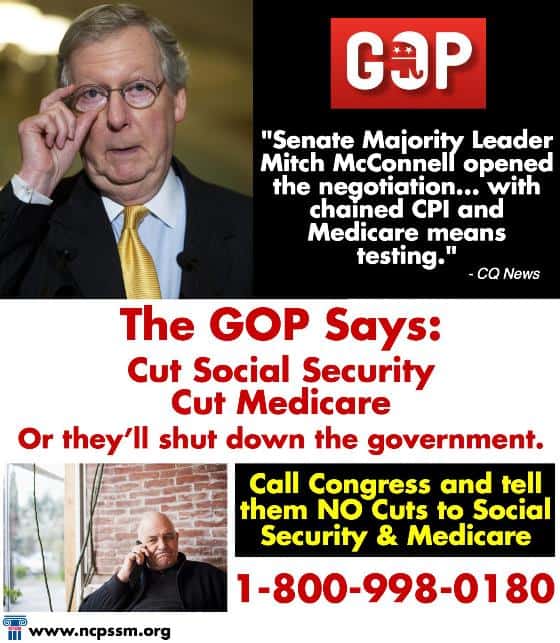

They Never Learn. The GOP Threatens Cut Social Security & Medicare or Else

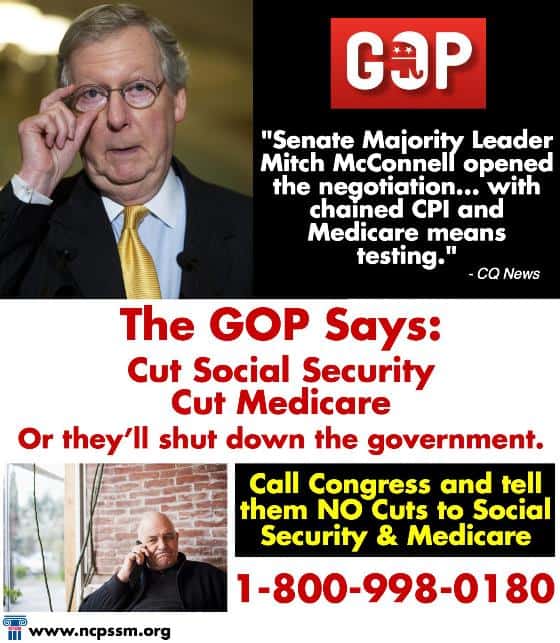

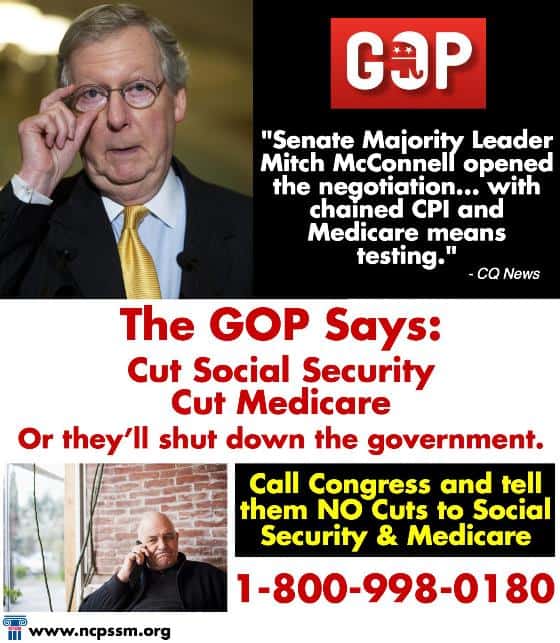

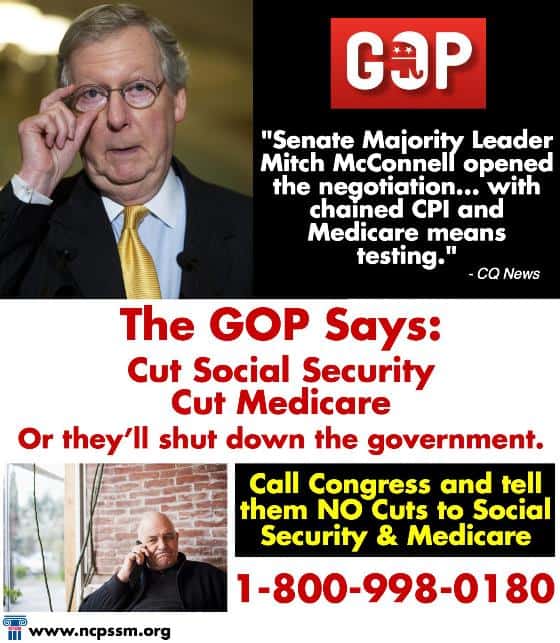

Senate Majority Leader Mitch McConnell has started budget and debt ceiling talks with the GOP’s favorite attack…cut Social Security or Medicare or else ______ (fill in the blank to fit the debate of the day). This time it’s… “or else we’ll shutdown the government.”

“Mitch McConnell privately wants the White House to pay this price to enact a major budget deal: Significant changes to Social Security and Medicare in exchange for raising the debt ceiling and funding the government.” CNN

“Chained CPI is off the table as an offset to pay for higher spending caps. One person with knowledge of the talks said Senate Majority Leader Mitch McConnell opened the negotiation with a proposal to offset higher discretionary spending with chained CPI and Medicare means testing, though McConnell’s office would not confirm that he made the request.” CQ News

“In a direct rebuke to his Republican counterpart, Senate Minority Leader Harry Reid (D-Nev.) said Tuesday that raising the debt limit is non-negotiable. Speaking hours before the first Democratic presidential debate, which is being held in his home state, Reid encouraged President Barack Obama not to enter into talks with congressional Republicans, who have plotted to use the debt limit as a means of extracting spending cuts.” Huffington Post

You’ll also note there is no talk of reversing trillions of dollars in tax breaks and loopholes for large corporations shipping jobs overseas. No talk of the billions more in tax breaks given to the ultra-wealthy. Instead, Republican leaders want to cut the whopping $1,291 average monthly Social Security retirement benefit. A benefit Americans have paid for throughout their working lives.

The debt limit expires November 5th so there’s not much time to make it clear…once again…that the American people are paying attention and you won’t stand by and watch as Social Security is used as a political bargaining chip. Make that call!

Two New Reports on Private Medicare Advantage Plans Reveal Real Problems for Seniors

“Federal investigators have found Medicare officials rarely enforce rules for private insurance plans intended to make sure beneficiaries will be able to see a doctor when they need care.

The U.S. Centers for Medicare and Medicaid Services, which oversees Medicare Advantage, requires the plans to have doctors in sufficient numbers and specialties who are near enough — in distance and travel time — so seniors can reach them.

But the GAO found CMS checked the provider networks of less than 1 percent of the plans since 2013 — serving just 2 percent of Medicare Advantage members — and only when the plans expanded to a new county.” … Kaiser Health News & Conn. Health I-Team

In 2013, United Healthcare, which is the nation’s biggest health insurance company and a provider of private Medicare Advantage in Connecticut, dropped hundreds of health care providers and 1,200 doctors. Medicare Advantage beneficiaries are restricted to a network of providers. If their provider leaves, they cannot change plans during the year. What happened in Connecticut is the perfect example of how MA plans have been allowed to skirt the rules, dropping providers thereby limiting coverage for seniors with little warning and leaving them with few options.

“The GAO report shows Medicare ‘was not verifying network adequacy. That’s their job and they abdicated that responsibility,’ said U.S. Rep. Rosa DeLauro, D-New Haven, who requested the investigation along with other members of the Connecticut congressional delegation.”

Also this week, a new Brown University study shows that once medical care becomes costly for seniors in Medicare Advantage and no longer meets their needs beneficiaries are leaving the private MA plans.

“Our results raise questions about whether current Medicare Advantage regulations and payment formulas are designed to meet the needs of Medicare Advantage members who use post-acute and long-term care,” wrote Momotazur Rahman, assistant professor (research) of health services, policy and practice in the Brown University School of Public Health, and colleagues in the October issue of the journal Health Affairs. “The unidirectional flow of these high-risk and often high-spending patients from Medicare Advantage to traditional Medicare appears to transfer responsibility to traditional Medicare just as patients enter a period of intensive health care needs.”

Private Medicare Advantage plans continue to see growth as they promise gym-memberships, limited optometric coverage or zero premium plans. However, as predicted by many healthcare experts and indicated in the Brown study, seniors find that once they actually need help with more costly care, MA plans aren’t providing the coverage they need.

Ultimately, this means that younger and healthier seniors are being lured into private insurers’ plans only to have to switch to traditional Medicare once they need coverage for more serious health issues (and isn’t that why we have health insurance in the first place – to cover when we get sick, not when we’re healthy?). Meanwhile, private insurance companies continue to reap the benefits of annual federal subsidies to provide this limited coverage for healthier seniors – which are tax dollars that could have been used in traditional Medicare to serve all beneficiaries.

