Five Ways Congress can Strengthen Social Security Now without Cutting Benefits

Social Security faces a funding shortfall in 2033 which, if not addressed, could result in across the board benefit cuts of about 23%. While this shortfall does not pose an immediate crisis, there are reasonable changes that Congress should enact to keep Social Security solvent and strengthen it for current and future generations:

1) Eliminate the cap on Social Security payroll contributions. In 2014, only wages up to $117,000 will be subject to the Social Security payroll deduction. Lifting the cap will subject all wages to the payroll contribution which will help address the majority of Social Security’s projected funding shortfall.

2) Slowly increase the payroll contribution rate by 1/20th of one percent over 20 years. This gradual increase in the rate will significantly strengthen Social Security’s financial condition well into the future.

3) Treat all salary reduction plans like 401ks. All workers pay Social Security and Medicare taxes on their contributions to retirement accounts but no payroll taxes are collected from workers flexible spending accounts such as HSAs, transit and dependent care plans. This change will add money to the program.

4) Increase the basic benefit for all current and future retirees by 5% of the basic benefit (about $55 per month). This modest but meaningful benefit improvement is a long-overdue boost, especially for low-to-middle income beneficiaries who rely upon their Social Security benefit for the majority of their income.

5) Provide Social Security credits for caregivers. When computing the Social Security benefit, grant up to five family service years to workers who leave paid employment to provide care to children under the age of 6 or to elderly or disabled family members. This will provide greater parity for women’s benefits which are typically less than men’s due to interruptions to paid employment caused by family caregiving needs.

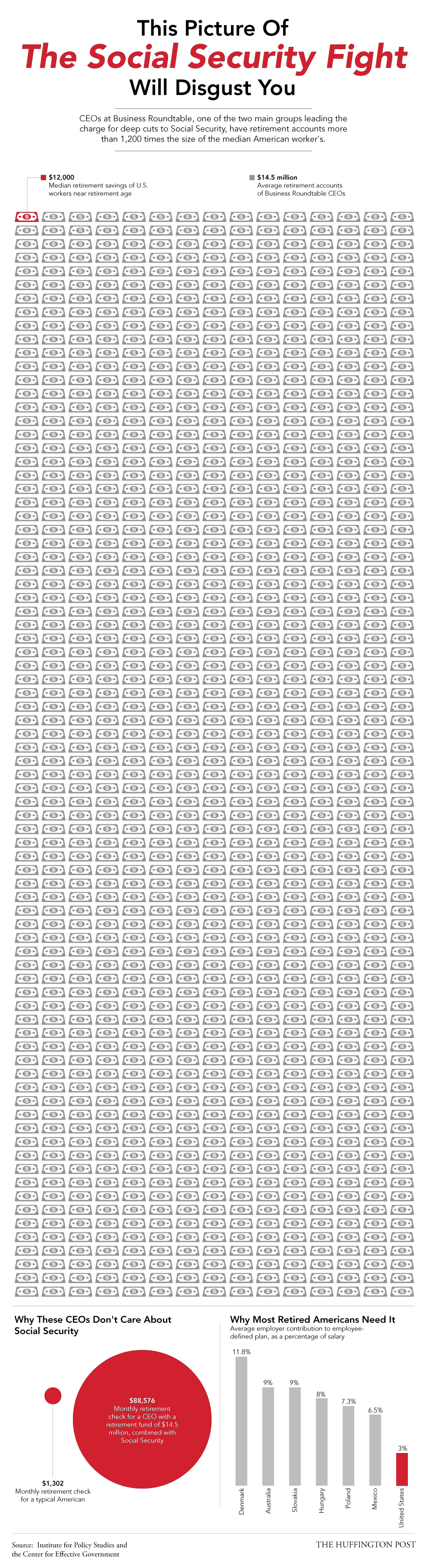

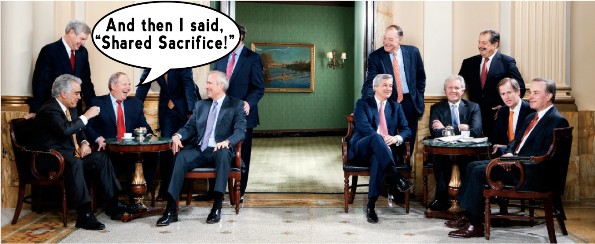

Meet the CEOs Who Want to Cut Your Social Security

We’ve written before about the billion dollar anti-Social Security lobby, led by Wall Streeter Pete Peterson and his myriad number of astroturf front groups, here, here and here. These CEO and Wall Street friendly groups are spending a lot of money to convince Congress that grandma and grandpa’s Social Security is to blame for our economic woes rather than talk about the real problem…$1 trillion in corporate loopholes and income inequality which is destroying the middle class.

Hats off to the Institute for Policy Studies and the Center for Effective Government for their new report detailing the truth behind America’s CEO-led campaign against Social Security. Thanks also to the Huffington Post for this terrific infographic highlighting the report’s key findings:

Senator Warren and the Retirement Crisis

It’s not very often a speech in Congress is so dead-on that we share it, in its entirety, here. Yesterday’s speech by Senator Elizabeth Warren on America’s retirement crisis is a notable exception. We highly recommend you give it a view:

Activists Stage White House Demonstration to End Chained CPI Proposal

Cuts to Social Security Will Hurt Seniors, Veterans, People with Disabilities and Children; Shackle Recovering Economy

Activists from the National Committee to Preserve Social Security and Medicare, AARP, NOW, Paralyzed Veterans of America, Generations United, NARFE, Social Security Works and other advocacy groups converged on the White House to tell President Obama “No” to the chained CPI. Protestors with signs illustrating the negative economic impact in each of the nation’s 50 states plus Washington, D.C. rallied along Pennsylvania Avenue and were joined by Rep. Keith Ellison (MN-5) and Rep. Mark Pocan (WI-2).

“The coalition here today is diverse, strong and unified in our opposition to Social Security benefit cuts like those that would come with the Chained CPI. Groups here today represent not just seniors but also young people, veterans, civilians, people with disabilities and middle class families. We’re all here together to say the negative impact of the Chained CPI should not be ignored or trivialized any longer. The White House and others have said this benefit cut is nothing more than a “technical tweak,”…but the truth is it would be a benefit cut imposed on the oldest and most vulnerable Americans who would be least able to afford it.” Max Richtman, NCPSSM President/CEO

Here’s a video of activists rallying at the White House.