Associated Press Flubs Social Security Trustees Story

We blogged earlier this week about the inaccuracy of media reports about Social Security’s financial future. Some mainstream media journalists seemed to rely on old tropes when covering the recent Social Security trustees report. A prime example: a news story from the Associated Press (AP) with the alarmist headline, Medicare and Social Security go-broke dates pushed up.

We asked our director of government relations and policy, Dan Adcock, to correct some of the inaccuracies in the AP piece…

Dan Adcock: Let’s start with the headline. It’s completely misleading. Neither program is “going broke.” In the case of Social Security, the combined trust fund is projected to become depleted in 2034 if Congress takes no action, at which time the system still could pay 81% of benefits. Social Security itself is not going broke or bankrupt. The only way that could happen is if we had 100% unemployment and no one was paying into the program.

AP: Social Security’s trust funds — which cover old age and disability recipients — will be unable to pay full benefits beginning in 2034, instead of last year’s estimate of 2035.

Adcock: The reporter omits that that Social Security also pays benefits to spouses and survivors (upon the death of a family breadwinner), including millions of children. Social Security is a retirement program for sure — but it is also so much more than that.

AP: The trustees say the latest findings show the urgency of needed changes to the programs, but… lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.

Adcock: This is a media trope that insists no one in Washington is thinking about Social Security’s future — or willing to take action. In fact, both parties have proposed solutions to ‘fix’ Social Security. The problem is that the Republicans focus exclusively on cutting benefits. Democrats have put forward proposals to bring more revenue into the program by demanding that the wealthy contribute their fair share. Opinion polling suggests that the public favors the approach of raising revenue rather than cutting benefits, regardless of party affiliation.

AP: President Donald Trump and other Republicans have vowed not to make any cuts to Medicare or Social Security, even as they seek to shrink the federal government’s expenditures.

Adcock: Those vows to protect Social Security have turned out to be quite hollow. The House Republican Study Committee has proposed cuts to Social Security (including raising the retirement age) in its budget blueprints. House and Senate Republicans have favored a fiscal commission that could fast-track cuts to the program through Congress. But more immediately, Trump unleashed Elon Musk & DOGE to wreak havoc on the Social Security Administration. The result has been severe cuts in staffing, mounting difficulty for customers accessing their benefits, multiple website crashes, and people being wrongly declared dead and having their benefits cut off. While these are not benefit cuts per se, they represent unprecedented interference in the delivery of Social Security — and break the President’s promise “not to touch” it.

AP: The report states that the Social Security Social Security Fairness Act (SSFA), enacted in January, which repealed the Windfall Elimination and Government Pension Offset provisions of the Social Security Act and increased Social Security benefit levels for some workers, had an impact on the depletion date of SSA’s trust funds.

Dan Adcock: The beneficiaries of the SSFA were not just “some workers.” They’re public sector employees like teachers, firefighters, and police officers who were denied full Social Security benefits until the Social Security Fairness Act was passed last year. The impact on the depletion date of the trust funds was only six months.

AP: Congressional Budget Office reporting has stated that the biggest drivers of debt rising in relation to GDP are increasing interest costs and spending for Medicare and Social Security. An aging population drives those numbers.

Dan Adcock: According to the nonpartisan Center for Budget and Policy Priorities, the biggest driver of the debt is TAX EXPENDITURES, including Trump’s huge tax cuts for the wealthy and big corporations. Social Security and Medicare Part A are completely self-funded by workers’ payroll contributions and DO NOT CONTRIBUTE to the debt. As Ronald Reagan said, “Social Security has nothing to do with the deficit.”

Many of the inaccuracies in the AP story reinforce, wittingly or not, the conservative narrative that Social Security is going broke and must be cut in order to survive. That can undermine public support for the program and pave the way for benefit reductions and privatization. We urge the mainstream media not to default to this narrative and at the least balance its coverage, which would acknowledge that some of our leaders in Washington have positive ideas for strengthening Social Security without cutting benefits — with the public squarely behind them.

Visit our website to view some common Social Security Myths!

Some of the Media Bungle Social Security Trustees Report

It’d be swell if more of the mainstream media would accurately report the financial status of Social Security. Unfortunately, much of the coverage is influenced by conservative propaganda rather than actual facts. Predictably, some of the reporting on the recently released Social Security trustees report is less journalistic than alarmist and simplistic.

As Los Angeles Times columnist Michael Hiltzik observes, “The annual report of the trustees provides yearly opportunities for misunderstandings by politicians, the media, and the general public about the health of (Social Security). This year is no exception,”

A quick review of the headlines following the release of the 2025 trustees report bears this out:

Social Security is set to dry up even sooner than expected – Forbes

Social Security Is Running Out of Money – Newsweek

Social Security go-broke date pushed up – Associated Press

Social Security Could Be Bankrupt By 2033 – iHeart Radio

For the record: Social Security is not drying up, running out of money, going broke, or facing bankruptcy. What the trustees reported is that, absent any action by Congress, the reserves in Social Security’s combined trust fund will become depleted by 2034 — a year earlier than was projected in the previous report. At that point, the program still could pay 81% of benefits. No one wants to see seniors suffer a 19% benefit cut, but that outcome is far from inevitable.

Let’s be clear: the only way that Social Security itself could go ‘bankrupt’ is if we had 100% unemployment and no one was paying into the program. Barring that unlikely event, Social Security still will have plenty of money. (There currently is a $2.7 trillion surplus in the trust fund.)

The trust fund’s projected depletion date has vacillated between 2033 and 2035 for several years now. The date moving up one year in the latest report is no cause for panic; but you’d never know that from the coverage.

Not all of the news media is bungling the story. Some of the reporting actually is fair and responsible. But the inaccurate coverage feeds directly into the conservative narrative that Social Security is on a path to oblivion — and that the only way to ‘save’ it is by cutting benefits or privatizing the program.

“We have a generational opportunity and a moral obligation to address the solvency and unsustainability of these programs,” insisted Rep. Jody Arrington (R-TX), Chair of the House Budget Committee. (Note: neither the trustees nor the program’s chief actuary has said that Social Security is “unsustainable.”)