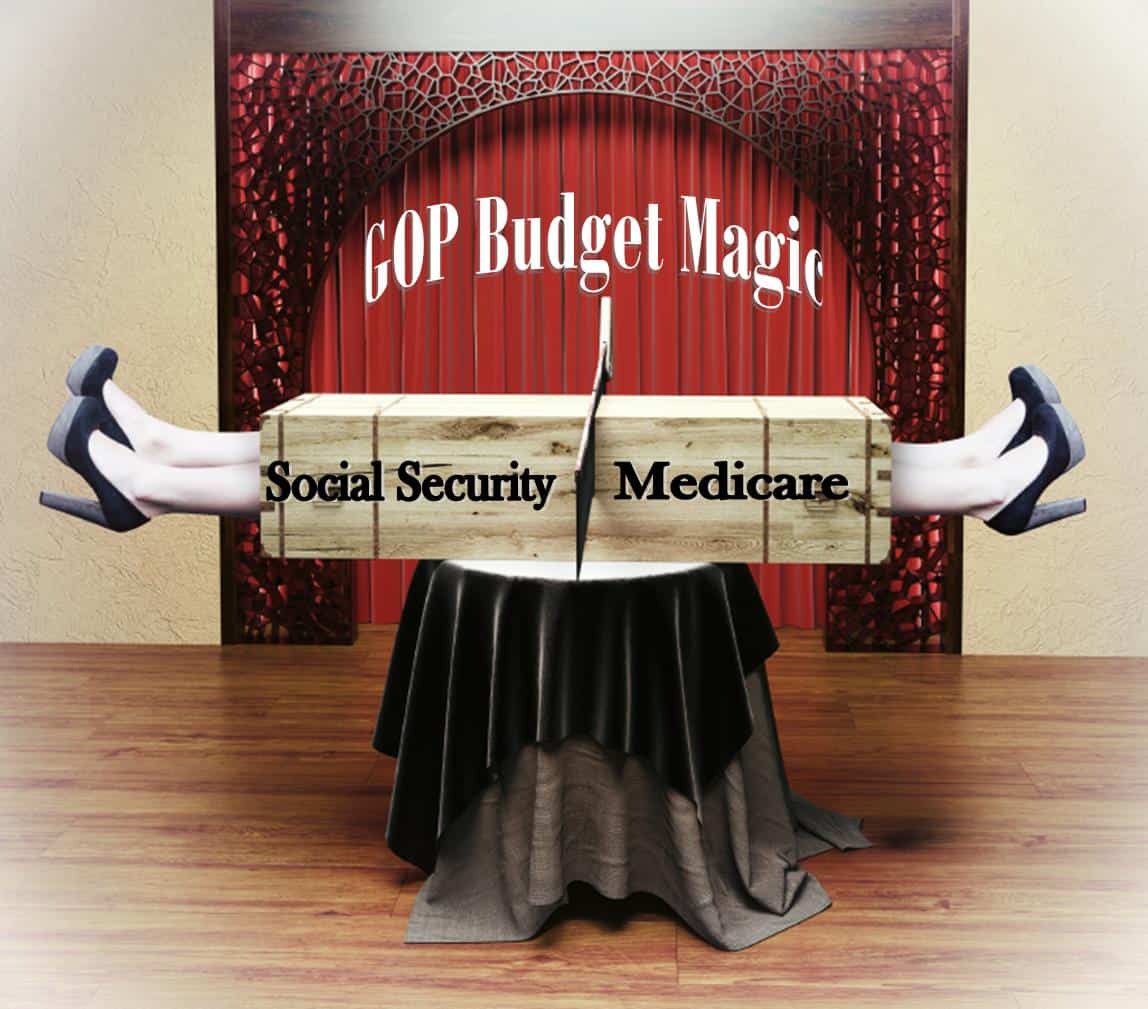

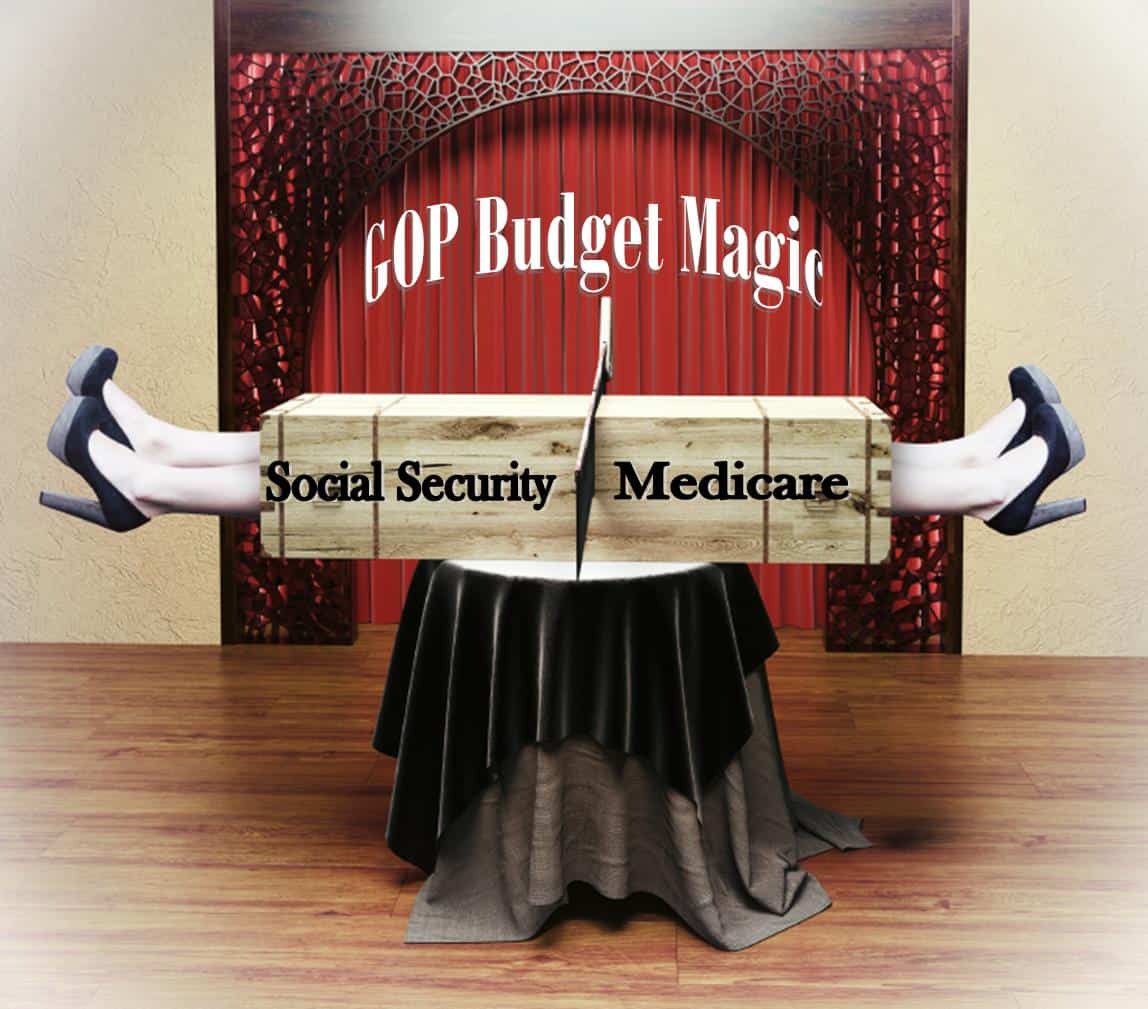

