GOP Budget Plan Released Today’Seniors Say Three Strikes You’re OUT

Today’s release of the GOP/Ryan budget reminds us of the famous line, “the definition of insanity is doing the same thing over and over again and expecting different results.” Today marks the third time House Republicans have released the Ryan budget, which in Rep. Paul Ryan’s Orwellian terms he’s also named a “Path to Prosperity.” Thankfully the result again this year will likely be the same. Dead on arrival. We say thankfully because, once again, this budget pretends deficit reduction alone is economic recovery, while ignoring the financial realities millions of America’s middle-class families still face in this slow economy. This plan also targets seniors in Medicaid with cuts, a “coupon care” plan for Medicare which would ultimately end traditional Medicare, and a fast-track plan to cut Social Security benefits:

“Once again, House Republicans have re-introduced the same flawed budget approach middle-class Americans have rejected in poll after poll and most importantly at the ballot box. Rather than deal with the true challenges facing this nation including, slow economic growth, high unemployment, and unprecedented income inequality, the GOP/Ryan budget targets middle-class seniors and their families with massive cuts to pay for tax cuts benefiting huge corporations and the wealthiest among us. Americans want a balanced approach to the national budget. This cuts-only plan isn’t it.

The Ryan plan would create vouchers in Medicare leaving seniors and the disabled – some of our most vulnerable Americans – hostage to the whims of private insurance companies. Over time, this will end traditional Medicare and make it harder for seniors to choose their own doctor. Vouchers are designed not to keep up with the increasing cost of health insurance… that is why they save money. If the GOP/Ryan budget becomes law, seniors would immediately lose billions in prescription drug savings, free wellness visits and preventative services provided in the ACA, and the Part D donut hole returns.

Destroying traditional Medicare and leaving millions of Americans without adequate health coverage is not a path to prosperity for anyone except for-profit insurers. The American people understand that.” Max Richtman, NCPSSM President/CEO

Senate Democrats have also prepared their budget plan which will be released tomorrow. According to Huffington Post, the Democratic Budget plan:

“… calls for $975 billion in additional revenues through closing loopholes and ending tax expenditures. The budget, unlike Ryan’s, doesn’t close the door on going beyond the fiscal cliff deal either; it calls for the continuation of current tax rates for middle and lower class Americans but does not specify whether current rates should be protected for high-end earners.

“While House Republicans are doubling down on the extreme budget that the American people already rejected, Senate Democrats are going to be working on a responsible budget that puts jobs and the economy first and reflects the values and priorities of middle class families across the country,” read a statement from Murray.

A top Senate Democratic aide said that the specifics — including where rates should be set, which loopholes should be closed, and which expenditures should be ended — would be left to the Senate Finance Committee. The Murray budget does give the Finance Committee some help, though, offering parliamentary instructions (known as reconciliation) to help ensure the tax reform bill it produces will be granted an up-or-down vote.

While the $975 billion figure is ambitious, the Senate aide pointed to a report by the Center for American Progress that showed $1 trillion in savings could be gained through “reducing or reforming tax breaks.”

On the spending side, Murray’s budget looks for $493 billion in domestic cuts, $275 billion of which will come from health care savings. The aide said that those health care savings, which will also be determined by the Finance Committee, would be felt solely on the provider side and not among beneficiaries. Additionally, the budget calls for $240 billion in defense spending cuts and $242 billion in reduced interest payments.

Those savings in total will replace the sequestration-related cuts that went into effect on March 1. Over a ten-year window, they will reduce the deficit by $1.95 trillion. But since Murray’s budget also sets aside $100 billion for economic stimulus measures — $50 billion on repairing highest transportation priorities, $10 billion on projects of major regional importance and the rest on other items like worker training — the total savings will be measured at $1.85 trillion.”

These budgets clearly lay out starkly different priority choices. Especially for middle-class families and retirees who understand first hand the value of programs like Social Security, Medicare and Medicaid, and who want those programs preserved for future generations.

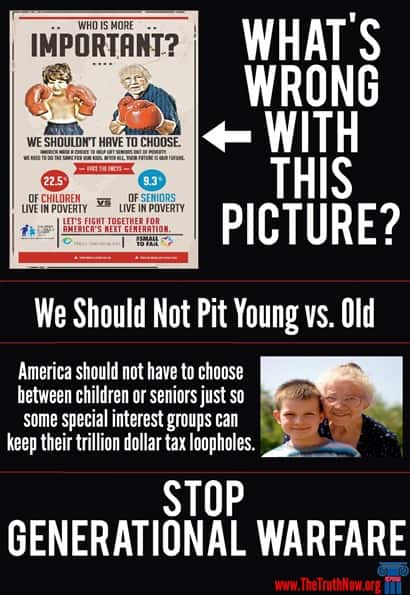

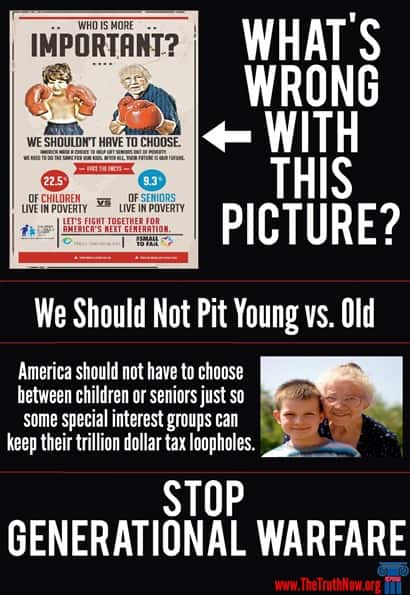

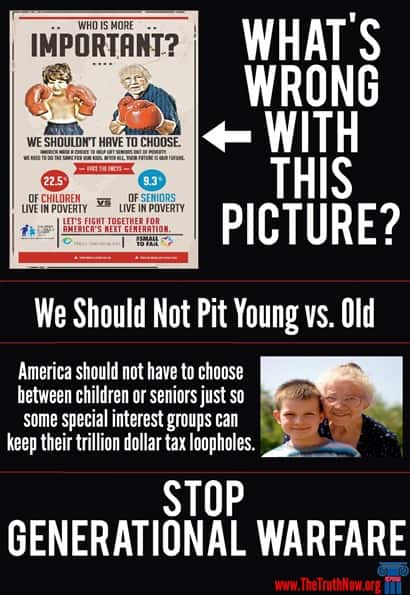

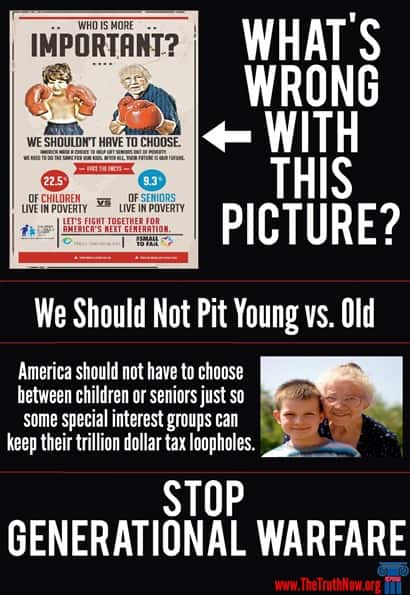

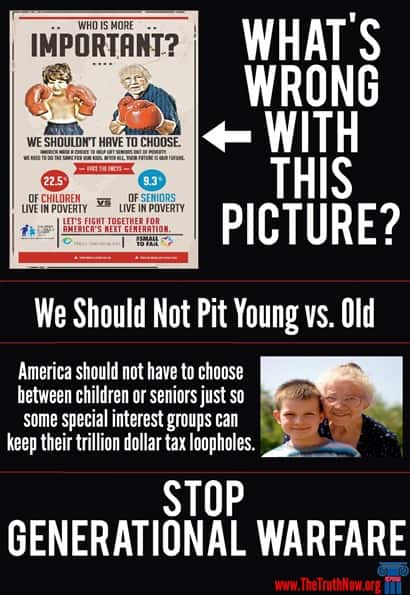

Corporate Lobbyists Launch Generational Warfare Campaign to Avoid Talking about the Real Problem…$1 Trillion in Tax Loopholes

If you listen to any of the hundreds of lobbyists and PR flaks who are part of a billion dollar corporate campaign to cut Social Security and Medicare benefits, our fiscal problems have nothing to do with economic collapse, Wall Street excess, or a trillion dollars in wasteful corporate tax loopholes. America’s real problem is grandma and grandpa. According to our nation’s wealthiest CEO’s and Wall Street millionaires, led by “Fix the Debt”, the Business Roundtable and countless other Pete Peterson backed organizations, the solution to our economic woes is to convince America’s young people that Social Security won’t be around for them. Then, make them believe that the “greedy geezers” (aka their parents/grandparents), who are trying to get-by on an average $14,000 annual Social Security benefit, really don’t care about the program’s future – just their own survival. It’s classic case of dodge and deflect — divide and conquer politics. Economist, Dean Baker explains:

“Peter Peterson, the Wall Street investment banker, has been most visible in this effort, committing over $1 billion of his fortune for this purpose. Recently he enlisted a group of CEOs in his organization, Fix the Debt, which quite explicitly hopes to divert concerns over income inequality into concerns over generational inequality. It argues that programs like Social Security and Medicare, whose direct beneficiaries are disproportionately elderly, are taking resources from the young.

It is easy to show the absurdity of this position. The amount of money that the young stand to lose from the upward redistribution of income is an order of magnitude larger than whatever hit to their after-tax income they might face due to the continuing drop in the ratio of workers to retirees. Also, older people generally have families. This means that when we cut the Social Security or Medicare benefits of middle and lower income beneficiaries we are often creating a gap that will be filled from the income of their children.”

This strategy is nothing new. In fact, it follows an especially cynical proposal (even by Washington standards) created in 1983, after conservatives were unsuccessful in their attempts to convince the Social Security Commission to privatize Social Security. The Los Angeles Times’ Michael Hiltzik describes the Cato Institute’s generational warfare strategy, now in full implementation here in Washington,

“The purest articulation of intergenerational warfare as a wedge to break up Social Security’s political coalition is a 1983 paper published by the libertarian Cato Journal. It was titled “Achieving a ‘Leninist’ Strategy,” an allusion to the Bolshevik leader’s supposed ideas about dividing and weakening his political adversaries.

The paper advocated making a commitment to honor Social Security’s commitment to the retired and near-retired as a tool to “detach, or at least neutralize” them as opponents of privatization or other changes. Meanwhile, doubts among the young about the survival of the program should be exploited so they could be “organized behind the private alternative.”

So when you hear a politician promising to exempt the retired and near retired from changes to Social Security, while offering to make it more “secure” for future generations, you now know the game plan.”

The real problem is this “game plan” will be devastating for America’s young people. The wealthy corporate “generals” of this generational warfare strategy claim to be “saving” the social safety net for future generations. In truth, it’s America’s young people who will face the biggest benefit cuts if they buy into this campaign. The fact is, the Recession Generation will need Social Security and Medicare just as much, if not more than the parents and grandparents these wealthy CEO’s are trying to demonize. The Center for Retirement Research of Boston College reports:

“Adults age 25 to 34 in 2008 will see their age-70 incomes fall by 4.9 percent (or $3,000 per person) as a result of the recession. Younger workers are especially hard hit since they lose the benefits of compounding interest. Compounding becomes an especially powerful force in a 401(k) when combined with pre-tax contributions and the fact that they do not pay taxes on their annual 401(k) account earnings.”

Not only couldl this generation face lower incomes but many younger households are also carrying more student loan debt after the recession than before: 40% had such debt in 2010, up from 34% in 2007 and 26% in 2001. Our nation’s seniors know that cutting already modest benefits for future generations will leave their children and grandchildren facing a retirement that could be just as financially difficult as the economic troubles they now face in their youth. That’s why the vast majority of Americans oppose cutting benefits under the guise of deficit reduction. In fact, a recent National Academy of Social Insurance poll shows most are willing to pay more to preserve and even improve benefits. That’s certainly doesn’t fit the “greedy geezer” propaganda offered by corporate lobbyists posing as deficit hawks.

Social Security and Medicare aren’t the problems. However, rising income inequality and Washington’s economic policies which have shifted income away from middle-class families (including the young and old alike) to America’s millionaires and corporations are the problems. That’s why groups like Fix the Debt, the Business Roundtable, the Peterson Foundation and the rest of Washington’s massive corporate lobby have made such a huge investment in slick messaging campaigns to convince America’s young people to focus on their grandparents’ $14,000 Social Security benefit rather than the trillion dollars in tax breaks and loopholes enjoyed by our nation’s wealthiest.

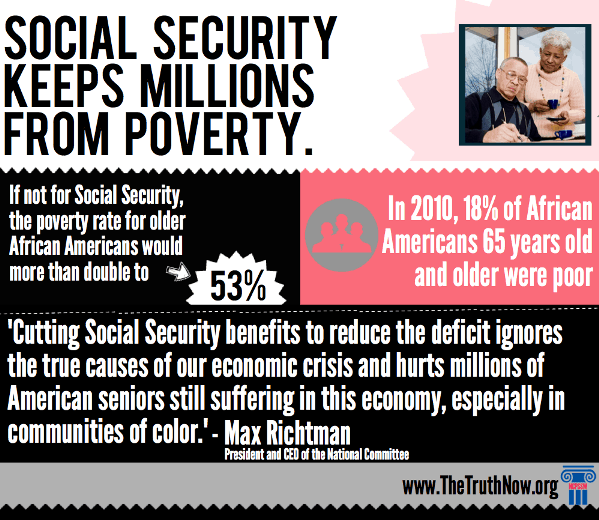

America’s Wealth Divide Continues: Cutting Social Security & Medicare Will Make it Even Worse

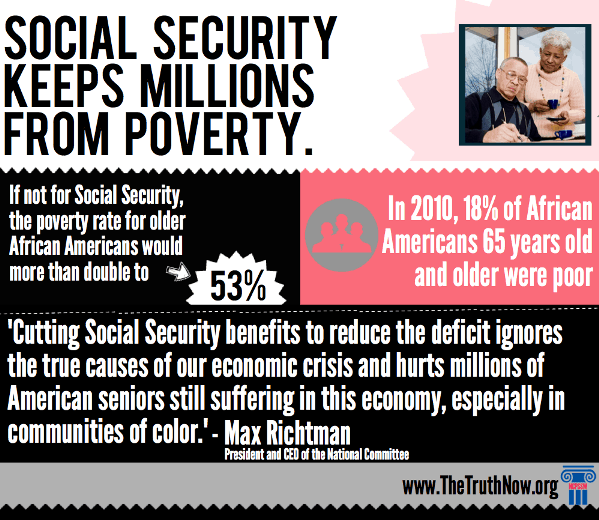

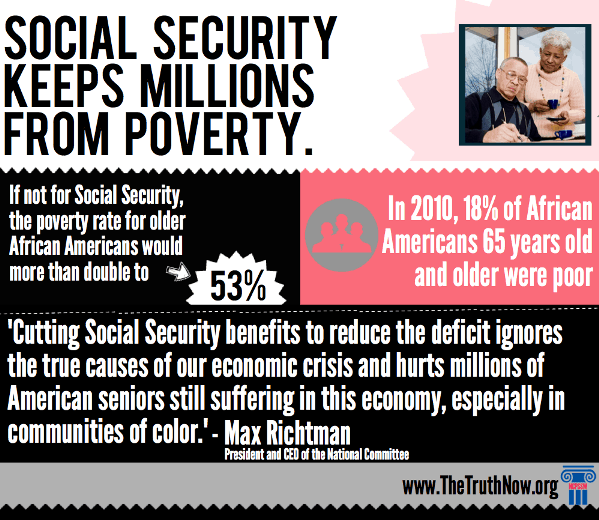

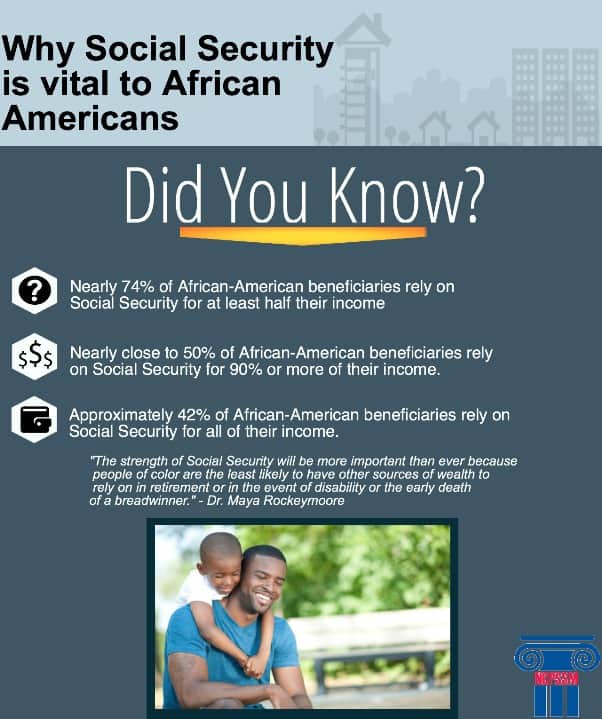

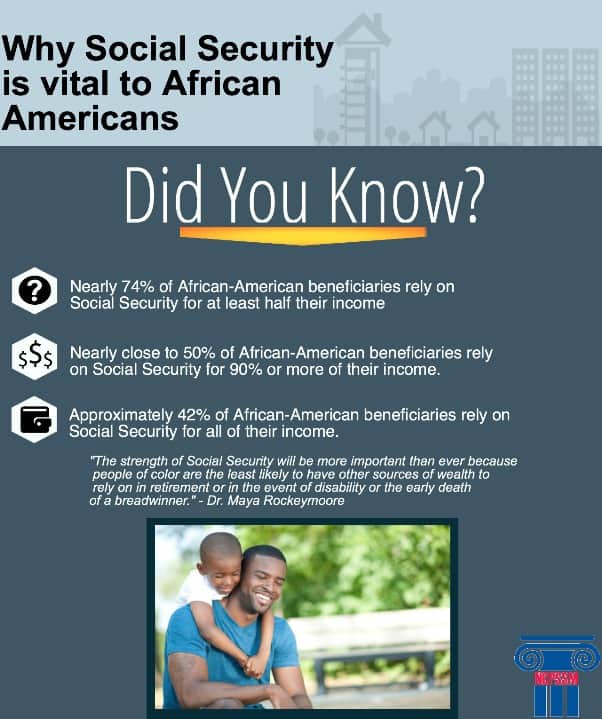

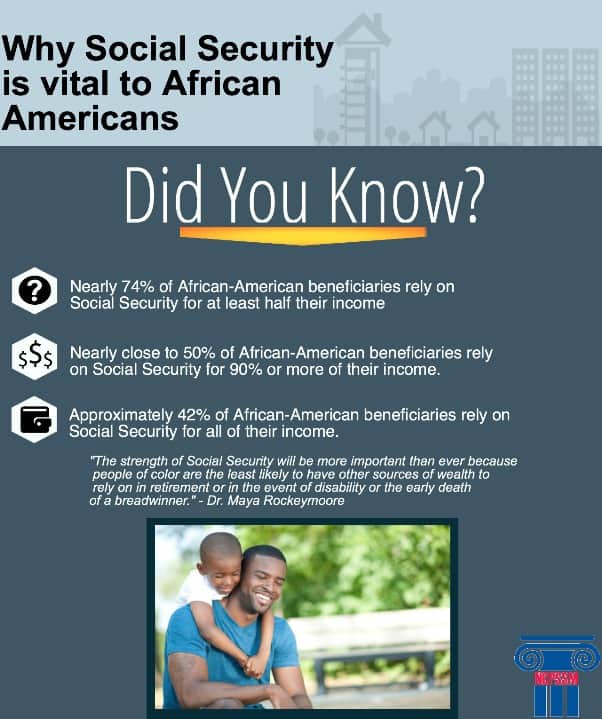

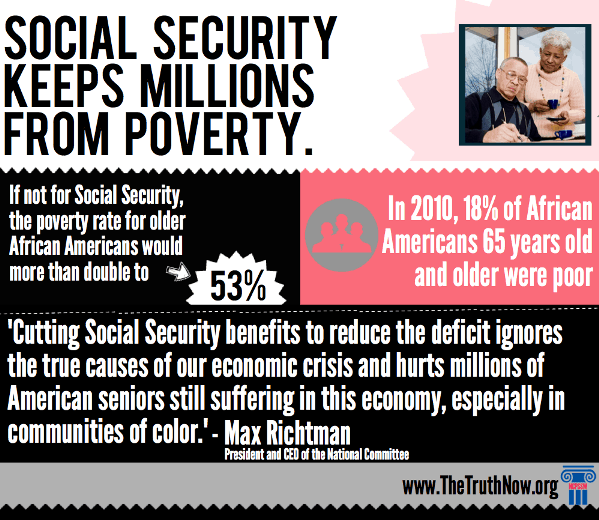

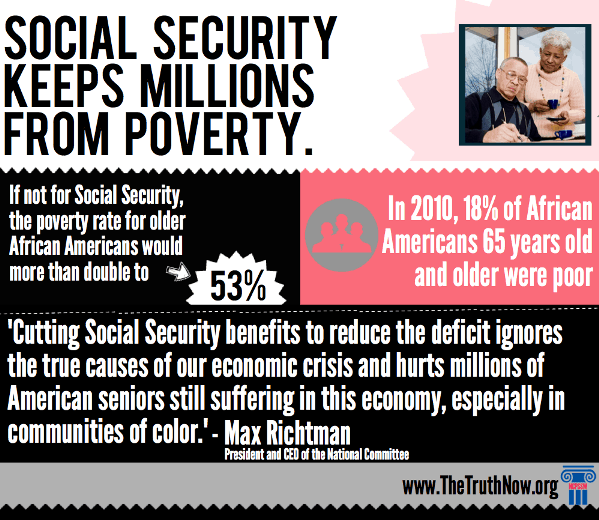

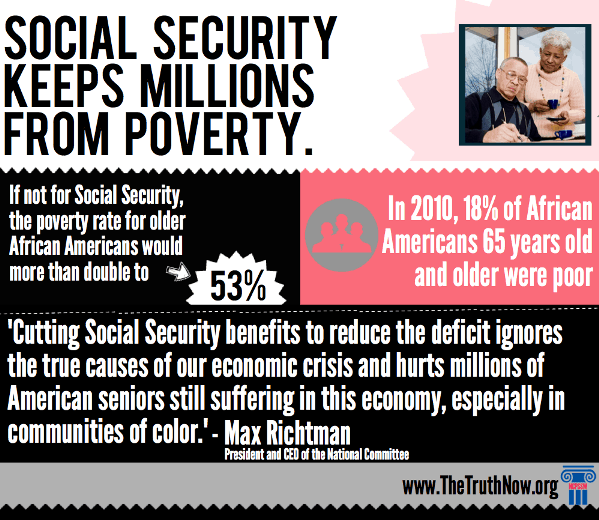

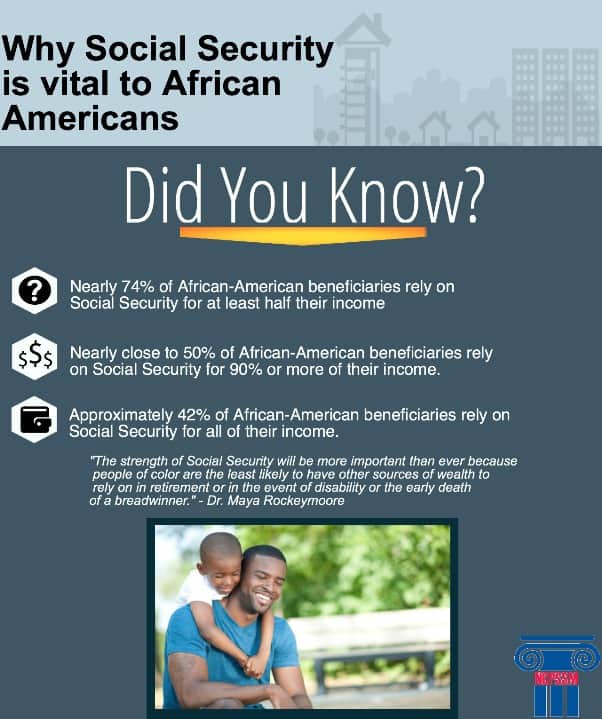

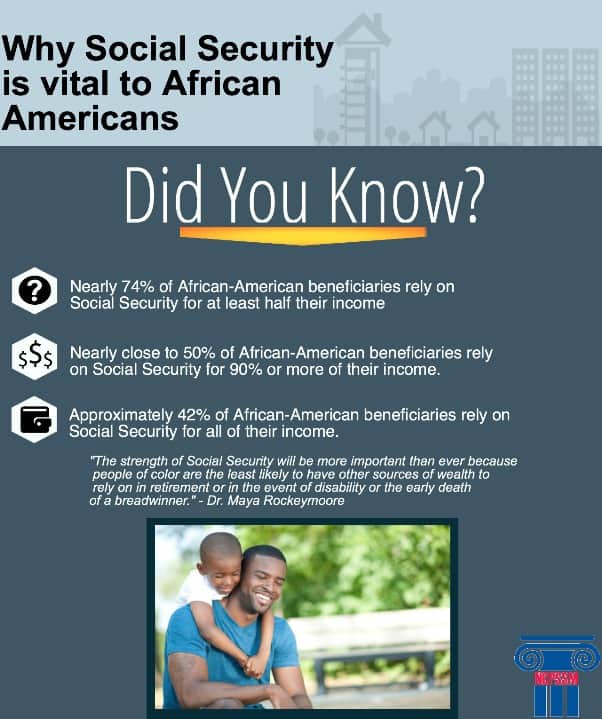

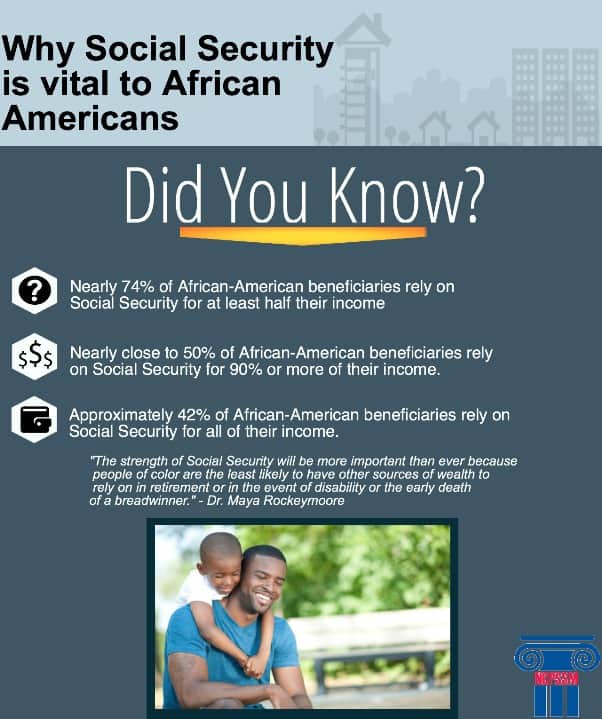

It’s easy in this era of Washington deficit mania to focus solely on the numbers on a budget spreadsheet while losing sight of the fact that the austerity agenda pushed by those least likely to be impacted by their policies will have serious implications for America’s middle class families. This is especially true for those already struggling in this economic slowdown, especially communities of color. We’ve talked about this a lot during February’s Black History month coverage and NCPSSM will continue to address these issues throughout the ongoing budget and deficit debate. In case you missed it, here’s a wrap up of some of our February coverage:

National Advocates Join Forces to Urge Equal Access to Social Security Benefits

We were proud today to release a new report, co-authored with the Human Rights Campaign detailing how current law leaves America’s same sex couples and their families living outside the safety net.

Social Security is the keystone of most Americans’ retirement planning and provides valuable income protection to families in case of a worker’s disability or death. Yet, same-sex couples and many of their children are denied access to Social Security benefits, even though they have contributed to the program throughout their working lives. The National Committee to Preserve Social Security and Medicare Foundation and the Human Rights Campaign Foundation have issued a new report “Living Outside the Safety Net.” This report examines the impact this inequality has on millions of lesbian and gay families and offers legislative solutions.

