Wanted: A Political Intervention for Alan Simpson

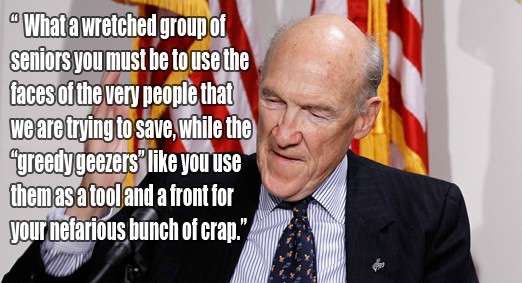

We wrote yesterday about Fiscal Commission Co-Chairman and former Senator Alan Simpson’s latest diatribe against seniors – this time launched at the Alliance for Retired Americans in California.For anyone who’s been in Washington for awhile, these rants are really just déjà vu all over again. But even as a “charter member of the Simpson tongue-lashing club” our President/CEO, Max Richtman, found this latest attack simply too much. So he wrote Senator Simpson a letter asking him to cease and desist his hate-filled attacks on seniors:

May 24, 2012

Dear Senator Simpson,

We’ve both been in this business for a long time and we’ve certainly had our share of fundamental disagreements about America’s priorities and how to protect them. As you well know, I’m a charter member of the Simpson tongue-lashing club going back to my time as Staff Director at the Senate Aging Committee and since.

However, after reading your letter to seniors in California, who simply dared to oppose your reforms for Social Security and Medicare, I feel compelled to ask you to refocus this debate where it belongs. Call this a political intervention, if you will.

The American people deserve and expect a true dialogue in which retirees are more than “greedy geezers” and those with opposing world views aren’t treated with the total disrespect you hand out so freely. After thirty years, isn’t it long past time to elevate the conversation beyond personal and profane attacks on those you simply disagree with?

I know this letter is likely an exercise in futility. However, I’m writing to you today with one simple request – please cease and desist with the mean-spirited, denigrating, and hate-filled personal attacks on America’s seniors. Sure, some in the press still love the profanity laden poison-pen letters and insulting sound-bites, but it only denigrates the serious policy work many honest and caring people on both sides of the debate perform each and every day, not to mention the American people who will ultimately be impacted by the reforms being debated.

No doubt you consider all of this “blather and drivel” or even your favorites “horse or bulls**t”. However, that fact has absolutely nothing to do with the serious business at hand. Please refocus your attention to what really matters – your proposed reforms and the American people who will be affected by them.

Sincerely,

Max Richtman

President/CEO

The National Committee to Preserve Social Security& Medicare

When Name-Calling and Profanity Replace the Truth about Social Security: Alan Simpson’s At it Again

Politico details yet another nasty tirade launched by Fiscal Commission co-chairman and former Senator Alan Simpson against America’s seniors who he once again describes as ‘greedy geezers’. This isn’t the first time he’s written nasty screeds to seniors’ advocates he doesn’t agree with. His latest poison pen letter went to the California Alliance for Retired Americans, who had the audacity to protest the Bowles-Simpson plan, which targets millions of seniors and their families with benefit cuts to balance the budget. The National Committee also opposes Bowles-Simpson maybe our hate letter is in the mail next! Clearly former Senator Simpson doesn’t believe that old adage that you can disagree without being disagreeable. Here’s the Politico article and his letter to CARA:

Politico details yet another nasty tirade launched by Fiscal Commission co-chairman and former Senator Alan Simpson against America’s seniors who he once again describes as ‘greedy geezers’. This isn’t the first time he’s written nasty screeds to seniors’ advocates he doesn’t agree with. His latest poison pen letter went to the California Alliance for Retired Americans, who had the audacity to protest the Bowles-Simpson plan, which targets millions of seniors and their families with benefit cuts to balance the budget. The National Committee also opposes Bowles-Simpson maybe our hate letter is in the mail next! Clearly former Senator Simpson doesn’t believe that old adage that you can disagree without being disagreeable. Here’s the Politico article and his letter to CARA:

To Whom It May Concern: Erskine Bowles and I thoroughly enjoyed our time on the West Coast and received an excellent reception from folks ? at least those who are using their heads and have given up using emotion, fear, guilt or racism to juice up their troops. Your little flyer entitled Bowles! Simpson! Stop using the deficit as a phony excuse to gut our Social Security!? is one of the phoniest excuses for a ‘flyer’ I have ever seen. You use the faces of young people, who are the ones who are going to get gutted while you continue to push out your blather and drivel. My suggestion to you, an honest one, read the damn report. The Moment of Truth 67 pages, and then tell me if we’re not doing the right thing with Social Security. What a wretched group of seniors you must be to use the faces of the very people that we are trying to save, while the ‘greedy geezers’ like you use them as a tool and a front for your nefarious bunch of crap. You must feel some sense of shame for shoveling out this bulls**t. Read the latest news from the Social Security Trustees. The Social Security System will not ‘hit the skids’ in 2033 instead of 2036. If you can’t understand all of this you need a pane of glass in your naval so you can see out during the day! Read the report. Get back to me. My address is below. If you don’t read the report, as Ebenezer Scrooge said in the Christmas Carol, Haunt me no longer! Best regards, Alan Simpson

Social Security Supports Your Local Economy

Billionaires Against Social Security Unite

It?s that time of year again when all of America?s well-funded fiscal hawks, their lobbyists and political supporters spend the day rubbing elbows in an all-day anti-Social Security and Medicare love fest.The Pete Peterson Fiscal Summit is one of the multi-billionaire Wall Street financier?s most visible legacies from his commitment to spend $1billion dollars in a campaign to convince America we can?t afford middle-class programs like Social Security and Medicare.Claiming these programs have led to ?generational theft? and ?fiscal child abuse?, Peterson kicked off the event with the standard boiler plate calls to cut Social Security and Medicare under the guise of deficit reduction, just as the plan created by Fiscal commission co-chairs Bowles/Simpson proposed. Economist Dean Baker describes it this way:

?This plan includes a wide range of budget cuts, including cuts to Social Security and Medicare. It would reduce the annual Social Security cost-of-living adjustment by 0.3 percent, which would lower lifetime benefits by an average of more than 3 percent. It would also raise the retirement age for Social Security. To balance these cuts to programs that benefit tens of millions of ordinary workers, Bowles and Simpson would cut the corporate tax rate from 35 to 28 percent and would lower the tax rate paid by the very wealthy from 40 percent to 28 percent. While these reductions in tax rates are supposed to be offset by the elimination of loopholes that benefit the wealthy, people have good cause for skepticism.?

Statement: Max Richtman, President/CEO

National Committee to Preserve Social Security and Medicare

Peterson Foundation Fiscal Summit Rally

May 15, 1012?I am so proud to be here today with Senator Bernie Sanders — NOW President Terry O?Neill — Global Policy Solutions CEO and National Committee Incoming Board of Directors Chair — Maya Rockeymoore — and Campaign for America?s Future?s Roger Hickey — to expose the myths and misinformation that are being sold to the American public, right now, inside the Fiscal Summit.Pete Peterson, the sponsor of this summit, is spending one billion dollars to promote the false and dangerous choice that to save Social Security and Medicare we have to destroy these vital systems through privatization and huge benefit cuts.Unfortunately, all too many members of Congress believe in the false choice of trading tax increases for cuts in Social Security and Medicare benefits.What is happening behind us today is a cynical attempt at manipulating the American public into believing that the only choices to fix Social Security, Medicare and Medicaid are to:1) Cut benefits, and2) Repeat choice #1Middle-class Americans — who have paid all of their working lives for these programs — are struggling with skyrocketing health care costs, diminished home values, unemployment and decimated savings. It is no wonder they feel abandoned when politicians try to undermine two of the remaining systems they can count on — Social Security and Medicare.In poll after poll, it is clear voters of all ages and political persuasions do not support cutting benefits for middle-class Americans who depend on Social Security and Medicare. There is no other issue that draws this level of nonpartisan support.In fact, 94 percent of Democrats, 82 percent of independents and 64 percent of Republicans prefer raising taxes on the richest 2 percent of income earners rather than cutting benefits.So if most Americans oppose cuts to our social insurance safety net, who supports the bill of goods being sold at Pete Peterson?s Fiscal Summit?Millionaires whose tax loopholes would be paid for by cuts to Medicare and Medicaid.Wall Street bankers who would reap a windfall of commissions and fees if Social Security was replaced by risky private accounts, andInsurance companies who would make billions more if Medicare was privatized.The evidence is clear. From what we have learned through polling, town hall meetings and focus groups held across the country, the American people stand with us and not with Pete Peterson, millionaires, Wall Street bankers and insurance companies.To the elected officials and opinion leaders attending this Summit —- for the sake of the American people —Distance yourselves from the propaganda being spread;Stand up for the millions of middle-class Americans;Fighting for them; andProtect the Social Security and Medicare benefits they have earned.?