The libertarian Cato Institute’s Romina Boccia called the 2025 report “bleak,” warning that “The program is barreling toward insolvency — and fast.” (Note: the trust fund will become insolvent if no action is taken to prevent it, but the program itself will remain solvent. The trust fund and the Social Security program are not the same thing.)

The second bogus claim in the media narrative is that ‘no one in Washington is taking the projected shortfall seriously or doing anything about it.’

“Lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.” – Associated Press, 6/18/25

In fact, both parties have proposed fixes for Social Security. Republicans have put forth plans to raise the retirement age (a huge benefit cut!), means test benefits (another cut), and implement a more miserly COLA formula (yes, an additional cut!) — on top of their ongoing calls to privatize the program. These proposals ask current or future seniors to bear the costs (and the risk, in the case of privatization) of ‘saving’ Social Security.

Democrats — including Rep. John Larson (D-CT), Senator Richard Blumenthal (D-CT), Senator Elizabeth Warren (D-MA), and Sen. Sheldon Whitehouse (D-RI) — have introduced legislation to bring more revenue into Social Security by asking the wealthy to contribute their fair share — with no benefit cuts. We fully embrace this approach.

There may be a lack of bipartisan consensus on the proper path, but to say that Congress is ‘kicking the can down the road’ is an oversimplification. These simple narratives are easier to fall back on for reporters facing deadlines, but they are grossly misleading — and can undermine public faith in Social Security. Of course, Congress should act, but there still is time before this becomes a full-blown crisis.

We’ll blog again later in the week with an analysis of a recent news story by the Associated Press, which (typically) mischaracterizes the implications of the trustees report. Stay tuned!

Hopes that Senate Would Mitigate Medicaid & SNAP Cuts Have Been Dashed

(Getty Images)

By Anne Montgomery, Senior Health Policy Expert

Seniors’ advocates who analyzed the reconciliation bill narrowly approved by the House of Representatives in May hoped that the U.S. Senate would temper unaffordable tax cuts for the wealthy — and avoid slashing Medicaid and SNAP. Those hopes have been dashed by Senate Republicans on the Finance and Agriculture Committees, who propose to end Medicaid and SNAP as we know them – as lifelines for millions of Americans across the country who need reliable access to basic health care and food to survive.

As Common Dreams so aptly put it in their news headline this week, “

“We’re watching in real time as Senate Republicans line up to gut healthcare for millions of Americans in order to pay for tax cuts for themselves, their wealthy donors, and big businesses.” – Common Dreams, 6/17/25

Although the Congressional Budget Office has yet to announce an estimate of the Senate bill’s funding reductions through 2034, most anticipate it will carve $1 trillion or so out of current federal funding for the two programs and use this as a partial offset for tax cuts that will benefit high-wealth individuals and businesses.

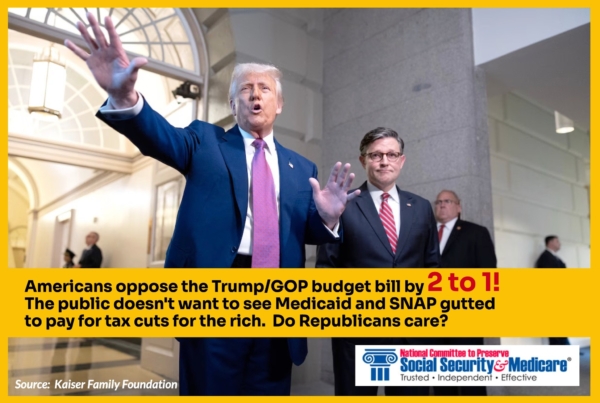

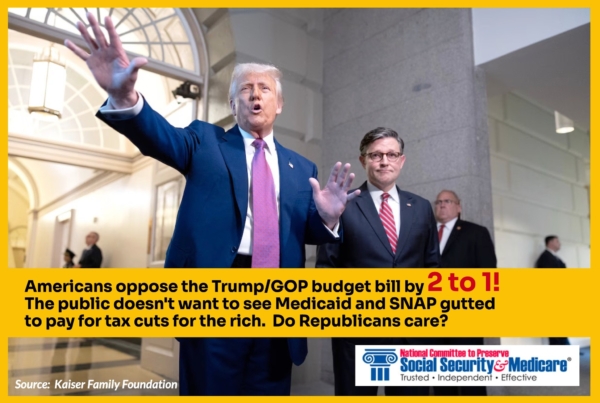

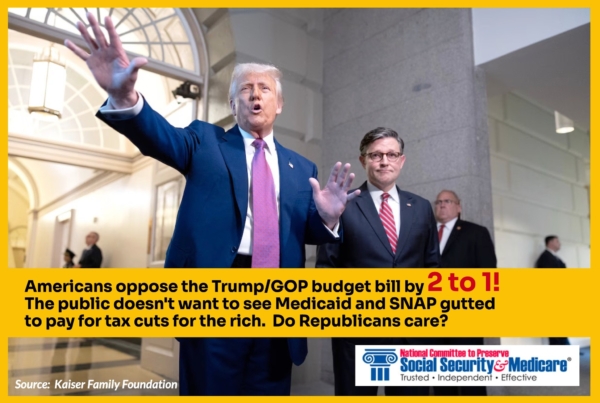

Senate Republicans are ploughing ahead with this devastating legislation despite the fact that new polling shows Americans oppose it by a margin of 2 to 1, among those who knew about the bill’s provisions.

If Congress shoves this bill forward into law, states will become quickly impoverished as the health care system begins to collapse. Hospitals will not be able to provide care to millions of newly uninsured people who come to emergency rooms with no source of coverage. Nursing homes will not be able to field sufficient staff to provide decent care to older adults. Seniors and people with disabilities will be unable to get care in the place of their choosing.

