News from the Frontlines of the Fight Against Alzheimer’s

In this week’s episode of our You Earned This podcast, Dr. Heather Snyder of the Alzheimer’s Association tells us some common misconceptions about Alzheimer’s disease while also sharing exciting developments in research, treatment, and prevention. These advances should be welcome news to America’s seniors, demonstrating important steps forward in the ongoing fight against Alzheimer’s.

Evaluating Data Beyond Anecdotes

Alzheimer’s affects more than 7 million Americans, with nearly 12 million caregivers supporting loved ones who live with the disease. Many people understand Alzheimer’s through the lens of personal experience — family or friends who gradually lost memory and independence. Dr. Snyder emphasized that while those experiences are painful and real, the latest research offers some hope.

“People often think there’s nothing you can do about it… but what we’re learning is that’s changing.” – Dr. Heather Snyder, Alzheimer’s Association

Scientists are identifying tools to diagnose the disease earlier, understand who’s most at risk, and slow cognitive decline with targeted interventions.

Alzheimer’s vs. Dementia

Dr. Snyder says that many people use “Alzheimer’s” and “dementia” interchangeably, but they’re not the same. “Dementia is an umbrella term describing symptoms like memory loss, language problems, and confusion severe enough to affect daily life. Alzheimer’s disease is one of several causes of dementia, along with Lewy body disease, vascular dementia, and others.”

Risk Factors and Genetics

Dr. Snyder noted that age is the strongest risk factor, but says that “aging itself is not the cause.” Other influences include cardiovascular health, metabolic issues, sleep quality, and head injury. Genetics also plays a role, especially a gene known as APOE4, which can increase a person’s risk of developing Alzheimer’s but doesn’t determine it. As Dr. Snyder explained, many people with two APOE4 copies (one from each parent) maintain healthy cognition “into their late nineties,” showing that lifestyle and overall health can affect whether the gene is activated.

“One in nine individuals over the age of 65 has Alzheimer’s or another form of Dementia.” – Dr. Heather Snyder

Dr. Heather Snyder of the Alzheimer’s Association

Dr. Snyder and her colleagues at the Alzheimer’s Association are at the forefront of cutting-edge research exploring how diet, exercise, and other lifestyle modifications may play a vital role in reducing cognitive decline. In a study known as the U.S. POINTER trial, researchers tracked more than 2,000 adults at risk of cognitive decline. Data from a study group that underwent a structured program of modifications —which combined exercise, a nutritious diet, and heart monitoring—showed promise for preserving brain health.

Participants maintained brain function equivalent to being “one to two years younger,” says Dr. Snyder, according to study results published in the Journal for American Medical Association (JAMA). POINTER is the first large-scale U.S. study proving that structured lifestyle changes might actively protect brain health and slow age-related decline.

Meanwhile, NPR reports that playing brain games may improve cognitive function. According to a new study, doing “rigorous mental exercises” for 30 minutes a day increases levels of the chemical messenger acetylcholine in a brain area involved in attention and memory. “The study comes amid a proliferation of online brain-training programs, including Lumosity, Elevate, Peak, CogniFit and BrainHQ,” says NPR.

New Blood Test Offers Earlier Detection

Dr. Snyder is hopeful about recent developments in blood testing to detect Alzheimer’s. Earlier this spring, the FDA cleared the first blood test designed to aid in diagnosis. The blood test offers a less invasive, more widely available method to support accurate and earlier diagnosis, which is crucial for timely intervention and better management of the disease.

“It is a very exciting time as we’re seeing all of this work in the research space translate into the clinical setting. And we’ll see this go even further as we move to primary care and other types of care settings as well for individuals.” – Dr. Heather Snyder

The First Disease-Modifying Treatments

Two medications—Leqembi (lecanemab) and Kisunla (donanemab)—have ushered in the first wave of disease-modifying Alzheimer’s treatments. Both drugs target beta-amyloids, helping clear harmful protein buildup from the brain and slow cognitive decline in early-stage patients.

Medicare covers these drugs under Part B (reimbursing about 80% of their cost once patients meet their deductible) — with the requirement that recipients participate in a data registry tracking real-world effectiveness. In August 2025, the FDA approved a subcutaneous, at-home version of Leqembi, reducing the need for frequent infusions. Kisunla’s monthly infusion model is also designed for shorter treatment duration. Both remain under long-term study to determine sustained benefits.