“Social Security has a long tradition of evolving to more effectively protect America’s workers and their families as our nation changes. In fact, that is key to the program’s unparalleled success across generations. America’s same-sex couples and their families have earned Social Security’s protections the same as any other working American and they deserve the same retirement and economic security the program provides.” … Carroll Estes, NCPSSM Foundation Chair

“Social Security is a safety net for many, and the sole source of income for some. However, same-sex couples go completely unrecognized by Social Security and are routinely denied this benefit. As a result, many surviving same-sex spouses find themselves in a financial free-fall following the death or disability of a spouse.” said HRC Legislative Counsel for Administrative Advocacy Robin Maril. “This report provides an overview of the extent of the economic loss many families are experiencing today because the Social Security system fails to recognize them as a family. Congress must right this wrong by passing legislation that makes these vital benefits available to all Americans.”

The National Committee and HRC support legislation introduced by Congresswoman Linda Sanchez (D-CA) to expand Social Security spousal benefits to same-sex couples. The Social Security Equality Act of 2012 (H.R. 4609) would require the Social Security Administration to provide same-sex couples with the same spousal, survivor and death benefits their heterosexual counterparts receive.

“Same-sex couples pay into Social Security, and they should receive the full benefits they have earned. It is time for us to end discrimination in Social Security so that same-sex couples are not treated as second class citizens. I’m proud to say that I will be re-introducing the ‘Social Security Equality Act’ this Congress to make sure every American receives a benefit based upon their contribution to the program, not their sexual orientation.” Rep. Linda Sanchez (D-CA)