Republicans are using fake arguments that Medicaid and SNAP are somehow wasteful and inefficient. But health care providers – doctors, hospitals, nurses, and other skilled practitioners – know otherwise. Medicaid payments for their services are already modest, in some cases lower than the actual cost of care. For families, the SNAP payments they use to buy groceries are hardly luxurious, averaging $726 per month (in Virginia, for example) for a family with two kids. That’s $181 per week.

Low-income adults between the ages 50 to 64 will be devastated by the House and Senate bills. Many are family caregivers, who are helping out their adult children with child care or providing support for older loved ones.

For the first time ever, these caregivers aged 50-64, who are not yet eligible for Medicare, would be subject to rigid work requirements in order to continue receiving health care and food assistance. The results are predictable: many of them will go without health care coverage themselves, and will be at risk of hunger.

To say all of this is cruel is an understatement. It will also damage the broader economy, which would be saddled with an additional five TRILLION dollars of debt. This means that interest payments on the debt that all taxpayers must pay will soar.

The National Committee to Preserve Social Security and Medicare sees this as a clarion call to stop what has been called “the largest transfer of wealth from the poor to the rich in U.S. history.” We urge you to raise your voices — as frequently as you can. Write letters and emails. Make appointments with staffers working for your Representative and the Senators in your state. Show up at rallies and share your story, or your neighbor’s story. Go to town halls. Elect those who show they care about YOU, not just getting rich and plunging the nation into fiscal chaos.

**************************************************************************************************************************************

LISTEN TO ANNE MONTGOMERY ON OUR PODCAST, WHERE SHE TALKS ABOUT THE DISADVANTAGES OF MEDICARE ADVANTAGE here.

Trump/DOGE Actions Fuel Surge in Social Security Claims

More Americans are suddenly filing for Social Security earlier than planned — and it isn’t necessarily because they’re eager to retire. Interference in the Social Security system by Trump, Musk and DOGE has triggered a wave of public panic about the future of the program. For many, it’s created a sense of urgency to claim benefits before any other harmful changes are made. The recent feuding between Trump and Musk — entertaining, disturbing, and inevitable as it is — does not undo their craven efforts to undermine public faith in Social Security. Unfortunately, it’s working.

According to CBS News, early Social Security claims have surged by 17% this year compared to the same period in 2024. If this trend continues, annual filings are on track to reach 4 million. This spike comes amid the slashing of workforce and resources at the Social Security Administration under the guise of ‘efficiency’ — along with Trump and Musk’s lies about the program (like the one about long-dead people supposedly receiving benefits). Trump’s SSA has even declared living people dead, forcing them to go to a field office in person to be officially ‘resurrected.’

Americans are Worried

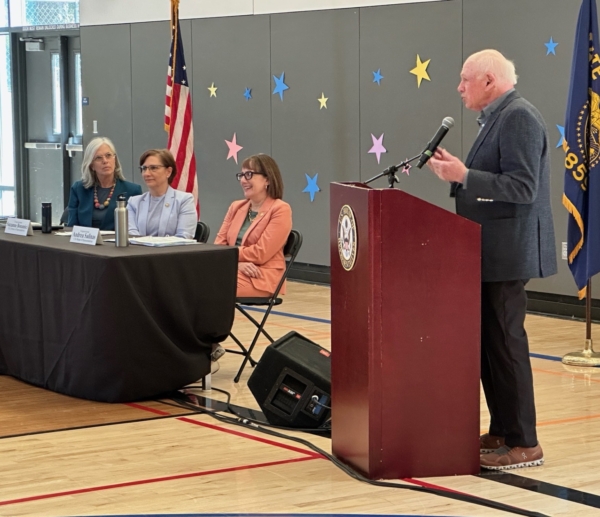

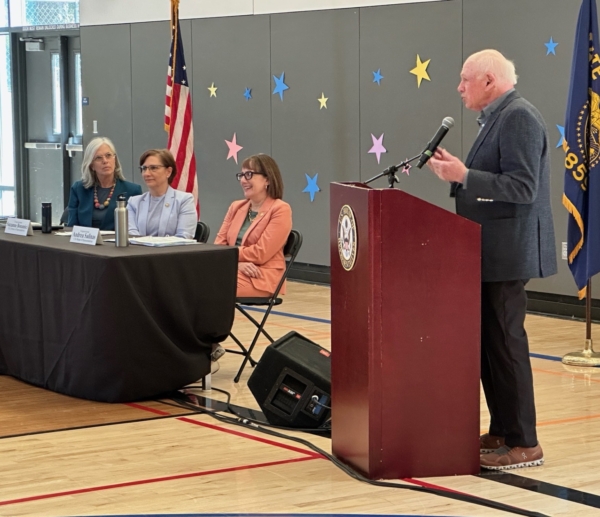

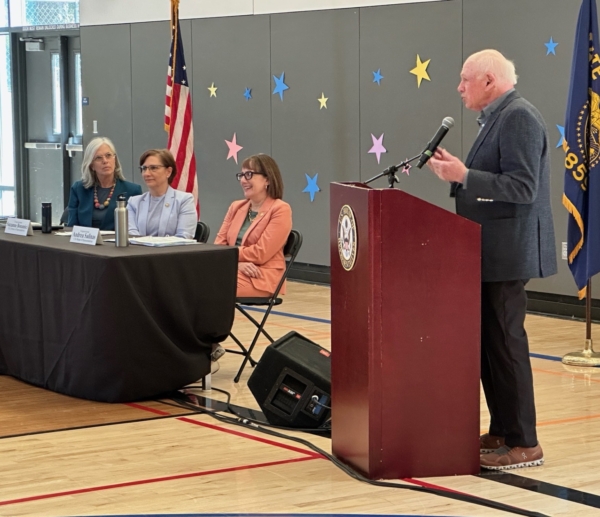

Many retirees are worried that these confusing, chaotic changes at SSA could impact their benefits. NCPSSM President and CEO Max Richtman has spoken at congressional town halls across the country, where constituents are voicing their concerns loudly and clearly. Richtman notes that attendees often ask if they should file for Social Security early to ensure they receive benefits before further disruptions affect the system.