“Every new study is building on the last. We’re learning from every trial, and each one brings us closer to changing the trajectory of the disease.” – Dr. Heather Snyder

While there’s still no cure for Alzheimer’s, the combined progress in detection, prevention, and treatment points the way toward a potentially brighter future.

**********************************************************

To listen to the full podcast with Dr. Heather Snyder, listen here

Read the Alzheimer’s Association’s FY2024 Annual Report here

For reliable information, resources, and community support, the Alzheimer’s Association offers a 24-hour helpline.

Open Enrollment Season Begins at a Fraught Time for Medicare

This year’s Medicare open enrollment season, which began on October 15, comes at a concerning time for the program. There are several crosswinds buffeting Medicare right now, including a government shutdown — and reckless Trump administration cuts at the Centers for Medicare and Medicaid Services. Add to that the increasing dysfunction in the privatized Medicare Advantage program, and you have a higher stakes enrollment season for seniors. We asked our senior health policy expert, Anne Montgomery, to answer some commonsense questions about enrolling in Medicare at this potentially fraught and confusing moment.

Q: Who needs to participate in Medicare open enrollment? Everyone on Medicare?

ANNE: Yes, everyone on Medicare. Whether they are entering the program (turning 65) or have been in it for some time, everyone should examine their options. If someone has already made a choice, they don’t have to change, but it’s always wise to look around and see what’s available. Medicare Advantage (also known as MA or Medicare Part C) is becoming increasingly dominant, with substantial marketing behind it as well. It’s important to understand that open enrollment runs through December. Do your homework: look at providers, drug coverage, and whether your medications are on the formulary. There are many things to check.

Q: What are the most important things for beneficiaries to do or look at this open enrollment season?

ANNE: This is a complicated season, made more so by the ongoing government shutdown. Thankfully, benefits and provider payments are not affected, but parts of Medicare’s administration are running on fumes. If you call 1‑800‑MEDICARE, you may not be able to get through right now, so it’s harder to get good information during a shutdown. The best option right now is to contact your State Health Insurance Assistance Program (SHIP). You can make appointments by phone or in person to sit down with someone who can answer your questions. In my opinion, this is the best way to get informed and explore your options.

Q: We are skeptical of Medicare Advantage as a choice for seniors, given the disadvantages we’ve noted over the years. What should people be cautious about when considering Medicare Advantage?

ANNE: Medicare Advantage plans can look attractive because they make enrollment easy with bundled coverage—you don’t need to think separately about Parts A, B, and D. Many Medicare Advantage plans are like HMOs with limited networks of providers and prior authorizations for care. If you need expensive treatments for cardiac issues or chronic disease, MA plans are notorious for delaying or denying payment for costly services and medications. Beneficiaries can be left financially and legally vulnerable. The appeals process is stressful and sometimes requires legal assistance, which is an added burden.

Q: This year we’ve seen major Medicare Advantage insurers pull out of the market or scale back services. Should this be a concern when choosing a plan?

ANNE: Yes, absolutely. If you sign up for a plan and it later withdraws from your region—these are, after all, for-profit enterprises—you may have to switch mid-course, which is especially difficult during active treatment. This is why personalized, unbiased counseling is crucial. Remember, Medicare Advantage brokers operate under financial incentives, while SHIP staff provide neutral guidance.

Q: The Washington Post reports that a new Trump administration directory designed to help seniors compare Medicare Advantage providers is riddled with errors. How should enrollees handle that?

ANNE: I haven’t tried it myself, but it’s meant to help people identify providers in a simple, comprehensive way. Unfortunately, it has glitches and isn’t yet the reliable resource it was promised to be. That doesn’t mean it can’t improve over time. But for now, it’s a flawed tool and not a complete solution.

Q: Many people are trying to switch out of Medicare Advantage during open enrollment. What obstacles might they face returning to traditional Medicare?

ANNE: There isn’t a structural obstacle, per se. You can still dis-enroll… and many people do after realizing the disadvantages of Medicare Advantage. However, if you return to traditional Medicare and want to buy a Medigap supplemental insurance policy to help with deductibles and co-pays,you may need medical underwriting if you’re more than five months past your 65th birthday. That means if you have pre-existing conditions, your monthly premiums could be significantly higher—or you may be denied a Medigap policy altogether.

