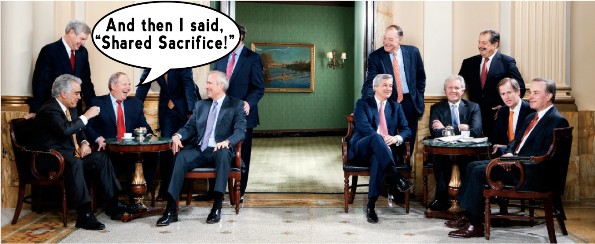

Meet the CEOs Who Want to Cut Your Social Security

We’ve written before about the billion dollar anti-Social Security lobby, led by Wall Streeter Pete Peterson and his myriad number of astroturf front groups, here, here and here. These CEO and Wall Street friendly groups are spending a lot of money to convince Congress that grandma and grandpa’s Social Security is to blame for our economic woes rather than talk about the real problem…$1 trillion in corporate loopholes and income inequality which is destroying the middle class.

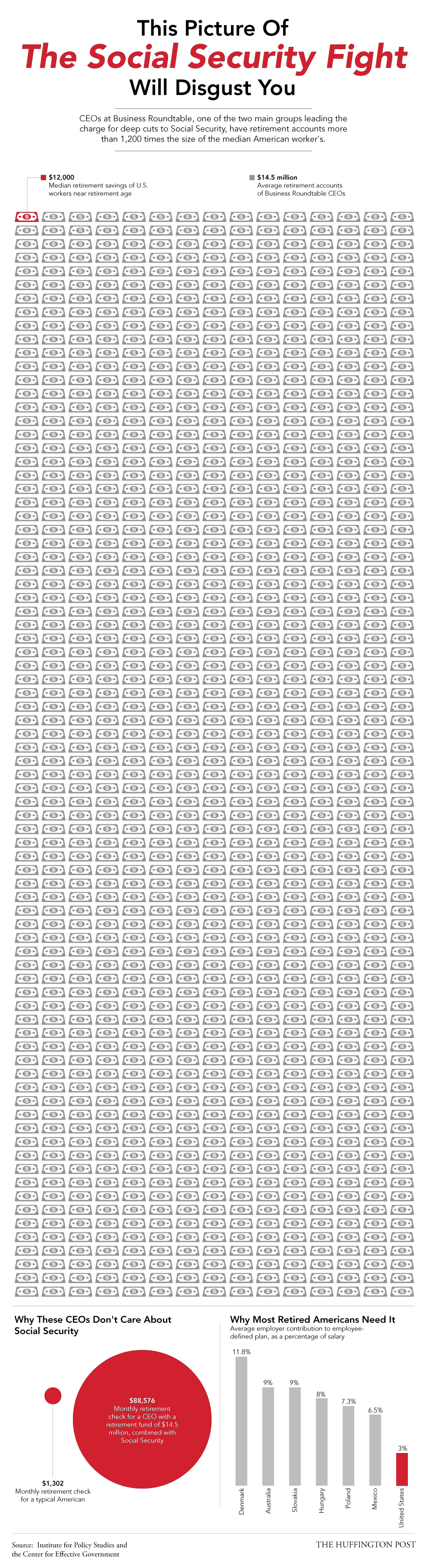

Hats off to the Institute for Policy Studies and the Center for Effective Government for their new report detailing the truth behind America’s CEO-led campaign against Social Security. Thanks also to the Huffington Post for this terrific infographic highlighting the report’s key findings:

Senator Warren and the Retirement Crisis

It’s not very often a speech in Congress is so dead-on that we share it, in its entirety, here. Yesterday’s speech by Senator Elizabeth Warren on America’s retirement crisis is a notable exception. We highly recommend you give it a view:

Activists Stage White House Demonstration to End Chained CPI Proposal

Cuts to Social Security Will Hurt Seniors, Veterans, People with Disabilities and Children; Shackle Recovering Economy

Activists from the National Committee to Preserve Social Security and Medicare, AARP, NOW, Paralyzed Veterans of America, Generations United, NARFE, Social Security Works and other advocacy groups converged on the White House to tell President Obama “No” to the chained CPI. Protestors with signs illustrating the negative economic impact in each of the nation’s 50 states plus Washington, D.C. rallied along Pennsylvania Avenue and were joined by Rep. Keith Ellison (MN-5) and Rep. Mark Pocan (WI-2).