On average, a full retirement age same-sex household with one wage-earner forfeits $675 monthly or $8,100 annually in lost spousal retirement benefits. Blair Dottin-Haley, from Alexandria, Virginia, works for a local non-profit and has been married for nearly two years. His husband is HIV positive; however, even though they both have contributed to Social Security throughout their working lives they are not eligible for spousal benefits.

Blair Dottin-Haley who married his husband two years ago in DC also be joined the panel. “As a married man, it’s important that I protect my family and work to secure the rights and benefits that we’ve earned by joining our lives together.”

This report recommends that Congress:

- Amend the Social Security Act to include same-sex domestic partners as eligible to receive equal benefits following the death, retirement, or disability of their loved one.

- Include language within the Social Security Act’s definition of “child” to reflect the permanent relationship between a legally-unrecognized same-sex parent and his or her child to end the exclusion of many children under current law.

- Repeal the Defense of Marriage Act (DOMA) which currently prevents surviving same-sex spouses from receiving Social Security benefits they are otherwise entitled to.

You can read the full report on the NCPSSM Foundation website here.

Celebrating Black History Month and Some of Our Wonderful Activists

Geneva Burns, a Memphis resident, has been a volunteer with the National Committee for more than 10 years where she has done radio and at least 20 presentations. She has worked with the AGE STAGE Theatre Group with the Commission on Aging and served as Vice Chair on the Tennessee Commission on Aging. Burns was the only African American during her four year tenure. “Social Security & Medicare are worth fighting for!”

Ruth Cossey, East Palo Alto, CA, concentrates on providing information to seniors by managing the National Committee resource tables in the minority community and across her congressional district. She is always willing to support our efforts and to educate people about Social Security and Medicare issues. “Volunteering for NCPSSM, gives me the opportunity to share news and updates about Social Security and Medicare with seniors.”

Pat Cotton, Hyattsville, MD, has been a media star for NCPSSM, speaking at press conferences on Capitol Hill and interviews with national publications. Pat is also a Rally Corp member and works as a CAN. “I am an activist to preserve Social Security, Medicare & Medicaid for me and for my patients. These programs add to the quality of life!”

Alberta Gaskins, Washington, DC, another media star, she is a member of our Rally Corp and has helped with numerous petition deliveries to Congressional offices, press events and briefings. “I say I will fight for Social Security, Medicare and Medicaid because these are things that matter!!!”

Nettie Haile, Washington, DC, is a member of our Rally Corp. She was a speaker at the Summit on Social Security sponsored by Senator Bernie Sanders in November, 2012. Congresswoman Eleanor Holmes Norton, after hearing Nettie speak on Social Security at a briefing several years ago, declared Nettie her “poster child for Social Security”.“It’s very important that we do all we can to insure that benefits promised and worked hard for are not taken away.”

Celestine Johnson, Washington, DC, is an active member of our Rally Corps, participating in the majority of our “short notice” events on Capitol Hill. She arranges speaking opportunities for National Committee representatives with senior/retiree groups at her church. She has also recruited other local activists to join the Rally Corps. “I especially enjoy working with NCPSSM. I have learned so much.”

Jerry Johnson, Las Vegas, NV , a recent retiree of Clark County’s Senior Advocate Program, was as active participant in the National Committee’s Rapid Response Campaign during the 2012 election. He serves as a Grassroots District Team member. He brings a wealth of knowledge with respect to the aging network in the state and of senior issues in the communities. “As a boomer, I’ve embraced the reality of the safety net that Social Security and Medicare provides and this was my incentive to join as a volunteer to insure that it prevails.”

Godfrey Laws splits his time between Seattle WA and Roxboro NC each year and he volunteers in both communities. He has been involved in many local events and helps with our education and outreach. He works with many churches, and particularly likes to inform younger people about Social Security. “Social Security and Medicare are so important in the lives of some many people. We need to educate people of all ages about the value of these programs and work to maintain them for the health and well-being of seniors and their families.”

Reverend Julius Turnipseed, Memphis, TN, has given many educational sessions on Social Security and Medicare and disseminated our materials in communities throughout his area. “I am very proud to be an advocate for NCPSSM. We are able to get the truth to the people about what’s going on in Washington.”

Rosie Lee Woods, a resident from Richmond, VA, has recruited some terrific family and friends from GA and AR to be NCPSSM volunteers. She sets up community education meetings and makes visits to her local Congressional offices. “After joining NCPSSM, I have become better informed and more involved with politics, advocacy and helping others to get involved too.”

GOP Budget Plan Released Today’Seniors Say Three Strikes You’re OUT

Today’s release of the GOP/Ryan budget reminds us of the famous line, “the definition of insanity is doing the same thing over and over again and expecting different results.” Today marks the third time House Republicans have released the Ryan budget, which in Rep. Paul Ryan’s Orwellian terms he’s also named a “Path to Prosperity.” Thankfully the result again this year will likely be the same. Dead on arrival. We say thankfully because, once again, this budget pretends deficit reduction alone is economic recovery, while ignoring the financial realities millions of America’s middle-class families still face in this slow economy. This plan also targets seniors in Medicaid with cuts, a “coupon care” plan for Medicare which would ultimately end traditional Medicare, and a fast-track plan to cut Social Security benefits:

“Once again, House Republicans have re-introduced the same flawed budget approach middle-class Americans have rejected in poll after poll and most importantly at the ballot box. Rather than deal with the true challenges facing this nation including, slow economic growth, high unemployment, and unprecedented income inequality, the GOP/Ryan budget targets middle-class seniors and their families with massive cuts to pay for tax cuts benefiting huge corporations and the wealthiest among us. Americans want a balanced approach to the national budget. This cuts-only plan isn’t it.

The Ryan plan would create vouchers in Medicare leaving seniors and the disabled – some of our most vulnerable Americans – hostage to the whims of private insurance companies. Over time, this will end traditional Medicare and make it harder for seniors to choose their own doctor. Vouchers are designed not to keep up with the increasing cost of health insurance… that is why they save money. If the GOP/Ryan budget becomes law, seniors would immediately lose billions in prescription drug savings, free wellness visits and preventative services provided in the ACA, and the Part D donut hole returns.

Destroying traditional Medicare and leaving millions of Americans without adequate health coverage is not a path to prosperity for anyone except for-profit insurers. The American people understand that.” Max Richtman, NCPSSM President/CEO

Senate Democrats have also prepared their budget plan which will be released tomorrow. According to Huffington Post, the Democratic Budget plan:

“… calls for $975 billion in additional revenues through closing loopholes and ending tax expenditures. The budget, unlike Ryan’s, doesn’t close the door on going beyond the fiscal cliff deal either; it calls for the continuation of current tax rates for middle and lower class Americans but does not specify whether current rates should be protected for high-end earners.

“While House Republicans are doubling down on the extreme budget that the American people already rejected, Senate Democrats are going to be working on a responsible budget that puts jobs and the economy first and reflects the values and priorities of middle class families across the country,” read a statement from Murray.

A top Senate Democratic aide said that the specifics — including where rates should be set, which loopholes should be closed, and which expenditures should be ended — would be left to the Senate Finance Committee. The Murray budget does give the Finance Committee some help, though, offering parliamentary instructions (known as reconciliation) to help ensure the tax reform bill it produces will be granted an up-or-down vote.

While the $975 billion figure is ambitious, the Senate aide pointed to a report by the Center for American Progress that showed $1 trillion in savings could be gained through “reducing or reforming tax breaks.”

