NCPSSM At White House for Release of First Ten Drugs for Medicare Price Negotiation

NCPSSM President Max Richtman and Policy Director Dan Adcock were at the White House Tuesday as the Biden administration released the names of the first ten drugs to be subject to price negotiation between Medicare and Big Pharma. They are some of the most common and most expensive prescription medications that seniors take. These essential medications do everything from preventing blood clots and strokes to treating diabetes, and they will soon cost a lot less for the federal government and for patients.

“This is a sea change in the government’s ability to lower prescription drug prices for older Americans, who all too often are compelled to ration medications or forgo filling prescriptions because of soaring costs.” – Max Richtman, NCPSSM President & CEO, 8/29/23

The Inflation Reduction Act of 2022 empowered Medicare to begin negotiating prices for targeted prescription drugs, something advocates including NCPSSM have struggled to achieve for more than twenty years. Here is a list of the first ten drugs that will be subject to price negotiation with Medicare:

- Eliquis, for preventing strokes and blood clots

- Jardiance, for diabetes and heart failure

- Xarelto,for preventing strokes and blood clots

- Januvia, for diabetes

- Farxiga, for diabetes, heart failure and chronic kidney disease

- Entresto, for heart failure

- Enbrel, for arthritis and other autoimmune conditions

- Imbruvica, for blood cancers

- Stelara, for Crohn’s disease

- Fiasp andNovoLog insulin products for diabetes

Drugmakers made a whopping $493 billion in revenue from these ten drugs, which have accounted for more than $170 billion in gross Medicare spending, according to a report from the nonprofit, Protect Our Care.

President Biden hailed the release of the first ten medications for negotiation as a victory for everyday Americans, who have been subject to price gouging by the drug industry. “There is no reason why Americans should be forced to pay more than any developed nation for life-saving prescriptions just to pad Big Pharma’s pockets,” he said

According to the White House, the 9 million seniors who take the ten targeted drugs will see their costs decrease. These seniors currently pay up to $6,500 in out-of-pocket costs per year for these prescriptions. The nonpartisan Congressional Budget Office reports that this will save taxpayers $160 billion by reducing how much Medicare pays for drugs through negotiation and inflation rebates.

The seniors who have been victimized by price gouging and now will finally get some relief are front of mind for advocates, including Patients for Affordable Drugs Now. The group quotes a Medicare beneficiary in North Carolina who lives with a rare cancer and type 2 diabetes:

“To treat my diabetes, I take Januvia, which carries a monthly list price of $547. Drugmaker Merck has made a fortune from patients like me who are forced to pay whatever price the company dictates. A fairer price for Januvia will mean a world of difference.” – Steven Hadfield, Matthews, NC

The list of drugs subject to negotiation will expand next year to 15, followed by another 15 medications the year after. Negotiated prices for the first ten drugs do not go into effect until 2026.

NCPSSM’s senior health policy expert, Anne Montgomery, says the Biden administration (HHS & CMS) did a “savvy job” of selecting the first set of drugs for negotiation because they are “ten of the highest cost and most commonly used medications” among seniors. “That’s very smart,” she says, “as a way of building a constituency among beneficiaries for the movement to lower drug prices.”

Several drugmakers are suing the Biden administration, claiming that Medicare drug price negotiation is unconstitutional — despite the fact that the V.A. has been successfully negotiating drug prices with Big Pharma for years. Administration officials say that they believe the drug companies have a weak case and will not prevail.

Advocates like NCPSSM are not resting with the implementation of the Inflation Reduction Act’s drug provisions. “The next step is to enlarge the number and type of medications subject to negotiation, to deliver maximum relief to seniors on fixed incomes,” says Richtman. “No one should have to choose between groceries, rent, or essential medications — especially our nation’s senior citizens.”

FDR’S Grandson Says This Is a ‘High Stakes Time’ For Social Security

By James Roosevelt, Jr.

Social Security — which turned 88 years old in August — is one of my grandfather’s greatest legacies. It’s no exaggeration to say that this is a high stakes time for his landmark program. Powerful opponents of Social Security are calling for privatization, cutting the annual COLA, raising the retirement age, and even “sunsetting” the program. That’s not something I could bear to see. Not at a time when so many Americans are counting on their earned benefits to make ends meet.

Yet, every time there is talk about reining in budget deficits, many politicians turn to Social Security. It’s always been an easy target for so-called “deficit hawks” in Washington who would much rather chip away at seniors’ earned benefits than reverse decades of unfair (and unpaid for!) tax policies that benefit wealthy Americans and huge corporations.

Fortunately, my grandfather helped structure the Social Security program to make it hard to cut or privatize Social Security. Because Social Security has its own dedicated income stream from the payroll tax, we don’t just trade it off against education or defense or other important priorities.

My grandfather famously said, “With those taxes in there, no damn politician can ever scrap my Social Security program.”

President Franklin D. Roosevelt signs Social Security into law (August 14, 1935)

But today hardliners in Congress are closer than ever to defunding this critical program that provides 66 million Americans and their families with basic financial security upon retirement or disability. The program has never missed a payment — even during war, recessions and a pandemic. And yet, I’m hearing more politicians than ever talking about the need to change, cut, scale back and even end Social Security “for the good of the economy.”

*Senator Rick Scott (R-FL) proposed a plan where Social Security would have to be reauthorized by Congress every five years.

*Senator Ron Johnson (R-WI) said that Social Security spending should be considered “discretionary spending” and subject to routine budget negotiations every year, even though the program is self-funded by workers.

*Other politicians, including potential 2024 presidential candidates, are calling for raising the retirement age to 70. While that may work out just fine for a lawyer or Wall Street broker, raising the retirement age would have the harshest impact on people working in physically demanding jobs.

*Former Vice President Mike Pence, a 2024 presidential candidate, is now calling for major reforms to Social Security, including privatization. And he recently said, “I think we can replace the New Deal programs with a better deal.”

As a reminder, in 2005, the National Committee helped lead intense grassroots activism against former President George W. Bush’s serious attempt to privatize Social Security. (Congressman Mike Pence was involved in that effort). If President Bush had succeeded, his plan would have handed over control of Social Security benefits to Wall Street brokers and subjected the earned benefits of millions of older Americans to the volatility of the Stock Market.

James Roosevelt, Jr., grandson of FDR & vice-chair of NCPSSM Advisory Board

Lawmakers pushing these dangerous and callous proposals are missing an important point: We can’t just change or cut Social Security without risking the livelihoods of millions of retirees. The real power to protect Social Security lies with us. When we stand shoulder-to-shoulder with millions of senior voters — Congress not only listens, it often reacts in our favor.

James Roosevelt, Jr. is the grandson of President Franklin D. Roosevelt, and son of NCPSSM’s founder, Congressman James Roosevelt, Sr. He is vice-chair of NCPSSM’s Advisory Board and served as CEO of Tufts Health Plan. Previously, he served as Associate Commissioner of the U.S. Social Security Administration.

Marking the First Anniversary of the Inflation Reduction Act

President Biden signed the historic Inflation Reduction Act (IRA) into law one year ago today. It was the first time Congress enacted major legislation to take on Big Pharma and lower the price of prescription drugs for seniors. For us, the IRA was the culmination of a 20 year struggle to reform Medicare Part D — the prescription drug benefit — so that seniors actually could afford crucial medications. We had seen too many statistics over the years about older Americans cutting pills in half or not filling prescriptions because of high costs — or having to choose between essentials like food and medicine.