“The coalition here today is diverse, strong and unified in our opposition to Social Security benefit cuts like those that would come with the Chained CPI. Groups here today represent not just seniors but also young people, veterans, civilians, people with disabilities and middle class families. We’re all here together to say the negative impact of the Chained CPI should not be ignored or trivialized any longer. The White House and others have said this benefit cut is nothing more than a “technical tweak,”…but the truth is it would be a benefit cut imposed on the oldest and most vulnerable Americans who would be least able to afford it.” Max Richtman, NCPSSM President/CEO

Here’s a video of activists rallying at the White House.

Do You “Know Your Rights”?

New Education Campaign Informs LGBT Community about Their New Social Security Benefits Eligibility

For the first time in its long history, the Social Security Administration is providing benefits to same sex married couples which has important financial implications for millions of LGBT Americans. The “Know Your Rights” campaign’s goal is to ensure LGBT Americans understand their rights to benefits.

“ ‘Know Your Rights’ is the first outreach program of its kind in the nation and a model for an education campaign potentially reaching millions of LGBT Americans from coast to coast.

The National Committee Foundation is proud to lead this campaign because it’s vital that we get the word out to the LGBT community so that they can begin the process of filing for benefits with the Social Security Administration.”…Carroll L. Estes, Ph.D., National Committee to Preserve Social Security and Medicare Foundation Board Chair

“We were honored to offer a launch pad for the National Committee Foundation’s critically important efforts to help make the Supreme Court’s historic decision effective by expanding the principles of social justice and equal treatment to Social Security. Over the coming years, millions of same-sex couples will get the federal benefits they have earned, and the human respect they deserve.”…Dr. Thomas Peters, President & CEO, Marin Community Foundation

With the support of a lead grant from the Marin Community Foundation, the Northern California sessions included panel discussions with the Social Security Administration, legal experts, and seniors’ and LGBT advocates. The outreach sessions in Marin, San Francisco and Sonoma Counties were coordinated with local partners, Spectrum LGBT Center and Openhouse.

“With marriage for same-sex couples now recognized by one third of the states and the federal government, more and more LGBT Americans have access to benefits and responsibilities we have not had to consider before,” said Openhouse Executive Director Seth Kilbourn. “For older same-sex couples, Social Security benefits are particularly important. These kinds of town hall meetings provide critical information about what these benefits mean for LGBT families and how to access them. The “Know Your Rights” outreach effort is a great model that brings the LGBT community together with local leaders and national partners to talk about these issues and begin the dialogue.”

“The Social Security Town Halls give LGBT Americans – and LGBT older adults in particular – an opportunity to learn about federal benefits previously denied to them because of the discriminatory policy of offering only married, heterosexual couples and their families this critical financial benefit. It is through robust education and outreach that we will reach these people – so used to being excluded from the system – and encourage them to apply.” Paula Pilecki, Spectrum LGBT Center Executive Director

Before the DOMA ruling, a child whose same-sex parent died forfeited as much as $15,000 each year in survivor income, totaling $256,000 before he/she reached age 18. There are an estimated quarter million children being raised by same-sex couples who can now qualify for Social Security survivors benefits. When it comes to retirement, same-sex spouses lost, on average, more than $8,000 each year in earned spousal retirement benefits because their marriage was not recognized by the federal government. The Social Security Administration has urged the LGBT community to file for benefits now, even as new regulations are being finalized.

California, with the largest LGBT population in the country and the largest number of Social Security beneficiaries, was the logical choice for the first series of educational forums and sets the stage for a nationwide outreach effort. You can find more information on the “Know Your Rights” campaign on our foundation’s website.

A $19 COLA Hike Too Generous?

