New Media Education Project Provides Missing Balance in Social Security & Medicare Coverage

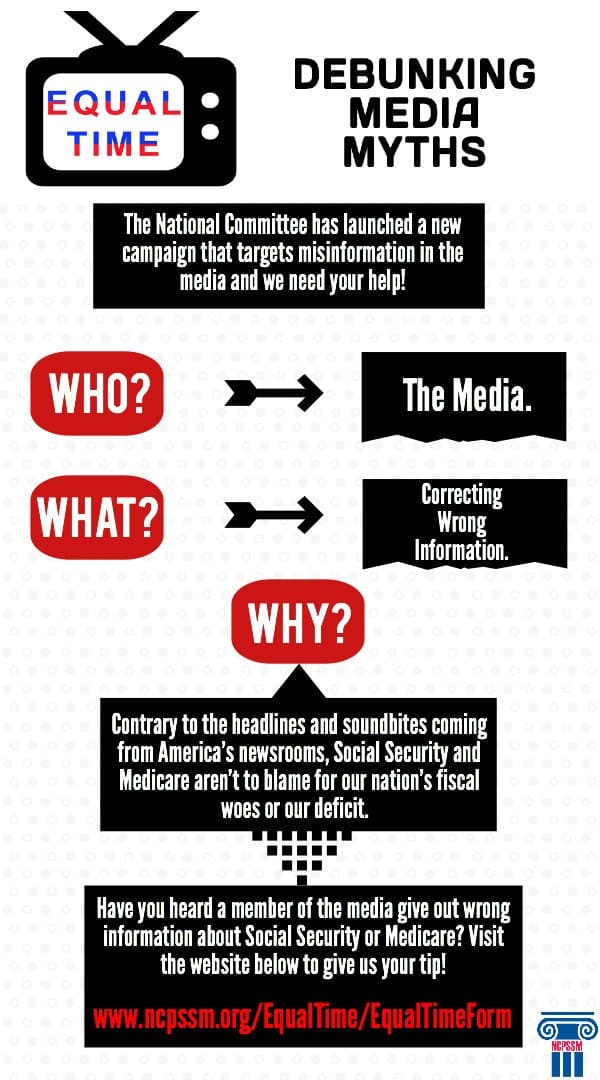

Contrary to the headlines and soundbites coming from America’s newsrooms, Social Security and Medicare aren’t to blame for our nation’s fiscal woes or our deficit. In fact, without these vital programs our economy would be in even worse shape and millions more American families would be threatened with economic insecurity. Why do so many journalists and news/talk-show hosts ignore the facts in favor of one-sided propaganda? Why won’t they allow all sides to weigh in on these important issues? Whatever the reasons, the National Committee to Preserve Social Security and Medicare believes the public deserves more balanced research and discussion. The truth about our nation’s most successful and revered programs deserves EQUAL TIME.

Contrary to the headlines and soundbites coming from America’s newsrooms, Social Security and Medicare aren’t to blame for our nation’s fiscal woes or our deficit. In fact, without these vital programs our economy would be in even worse shape and millions more American families would be threatened with economic insecurity. Why do so many journalists and news/talk-show hosts ignore the facts in favor of one-sided propaganda? Why won’t they allow all sides to weigh in on these important issues? Whatever the reasons, the National Committee to Preserve Social Security and Medicare believes the public deserves more balanced research and discussion. The truth about our nation’s most successful and revered programs deserves EQUAL TIME.

Our new project, EQUAL TIME, will bust through the myths and misleading statements in the news about Social Security and Medicare. We will find and correct the factual errors and politically charged perspectives. We’ll use social media like Facebook and Twitter to inform the reporters, pundits and anchors when they’ve been the subject of an EQUAL TIME correction. In this way, we hope to influence the mainstream media to use facts, not fiction, in their coverage of these important programs.

Here’s a look at our first Equal Time analysis:

An online form will also provide an easy way for advocates and citizens nationwide to submit news stories in which the media got it wrong and NCPSSM will track it down to provide the truth about Social Security and Medicare.

How Much Should Mom Be Paid?

Each year Salary.com provides an interesting look into the uncompensated work performed by American mothers who are often their families’ CEO, driver, cook, housekeeper, psychologist, and daycare provider.

“Obviously this is all in good fun and in no way 100% scientific, but for the 13th consecutive year we’re doing our small part to show everyone how important mothers are by calculating what they would be paid if they actually received a salary for all of their hard work.” Salary.com

Salary.com also provides a tool to help you break down, in dollars and cents, the value of work which is generally ignored by government, employers and other official institutions that calculate productivity.

Here are some basics found in this year’s survey:

· Stay-at-home moms work an average of 94 hours per week for a total estimated “mom salary” of $113,586 a year. That figure is slightly more than last year. The average salary for stay-at-home moms – calculated based on what they would be paid if they were compensated for their work – rose by $624.

This survey provides a lighthearted perspective on an issue with real economic and policy implications for American families. What happens to the millions of American women who worked in the home (not in a traditional job) when they retire? How about those women who quit jobs to become full-time caregivers for a family member? Unfortunately, far too many women face economic insecurity in their retirement.

For too long, the real world challenges facing millions of American retirees have been ignored in favor of a single-minded quest by many in Washington to use Social Security and Medicare benefit cuts to reduce the deficit. However, the National Committee to Preserve Social Security and Medicare believes our focus should be on passage of initiatives to ensure Social Security benefits are adequate for all Americans, particularly for women. The poverty rate for senior women and widows is 50% higher than other retirees 65 and older, yet even as we celebrate this Mother’s Day, this benefit inequity is largely ignored and millions of American mothers, grandmothers, and widows pay the price.

Some highlights of our proposals include:

– Improving Survivor Benefits. Women living alone often are forced into poverty because of benefit reductions stemming from the death of a spouse. Providing a widow or widower with 75 percent of the couple’s combined benefit treats one-earner and two-earner couples more fairly and reduces the likelihood of leaving the survivor in poverty.

– Providing Social Security Credits for Caregivers. We recommend imputed earnings for up to five family service years be granted to a worker who leaves or reduces his/her participation in the work force to provide care to children under the age of six or to elderly family members.

This Mother’s Day the National Committee would like to suggest a gift of economic security for our moms. Of course, this isn’t something you can wrap with a bow but it’s something we should all demand that Congress address for current and future generations of retirees.