“We took on Big Pharma, and we won,” proclaimed President Biden after the IRA was enacted. Though the IRA cannot solve the entire drug pricing problem, it will provide relief to millions of American seniors. Here are its major provisions:

*Empowers Medicare to negotiate prices with drug-makers

*Caps Medicare Part D patients’ annual out-of-pocket payments at $2,000

*Caps the cost of insulin for Part D patients at $35/month

*Penalizes drug-makers for raising prices above the rate of inflation

The IRA’s most historic aspect is the drug price negotiation provision – more modest than originally envisioned, but still extremely significant. At first, only ten drugs will be eligible for negotiations, and new brand-name drugs are excluded. Negotiated prices will not take effect until 2026. But Big Pharma opposed these relatively modest measures, and is currently trying to block them in court.

Undaunted, the Biden administration has been spending the past year fleshing out rules for implementing the Inflation Reduction Act’s drug pricing provisions.

“Starting this year, Medicare will begin to negotiate directly with drug manufacturers to bring down the price of covered high-cost prescription drugs. CMS will announce the first 10 drugs selected for negotiation by September 1, 2023. The first round of negotiations will occur during 2023 and 2024. The prices that are negotiated will be effective starting in 2026.” – Center for Medicare & Medicaid Services, 6/30/23

In March, CMS released initial guidance on the drug price negotiation process, outlining “how the agency will select drugs for negotiation this year and how those negotiations will be conducted.” At the end of June, CMS released a revised framework, “informed by public input,” for how the government will negotiate with drugmakers on a maximum fair price for selected drugs. This, the agency says, will ensure “that Medicare beneficiaries have access to innovative, life-saving treatments” at a lower cost for patients and for the Medicare program itself.

On July 1st, the Inflation Reduction Act’s cap on insulin costs for Medicare patients went into effect. Beneficiaries will pay no more than $35/month for insulin. Insulin prices had soared nearly 40% from 2014-2018, and patients’ out-of-pocket costs were running from $300 to $1,000 per month. Over the years, we heard heartbreaking stories about diabetics who rationed insulin because of the high cost and ended up gravely ill or dead. In addition to lowering prices, the Inflation Reduction Act can truly be a lifesaver.

The IRA’s cap on out-of-pocket drug costs for Medicare Part D beneficiaries is especially crucial for patients with serious chronic conditions like cancer or multiple sclerosis. As Kaiser Family Foundation reported, out-of-pocket costs for medications to treat those conditions can be staggering – especially for seniors on fixed incomes:

“For example, in 2020, among Part D enrollees without low-income subsidies, average annual out-of-pocket spending for the cancer drug Revlimid was $6,200 $5,700 for the cancer drug Imbruvica; and $4,100 for the MS drug Avonex.” – Kaiser Family Foundation, 1/24/23

Seniors without subsidies will have to continue paying those higher prices until 2025, when the $2,000 out-of-pocket cap takes effect.

The Inflation Reduction Act was an ambitious, wide-ranging piece of legislation that included not only prescription drug pricing reform, but climate change mitigation and measures to make the U.S. more economically competitive in the 21st century.

Not all Americans, let alone, seniors are aware of the historic drug pricing reforms in the Inflation Reduction Act. The Biden administration has been working to enhance the public’s understanding of the law’s positive impact on their pocketbooks and overall health. CMS posts updates on its activities here. And HHS’ Office of the Assistant Secretary for Planning & Evaluation (ASPE) has a great informational resource on prescription drug price reform, as well.

Meanwhile, the National Committee to Preserve Social Security and Medicare, which tirelessly advocated for the prescription drug reforms in the IRA, will continue to keep the pressure on Congress to lower prices for seniors and all Americans.

“We want the number and types of drugs subject to negotiation to be broadened. Eventually we would like to see all drugs subject to Medicare price negotiation,” said NCPSSM legislative director, Dan Adcock. “The door has been opened. Now it’s our job to keep pushing it ever wider so that older Americans can afford the drugs they need to save their lives — and have a better quality of life.”