“Seniors know all to well, their living costs often outpace the COLA increase and a 1.5% increase is anything but too generous. Proponents of a stingier COLA formula claim the Chained CPI is more accurate; however, in truth it is a benefit cut for millions of current and future retirees, veterans, people with disabilities and their families. Replacing the current COLA formula with the chained CPI will mean the typical 65 year-old, who filed for benefits at 62, would lose about $130 per year in benefits. By the time that senior reaches 95, the annual benefit cut will be almost $1,400, which is a 9.2 percent cut.

Given that the average senior currently receives just over $14,000 a year in Social Security, it’s hard to imagine how anyone can argue the COLA should be cut.. Yet this is exactly what has been proposed by the White House and in budget negotiations on Capitol Hill. The American people don’t support cutting Social Security to balance the budget and this annual COLA announcement should remind Washington why adopting the chained CPI is not only bad policy, it’s also bad politics.”…Max Richtman, NCPSSM President/CEO

There is a better way as our President/CEO, Max Richtman, has reported:

The BLS acknowledges the current CPI-W does not “produce official estimates for the rate of inflation experienced by subgroups of the population, such as the elderly or the poor. This is why we need a true elderly index like the CPI-E and not a formula change that will cut benefits and drive more seniors into poverty. A provision in Senator Bernie Sanders’s bill to reauthorize the Older Americans Act (S. 1028) would require the BLS improve the CPI-E and should be adopted by this Congress without any further delay.

Meet the CEOs Who Want to Cut Your Social Security

We’ve written before about the billion dollar anti-Social Security lobby, led by Wall Streeter Pete Peterson and his myriad number of astroturf front groups, here, here and here. These CEO and Wall Street friendly groups are spending a lot of money to convince Congress that grandma and grandpa’s Social Security is to blame for our economic woes rather than talk about the real problem…$1 trillion in corporate loopholes and income inequality which is destroying the middle class.

Hats off to the Institute for Policy Studies and the Center for Effective Government for their new report detailing the truth behind America’s CEO-led campaign against Social Security. Thanks also to the Huffington Post for this terrific infographic highlighting the report’s key findings:

Senator Warren and the Retirement Crisis

It’s not very often a speech in Congress is so dead-on that we share it, in its entirety, here. Yesterday’s speech by Senator Elizabeth Warren on America’s retirement crisis is a notable exception. We highly recommend you give it a view:

Activists Stage White House Demonstration to End Chained CPI Proposal

Cuts to Social Security Will Hurt Seniors, Veterans, People with Disabilities and Children; Shackle Recovering Economy

Activists from the National Committee to Preserve Social Security and Medicare, AARP, NOW, Paralyzed Veterans of America, Generations United, NARFE, Social Security Works and other advocacy groups converged on the White House to tell President Obama “No” to the chained CPI. Protestors with signs illustrating the negative economic impact in each of the nation’s 50 states plus Washington, D.C. rallied along Pennsylvania Avenue and were joined by Rep. Keith Ellison (MN-5) and Rep. Mark Pocan (WI-2).

“The coalition here today is diverse, strong and unified in our opposition to Social Security benefit cuts like those that would come with the Chained CPI. Groups here today represent not just seniors but also young people, veterans, civilians, people with disabilities and middle class families. We’re all here together to say the negative impact of the Chained CPI should not be ignored or trivialized any longer. The White House and others have said this benefit cut is nothing more than a “technical tweak,”…but the truth is it would be a benefit cut imposed on the oldest and most vulnerable Americans who would be least able to afford it.” Max Richtman, NCPSSM President/CEO

Here’s a video of activists rallying at the White House.

Do You “Know Your Rights”?

New Education Campaign Informs LGBT Community about Their New Social Security Benefits Eligibility

For the first time in its long history, the Social Security Administration is providing benefits to same sex married couples which has important financial implications for millions of LGBT Americans. The “Know Your Rights” campaign’s goal is to ensure LGBT Americans understand their rights to benefits.

“ ‘Know Your Rights’ is the first outreach program of its kind in the nation and a model for an education campaign potentially reaching millions of LGBT Americans from coast to coast.