Understandable as those concerns are, Richtman cautions against filing out of fear. At a recent town hall he explained, “It’s reasonable to be worried, but claiming benefits early may hurt you in the long run. We normally encourage workers to wait till full retirement age or beyond, because the longer you wait (up to age 70), the higher your lifetime benefit will be.”

Conversely, workers who claim before full retirement age take a 7% hit in lifetime benefits for every year they file early. “Those who can wait to claim benefits often end up in a much better financial position over the long term,” Richtman says.

Customer Service at SSA is Suffering

Trump, Musk, and DOGE-instigated cutbacks at the Social Security Administration have disrupted customer service, fueling public concern about their benefits. Long waits, busy signals, and ongoing issues with new AI-powered customer service systems have further complicated operations. CNET called SSA’s customer service bots “maddeningly bad” – answering questions in non-sequiturs and refusing to connect callers to live agents. (See the AI bot talking in circles to an MSNBC anchor here.) Meanwhile, SSA’s website has crashed multiple times since DOGE’s tech bros invaded the agency.

Making matters even worse, Ill-advised policies (mandated by the Trump administration) have put up unnecessary roadblocks for customers simply trying to access their Social Security accounts or make changes to their information. Supposed ‘anti-fraud’ measures on the 1-800 phone lines are causing more claimants to travel to understaffed Social Security field offices for help.

The Center on Budget and Policy Priorities reports that SSA’s restrictive, new policies will require claimants to make nearly 2 million additional trips to understaffed Social Security field offices every year. Imposing this burden on seniors and people with disabilities is further proof of the administration’s indifference to the people who rely on this program as a financial lifeline.

Public Pushback

Americans are alarmed by these changes and are making their voices heard. Protests under the banner “Hands Off Social Security” have gained traction nationwide. Congressional town halls around the country are drawing standing-room-only crowds. Max Richtman is encouraged by these grassroots efforts, comparing them to the successful public campaign that halted George W. Bush’s plans to privatize Social Security in 2005. “We can stop bad things from happening if people continue to make their voices heard.”

NCPSSM CEO Max Richtman speaks at Social Security town hall in Oregon (April, 2025)

Town halls across the country are drawing packed audiences worried about Social Security

As evidence, Richtman points out that SSA has walked back some of its more egregious, new policies in the face of public blowback. Earlier this spring, the agency announced that claimants could no longer verify their identities via the 1-800 phone line because of ‘fraud,’ even though actual telephone fraud in the program is about .001% of total benefits paid. When the advocacy community and the grassroots movement pushed back in a very public way, the SSA loosened the new policy so that not every senior would have to travel to a crowded field office or go online to verify ID.

Social Security has been a lifeline for seniors for nearly 90 years. The Trump/Musk/DOGE changes to the system are dangerous and unnecessary. (Musk even called Social Security a Ponzi scheme.) “This program works and has stood the test of time,” Richtman says. “We must ensure it continues to do so for decades to come” by maintaining public pressure on President Trump and his acolytes at the Social Security Administration.

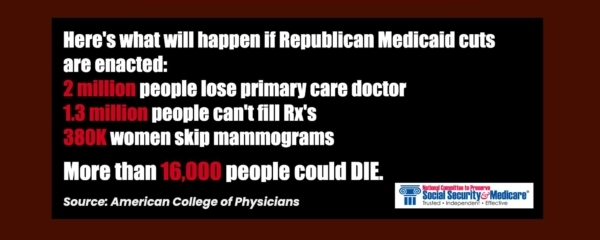

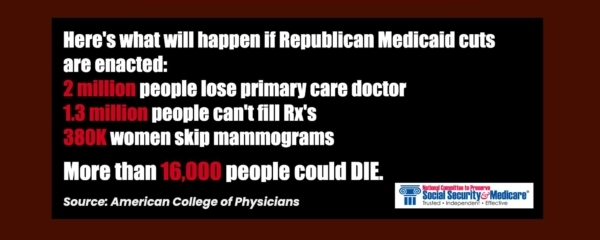

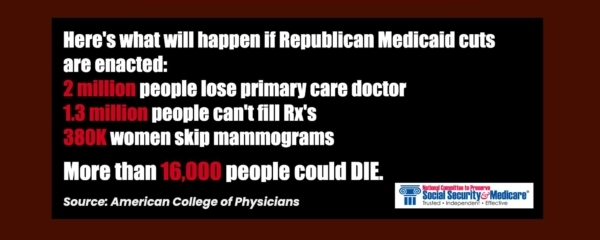

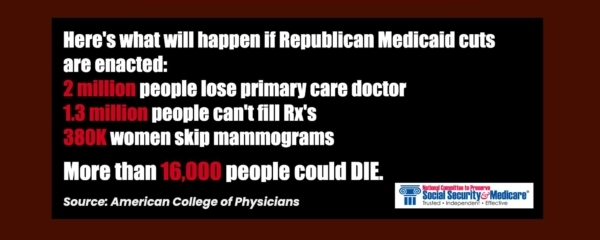

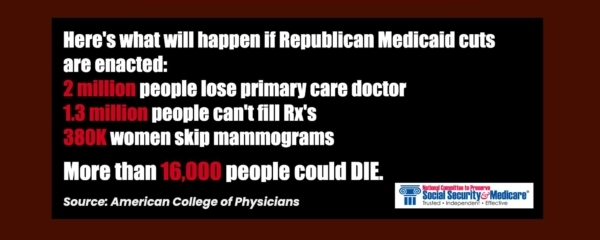

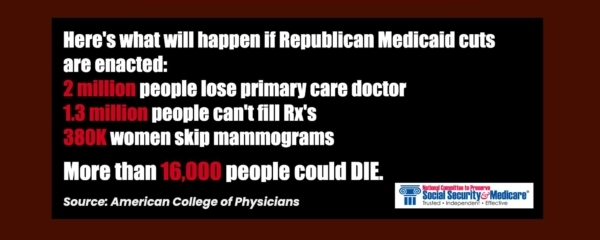

The Devastating Consequences of GOP Medicaid Cuts

House Republicans have taken another major step toward gutting the Medicaid program to pay for tax cuts largely benefitting their wealthy donors. On May 14, the GOP-controlled House Committee on Energy and Commerce approved budget legislation that slashes Medicaid funding by a jaw-dropping $717 billion over the next decade.

