Seniors’ Voting Rights on the Line As Schumer Vows Senate Action

Senate Majority Leader Chuck Schumer (D-NY) has set a self-imposed deadline of January 17th – Martin Luther King Day – to pass sweeping voting rights legislation. This will be a heavy lift given opposition from Democratic Senators Joe Manchin and Kyrsten Sinema to adjusting the filibuster, an essential step in passing voting rights legislation without Republican votes. Nevertheless, President Biden and Hill Democrats feel compelled to try, given that the voting rights of millions of Americans – including and especially seniors – are very much at stake with the 2022 midterm elections approaching.

The push for new federal voting rights legislation became more urgent when Republican-controlled state legislatures across the country began passing restrictive voting laws in the wake of the 2020 election, based on the Big Lie that it was plagued by massive voter fraud.

“Anything that makes it harder for people to cast their vote will have an oversized impact on seniors.” – Florida state Sen. Jeff Brandes

From Florida to Arizona, onerous state laws would make it harder for seniors to vote by imposing new restrictions on mail-in voting, drop boxes, and early voting – all of which older Americans have come to depend on in exercising their right to cast ballots. Some 54% of senior voters cast votes by mail in 2020, according the Chicago Tribune.

The new restrictions would particularly impact seniors of color, many of whom continue to prefer voting in person. Some of the laws erect obstacles to in-person voting, affecting minority precincts the most. Restricted voting hours, stringent ID requirements, and arbitrary prohibitions (enacted in Georgia) against volunteers providing voters with water and food while they wait in overly long lines, seemed designed to target minority voters (especially elderly ones).

“Most people who live in (minority) wards are older African Americans who like to go to the polls because they fought for their right to vote. But… some polling stations (in 2020) were lacking poll workers and not abiding by health guidelines during the coronavirus pandemic.” – St. Louis Public Radio

It’s no secret that Republican state legislators have enacted these laws in order to suppress Democratic votes, alarmed that some traditionally red states turned purple in 2020. But observers have noted that Republicans’ fixation on limiting mail-in voting, for instance, could backfire, as many of their voters are seniors who cast ballots by mail.

“Smaller rural counties have a large elderly population who typically choose to vote absentee because of weather or health concerns. Why are we making it harder for them to vote?” Rebecca Bissell, Adams County, FL Elections Commissioner

The Senate Democrats’ voting rights bill, based on legislation passed in the House in 2021, would neutralize many of the objectionable voting laws enacted in the states. It would, in effect, restore many of the Voting Rights Act protections that the Supreme Court invalidated in 2013, giving the federal government greater oversight of state election laws.

The Senate voting rights bill would also:

*Make Election Day a public holiday;

*Mandate same-day voter registration;

*Guarantee that all voters can request mail-in ballots;

*Restore federal voting rights for ex-felons.

In September, the National Committee to Preserve Social Security and Medicare sent letters to Senators Manchin and Sinema, imploring them to support changes to the filibuster that would allow voting rights legislation to pass the Senate.

“We urge you to support a narrow change to the filibuster rule to allow the Senate to approve new voting rights legislation by a simple majority vote. This crucial legislation will help to protect our democracy and the right to vote for all Americans.” – NCPSSM President Max Richtman, 9/21/21

Unfortunately, neither Senator has budged yet, effectively blocking commonsense legislation that would make it easier for their own constituents to vote. In order to rally support, President Biden will campaign for a “filibuster carveout” during a scheduled trip to Georgia on Tuesday.

Meanwhile, former First Lady Michelle Obama announced on Sunday that she will lead “a coalition of voting rights organizations to register more than a million new voters in the run-up to this year’s mid-term elections,” reports Politico.

With the political muscle of the President and former First Lady behind it, voting rights legislation may have a slightly better chance of passage. At the very least, a Senate floor vote will force Senators to go squarely on the record as supporting – or opposing – fundamental rights cherished by seniors, people of color, and, presumably, all Americans.

Trump Plan to Privatize Medicare Is Alive and Well

Seniors and their loved ones may be alarmed to learn that there is an insidious, but largely unpublicized effort underway to gradually privatize Medicare. According to media reports, some traditional Medicare patients are now being placed in for-profit managed care plans without even knowing, thanks to a Trump administration policy that is still in effect. Under this pilot program, called “Direct Contracting,” private companies are supervising selected Medicare patients’ care, even though the beneficiaries signed up for traditional Medicare.

“The experiment is likely to make traditional Medicare a gold-mine for for-profit companies, who will make money for executives and shareholders by establishing complex administrative rules that undermine access to care and by imposing high out-of-pocket costs that discourage care.” – Common Dreams, 3/8/21

Up to now, traditional Medicare has been administered exclusively by the government, with no profit motive – unlike the Medicare Advantage program, which is run by private, corporate interests. The Direct Contracting model is a serious, but lesser-known move toward privatizing the entire Medicare program – something the majority of the public and seniors’ advocates fiercely oppose. With good reason.

“Instead of paying doctors and hospitals directly for seniors’ care, Medicare gives these middlemen (called Direct Contracting Entities, or DCEs) a monthly payment to cover a defined portion of each seniors’ medical expenses. DCEs are then allowed to keep what they don’t pay for in health services, a dangerous financial incentive to restrict and ration seniors’ care.” – Rep. Pramila Jayapal, The Hill, 12/9/21

“The lure of Direct Contracting for these companies is potential profits. The limits on the amount of money a Direct Contracting entity can keep that’s not used for a patient’s medical needs is significantly more generous than those imposed by Medicare Advantage.” – Helaine Olen, Washington Post, 12/13/21

Worse yet, the Direct Contractors needn’t have any experience in the health care field. Venture capital and private equity firms (some with ties to former Trump administration officials) are among the corporate concerns “who are lined up like pigs at the trough to get their hands on taxpayer dollars,” according to Helaine Olen of The Washington Post. In fact, Congress has no oversight authority over the selection of direct contractors in the pilot program.

“This should be a huge red flag for taxpayers and anyone concerned about funding Medicare for future generations,” says Rep. Japyal, who sits on the House Budget Committee.

