by the right-wing Heritage Foundation, is a blueprint for his second term. Project 2025 proposes devastating cuts to Medicare — and the Heritage Foundation itself has called for cuts to Social Security. It is disingenuous for Trump to try to distance himself from Heritage and Project 2025?

The Heritage foundation authored Project 2025, and they aren’t going anywhere. They’ve made it clear that they will be behind a substantial number of potential Trump administration nominations, which will be based on ideology and loyalty to the President — as opposed to expertise. These would be the people that he feels are most loyal to him and his staff. The Heritage Foundation considers itself the “brain trust” of any potential Trump Administration, and often focuses on cherished issues of the conservative elite that Trump may not know in detail or care much about. But he will do their bidding, if past is precedent. The Heritage Foundation will have a lot of influence if Trump is re-elected.

Q: Republicans often claim that they have not called for any changes to Social Security affecting today’s seniors. But they leave the door open for cuts impacting the younger generations of workers. In truth, haven’t Republicans proposed significant benefit cuts — and won’t younger workers need every dollar of those benefits when they retire?

A: It’s clear when you look at the 2025 budget blueprint of the House Republican Study Committee, which includes 80% of the House Republican Caucus and 100% of the leadership, that they would raise the Social Security retirement age to 69 or 70. That is a huge lifetime benefit cut! And, of course, today’s younger workers will need every dollar of their promised benefits once they retire. Some House Republicans also would like to make the annual Social Security cost of living adjustment (COLA) discretionary, to be decided by each congress. Currently, seniors automatically get a yearly boost in benefits based on inflation. And on the Medicare side, the House Republican Study Committee plan would stack the deck against traditional Medicare in favor of privatized, for-profit plans that often provide inferior coverage.

Q: Any last comments on the FactCheck article and the claims it made?

A: I just want to reiterate the importance of Social Security survivor and disability benefits. President Trump has been all over the place with his rhetoric about Social Security as he tries to court support from seniors while placating his wealthy and influential backers on the right. But he and his allies have made it clear that they are coming for the disability and survivorship aspects of the program if Trump wins a second term. This isn’t okay. Like I said before, it’s all one program!

Tester Opponent’s Ad Full of Falsehoods on Social Security

The campaign of Montana GOP Senate candidate Tim Sheehy stooped to new lows in a recent ad. In less than 30 seconds, the Koch-funded, billionaire-backed campaign unveiled a series of baseless claims about incumbent Senator Jon Tester’s record on Social Security. Terry Minnow, chair of the Montana seniors’ group Big Sky 55+, excoriated the Sheehy campaign in an open letter published in a local newspaper, demanding that the ad be taken off the air:

“The gross misrepresentations put forth in your ad play political games with (Montana seniors’) livelihoods and their sense of well-being. It is reckless and irresponsible to distress and scare Montanans with patently false information that will bring them anxiety, worry and sleepless nights.” – Terry Minnow, Chair, Big Sky 55+

Let’s take a closer look at the falsehoods in Sheehy’s ad, and where the two candidates really land on Social Security.

Falsehood #1: Jon Tester and other Democrats have “raided” the Social Security trust fund

There are no facts to back up this claim. The trust fund is invested in special U.S. Treasury notes which are repaid to Social Security with interest— just like other government bonds. The trust fund serves a designated purpose, and can only be used to pay for Social Security benefits and administrative costs. Contrary to the popular myth, no one is “raiding” the trust fund or “stealing” from it.

Falsehood #2: Jon Tester supported huge cuts to Social Security

Jon Tester has never supported “huge cuts” to Social Security. He earned a 100% rating on our legislative scorecard two congressional sessions in a row. Lawmakers only receive a 100% rating by consistently supporting Social Security. “I will always defend Medicare and Social Security with all I’ve got,” says Senator Tester. This is why we formally endorsed him in June.