The Congressional Budget Office (CBO) estimates that the Republican budget could strip health coverage from at least 13.7 million people. “Republicans are cutting them adrift, with no place else to turn for medical care except perhaps the emergency room,” says NCPSSM President Max Richtman, who labeled it “the most massive cut in Medicaid’s 60-year history.”

Richtman emphasizes that, “with coverage ripped from millions of Americans, the health care system itself could collapse. Republicans may claim that these cuts are aimed at ‘waste, fraud, and abuse,’ but there isn’t anywhere near $717 billion worth of it in today’s Medicaid system.

The Center for American Progress called it “…the largest transfer of wealth from the poor to the rich in U.S. history.”

States Cannot Pick Up the Slack

States don’t have the resources to close the gaps in Medicaid funding. With federal payments slashed, they will face impossible choices. Forecasts provide little reassurance. Nearly 40% of economists polled by the National Association of Business Economics believe there’s a greater than 50% chance of a recession in the next year. If that happens, state tax revenues will shrink just as Medicaid needs spike. Even if the economy holds up, states will likely be forced to cut eligibility and benefits to cope with these federal cuts.

Cuts to Medicaid Will Undermine the Health Care Provider Infrastructure

Medicaid isn’t just a healthcare safety net. It’s a key driver of the economy, accounting for 18% of national healthcare spending. Reducing this massive investment impacts everyone, not just Medicaid beneficiaries. Republicans have proposed no alternate programs have to fill these gaps.

A joint study from the Urban Institute and the Robert Wood Johnson Foundation revealed that if Republicans defund Medicaid expansion under the Affordable Care Act, hospitals alone would lose $32 billion in revenue while absorbing $6.3 billion in unpaid care costs.

Prescription drug spending would drop by $20.9 billion, other health services (like home care) by $20.7 billion, and physician office revenue by $6.4 billion. These aren’t abstract numbers; they represent a threat to providers and patients alike.

Cutting Medicaid Could Mean the End of Optional Home and Community-Based Services

“The GOP cuts,” says Richtman, “would hit seniors especially hard,” as Medicaid pays for 60% of long-term care services and supports. Worse yet, a population deprived of basic health care will ultimately be sicker and cost taxpayers more in the long run.”

Approximately 700,000 Americans are currently on waiting lists for Medicaid Home and Community-Based Services (HCBS). These services allow seniors to maintain their independence, stay in their homes, and receive essential supports such as transportation and caregiver respite. Medicaid HCBS helps older adults avoid institutional settings like nursing homes.

The current 4.5 million HCBS recipients would see their coverage evaporate under the proposed Republican cuts. For many older Americans, their only option would be nursing home care, which is often more expensive and less desirable. As Richtman says, “Older Americans have made it clear they want to age in their homes with dignity.”

Trump & House Speaker Mike Johnson. Americans can blame these two for “the largest transfer of wealth from the poor to the rich in U.S. history.”

Requiring Mature Americans to Work for Medicaid Eligibility

The legislation proposes raising work requirements for Medicaid eligibility to include people up to age 65. This change is wildly unrealistic given the barriers older Americans face in the workforce. AARP data shows that nearly two-thirds of workers aged 55-64 believe their age prevents them from finding jobs. Employers are less likely to hire older workers. Economic downturns make these issues worse, as older employees are often the first to be laid off.

Work requirements already proved disastrous in New Hampshire and Arkansas, where implementation led to significant drops in Medicaid enrollment. A Kaiser Family Foundation analysis projected that work requirements could cause 5 million Americans to lose coverage.

“These cuts are not ‘pennywise,’ but they’re definitely ‘pound foolish,’” says Richtman. “This proposal is about barriers, not solutions… It punishes older workers for being unemployed in a system rigged against them.”

The Bottom Line

The devastating effects of this bill can’t be understated. Slashing Medicaid’s budget would lead to massive job losses in healthcare, worsen chronic illnesses, and force millions into poverty or homelessness. This isn’t just about money; it’s about lives. Or, as Richtman puts it, “There are two deficits in GOP-controlled Washington today… the budget deficit and an apparent deficit of empathy on the part of many Republicans.”

Associated Press Flubs Social Security Trustees Story

We blogged earlier this week about the inaccuracy of media reports about Social Security’s financial future. Some mainstream media journalists seemed to rely on old tropes when covering the recent Social Security trustees report. A prime example: a news story from the Associated Press (AP) with the alarmist headline, Medicare and Social Security go-broke dates pushed up.

We asked our director of government relations and policy, Dan Adcock, to correct some of the inaccuracies in the AP piece…

Dan Adcock: Let’s start with the headline. It’s completely misleading. Neither program is “going broke.” In the case of Social Security, the combined trust fund is projected to become depleted in 2034 if Congress takes no action, at which time the system still could pay 81% of benefits. Social Security itself is not going broke or bankrupt. The only way that could happen is if we had 100% unemployment and no one was paying into the program.

AP: Social Security’s trust funds — which cover old age and disability recipients — will be unable to pay full benefits beginning in 2034, instead of last year’s estimate of 2035.

Adcock: The reporter omits that that Social Security also pays benefits to spouses and survivors (upon the death of a family breadwinner), including millions of children. Social Security is a retirement program for sure — but it is also so much more than that.

AP: The trustees say the latest findings show the urgency of needed changes to the programs, but… lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.

Adcock: This is a media trope that insists no one in Washington is thinking about Social Security’s future — or willing to take action. In fact, both parties have proposed solutions to ‘fix’ Social Security. The problem is that the Republicans focus exclusively on cutting benefits. Democrats have put forward proposals to bring more revenue into the program by demanding that the wealthy contribute their fair share. Opinion polling suggests that the public favors the approach of raising revenue rather than cutting benefits, regardless of party affiliation.

AP: President Donald Trump and other Republicans have vowed not to make any cuts to Medicare or Social Security, even as they seek to shrink the federal government’s expenditures.