Q: How concerned should we be about the Trump administration’s changes to traditional Medicare, such as using AI bots for prior authorizations?

Answer: It’s an interesting development. Prior Authorization has long existed in Medicare Advantage through administrative contractors who are brought in to flag potential overuse by providers. The concern is that AI‑driven prior authorizations in traditional Medicare—run by organizations whose motives aren’t fully clear—might be used in the same restrictive way. That hasn’t happened yet, but if it does, it could harm beneficiaries. All in all, we’d rather have human beings making decisions about our healthcare instead of bots.

Q: The Trump administration has reduced staff at the Centers for Medicare and Medicaid Services. Is that affecting Medicare’s administration?

Answer: It’s difficult to say definitively, but we’re seeing longer wait times and reduced availability for public-facing services like 1‑800‑MEDICARE. Layoffs and budget cuts weaken administrative support, and the problem will grow if these agencies continue being targeted. This pattern extends beyond Medicare. We are seeing it at the Social Security Administration, the Department of Education, HUD, and even air traffic control. Wantonly cutting staff in this way has serious consequences.

Q: Has the government shutdown had any direct effects on Medicare?

ANNE: The hotline is slower, but still functional. It’s taking longer for people to get appointments or resolve administrative issues, and the strain increases the longer the shutdown continues. The good news is that no one’s benefits have been directly affected so far. Regardless, it would be in the program’s best interests if the shutdown ended as soon as possible.

*********************************************************************

Listen to Anne Montgomery on our podcast episode entitled, “For Bots’ Sake, Keep AI out of Medicare!” here.

Don’t forget to watch our new historical documentary, “Social Security: 90 Years Strong.”

Trump’s ‘Reaper’ is Coming for Your Disability Benefits

Trump & OMB Director Russell Vought (aka “The Reaper”)

The Trump administration is escalating its attacks on Social Security. As reported by the Washington Post, a proposed new rule would strip disability benefits from hundreds of thousands of older Americans who are unable to work.

White House officials reportedly are planning to completely rewrite the criteria for determining eligibility for Social Security Disability Insurance (SSDI). Proposed changes would weaken or even eliminate age as a key factor in disability determinations. Advocates warn that this could deny benefits to nearly one million Americans over the next decade.

As it is, older Americans face an uphill battle in applying for SSDI benefits, and are often unable to find appropriate work. Currently, the Social Security Administration (SSA) considers a worker’s age, education, and work experience when determining if their disability prevents them from finding new work. Under the Trump plan, age would no longer carry the same weight.

For millions of older Americans with disabilities, these benefits are a lifeline. If age is removed as a consideration, many could be forced into premature retirement at 62, receiving 30% less in Social Security benefits for the rest of their lives.

“SSA’s proposed changes could reduce disability benefit eligibility for hundreds of thousands of Americans, particularly older workers. Policymakers, advocates, and researchers should understand the implications for income support, health coverage, and retirement decisions.” – Jack Smalligan, Urban Institute

The prime mover in rewriting SSDI eligibility rules is Russell Vought, Director of the Office of Management and Budget, and main author of the notorious Project 2025 blueprint for radically reconfiguring the federal government. The White House shared a disturbing AI video depicting Vought as “The Reaper”. In the video, the OMB director is dressed as the infamous character, cavorting around Washington and wielding a scythe.

The architect of the miserly SSDI rules is portrayed as The Reaper in a disturbing AI video shared by Trump

The Trump administration’s ultimate goal is clear: shrink or privatize federal programs that the most vulnerable members of our society rely upon, including Social Security. Congressional Democrats are appalled by the rewriting of SSDI rules.

“Donald Trump is plotting to cut Social Security benefits for older Americans — after he promised during the campaign that he wouldn’t touch Social Security. We must call it out and stop these cuts.” – Senator Elizabeth Warren (D-MA) on X

Trump may claim to support Social Security, but his record tells a different story. Reckless and misguided decisions emanating from the White House and DOGE have led to trauma and chaos at SSA, even as Social Security claims surge as a result of public panic about the program.

Every time the Trump administration talks about “modernizing” or “reforming” Social Security, older Americans end up paying the price. Rather than believe these vague and untrue claims, look no further than the video of Vought as the Grim Reaper — and Trump’s claims that Social Security will die “very shortly”.

As we know, elections have consequences. In 2024, we warned against the dangers of a second Trump administration using Vought’s Project 2025 as its playbook. As Rep. John Larson (D-RI) said in response to Trump’s manipulation of SSDI rules: “Whether it is health care, food assistance, or Social Security, Donald Trump’s mission is the same: cut benefits for working people and hand the ‘savings’ to billionaires on Wall Street. Democrats will not let that happen. We will fight tooth and nail to protect the basic support Americans have earned.”

*****************************************************************

Listen to our podcast interview with former Social Security Commissioner Martin O’Malley… on the havoc that Trump/DOGE are wreaking at SSA here.

Also— we spoke with SSA whistleblower Laura Haltzel for an insiders’ take on Trump/DOGE interference in Social Security here.

Don’t forget to watch our new historical documentary, “Social Security: 90 Years Strong.”

Let the Drug Pricing Games Begin!

Under pressure from the White House, Big Pharma has been touting “discounts” via Direct to Consumer (DTC) websites. Meanwhile, the Trump administration promises to unveil its own prescription website, immodestly named TrumpRx, in 2026. Prescription drug prices obviously are still too high, though President Biden’s Inflation Reduction Act (IRA) of 2022 was beginning to make headway in bringing them down. Unlike Biden’s IRA, these latest gestures by Big Pharma and the Trump Administration should be viewed with a healthy dose of skepticism.

Last month, drugmaker AstraZeneca launched a new direct-to-consumer (DTC) website to sell three popular drugs to customers with no insurance at lower-than-list prices – Farxiga, Flumist and AirSpura. Shortly afterwards, the CEO of Pfizer appeared at a White House event to announce that company would make certain drugs available to Medicaid beneficiaries at lower-than-list prices.

It is unlikely that ‘discounts’ offered by Big Pharma and “TrumpRx” website are actually a good deal for consumers . As Yahoo!News reports, some experts have characterized TrumpRx as a “gimmick” that “is not going to help the average person, particularly those who purchase prescription drugs through their insurance plans.” Experts worry that the discounts on TrumpRx won’t offset the Trump tariffs on drugs, which will raise consumers’ prices, not lower them.

Health care advocates also are skeptical of Big Pharma’s own Direct to Consumer sites. A case in point is AstraZeneca’s announcement that the diabetes drug, Farxiga, will be sold for $182 per month on its AstraZeneca Direct website. But for Medicare beneficiaries, the price of Farxiga is already much lower, averaging $39 per month, thanks to the Inflation Reduction Act.

For those who don’t have insurance (or who have skimpy insurance) it’s unclear whether the industry’s Direct to Consumer websites will be genuinely helpful. Workers living paycheck-to-paycheck still may not be able to afford hundreds of dollars or more per month for any single prescription. People with employer-sponsored drug coverage will need to determine whether purchases from a pharmaceutical DTC website — or from “TrumpRx” — actually count toward annual deductibles and out-of-pocket spending maximums.

The diabetes medication Farxiga is $182/mo. on AstraZeneca’s ‘discount site,’ but it’s only $39/mo. for Medicare Part D beneficiaries, thanks to Biden’s Inflation Reduction Act

Biden’s Inflation Reduction Act contained well-considered measures that were beginning to work (See the $39 per month for Farxiga). For the first time, the IRA empowered Medicare to negotiate prices with Big Pharma. It also included penalties for manufacturers that raise prices above the inflation — and a $2,000 cap on out-of-pocket costs for patients in Medicare Part D.

This is a far better approach than Trump’s efforts to coax drug companies into lowering prices by threatening tariffs. During both of his terms in office, Trump’s actions on prescription drug pricing have always seemed more performative than serious. There also is a certain smoke-and-mirror synergy between Trump and Big Pharma. Drugmakers can conjure any list price (or retail price) for their products in the U.S. market, making the concept of a ‘discount’ somewhat sketchy. Manufacturers promising to offer 50% discounts next year could simply double their prices on January 1, rendering the discount meaningless.

Biden’s Inflation Reduction Act resulted in real cost savings for seniors

What Trump would posit as progress on drug pricing reform may, in reality, represent backsliding. Trump’s Unfair, Ugly Bill diluted the Inflation Reduction Act’s drug negotiation powers — giving the government less leverage over Big Pharma. Meanwhile, it is unclear how robustly the administration will implement the next round of prescription drug price negotiations. All told, none of the latest news is reassuring for seniors or anyone else who depends on life-saving medications — but struggles to afford them. It remains to be seen whether TrumpRx will truly save anyone money, or whether it will join Trump Sneakers, Trump Steaks, and Trump University in ignobility.

