“Historic Victory for American People” is a Winner for Seniors

****Updated 3/11/21 3:30pm****

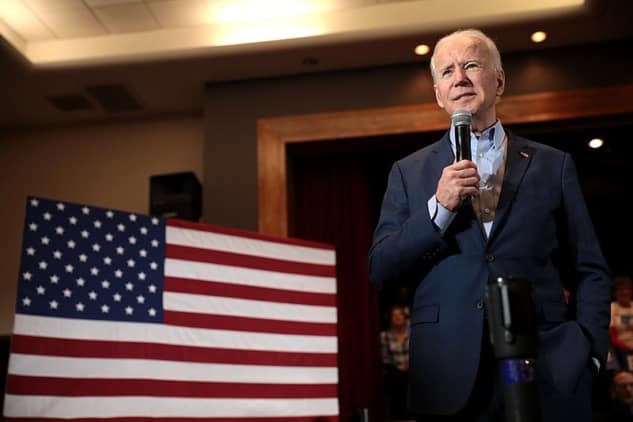

President Biden signed his $1.9 trillion COVID relief bill into law today — on the first anniversary of the pandemic. The American Rescue Act unleashes $1.9 trillion in federal aid to help hard hit Americans, small businesses, and state and local governments. President Biden called the bill’s enactment “a historic victory for the American people.” House Speaker Nancy Pelosi said that the American Rescue Act is “the most consequential piece of legislation we’ll ever be party to in our lifetimes.” It fulfills a promise President Biden made to the American people to provide substantial relief to a country still reeling from the COVID pandemic – and seeking to get back on its feet as quickly as possible.

“The signing of this landmark legislation is a great moment for all Americans who have struggled to survive and stay financially afloat during this pandemic, especially seniors, people with disabilities, and their families.” – Max Richtman, president and CEO, National Committee to Preserve Social Security and Medicare

The President’s COVID relief package gives seniors’ health and economic security a much-needed boost. Millions of Social Security beneficiaries will be eligible for $1,400 stimulus payments to keep their heads above water financially. The legislation also contains crucial new funds for vaccinations, testing, and safer nursing home care.

President Biden called passage of the COVID relief bill “a historic victory for the American people.”

The American Rescue Act includes $12.6 billion in additional federal Medicaid payments that states can use to expand home and community-based services (HCBS), where exposure to COVID is minimal compared to nursing homes.

The COVID relief legislation adds $4.5 billion for LIHEAP, the federally-funded program that helps keep low-income seniors’ homes heated and cooled — and invests more than $1.4 billion to strengthen critical programs for older adults — including nutrition assistance (such as Meals on Wheels), vaccination support, and caregiver support —under the Older Americans Act and the Elder Justice Act, among other provisions.

