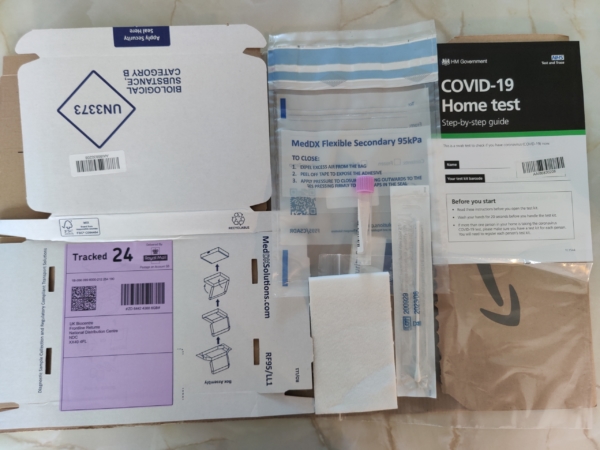

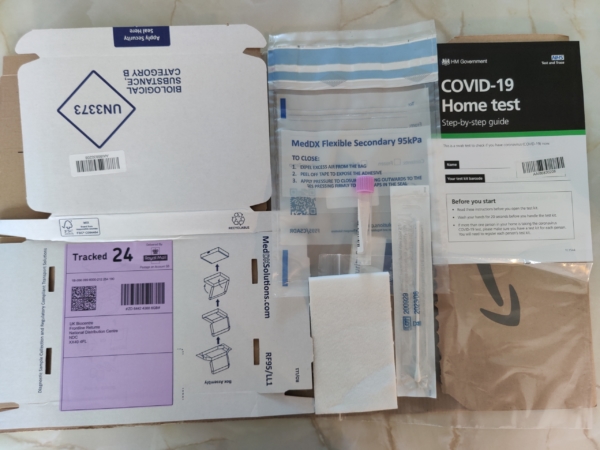

Medicare To Cover At-Home COVID Test Kits

Wikimedia Commons

Seniors on Medicare soon won’t have to pay for over-the-counter COVID test kits, thanks to a rule change from the Centers for Medicare and Medicaid Services. CMS announced Wednesday that Medicare will begin covering the cost of home kits sold at pharmacies and other retailers starting in early spring.

It’s a reversal of course for the Biden administration, which last month required insurance companies – but not Medicare – to cover retail at-home test kits. Seniors and their advocates strongly objected to the original policy. On January 24th, the National Committee to Preserve Social Security and Medicare, along with 50 other advocacy groups, sent a letter to Health and Human Services (HHS) Secretary Xavier Becerra and CMS administrator Chiquita Brooks-LaSure, urging that Medicare cover over-the-counter test kits:

“The Administration’s efforts to increase outreach and education about vaccines, boosters, testing, and masks are important. However, we are urging HHS to do more to truly center its response on protecting the lives of older adults and people with disabilities in communities most at risk (by extending) coverage of at-home over-the-counter COVID-19 testing, with no cost-sharing, for all people on Medicare.” – Advocates’ letter to HHS and CMS, 1/24/22

As CNN reported, some seniors on Medicare complained that their over-the-counter COVID tests should be covered like everyone else’s. Many beneficiaries live on fixed incomes and cannot afford to buy the tests.

“The shift means that Medicare and Medicare Advantage enrollees will be able to pick up home tests at no cost. The agency will release a list of participating pharmacies and retailers when coverage begins.” – CNN, 2/02/22

The rule change will give seniors a convenient option for COVID testing. Medicare already covered COVID tests administered by doctor’s offices and laboratories – along with testing for patients with a prescription from their health care provider.

Beginning in early spring, Medicare enrollees – like patients with private insurance – will be able to order eight free home test kits per month. Before the new coverage goes into effect, the administration recommends that beneficiaries wishing to acquire home test kits at no cost visit the recently-launched government distribution site at covidtests.gov.

Seniors’ Champions in Washington State Continue to Lead the Way on Long-Term Care, Despite Roadblocks

The Washington State capitol in Olympia, cradle of the nation’s first comprehensive, public long term-care insurance program (Wikimedia Commons)

In 2019, the state of Washington plunged headlong into the treacherous waters of public long-term care insurance with WA Cares – the first comprehensive program of its kind in the country. WA Cares was born out of the realization that most seniors will need some form of long term-care at some point in their lives, but may not be able to afford the exorbitant costs – which can amount to tens – if not hundreds – of thousands of dollars per year. Policymakers wanted the state to be prepared for the swelling number of Baby Boomers who would eventually require care but not be able to pay for it on their own.

The need for government-sponsored long-term care insurance has become increasingly obvious. The private long-term care insurance market is in retreat. Private policies are expensive and hard to find. Many people falsely believe that Medicare covers long-term care, but it doesn’t (except for a limited amount of time after hospitalization or acute illness). Nonetheless, a recent AARP survey indicates that 78% of voters think that Medicare pays for extended long-term care.