Adcock: Those vows to protect Social Security have turned out to be quite hollow. The House Republican Study Committee has proposed cuts to Social Security (including raising the retirement age) in its budget blueprints. House and Senate Republicans have favored a fiscal commission that could fast-track cuts to the program through Congress. But more immediately, Trump unleashed Elon Musk & DOGE to wreak havoc on the Social Security Administration. The result has been severe cuts in staffing, mounting difficulty for customers accessing their benefits, multiple website crashes, and people being wrongly declared dead and having their benefits cut off. While these are not benefit cuts per se, they represent unprecedented interference in the delivery of Social Security — and break the President’s promise “not to touch” it.

AP: The report states that the Social Security Social Security Fairness Act (SSFA), enacted in January, which repealed the Windfall Elimination and Government Pension Offset provisions of the Social Security Act and increased Social Security benefit levels for some workers, had an impact on the depletion date of SSA’s trust funds.

Dan Adcock: The beneficiaries of the SSFA were not just “some workers.” They’re public sector employees like teachers, firefighters, and police officers who were denied full Social Security benefits until the Social Security Fairness Act was passed last year. The impact on the depletion date of the trust funds was only six months.

AP: Congressional Budget Office reporting has stated that the biggest drivers of debt rising in relation to GDP are increasing interest costs and spending for Medicare and Social Security. An aging population drives those numbers.

Dan Adcock: According to the nonpartisan Center for Budget and Policy Priorities, the biggest driver of the debt is TAX EXPENDITURES, including Trump’s huge tax cuts for the wealthy and big corporations. Social Security and Medicare Part A are completely self-funded by workers’ payroll contributions and DO NOT CONTRIBUTE to the debt. As Ronald Reagan said, “Social Security has nothing to do with the deficit.”

Many of the inaccuracies in the AP story reinforce, wittingly or not, the conservative narrative that Social Security is going broke and must be cut in order to survive. That can undermine public support for the program and pave the way for benefit reductions and privatization. We urge the mainstream media not to default to this narrative and at the least balance its coverage, which would acknowledge that some of our leaders in Washington have positive ideas for strengthening Social Security without cutting benefits — with the public squarely behind them.

Visit our website to view some common Social Security Myths!

Some of the Media Bungle Social Security Trustees Report

It’d be swell if more of the mainstream media would accurately report the financial status of Social Security. Unfortunately, much of the coverage is influenced by conservative propaganda rather than actual facts. Predictably, some of the reporting on the recently released Social Security trustees report is less journalistic than alarmist and simplistic.

As Los Angeles Times columnist Michael Hiltzik observes, “The annual report of the trustees provides yearly opportunities for misunderstandings by politicians, the media, and the general public about the health of (Social Security). This year is no exception,”

A quick review of the headlines following the release of the 2025 trustees report bears this out:

Social Security is set to dry up even sooner than expected – Forbes

Social Security Is Running Out of Money – Newsweek

Social Security go-broke date pushed up – Associated Press

Social Security Could Be Bankrupt By 2033 – iHeart Radio

For the record: Social Security is not drying up, running out of money, going broke, or facing bankruptcy. What the trustees reported is that, absent any action by Congress, the reserves in Social Security’s combined trust fund will become depleted by 2034 — a year earlier than was projected in the previous report. At that point, the program still could pay 81% of benefits. No one wants to see seniors suffer a 19% benefit cut, but that outcome is far from inevitable.

Let’s be clear: the only way that Social Security itself could go ‘bankrupt’ is if we had 100% unemployment and no one was paying into the program. Barring that unlikely event, Social Security still will have plenty of money. (There currently is a $2.7 trillion surplus in the trust fund.)

The trust fund’s projected depletion date has vacillated between 2033 and 2035 for several years now. The date moving up one year in the latest report is no cause for panic; but you’d never know that from the coverage.

Not all of the news media is bungling the story. Some of the reporting actually is fair and responsible. But the inaccurate coverage feeds directly into the conservative narrative that Social Security is on a path to oblivion — and that the only way to ‘save’ it is by cutting benefits or privatizing the program.

“We have a generational opportunity and a moral obligation to address the solvency and unsustainability of these programs,” insisted Rep. Jody Arrington (R-TX), Chair of the House Budget Committee. (Note: neither the trustees nor the program’s chief actuary has said that Social Security is “unsustainable.”)

The libertarian Cato Institute’s Romina Boccia called the 2025 report “bleak,” warning that “The program is barreling toward insolvency — and fast.” (Note: the trust fund will become insolvent if no action is taken to prevent it, but the program itself will remain solvent. The trust fund and the Social Security program are not the same thing.)

The second bogus claim in the media narrative is that ‘no one in Washington is taking the projected shortfall seriously or doing anything about it.’

“Lawmakers have repeatedly kicked Social Security and Medicare’s troubling math to the next generation.” – Associated Press, 6/18/25

In fact, both parties have proposed fixes for Social Security. Republicans have put forth plans to raise the retirement age (a huge benefit cut!), means test benefits (another cut), and implement a more miserly COLA formula (yes, an additional cut!) — on top of their ongoing calls to privatize the program. These proposals ask current or future seniors to bear the costs (and the risk, in the case of privatization) of ‘saving’ Social Security.

Democrats — including Rep. John Larson (D-CT), Senator Richard Blumenthal (D-CT), Senator Elizabeth Warren (D-MA), and Sen. Sheldon Whitehouse (D-RI) — have introduced legislation to bring more revenue into Social Security by asking the wealthy to contribute their fair share — with no benefit cuts. We fully embrace this approach.

There may be a lack of bipartisan consensus on the proper path, but to say that Congress is ‘kicking the can down the road’ is an oversimplification. These simple narratives are easier to fall back on for reporters facing deadlines, but they are grossly misleading — and can undermine public faith in Social Security. Of course, Congress should act, but there still is time before this becomes a full-blown crisis.

We’ll blog again later in the week with an analysis of a recent news story by the Associated Press, which (typically) mischaracterizes the implications of the trustees report. Stay tuned!