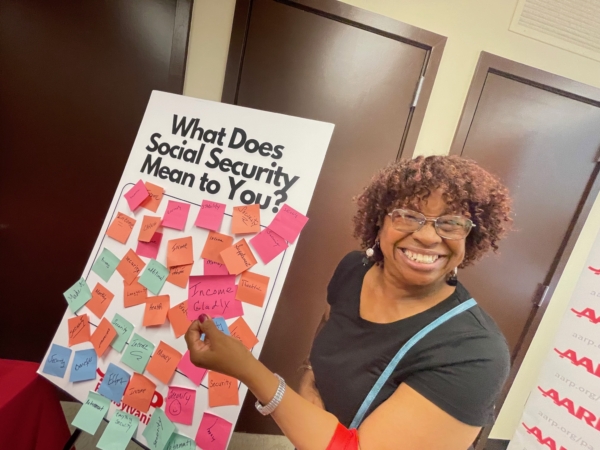

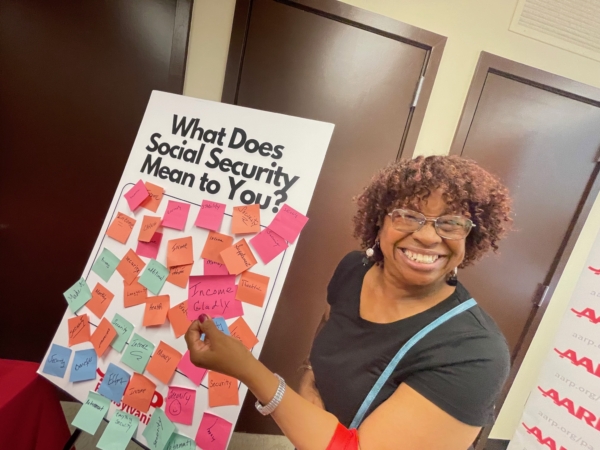

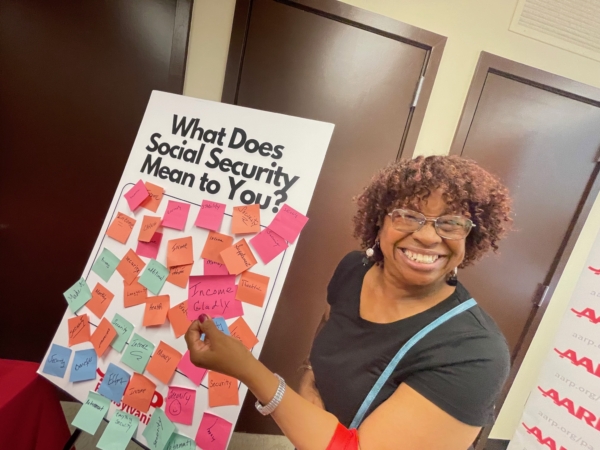

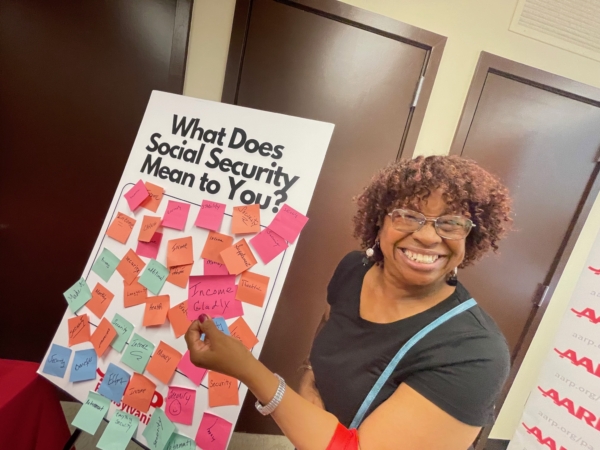

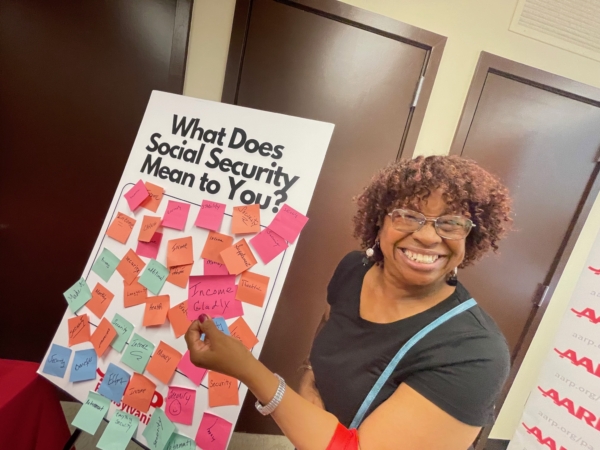

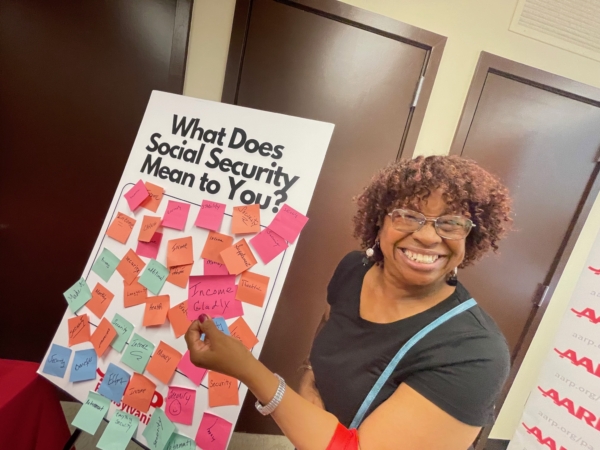

Philadelphians Flock to NCPSSM/AARP Town Hall on Social Security

More than 150 Philadelphians turned out at Center in the Park for a town hall emphasizing Social Security’s importance to the Black community, co-presented by NCPSSM and AARP Pennsylvania. Attendees learned about their earned benefits and played Social Security-themed games — including Social Security Plinko and “What does Social Security Mean to You?”

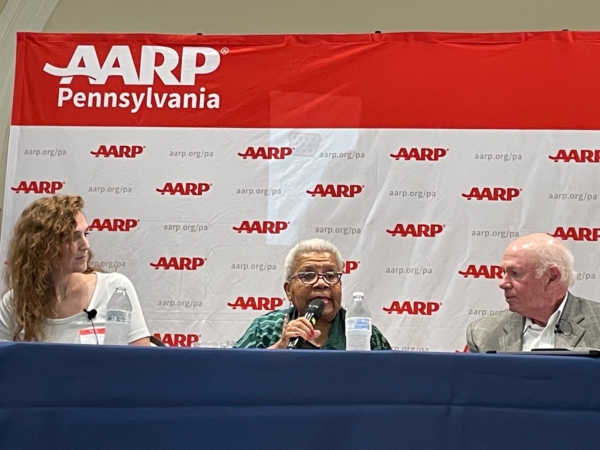

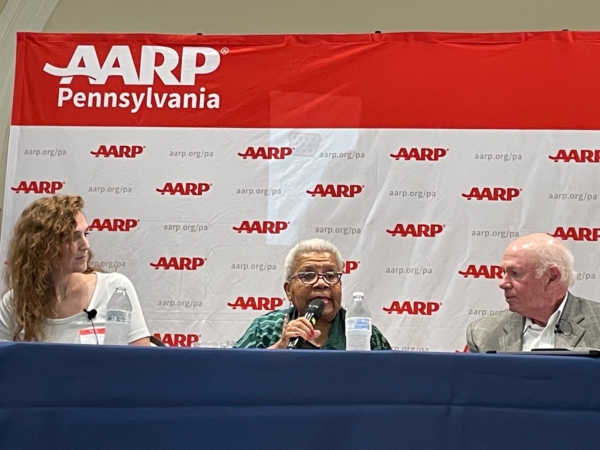

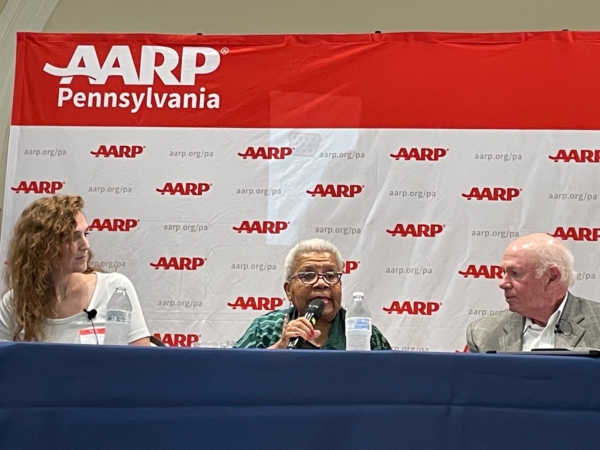

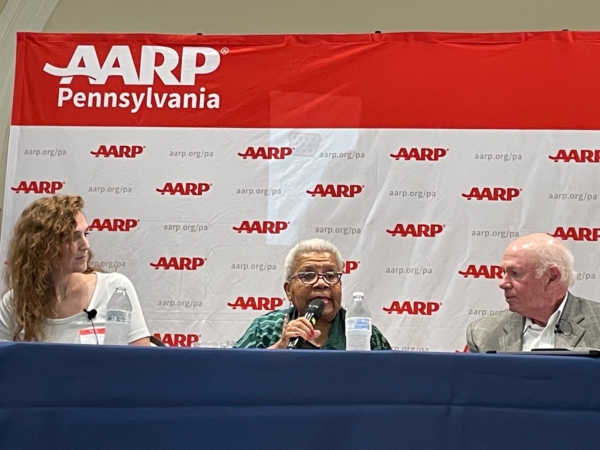

The event featured a public forum with panelists Max Richtman (NCPSSM President), Carolyn Colvin (former Social Security Commissioner), and representatives from Community Legal Services of Philadelphia. The town hall portion was moderated by Philadelphia radio personality Frankie Darcell of WDAS-FM.

Attendees included near-seniors (aged 55-65) and workers who have already retired. “I learned many things, from beginning to end,” said Lue D., a retired pharmaceutical manager, who says she appreciated the forum’s debunking of Social Security myths and misinformation. “It reinforced to me that we need the truth about Social Security in order to talk about it more intelligently out in the community.”