“Middle-income families do not anticipate how much long-term care is going to cost. Unless they have extra financial resources, they’re stuck with the cost of long-term care. And their only alternative is to spend down to poverty and go onto Medicaid. This is about giving people a choice about how they want to age and live out their lives when they need long-term care.” – Cathy MacCaul, advocacy director at AARP Washington, 1/26/22

AARP Washington was a prime mover in the creation of WA Cares, working with Governor Jay Inslee, the state Department of Social and Health Services (DSHS), other members of the advocacy community, and Democratic state legislators. The coalition celebrated the enactment of WA Cares three years ago, only to run into severe political turbulence today.

The current controversy surrounds the .058% payroll tax to fund the program, which was imposed beginning January 1st, 2022. Republicans insist it’s a burden for taxpayers – a bad deal – and claim that the program is insolvent, none of which is true. (More on that below.) Nevertheless, the legislature has voted to suspend the payroll tax for 18 months, and is in the process of revisiting the original law.

“Democrats hope by then to erase concerns about the future solvency of their initiative to provide workers with money to defray the costs of long-term care. Republicans hope by then to kill the program as now designed, and maybe replace it with something else.” – Forbes, 1/9/22

Advocates acknowledge that WA Cares was not properly marketed to the public once the law was enacted in 2019. In fairness, the COVID pandemic came less than a year later, shoving other issues aside. Suddenly, people were talking about seniors dying from COVID, not WA Cares. Advocates say the ‘messaging vacuum’ gave the program’s conservative opponents (including the private insurance industry) an opportunity to sweep in and turn the public against it.

“We were caught not controlling the narrative,” says AARP Washington’s policy director, Cathy MacCaul. “The first message consumers got was, ‘This is not good,’ with no context, without any information regarding the actual need for public long-term care insurance.”

While Republicans pledge to use the year-and-a-half delay to “kill” the program, advocates view the 18-month hold as an opportunity to improve the law. Similar to the Affordable Care Act, WA Cares’ authors knew that the original law wasn’t perfect and would need adjustments. Targeted improvements include ensuring that near-retirees can access benefits – and enacting payroll tax exemptions for people who worked in Washington state but moved elsewhere, military spouses, and some veterans.

MacCaul compares the program to a train that needs a fresh coat of paint. “Do you try to paint the train while it’s rolling down the track, or do you stop the train and paint it? We think it makes sense to hold the train, look at all the data we’ve accumulated, and make sure everything is in place that the program needs.”

WA Cares provides a $36,500 lifetime benefit for those who paid into the program for ten years and need long-term care at some point in their lives. The benefit is to be paid directly to providers by DSHS. With the .058% payroll tax, a resident earning $50,000 in annual income would contribute less than $300 per year in exchange for the long-term care benefit. It’s a classic social insurance model, patterned after Social Security and Medicare Part A. MacCaul says actuarial projections indicate that, with the payroll tax revenue invested in U.S. treasury notes, WA Cares will remain solvent until at least 2075, contrary to Republicans’ claims.

To the GOP’s argument that the $36,500 benefit is “insignificant,” MacCaul responds that while a few months of nursing care can cost that much, the benefit also applies to less expensive in-home care. “The benefit might be put toward 4-5 hours a day of in-home care for more than a year. It could be used for a home modification for a patient with disabilities, for home-delivered meals, or to pay a family caregiver,” she says, reflecting a newer, broader concept of long-term care beyond sticking seniors in nursing homes.

AARP’s October, 2021 survey suggests the need for more public outreach about the positives of the WA Cares program. In that survey, 51% percent of voters supported the program, 33% opposed it, and 15% were unsure.

“Support for the program increases as people learn more about the specific features of WA Cares and how it differs from what is currently available from private long-term care insurers.” – AARP Survey, October, 2021

The absence of a federal long term care insurance program has left individual states like Washington to explore solutions on their own. The National Committee to Preserve Social Security and Medicare has long advocated for a federal program. There have been efforts in Congress, most recently from Rep. Thomas Suozzi (D-NY), to craft federal long-term care legislation, but so far those efforts haven’t gained traction. (The ill-fated federal CLASS Act, enacted under President Obama, would have provided consumers with help paying for long-term care, but proved to be financially infeasible and had to be shut down in 2011.) While advocates continue to press the federal government to enact a long-term care program at some point in the future, Washington state is doggedly leading the way.

SSA Field Offices to Re-open in March

After nearly two years of Social Security field offices being closed for all but “dire needs,” the Social Security Administration indicated Thursday that there is progress toward re-opening. Acting SSA Commissioner Kilolo Kijakazi announced in a press release that the agency and its three main labor unions have reached agreement on a re-opening plan. The news site Government Executive reported that the target re-opening date is March, 30, “although that date can be postponed if there is another spike in COVID-19 cases.”

“I’m happy with this agreement because it’s going to save lives, and that’s not an exaggeration… We’ve seen how pervasive the Omicron and Delta variants have been in this country, particularly in recent weeks, and pushing out the reentry date to the end of March gives everybody the opportunity to wait out the wave, which will hopefully subside, and plan accordingly.” – Rich Couture, President of AFGE Council 215

The re-opening plan includes an agreement with the Association of Administrative Law Judges (AALJ) to restore in-person Social Security disability hearings, which have been mostly virtual since the beginning of the pandemic. As Federal News Network reports, the agreement sets up a “hybrid model of in-person and virtual hearings… as a promising model for the future of work.”

AALJ President Som Ramrup praised the agreement as a win for disability claimants.

“AALJ (judges are) really focused on providing due process to the claimants that appear before us. Part of that process is the method of the hearing, and to the extent that certain individuals and claimants are uncomfortable with video or telephone, we’re going to give them the opportunity to do it in-person.” AALJ President Som Ramrup, 1/20/22

The National Committee to Preserve Social Security and Medicare has advocated for the resumption of in-person hearings and the re-opening of field offices, so long as it could be done safely for seniors and other beneficiaries. “It’s a good thing that SSA has begun the arduous task of reopening its network of field offices to Americans who depend on the in-person services they offer,” says NCPSSM Senior Policy Analyst Webster Phillips.

SSA field offices have been largely closed since March, 2020, forcing most seniors and people with disabilities to obtain customer service virtually – via the internet, telephone, and video conferencing. This has been a burden for beneficiaries who lack internet access or adequate technical skills to navigate virtual services.

“Applying for disability benefits in particular can be a very cumbersome process, especially virtually,” says NCPSSM Senior Policy Analyst Maria Freese, along with applying for a Social Security number, change of name, and other services. “These things require a lot of documentation. During the pandemic, people have had to mail-in original documents, and SSA might keep them for a really long time because of service backlogs. You could get stuck for months without your driver’s license or other personal documents, waiting for SSA to return them.”

Acting SSA Commissioner Kilolo Kijakazi

With the details of field office re-openings still pending, SSA Commissioner Kajakazi urges claimants and beneficiaries to continue using the agency’s virtual resources.

“For now, you should continue to reach us online at www.socialsecurity.gov or by calling our National 800 Number or your local office. We will let you know when we are able to restore additional services,” Kajakazi says.

Pending Aduhelm Coverage Decision Could Pave the Way for Lower Medicare Premiums

HHS Secretary Xavier Becerra

**** THIS IS AN UPDATE OF A BLOG POST FROM JANUARY, 2022 ****

HHS Secretary Xavier Becerra confirmed last Thursday that he could lower the large 2022 Medicare Part B premium increase right now, but he would rather wait until Medicare makes a final decision on whether to cover the controversial and expensive Alzheimer’s drug, Aduhelm.

“Once we have that determination, we’ll be able to fully assess what impact Aduhelm may have had on premiums for seniors in Medicare… We’re gonna make sure that seniors don’t pay more than they have to.” – HHS Secretary Xavier Becerra, 3/17/22

Medicare’s final decision is due by April 11, 2022. Back in January, the Centers for Medicare and Medicaid Services announced a preliminary decision to limit Aduhelm coverage to patients who are participating in approved clinical trials. That means most Part B beneficiaries would not have coverage for Aduhelm.

The arrival of Aduhelm, originally priced at $56,000 per year (and later lowered to $28,200) contributed to the highest increase in Medicare Part B premiums in recent history. Beneficiaries have seen their monthly premiums jump to from $148.50 to $170.10 this year. The preliminary coverage decision on Aduhelm should clear the way for the Biden administration to roll back the Part B premium increase, something seniors’ advocates have demanded since the premium hike was announced last month.

“Medicare’s preliminary decision to limit Part B coverage for the Alzheimer’s drug Aduhelm is good news for beneficiaries. Restricting coverage to patients in clinical trials is sound policy, given concerns about Aduhelm’s efficacy and side effects — and will significantly lower Medicare’ costs. Seniors on fixed incomes should not have to subsidize a questionably effective new drug, grossly overpriced by Big Pharma.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare, 1/12/22

Last month, NCPSSM President and CEO Max Richtman sent a letter to the White House on December 14th asking President Biden to intervene.

“To many seniors and people with disabilities living on a fixed income, a $21 increase will cause hardship. The Part B premium hike will consume a significant amount of their Social Security Cost of Living Adjustment (COLA) at a time when inflation is making so many other goods and services… more expensive.” – NCPSSM letter to President Biden, 12/14/21

NCPSSM and other seniors advocates were encouraged earlier this week when HHS Secretary Xavier Becerra ordered the Medicare program to re-assess the Part B premium increase. The Centers for Medicare and Medicaid services now has until April to respond.

The grossly overpriced medication, whose efficacy and side effects are problematic, brought fresh scrutiny of Big Pharma price gouging. Independent analysis places the value of Aduhelm at a fraction of its $28,200 a year cost. The National Committee has long fought for Medicare to have the ability to negotiate prices with drugmakers. But the current version of the Democrats’ Build Back Better plan, currently stalled in the U.S. Senate, would not allow Medicare to negotiate the price of new drugs like Aduhelm. Build Back Better originally included more robust price negotiation, but it was diluted after objections from Democratic centrists.

“What makes Aduhelm’s exorbitant cost all the more unconscionable is that many in the scientific establishment do not think the drug is even safe or effective. The American Academy of Neurology has raised concerns about the drug’s safety — it can cause brain swelling — and the ‘absence of convincing scientific evidence of efficacy.’” – NCPSSM letter, 12/14/21

Meanwhile, NCPSSM has urged President Biden to reinstate the ‘reasonable pricing clause’ established by the National Institutes of Health in 1989 but later revoked. “Medicare beneficiaries and taxpayers should pay a reasonable price for effective drugs that are worth the amount manufacturers charge,” writes Richtman.

“It’s unlikely that the President would roll back the entire Part B premium increase,” says NCPSSM legislative and policy director Dan Adcock. “It’s more plausible that he would reduce the premium by about $11.50 per month, the amount attributable to the cost of Aduhelm.”

Seniors’ Voting Rights on the Line As Schumer Vows Senate Action

Senate Majority Leader Chuck Schumer (D-NY) has set a self-imposed deadline of January 17th – Martin Luther King Day – to pass sweeping voting rights legislation. This will be a heavy lift given opposition from Democratic Senators Joe Manchin and Kyrsten Sinema to adjusting the filibuster, an essential step in passing voting rights legislation without Republican votes. Nevertheless, President Biden and Hill Democrats feel compelled to try, given that the voting rights of millions of Americans – including and especially seniors – are very much at stake with the 2022 midterm elections approaching.

The push for new federal voting rights legislation became more urgent when Republican-controlled state legislatures across the country began passing restrictive voting laws in the wake of the 2020 election, based on the Big Lie that it was plagued by massive voter fraud.

“Anything that makes it harder for people to cast their vote will have an oversized impact on seniors.” – Florida state Sen. Jeff Brandes

From Florida to Arizona, onerous state laws would make it harder for seniors to vote by imposing new restrictions on mail-in voting, drop boxes, and early voting – all of which older Americans have come to depend on in exercising their right to cast ballots. Some 54% of senior voters cast votes by mail in 2020, according the Chicago Tribune.

The new restrictions would particularly impact seniors of color, many of whom continue to prefer voting in person. Some of the laws erect obstacles to in-person voting, affecting minority precincts the most. Restricted voting hours, stringent ID requirements, and arbitrary prohibitions (enacted in Georgia) against volunteers providing voters with water and food while they wait in overly long lines, seemed designed to target minority voters (especially elderly ones).

“Most people who live in (minority) wards are older African Americans who like to go to the polls because they fought for their right to vote. But… some polling stations (in 2020) were lacking poll workers and not abiding by health guidelines during the coronavirus pandemic.” – St. Louis Public Radio

It’s no secret that Republican state legislators have enacted these laws in order to suppress Democratic votes, alarmed that some traditionally red states turned purple in 2020. But observers have noted that Republicans’ fixation on limiting mail-in voting, for instance, could backfire, as many of their voters are seniors who cast ballots by mail.

“Smaller rural counties have a large elderly population who typically choose to vote absentee because of weather or health concerns. Why are we making it harder for them to vote?” Rebecca Bissell, Adams County, FL Elections Commissioner

The Senate Democrats’ voting rights bill, based on legislation passed in the House in 2021, would neutralize many of the objectionable voting laws enacted in the states. It would, in effect, restore many of the Voting Rights Act protections that the Supreme Court invalidated in 2013, giving the federal government greater oversight of state election laws.

The Senate voting rights bill would also:

*Make Election Day a public holiday;

*Mandate same-day voter registration;

*Guarantee that all voters can request mail-in ballots;

*Restore federal voting rights for ex-felons.

In September, the National Committee to Preserve Social Security and Medicare sent letters to Senators Manchin and Sinema, imploring them to support changes to the filibuster that would allow voting rights legislation to pass the Senate.

“We urge you to support a narrow change to the filibuster rule to allow the Senate to approve new voting rights legislation by a simple majority vote. This crucial legislation will help to protect our democracy and the right to vote for all Americans.” – NCPSSM President Max Richtman, 9/21/21

Unfortunately, neither Senator has budged yet, effectively blocking commonsense legislation that would make it easier for their own constituents to vote. In order to rally support, President Biden will campaign for a “filibuster carveout” during a scheduled trip to Georgia on Tuesday.

Meanwhile, former First Lady Michelle Obama announced on Sunday that she will lead “a coalition of voting rights organizations to register more than a million new voters in the run-up to this year’s mid-term elections,” reports Politico.

With the political muscle of the President and former First Lady behind it, voting rights legislation may have a slightly better chance of passage. At the very least, a Senate floor vote will force Senators to go squarely on the record as supporting – or opposing – fundamental rights cherished by seniors, people of color, and, presumably, all Americans.

