It’s been a busy week for Social Security watchers and advocates. Here are some of the major developments from Washington, D.C.:

Larson Re-Introduces Social Security Expansion Bill

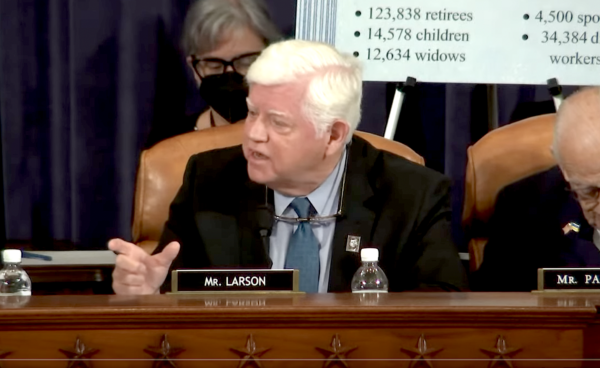

Rep. John Larson on Wednesday re-introduced his Social Security 2100 Act, the sixth time he has offered this legislation. The 2100 Act would boost benefits across the board — and would also provide targeted increases to the most vulnerable seniors; It would replace the current COLA formula with the more accurate (and generous) CPI-E; and it would repeal the wildly unpopular Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

Equally importantly, the Larson bill would extend the solvency of the Social Security trust fund, currently projected to become depleted in 2034, for another 32 years – according to an estimate from the program’s Chief Actuary.

The bill pays for expanded benefits and extended solvency by:

- Ensuring millionaires and billionaires pay their fair share by applying FICA to earnings above $400,000, with those extra earnings counted toward benefits at a reduced rate.

- Closing the loophole of avoiding FICA taxes and receiving a lower rate on investment income by adding an additional 12.4% net investment income tax (NIIT) only for taxpayers making over $400,000.

“Seniors across the country rely on Social Security benefits to ensure they can retire with dignity after a lifetime of hard work. It’s been 52 years since Congress has acted to enhance Social Security on their behalf, and while Republicans band together to dismantle the program, Democrats are making it clear they are coming together to both protect and expand Social Security.” – Rep. John Larson (D-CT), 7/12/23

Congressman Larson’s bill has almost 200 cosponsors in the U.S. House.

Senate Committee Holds Hearing on Medicare and Social Security Fair Share Act

Senator Sheldon Whitehouse, chair of the Senate Budget Committee, held a hearing this week on his bill, the Medicare and Social Security Fair Share Act. Like Larson’s legislation, Senator Whitehouse’s bill that would require wages above $400,000 to be taxed for Social Security.

“Right now, the cap on Social Security contributions means a tech exec making $1 million effectively stops paying into the program at the end of February, while a schoolteacher making far less contributes their share through every single paycheck all year.” – Senator Sheldon Whitehouse (D-RI)

Unlike the Larson bill, Senator Whitehouse’s does not expand benefits. Meanwhile, House Republicans have proposed to cut benefits by raising the retirement age, means testing, and adopting a more miserly COLA formula.

2024 Social Security COLA May Be a Paltry 3%

“The COLA is estimated at 3% next year, according to a forecast from The Senior Citizens League, a nonprofit seniors’ group. That’s much less than the four-decade high 8.7% COLA in 2023 but above last month’s estimate for a 2.7% increase for 2024,” reports CNBC.

Most seniors need every dollar of cost-of-living adjustments that they can get, as the cost of essentials like housing, food, and medical care continue to rise. Unfortunately, the current COLA formula does not fully take into account the goods and services that seniors depend on. The National Committee supports the adoption of the CPI-E (Consumer Price Index – Elderly), which is included in Congressman Larson’s bill.