Privatized plans generally cost the Medicare program more money and can erect barriers to proper care, in the form of higher out-of-pocket costs, denied claims, and limited networks of health care providers. In other words, patients suffer while the private plans make billions.

Medicare Advantage plans have also been caught overcharging the program (i.e., American taxpayers) and using other deceptive tactics. “The incentive is to deny as much care as possible,” health advocate Diane Archer told The Intercept. “It’s also to delay as much care as possible.”

The Direct Contracting model has different rules than Medicare Advantage, but the pilot program clearly incentivizes profit over patient care.

“While Traditional Medicare spends an impressive 98 percent of its budget on patient care, Direct Contracting Entities only spends 60 percent of our tax dollars on patient care — keeping up to 40% of revenues for their own profit and overhead.” – Common Dreams, 3/8/21

Seniors’ advocates and champions in Congress are pushing-back on the Direct Contracting program, insisting that the Biden administration cancel it. According to Rep. Jayapal, advocates have met with Health and Human Services Secretary Xavier Becerra to make their objections known, and have demanded that Congress hold hearings on the program.

Rep. Pramila Jayapal calls the Trump-era policy a” dangerous financial incentive to restrict and ration seniors’ care.”

Four Democratic members of Congress sent Becerra a letter last May, requesting that the Direct Contracting program be frozen because it funnels patients into “Medicare Advantage-like plans, (which) not only eliminates beneficiary choice, but also erects more barriers and provides fewer consumer protections for beneficiaries.”

Olen reports in The Post that the Biden administration put a “temporary stop” on “an even more egregious version of the (pilot) program.” But “CMS, HHS, and ultimately, the White House are continuing to press ahead with Direct Contracting, even though they could end it if they choose.”

Despite journalists’ efforts to shine light on the program and objections from members of Congress and the advocacy community, the Direct Contracting program – a vestige of the Trump administration that favored profits over patients – proceeds unimpeded.

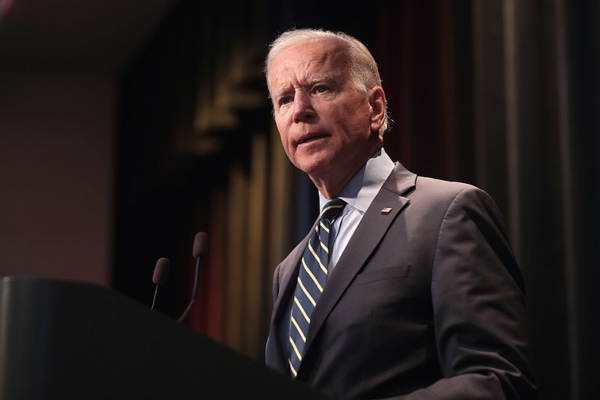

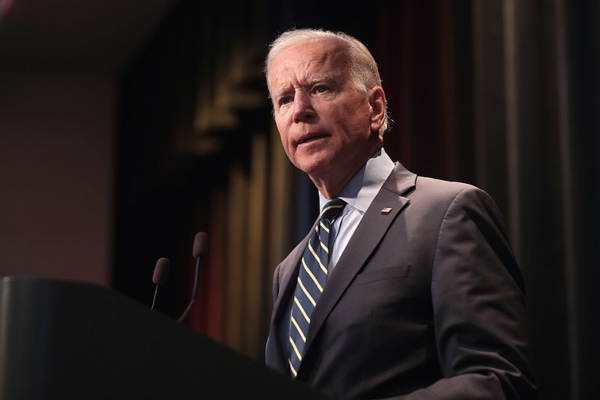

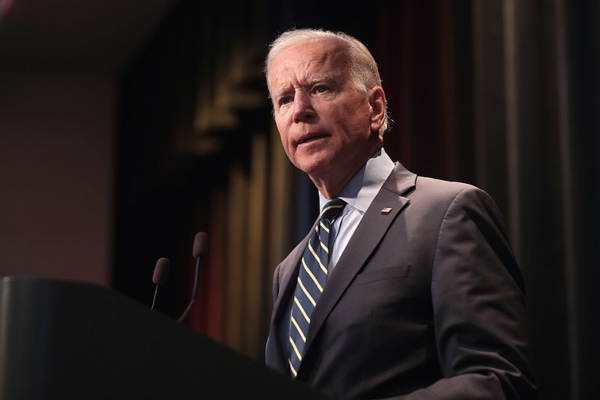

President Biden Should Roll Back Medicare Premium Hike

photo courtesy of Wikimedia Commons

Note: Since this post was published, the drugmaker Biogen reduced the price of Aduhelm from $56,000 to $28,200. It is unclear, however, whether that will lower the scheduled Medicare Part B premium increase for 2022.

*************************************************************************************************************************

The National Committee is urging President Biden to mitigate the announced $21 monthly increase in Medicare Part B premiums. President and CEO Max Richtman sent a letter to the White House this week asking President Biden to intervene before the premium hike takes effect in 2022.

“To many seniors and people with disabilities living on a fixed income, a $21 increase will cause hardship. The Part B premium hike will consume a significant amount of their Social Security Cost of Living Adjustment (COLA) at a time when inflation is making so many other goods and services… more expensive.” – NCPSSM letter to President Biden, 12/14/21

The premium increase is driven partly by the introduction of the new Alzeheimer’s drug, Aduhelm, with a price tag of $56,000. The cost of Aduhelm was factored into the 2022 premium hike in the event that Medicare Part B covers it, which is not even certain.

“Beneficiaries in traditional Medicare without supplemental coverage would be forced to pay a 20 percent co-payment of $11,200 out of pocket for Aduhelm. This medication is ‘Exhibit A’ for what is wrong with drug pricing in the United States and why Medicare should have broad authority to negotiate prescription drugs prices, including medications under patent or exclusivity.” – NCPSSM letter, 12/14/21

The current version of President Biden’s Build Back Better plan would not allow Medicare to negotiate the price of new drugs like Aduhelm. Build Back Better originally included more robust price negotiation, but it was diluted after objections from Democratic centrists.