Hopes that Senate Would Mitigate Medicaid & SNAP Cuts Have Been Dashed

(Getty Images)

By Anne Montgomery, Senior Health Policy Expert

Seniors’ advocates who analyzed the reconciliation bill narrowly approved by the House of Representatives in May hoped that the U.S. Senate would temper unaffordable tax cuts for the wealthy — and avoid slashing Medicaid and SNAP. Those hopes have been dashed by Senate Republicans on the Finance and Agriculture Committees, who propose to end Medicaid and SNAP as we know them – as lifelines for millions of Americans across the country who need reliable access to basic health care and food to survive.

As Common Dreams so aptly put it in their news headline this week, “

“We’re watching in real time as Senate Republicans line up to gut healthcare for millions of Americans in order to pay for tax cuts for themselves, their wealthy donors, and big businesses.” – Common Dreams, 6/17/25

Although the Congressional Budget Office has yet to announce an estimate of the Senate bill’s funding reductions through 2034, most anticipate it will carve $1 trillion or so out of current federal funding for the two programs and use this as a partial offset for tax cuts that will benefit high-wealth individuals and businesses.

Senate Republicans are ploughing ahead with this devastating legislation despite the fact that new polling shows Americans oppose it by a margin of 2 to 1, among those who knew about the bill’s provisions.

If Congress shoves this bill forward into law, states will become quickly impoverished as the health care system begins to collapse. Hospitals will not be able to provide care to millions of newly uninsured people who come to emergency rooms with no source of coverage. Nursing homes will not be able to field sufficient staff to provide decent care to older adults. Seniors and people with disabilities will be unable to get care in the place of their choosing.

Republicans are using fake arguments that Medicaid and SNAP are somehow wasteful and inefficient. But health care providers – doctors, hospitals, nurses, and other skilled practitioners – know otherwise. Medicaid payments for their services are already modest, in some cases lower than the actual cost of care. For families, the SNAP payments they use to buy groceries are hardly luxurious, averaging $726 per month (in Virginia, for example) for a family with two kids. That’s $181 per week.

Low-income adults between the ages 50 to 64 will be devastated by the House and Senate bills. Many are family caregivers, who are helping out their adult children with child care or providing support for older loved ones.

For the first time ever, these caregivers aged 50-64, who are not yet eligible for Medicare, would be subject to rigid work requirements in order to continue receiving health care and food assistance. The results are predictable: many of them will go without health care coverage themselves, and will be at risk of hunger.

To say all of this is cruel is an understatement. It will also damage the broader economy, which would be saddled with an additional five TRILLION dollars of debt. This means that interest payments on the debt that all taxpayers must pay will soar.

The National Committee to Preserve Social Security and Medicare sees this as a clarion call to stop what has been called “the largest transfer of wealth from the poor to the rich in U.S. history.” We urge you to raise your voices — as frequently as you can. Write letters and emails. Make appointments with staffers working for your Representative and the Senators in your state. Show up at rallies and share your story, or your neighbor’s story. Go to town halls. Elect those who show they care about YOU, not just getting rich and plunging the nation into fiscal chaos.

**************************************************************************************************************************************

LISTEN TO ANNE MONTGOMERY ON OUR PODCAST, WHERE SHE TALKS ABOUT THE DISADVANTAGES OF MEDICARE ADVANTAGE here.

Trump/DOGE Actions Fuel Surge in Social Security Claims

More Americans are suddenly filing for Social Security earlier than planned — and it isn’t necessarily because they’re eager to retire. Interference in the Social Security system by Trump, Musk and DOGE has triggered a wave of public panic about the future of the program. For many, it’s created a sense of urgency to claim benefits before any other harmful changes are made. The recent feuding between Trump and Musk — entertaining, disturbing, and inevitable as it is — does not undo their craven efforts to undermine public faith in Social Security. Unfortunately, it’s working.

According to CBS News, early Social Security claims have surged by 17% this year compared to the same period in 2024. If this trend continues, annual filings are on track to reach 4 million. This spike comes amid the slashing of workforce and resources at the Social Security Administration under the guise of ‘efficiency’ — along with Trump and Musk’s lies about the program (like the one about long-dead people supposedly receiving benefits). Trump’s SSA has even declared living people dead, forcing them to go to a field office in person to be officially ‘resurrected.’

Americans are Worried

Many retirees are worried that these confusing, chaotic changes at SSA could impact their benefits. NCPSSM President and CEO Max Richtman has spoken at congressional town halls across the country, where constituents are voicing their concerns loudly and clearly. Richtman notes that attendees often ask if they should file for Social Security early to ensure they receive benefits before further disruptions affect the system.

Understandable as those concerns are, Richtman cautions against filing out of fear. At a recent town hall he explained, “It’s reasonable to be worried, but claiming benefits early may hurt you in the long run. We normally encourage workers to wait till full retirement age or beyond, because the longer you wait (up to age 70), the higher your lifetime benefit will be.”

Conversely, workers who claim before full retirement age take a 7% hit in lifetime benefits for every year they file early. “Those who can wait to claim benefits often end up in a much better financial position over the long term,” Richtman says.

Customer Service at SSA is Suffering

Trump, Musk, and DOGE-instigated cutbacks at the Social Security Administration have disrupted customer service, fueling public concern about their benefits. Long waits, busy signals, and ongoing issues with new AI-powered customer service systems have further complicated operations. CNET called SSA’s customer service bots “maddeningly bad” – answering questions in non-sequiturs and refusing to connect callers to live agents. (See the AI bot talking in circles to an MSNBC anchor here.) Meanwhile, SSA’s website has crashed multiple times since DOGE’s tech bros invaded the agency.

Making matters even worse, Ill-advised policies (mandated by the Trump administration) have put up unnecessary roadblocks for customers simply trying to access their Social Security accounts or make changes to their information. Supposed ‘anti-fraud’ measures on the 1-800 phone lines are causing more claimants to travel to understaffed Social Security field offices for help.