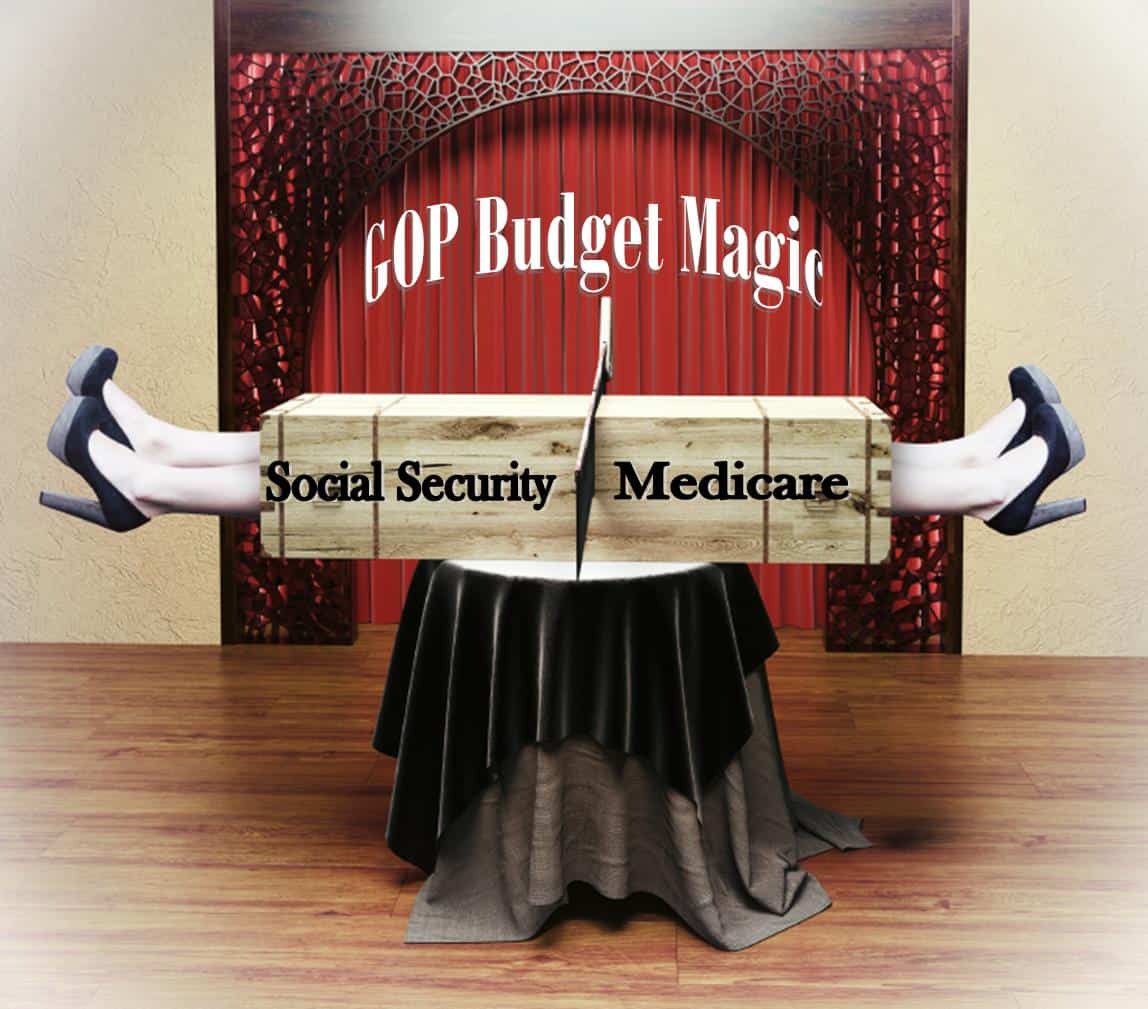

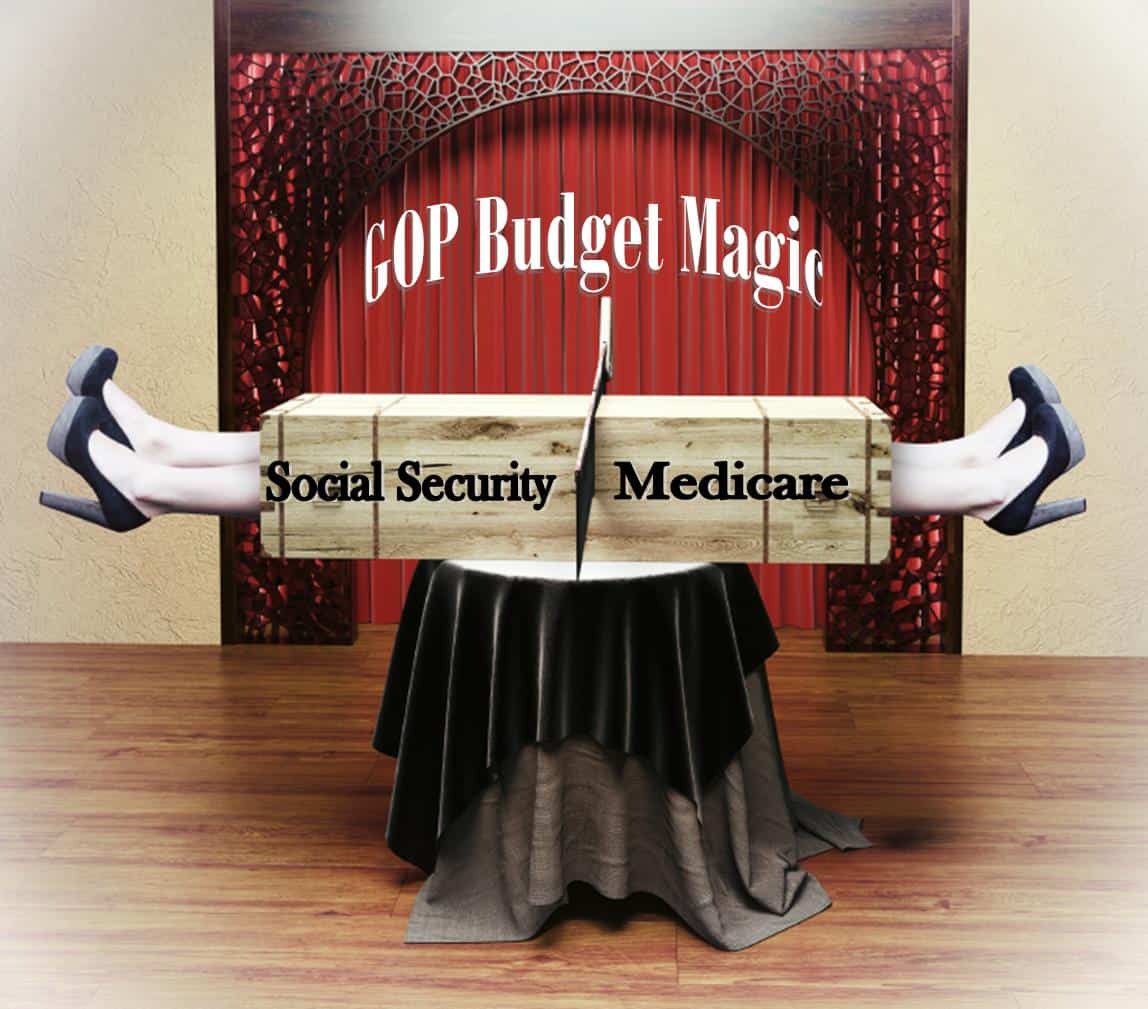

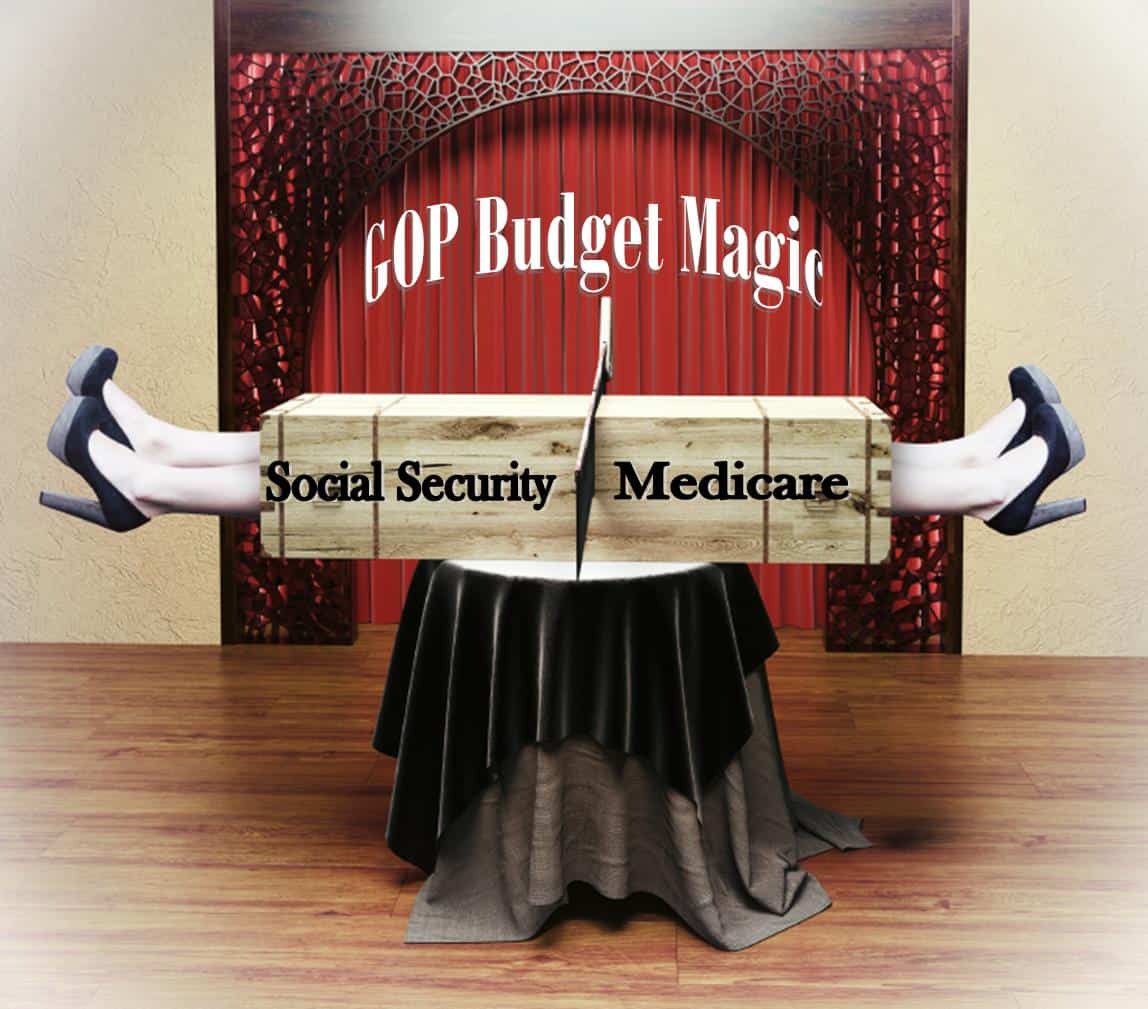

What the GOP’s Sleight of Hand Budgeting and Deflection Politics Means for Social Security & Medicare