Attendees watch the panel discussion on the importance of Social Security

During the public forum, National Committee president and CEO Max Richtman corrected several harmful Social Security myths:

*Social Security is not going bankrupt;

*The trust fund is not full of “worthless IOUs”

*Politicians are not ‘stealing’ from Social Security;

*Undocumented immigrants are not draining the system’s finances.

Without naming names, Richtman said that myths and misinformation “are designed to undermine the support and faith that Americans have in Social Security” by those who wish to cut and privatize the program. Fortunately, he said, “the polling we’ve seen shows 80-90% support for Social Security across the board.”

L-R, Panelists Allison Schilling, Sarah Martinez, Carolyn Colvin, and Max Richtman

The benefit to Black families was a major theme of the forum’s panel discussion. Ava, a retiree in the audience, said that she “hadn’t understood how Social Security helps families” until she attended the event.

Former Social Security Commissioner Colvin (who ran the program under President Obama) explained that, on average, Black workers become disabled earlier and live fewer years than others. Social Security, she said, provides families with disability, spousal, and survivor’s benefits. “The Social Security benefits available to families is extremely important,” Colvin told the audience. “Social Security guarantees benefits for various stages of family experience.”

Former Social Security Commissioner Carolyn Colvin speaks at the town hall

Colvin pointed out that Black retirees rely on Social Security more than their white counterparts, due to job and wage discrimination and other socioeconomic factors. Without Social Security, 50.5% of Black retirees would be living in poverty.

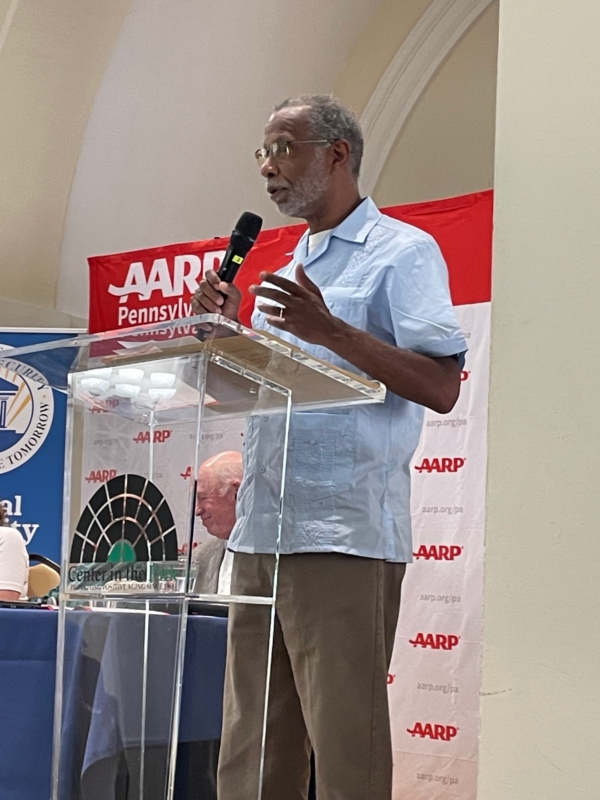

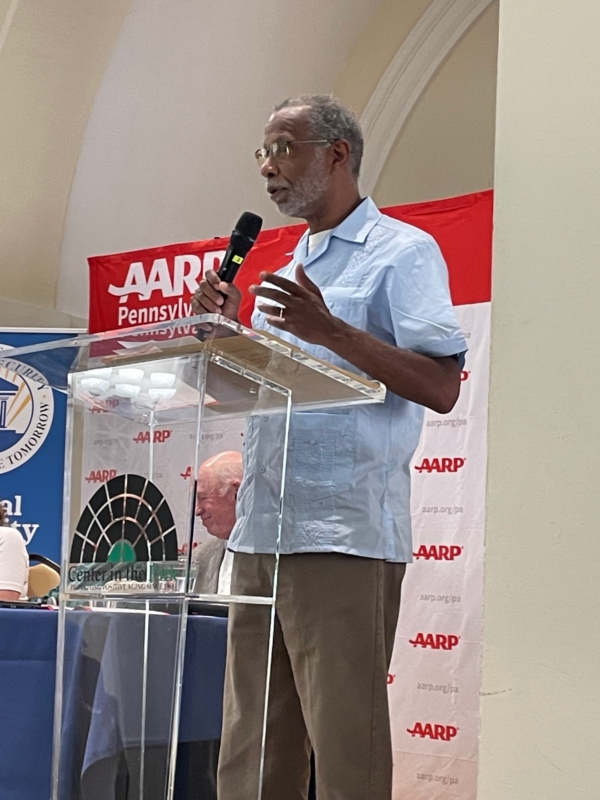

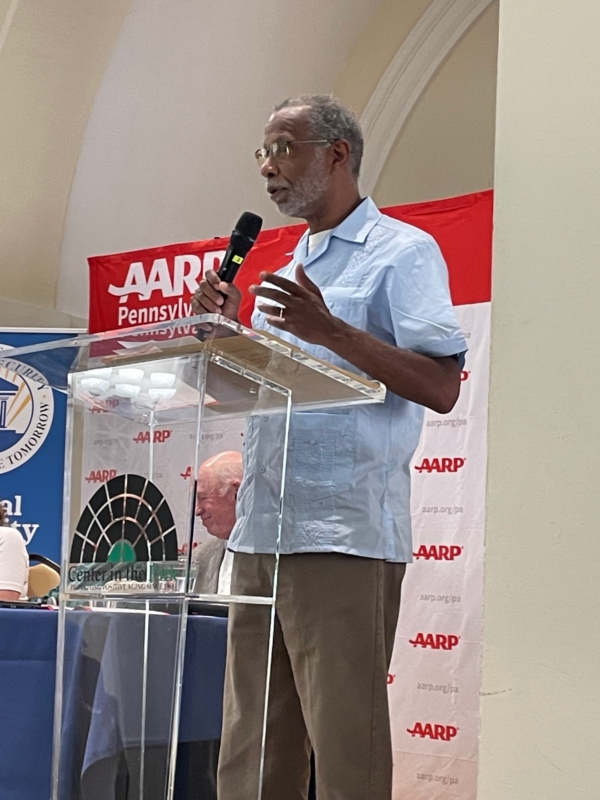

Pennsylvania State Senator Art Haywood kicked off the town hall with a passionate statement of support for Social Security. Haywood, who was raised by a single mom and began working at age 9 as a newspaper delivery boy, said that “Social Security was designed to preserve the dignity” of retirees. “That’s why it’s so important to have this forum… to talk in detail about the fact that Social Security is still there for us.”