Independent analysis places the value of Aduhelm at a fraction of its $56,000 a year cost.

“What makes Aduhelm’s exorbitant cost all the more unconscionable is that many in the scientific establishment do not think the drug is even safe or effective. The American Academy of Neurology has raised concerns about the drug’s safety — it can cause brain swelling — and the ‘absence of convincing scientific evidence of efficacy.’” – NCPSSM letter, 12/14/21

The National Committee is calling on President Biden to take steps to prevent Aduhelm from driving up the cost of Part B premiums for seniors and people with disabilities. In addition, NCPSSM urges the President to reinstate the ‘reasonable pricing clause’ established by the National Institutes of Health in 1989 but later revoked. “Medicare beneficiaries and taxpayers should pay a reasonable price for effective drugs that are worth the amount manufacturers charge,” writes Richtman.

“It’s unlikely that the President would roll back the entire Part B premium increase,” says NCPSSM legislative and policy director Dan Adcock. “It’s more plausible that he would reduce the premium by about $11.50 per month, the amount attributable to the cost of Aduhelm.”

NCPSSM President Testifies at Hill Hearing on Social Security Legislation

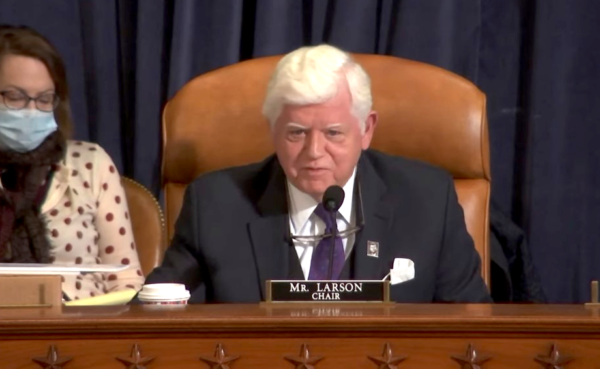

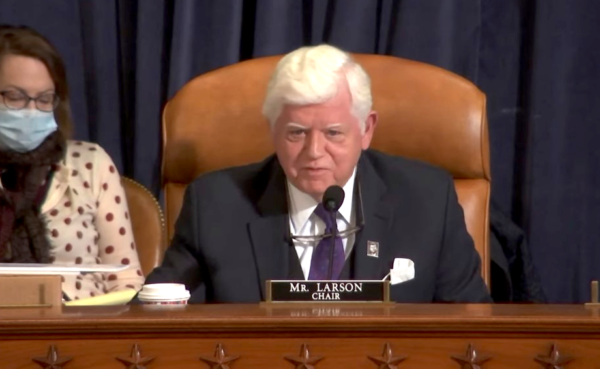

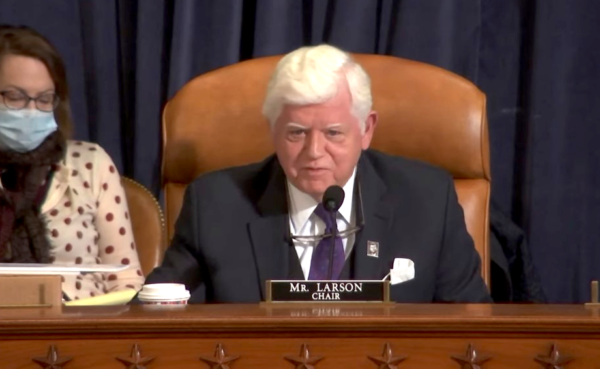

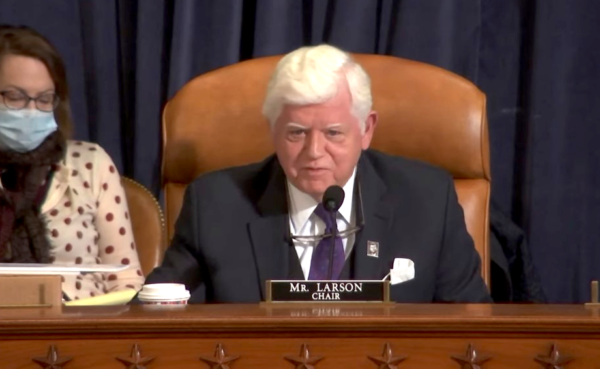

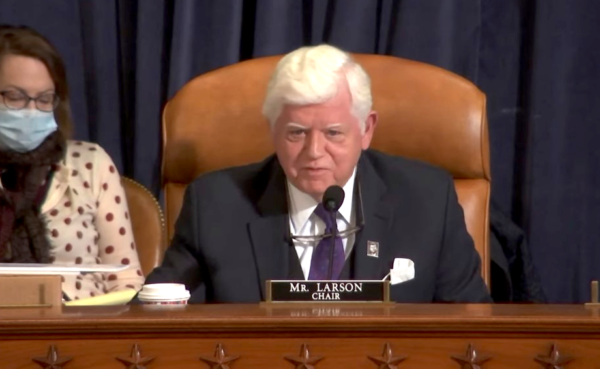

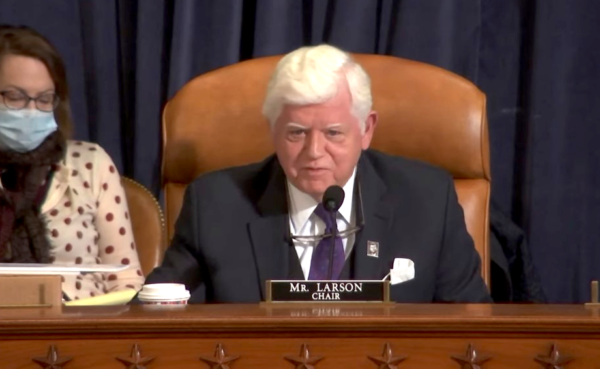

Social Security must be expanded and strengthened now. That was the message National Committee president Max Richtman delivered in testimony today before the House Ways and Means Social Security subcommittee, chaired by Rep. John Larson (D-CT). This was the first and possibly only hearing on Congressman Larson’s Social Security 2100: A Sacred Trust legislation, which would boost benefits and extend the solvency of the program’s trust fund.

