Talking about Social Security financing in a way that the average person can truly understand is a challenge. Yet given the constant–and often purposeful– misinformation provided by those who hope to undermine the program, it’s a challenge we all must undertake because as FDR said “Repetition does not transform a lie into a truth.”Angry Bear blog is one of the web’s best when it comes to the issue of Social Security. This weekend’s post “Social Security: The Elevator Pitch” does a terrific job of breaking down the issue to its core. Print this one–stick it on the refrigerator–email it to your friends…It’s a keeper and this month’s Networthy Award winner.

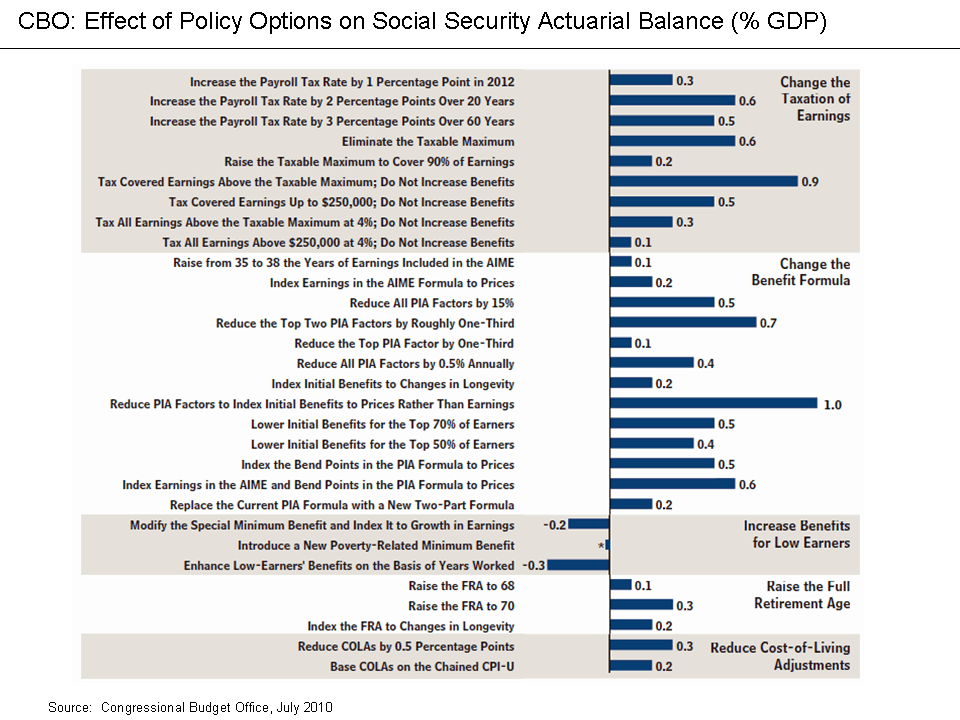

Social Security: The Elevator PitchPosted by Steve Roth | 1/29/2012 10:34:00 AMSteve Roth? Since Social Security started it has always brought in more money than was spent. It contributes a surplus to the total federal budget. That?s true today and will continue for quite some time.? The extra revenue needed to make SS solid far beyond the foreseeable future (75 years) is tiny: 0.6% of GDP.? A 0.6% revenue increase would not be a big burden. The U.S. has been taxing about 28% of GDP for decades, compared to 30-50% in other rich countries (average: 40%).? Coincidentally, Scrapping the Cap on SS contributions ? so high earners paid payroll tax above $110K ? would deliver ? 0.6% of GDP

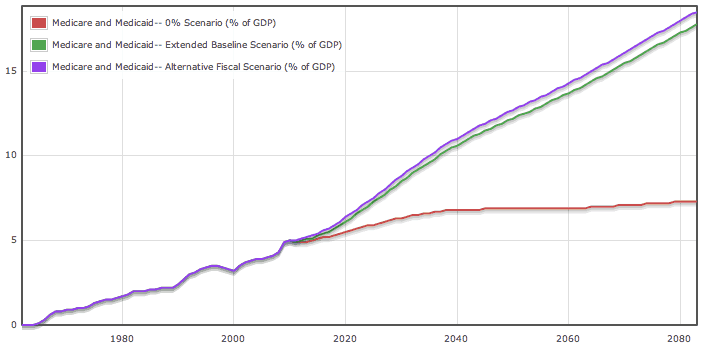

Worried about our fiscal future? It?s the health care costs, stupid. What providers charge.U.S. providers charge two to five times what they charge in other countries, and it?s rising faster ? and faster than wages, GDP, inflation.If you?re not talking about that, you have nothing useful to say about our fiscal future: