Rep. Larson Introduces Social Security 2100: A Sacred Trust bill

Rep. John Larson (D-CT) introduced landmark legislation today to expand and strengthen Social Security, with leading members of the seniors’ advocacy community present – including NCPSSM president and CEO Max Richtman. In introducing his Social Security 2100: A Sacred Trust bill, Rep. Larson said that benefits must be boosted and Social Security financially fortified:

“Every day, hard-working Americans contribute to this great program that has never missed a payment and stands as a hallmark to what good governance is about. This bill is what the American people need and richly deserve. Now is the time for us to act.” – Rep. John Larson, 10/26/21

Congressman Larson unveiled the bill in the committee room of the House Ways and Means Social Security subcommittee, which he chairs. Speakers at the event noted that it is the same room where Social Security and Medicare legislation was hammered out in the 1930’s and 1960’s. Rep. Larson pointed out that Social Security benefits have not been enhanced during the past fifty years, and that many seniors are teetering on the edge of poverty — unable to make ends meet under the current benefit structure.

The bill has nearly 200 cosponsors and the enthusiastic backing of the advocacy community. The National Committee to Preserve Social Security and Medicare has championed the program’s expansion for many years, working closely with Rep. Larson’s office.

“To those who claim that no one in Washington has the courage to address Social Security’s challenges, or that the only solution is to cut benefits for future generations, Congressman Larson’s bill is a stunning refutation. For years, seniors and their advocates have demanded these improvements. Rep. Larson has admirably led the charge on Capitol Hill, and with this bill, he has delivered.” – Max Richtman, NCPSSM president and CEO, 10/26/21

Larson’s fellow subcommittee members and other cosponsors of the bill praised the new bill – and Rep. Larson’s leadership on this issue:

“Social Security is one of our nation’s greatest success stories. It stands as a monument to decency and dignity, and is the birthright of every American worker. We have a sacred responsibility to assure its preservation. No one knows that better than John Larson.” – Rep. Bill Pascrell (D-NJ), 10/26/21

The Sacred Trust legislation would boost benefits for everyone on Social Security and provide extra increases to vulnerable groups, such as widows, widowers, and low-wage workers. Rep. Lynda Sanchez, a cosponsor of the bill, said these increases will benefit communities of color, whose lifetime earnings are lower and who typically depend on Social Security for all or most of their income. This bill, she said, “would reach down into these communities and help them live out their older years in dignity.”

Rep. Alexandria Ocasio-Cortez said, “Social Security helped my family through” when her father died of cancer. Rep. Conor Lamb (center) emphasized the program’s importance to veterans.

Rep. Conor Lamb (D-PA) spoke of Social Security’s importance to disabled veterans, while Rep. Alexandria Ocasio Cortez (D-NY) reminded Millennials that they, too, benefit from the social insurance that the program provides all adults and children in the event of a loss of a spouse or family breadwinner – or when a worker becomes disabled.

“When I was a kid, my dad passed away of cancer. My mother was a domestic worker. Social Security checks helped my family through. To have that social safety net isn’t just good for us individually; it helps us feel like we are part of a society that respects our elders and values our vulnerable.” – Rep. Alexandria Ocasio-Cortez (D-NY), 10/26/21

The Sacred Trust bill contains several provisions that seniors and their advocates have sought for years, including:

- An across-the-board benefit boost for all beneficiaries

- Adoption of a fairer, more accurate COLA formula (CPI-E)

- Improving benefits for long-serving, low-wage workers;

- Repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) that penalize many public servants;

- Providing caregiver credits for time taken out of the workforce to care for children and other dependents.

“Women especially will benefit from this legislation. Women often leave the workforce to take care of loved ones, which lowers their lifetime earnings on which Social Security benefits are based. Under this bill, there will be a credit for those who take time off of work, which will enhance their retirement benefits.” – Rep. Jan Schakowsky, (D-IL), 10/26/21

To pay for these improvements and forestall a projected shortfall in the Social Security trust fund in 2034, the Sacred Trust Act adjusts the wage cap so that earnings above $400,000 are subject to Social Security payroll taxes. This is a long-overdue correction for rising income inequality, where the percentage of wages subject to Social Security payroll taxes has shrunk over the past four decades. It also aligns with President Biden’s pledge not to raise taxes on anyone earning under $400,000 per year.