“The last major Social Security reform was almost four decades ago and the value of some of its benefits have eroded. Enactment of the Social Security 2100: A Sacred Trust would provide critical financial support to millions of your constituents, helping them afford their medications and put food on the table…” – Max Richtman, NCPSSM president, 12/7/21

Congressman Larson’s bill would give all beneficiaries a 2% benefit increase, improve the formula for calculating COLAs (cost-of-lving adjustments), and enhance benefits for especially vulnerable groups – including widows and widowers, the lowest income earners, and the ‘oldest of the old’ (seniors 85 and over).

The National Committee to Preserve Social Security and Medicare endorsed Rep. Larson’s bill when he introduced it in October, believing that current benefits and COLAs are inadequate for today’s seniors. Even before COVID pummeled America’s senior population, too many older Americans were struggling to keep their heads above water financially in the face of rising costs for everything from health care to prescription drugs to housing. “Five million seniors are living in poverty in wealthiest nation in world,” said Rep. Larson.

At the same time, two of the legs in the old ‘three-legged stool’ of retirement security – pensions and retirement savings – are dwindling, leaving Social Security as the main source of income for nearly half of all retirees.

“The nation is facing a retirement income crisis. Social Security is the most important source of retirement income, last expanded when Richard Nixon was president. A vote on Social Security 2100 will begin to restore the intangible, but essential benefit of retirement security which too many Americans have lost.” – Nancy Altman, President, Social Security Works

The “Sacred Trust” bill would raise revenue for the program by adjusting the payroll wage cap so that high income earners begin to pay their fair share. The cap is currently set at $142,800 in annual wages. The bill would re-impose payroll taxes at $400,000 in annual income and above, bringing billions of dollars in new revenue into the system. If Congress fails to act, the Social Security trust fund will become depleted in 2034.

Amy Matsui of the National Women’s Law Center testifies during Tuesday’s hearing.

Other witnesses at today’s hearing spoke of the importance of expanding Social Security for women and minority communities. Amy Matsui, Director of Income Security at the National Women’s Law Center, pointed out that “the cumulative impact of a lifetime of economic disparities decreases women’s retirement security.” She said that the lifetime earnings of black and Latino women is typically lower than other women’s, translating into lower Social Security benefits.

Yanira Cruz, President and CEO of the National Hispanic Council on Aging, testified that Latinos, in particular, would benefit from the Social Security 2100: A Sacred Trust:

“Many Hispanics are among the working poor… and they depend on Social Security for economic security after a lifetime of hard work. They tend to work in jobs that pay lower wages and are less likely to have pension coverage. Social Security is the sole source of income for more than 40% of Hispanic seniors.” – Yanira Cruz, President & CEO, NHCOA

Yanira Cruz of the National Hispanic Council on Aging

While paying lip service to preserving Social Security, Republican witnesses argued that Rep. Larson’s bill is unnecessary and overly broad, claiming that most seniors are financially secure and don’t need better benefits. They claimed that improving Social Security would harm the economy, when, in fact, the program provides more than one trillion dollars in economic stimulus every year. Andrew Biggs of the American Enterprise Institute testified that it would be better to cut benefits (mainly by raising the retirement age) and privatize Social Security than to enact Rep. Larson’s bill.

Congressman Larson fired back, saying that conservatives are suggesting that the country would be better off without Social Security. He accused Republicans of wanting to “dismantle Social Security brick by brick,” which he said would be “devastating to the American people.”

“That is not where the American people are. They know Social Security has strengthened the fabric of this nation and will continue to do so as long as Congress acts.” – Rep. John Larson, Chairman of the House Ways & Means Social Security subcommittee, 12/7/21

Majorities of Americans across party lines support the main provisions of Rep. Larson’s bill, including a benefit boost, improved COLA formula, and adjusting the payroll wage cap.

Social Security subcommittee chairman John Larson: “The time to act is now.”

Paraphrasing Dr. Martin Luther King, Congressman Larson, spoke of “the fierce urgency of now,” imploring Congress to take action to boost and strengthen Social Security immediately. NCPSSM President Max Richtman reinforced the urgency of the situation in his testimony:

“Congress simply cannot sit by and allow millions of our fellow citizens, who worked hard their entire lives, to spend their golden years struggling to get by. That’s why we urge you to alleviate the suffering of your senior constituents by voting now on Rep. Larson’s bill.” – Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare

The next step for the Social Security 2100: A Sacred Trust bill is a committee markup. After that, Congressman Larson hopes the legislation will move quickly to the House floor for a vote. He wants members of Congress to go on record as having voted for – or against – improving Americans’ earned benefits. At today’s hearing, Republican members of the Social Security subcommittee pledged to vote against the bill in its current form.

Read Max Richtman’s complete written testimony here.

Stop Scaring Millennials About the Future of Social Security

Some tropes never die. The one about Millennials not being able to rely on Social Security when they retire re-surfaces every few months, most recently in an article by John Csiszar on the financial news site GoBankingRates. The article, Here’s How Social Security Will Look for Millennial Retirees, paints a bleak picture for the future of a program that has provided seniors with basic financial security since the 1930s.

It is true that, if Congress takes no action, the combined Social Security trust funds will become depleted in 2034, after which the program could pay 76% of benefits. But that is far from a forgone conclusion. Democrats in Congress are taking action to avert trust fund insolvency — and actually boost benefits at the same time. Rep. John Larson’s Social Security 2100 Act: A Sacred Trust, which he just introduced this fall, would do both — and improve the cost-of-living adjustment formula (COLA) for seniors.

But Csiszar suggests that in order to avoid insolvency, Congress would have little choice but to raise the Social Security retirement age to 70. What he doesn’t say is that this would be a huge benefit cut. Raising the retirement age from 67 to 70 would drastically reduce the net amount of income workers receive during the entirety of their senior years, especially if they must file for benefits before their full retirement age.