Falsehood #3: Tim Sheehy opposes cuts to Social Security and Medicare

While Jon Tester has always opposed Republican proposals to “sunset” Social Security, Tim Sheehy can’t say the same. Sheehy told a conservative radio host that he agreed with a “mandatory sunset clause in every bill,” leaving Social Security benefits to the whims of politicians year after year. Sheehy, who was endorsed by Donald Trump, has shown he will align with the most extreme members of Congress. Florida Senator Rick Scott, the architect of a plan to sunset Social Security, has endorsed Sheehy and even spent time in Bozeman this summer speaking at his campaign events.

Sheehy has supported GOP efforts to make the Trump tax cuts permanent. This would add nearly $2 trillion to the federal debt. Some Republicans set their sights on Social Security and Medicare to make up the difference. Sheehy himself admits that making the Trump tax cuts permanent could jeopardize Social Security.

NCPSSM president Max Richtman endorses Jon Tester (R) and House candidate Monica Tranel (L) as seniors’ champions in Big Fork, MT

We are hopeful that Montana voters who care about Social Security will see through the falsehoods — and familiarize themselves with where the two candidates truly stand. This past June, NCPSSM President and CEO Max Richtman traveled to Big Fork, Montana to deliver our PAC’s endorsement of Senator Tester. The Senator has received similar endorsements from other seniors’ advocates as well, while Tim Sheehy peddles misinformation on these issues.

Check out this Facebook video from a real Montana Voter! It’s a lot more honest than Sheehy’s ad.

Dems, Republicans Spar on Social Security at Senate Hearing

Senate Budget Committee Chairman Sheldon Whitehouse (D-RI)

Senate Budget Committee chairman Sheldon Whitehouse (D-RI) and his colleagues welcomed two panels of witnesses to a hearing on Capitol Hill on September 10th to discuss the future of Social Security. The star witness was Social Security Administration (SSA) Commissioner Martin O’Malley, who took command of the agency in late 2023 pledging to improve customer service.

Democrats at the hearing criticized the House Republican Study Committee 2025 spending plan that would gut Social Security if implemented, cutting benefits for 3 out of 4 Americans. Democratic committee members reiterated their commitment not only to maintaining the solvency of the program’s trust fund (which is projected to become depleted in 2035 without Congressional action), but expanding benefits. Senator Whitehouse expressed frustration with Republicans for failing to support Democratic bills to strengthen the program, while offering no legislation of their own.

“Here’s what I think the plan is for Republicans: Run out the clock until insolvency. Then, when there is a crisis, try to get Democrats into a back room, where Republicans can secretly negotiate benefit cuts, and then bring them out to the public under cover of bipartisanship. That won’t work.” – Senator Sheldon Whitehouse (D-RI)

If that isn’t the plan, Senator Whitehouse challenged Republicans to introduce Social Security legislation — which they haven’t done since 2016. (That bill would have cut benefits by more than 30%). Democrats say that their goal is clear: maintain the financial health of Social Security without cutting benefits — mainly by demanding that high earners begin paying their fair share in payroll contributions. (This is why we a have endorsed Democrats up and down the ballot, including Kamala Harris.)

Senator Ron Wyden (D-OR)

“The ultra wealthy are avoiding nearly $2 Trillion in taxes every 10 years. That is enough to keep Social Security whole until the end of this century.” – Senator Ron Wyden (D-OR)

The nation’s nearly 70 million Social Security beneficiaries not only deserve an expanded and strengthened program; they rightly expect proper customer service from the Social Security Administration. Commissioner O’Malley touted the agency’s achievements since he took office, including cutting wait times on the 1-800 phone line and making the process of recovering benefit overpayments less painful for seniors, despite underfunding by the U.S. Congress, resulting in a 50-year low in SSA staffing

“We have now reduced wait times on the 1-800 number by 50%… We have now cleared more cases every week for 12 weeks in a row and have reduced the (appeals backlog for disability claims) to a 30-year low. (But) these recent gains will be short-lived without your immediate attention and support.” – Social Security Administration Commissioner Martin O’Malley, 9/11/24

NCPSSM’s senior Social Security expert, Maria Freese, praised O’Malley’s advocacy for better SSA funding::

With 10,000 Americans turning 65 each day, it’s critical that SSA receive adequate funds each year during the appropriations process. Commissioner O’Malley did a masterful job of explaining the negative consequences that would result if the agency continues to be underfunded. ” – Maria Freese, NCPSSM Senior Policy Advisor

Even so, the commissioner pointed out that a majority of Americans hold favorable views of SSA, especially compared to other parts of the federal government.

O’Malley engaged in a spirited back and forth with Sen. Ron Johnson (R-WI), who did not conceal his disdain for Social Security, calling it a “paternalistic” program with “forced” participation. In 2022, Johnson proposed that Social Security be downgraded from a ‘mandatory’ to a ‘voluntary’ spending program. At this week’s hearing, he advocated raising the retirement age. Like other proponents of this idea, Johnson uses the canard that Americans are “living longer” and shouldn’t be able to collect benefits until age 69 or 70.

Commissioner O’Malley reminded the Senator that many socioeconomically challenged groups face lower life expectancies — and that people in physically demanding jobs may not be able to continue working until their late 60s. (Raising the retirement age would be a huge lifetime benefit cut.)

Social Security Administration Commissioner Martin O’Malley

The second panel of witnesses featured Rebecca Vallas, who recently became CEO of the National Academy of Social Insurance. She stressed importance of Social Security benefits to millions of Americans while expressing optimism in legislators’ ability to address looming solvency issues:

“Social Security isn’t just a government program, and it isn’t just a math problem that needs to be solved. It’s a reflection of our shared values as Americans and a commitment that we make to each other. The reason there’s so much bipartisan support and love for this program is that we feel this not just financially, but spiritually” – Ms. Rebecca D. Vallas, CEO of the National Academy of Social Insurance

Several Democrats in the House and Senate have introduced legislation that would strengthen and expand Social Security, but few of these bills have come up for a vote.

Earlier this week, Sen. Brian Schatz (D-HI) introduced a bill endorsed by NCPSSM. Our president and CEO Max Richtman said the legislation will “enhance Social Security for current beneficiaries and future generations.” Democratic Senators Whitehouse and Sanders along with Rep. John Larson and (several others in the House) have introduced their own legislation to improve Social Security without cutting benefits. Some of these bills would expand benefits across the board. Democrats have called on GOP lawmakers to support these commonsense measures, but, as this week’s hearing demonstrates, there is little consensus between the two parties as of now – and perhaps little in sight.

Harris, Dems Promise to Protect Seniors’ Earned Benefits at Convention

Along with powerful speakers from across the Democratic party (and even some Republicans), heartfelt personal testimonials, and a music-infused roll call, Social Security and Medicare played a prominent role during this week’s convention in Chicago. Democrats hammered home the message that Kamala Harris will protect senior’s earned benefits while Donald Trump and Project 2025 pose a clear threat to Social Security and Medicare (despite Trump’s mixed-messages on the subject).

“We’re not going back” became the rallying cry at the convention, which Harris employed in her acceptance speech to warn voters that a second Trump administration would undermine Americans’ retirement and health security::::

“We are not going back to when Donald Trump tried to cut Social Security and Medicare. We are not going back to when he tried to get rid of the Affordable Care Act.” – Kamala Harris, 8/22/24

During his presidency, Trump submitted White House budgets that included billions of dollars in cuts to Social Security and Medicare. He tried unsuccessfully to repeal the Affordable Care Act. He suspended the Social Security payroll tax and hoped it would be “terminated.” This year, he said he was “open” to “cutting entitlements” and proposes to eliminate the tax on Social Security benefits which helps to fund the program.

By contrast, Harris pledged in her speech to “protect Social Security and Medicare” — a salient promise that squarely aligns with public opinion. In recent polling, some 80% of Americans across party lines do not want to see Social Security and Medicare cut. In fact, majorities want to see Social Security expanded by having the wealthy contribute their fair share.