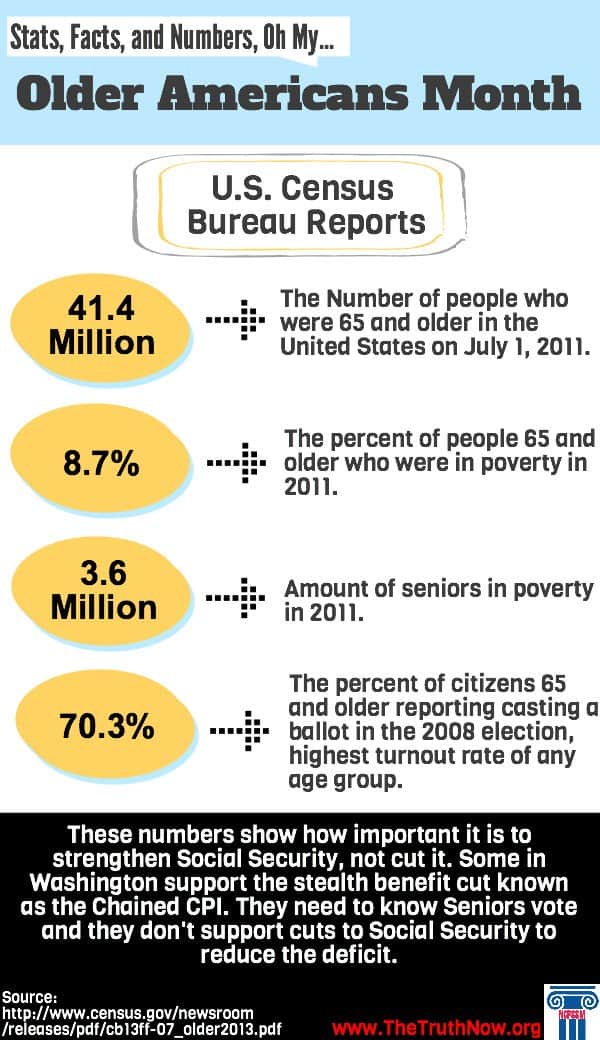

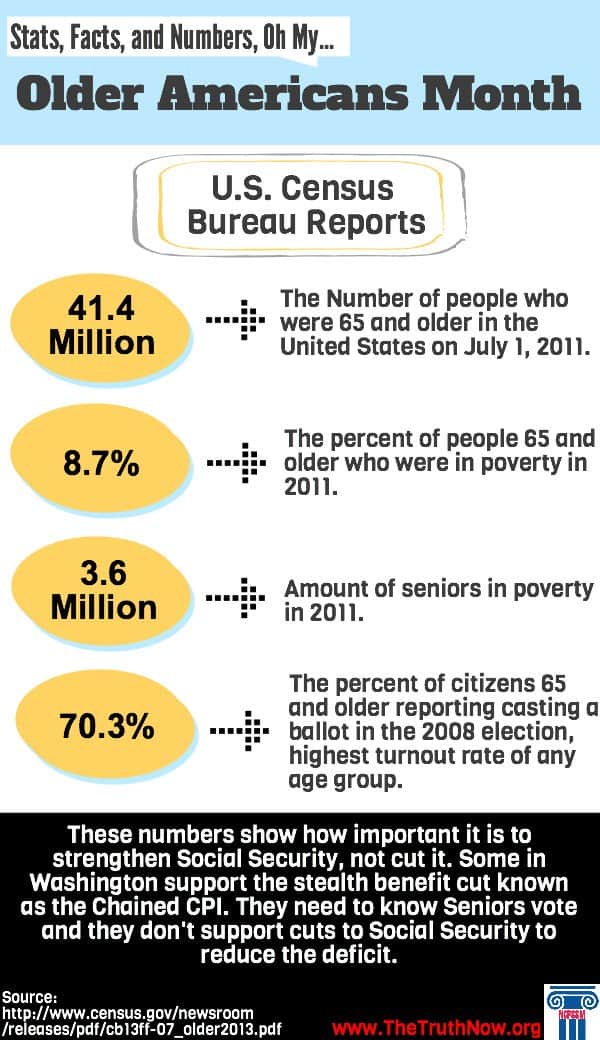

Celebrating Older Americans Month

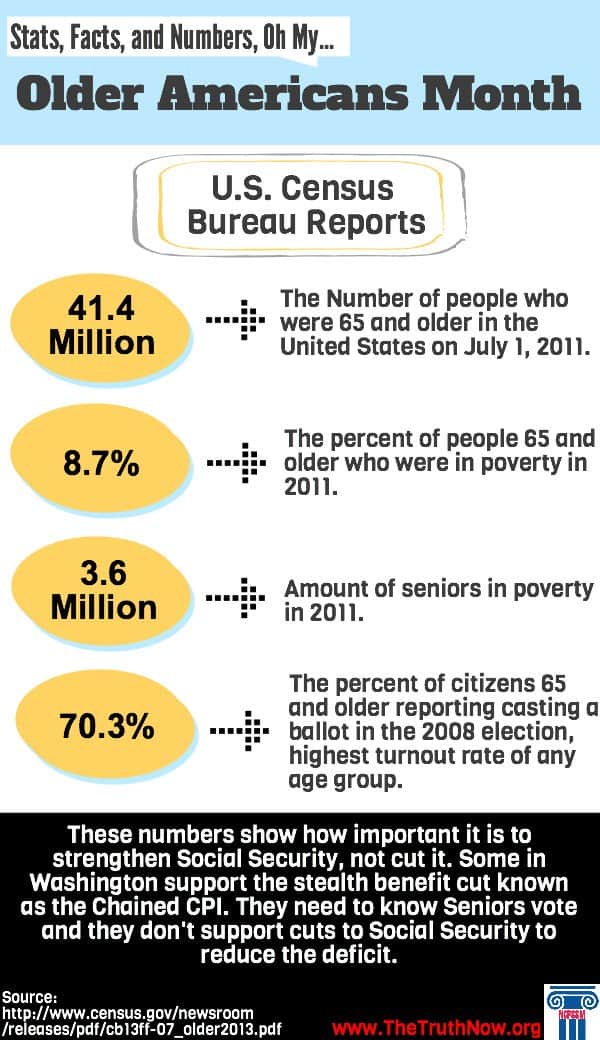

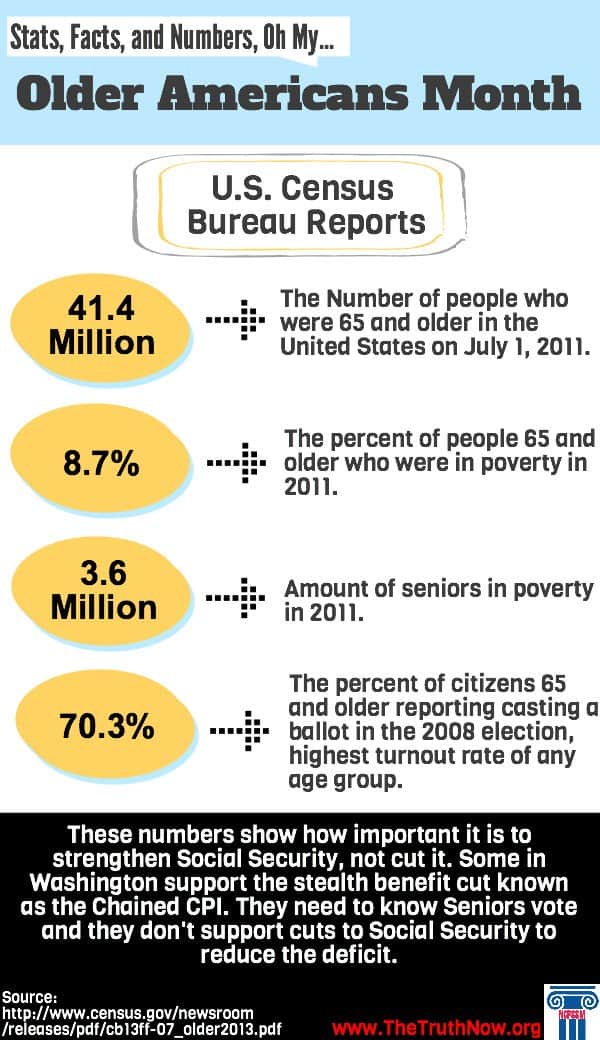

In the case of older Americans, the U.S. Census Bureau has provided a terrific breakdown of its most recent survey’s statistics on what our nation’s senior community looks like. Here are some interesting stats:

41.4 million – The number of people who were 65 and older in the United States on July 1, 2011, up from 40.3 million on April 1, 2010 (Census Day). In 2011, this group accounted for 13.3 percent of the total population.

92.0 million – Projected population of people 65 and older in 2060. People in this age group would comprise just over one in five U.S. residents at that time. Of this number, 18.2 million would be 85 or older.

Nearly 17% – Projected percentage of the global population that would be 65 and older in 2050, up from 8 percent today. In 2005, Europe became the first major world region where the population 65 and older outnumbered those younger than 15. By 2050, it would be joined by Northern America (which includes Canada and the United States), Asia, Latin America and the Caribbean and Oceania (which includes Australia and New Zealand).

$33,118 – The 2011 median income of households with householders 65 and older, not significantly different from the previous year.

8.7% – The percent of people 65 and older who were in poverty in 2011, statistically unchanged from 2010. There were 3.6 million seniors in poverty in 2011.

16.1% – The percentage of people 65 and older who were in the labor force in 2010, up from 12.1 percent in 1990. These older workers numbered 6.5 million in 2010, up from 3.8 million in 1990. By 2011, this rate had increased to 16.2 percent.

70.3% – Percentage of citizens 65 and older reporting casting a ballot in the 2008 presidential election. Not statistically different from those 45 to 64 (69.2 percent), people 65 and older had the highest turnout rate of any age group.

53,364 – The number of people 100 years old and older counted by the 2010 Census.

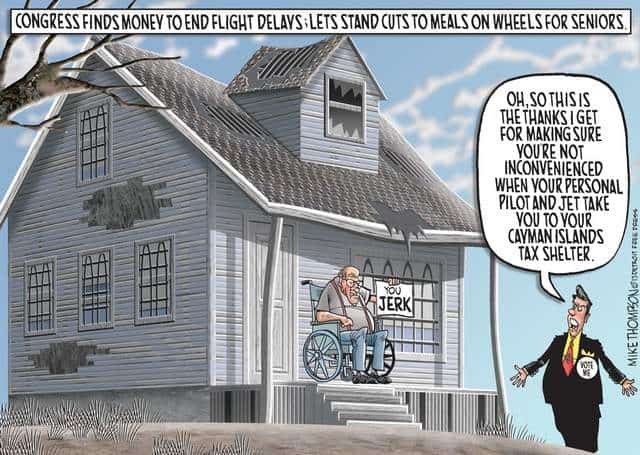

In Washington, Flight Delays = “Crisis”; Meals on Wheels Cuts = “Oh, well”

“Congress cited public outrage as the reason for moving swiftly to end flight delays caused by the sequester. However, very few Americans were actually impacted.”

In fact, only 16% of Americans even know anyone impacted. Commentator Richard Eskow was among that tiny minority. He offers these thoughts:

“At no point during my mini-“ordeal” did I think “Boy, I’d be happy to cut my Social Security and everybody else’s too so this won’t happen again.” The thought never even crossed my mind.

So I was disappointed when the President used his weekly national address to push, not for a total repeal of the sequester, but for his “compromise” austerity budget – a budget which includes unnecessary cuts to Social Security. The title of his address – “Time to Replace the Sequester with a Balanced Approach to Deficit Reduction” – betrays a continued unawareness of either the pain caused by these unwise cuts or the shifting economic reality which has discredited Washington’s deficit mania.

The only sensible thing to do is to cancel the entire sequester. And stop trying to use it to gin up hysteria so they can put through other unpopular cuts. Just can it.”

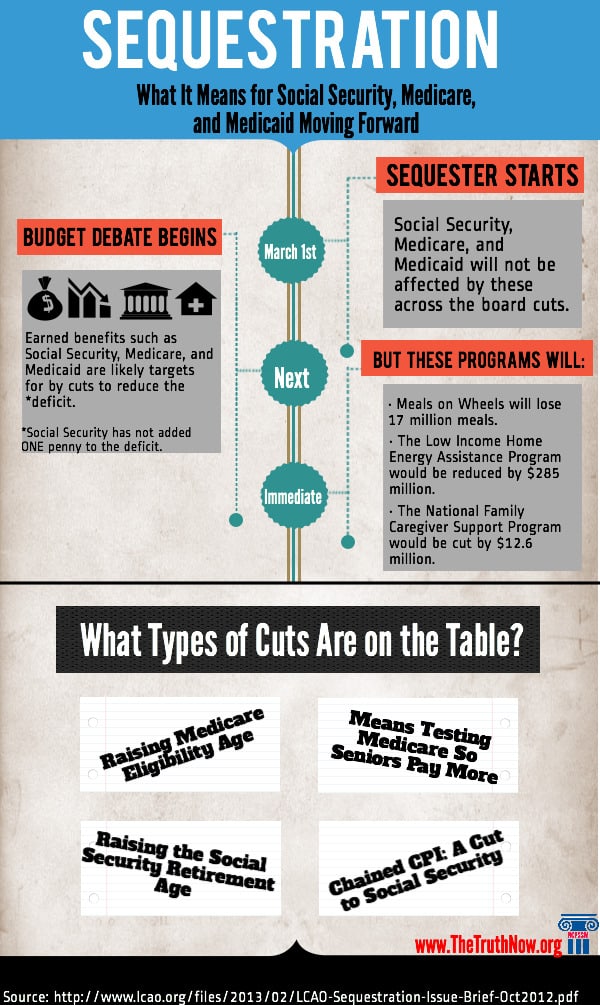

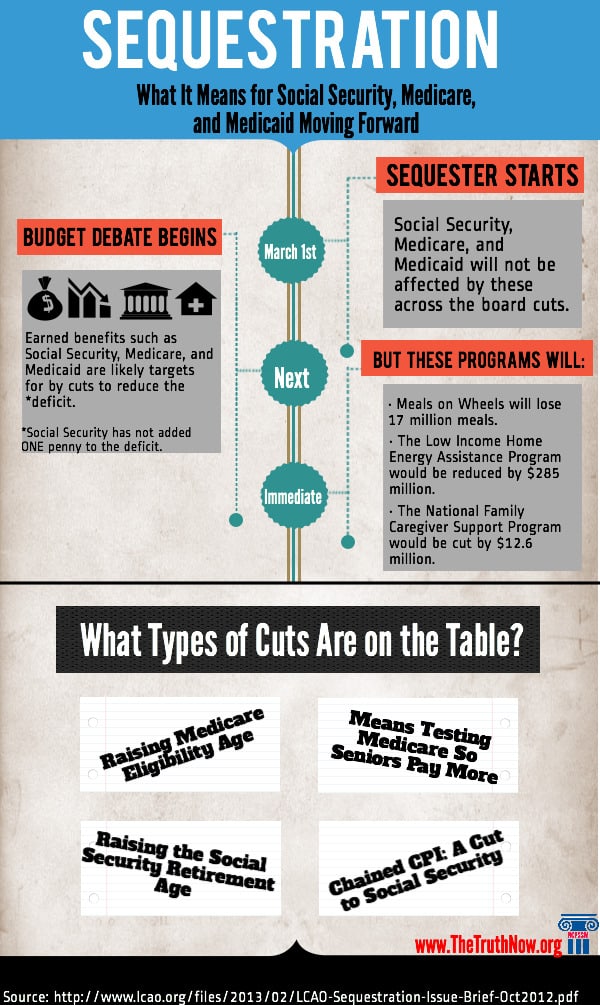

As a reminder, here are just some of the real cuts Americans face because of this sequester:

-

Thousands of cancer patients are being turned away from cancer clinics for chemotherapy treatments due to Medicare cuts

-

140,000 low-income families – mostly disabled elders and families with children – are losing rental assistance vouchers

- 70,000 children are being kicked out of Head Start programs

- The Caregiver support program will be cut by $12.6 million

- The Meals on Wheels program will be cut by 17 million meals

“Michele Daley, director of nutrition services at the Local Office on Aging, which serves Roanoke, Alleghany, Botetourt and Craig counties in Virginia, said the agency expects to receive $95,000 less in federal funds this year (it has an operating budget of $1 million). They’re gradually reducing the number of people receiving daily meals from 650 to 600 as a result of the budget cuts. Already, the office has planned to stop handing out most emergency meals — bags of shelf-stable items like canned beans distributed in advance of snowstorms and holidays. And they’ve instituted a waiting list. “We’ve never had a waiting list,” Daley said. “This is the first time ever and it’s a direct result of sequestration.” Huffington Post

Time Goes By blogger, Ronni Bennett expressed the frustration so many feel (outside the Beltway anyway),

“Judging from past performance and publicly professed ideology, I would have thought there are several senators who coulda/woulda/shoulda stopped this legislation: Bernie Sanders (I-Vermont), Elizabeth Warren (D-MA), maybe even my two Oregon senators, Democrats Ron Wyden and Jeff Merkley.

But no. Not one senator (nor even the president) took a principled stand for needy elders, children and their families not to mention Medicare cancer patients denied chemotherapy drugs, some of whom will die as a result. (Yes, they will.)

But never mind. Congress members and rich people will not be caused “unnecessary harm,” (as White House Spokesman Carney so helpfully explained) by airport delays. This is the country we live in now. “

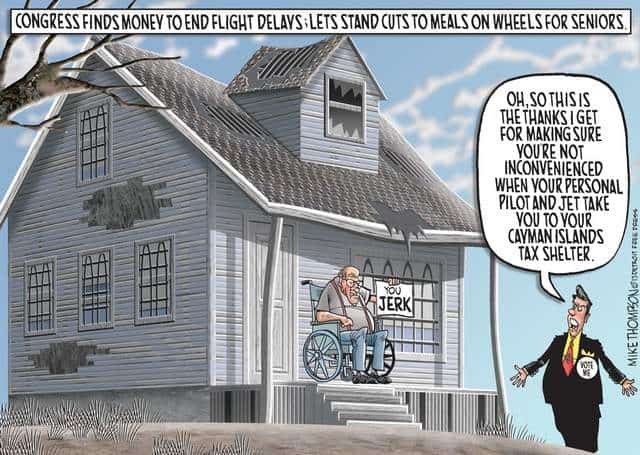

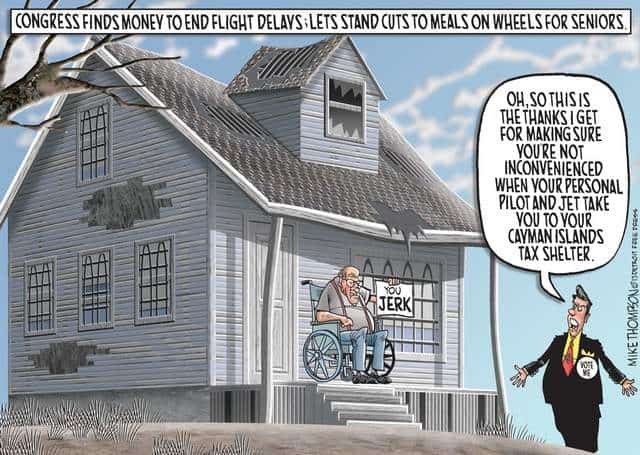

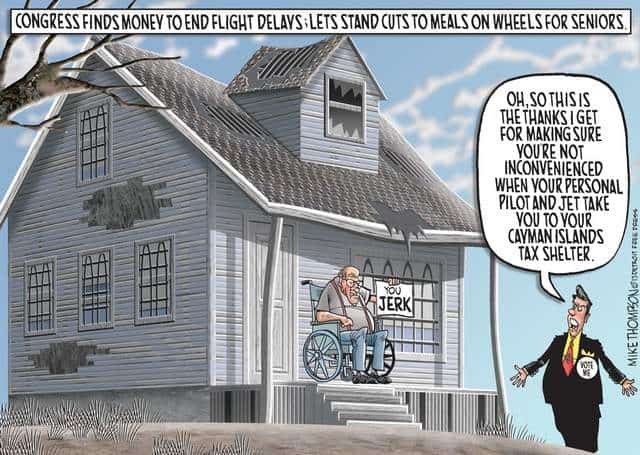

Rather than end on such a down note, we thought you’d also enjoy comedian Jon Stewart‘s take on the whole ridiculous situation and Mike Thompson’s editorial cartoon to help soften the edges of your outrage:

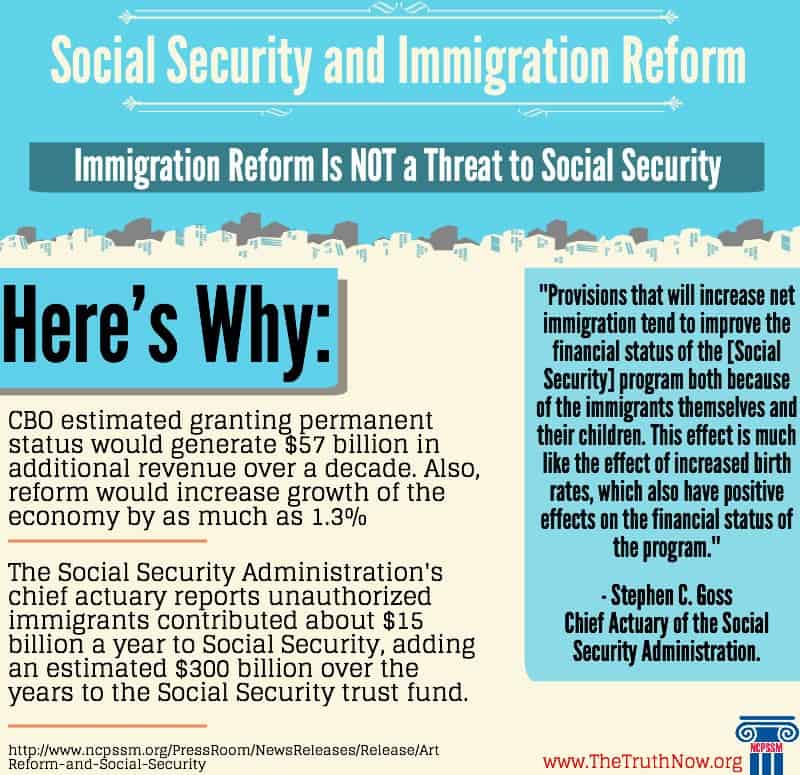

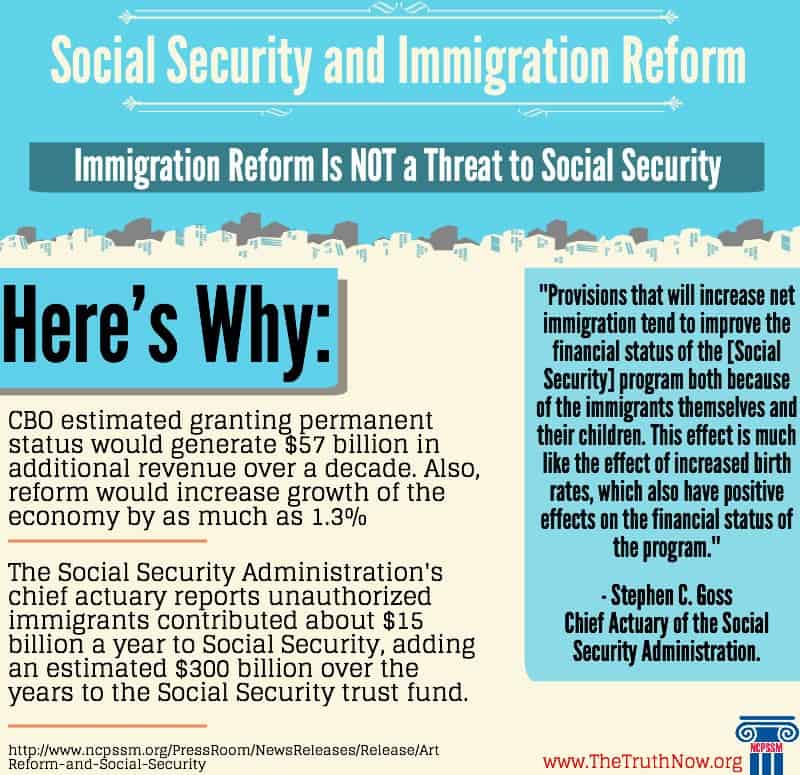

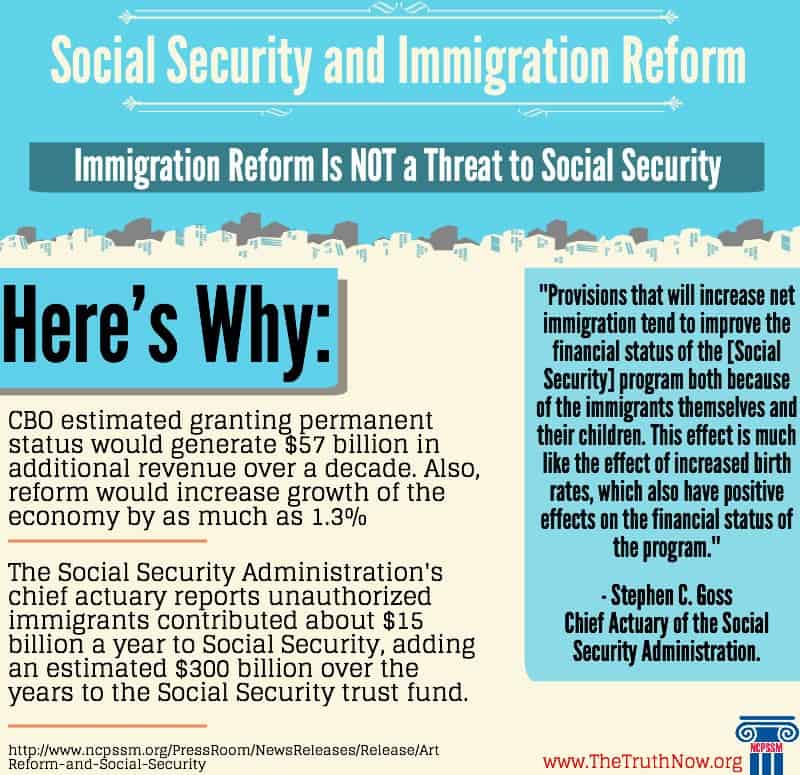

Immigration Reform Is Not a Threat to Social Security

“Those opposed to immigration reform have attempted to use vital programs, like Social Security, as an economic excuse to avoid doing the right thing. The truth is, comprehensive immigration reform is not a threat to Social Security. In fact, earlier immigration reform proposals moderately strengthened Social Security’s financing, and the legislation under consideration today should do the same. By bringing undocumented workers out of the shadows of our economy and into its mainstream, immigration reform has the potential to strengthen Social Security and accelerate overall economic growth.” …Max Richtman, NCPSSM President/CEO

The National Council on Aging and the National Hispanic Council on Aging have also examined immigration reform’s impact on vital programs in their policy brief, “Immigration Reform: Key Issues for Older Adults and People with Disabilities.”

“Comprehensive immigration reform will help millions come out of the shadows. Many of the half million older adult immigrants have worked for decades and contributed millions to Social Security. They should be able to receive the payments they’ve earned. Hispanic seniors, immigrant or not, struggle to reach economic security and without Social Security 50% would live in poverty. Social Security is particularly important to them and instead of denying earned Social Security benefits to new Americans, we should reward their contributions to the United States.” …Jason Coates, NHCOA Public Policy Associate

The NCOA/NHCOA joint study highlighted several important findings, including: immigration reform will increase the number of workers contributing taxes adding additional federal and state revenue, the future ratio of workers to beneficiaries for Social Security and Medicare will be enhanced by the addition of children and grandchildren of immigrants, and the strengthening of a stable direct care work force will assist individuals with disabilities, older adults, and informal family caregivers and also allow newly legalized workers to contribute economically. U.S. businesses lose up to an estimated $33.6 billion per year in lost productivity from full time working informal family caregivers.

“Immigration reform is the right thing to do and the smart thing to do. The practical matter is the number of older people who will need long-term care as they age will double in the coming decade. One in five of our current direct care workforce was born abroad. An estimated 27 million seniors will need long term help by 2050 and the need for direct care workers will grow dramatically, an estimated 1.6 million workers by 2020 and 3 million workers by 2050. Finding a way to provide a stable and steady workforce is crucial.”… James Firman, NCOA President/CEO

Here are some highlights from our report that opponents of immigration reform will never tell you:

- Stephen C. Goss, the chief actuary of the Social Security Administration, has reported that unauthorized immigrants contributed about $15 billion a year to Social Security, adding an estimated $300 billion over the years to the Social Security trust fund. During the most recent attempt to reform our immigration system in 2007, the Congressional Budget Office (CBO) estimated granting permanent status would generate $57 billion in additional revenue over a decade,

- As legal status is granted to current undocumented immigrants, allowing workers to step out of the shadows, contributions to the Social Security program will increase. The CBO estimated that reform would increase the growth of the economy by as much as 1.3 percent.

- Social Security trustees project that an increase in immigration of 100,000 persons a year would improve the long-term actuarial balance of the Social Security’s trust fund by about 3.5% of the projected 75-year deficit.

- The immigrant population, in particular undocumented workers, is very young. In fact 59% are between 25 and 44 years of age. History has shown that their children, as legal second- generation Americans, would make measureable contributions to our nation and economy. A Pew research study of the 20 million adult U.S.-born children of immigrants shows that these adult children have median incomes and homeownership rates similar to the general U.S. population. In fact, second generation adult children of immigrants have a lower poverty rate and higher college graduation rates. All of these demographic factors are potentially good – not bad – news for Social Security.

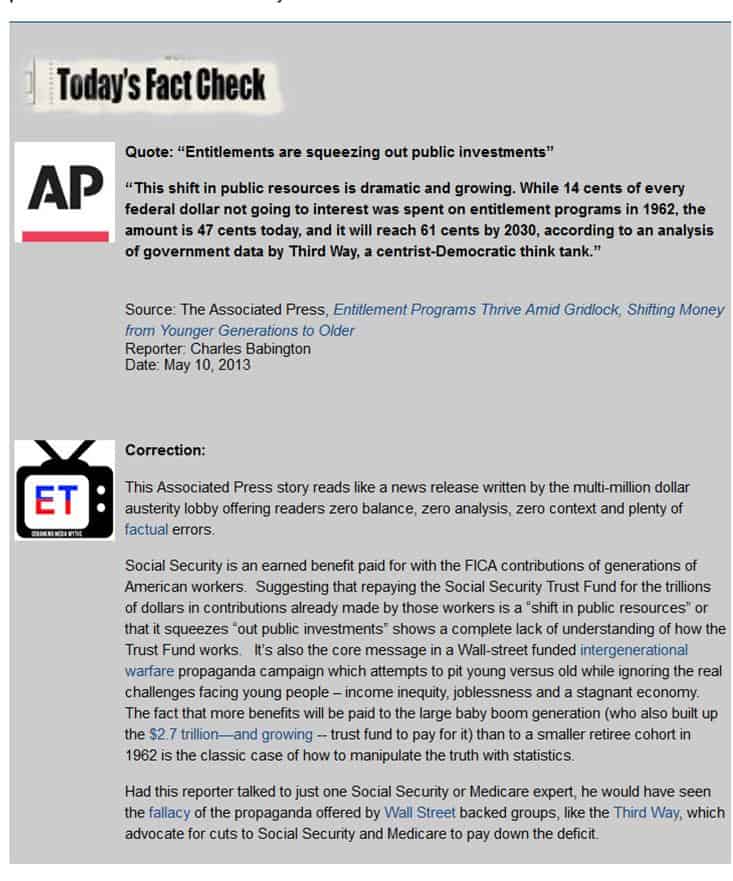

New Media Education Project Provides Missing Balance in Social Security & Medicare Coverage

Our new project, EQUAL TIME, will bust through the myths and misleading statements in the news about Social Security and Medicare. We will find and correct the factual errors and politically charged perspectives. We’ll use social media like Facebook and Twitter to inform the reporters, pundits and anchors when they’ve been the subject of an EQUAL TIME correction. In this way, we hope to influence the mainstream media to use facts, not fiction, in their coverage of these important programs.

Here’s a look at our first Equal Time analysis:

An online form will also provide an easy way for advocates and citizens nationwide to submit news stories in which the media got it wrong and NCPSSM will track it down to provide the truth about Social Security and Medicare.

How Much Should Mom Be Paid?

Each year Salary.com provides an interesting look into the uncompensated work performed by American mothers who are often their families’ CEO, driver, cook, housekeeper, psychologist, and daycare provider.

“Obviously this is all in good fun and in no way 100% scientific, but for the 13th consecutive year we’re doing our small part to show everyone how important mothers are by calculating what they would be paid if they actually received a salary for all of their hard work.” Salary.com

Salary.com also provides a tool to help you break down, in dollars and cents, the value of work which is generally ignored by government, employers and other official institutions that calculate productivity.

Here are some basics found in this year’s survey:

· Stay-at-home moms work an average of 94 hours per week for a total estimated “mom salary” of $113,586 a year. That figure is slightly more than last year. The average salary for stay-at-home moms – calculated based on what they would be paid if they were compensated for their work – rose by $624.