Nonetheless, Csiszar presents it as a reasonable proposition, since Americans are living longer than when the program was created:

“For starters, in 1930, just before Social Security came to be, life expectancy in the U.S. was just 58 years for men and 62 years for women. As of 2020, those numbers have jumped to 75.1 years and 80.5 years, respectively.” – GoBankingRates, 11/29/21

Just because Americans are living longer does not mean they can work until they are seventy – or that they do not deserve a financially secure retirement after the current eligibility age of 67. (The retirement age was raised from 65 by previous Social Security reform legislation.) What’s more, seniors in their late 60s who still want to work may be laid off – or unable to find employment – because of pervasive and enduring age discrimination in the workplace.

The fact that raising the retirement age to 70 could save the program $120 billion (according to the article) does not make it a wise policy. As we have often pointed out, seniors are not figures on a ledger; they are human beings with real needs like everyone else. Seniors living longer need more – not less – retirement income over a longer period of time.

There would be no need to even consider raising the retirement age for Social Security if the program can bring in more revenue. Rep. Larson’s bill would achieve that by adjusting the payroll wage cap so that high earners would contribute payroll taxes on income exceeding $400,000 per year. But Csiszar turns this equitable fix into a negative, claiming that it will hurt younger workers:

“High earners would be forced to fork over additional taxes to the Social Security program, providing additional funding for retirees. This could translate to higher tax bills for top-earning millennials.” – GoBankingRates, 11/29/21

This is a disingenuous argument. Adjusting the cap would not impact the majority of wage earners (since most workers make significantly less than $400,000 per year). The average Millennial earned $47,000 in 2021, placing that age group well below the income level where they would have to contribute additional payroll taxes. Meanwhile, it’s reasonable that high income earners pay their fair share into Social Security, in exchange for higher benefits.

Instead of encouraging Millennials to support commonsense reform like Rep. Larson’s bill, Csiszar prefers to sow fear that Social Security won’t be around when this generation retires.

“Rather than relying on Social Security benefits that may or may not be there, Millennials should take the decades they still have ahead of them to max out 401(k) and IRA contributions and build up their supplementary savings to the point where they won’t need to rely on Social Security.” – GoBankingRates, 11/29/21

While there’s nothing wrong with encouraging Millennials to save for retirement, it is becoming increasingly difficult for workers to put away money. Rising living costs and stagnant wages have made it enough of a challenge for most Millennials to pay their monthly bills, let alone save for retirement. Older Americans are relying more and more on their Social Security benefits for financial survival.

Millennials are expected to receive twice as much as today’s retirees in retirement benefits as today’s seniors do, and they will need every penny. Meanwhile, many younger adults are unaware that Social Security is there for them in case of disability or the death of a family breadwinner. The average worker with a spouse and two children would have to purchase more than $600,000 in life and disability insurance to replace the protections Social Security provides. In fact, some 1.2 million millennials already receive Social Security benefits.

Millennials will rely on Social Security even more than previous generations. But the program’s opponents want younger adults to believe Social Security won’t be around when they need it.

Scaring Millennials into believing Social Security won’t be there for them upon retirement can become ‘self-fulfilling prophecy.’ If Millennials, along with other age groups, don’t support commonsense improvements to Social Security of the kind Rep. Larson offers, then the program may suffer from a revenue shortfall in the 2030s, triggering severe benefit cuts. Opponents of the program have long attempted to divide the generations in order to weaken support for Social Security.

The best way to ensure that Social Security will be there for future retirees is for the American people to unite around an agenda to increase revenues and boost benefits. In so doing, we must reject conservative scare tactics designed to undermine the program. We are not saying that Csiszar falls into this camp, but his article clearly is influenced by propaganda that says we must cut Social Security in order to save it.

Seniors’ Voting Rights on the Line As Schumer Vows Senate Action

Senate Majority Leader Chuck Schumer (D-NY) has set a self-imposed deadline of January 17th – Martin Luther King Day – to pass sweeping voting rights legislation. This will be a heavy lift given opposition from Democratic Senators Joe Manchin and Kyrsten Sinema to adjusting the filibuster, an essential step in passing voting rights legislation without Republican votes. Nevertheless, President Biden and Hill Democrats feel compelled to try, given that the voting rights of millions of Americans – including and especially seniors – are very much at stake with the 2022 midterm elections approaching.

The push for new federal voting rights legislation became more urgent when Republican-controlled state legislatures across the country began passing restrictive voting laws in the wake of the 2020 election, based on the Big Lie that it was plagued by massive voter fraud.

“Anything that makes it harder for people to cast their vote will have an oversized impact on seniors.” – Florida state Sen. Jeff Brandes

From Florida to Arizona, onerous state laws would make it harder for seniors to vote by imposing new restrictions on mail-in voting, drop boxes, and early voting – all of which older Americans have come to depend on in exercising their right to cast ballots. Some 54% of senior voters cast votes by mail in 2020, according the Chicago Tribune.

The new restrictions would particularly impact seniors of color, many of whom continue to prefer voting in person. Some of the laws erect obstacles to in-person voting, affecting minority precincts the most. Restricted voting hours, stringent ID requirements, and arbitrary prohibitions (enacted in Georgia) against volunteers providing voters with water and food while they wait in overly long lines, seemed designed to target minority voters (especially elderly ones).

“Most people who live in (minority) wards are older African Americans who like to go to the polls because they fought for their right to vote. But… some polling stations (in 2020) were lacking poll workers and not abiding by health guidelines during the coronavirus pandemic.” – St. Louis Public Radio

It’s no secret that Republican state legislators have enacted these laws in order to suppress Democratic votes, alarmed that some traditionally red states turned purple in 2020. But observers have noted that Republicans’ fixation on limiting mail-in voting, for instance, could backfire, as many of their voters are seniors who cast ballots by mail.

“Smaller rural counties have a large elderly population who typically choose to vote absentee because of weather or health concerns. Why are we making it harder for them to vote?” Rebecca Bissell, Adams County, FL Elections Commissioner

The Senate Democrats’ voting rights bill, based on legislation passed in the House in 2021, would neutralize many of the objectionable voting laws enacted in the states. It would, in effect, restore many of the Voting Rights Act protections that the Supreme Court invalidated in 2013, giving the federal government greater oversight of state election laws.