“Social Security stands as a monument to decency and dignity,” said Rep. Bill Pascrell.

Rep. Larson said that he plans to hold hearings on the Sacred Trust legislation in November, followed by a markup and floor vote in the House. The bill would need at least ten Republican votes to pass the Senate (an outcome that is far from guaranteed) and move to the President’s desk for signature. “No one understands better than President Biden that Social Security is a sacred trust between the people and their government,” said Larson.

A Higher Minimum Wage Would Boost Women in Retirement

The national debate over raising the minimum wage may not seem to have much to do with retirement security. But it truly does, especially for women —– and women of color, in particular. As the Baltimore Sun reported this week, “Female workers make up a large share of low-wage workers, so they stand to benefit from the proposed federal increase as well as from planned phased-in increases in (the states).” The National Committee advocates for a $15 minimum/hour minimum wage, not only because we want workers to earn a living wage, but because it improves women’s retirement security.

We asked NCPSSM senior policy analyst Maria Freese, an expert in women’s retirement issues, why a higher minimum wage is so crucial for women in the long run. For more information, visit www.eleanorshope.org.

How does the minimum wage affect women’s retirement security?

A: The primary reason is that you more you make, the more you’re likely to save for retirement. If you’re a minimum wage worker and the minimum wage goes up — and you have more money in your pocket — you’ll have more money left over to save for retirement. Women’s retirement savings rates historically have lagged behind men’s.

Why does the minimum wage affect women more than men?

A: Because women tend to be in jobs that pay minimum wage, especially women of color. Typical ‘job tracks’ tend to steer women toward lower-paying service and retail positions. There are many reasons for this, including discrimination and a lack of encouragement and training for some women to seek more professional-level work that pays more.

Does the minimum wage affect retirement security in other ways?

A: Yes. It helps hourly wage-earners who have retirement plans at work (such as 401Ks), which are based on a percentage of wages. If your wages go up, your dollar amount contribution to the 401K goes up automatically. You don’t even have to make a change in your 401K plan for that to happen.

How does the minimum wage affect Social Security benefits?

A: Social Security benefits are based on lifetime earnings. If the minimum wage goes up, then many hourly workers earning the minimum wage will receive higher Social Security benefits when they retire.

How would a rise in the minimum wage benefit non-minimum wage earners?

A: There is a linkage between the wages of hourly workers at any given employer and what the employer pays salaried workers. Generally, the higher the wages at the bottom of the ladder, the better the pay at higher levels. It’s a ‘rising tide lifts all boats’ situation. So even if you don’t earn the minimum wage, your pay may go up if the minimum wage increases.

Many in the business community have claimed that raising the minimum wage to $15/hour would kill jobs and drive people out of business. What is your response to that?

A: It’s a myth. Not true. Real-world experience does not bear that out. Look at Washington state, for example. The state raised the minimum wage to nearly $15 an hour, and we have not seen an outflow of businesses or precipitous falloff in jobs (unrelated to the pandemic) compared with other states. In fact, from all indications, the business climate in Washington state (with its higher minimum wage) is very good.

Has there been any progress in Congress on raising the federal minimum wage from the current $7.50/hour?

A: Not much, unfortunately. A $15 federal minimum wage was part of President Biden’s original Build Back Better agenda, but the Senate parliamentarian ruled that the minimum wage couldn’t be raised through the budget reconciliation process — the vehicle that Democrats are using to enact other parts of the President’s agenda on a simple, party-line vote. It appears that enough Republicans would have to vote for a higher minimum wage in order for the measure to pass the Senate. There is more than one bill to do so in Congress, but don’t expect them to go too far until the makeup of the Senate changes. In the meantime, we’ll keep fighting for it.

Visit www.eleanorshope.org for more information!

Dems Should Unite Around Medicare Expansion, RX Drug Price Negotiation

***This is an update of a previous Entitled to Know blog post.***

For years, we have been advocating for the expansion of seniors’ Medicare benefits. Traditional Medicare doesn’t cover basic dental, hearing, or vision care – which are the gateways to good health. Many seniors on fixed incomes simply can’t afford this kind of care on their own, so they skip visits to the eye doctor, the audiologist, or the dentist. We and other seniors’ advocates cheered President Biden’s Build Back Better plan, which called for adding dental, vision, and hearing coverage to Medicare. That plan is having a difficult birth in Congress, as moderate and Progressive Democrats wrangle over the plan’s size and scope, in anticipation of passing it via the budget reconciliation process.

Democratic leadership has set its sights on a possible vote on the package by the end of October, but some Hill-watchers believe that may be an overly optimistic target – as the party’s factions seem no closer to agreement than they were a few weeks ago. Meanwhile, seniors and their advocates anxiously await the outcome – hoping that long sought-after Medicare expansions will finally be enacted – and knowing that there is a limited window of opportunity to get it done, given that Democrats may lose control of one or both houses of Congress in 2022.

Policy analysts say that the most endangered of the potential new benefits is dental care, because it likely would be the most costly of the putative Medicare expansions – and would take the longest to get up and running. Dental coverage also faces dogged opposition from the American Dental Association (ADA), which is lobbying hard against it. Some Democrats have proposed dental vouchers as a compromise measure that could be activated much more quickly than a full-out dental benefit. But seniors’ advocates are wary of vouchers, because dentists could simply increase their prices significantly above the value of the vouchers, negating any serious net out-of-pocket savings for patients. Vouchers are also regarded as a big step toward privatization of Medicare, which advocates and the majority of the public rightly oppose. The ADA (and some Democrats) have even proposed the wrong-headed idea of means-testing any new benefits – so that only the poorest of beneficiaries would be eligible.

These roadblocks to Medicare expansion could have grave real-life consequences. Forgoing dental, vision, and hearing care increases seniors’ risk of serious injury and other health issues, which endangers beneficiaries and costs Medicare even more in the long run.