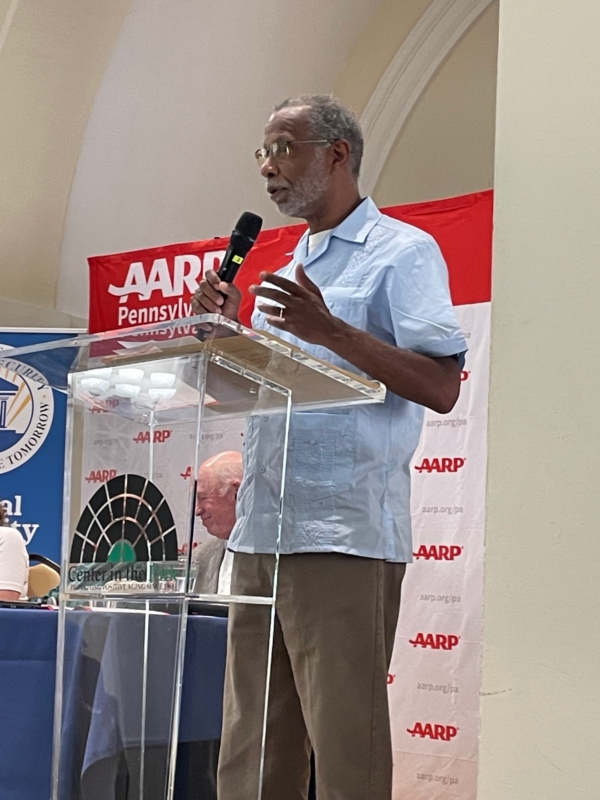

PA State Senator Art Haywood: Social Security allows workers to retire “with dignity”

Sarah Martinez and Allison Schilling of Community Legal Services of Philadelphia covered the nitty-gritty details of Social Security and the difference between Social Security retirement benefits, Social Security Disability Insurance (SSDI), and Supplemental Security Income (SSI) — including the nuances on how to qualify and apply for each program.

Martinez acknowledged that qualifying for SSDI can be difficult, especially given customer service issues at the fiscally struggling Social Security Administration (SSA). “If you’re denied there’s likely a long appeals process. I’ve seen some of these cases go for years, with multiple appeals. The quickest I’ve seen an SSDI appeal resolved in the claimant’s favor is around one year,” she said. (More than 10,000 claimants have died awaiting a hearing on their SSDI appeals.)

A few hours before the town hall began, President Biden named former Maryland Governor Martin O’Malley as permanent commissioner for SSA. In a press statement, Richtman praised O’Malley for his support of Social Security as a presidential candidate in 2016. “As a confirmed commissioner, Martin O’Malley will be able to advocate effectively for SSA, which has been chronically underfunded and has struggled to provide adequate customer service,” said Richtman.

Representatives from the regional SSA office and the staffs of U.S. Senator Bob Casey (D-PA) and Rep. Dwight Evans (D-PA) were on hand to answer attendees’ personal Social Security questions. Audience member Pat Pinkett, who is still working but nearing Social Security retirement age, said she attended the town hall because many people “have no clue about how Social Security really works. I wanted to come to the source and get the facts!”

Philadelphians packed Center in the Park for the NCPSSM/AARP town hall

The Philadelphia town hall was part of a joint NCPSSM-AARP public education campaign entitled, “Social Security: Here Today, Here Tomorrow,” to better inform Americans about the value of the program to workers and their families. The first town hall took place in Richmond, VA in June. The campaign is coming to Lansing, MI, Las Vegas, NV, and Milwaukee, WI between now and October.

Watch a recording of the entire Philadelphia town hall here.

For more information on the town halls, visit the campaign website www.socialsecurity.org

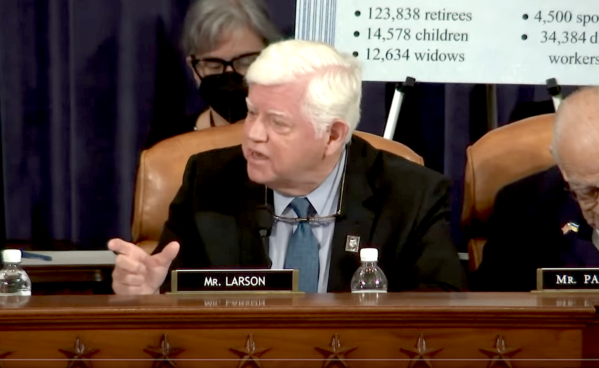

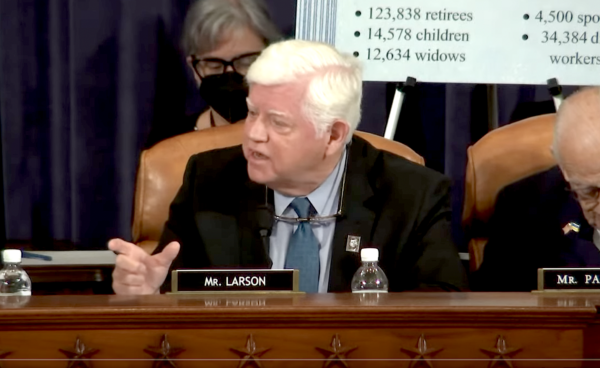

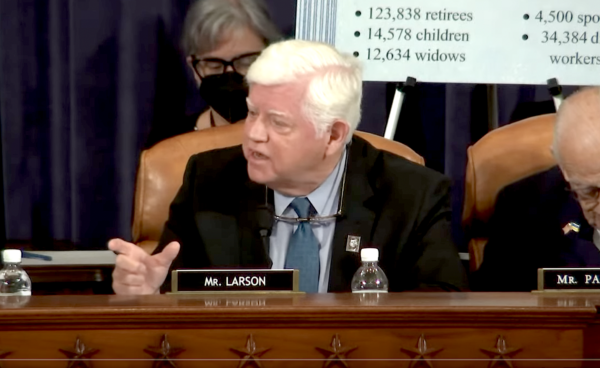

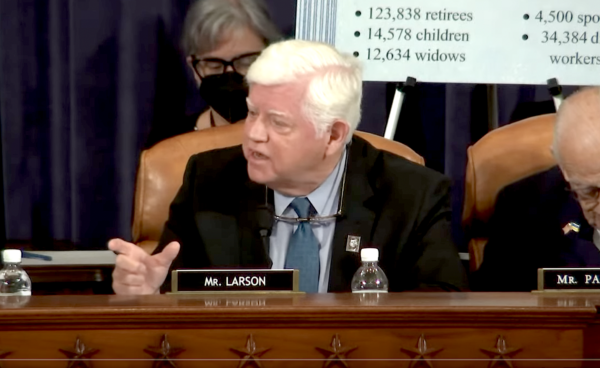

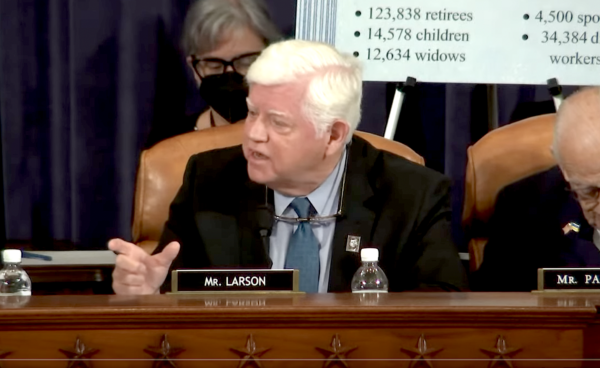

Rep. Larson Re-introduces His Social Security 2100 Act & Other Top News of the Week

It’s been a busy week for Social Security watchers and advocates. Here are some of the major developments from Washington, D.C.:

Larson Re-Introduces Social Security Expansion Bill

Rep. John Larson on Wednesday re-introduced his Social Security 2100 Act, the sixth time he has offered this legislation. The 2100 Act would boost benefits across the board — and would also provide targeted increases to the most vulnerable seniors; It would replace the current COLA formula with the more accurate (and generous) CPI-E; and it would repeal the wildly unpopular Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

Equally importantly, the Larson bill would extend the solvency of the Social Security trust fund, currently projected to become depleted in 2034, for another 32 years – according to an estimate from the program’s Chief Actuary.