On the spending side, Murray’s budget looks for $493 billion in domestic cuts, $275 billion of which will come from health care savings. The aide said that those health care savings, which will also be determined by the Finance Committee, would be felt solely on the provider side and not among beneficiaries. Additionally, the budget calls for $240 billion in defense spending cuts and $242 billion in reduced interest payments.

Those savings in total will replace the sequestration-related cuts that went into effect on March 1. Over a ten-year window, they will reduce the deficit by $1.95 trillion. But since Murray’s budget also sets aside $100 billion for economic stimulus measures — $50 billion on repairing highest transportation priorities, $10 billion on projects of major regional importance and the rest on other items like worker training — the total savings will be measured at $1.85 trillion.”

These budgets clearly lay out starkly different priority choices. Especially for middle-class families and retirees who understand first hand the value of programs like Social Security, Medicare and Medicaid, and who want those programs preserved for future generations.

Corporate Lobbyists Launch Generational Warfare Campaign to Avoid Talking about the Real Problem…$1 Trillion in Tax Loopholes

If you listen to any of the hundreds of lobbyists and PR flaks who are part of a billion dollar corporate campaign to cut Social Security and Medicare benefits, our fiscal problems have nothing to do with economic collapse, Wall Street excess, or a trillion dollars in wasteful corporate tax loopholes. America’s real problem is grandma and grandpa. According to our nation’s wealthiest CEO’s and Wall Street millionaires, led by “Fix the Debt”, the Business Roundtable and countless other Pete Peterson backed organizations, the solution to our economic woes is to convince America’s young people that Social Security won’t be around for them. Then, make them believe that the “greedy geezers” (aka their parents/grandparents), who are trying to get-by on an average $14,000 annual Social Security benefit, really don’t care about the program’s future – just their own survival. It’s classic case of dodge and deflect — divide and conquer politics. Economist, Dean Baker explains:

“Peter Peterson, the Wall Street investment banker, has been most visible in this effort, committing over $1 billion of his fortune for this purpose. Recently he enlisted a group of CEOs in his organization, Fix the Debt, which quite explicitly hopes to divert concerns over income inequality into concerns over generational inequality. It argues that programs like Social Security and Medicare, whose direct beneficiaries are disproportionately elderly, are taking resources from the young.

It is easy to show the absurdity of this position. The amount of money that the young stand to lose from the upward redistribution of income is an order of magnitude larger than whatever hit to their after-tax income they might face due to the continuing drop in the ratio of workers to retirees. Also, older people generally have families. This means that when we cut the Social Security or Medicare benefits of middle and lower income beneficiaries we are often creating a gap that will be filled from the income of their children.”

This strategy is nothing new. In fact, it follows an especially cynical proposal (even by Washington standards) created in 1983, after conservatives were unsuccessful in their attempts to convince the Social Security Commission to privatize Social Security. The Los Angeles Times’ Michael Hiltzik describes the Cato Institute’s generational warfare strategy, now in full implementation here in Washington,

“The purest articulation of intergenerational warfare as a wedge to break up Social Security’s political coalition is a 1983 paper published by the libertarian Cato Journal. It was titled “Achieving a ‘Leninist’ Strategy,” an allusion to the Bolshevik leader’s supposed ideas about dividing and weakening his political adversaries.

The paper advocated making a commitment to honor Social Security’s commitment to the retired and near-retired as a tool to “detach, or at least neutralize” them as opponents of privatization or other changes. Meanwhile, doubts among the young about the survival of the program should be exploited so they could be “organized behind the private alternative.”

So when you hear a politician promising to exempt the retired and near retired from changes to Social Security, while offering to make it more “secure” for future generations, you now know the game plan.”

The real problem is this “game plan” will be devastating for America’s young people. The wealthy corporate “generals” of this generational warfare strategy claim to be “saving” the social safety net for future generations. In truth, it’s America’s young people who will face the biggest benefit cuts if they buy into this campaign. The fact is, the Recession Generation will need Social Security and Medicare just as much, if not more than the parents and grandparents these wealthy CEO’s are trying to demonize. The Center for Retirement Research of Boston College reports:

“Adults age 25 to 34 in 2008 will see their age-70 incomes fall by 4.9 percent (or $3,000 per person) as a result of the recession. Younger workers are especially hard hit since they lose the benefits of compounding interest. Compounding becomes an especially powerful force in a 401(k) when combined with pre-tax contributions and the fact that they do not pay taxes on their annual 401(k) account earnings.”

Not only couldl this generation face lower incomes but many younger households are also carrying more student loan debt after the recession than before: 40% had such debt in 2010, up from 34% in 2007 and 26% in 2001. Our nation’s seniors know that cutting already modest benefits for future generations will leave their children and grandchildren facing a retirement that could be just as financially difficult as the economic troubles they now face in their youth. That’s why the vast majority of Americans oppose cutting benefits under the guise of deficit reduction. In fact, a recent National Academy of Social Insurance poll shows most are willing to pay more to preserve and even improve benefits. That’s certainly doesn’t fit the “greedy geezer” propaganda offered by corporate lobbyists posing as deficit hawks.

Social Security and Medicare aren’t the problems. However, rising income inequality and Washington’s economic policies which have shifted income away from middle-class families (including the young and old alike) to America’s millionaires and corporations are the problems. That’s why groups like Fix the Debt, the Business Roundtable, the Peterson Foundation and the rest of Washington’s massive corporate lobby have made such a huge investment in slick messaging campaigns to convince America’s young people to focus on their grandparents’ $14,000 Social Security benefit rather than the trillion dollars in tax breaks and loopholes enjoyed by our nation’s wealthiest.

America’s Wealth Divide Continues: Cutting Social Security & Medicare Will Make it Even Worse

It’s easy in this era of Washington deficit mania to focus solely on the numbers on a budget spreadsheet while losing sight of the fact that the austerity agenda pushed by those least likely to be impacted by their policies will have serious implications for America’s middle class families. This is especially true for those already struggling in this economic slowdown, especially communities of color. We’ve talked about this a lot during February’s Black History month coverage and NCPSSM will continue to address these issues throughout the ongoing budget and deficit debate. In case you missed it, here’s a wrap up of some of our February coverage:

National Advocates Join Forces to Urge Equal Access to Social Security Benefits

We were proud today to release a new report, co-authored with the Human Rights Campaign detailing how current law leaves America’s same sex couples and their families living outside the safety net.