*****************************************************

Check out our “You Earned This” podcast, with the latest insights on Medicare, Prescription Drug Pricing, Caregiving and more! Listen here.

Trump Shutdown Could Snag Social Security, Medicare

In normal times, a government shutdown — while unfortunate — would not be cause for immediate alarm for people on Social Security and Medicare. But these are not normal times. The Trump administration has made the shutdown more perilous for the most vulnerable Americans because of its campaign to undermine the delivery of both programs — not to mention the President’s recent threat to cut benefits.

While benefits will continue to be paid during the shutdown, Americans’ ability to access their benefits could be compromised. Anyone trying to verify benefits, report changes in circumstances, or obtain replacement Medicare cards may have to wait until the shutdown is over. But that may not be all.

“Hands Off” protest against Trump cuts at Social Security Security Administration last Spring

Since Trump and DOGE hijacked the Social Security Administration (SSA) last winter, they have ruthlessly slashed the agency’s workforce — at a time when staffing was already at a 50-year low. The administration also put up barriers for people trying to simply access their earned benefits. All of this was done under the guise of hunting for “waste, fraud, and abuse” — which are extremely rare at SSA.

Although some of the SSA workforce will be deemed ‘essential employees’ during the shutdown and continue working, the shrinking of staff by Trump and DOGE can only slow down already diminished customer service. Wait times on the 1-800 phone line and at overcrowded, understaffed field offices could be exacerbated by the shutdown.

“It’s perfectly understandable that beneficiaries would be concerned about additional disruptions during a shutdown. We would like to reassure the public about customer service at SSA, but we cannot honestly do that — given the administration’s blatant disregard for the needs of Social Security recipients.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

More ominously, Trump threatened to use the shutdown as an opportunity to (illegally) fire federal workers. Staffing at the Centers for Medicare and Medicaid Services (CMS) already has been brutally cut. Further firings would hobble the agency’s ability to administer the Medicare and Medicaid programs.

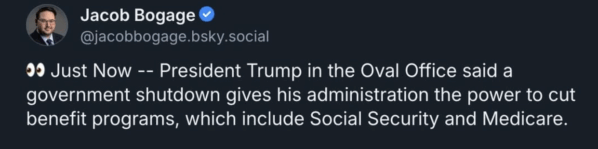

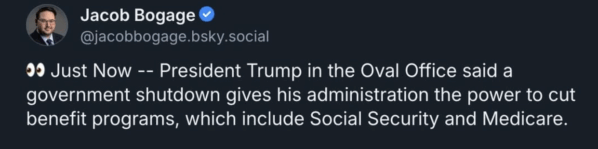

Worse yet, Trump claimed the power to cut benefits during the shutdown in order to punish Democrats. “We can do things during the shutdown that… are bad for them… We can do things medically and other ways, including benefits. We can cut large numbers of people.”

Cut large numbers of people? It was a word salad, for sure, but also a declaration that this President is willing to illegally cut crucial benefits — as revenge against his political opponents and their constituents.

The shutdown is disturbing on many levels. It happened because Trump and Republicans in Congress refused to simply extend subsidies to help people pay for health coverage under the Affordable Care Act. Without those subsidies, premiums could more than double — leaving millions of Americans unable to afford coverage (including many ‘near seniors’ who aren’t yet old enough for Medicare). Instead, the president who rammed through a $3 trillion tax cut mostly benefitting the rich is cynically using the shutdown as an excuse to inflict further damage on seniors, people with disabilities, and their families.

*******************************************************

A bonus gift from Trump and the Republicans: The announcement of the 2026 Social Security cost-of-living announcement (COLA) may be delayed because of the shutdown. Why? Because workers at the Bureau of Labor Statistics, which calculates the inflation rate used to determine COLAs, are deemed ‘non-essential’ employees. The COLA announcement, previously expected on October 15th, may have to be pushed back. If the shutdown drags on lone enough, this could even impact the payment of the new COLA — and hit beneficiaries right in the wallet. Thanks again, President Trump & The GOP!