The bill pays for expanded benefits and extended solvency by:

- Ensuring millionaires and billionaires pay their fair share by applying FICA to earnings above $400,000, with those extra earnings counted toward benefits at a reduced rate.

- Closing the loophole of avoiding FICA taxes and receiving a lower rate on investment income by adding an additional 12.4% net investment income tax (NIIT) only for taxpayers making over $400,000.

“Seniors across the country rely on Social Security benefits to ensure they can retire with dignity after a lifetime of hard work. It’s been 52 years since Congress has acted to enhance Social Security on their behalf, and while Republicans band together to dismantle the program, Democrats are making it clear they are coming together to both protect and expand Social Security.” – Rep. John Larson (D-CT), 7/12/23

Congressman Larson’s bill has almost 200 cosponsors in the U.S. House.

Senate Committee Holds Hearing on Medicare and Social Security Fair Share Act

Senator Sheldon Whitehouse, chair of the Senate Budget Committee, held a hearing this week on his bill, the Medicare and Social Security Fair Share Act. Like Larson’s legislation, Senator Whitehouse’s bill that would require wages above $400,000 to be taxed for Social Security.

“Right now, the cap on Social Security contributions means a tech exec making $1 million effectively stops paying into the program at the end of February, while a schoolteacher making far less contributes their share through every single paycheck all year.” – Senator Sheldon Whitehouse (D-RI)

Unlike the Larson bill, Senator Whitehouse’s does not expand benefits. Meanwhile, House Republicans have proposed to cut benefits by raising the retirement age, means testing, and adopting a more miserly COLA formula.

2024 Social Security COLA May Be a Paltry 3%

“The COLA is estimated at 3% next year, according to a forecast from The Senior Citizens League, a nonprofit seniors’ group. That’s much less than the four-decade high 8.7% COLA in 2023 but above last month’s estimate for a 2.7% increase for 2024,” reports CNBC.

Most seniors need every dollar of cost-of-living adjustments that they can get, as the cost of essentials like housing, food, and medical care continue to rise. Unfortunately, the current COLA formula does not fully take into account the goods and services that seniors depend on. The National Committee supports the adoption of the CPI-E (Consumer Price Index – Elderly), which is included in Congressman Larson’s bill.

NCPSSM At White House for Release of First Ten Drugs for Medicare Price Negotiation

NCPSSM President Max Richtman and Policy Director Dan Adcock were at the White House Tuesday as the Biden administration released the names of the first ten drugs to be subject to price negotiation between Medicare and Big Pharma. They are some of the most common and most expensive prescription medications that seniors take. These essential medications do everything from preventing blood clots and strokes to treating diabetes, and they will soon cost a lot less for the federal government and for patients.

“This is a sea change in the government’s ability to lower prescription drug prices for older Americans, who all too often are compelled to ration medications or forgo filling prescriptions because of soaring costs.” – Max Richtman, NCPSSM President & CEO, 8/29/23

The Inflation Reduction Act of 2022 empowered Medicare to begin negotiating prices for targeted prescription drugs, something advocates including NCPSSM have struggled to achieve for more than twenty years. Here is a list of the first ten drugs that will be subject to price negotiation with Medicare:

- Eliquis, for preventing strokes and blood clots

- Jardiance, for diabetes and heart failure

- Xarelto,for preventing strokes and blood clots

- Januvia, for diabetes

- Farxiga, for diabetes, heart failure and chronic kidney disease

- Entresto, for heart failure

- Enbrel, for arthritis and other autoimmune conditions

- Imbruvica, for blood cancers

- Stelara, for Crohn’s disease

- Fiasp andNovoLog insulin products for diabetes

Drugmakers made a whopping $493 billion in revenue from these ten drugs, which have accounted for more than $170 billion in gross Medicare spending, according to a report from the nonprofit, Protect Our Care.

President Biden hailed the release of the first ten medications for negotiation as a victory for everyday Americans, who have been subject to price gouging by the drug industry. “There is no reason why Americans should be forced to pay more than any developed nation for life-saving prescriptions just to pad Big Pharma’s pockets,” he said

According to the White House, the 9 million seniors who take the ten targeted drugs will see their costs decrease. These seniors currently pay up to $6,500 in out-of-pocket costs per year for these prescriptions. The nonpartisan Congressional Budget Office reports that this will save taxpayers $160 billion by reducing how much Medicare pays for drugs through negotiation and inflation rebates.

The seniors who have been victimized by price gouging and now will finally get some relief are front of mind for advocates, including Patients for Affordable Drugs Now. The group quotes a Medicare beneficiary in North Carolina who lives with a rare cancer and type 2 diabetes:

“To treat my diabetes, I take Januvia, which carries a monthly list price of $547. Drugmaker Merck has made a fortune from patients like me who are forced to pay whatever price the company dictates. A fairer price for Januvia will mean a world of difference.” – Steven Hadfield, Matthews, NC

The list of drugs subject to negotiation will expand next year to 15, followed by another 15 medications the year after. Negotiated prices for the first ten drugs do not go into effect until 2026.

NCPSSM’s senior health policy expert, Anne Montgomery, says the Biden administration (HHS & CMS) did a “savvy job” of selecting the first set of drugs for negotiation because they are “ten of the highest cost and most commonly used medications” among seniors. “That’s very smart,” she says, “as a way of building a constituency among beneficiaries for the movement to lower drug prices.”

Several drugmakers are suing the Biden administration, claiming that Medicare drug price negotiation is unconstitutional — despite the fact that the V.A. has been successfully negotiating drug prices with Big Pharma for years. Administration officials say that they believe the drug companies have a weak case and will not prevail.

Advocates like NCPSSM are not resting with the implementation of the Inflation Reduction Act’s drug provisions. “The next step is to enlarge the number and type of medications subject to negotiation, to deliver maximum relief to seniors on fixed incomes,” says Richtman. “No one should have to choose between groceries, rent, or essential medications — especially our nation’s senior citizens.”

FDR’S Grandson Says This Is a ‘High Stakes Time’ For Social Security

By James Roosevelt, Jr.

Social Security — which turned 88 years old in August — is one of my grandfather’s greatest legacies. It’s no exaggeration to say that this is a high stakes time for his landmark program. Powerful opponents of Social Security are calling for privatization, cutting the annual COLA, raising the retirement age, and even “sunsetting” the program. That’s not something I could bear to see. Not at a time when so many Americans are counting on their earned benefits to make ends meet.

Yet, every time there is talk about reining in budget deficits, many politicians turn to Social Security. It’s always been an easy target for so-called “deficit hawks” in Washington who would much rather chip away at seniors’ earned benefits than reverse decades of unfair (and unpaid for!) tax policies that benefit wealthy Americans and huge corporations.

Fortunately, my grandfather helped structure the Social Security program to make it hard to cut or privatize Social Security. Because Social Security has its own dedicated income stream from the payroll tax, we don’t just trade it off against education or defense or other important priorities.