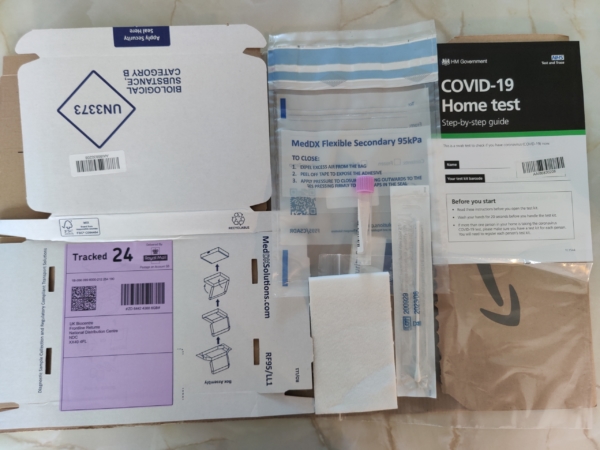

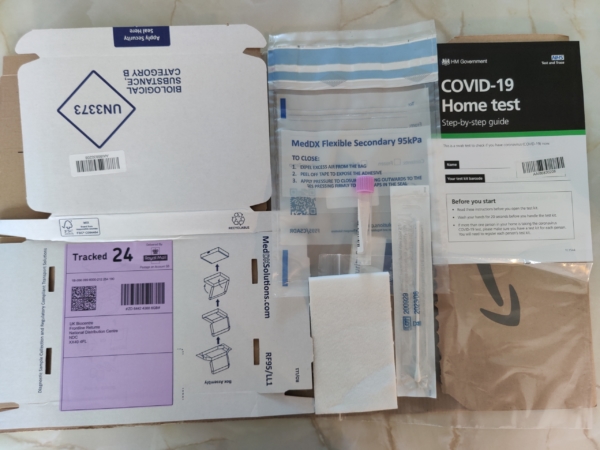

Medicare To Cover At-Home COVID Test Kits

Wikimedia Commons

Seniors on Medicare soon won’t have to pay for over-the-counter COVID test kits, thanks to a rule change from the Centers for Medicare and Medicaid Services. CMS announced Wednesday that Medicare will begin covering the cost of home kits sold at pharmacies and other retailers starting in early spring.

It’s a reversal of course for the Biden administration, which last month required insurance companies – but not Medicare – to cover retail at-home test kits. Seniors and their advocates strongly objected to the original policy. On January 24th, the National Committee to Preserve Social Security and Medicare, along with 50 other advocacy groups, sent a letter to Health and Human Services (HHS) Secretary Xavier Becerra and CMS administrator Chiquita Brooks-LaSure, urging that Medicare cover over-the-counter test kits:

“The Administration’s efforts to increase outreach and education about vaccines, boosters, testing, and masks are important. However, we are urging HHS to do more to truly center its response on protecting the lives of older adults and people with disabilities in communities most at risk (by extending) coverage of at-home over-the-counter COVID-19 testing, with no cost-sharing, for all people on Medicare.” – Advocates’ letter to HHS and CMS, 1/24/22

As CNN reported, some seniors on Medicare complained that their over-the-counter COVID tests should be covered like everyone else’s. Many beneficiaries live on fixed incomes and cannot afford to buy the tests.

“The shift means that Medicare and Medicare Advantage enrollees will be able to pick up home tests at no cost. The agency will release a list of participating pharmacies and retailers when coverage begins.” – CNN, 2/02/22

The rule change will give seniors a convenient option for COVID testing. Medicare already covered COVID tests administered by doctor’s offices and laboratories – along with testing for patients with a prescription from their health care provider.

Beginning in early spring, Medicare enrollees – like patients with private insurance – will be able to order eight free home test kits per month. Before the new coverage goes into effect, the administration recommends that beneficiaries wishing to acquire home test kits at no cost visit the recently-launched government distribution site at covidtests.gov.

Seniors’ Champions in Washington State Continue to Lead the Way on Long-Term Care, Despite Roadblocks

The Washington State capitol in Olympia, cradle of the nation’s first comprehensive, public long term-care insurance program (Wikimedia Commons)

In 2019, the state of Washington plunged headlong into the treacherous waters of public long-term care insurance with WA Cares – the first comprehensive program of its kind in the country. WA Cares was born out of the realization that most seniors will need some form of long term-care at some point in their lives, but may not be able to afford the exorbitant costs – which can amount to tens – if not hundreds – of thousands of dollars per year. Policymakers wanted the state to be prepared for the swelling number of Baby Boomers who would eventually require care but not be able to pay for it on their own.

The need for government-sponsored long-term care insurance has become increasingly obvious. The private long-term care insurance market is in retreat. Private policies are expensive and hard to find. Many people falsely believe that Medicare covers long-term care, but it doesn’t (except for a limited amount of time after hospitalization or acute illness). Nonetheless, a recent AARP survey indicates that 78% of voters think that Medicare pays for extended long-term care.