The Center on Budget and Policy Priorities reports that SSA’s restrictive, new policies will require claimants to make nearly 2 million additional trips to understaffed Social Security field offices every year. Imposing this burden on seniors and people with disabilities is further proof of the administration’s indifference to the people who rely on this program as a financial lifeline.

Public Pushback

Americans are alarmed by these changes and are making their voices heard. Protests under the banner “Hands Off Social Security” have gained traction nationwide. Congressional town halls around the country are drawing standing-room-only crowds. Max Richtman is encouraged by these grassroots efforts, comparing them to the successful public campaign that halted George W. Bush’s plans to privatize Social Security in 2005. “We can stop bad things from happening if people continue to make their voices heard.”

NCPSSM CEO Max Richtman speaks at Social Security town hall in Oregon (April, 2025)

Town halls across the country are drawing packed audiences worried about Social Security

As evidence, Richtman points out that SSA has walked back some of its more egregious, new policies in the face of public blowback. Earlier this spring, the agency announced that claimants could no longer verify their identities via the 1-800 phone line because of ‘fraud,’ even though actual telephone fraud in the program is about .001% of total benefits paid. When the advocacy community and the grassroots movement pushed back in a very public way, the SSA loosened the new policy so that not every senior would have to travel to a crowded field office or go online to verify ID.

Social Security has been a lifeline for seniors for nearly 90 years. The Trump/Musk/DOGE changes to the system are dangerous and unnecessary. (Musk even called Social Security a Ponzi scheme.) “This program works and has stood the test of time,” Richtman says. “We must ensure it continues to do so for decades to come” by maintaining public pressure on President Trump and his acolytes at the Social Security Administration.

The Devastating Consequences of GOP Medicaid Cuts

House Republicans have taken another major step toward gutting the Medicaid program to pay for tax cuts largely benefitting their wealthy donors. On May 14, the GOP-controlled House Committee on Energy and Commerce approved budget legislation that slashes Medicaid funding by a jaw-dropping $717 billion over the next decade.

The Congressional Budget Office (CBO) estimates that the Republican budget could strip health coverage from at least 13.7 million people. “Republicans are cutting them adrift, with no place else to turn for medical care except perhaps the emergency room,” says NCPSSM President Max Richtman, who labeled it “the most massive cut in Medicaid’s 60-year history.”

Richtman emphasizes that, “with coverage ripped from millions of Americans, the health care system itself could collapse. Republicans may claim that these cuts are aimed at ‘waste, fraud, and abuse,’ but there isn’t anywhere near $717 billion worth of it in today’s Medicaid system.

The Center for American Progress called it “…the largest transfer of wealth from the poor to the rich in U.S. history.”

States Cannot Pick Up the Slack

States don’t have the resources to close the gaps in Medicaid funding. With federal payments slashed, they will face impossible choices. Forecasts provide little reassurance. Nearly 40% of economists polled by the National Association of Business Economics believe there’s a greater than 50% chance of a recession in the next year. If that happens, state tax revenues will shrink just as Medicaid needs spike. Even if the economy holds up, states will likely be forced to cut eligibility and benefits to cope with these federal cuts.

Cuts to Medicaid Will Undermine the Health Care Provider Infrastructure

Medicaid isn’t just a healthcare safety net. It’s a key driver of the economy, accounting for 18% of national healthcare spending. Reducing this massive investment impacts everyone, not just Medicaid beneficiaries. Republicans have proposed no alternate programs have to fill these gaps.

A joint study from the Urban Institute and the Robert Wood Johnson Foundation revealed that if Republicans defund Medicaid expansion under the Affordable Care Act, hospitals alone would lose $32 billion in revenue while absorbing $6.3 billion in unpaid care costs.

Prescription drug spending would drop by $20.9 billion, other health services (like home care) by $20.7 billion, and physician office revenue by $6.4 billion. These aren’t abstract numbers; they represent a threat to providers and patients alike.

Cutting Medicaid Could Mean the End of Optional Home and Community-Based Services

“The GOP cuts,” says Richtman, “would hit seniors especially hard,” as Medicaid pays for 60% of long-term care services and supports. Worse yet, a population deprived of basic health care will ultimately be sicker and cost taxpayers more in the long run.”

Approximately 700,000 Americans are currently on waiting lists for Medicaid Home and Community-Based Services (HCBS). These services allow seniors to maintain their independence, stay in their homes, and receive essential supports such as transportation and caregiver respite. Medicaid HCBS helps older adults avoid institutional settings like nursing homes.

The current 4.5 million HCBS recipients would see their coverage evaporate under the proposed Republican cuts. For many older Americans, their only option would be nursing home care, which is often more expensive and less desirable. As Richtman says, “Older Americans have made it clear they want to age in their homes with dignity.”

Trump & House Speaker Mike Johnson. Americans can blame these two for “the largest transfer of wealth from the poor to the rich in U.S. history.”

Requiring Mature Americans to Work for Medicaid Eligibility

The legislation proposes raising work requirements for Medicaid eligibility to include people up to age 65. This change is wildly unrealistic given the barriers older Americans face in the workforce. AARP data shows that nearly two-thirds of workers aged 55-64 believe their age prevents them from finding jobs. Employers are less likely to hire older workers. Economic downturns make these issues worse, as older employees are often the first to be laid off.

Work requirements already proved disastrous in New Hampshire and Arkansas, where implementation led to significant drops in Medicaid enrollment. A Kaiser Family Foundation analysis projected that work requirements could cause 5 million Americans to lose coverage.

“These cuts are not ‘pennywise,’ but they’re definitely ‘pound foolish,’” says Richtman. “This proposal is about barriers, not solutions… It punishes older workers for being unemployed in a system rigged against them.”

The Bottom Line

The devastating effects of this bill can’t be understated. Slashing Medicaid’s budget would lead to massive job losses in healthcare, worsen chronic illnesses, and force millions into poverty or homelessness. This isn’t just about money; it’s about lives. Or, as Richtman puts it, “There are two deficits in GOP-controlled Washington today… the budget deficit and an apparent deficit of empathy on the part of many Republicans.”