The National Committee Foundation is proud to lead this campaign because it’s vital that we get the word out to the LGBT community so that they can begin the process of filing for benefits with the Social Security Administration.”…Carroll L. Estes, Ph.D., National Committee to Preserve Social Security and Medicare Foundation Board Chair

“We were honored to offer a launch pad for the National Committee Foundation’s critically important efforts to help make the Supreme Court’s historic decision effective by expanding the principles of social justice and equal treatment to Social Security. Over the coming years, millions of same-sex couples will get the federal benefits they have earned, and the human respect they deserve.”…Dr. Thomas Peters, President & CEO, Marin Community Foundation

With the support of a lead grant from the Marin Community Foundation, the Northern California sessions included panel discussions with the Social Security Administration, legal experts, and seniors’ and LGBT advocates. The outreach sessions in Marin, San Francisco and Sonoma Counties were coordinated with local partners, Spectrum LGBT Center and Openhouse.

“With marriage for same-sex couples now recognized by one third of the states and the federal government, more and more LGBT Americans have access to benefits and responsibilities we have not had to consider before,” said Openhouse Executive Director Seth Kilbourn. “For older same-sex couples, Social Security benefits are particularly important. These kinds of town hall meetings provide critical information about what these benefits mean for LGBT families and how to access them. The “Know Your Rights” outreach effort is a great model that brings the LGBT community together with local leaders and national partners to talk about these issues and begin the dialogue.”

“The Social Security Town Halls give LGBT Americans – and LGBT older adults in particular – an opportunity to learn about federal benefits previously denied to them because of the discriminatory policy of offering only married, heterosexual couples and their families this critical financial benefit. It is through robust education and outreach that we will reach these people – so used to being excluded from the system – and encourage them to apply.” Paula Pilecki, Spectrum LGBT Center Executive Director

Before the DOMA ruling, a child whose same-sex parent died forfeited as much as $15,000 each year in survivor income, totaling $256,000 before he/she reached age 18. There are an estimated quarter million children being raised by same-sex couples who can now qualify for Social Security survivors benefits. When it comes to retirement, same-sex spouses lost, on average, more than $8,000 each year in earned spousal retirement benefits because their marriage was not recognized by the federal government. The Social Security Administration has urged the LGBT community to file for benefits now, even as new regulations are being finalized.

California, with the largest LGBT population in the country and the largest number of Social Security beneficiaries, was the logical choice for the first series of educational forums and sets the stage for a nationwide outreach effort. You can find more information on the “Know Your Rights” campaign on our foundation’s website.

A $19 COLA Hike Too Generous?

“Seniors know all to well, their living costs often outpace the COLA increase and a 1.5% increase is anything but too generous. Proponents of a stingier COLA formula claim the Chained CPI is more accurate; however, in truth it is a benefit cut for millions of current and future retirees, veterans, people with disabilities and their families. Replacing the current COLA formula with the chained CPI will mean the typical 65 year-old, who filed for benefits at 62, would lose about $130 per year in benefits. By the time that senior reaches 95, the annual benefit cut will be almost $1,400, which is a 9.2 percent cut.

Given that the average senior currently receives just over $14,000 a year in Social Security, it’s hard to imagine how anyone can argue the COLA should be cut.. Yet this is exactly what has been proposed by the White House and in budget negotiations on Capitol Hill. The American people don’t support cutting Social Security to balance the budget and this annual COLA announcement should remind Washington why adopting the chained CPI is not only bad policy, it’s also bad politics.”…Max Richtman, NCPSSM President/CEO

There is a better way as our President/CEO, Max Richtman, has reported:

The BLS acknowledges the current CPI-W does not “produce official estimates for the rate of inflation experienced by subgroups of the population, such as the elderly or the poor. This is why we need a true elderly index like the CPI-E and not a formula change that will cut benefits and drive more seniors into poverty. A provision in Senator Bernie Sanders’s bill to reauthorize the Older Americans Act (S. 1028) would require the BLS improve the CPI-E and should be adopted by this Congress without any further delay.