The Senate voting rights bill would also:

*Make Election Day a public holiday;

*Mandate same-day voter registration;

*Guarantee that all voters can request mail-in ballots;

*Restore federal voting rights for ex-felons.

In September, the National Committee to Preserve Social Security and Medicare sent letters to Senators Manchin and Sinema, imploring them to support changes to the filibuster that would allow voting rights legislation to pass the Senate.

“We urge you to support a narrow change to the filibuster rule to allow the Senate to approve new voting rights legislation by a simple majority vote. This crucial legislation will help to protect our democracy and the right to vote for all Americans.” – NCPSSM President Max Richtman, 9/21/21

Unfortunately, neither Senator has budged yet, effectively blocking commonsense legislation that would make it easier for their own constituents to vote. In order to rally support, President Biden will campaign for a “filibuster carveout” during a scheduled trip to Georgia on Tuesday.

Meanwhile, former First Lady Michelle Obama announced on Sunday that she will lead “a coalition of voting rights organizations to register more than a million new voters in the run-up to this year’s mid-term elections,” reports Politico.

With the political muscle of the President and former First Lady behind it, voting rights legislation may have a slightly better chance of passage. At the very least, a Senate floor vote will force Senators to go squarely on the record as supporting – or opposing – fundamental rights cherished by seniors, people of color, and, presumably, all Americans.

Trump Plan to Privatize Medicare Is Alive and Well

Seniors and their loved ones may be alarmed to learn that there is an insidious, but largely unpublicized effort underway to gradually privatize Medicare. According to media reports, some traditional Medicare patients are now being placed in for-profit managed care plans without even knowing, thanks to a Trump administration policy that is still in effect. Under this pilot program, called “Direct Contracting,” private companies are supervising selected Medicare patients’ care, even though the beneficiaries signed up for traditional Medicare.

“The experiment is likely to make traditional Medicare a gold-mine for for-profit companies, who will make money for executives and shareholders by establishing complex administrative rules that undermine access to care and by imposing high out-of-pocket costs that discourage care.” – Common Dreams, 3/8/21

Up to now, traditional Medicare has been administered exclusively by the government, with no profit motive – unlike the Medicare Advantage program, which is run by private, corporate interests. The Direct Contracting model is a serious, but lesser-known move toward privatizing the entire Medicare program – something the majority of the public and seniors’ advocates fiercely oppose. With good reason.

“Instead of paying doctors and hospitals directly for seniors’ care, Medicare gives these middlemen (called Direct Contracting Entities, or DCEs) a monthly payment to cover a defined portion of each seniors’ medical expenses. DCEs are then allowed to keep what they don’t pay for in health services, a dangerous financial incentive to restrict and ration seniors’ care.” – Rep. Pramila Jayapal, The Hill, 12/9/21

“The lure of Direct Contracting for these companies is potential profits. The limits on the amount of money a Direct Contracting entity can keep that’s not used for a patient’s medical needs is significantly more generous than those imposed by Medicare Advantage.” – Helaine Olen, Washington Post, 12/13/21

Worse yet, the Direct Contractors needn’t have any experience in the health care field. Venture capital and private equity firms (some with ties to former Trump administration officials) are among the corporate concerns “who are lined up like pigs at the trough to get their hands on taxpayer dollars,” according to Helaine Olen of The Washington Post. In fact, Congress has no oversight authority over the selection of direct contractors in the pilot program.

“This should be a huge red flag for taxpayers and anyone concerned about funding Medicare for future generations,” says Rep. Japyal, who sits on the House Budget Committee.

Privatized plans generally cost the Medicare program more money and can erect barriers to proper care, in the form of higher out-of-pocket costs, denied claims, and limited networks of health care providers. In other words, patients suffer while the private plans make billions.

Medicare Advantage plans have also been caught overcharging the program (i.e., American taxpayers) and using other deceptive tactics. “The incentive is to deny as much care as possible,” health advocate Diane Archer told The Intercept. “It’s also to delay as much care as possible.”

The Direct Contracting model has different rules than Medicare Advantage, but the pilot program clearly incentivizes profit over patient care.

“While Traditional Medicare spends an impressive 98 percent of its budget on patient care, Direct Contracting Entities only spends 60 percent of our tax dollars on patient care — keeping up to 40% of revenues for their own profit and overhead.” – Common Dreams, 3/8/21

Seniors’ advocates and champions in Congress are pushing-back on the Direct Contracting program, insisting that the Biden administration cancel it. According to Rep. Jayapal, advocates have met with Health and Human Services Secretary Xavier Becerra to make their objections known, and have demanded that Congress hold hearings on the program.

Rep. Pramila Jayapal calls the Trump-era policy a” dangerous financial incentive to restrict and ration seniors’ care.”

Four Democratic members of Congress sent Becerra a letter last May, requesting that the Direct Contracting program be frozen because it funnels patients into “Medicare Advantage-like plans, (which) not only eliminates beneficiary choice, but also erects more barriers and provides fewer consumer protections for beneficiaries.”

Olen reports in The Post that the Biden administration put a “temporary stop” on “an even more egregious version of the (pilot) program.” But “CMS, HHS, and ultimately, the White House are continuing to press ahead with Direct Contracting, even though they could end it if they choose.”

Despite journalists’ efforts to shine light on the program and objections from members of Congress and the advocacy community, the Direct Contracting program – a vestige of the Trump administration that favored profits over patients – proceeds unimpeded.

President Biden Should Roll Back Medicare Premium Hike

photo courtesy of Wikimedia Commons

Note: Since this post was published, the drugmaker Biogen reduced the price of Aduhelm from $56,000 to $28,200. It is unclear, however, whether that will lower the scheduled Medicare Part B premium increase for 2022.

*************************************************************************************************************************

The National Committee is urging President Biden to mitigate the announced $21 monthly increase in Medicare Part B premiums. President and CEO Max Richtman sent a letter to the White House this week asking President Biden to intervene before the premium hike takes effect in 2022.