“Middle-income families do not anticipate how much long-term care is going to cost. Unless they have extra financial resources, they’re stuck with the cost of long-term care. And their only alternative is to spend down to poverty and go onto Medicaid. This is about giving people a choice about how they want to age and live out their lives when they need long-term care.” – Cathy MacCaul, advocacy director at AARP Washington, 1/26/22

AARP Washington was a prime mover in the creation of WA Cares, working with Governor Jay Inslee, the state Department of Social and Health Services (DSHS), other members of the advocacy community, and Democratic state legislators. The coalition celebrated the enactment of WA Cares three years ago, only to run into severe political turbulence today.

The current controversy surrounds the .058% payroll tax to fund the program, which was imposed beginning January 1st, 2022. Republicans insist it’s a burden for taxpayers – a bad deal – and claim that the program is insolvent, none of which is true. (More on that below.) Nevertheless, the legislature has voted to suspend the payroll tax for 18 months, and is in the process of revisiting the original law.

“Democrats hope by then to erase concerns about the future solvency of their initiative to provide workers with money to defray the costs of long-term care. Republicans hope by then to kill the program as now designed, and maybe replace it with something else.” – Forbes, 1/9/22

Advocates acknowledge that WA Cares was not properly marketed to the public once the law was enacted in 2019. In fairness, the COVID pandemic came less than a year later, shoving other issues aside. Suddenly, people were talking about seniors dying from COVID, not WA Cares. Advocates say the ‘messaging vacuum’ gave the program’s conservative opponents (including the private insurance industry) an opportunity to sweep in and turn the public against it.

“We were caught not controlling the narrative,” says AARP Washington’s policy director, Cathy MacCaul. “The first message consumers got was, ‘This is not good,’ with no context, without any information regarding the actual need for public long-term care insurance.”

While Republicans pledge to use the year-and-a-half delay to “kill” the program, advocates view the 18-month hold as an opportunity to improve the law. Similar to the Affordable Care Act, WA Cares’ authors knew that the original law wasn’t perfect and would need adjustments. Targeted improvements include ensuring that near-retirees can access benefits – and enacting payroll tax exemptions for people who worked in Washington state but moved elsewhere, military spouses, and some veterans.

MacCaul compares the program to a train that needs a fresh coat of paint. “Do you try to paint the train while it’s rolling down the track, or do you stop the train and paint it? We think it makes sense to hold the train, look at all the data we’ve accumulated, and make sure everything is in place that the program needs.”

WA Cares provides a $36,500 lifetime benefit for those who paid into the program for ten years and need long-term care at some point in their lives. The benefit is to be paid directly to providers by DSHS. With the .058% payroll tax, a resident earning $50,000 in annual income would contribute less than $300 per year in exchange for the long-term care benefit. It’s a classic social insurance model, patterned after Social Security and Medicare Part A. MacCaul says actuarial projections indicate that, with the payroll tax revenue invested in U.S. treasury notes, WA Cares will remain solvent until at least 2075, contrary to Republicans’ claims.

To the GOP’s argument that the $36,500 benefit is “insignificant,” MacCaul responds that while a few months of nursing care can cost that much, the benefit also applies to less expensive in-home care. “The benefit might be put toward 4-5 hours a day of in-home care for more than a year. It could be used for a home modification for a patient with disabilities, for home-delivered meals, or to pay a family caregiver,” she says, reflecting a newer, broader concept of long-term care beyond sticking seniors in nursing homes.

AARP’s October, 2021 survey suggests the need for more public outreach about the positives of the WA Cares program. In that survey, 51% percent of voters supported the program, 33% opposed it, and 15% were unsure.

“Support for the program increases as people learn more about the specific features of WA Cares and how it differs from what is currently available from private long-term care insurers.” – AARP Survey, October, 2021

The absence of a federal long term care insurance program has left individual states like Washington to explore solutions on their own. The National Committee to Preserve Social Security and Medicare has long advocated for a federal program. There have been efforts in Congress, most recently from Rep. Thomas Suozzi (D-NY), to craft federal long-term care legislation, but so far those efforts haven’t gained traction. (The ill-fated federal CLASS Act, enacted under President Obama, would have provided consumers with help paying for long-term care, but proved to be financially infeasible and had to be shut down in 2011.) While advocates continue to press the federal government to enact a long-term care program at some point in the future, Washington state is doggedly leading the way.

SSA Field Offices to Re-open in March

After nearly two years of Social Security field offices being closed for all but “dire needs,” the Social Security Administration indicated Thursday that there is progress toward re-opening. Acting SSA Commissioner Kilolo Kijakazi announced in a press release that the agency and its three main labor unions have reached agreement on a re-opening plan. The news site Government Executive reported that the target re-opening date is March, 30, “although that date can be postponed if there is another spike in COVID-19 cases.”