Social Security is the keystone of most Americans’ retirement planning and provides valuable income protection to families in case of a worker’s disability or death. Yet, same-sex couples and many of their children are denied access to Social Security benefits, even though they have contributed to the program throughout their working lives. The National Committee to Preserve Social Security and Medicare Foundation and the Human Rights Campaign Foundation have issued a new report “Living Outside the Safety Net.” This report examines the impact this inequality has on millions of lesbian and gay families and offers legislative solutions.

“Social Security has a long tradition of evolving to more effectively protect America’s workers and their families as our nation changes. In fact, that is key to the program’s unparalleled success across generations. America’s same-sex couples and their families have earned Social Security’s protections the same as any other working American and they deserve the same retirement and economic security the program provides.” … Carroll Estes, NCPSSM Foundation Chair

“Social Security is a safety net for many, and the sole source of income for some. However, same-sex couples go completely unrecognized by Social Security and are routinely denied this benefit. As a result, many surviving same-sex spouses find themselves in a financial free-fall following the death or disability of a spouse.” said HRC Legislative Counsel for Administrative Advocacy Robin Maril. “This report provides an overview of the extent of the economic loss many families are experiencing today because the Social Security system fails to recognize them as a family. Congress must right this wrong by passing legislation that makes these vital benefits available to all Americans.”

The National Committee and HRC support legislation introduced by Congresswoman Linda Sanchez (D-CA) to expand Social Security spousal benefits to same-sex couples. The Social Security Equality Act of 2012 (H.R. 4609) would require the Social Security Administration to provide same-sex couples with the same spousal, survivor and death benefits their heterosexual counterparts receive.

“Same-sex couples pay into Social Security, and they should receive the full benefits they have earned. It is time for us to end discrimination in Social Security so that same-sex couples are not treated as second class citizens. I’m proud to say that I will be re-introducing the ‘Social Security Equality Act’ this Congress to make sure every American receives a benefit based upon their contribution to the program, not their sexual orientation.” Rep. Linda Sanchez (D-CA)

On average, a full retirement age same-sex household with one wage-earner forfeits $675 monthly or $8,100 annually in lost spousal retirement benefits. Blair Dottin-Haley, from Alexandria, Virginia, works for a local non-profit and has been married for nearly two years. His husband is HIV positive; however, even though they both have contributed to Social Security throughout their working lives they are not eligible for spousal benefits.

Blair Dottin-Haley who married his husband two years ago in DC also be joined the panel. “As a married man, it’s important that I protect my family and work to secure the rights and benefits that we’ve earned by joining our lives together.”

This report recommends that Congress:

- Amend the Social Security Act to include same-sex domestic partners as eligible to receive equal benefits following the death, retirement, or disability of their loved one.

- Include language within the Social Security Act’s definition of “child” to reflect the permanent relationship between a legally-unrecognized same-sex parent and his or her child to end the exclusion of many children under current law.

- Repeal the Defense of Marriage Act (DOMA) which currently prevents surviving same-sex spouses from receiving Social Security benefits they are otherwise entitled to.

You can read the full report on the NCPSSM Foundation website here.

Celebrating Black History Month and Some of Our Wonderful Activists

Geneva Burns, a Memphis resident, has been a volunteer with the National Committee for more than 10 years where she has done radio and at least 20 presentations. She has worked with the AGE STAGE Theatre Group with the Commission on Aging and served as Vice Chair on the Tennessee Commission on Aging. Burns was the only African American during her four year tenure. “Social Security & Medicare are worth fighting for!”

Ruth Cossey, East Palo Alto, CA, concentrates on providing information to seniors by managing the National Committee resource tables in the minority community and across her congressional district. She is always willing to support our efforts and to educate people about Social Security and Medicare issues. “Volunteering for NCPSSM, gives me the opportunity to share news and updates about Social Security and Medicare with seniors.”

Pat Cotton, Hyattsville, MD, has been a media star for NCPSSM, speaking at press conferences on Capitol Hill and interviews with national publications. Pat is also a Rally Corp member and works as a CAN. “I am an activist to preserve Social Security, Medicare & Medicaid for me and for my patients. These programs add to the quality of life!”

Alberta Gaskins, Washington, DC, another media star, she is a member of our Rally Corp and has helped with numerous petition deliveries to Congressional offices, press events and briefings. “I say I will fight for Social Security, Medicare and Medicaid because these are things that matter!!!”

Nettie Haile, Washington, DC, is a member of our Rally Corp. She was a speaker at the Summit on Social Security sponsored by Senator Bernie Sanders in November, 2012. Congresswoman Eleanor Holmes Norton, after hearing Nettie speak on Social Security at a briefing several years ago, declared Nettie her “poster child for Social Security”.“It’s very important that we do all we can to insure that benefits promised and worked hard for are not taken away.”

Celestine Johnson, Washington, DC, is an active member of our Rally Corps, participating in the majority of our “short notice” events on Capitol Hill. She arranges speaking opportunities for National Committee representatives with senior/retiree groups at her church. She has also recruited other local activists to join the Rally Corps. “I especially enjoy working with NCPSSM. I have learned so much.”

Jerry Johnson, Las Vegas, NV , a recent retiree of Clark County’s Senior Advocate Program, was as active participant in the National Committee’s Rapid Response Campaign during the 2012 election. He serves as a Grassroots District Team member. He brings a wealth of knowledge with respect to the aging network in the state and of senior issues in the communities. “As a boomer, I’ve embraced the reality of the safety net that Social Security and Medicare provides and this was my incentive to join as a volunteer to insure that it prevails.”

Godfrey Laws splits his time between Seattle WA and Roxboro NC each year and he volunteers in both communities. He has been involved in many local events and helps with our education and outreach. He works with many churches, and particularly likes to inform younger people about Social Security. “Social Security and Medicare are so important in the lives of some many people. We need to educate people of all ages about the value of these programs and work to maintain them for the health and well-being of seniors and their families.”

Reverend Julius Turnipseed, Memphis, TN, has given many educational sessions on Social Security and Medicare and disseminated our materials in communities throughout his area. “I am very proud to be an advocate for NCPSSM. We are able to get the truth to the people about what’s going on in Washington.”

Rosie Lee Woods, a resident from Richmond, VA, has recruited some terrific family and friends from GA and AR to be NCPSSM volunteers. She sets up community education meetings and makes visits to her local Congressional offices. “After joining NCPSSM, I have become better informed and more involved with politics, advocacy and helping others to get involved too.”