“To many seniors and people with disabilities living on a fixed income, a $21 increase will cause hardship. The Part B premium hike will consume a significant amount of their Social Security Cost of Living Adjustment (COLA) at a time when inflation is making so many other goods and services… more expensive.” – NCPSSM letter to President Biden, 12/14/21

The premium increase is driven partly by the introduction of the new Alzeheimer’s drug, Aduhelm, with a price tag of $56,000. The cost of Aduhelm was factored into the 2022 premium hike in the event that Medicare Part B covers it, which is not even certain.

“Beneficiaries in traditional Medicare without supplemental coverage would be forced to pay a 20 percent co-payment of $11,200 out of pocket for Aduhelm. This medication is ‘Exhibit A’ for what is wrong with drug pricing in the United States and why Medicare should have broad authority to negotiate prescription drugs prices, including medications under patent or exclusivity.” – NCPSSM letter, 12/14/21

The current version of President Biden’s Build Back Better plan would not allow Medicare to negotiate the price of new drugs like Aduhelm. Build Back Better originally included more robust price negotiation, but it was diluted after objections from Democratic centrists.

Independent analysis places the value of Aduhelm at a fraction of its $56,000 a year cost.

“What makes Aduhelm’s exorbitant cost all the more unconscionable is that many in the scientific establishment do not think the drug is even safe or effective. The American Academy of Neurology has raised concerns about the drug’s safety — it can cause brain swelling — and the ‘absence of convincing scientific evidence of efficacy.’” – NCPSSM letter, 12/14/21

The National Committee is calling on President Biden to take steps to prevent Aduhelm from driving up the cost of Part B premiums for seniors and people with disabilities. In addition, NCPSSM urges the President to reinstate the ‘reasonable pricing clause’ established by the National Institutes of Health in 1989 but later revoked. “Medicare beneficiaries and taxpayers should pay a reasonable price for effective drugs that are worth the amount manufacturers charge,” writes Richtman.

“It’s unlikely that the President would roll back the entire Part B premium increase,” says NCPSSM legislative and policy director Dan Adcock. “It’s more plausible that he would reduce the premium by about $11.50 per month, the amount attributable to the cost of Aduhelm.”

NCPSSM President Testifies at Hill Hearing on Social Security Legislation

Social Security must be expanded and strengthened now. That was the message National Committee president Max Richtman delivered in testimony today before the House Ways and Means Social Security subcommittee, chaired by Rep. John Larson (D-CT). This was the first and possibly only hearing on Congressman Larson’s Social Security 2100: A Sacred Trust legislation, which would boost benefits and extend the solvency of the program’s trust fund.

“The last major Social Security reform was almost four decades ago and the value of some of its benefits have eroded. Enactment of the Social Security 2100: A Sacred Trust would provide critical financial support to millions of your constituents, helping them afford their medications and put food on the table…” – Max Richtman, NCPSSM president, 12/7/21

Congressman Larson’s bill would give all beneficiaries a 2% benefit increase, improve the formula for calculating COLAs (cost-of-lving adjustments), and enhance benefits for especially vulnerable groups – including widows and widowers, the lowest income earners, and the ‘oldest of the old’ (seniors 85 and over).

The National Committee to Preserve Social Security and Medicare endorsed Rep. Larson’s bill when he introduced it in October, believing that current benefits and COLAs are inadequate for today’s seniors. Even before COVID pummeled America’s senior population, too many older Americans were struggling to keep their heads above water financially in the face of rising costs for everything from health care to prescription drugs to housing. “Five million seniors are living in poverty in wealthiest nation in world,” said Rep. Larson.

At the same time, two of the legs in the old ‘three-legged stool’ of retirement security – pensions and retirement savings – are dwindling, leaving Social Security as the main source of income for nearly half of all retirees.

“The nation is facing a retirement income crisis. Social Security is the most important source of retirement income, last expanded when Richard Nixon was president. A vote on Social Security 2100 will begin to restore the intangible, but essential benefit of retirement security which too many Americans have lost.” – Nancy Altman, President, Social Security Works

The “Sacred Trust” bill would raise revenue for the program by adjusting the payroll wage cap so that high income earners begin to pay their fair share. The cap is currently set at $142,800 in annual wages. The bill would re-impose payroll taxes at $400,000 in annual income and above, bringing billions of dollars in new revenue into the system. If Congress fails to act, the Social Security trust fund will become depleted in 2034.

Amy Matsui of the National Women’s Law Center testifies during Tuesday’s hearing.

Other witnesses at today’s hearing spoke of the importance of expanding Social Security for women and minority communities. Amy Matsui, Director of Income Security at the National Women’s Law Center, pointed out that “the cumulative impact of a lifetime of economic disparities decreases women’s retirement security.” She said that the lifetime earnings of black and Latino women is typically lower than other women’s, translating into lower Social Security benefits.

Yanira Cruz, President and CEO of the National Hispanic Council on Aging, testified that Latinos, in particular, would benefit from the Social Security 2100: A Sacred Trust:

“Many Hispanics are among the working poor… and they depend on Social Security for economic security after a lifetime of hard work. They tend to work in jobs that pay lower wages and are less likely to have pension coverage. Social Security is the sole source of income for more than 40% of Hispanic seniors.” – Yanira Cruz, President & CEO, NHCOA

Yanira Cruz of the National Hispanic Council on Aging

While paying lip service to preserving Social Security, Republican witnesses argued that Rep. Larson’s bill is unnecessary and overly broad, claiming that most seniors are financially secure and don’t need better benefits. They claimed that improving Social Security would harm the economy, when, in fact, the program provides more than one trillion dollars in economic stimulus every year. Andrew Biggs of the American Enterprise Institute testified that it would be better to cut benefits (mainly by raising the retirement age) and privatize Social Security than to enact Rep. Larson’s bill.

Congressman Larson fired back, saying that conservatives are suggesting that the country would be better off without Social Security. He accused Republicans of wanting to “dismantle Social Security brick by brick,” which he said would be “devastating to the American people.”