“I’m happy with this agreement because it’s going to save lives, and that’s not an exaggeration… We’ve seen how pervasive the Omicron and Delta variants have been in this country, particularly in recent weeks, and pushing out the reentry date to the end of March gives everybody the opportunity to wait out the wave, which will hopefully subside, and plan accordingly.” – Rich Couture, President of AFGE Council 215

The re-opening plan includes an agreement with the Association of Administrative Law Judges (AALJ) to restore in-person Social Security disability hearings, which have been mostly virtual since the beginning of the pandemic. As Federal News Network reports, the agreement sets up a “hybrid model of in-person and virtual hearings… as a promising model for the future of work.”

AALJ President Som Ramrup praised the agreement as a win for disability claimants.

“AALJ (judges are) really focused on providing due process to the claimants that appear before us. Part of that process is the method of the hearing, and to the extent that certain individuals and claimants are uncomfortable with video or telephone, we’re going to give them the opportunity to do it in-person.” AALJ President Som Ramrup, 1/20/22

The National Committee to Preserve Social Security and Medicare has advocated for the resumption of in-person hearings and the re-opening of field offices, so long as it could be done safely for seniors and other beneficiaries. “It’s a good thing that SSA has begun the arduous task of reopening its network of field offices to Americans who depend on the in-person services they offer,” says NCPSSM Senior Policy Analyst Webster Phillips.

SSA field offices have been largely closed since March, 2020, forcing most seniors and people with disabilities to obtain customer service virtually – via the internet, telephone, and video conferencing. This has been a burden for beneficiaries who lack internet access or adequate technical skills to navigate virtual services.

“Applying for disability benefits in particular can be a very cumbersome process, especially virtually,” says NCPSSM Senior Policy Analyst Maria Freese, along with applying for a Social Security number, change of name, and other services. “These things require a lot of documentation. During the pandemic, people have had to mail-in original documents, and SSA might keep them for a really long time because of service backlogs. You could get stuck for months without your driver’s license or other personal documents, waiting for SSA to return them.”

Acting SSA Commissioner Kilolo Kijakazi

With the details of field office re-openings still pending, SSA Commissioner Kajakazi urges claimants and beneficiaries to continue using the agency’s virtual resources.

“For now, you should continue to reach us online at www.socialsecurity.gov or by calling our National 800 Number or your local office. We will let you know when we are able to restore additional services,” Kajakazi says.

Pending Aduhelm Coverage Decision Could Pave the Way for Lower Medicare Premiums

HHS Secretary Xavier Becerra

**** THIS IS AN UPDATE OF A BLOG POST FROM JANUARY, 2022 ****

HHS Secretary Xavier Becerra confirmed last Thursday that he could lower the large 2022 Medicare Part B premium increase right now, but he would rather wait until Medicare makes a final decision on whether to cover the controversial and expensive Alzheimer’s drug, Aduhelm.

“Once we have that determination, we’ll be able to fully assess what impact Aduhelm may have had on premiums for seniors in Medicare… We’re gonna make sure that seniors don’t pay more than they have to.” – HHS Secretary Xavier Becerra, 3/17/22

Medicare’s final decision is due by April 11, 2022. Back in January, the Centers for Medicare and Medicaid Services announced a preliminary decision to limit Aduhelm coverage to patients who are participating in approved clinical trials. That means most Part B beneficiaries would not have coverage for Aduhelm.

The arrival of Aduhelm, originally priced at $56,000 per year (and later lowered to $28,200) contributed to the highest increase in Medicare Part B premiums in recent history. Beneficiaries have seen their monthly premiums jump to from $148.50 to $170.10 this year. The preliminary coverage decision on Aduhelm should clear the way for the Biden administration to roll back the Part B premium increase, something seniors’ advocates have demanded since the premium hike was announced last month.

“Medicare’s preliminary decision to limit Part B coverage for the Alzheimer’s drug Aduhelm is good news for beneficiaries. Restricting coverage to patients in clinical trials is sound policy, given concerns about Aduhelm’s efficacy and side effects — and will significantly lower Medicare’ costs. Seniors on fixed incomes should not have to subsidize a questionably effective new drug, grossly overpriced by Big Pharma.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare, 1/12/22

Last month, NCPSSM President and CEO Max Richtman sent a letter to the White House on December 14th asking President Biden to intervene.

“To many seniors and people with disabilities living on a fixed income, a $21 increase will cause hardship. The Part B premium hike will consume a significant amount of their Social Security Cost of Living Adjustment (COLA) at a time when inflation is making so many other goods and services… more expensive.” – NCPSSM letter to President Biden, 12/14/21

NCPSSM and other seniors advocates were encouraged earlier this week when HHS Secretary Xavier Becerra ordered the Medicare program to re-assess the Part B premium increase. The Centers for Medicare and Medicaid services now has until April to respond.

The grossly overpriced medication, whose efficacy and side effects are problematic, brought fresh scrutiny of Big Pharma price gouging. Independent analysis places the value of Aduhelm at a fraction of its $28,200 a year cost. The National Committee has long fought for Medicare to have the ability to negotiate prices with drugmakers. But the current version of the Democrats’ Build Back Better plan, currently stalled in the U.S. Senate, would not allow Medicare to negotiate the price of new drugs like Aduhelm. Build Back Better originally included more robust price negotiation, but it was diluted after objections from Democratic centrists.