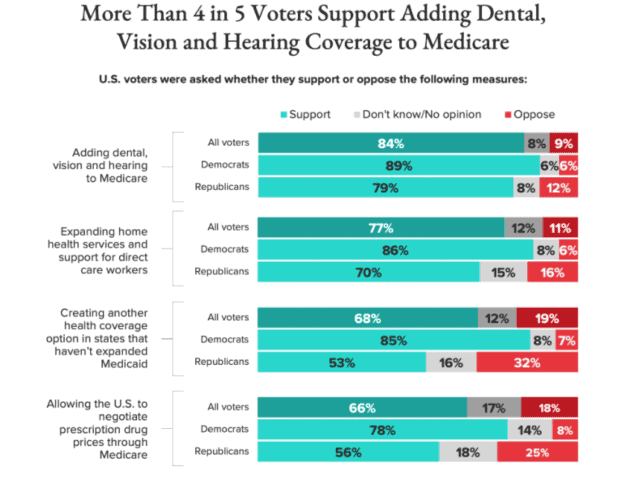

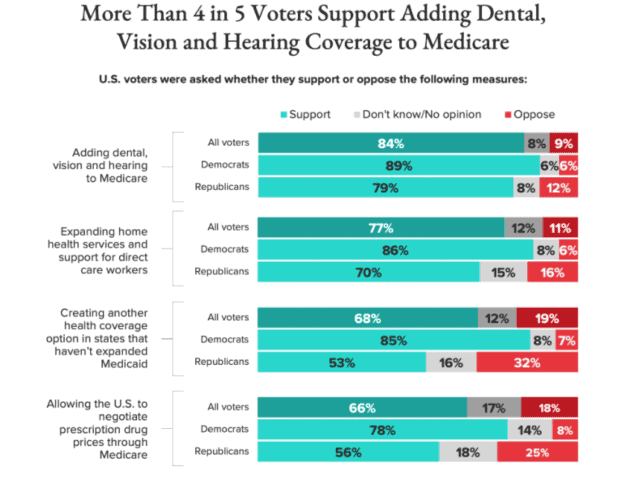

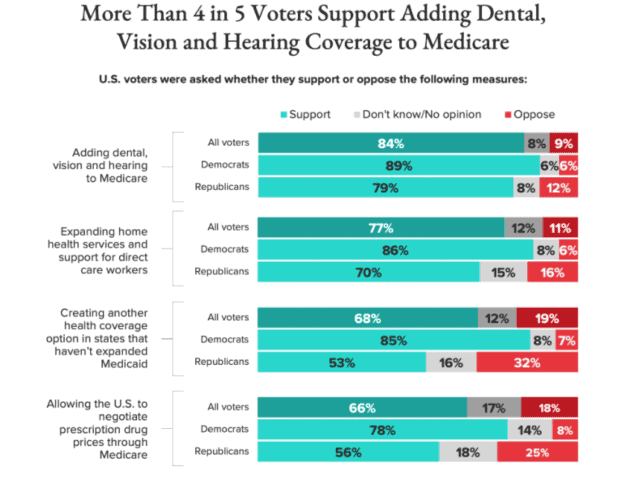

One thing is clear: the public wants Medicare expanded. According to a new Morning Consult poll, 84% of voters support adding dental, vision and hearing coverage to traditional Medicare. That number includes 79% percent of Republicans. Clearly, there is immense bipartisan support among everyday Americans for giving seniors these crucial coverages.

Morning Consult poll

Originally, Democrats wanted to pay for expanding Medicare with savings achieved through prescription drug pricing reform. The House-passed Elijah Cummings Lower Drug Costs Now Act (H.R.3) would save Medicare some $450 billion over ten years, mainly by allowing the program to negotiate prices directly with Big Pharma. But Democratic centrists in both chambers have balked at Medicare price negotiation, leaving the fate of the measure uncertain. Analysts say that a compromise negotiation measure may emerge, but that it could have less impact on actual drug prices.

On this issue, the public has made its preferences crystal clear. Poll indicates that a majority of voters across party lines support Medicare drug price negotiations. Republicans in Congress have called this commonsense proposal “Socialism,” even though the V.A. has been negotiating prices with drug-makers for years – and realizing significant savings in the process. According to one analysis, Medicare could save some 40% in drug costs if it were allowed to negotiate as the V.A. does. Of course, Big Pharma has launched an expensive lobbying effort and ad blitz against Medicare negotiation.

If drug pricing legislation is weakened in the budget reconciliation process, there will be less savings to the Medicare program. According to Adcock, that may limit the scope of dental, hearing, and vision coverage that can be added to Medicare. In fact, one or more of those coverages may not make it into the final legislation if there aren’t sufficient Medicare savings to pay for them.

“It’s possible we will see Medicare expansion enacted by the end of the year. It depends on how the Democrats are able to finesse this process. I wouldn’t bet the farm on it, but there’s a decent chance we’ll get something.” – Dan Adcock, NCPSSM Director of Government Relations and Policy

Seniors and their advocates will be understandably frustrated and disappointed if this historic opportunity to expand Medicare and tame Big Pharma price increases slips away because of intra-party conflicts. Voters delivered the White House and the House and Senate to Democrats in 2020, but left the party with slim majorities leaving little room for defections. As one analyst puts it, “Trying to do transformational change with a razor thin majority was going to be a daunting task in the first place. It’s going to remain an uphill slog.” We hope that Congress will keep slogging until seniors receive the coverage expansions they need to stay healthy — and some sorely-needed relief from soaring drug prices.

5.9% COLA is Good, But Seniors Need a Permanent Boost

The federal government announced today that Social Security beneficiaries will receive a 5.9% cost-of-living adjustment (COLA) in 2022. That’s about $92 extra per month for the average beneficiary. According to USA Today, “the sharp increase is tied to a COVID-19-fueled spike in inflation after years of paltry consumer price increases.” The 5.9% COLA is the largest in nearly forty years.

“This is welcome news for seniors, who need a boost to confront ever-rising living costs. However, the fact that this is the highest COLA since 1982 does not speak well for Social Security’s ability to keep pace with those expenses. The average COLA for the past ten years was only 1.65%. In three of the past 12 years the COLA was zero. Were it not for COVID-related inflation, the COLA for 2022 likely would have been more in line with the modest increases of decades past.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

Meanwhile, the cost of essentials such as housing, food, and health care have skyrocketed. So, while an average $92 per month increase in Social Security benefits is helpful, it may only make a dent in many seniors’ ability to pay their monthly bills. Not to mention that an increase in Medicare premiums – to be announced in November – will take a bite out of most beneficiaries’ COLAs.