Other VIP speakers reinforced Harris’ promise throughout the week:::

“As President, Kamala will fight to lower the cost of health care and eldercare for EVERY family.” – Gov. Gretchen Whitmer (D-MI)

“For workers striving for a secure retirement, Kamala will fight for you.” – Gov. Roy Cooper (D-NC)

“I had two incredible grandparents who stepped in and raised me. When I work to protect Medicare and social security, I do it with a personal knowledge of what those big programs meant in small but deeply meaningful ways to our family.” – Senator Tammy Baldwin (D-IL)

Vice presidential nominee Tim Walz offered his own testimonial about Social Security. His father died of lung cancer when Walz was 19, leaving the family with a “a mountain of medical debt” — but Social Security kept them from falling into poverty. In his acceptance speech Wednesday night, Walz said simply, “Thank God for Social Security survivor benefits!”

The National Committee to Preserve Social Security and Medicare was represented at the convention by political director Luke Warren, director of government relations and policy Dan Adcock, and president/CEO Max Richtman — who was selected to serve on the Democratic Platform Committee.

“This obviously was a historic convention and it was exciting to be there. I think that what’s remarkable is that Social Security and Medicare, which we have been telling Democrats for years are winning issues, were very much in the mix,” says Dan Adcock, who has attended every Democratic convention since 2004. “In past conventions, seniors’ programs were hardly mentioned at all. But this time, they were prominent in the speeches of both Kamala Harris and Tim Walz.”

NCPSSM’s Dan Adcock & Max Richtman in Chicago

NCPSSM President and CEO Max Richtman spoke at the DNC Seniors’ Council meeting in Chicago on Wednesday, echoing Harris’ commitment to improving Social Security’s finances by adjusting the payroll wage cap that currently exempts wages above $168,600, depriving the program of much-needed revenue:

“Kamala Harris and Tim Walz support extending the solvency of Social Security’s trust fund — and boosting Social Security benefits. They also believe the wealthy should pay their fair share in Social Security payroll contributions.” – Max Richtman, 8/21/24

Richtman pointed out that seniors are an important voting bloc who reliably show up at the polls. An Emerson College survey released on Thursday show Harris gaining ground over Trump among older Baby Boomers and the Silent Generation. According to Newsweek, “The majority of voters over 70 support Harris over Trump, 51% to 48%. (This) represents a major breakthrough for Harris.”

“Close elections can turn on how the largest and most dependable age group votes. Seniors know – or should know — that Democrats will go to the mat for them,” Richtman told the Seniors’ Council.

Social Security Celebrates 89 Years of Keeping Seniors Financially Secure

Social Security turns 89 years old today. That’s nearly nine decades of providing baseline financial security to America’s retirees and their families — and since 1956, to people with disabilities. Today, 67 million people — or 1 in 5 U.S. residents — receive Social Security benefits. And in all these years, Social Security has never missed a payment. Not once.

When President Franklin D. Roosevelt signed Social Security into law on August 14, 1935, about half of the nation’s seniors lived in poverty. Many were living in actual poor houses. (As of 2021, only 8 percent of people over 65 fell beneath the poverty line.) “We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life,” FDR declared at the signing ceremony in 1935. “But we have tried to frame a law which will give some measure of protection to the average citizen and to his family… against poverty-ridden old age.”

That “measure of protection” is modest, but crucial. The average Social Security check for retirees is about $1,900 per month… or $22,800 per year. If you talk to seniors on fixed incomes, as I do when I’m traveling around the country speaking about Social Security, they will tell you that their earned benefits are a financial lifeline. “It’s a sizable chunk of my income,” a beneficiary in Milwaukee told us. “It’s my livelihood,” said a retiree in Richmond. Another senior put it simply: “Thank God for Social Security.”

Social Security not only provides retirement benefits; it serves as insurance for eligible workers and their families. In fact, the average 27 year-old worker with a family already has the equivalent of some $2 million in life and disability insurance from Social Security. This simple truth betrays the claims of politicians and pundits who claim that the program somehow is unfair to younger Americans paying into it. In fact, Social Security truly is intergenerational. It is there for workers today — and when they retire.