My grandfather famously said, “With those taxes in there, no damn politician can ever scrap my Social Security program.”

President Franklin D. Roosevelt signs Social Security into law (August 14, 1935)

But today hardliners in Congress are closer than ever to defunding this critical program that provides 66 million Americans and their families with basic financial security upon retirement or disability. The program has never missed a payment — even during war, recessions and a pandemic. And yet, I’m hearing more politicians than ever talking about the need to change, cut, scale back and even end Social Security “for the good of the economy.”

*Senator Rick Scott (R-FL) proposed a plan where Social Security would have to be reauthorized by Congress every five years.

*Senator Ron Johnson (R-WI) said that Social Security spending should be considered “discretionary spending” and subject to routine budget negotiations every year, even though the program is self-funded by workers.

*Other politicians, including potential 2024 presidential candidates, are calling for raising the retirement age to 70. While that may work out just fine for a lawyer or Wall Street broker, raising the retirement age would have the harshest impact on people working in physically demanding jobs.

*Former Vice President Mike Pence, a 2024 presidential candidate, is now calling for major reforms to Social Security, including privatization. And he recently said, “I think we can replace the New Deal programs with a better deal.”

As a reminder, in 2005, the National Committee helped lead intense grassroots activism against former President George W. Bush’s serious attempt to privatize Social Security. (Congressman Mike Pence was involved in that effort). If President Bush had succeeded, his plan would have handed over control of Social Security benefits to Wall Street brokers and subjected the earned benefits of millions of older Americans to the volatility of the Stock Market.

James Roosevelt, Jr., grandson of FDR & vice-chair of NCPSSM Advisory Board

Lawmakers pushing these dangerous and callous proposals are missing an important point: We can’t just change or cut Social Security without risking the livelihoods of millions of retirees. The real power to protect Social Security lies with us. When we stand shoulder-to-shoulder with millions of senior voters — Congress not only listens, it often reacts in our favor.

James Roosevelt, Jr. is the grandson of President Franklin D. Roosevelt, and son of NCPSSM’s founder, Congressman James Roosevelt, Sr. He is vice-chair of NCPSSM’s Advisory Board and served as CEO of Tufts Health Plan. Previously, he served as Associate Commissioner of the U.S. Social Security Administration.

Marking the First Anniversary of the Inflation Reduction Act

President Biden signed the historic Inflation Reduction Act (IRA) into law one year ago today. It was the first time Congress enacted major legislation to take on Big Pharma and lower the price of prescription drugs for seniors. For us, the IRA was the culmination of a 20 year struggle to reform Medicare Part D — the prescription drug benefit — so that seniors actually could afford crucial medications. We had seen too many statistics over the years about older Americans cutting pills in half or not filling prescriptions because of high costs — or having to choose between essentials like food and medicine.

“We took on Big Pharma, and we won,” proclaimed President Biden after the IRA was enacted. Though the IRA cannot solve the entire drug pricing problem, it will provide relief to millions of American seniors. Here are its major provisions:

*Empowers Medicare to negotiate prices with drug-makers

*Caps Medicare Part D patients’ annual out-of-pocket payments at $2,000

*Caps the cost of insulin for Part D patients at $35/month

*Penalizes drug-makers for raising prices above the rate of inflation

The IRA’s most historic aspect is the drug price negotiation provision – more modest than originally envisioned, but still extremely significant. At first, only ten drugs will be eligible for negotiations, and new brand-name drugs are excluded. Negotiated prices will not take effect until 2026. But Big Pharma opposed these relatively modest measures, and is currently trying to block them in court.

Undaunted, the Biden administration has been spending the past year fleshing out rules for implementing the Inflation Reduction Act’s drug pricing provisions.

“Starting this year, Medicare will begin to negotiate directly with drug manufacturers to bring down the price of covered high-cost prescription drugs. CMS will announce the first 10 drugs selected for negotiation by September 1, 2023. The first round of negotiations will occur during 2023 and 2024. The prices that are negotiated will be effective starting in 2026.” – Center for Medicare & Medicaid Services, 6/30/23

In March, CMS released initial guidance on the drug price negotiation process, outlining “how the agency will select drugs for negotiation this year and how those negotiations will be conducted.” At the end of June, CMS released a revised framework, “informed by public input,” for how the government will negotiate with drugmakers on a maximum fair price for selected drugs. This, the agency says, will ensure “that Medicare beneficiaries have access to innovative, life-saving treatments” at a lower cost for patients and for the Medicare program itself.

On July 1st, the Inflation Reduction Act’s cap on insulin costs for Medicare patients went into effect. Beneficiaries will pay no more than $35/month for insulin. Insulin prices had soared nearly 40% from 2014-2018, and patients’ out-of-pocket costs were running from $300 to $1,000 per month. Over the years, we heard heartbreaking stories about diabetics who rationed insulin because of the high cost and ended up gravely ill or dead. In addition to lowering prices, the Inflation Reduction Act can truly be a lifesaver.

The IRA’s cap on out-of-pocket drug costs for Medicare Part D beneficiaries is especially crucial for patients with serious chronic conditions like cancer or multiple sclerosis. As Kaiser Family Foundation reported, out-of-pocket costs for medications to treat those conditions can be staggering – especially for seniors on fixed incomes:

“For example, in 2020, among Part D enrollees without low-income subsidies, average annual out-of-pocket spending for the cancer drug Revlimid was $6,200 $5,700 for the cancer drug Imbruvica; and $4,100 for the MS drug Avonex.” – Kaiser Family Foundation, 1/24/23

Seniors without subsidies will have to continue paying those higher prices until 2025, when the $2,000 out-of-pocket cap takes effect.

The Inflation Reduction Act was an ambitious, wide-ranging piece of legislation that included not only prescription drug pricing reform, but climate change mitigation and measures to make the U.S. more economically competitive in the 21st century.

Not all Americans, let alone, seniors are aware of the historic drug pricing reforms in the Inflation Reduction Act. The Biden administration has been working to enhance the public’s understanding of the law’s positive impact on their pocketbooks and overall health. CMS posts updates on its activities here. And HHS’ Office of the Assistant Secretary for Planning & Evaluation (ASPE) has a great informational resource on prescription drug price reform, as well.

Meanwhile, the National Committee to Preserve Social Security and Medicare, which tirelessly advocated for the prescription drug reforms in the IRA, will continue to keep the pressure on Congress to lower prices for seniors and all Americans.

“We want the number and types of drugs subject to negotiation to be broadened. Eventually we would like to see all drugs subject to Medicare price negotiation,” said NCPSSM legislative director, Dan Adcock. “The door has been opened. Now it’s our job to keep pushing it ever wider so that older Americans can afford the drugs they need to save their lives — and have a better quality of life.”

Philadelphians Flock to NCPSSM/AARP Town Hall on Social Security

More than 150 Philadelphians turned out at Center in the Park for a town hall emphasizing Social Security’s importance to the Black community, co-presented by NCPSSM and AARP Pennsylvania. Attendees learned about their earned benefits and played Social Security-themed games — including Social Security Plinko and “What does Social Security Mean to You?”