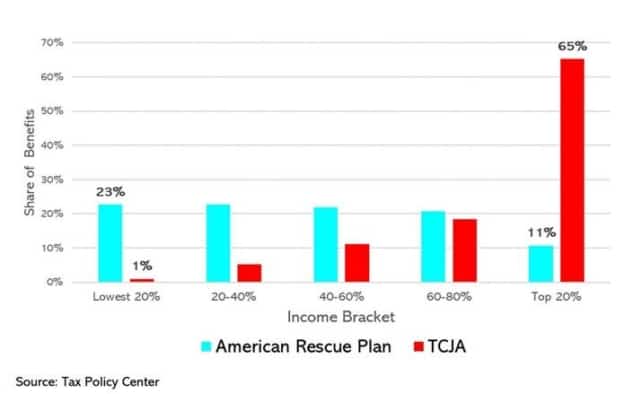

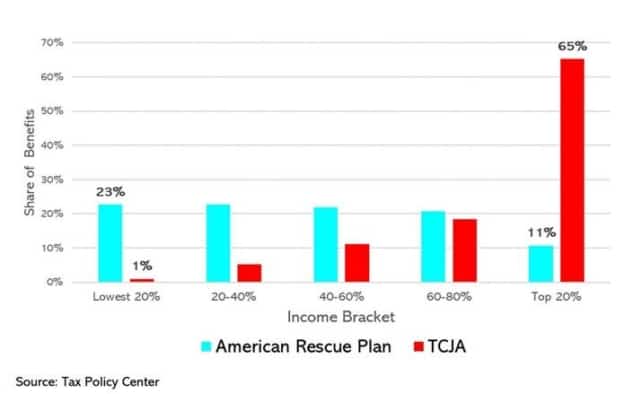

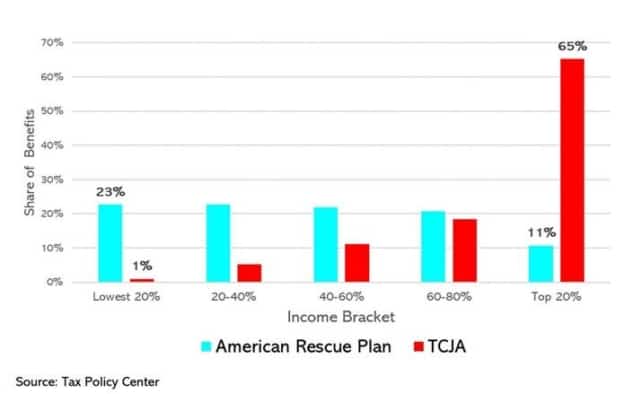

The American Rescue Act is the polar opposite of the Trump/GOP tax cuts in 2017, which mostly benefited the wealthy and large corporations. President Biden’s legislation actually helps those on the bottom and middle of the economic ladder the most. It is a ‘bottom up’ strategy for rebuilding the economy versus the failed ‘trickle down’ approach of Republicans from Reagan to Trump.

The National Committee salutes President Biden for his steely determination to enact this legislation, along with House committee chairs Rep. Richard Neal (Ways & Means), Rep. Frank Pallone (Energy & Commerce), and Senator Ron Wyden (Finance committee chair). We also thank Rep. Debbie Dingell for championing the HCBS provisions of the bill.

The bill passed the House on Wednesday with zero Republican support, despite public polling that shows some 75% of Americans across party lines support the package as whole. It now goes to President Biden for signature. He is expected to sign the American Rescue Act by Friday. In so doing, President Biden and Congressional Democrats will have enacted one of the most far-reaching, most compassionate pieces of legislation to help seniors and other everyday Americans since the Great Society.

COVID Relief Should be a Big Relief for Seniors

The Senate is expected to pass President Biden’s $1.9 trillion COVID relief bill over the next several days. Though concessions have been made to improve its chances of passage, the legislation remains the best hope of getting seniors and other struggling Americans the relief they so badly need.

Under the COVID relief act, millions of Social Security beneficiaries will be eligible for $1,400 stimulus payments to keep their heads above water financially. The legislation also contains crucial new funds for vaccinations, testing, and safer nursing home care that is so crucial to older Americans.

There is more good news in this bill for seniors. It also includes:

*$12.6 billion in additional federal Medicaid payments that states can use to expand home and community-based services (HCBS), which generally is a healthier option for seniors than nursing homes;

*47.8 billion for Coronavirus testing and mitigation;

*$4.5 billion for LIHEAP, the federally-funded program that helps keep low-income seniors’ homes heated and cooled;

*$276 million for aging and disability programs under the Elder Justice Act.

Seniors have been among the hardest hit by the pandemic, in terms of sickness and deaths, mental and emotional stress, and financial strain. The relief package should go a long way toward mitigating their pain.

“The vast majority of Americans believe this plan is essential to giving them help. It’ll grow the economy in the process. This is a lifeline for getting the upper hand against COVID. This isn’t some academic discussion. It’s about you, and people like you.” – President Biden, 3/5/21

We salute President Biden for his steely determination to enact this legislation, along with House committee chairs Rep. Richard Neal (Ways & Means), Rep. Frank Pallone (Energy & Commerce), and Senator Ron Wyden (Finance committee chair). We also thank Rep. Debbie Dingell for championing the HCBS provisions of the bill.

Once the COVID relief package passes the Senate, it will go back to the House for final approval and on to President Biden’s desk for signature. On Friday, National Committee president and CEO Max Richtman said, “The passage of this landmark legislation will be a great moment for all Americans who have struggled to survive and stay financially afloat during this pandemic, especially seniors, people with disabilities, and their families.”

Millionaires Are Done Paying Into Social Security for the Year

Today is the day most millionaires stop paying into Social Security for the rest of the year, while most of us will continue contributing FICA payroll taxes through the end of December. The payroll tax cap for 2021 is $142,800 in annual wages. As of today, people grossing $1,000,000 a year in wages have now exceeded the cap; hence, no more payroll contributions for millionaires until 2022. If that sounds unfair, it should be noted that billionaires stopped paying into Social Security in January!

In effect, higher income earners pay a significantly smaller percentage of their wages into Social Security than everyone else. This not only is patently unfair; it deprives Social Security of much-needed revenue. Without additional revenue, the Social Security trust fund will become depleted in 2035 (at which time the program could still pay roughly 80% of benefits).

It wasn’t always this way. In years past, 90% of wages earned in this country fell below the payroll tax cap. But due to rising wealth inequality in recent decades, only 82.5% of those earnings are now subject to the Social Security payroll tax.

“The extraordinary growth of income for those at the highest end of the wage scale was not anticipated by those who established the formulas that fund Social Security today. Wages for middle-and-lower income workers have remained stagnant for over a decade, while higher-wage workers have seen significant wage growth during that time.” – www.ncpssm.org

Even millionaires recognize this is unfair. As the advocacy group Patriotic Millionaires points out:

“The income cap is not only regressive, but unnecessary. It has been around since the tax began in 1937, but has not kept up with disproportionate wage growth or explosive wealth inequality. As a result, almost $2 trillion in earnings a year are not subject to the payroll tax, limiting the amount of revenue collected for Social Security.” – Patrioticmillionaires.org

The COVID economy is putting additional strain on Social Security’s finances. Some predict that the drop in payroll tax revenue from chronic unemployment will deplete the Social Security trust fund sooner than previously projected. Adjusting the payroll wage cap would be the surest way to forestall that unfortunate outcome.

The pandemic also has reminded us that Social Security is a financial lifeline to millions of American families. The program is there for older workers who are forced by the pandemic to retire early. It is also there for widows, widowers, and children of family breadwinners who pass away. Working Americans cannot afford to see Social Security’s finances further eroded because the wealthy don’t pay their fair share.

For years, we and other seniors’ advocates have supported “scrapping” the payroll wage cap – either immediately or over a period of time. After four years of a Trump presidency and GOP control of the Senate, we finally have a chance to make this happen. If Congress is able to muster the political will, Social Security’s finances can be strengthened in a fair and equitable way. The electorate has given us a golden opportunity. In fact, public opinion polling indicates broad support for eliminating the wage cap.

For his part, President Biden proposes to re-instate the payroll tax at $400,000 in annual wages. That closely tracks the payroll tax provisions in Rep. John Larson’s Social Security 2100 Act. Lifting the cap would extend the solvency of the Social Security trust fund. It also would help cover the cost of boosting Social Security benefits, which both President Biden and Rep. Larson want to do. The President would start by increasing benefits for some of the most financially vulnerable members of society — low-income workers, widows and widowers, and retirees over 85 years of age.

So-called ‘fiscal conservatives’ argue that Social Security must be cut in order to save it, by raising the retirement age, means testing or by other measures. We disagree. It’s unfair to ask seniors, workers with disabilities, and their families to bear the brunt of strengthening Social Security’s finances. The more equitable path is to ‘Scrap the Cap,’ so that the wealthy pay their fair share — and all Americans can count on the benefits they’ve earned over a lifetime of work.

Biden’s Choice for CMS Director a Welcome Change for Post-Trump Era

President Biden has made his choice for a key administration official. Today, he named Chiquita Brooks-LaSure as Director of the Centers for Medicare and Medicaid Services (CMS), an agency with sweeping jurisdiction over health policy affecting seniors, workers with disabilities, and their families. If confirmed by the Senate, Brooks-LaSure will be the first African-American woman to hold that post.

CMS director-designate Chiquita Brooks-LaSure

Brooks-LaSure, a former Obama administration healthcare policy official, will replace President Trump’s CMS chief, Seema Verma, who left the job when Joe Biden was inaugurated on January 20th. Verma – a corporatist conservative idealogue – spent four years undermining traditional Medicare, Medicaid, and the Affordable Care Act. Her actions in office also came under scrutiny by the HHS Inspector General for her “use of outside consultants to perform inherently governmental functions,” including burnishing her own image.

As President Biden’s designated CMS director, Brooks-LaSure represents a welcome change, with a solid background in Democratic health policy circles:

“[She] has a long track record in government, having held health policy jobs at the White House, in Congress, and at CMS during the Obama administration. Most recently she led the Biden transition’s ‘landing team’ for the Department of Health and Human Services, laying the groundwork for the new administration.” – Associated Press, 2/18/21

She appears very much in sync with President Biden’s healthcare priorities. The Associated Press reports that Brooks-LaSure is expected to increase Obamacare enrollment and “persuade holdout states to adopt Medicaid expansion.”

According to the Washington Post, Brooks-LaSure was “championed by allies on Capitol Hill, including the Congressional Black Caucus.” She no doubt will be a powerful advocate for President Biden’s legislative efforts to boost health care access – especially for older Americans. President Biden campaigned on a platform of expanding not only Medicaid, but Medicare – a key goal for the National Committee and our members and supporters across the country.