“What makes Aduhelm’s exorbitant cost all the more unconscionable is that many in the scientific establishment do not think the drug is even safe or effective. The American Academy of Neurology has raised concerns about the drug’s safety — it can cause brain swelling — and the ‘absence of convincing scientific evidence of efficacy.’” – NCPSSM letter, 12/14/21

Meanwhile, NCPSSM has urged President Biden to reinstate the ‘reasonable pricing clause’ established by the National Institutes of Health in 1989 but later revoked. “Medicare beneficiaries and taxpayers should pay a reasonable price for effective drugs that are worth the amount manufacturers charge,” writes Richtman.

“It’s unlikely that the President would roll back the entire Part B premium increase,” says NCPSSM legislative and policy director Dan Adcock. “It’s more plausible that he would reduce the premium by about $11.50 per month, the amount attributable to the cost of Aduhelm.”

Seniors’ Voting Rights on the Line As Schumer Vows Senate Action

Senate Majority Leader Chuck Schumer (D-NY) has set a self-imposed deadline of January 17th – Martin Luther King Day – to pass sweeping voting rights legislation. This will be a heavy lift given opposition from Democratic Senators Joe Manchin and Kyrsten Sinema to adjusting the filibuster, an essential step in passing voting rights legislation without Republican votes. Nevertheless, President Biden and Hill Democrats feel compelled to try, given that the voting rights of millions of Americans – including and especially seniors – are very much at stake with the 2022 midterm elections approaching.

The push for new federal voting rights legislation became more urgent when Republican-controlled state legislatures across the country began passing restrictive voting laws in the wake of the 2020 election, based on the Big Lie that it was plagued by massive voter fraud.

“Anything that makes it harder for people to cast their vote will have an oversized impact on seniors.” – Florida state Sen. Jeff Brandes

From Florida to Arizona, onerous state laws would make it harder for seniors to vote by imposing new restrictions on mail-in voting, drop boxes, and early voting – all of which older Americans have come to depend on in exercising their right to cast ballots. Some 54% of senior voters cast votes by mail in 2020, according the Chicago Tribune.

The new restrictions would particularly impact seniors of color, many of whom continue to prefer voting in person. Some of the laws erect obstacles to in-person voting, affecting minority precincts the most. Restricted voting hours, stringent ID requirements, and arbitrary prohibitions (enacted in Georgia) against volunteers providing voters with water and food while they wait in overly long lines, seemed designed to target minority voters (especially elderly ones).

“Most people who live in (minority) wards are older African Americans who like to go to the polls because they fought for their right to vote. But… some polling stations (in 2020) were lacking poll workers and not abiding by health guidelines during the coronavirus pandemic.” – St. Louis Public Radio

It’s no secret that Republican state legislators have enacted these laws in order to suppress Democratic votes, alarmed that some traditionally red states turned purple in 2020. But observers have noted that Republicans’ fixation on limiting mail-in voting, for instance, could backfire, as many of their voters are seniors who cast ballots by mail.

“Smaller rural counties have a large elderly population who typically choose to vote absentee because of weather or health concerns. Why are we making it harder for them to vote?” Rebecca Bissell, Adams County, FL Elections Commissioner

The Senate Democrats’ voting rights bill, based on legislation passed in the House in 2021, would neutralize many of the objectionable voting laws enacted in the states. It would, in effect, restore many of the Voting Rights Act protections that the Supreme Court invalidated in 2013, giving the federal government greater oversight of state election laws.

The Senate voting rights bill would also:

*Make Election Day a public holiday;

*Mandate same-day voter registration;

*Guarantee that all voters can request mail-in ballots;

*Restore federal voting rights for ex-felons.

In September, the National Committee to Preserve Social Security and Medicare sent letters to Senators Manchin and Sinema, imploring them to support changes to the filibuster that would allow voting rights legislation to pass the Senate.

“We urge you to support a narrow change to the filibuster rule to allow the Senate to approve new voting rights legislation by a simple majority vote. This crucial legislation will help to protect our democracy and the right to vote for all Americans.” – NCPSSM President Max Richtman, 9/21/21

Unfortunately, neither Senator has budged yet, effectively blocking commonsense legislation that would make it easier for their own constituents to vote. In order to rally support, President Biden will campaign for a “filibuster carveout” during a scheduled trip to Georgia on Tuesday.

Meanwhile, former First Lady Michelle Obama announced on Sunday that she will lead “a coalition of voting rights organizations to register more than a million new voters in the run-up to this year’s mid-term elections,” reports Politico.

With the political muscle of the President and former First Lady behind it, voting rights legislation may have a slightly better chance of passage. At the very least, a Senate floor vote will force Senators to go squarely on the record as supporting – or opposing – fundamental rights cherished by seniors, people of color, and, presumably, all Americans.