First pulished on Huffington Post by Max Richtman, NCPSSM President/CEO

Any good magician will tell you, the best tricks depend on misdirection. So while all eyes are on the spectacle of the House GOP’s in-fighting, its search for a new Speaker and the never-ending “who-insulted-who” shenanigans of the GOP Presidential primary, it’s easy to forget that Congress is now also quietly working on legislation that could impact virtually every American family, especially those that depend on Social Security, Medicare and Medicaid. The American people must not be distracted by the ongoing political show to the point that they miss the real action occurring behind the scenes.

Before leaving for recess in December, Congress faces legislative deadlines to avoid a government shutdown, a default, an extension for transportation funding and tax breaks. While the shutdown has been narrowly averted, the annual appropriations process continues as the President and Congressional Democrats push GOP leaders for a deal to mitigate automatic across-the-board cuts to defense and non-defense programs – also known as the “sequester.”

No amount of political magic can hide the fact that three years of sequester caps have had serious consequences for important seniors programs, including the Older Americans Act and the Low Income Home Energy Assistance Program, along with service reductions at Social Security Administration field offices. That’s why the National Committee supports the President’s plan to increase spending caps. However, some conservatives in Congress insist that relief for programs like the Older Americans Act be paid for by cutting Medicare and Medicaid. This budgetary sleight-of-hand could trade partial relief for some seniors’ programs by cutting other essential health security programs like Medicare and Medicaid, thus further eroding the tenuous economic situation many older Americans face.

It’s no mystery where these Medicare and Medicaid cuts are likely to come from. You have to look no further than the GOP Budget plan for a blueprint of the House leadership’s favorite benefit cut proposals, such as:

- Ending the Medicaid joint federal/state financing partnership and replacing it with fixed dollar amount block grants, giving states less money than they would receive under current law.

- Repealing Medicaid expansion. Since 2014, states have had the option to receive federal funding to expand Medicaid coverage. Over half of the states have expanded their Medicaid programs, and others will likely do so in the future. Repealing this option would result in at least 14 million people losing their Medicaid coverage and state Medicaid programs would lose a total of $900 billion over 10 years.

- Cutting Medicare by $431 billion over ten years. Over half of Medicare beneficiaries had incomes below $23,500 per year in 2013, and they are already paying 23 percent of their average Social Security check for Medicare cost-sharing in addition to out-of-pocket costs.

The National Committee to Preserve Social Security & Medicare has prepared a detailed look at the many policy options in our Fall Budget Outlook brief.

Legislation may need to be enacted by late November or early December to allow the government to continue borrowing and avoid a government default. Allowing a default would result in an economic catastrophe and jeopardize the payment of Social Security, Medicare and Medicaid benefits. In addition, default would jeopardize Medicare and Medicaid payments to doctors and hospitals and coverage for prescription drugs, which are critical to the health security of millions of Americans.

As if all of this isn’t enough, funding for the nation’s roads and public transit will also expire at the end of October. Because the Highway Trust Fund no longer takes in enough gasoline tax revenue to cover surface transportation costs, Congress must come up with more funding. When Congress passed a temporary funding fix this summer, House leaders proposed using Social Security funds to pay for it. This was the third time in little over a year that Congress has attempted to use Social Security and/or Medicare as an ATM to pay for a completely unrelated priority. Last year Congress voted to extend the Medicare sequester cuts into 2024 to cover a reversal of cost-of-living cuts to veterans’ pension benefits. This summer Medicare was cut again to help pay for the Trade bill. Rather than consider tax reform for huge corporate tax dodgers sending billions of profits oversee to avoid paying taxes, GOP leaders tried again (unsuccessfully this time) to cut benefits to seniors, people with disabilities and their families who depend on Social Security to pay for highways. Unfortunately, Congress could pull this outrageous strategy out of its hat once again. Need money for highways, to relieve sequester cuts, deficit reduction or anything at all? Voila! Let’s take if from Social Security and Medicare.