The event featured a public forum with panelists Max Richtman (NCPSSM President), Carolyn Colvin (former Social Security Commissioner), and representatives from Community Legal Services of Philadelphia. The town hall portion was moderated by Philadelphia radio personality Frankie Darcell of WDAS-FM.

Attendees included near-seniors (aged 55-65) and workers who have already retired. “I learned many things, from beginning to end,” said Lue D., a retired pharmaceutical manager, who says she appreciated the forum’s debunking of Social Security myths and misinformation. “It reinforced to me that we need the truth about Social Security in order to talk about it more intelligently out in the community.”

Attendees watch the panel discussion on the importance of Social Security

During the public forum, National Committee president and CEO Max Richtman corrected several harmful Social Security myths:

*Social Security is not going bankrupt;

*The trust fund is not full of “worthless IOUs”

*Politicians are not ‘stealing’ from Social Security;

*Undocumented immigrants are not draining the system’s finances.

Without naming names, Richtman said that myths and misinformation “are designed to undermine the support and faith that Americans have in Social Security” by those who wish to cut and privatize the program. Fortunately, he said, “the polling we’ve seen shows 80-90% support for Social Security across the board.”

L-R, Panelists Allison Schilling, Sarah Martinez, Carolyn Colvin, and Max Richtman

The benefit to Black families was a major theme of the forum’s panel discussion. Ava, a retiree in the audience, said that she “hadn’t understood how Social Security helps families” until she attended the event.

Former Social Security Commissioner Colvin (who ran the program under President Obama) explained that, on average, Black workers become disabled earlier and live fewer years than others. Social Security, she said, provides families with disability, spousal, and survivor’s benefits. “The Social Security benefits available to families is extremely important,” Colvin told the audience. “Social Security guarantees benefits for various stages of family experience.”

Former Social Security Commissioner Carolyn Colvin speaks at the town hall

Colvin pointed out that Black retirees rely on Social Security more than their white counterparts, due to job and wage discrimination and other socioeconomic factors. Without Social Security, 50.5% of Black retirees would be living in poverty.

Pennsylvania State Senator Art Haywood kicked off the town hall with a passionate statement of support for Social Security. Haywood, who was raised by a single mom and began working at age 9 as a newspaper delivery boy, said that “Social Security was designed to preserve the dignity” of retirees. “That’s why it’s so important to have this forum… to talk in detail about the fact that Social Security is still there for us.”

PA State Senator Art Haywood: Social Security allows workers to retire “with dignity”

Sarah Martinez and Allison Schilling of Community Legal Services of Philadelphia covered the nitty-gritty details of Social Security and the difference between Social Security retirement benefits, Social Security Disability Insurance (SSDI), and Supplemental Security Income (SSI) — including the nuances on how to qualify and apply for each program.

Martinez acknowledged that qualifying for SSDI can be difficult, especially given customer service issues at the fiscally struggling Social Security Administration (SSA). “If you’re denied there’s likely a long appeals process. I’ve seen some of these cases go for years, with multiple appeals. The quickest I’ve seen an SSDI appeal resolved in the claimant’s favor is around one year,” she said. (More than 10,000 claimants have died awaiting a hearing on their SSDI appeals.)

A few hours before the town hall began, President Biden named former Maryland Governor Martin O’Malley as permanent commissioner for SSA. In a press statement, Richtman praised O’Malley for his support of Social Security as a presidential candidate in 2016. “As a confirmed commissioner, Martin O’Malley will be able to advocate effectively for SSA, which has been chronically underfunded and has struggled to provide adequate customer service,” said Richtman.

Representatives from the regional SSA office and the staffs of U.S. Senator Bob Casey (D-PA) and Rep. Dwight Evans (D-PA) were on hand to answer attendees’ personal Social Security questions. Audience member Pat Pinkett, who is still working but nearing Social Security retirement age, said she attended the town hall because many people “have no clue about how Social Security really works. I wanted to come to the source and get the facts!”

Philadelphians packed Center in the Park for the NCPSSM/AARP town hall

The Philadelphia town hall was part of a joint NCPSSM-AARP public education campaign entitled, “Social Security: Here Today, Here Tomorrow,” to better inform Americans about the value of the program to workers and their families. The first town hall took place in Richmond, VA in June. The campaign is coming to Lansing, MI, Las Vegas, NV, and Milwaukee, WI between now and October.

Watch a recording of the entire Philadelphia town hall here.

For more information on the town halls, visit the campaign website www.socialsecurity.org

Rep. Larson Re-introduces His Social Security 2100 Act & Other Top News of the Week

It’s been a busy week for Social Security watchers and advocates. Here are some of the major developments from Washington, D.C.:

Larson Re-Introduces Social Security Expansion Bill

Rep. John Larson on Wednesday re-introduced his Social Security 2100 Act, the sixth time he has offered this legislation. The 2100 Act would boost benefits across the board — and would also provide targeted increases to the most vulnerable seniors; It would replace the current COLA formula with the more accurate (and generous) CPI-E; and it would repeal the wildly unpopular Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

Equally importantly, the Larson bill would extend the solvency of the Social Security trust fund, currently projected to become depleted in 2034, for another 32 years – according to an estimate from the program’s Chief Actuary.

The bill pays for expanded benefits and extended solvency by:

- Ensuring millionaires and billionaires pay their fair share by applying FICA to earnings above $400,000, with those extra earnings counted toward benefits at a reduced rate.

- Closing the loophole of avoiding FICA taxes and receiving a lower rate on investment income by adding an additional 12.4% net investment income tax (NIIT) only for taxpayers making over $400,000.

“Seniors across the country rely on Social Security benefits to ensure they can retire with dignity after a lifetime of hard work. It’s been 52 years since Congress has acted to enhance Social Security on their behalf, and while Republicans band together to dismantle the program, Democrats are making it clear they are coming together to both protect and expand Social Security.” – Rep. John Larson (D-CT), 7/12/23

Congressman Larson’s bill has almost 200 cosponsors in the U.S. House.

Senate Committee Holds Hearing on Medicare and Social Security Fair Share Act

Senator Sheldon Whitehouse, chair of the Senate Budget Committee, held a hearing this week on his bill, the Medicare and Social Security Fair Share Act. Like Larson’s legislation, Senator Whitehouse’s bill that would require wages above $400,000 to be taxed for Social Security.

“Right now, the cap on Social Security contributions means a tech exec making $1 million effectively stops paying into the program at the end of February, while a schoolteacher making far less contributes their share through every single paycheck all year.” – Senator Sheldon Whitehouse (D-RI)

Unlike the Larson bill, Senator Whitehouse’s does not expand benefits. Meanwhile, House Republicans have proposed to cut benefits by raising the retirement age, means testing, and adopting a more miserly COLA formula.

2024 Social Security COLA May Be a Paltry 3%

“The COLA is estimated at 3% next year, according to a forecast from The Senior Citizens League, a nonprofit seniors’ group. That’s much less than the four-decade high 8.7% COLA in 2023 but above last month’s estimate for a 2.7% increase for 2024,” reports CNBC.

Most seniors need every dollar of cost-of-living adjustments that they can get, as the cost of essentials like housing, food, and medical care continue to rise. Unfortunately, the current COLA formula does not fully take into account the goods and services that seniors depend on. The National Committee supports the adoption of the CPI-E (Consumer Price Index – Elderly), which is included in Congressman Larson’s bill.