More than half of seniors receive over 50 percent of their income from Social Security, and it provides at least 90 percent of income for more than one-in-five seniors. They deserve a COLA formula that reflects their spending patterns. The current formula, the Consumer Price Index for Urban Wage Earners (CPI-W), simply does not. That’s why we support legislation to adopt the Consumer Price Index for the Elderly (CPI-E), which is designed to calculate the true impact of inflation on seniors.

But the problem runs deeper. Seniors haven’t received an increase in their baseline monthly benefits in fifty years. The average annual benefit is only a few thousand dollars above the federal poverty line. It is time to boost benefits for everyone on Social Security. Rep. John Larson (D-CT) has for years been leading an effort, which we support, to expand Social Security, including an across-the-board benefit increase — and a specific boost for lower income workers.

“Congress has failed seniors and that needs to change. Next week we will be introducing the bill, Social Security 2100: A Sacred Trust, to strengthen Social Security and expand benefits. The time is now to enhance Social Security.” – Rep. John Larson, 10/13/21

America’s seniors have paid into the system their entire working lives. They shouldn’t have to walk a financial tightrope every month, in constant fear of falling into poverty. This Congress, representing the wealthiest country in the world, must do better for its older – and most vulnerable – citizens.

What’s Happening with Budget Reconciliation Legislation Affecting Seniors?

Q: Is it still realistic that the Democrats’ final reconciliation bill will include dental, vision, and hearing coverage for Medicare beneficiaries?

A: It’s hard to know at this point. Benefits improvements may be scaled back, especially if prescription drug reforms are weakened. Democrats had planned to use savings from prescription drug reform to pay for some of these expansions, but now those reforms may not be as robust and produce fewer savings. There are other ways to pay for Medicare expansion, such as higher taxes on the wealthy and big corporations included in the budget reconciliation bill approved by the House Ways and Means Committee. But how this revenue will be used in the final spending bill is still uncertain.

Q: If Medicare expansion is pared back, which of the new coverages would likely survive?

A: For months, the odds-on favorite was dental benefits. But the problem is that a dental benefit will take longer to implement. It could take anywhere from 3-5 years to design and put into effect. From a policy standpoint, that’s a laudable objective, but from a political standpoint, it creates a problem. Vision and hearing coverage would be easier to assemble and get off the ground – maybe just a year or two.

Q: Are there any workarounds for getting a dental benefit up and running sooner?

A: Some centrist Democrats have proposed giving beneficiaries dental vouchers in lieu of a formal benefit. The problem with that is that dentists could raise prices for their services so that the net out-of-pocket expense for seniors would still be high, even with the vouchers. The voucher plan might also deprive CMS of money and administrative bandwidth to develop a fuller dental benefit in the future. For these reasons, we don’t support vouchers. However, in the meantime, Medicare could expand existing coverage for dental care considered “medically necessary,” so that more dental procedures would be covered moving forward.

Q: Seniors’ advocates have pressed very hard for Medicare to be allowed to negotiate prescription drug prices, but the fate of that provision in the reconciliation bill is unclear?

A: I would say that Medicare price negotiation is not dead, but is on ‘life support.’ The final reconciliation package is unlikely to have full-on negotiation. But we and other seniors’ advocates are still pushing for it. And we are encouraging our members and supporters to contact their members of Congress to demand Medicare price negotiation. Unfortunately, Big Pharma has been pulling out all the stops to stop Medicare negotiation, and the industry wields outsized power on Capitol Hill. Centrist Democrats, especially in the Senate, may not vote for a final package if it contains price negotiation.

Q: Without Medicare price negotiation, what kind of drug cost reform can we still expect?

A: We expect to at least see something resembling the Grassley-Widen bill (first introduced in the previous Congress), which would cap drug price increases at the rate of inflation and peg some prices to what other countries pay for drugs. These reforms would not be as effective as Medicare negotiation, but they would definitely lower what seniors pay for prescription drugs. Given that many seniors can’t currently afford their medications, these other reforms would be a step in the right direction and provide some much-needed relief.

Q: When do you think the reconciliation package will actually be finalized and brought to the floor for a vote?

A: I think it’s unlikely to be this week. The hold-up is that Democrats need a bill that can pass both the House and Senate. Leadership is trying to ascertain what centrists will support in the end. The problem is that some centrists have said what they’re against in the reconciliation package, but not what they’re for. Until that is made apparent, it will be hard to bring a final bill to the floor.