Social Security’s impact goes beyond workers and retirees. The program provides economic stimulus for the entire nation. Thanks to the ‘multiplier effect,’ every dollar of Social Security benefits produces $2 in economic stimulus. That adds up to more than $1.6 trillion in stimulus as benefits are spent and generate economic activity in every state. Social Security also acts as an automatic economic stabilizer because benefits are paid even during economic downturns.

The program has its challenges. The Social Security Trustees project that reserves in the combined retirement and disability trust fund will become depleted by 2035 if Congress doesn’t take pre-emptive action. Contrary to popular belief, this is not because of the increasing ratio of retirees collecting benefits to workers paying into the program. The lawmakers behind the 1983 Social Security reforms had already anticipated that, which is why they increased revenue and raised the retirement age to 67 for anyone born in 1960 or later.

The primary reason for the current projected shortfall is growing income inequality. The 1983 reformers did not anticipate the widening gap between higher earners and everyone else who contributes to Social Security through payroll taxes. Those payroll taxes are capped at a certain level of income, also known as the “tax max.” (The current cap is $168,600 in annual wages.) Back in the early 1980s, the Social Security “tax maximum” captured 90 percent of Americans’ earnings. With the rich getting richer and middle-class income stagnating, that figure has decreased to only 82 percent today. More and more high earners were “maxing out,” depriving the system of much-needed revenue.

The system can be restored to financial health by adjusting the payroll wage cap so that the wealthy begin paying their fair share. We support Representative John Larson’s (D-Conn.) Social Security 2100 Act, which re-imposes payroll taxes at $400,000 in wages — and for the first time would include some of high-earners’ investment income. (We have endorsed similar legislation from Senator Bernie Sanders (D-Vt.), Senator Sheldon Whitehouse (D-R.I.), Rep. Jan Schakowsky (D-Ill.), Rep. Brendan Boyle (D-Penn.)

Rep. Larson’s bill not only would extend the solvency of the trust fund; it would expand benefits across the board — and provide especially vulnerable groups of beneficiaries with targeted benefit increases.

Some on Capitol Hill reject any measures to increase revenue, and insist that Social Security must be “reformed,” which is code for cutting benefits. We reject benefit cuts as unnecessary and harmful to current and future retirees. These include raising the retirement age to 69 or 70, means-testing benefits, adopting a more miserly COLA formula, or privatizing Social Security.

We push back when conservatives say benefits must be cut to address the federal debt. Social Security is self-funded and does not contribute to the debt. In fact, according to the Center on Budget and Policy Priorities, the number one driver of debt is tax giveaways to the wealthy and profitable corporations, such as the Trump tax cuts of 2017, which some lawmakers now want to make permanent.

Some proponents of cutting Social Security claim they won’t touch benefits for today’s seniors, but that future generations will have to count on less from the program. We say that our children and grandchildren will rely on Social Security even more than current seniors do — because of the disappearance of employer-provided pensions, mounting student debt, and rising income inequality making it harder to save for retirement. Younger workers will need every dollar of their promised retirement benefits, if not more.

This 89th anniversary year for Social Security is also a crucial one for the program, because the future of Social Security hinges, in part, on the results of the 2024 elections. Most politicians claim to support Social Security. We urge voters to look beyond the rhetoric and assess what candidates for federal office truly propose for Social Security. Those who advocate cutting benefits (by raising the retirement age or by other means), either for today’s retirees or tomorrow’s, do not have seniors’ true interests in mind. Candidates who want to strengthen and expand Social Security are the ones looking out for workers’ financial security — and honoring the legacy of Franklin D. Roosevelt, who said 89 years ago that the Social Security Act was “a cornerstone in a structure which is being built but is by no means complete.”