“That is not where the American people are. They know Social Security has strengthened the fabric of this nation and will continue to do so as long as Congress acts.” – Rep. John Larson, Chairman of the House Ways & Means Social Security subcommittee, 12/7/21

Majorities of Americans across party lines support the main provisions of Rep. Larson’s bill, including a benefit boost, improved COLA formula, and adjusting the payroll wage cap.

Social Security subcommittee chairman John Larson: “The time to act is now.”

Paraphrasing Dr. Martin Luther King, Congressman Larson, spoke of “the fierce urgency of now,” imploring Congress to take action to boost and strengthen Social Security immediately. NCPSSM President Max Richtman reinforced the urgency of the situation in his testimony:

“Congress simply cannot sit by and allow millions of our fellow citizens, who worked hard their entire lives, to spend their golden years struggling to get by. That’s why we urge you to alleviate the suffering of your senior constituents by voting now on Rep. Larson’s bill.” – Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare

The next step for the Social Security 2100: A Sacred Trust bill is a committee markup. After that, Congressman Larson hopes the legislation will move quickly to the House floor for a vote. He wants members of Congress to go on record as having voted for – or against – improving Americans’ earned benefits. At today’s hearing, Republican members of the Social Security subcommittee pledged to vote against the bill in its current form.

Read Max Richtman’s complete written testimony here.

Stop Scaring Millennials About the Future of Social Security

Some tropes never die. The one about Millennials not being able to rely on Social Security when they retire re-surfaces every few months, most recently in an article by John Csiszar on the financial news site GoBankingRates. The article, Here’s How Social Security Will Look for Millennial Retirees, paints a bleak picture for the future of a program that has provided seniors with basic financial security since the 1930s.

It is true that, if Congress takes no action, the combined Social Security trust funds will become depleted in 2034, after which the program could pay 76% of benefits. But that is far from a forgone conclusion. Democrats in Congress are taking action to avert trust fund insolvency — and actually boost benefits at the same time. Rep. John Larson’s Social Security 2100 Act: A Sacred Trust, which he just introduced this fall, would do both — and improve the cost-of-living adjustment formula (COLA) for seniors.

But Csiszar suggests that in order to avoid insolvency, Congress would have little choice but to raise the Social Security retirement age to 70. What he doesn’t say is that this would be a huge benefit cut. Raising the retirement age from 67 to 70 would drastically reduce the net amount of income workers receive during the entirety of their senior years, especially if they must file for benefits before their full retirement age.

Nonetheless, Csiszar presents it as a reasonable proposition, since Americans are living longer than when the program was created:

“For starters, in 1930, just before Social Security came to be, life expectancy in the U.S. was just 58 years for men and 62 years for women. As of 2020, those numbers have jumped to 75.1 years and 80.5 years, respectively.” – GoBankingRates, 11/29/21

Just because Americans are living longer does not mean they can work until they are seventy – or that they do not deserve a financially secure retirement after the current eligibility age of 67. (The retirement age was raised from 65 by previous Social Security reform legislation.) What’s more, seniors in their late 60s who still want to work may be laid off – or unable to find employment – because of pervasive and enduring age discrimination in the workplace.

The fact that raising the retirement age to 70 could save the program $120 billion (according to the article) does not make it a wise policy. As we have often pointed out, seniors are not figures on a ledger; they are human beings with real needs like everyone else. Seniors living longer need more – not less – retirement income over a longer period of time.

There would be no need to even consider raising the retirement age for Social Security if the program can bring in more revenue. Rep. Larson’s bill would achieve that by adjusting the payroll wage cap so that high earners would contribute payroll taxes on income exceeding $400,000 per year. But Csiszar turns this equitable fix into a negative, claiming that it will hurt younger workers:

“High earners would be forced to fork over additional taxes to the Social Security program, providing additional funding for retirees. This could translate to higher tax bills for top-earning millennials.” – GoBankingRates, 11/29/21

This is a disingenuous argument. Adjusting the cap would not impact the majority of wage earners (since most workers make significantly less than $400,000 per year). The average Millennial earned $47,000 in 2021, placing that age group well below the income level where they would have to contribute additional payroll taxes. Meanwhile, it’s reasonable that high income earners pay their fair share into Social Security, in exchange for higher benefits.

Instead of encouraging Millennials to support commonsense reform like Rep. Larson’s bill, Csiszar prefers to sow fear that Social Security won’t be around when this generation retires.

“Rather than relying on Social Security benefits that may or may not be there, Millennials should take the decades they still have ahead of them to max out 401(k) and IRA contributions and build up their supplementary savings to the point where they won’t need to rely on Social Security.” – GoBankingRates, 11/29/21

While there’s nothing wrong with encouraging Millennials to save for retirement, it is becoming increasingly difficult for workers to put away money. Rising living costs and stagnant wages have made it enough of a challenge for most Millennials to pay their monthly bills, let alone save for retirement. Older Americans are relying more and more on their Social Security benefits for financial survival.

Millennials are expected to receive twice as much as today’s retirees in retirement benefits as today’s seniors do, and they will need every penny. Meanwhile, many younger adults are unaware that Social Security is there for them in case of disability or the death of a family breadwinner. The average worker with a spouse and two children would have to purchase more than $600,000 in life and disability insurance to replace the protections Social Security provides. In fact, some 1.2 million millennials already receive Social Security benefits.

Millennials will rely on Social Security even more than previous generations. But the program’s opponents want younger adults to believe Social Security won’t be around when they need it.

Scaring Millennials into believing Social Security won’t be there for them upon retirement can become ‘self-fulfilling prophecy.’ If Millennials, along with other age groups, don’t support commonsense improvements to Social Security of the kind Rep. Larson offers, then the program may suffer from a revenue shortfall in the 2030s, triggering severe benefit cuts. Opponents of the program have long attempted to divide the generations in order to weaken support for Social Security.

The best way to ensure that Social Security will be there for future retirees is for the American people to unite around an agenda to increase revenues and boost benefits. In so doing, we must reject conservative scare tactics designed to undermine the program. We are not saying that Csiszar falls into this camp, but his article clearly is influenced by propaganda that says we must cut Social Security in order to save it.