One of Brooks-LaSure’s early challenges will be reversing some of the most insidious Trump administration healthcare policies. The Biden administration already is off to a good start. On February 12th, CMS sent letters to several states, rescinding Trump administration waivers allowing Medicaid work requirements. Los Angeles Times columnist Michael Hiltzik celebrated the end of this mean-spirited Trump policy, pointing out that forcing Medicaid patients to work is unfair and contrary to the program’s mission. In a column aptly titled, Goodbye to those stupid, useless and biased Medicaid work requirements, Hiltzik writes:

“Healthcare experts warned from the inception that work requirements would throw thousands of people off Medicaid, wouldn’t increase employment, would be expensive to administer, would probably be ruled illegal and were unnecessary. They were right on all counts.” – Michael Hiltzik, Los Angeles Times, 2/17/21

We also hope that Brooks-LaSure will steer CMS in the opposite direction in its public outreach for Medicare Open Enrollment. Trump’s CMS showed blatant bias toward private Medicare Advantage plans, especially in its annual enrollment materials. We look to Biden’s CMS chief to ensure that enrollees receive balanced information about their Medicare options.

Between undoing Trump administration policies and implementing President Biden’s proposals, there are myriad challenges facing the new CMS director. Fortunately, Brooks-LaSure brings to the job her leadership skills, policy chops, and a fresh perspective as the first black woman to helm CMS.

*************************************************

View the National Committee’s 2021 Legislative Agenda.

COVID Relief Package Should be a Relief for Seniors

President Biden’s COVID $1.9 trillion relief package should be a relief to seniors, who stand to benefit from some of its key provisions. On Friday morning, the Senate passed a budget resolution (51-50, with Vice President Harris breaking the tie) launching the COVID package on its journey through the budget reconciliation process. A few hours later, the House adopted a budget blueprint with instructions for congressional committees drafting relief legislation.

By using the reconciliation process, the Democrats’ final bill can pass the Senate with no risk of a Republican filibuster – placing it on a fairly straight path to the President’s desk for signature. Democrats say they would like the relief package to be enacted no later than mid-March, when enhanced unemployment benefits expire.

The COVID package will contain billions of dollars for vaccine distribution. That should be welcome news for seniors, many of whom are still awaiting vaccination due to shortages and inefficiencies in the distribution process. As NPR reports:

“With millions of older Americans eligible for COVID-19 vaccines and limited supplies, many continue to describe a frantic and frustrating search to secure a shot, beset by uncertainty and difficulty.” – NPR, 2/4/21

The relief package also includes $1,400 stimulus payments (in addition to the $600 in the previous legislation). The extra money should help eligible older Americans on fixed incomes struggling to stay financially afloat during the pandemic.

There also is good news for the Medicaid program, which pays for the lion’s share of seniors’ long term care services and supports. The COVID relief package extends an additional 6.2% in federal Medicaid matching funds contained in last year’s bill through the end of 2021.

The proposed package contains $9 billion in dedicated Medicaid funds for home and community-based care. We and other seniors’ organizations encourage elder care outside of nursing homes in favor of home and community settings, which can offer better physical and mental health outcomes for older patients.

“Home and community-based care is significantly less costly than nursing home care. What’s more, seniors are more likely to thrive when they are able to remain in their homes and communities — with familiar surroundings and more frequent interactions with friends and family.” – National Committee president and CEO Max Richtman, 7/13/20

The legislation now being shaped on Capitol Hill also will include several hundred billion dollars in aid for state and local governments. That’s good for seniors as state and local governments expend money on their behalf, including Older Americans Act programs. Seniors also stand to benefit from the infusion of federal funds that states and localities may use for everything from Medicaid to police and fire services.

President Biden pledges not to budge on amount of $1,400 stimulus payments

President Biden’s relief plan featured a $15 per hour federal minimum wage, which would boost the income of seniors working in retail and service jobs. However, it’s not yet clear that the minimum wage provision meets rules governing the reconciliation process – or whether it will garner enough Democratic votes to pass the Senate.

COVID relief legislation will no doubt undergo changes as it moves through committees and onto the floor of each house of Congress. President Biden has so far stood firm against Republican attempts to reduce the $1.9 trillion price tag, but has signaled flexibility on precisely who is eligible for stimulus payments. The President said on Friday that he will not budge on the $1,400 stimulus payment amount, and pledged to get “money directly in people’s pockets” who need it most.