This survey provides a lighthearted perspective on an issue with real economic and policy implications for American families. What happens to the millions of American women who worked in the home (not in a traditional job) when they retire? How about those women who quit jobs to become full-time caregivers for a family member? Unfortunately, far too many women face economic insecurity in their retirement.

For too long, the real world challenges facing millions of American retirees have been ignored in favor of a single-minded quest by many in Washington to use Social Security and Medicare benefit cuts to reduce the deficit. However, the National Committee to Preserve Social Security and Medicare believes our focus should be on passage of initiatives to ensure Social Security benefits are adequate for all Americans, particularly for women. The poverty rate for senior women and widows is 50% higher than other retirees 65 and older, yet even as we celebrate this Mother’s Day, this benefit inequity is largely ignored and millions of American mothers, grandmothers, and widows pay the price.

Some highlights of our proposals include:

– Improving Survivor Benefits. Women living alone often are forced into poverty because of benefit reductions stemming from the death of a spouse. Providing a widow or widower with 75 percent of the couple’s combined benefit treats one-earner and two-earner couples more fairly and reduces the likelihood of leaving the survivor in poverty.

– Providing Social Security Credits for Caregivers. We recommend imputed earnings for up to five family service years be granted to a worker who leaves or reduces his/her participation in the work force to provide care to children under the age of six or to elderly family members.

This Mother’s Day the National Committee would like to suggest a gift of economic security for our moms. Of course, this isn’t something you can wrap with a bow but it’s something we should all demand that Congress address for current and future generations of retirees.

Celebrating Older Americans Month

In the case of older Americans, the U.S. Census Bureau has provided a terrific breakdown of its most recent survey’s statistics on what our nation’s senior community looks like. Here are some interesting stats:

41.4 million – The number of people who were 65 and older in the United States on July 1, 2011, up from 40.3 million on April 1, 2010 (Census Day). In 2011, this group accounted for 13.3 percent of the total population.

92.0 million – Projected population of people 65 and older in 2060. People in this age group would comprise just over one in five U.S. residents at that time. Of this number, 18.2 million would be 85 or older.

Nearly 17% – Projected percentage of the global population that would be 65 and older in 2050, up from 8 percent today. In 2005, Europe became the first major world region where the population 65 and older outnumbered those younger than 15. By 2050, it would be joined by Northern America (which includes Canada and the United States), Asia, Latin America and the Caribbean and Oceania (which includes Australia and New Zealand).

$33,118 – The 2011 median income of households with householders 65 and older, not significantly different from the previous year.

8.7% – The percent of people 65 and older who were in poverty in 2011, statistically unchanged from 2010. There were 3.6 million seniors in poverty in 2011.

16.1% – The percentage of people 65 and older who were in the labor force in 2010, up from 12.1 percent in 1990. These older workers numbered 6.5 million in 2010, up from 3.8 million in 1990. By 2011, this rate had increased to 16.2 percent.

70.3% – Percentage of citizens 65 and older reporting casting a ballot in the 2008 presidential election. Not statistically different from those 45 to 64 (69.2 percent), people 65 and older had the highest turnout rate of any age group.

53,364 – The number of people 100 years old and older counted by the 2010 Census.

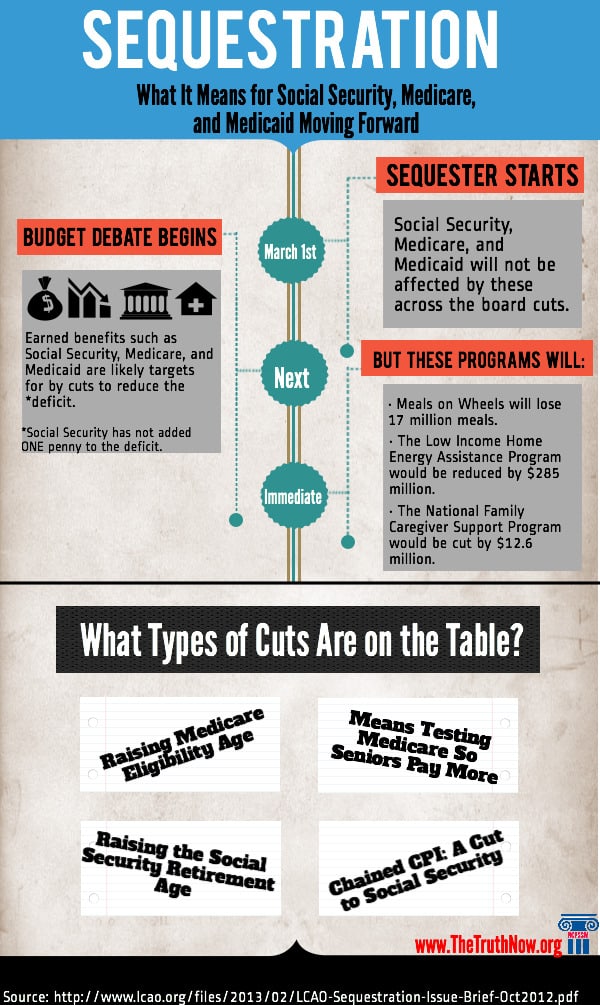

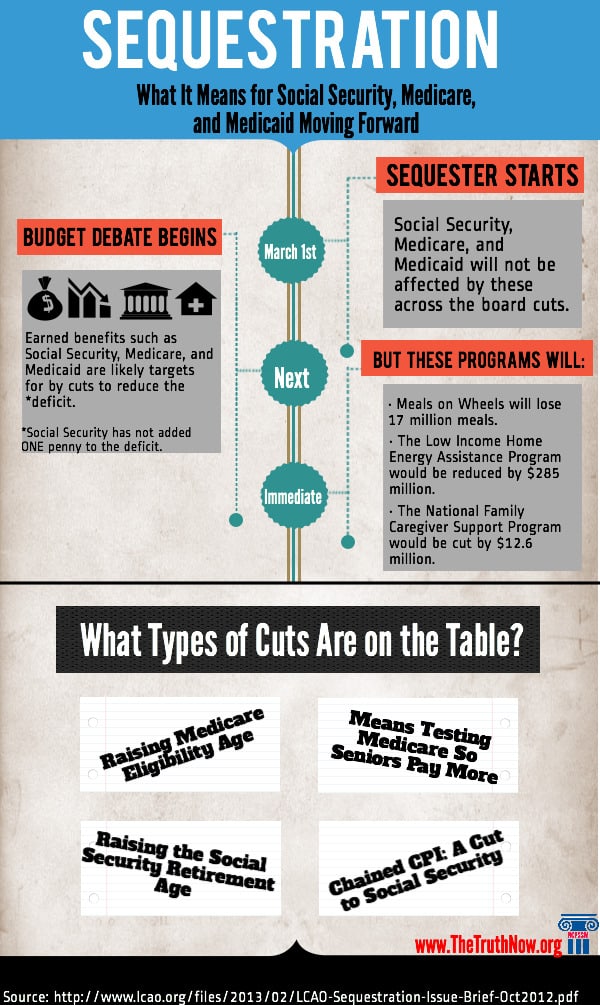

In Washington, Flight Delays = “Crisis”; Meals on Wheels Cuts = “Oh, well”

“Congress cited public outrage as the reason for moving swiftly to end flight delays caused by the sequester. However, very few Americans were actually impacted.”