Our Fact Checker Says FactCheck.Org Missed the Bigger Picture on Trump, Social Security & Medicare

Our Director of Government Relations & Policy, Dan Adcock

Late last month, FactCheck.org published an article titled ‘FactChecking Vice President Kamala Harris’ which included misleading claims on the two presidential candidates and their stances on Social Security and Medicare. The Heritage Foundation, a right-wing think tank, and other groups like it, have taken positions that would seriously undermine the nation’s most popular social insurance programs. Donald Trump has tried to distance himself from Heritage Foundation’s Project 2025 policy blueprint, but the people behind it undoubtedly would play an influential role in a second Trump Administration. We chatted with our Government Relations and Policy Director, Dan Adcock, about some of the missing context in the FactCheck.org article — and the bigger picture on Social Security and Medicare in 2024.

Q: The FactCheck piece quotes Donald Trump claiming he would “get rid of the waste and fraud” and “save (Social Security and Medicare) without cuts.” Why should America’s seniors believe that “getting rid of waste and fraud” isn’t just a fancy way of saying “cutting benefits?”

A: Trump’s previous public statements make it clear that he’s open to the idea of making cuts. He said on CNBC that cutting “entitlements” would be easy. Then, of course, he walked that back. In one of his books he compared Social Security to a “Ponzi scheme.” It’s clear that he doesn’t really care about Social Security. On one hand, he’s said that he won’t cut benefits… and that’s great. But as president, his budgets proposed to cut Social Security Disability Insurance by billions of dollars. He also proposed getting rid of the Social Security payroll tax — which finances the program itself. Without the Social Security payroll tax, there would be no Social Security.

Q: The FactCheck article makes the claim,“In his four years as president, Trump did not propose cutting Social Security’s retirement benefits.” Is this misleading? If so, how?

A: This is definitely misleading wording from FactCheck. To imply that disability insurance can be isolated from retirement insurance is hogwash. It’s all the same program. Workers pay for both retirement and disability insurance together with every paycheck. We are currently part of efforts, both legislatively and in the press, to make it clear that it is in fact a single program, and that cutting any component of Social Security would mean tearing the whole thing down.

Q: Trump denies that Project 2025, authored by the right-wing Heritage Foundation, is a blueprint for his second term. Project 2025 proposes devastating cuts to Medicare — and the Heritage Foundation itself has called for cuts to Social Security. It is disingenuous for Trump to try to distance himself from Heritage and Project 2025?

The Heritage foundation authored Project 2025, and they aren’t going anywhere. They’ve made it clear that they will be behind a substantial number of potential Trump administration nominations, which will be based on ideology and loyalty to the President — as opposed to expertise. These would be the people that he feels are most loyal to him and his staff. The Heritage Foundation considers itself the “brain trust” of any potential Trump Administration, and often focuses on cherished issues of the conservative elite that Trump may not know in detail or care much about. But he will do their bidding, if past is precedent. The Heritage Foundation will have a lot of influence if Trump is re-elected.

Q: Republicans often claim that they have not called for any changes to Social Security affecting today’s seniors. But they leave the door open for cuts impacting the younger generations of workers. In truth, haven’t Republicans proposed significant benefit cuts — and won’t younger workers need every dollar of those benefits when they retire?

A: It’s clear when you look at the 2025 budget blueprint of the House Republican Study Committee, which includes 80% of the House Republican Caucus and 100% of the leadership, that they would raise the Social Security retirement age to 69 or 70. That is a huge lifetime benefit cut! And, of course, today’s younger workers will need every dollar of their promised benefits once they retire. Some House Republicans also would like to make the annual Social Security cost of living adjustment (COLA) discretionary, to be decided by each congress. Currently, seniors automatically get a yearly boost in benefits based on inflation. And on the Medicare side, the House Republican Study Committee plan would stack the deck against traditional Medicare in favor of privatized, for-profit plans that often provide inferior coverage.

Q: Any last comments on the FactCheck article and the claims it made?

A: I just want to reiterate the importance of Social Security survivor and disability benefits. President Trump has been all over the place with his rhetoric about Social Security as he tries to court support from seniors while placating his wealthy and influential backers on the right. But he and his allies have made it clear that they are coming for the disability and survivorship aspects of the program if Trump wins a second term. This isn’t okay. Like I said before, it’s all one program!