It’s Time to Change the Social Security Conversation

“The truth is — as our nation ages and retirement income continues to decline for millions of Americans – Congress should be talking about the adequacy of Social Security’s benefits not cutting them. Congress should examine the inequities that have created a poverty rate for senior women and widows that is 50% higher than other retirees 65 and older. We can break this Social Security glass ceiling…in fact, we must do so to preserve the economic security of generations of American women and their families.” Max Richtman, NCPSSM President/CEO“Our proposals are designed to modernize the Social Security system and recognize particularly the changes that have occurred in women’s lives and in family life, so that women will be rewarded more fairly for the full value of the work they do, both in the labor market and in raising the next generation. We can strengthen the Social Security system to address the gender gap in retirement that reveals many more older women in poverty than older men, while still addressing the financial needs of the program.” Dr. Heidi Hartmann, Institute for Women’s Policy Research President “If implemented, the recommendations we make in ‘Breaking the Social Security Glass Ceiling’ will go a long way toward creating a retirement and disability insurance program that recognizes the new reality of working women and men and values women’s role in society as both breadwinners and primary caregivers. Crediting women’s years out of the paid labor force is a long overdue feature that NOW strongly supports and urges lawmakers to support as well.” Terry O’Neill, NOW Foundation President

Here are just some of the recommendations in this groundbreaking report:

- Improving Survivor Benefits. Women living alone often are forced into poverty because of benefit reductions stemming from the death of a spouse. Providing a widow or widower with 75 percent of the couple’s combined benefit treats one-earner and two-earner couples more fairly and reduces the likelihood of leaving the survivor in poverty.

- Providing Social Security Credits for Caregivers. We recommend imputed earnings for up to five family service years be granted to a worker who leaves or reduces his/her participation in the work force to provide care to children under the age of six or to elderly family members.

- Equal Benefits for Same-Sex Married Couples and Partners. Gay and lesbian same-sex couples, whether married or not, are denied a host of benefits under state and federal law that are routinely provided to heterosexual married couples. Social Security benefits should not be denied to qualified retirees because of their sexual orientation.

- Restoring Student Benefits. Social Security pays benefits to children until age 18, or 19 if they are still attending high school, if a working parent has died, become disabled or retired. In the past, those benefits continued until age 22 if the child was a full-time student in college or a vocational school. Congress ended post-secondary students’ benefits in 1981 which has disproportionately hurt children of parents in blue-collar jobs, African Americans, and lower income students.

“Social Security is a vital lifeline for all Americans, especially women and people of color. When you consider that Social Security provides 90% of seniors’ income for 58% of unmarried women of color, 53% of Hispanics and 47% of African Americans it’s hard to understand why benefit cuts are always the first answer for fiscal hawks hoping to use Social Security for deficit reduction. Building on what works, ‘Breaking the Social Security Glass Ceiling’ offers a modernization plan for Social Security that would strengthen benefits for women and their families while improving the equity and adequacy for generations of Americans.” Dr. Carroll Estes, NPCSSM Foundation Board Chair

While some suggest we can’t afford to provide even current level benefits to America’s retirees, disabled and their families, we disagree. In fact, we believe our nation can’t afford not to provide fair and adequate benefits for future generations of working Americans. A number of funding options are included in this research, including:

- Eliminate the Cap on Social Security Payroll Contributions.

- Slowly Increase the Contribution Rate by 1/40th of One Percent over 20 years.

- Treat all Salary Reduction Plans like 401K’s.

Together, these proposals provide revenue increases equal to 3.99% of taxable payroll. They would close the actuarial deficit (2.67% of payroll) while also funding the modest program improvements recommended.Here’s the link to the full report, “Breaking the Social Security Glass Ceiling”.You can watch the entire briefing here on CSPAN.