In fact, only 16% of Americans even know anyone impacted. Commentator Richard Eskow was among that tiny minority. He offers these thoughts:

“At no point during my mini-“ordeal” did I think “Boy, I’d be happy to cut my Social Security and everybody else’s too so this won’t happen again.” The thought never even crossed my mind.

So I was disappointed when the President used his weekly national address to push, not for a total repeal of the sequester, but for his “compromise” austerity budget – a budget which includes unnecessary cuts to Social Security. The title of his address – “Time to Replace the Sequester with a Balanced Approach to Deficit Reduction” – betrays a continued unawareness of either the pain caused by these unwise cuts or the shifting economic reality which has discredited Washington’s deficit mania.

The only sensible thing to do is to cancel the entire sequester. And stop trying to use it to gin up hysteria so they can put through other unpopular cuts. Just can it.”

As a reminder, here are just some of the real cuts Americans face because of this sequester:

-

Thousands of cancer patients are being turned away from cancer clinics for chemotherapy treatments due to Medicare cuts

-

140,000 low-income families – mostly disabled elders and families with children – are losing rental assistance vouchers

- 70,000 children are being kicked out of Head Start programs

- The Caregiver support program will be cut by $12.6 million

- The Meals on Wheels program will be cut by 17 million meals

“Michele Daley, director of nutrition services at the Local Office on Aging, which serves Roanoke, Alleghany, Botetourt and Craig counties in Virginia, said the agency expects to receive $95,000 less in federal funds this year (it has an operating budget of $1 million). They’re gradually reducing the number of people receiving daily meals from 650 to 600 as a result of the budget cuts. Already, the office has planned to stop handing out most emergency meals — bags of shelf-stable items like canned beans distributed in advance of snowstorms and holidays. And they’ve instituted a waiting list. “We’ve never had a waiting list,” Daley said. “This is the first time ever and it’s a direct result of sequestration.” Huffington Post

Time Goes By blogger, Ronni Bennett expressed the frustration so many feel (outside the Beltway anyway),

“Judging from past performance and publicly professed ideology, I would have thought there are several senators who coulda/woulda/shoulda stopped this legislation: Bernie Sanders (I-Vermont), Elizabeth Warren (D-MA), maybe even my two Oregon senators, Democrats Ron Wyden and Jeff Merkley.

But no. Not one senator (nor even the president) took a principled stand for needy elders, children and their families not to mention Medicare cancer patients denied chemotherapy drugs, some of whom will die as a result. (Yes, they will.)

But never mind. Congress members and rich people will not be caused “unnecessary harm,” (as White House Spokesman Carney so helpfully explained) by airport delays. This is the country we live in now. “

Rather than end on such a down note, we thought you’d also enjoy comedian Jon Stewart‘s take on the whole ridiculous situation and Mike Thompson’s editorial cartoon to help soften the edges of your outrage:

Immigration Reform Is Not a Threat to Social Security

“Those opposed to immigration reform have attempted to use vital programs, like Social Security, as an economic excuse to avoid doing the right thing. The truth is, comprehensive immigration reform is not a threat to Social Security. In fact, earlier immigration reform proposals moderately strengthened Social Security’s financing, and the legislation under consideration today should do the same. By bringing undocumented workers out of the shadows of our economy and into its mainstream, immigration reform has the potential to strengthen Social Security and accelerate overall economic growth.” …Max Richtman, NCPSSM President/CEO

The National Council on Aging and the National Hispanic Council on Aging have also examined immigration reform’s impact on vital programs in their policy brief, “Immigration Reform: Key Issues for Older Adults and People with Disabilities.”

“Comprehensive immigration reform will help millions come out of the shadows. Many of the half million older adult immigrants have worked for decades and contributed millions to Social Security. They should be able to receive the payments they’ve earned. Hispanic seniors, immigrant or not, struggle to reach economic security and without Social Security 50% would live in poverty. Social Security is particularly important to them and instead of denying earned Social Security benefits to new Americans, we should reward their contributions to the United States.” …Jason Coates, NHCOA Public Policy Associate

The NCOA/NHCOA joint study highlighted several important findings, including: immigration reform will increase the number of workers contributing taxes adding additional federal and state revenue, the future ratio of workers to beneficiaries for Social Security and Medicare will be enhanced by the addition of children and grandchildren of immigrants, and the strengthening of a stable direct care work force will assist individuals with disabilities, older adults, and informal family caregivers and also allow newly legalized workers to contribute economically. U.S. businesses lose up to an estimated $33.6 billion per year in lost productivity from full time working informal family caregivers.

“Immigration reform is the right thing to do and the smart thing to do. The practical matter is the number of older people who will need long-term care as they age will double in the coming decade. One in five of our current direct care workforce was born abroad. An estimated 27 million seniors will need long term help by 2050 and the need for direct care workers will grow dramatically, an estimated 1.6 million workers by 2020 and 3 million workers by 2050. Finding a way to provide a stable and steady workforce is crucial.”… James Firman, NCOA President/CEO

Here are some highlights from our report that opponents of immigration reform will never tell you:

- Stephen C. Goss, the chief actuary of the Social Security Administration, has reported that unauthorized immigrants contributed about $15 billion a year to Social Security, adding an estimated $300 billion over the years to the Social Security trust fund. During the most recent attempt to reform our immigration system in 2007, the Congressional Budget Office (CBO) estimated granting permanent status would generate $57 billion in additional revenue over a decade,

- As legal status is granted to current undocumented immigrants, allowing workers to step out of the shadows, contributions to the Social Security program will increase. The CBO estimated that reform would increase the growth of the economy by as much as 1.3 percent.

- Social Security trustees project that an increase in immigration of 100,000 persons a year would improve the long-term actuarial balance of the Social Security’s trust fund by about 3.5% of the projected 75-year deficit.

- The immigrant population, in particular undocumented workers, is very young. In fact 59% are between 25 and 44 years of age. History has shown that their children, as legal second- generation Americans, would make measureable contributions to our nation and economy. A Pew research study of the 20 million adult U.S.-born children of immigrants shows that these adult children have median incomes and homeownership rates similar to the general U.S. population. In fact, second generation adult children of immigrants have a lower poverty rate and higher college graduation rates. All of these demographic factors are potentially good – not bad – news for Social Security.