There’s no doubt about it — it will take more than legislative smoke and mirrors and political magic for Congress to get the job done right. But the American people also need to be more than an audience in this process. We need to pull back the curtain on this benefit cut agenda so the American people can avert any surprises Congressional leaders have up their sleeves for vital programs like Social Security, Medicare and Medicaid.

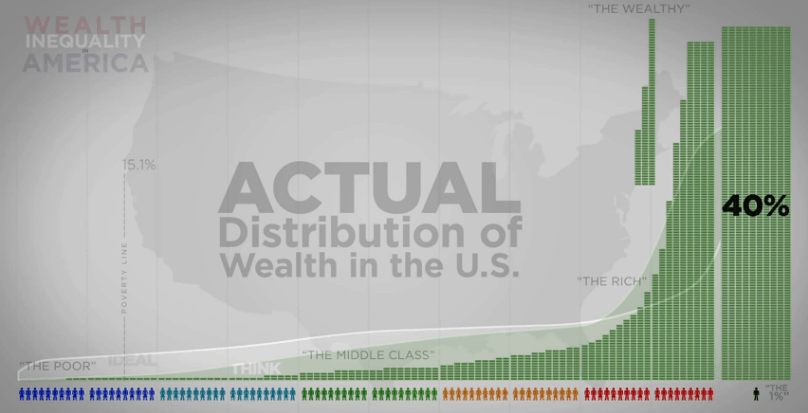

It’s Inequality, Stupid. Why Income Inequality, the Longevity Gap and Social Security are All Connected

One of the favored political tropes repeated often by the billion-dollar anti-Social Security lobby and its supporters in Congress as a justification to cut Social Security is: “Americans are living longer so they should just work longer.” That’s usually followed up with a personal anecdote like “Everyone I know plans to keep working into their 70’s.” Maybe that’s true for hedge-fund billionaires like Pete Peterson and politicians like Alan Simpson. Rich, white men live longer, healthier lives and no doubt it’s easier to consider working until 70 if the boardroom or committee room is where you spend your work day.

However, for the rest of America the “you can work until your 70” claim is built on the lie that “Americans are living longer.” Multiple studies have shown the opposite to be true. All Americans are definitely not living long. Yet another report from the National Academy of Science this week reports:

“Men at the top of the economic ladder saw an eight-year increase in life expectancy, while men at the bottom saw virtually no change.”

No change.

According to researchers, an increasing gap in life expectancy between the wealthy and the working class has come – and may even be caused by — the growing inequality of wealth and income in America. If you can afford the best healthcare, work in high income careers requiring less physical labor and have a higher education allowing you to navigate America’s complicated healthcare system, is it any surprise you might live longer? As more income goes to the richest Americans, our middle-class is shrinking leaving even more people vulnerable.

Teresa Ghilarducci is a labor economist who directs the Retirement Equity lab at The New School. She sums it up this way:

“The idea that everyone should work longer since everyone is living longer is one used to justify policy proposals such as cutting Social Security benefits. But that idea is a misleading oversimplification.

The Retirement Equity Lab at The New School (a project I direct) has pointed out that the growing class and racial gaps have dire implications for retirement policies. A cut to Social Security benefits—which raising the retirement age, an oft-suggested proposal, essentially is—would induce people without means to work in old age. This would produce an unseemly form of inequality: The people who live the longest will be able to retire, and the people who have to work longer will be the same people who are losing at longevity. The poorer will work and the richer will play in old age, a class divide we’ve already seen in the 19th and early 20th centuries. If post-work benefits are not shored up, this disparity will only get worse.”

Budget Squabbling and Its Potential Impact on Social Security & Medicare

With the clock ticking, Congress is scrambling to not only avoid a government shutdown and default but also pass an extension for transportation funding and tax breaks. Will the sequester continue or can Congress find a better way to manage our nation’s finances? This political gamesmanship and inability to get anything done impacts far more than one federal program. Seniors programs like Social Security and Medicare are also in the cross-hairs.

“America’s seniors have become especially weary of these Congressional dramas as they have learned, the hard way, that Social Security and Medicare have become the favored target for budget cuts or “pay-fors” for a host of Congressional programs that have nothing to do with providing the earned benefits seniors depend on. From highways to trade and beyond, Congress continues to try and use seniors’ programs as a national ATM. The next few weeks promises more of the same”… Max Richtman, NCPSSM President/CEO

The National Committee to Preserve Social Security and Medicare has prepared a detailed Fall Legislative Update mapping the current legislative minefield for programs which touch the lives of virtually every American family.

We’ve identified the numerous legislative hurdles still ahead, the possible threats to Social Security, Medicare and Medicaid and our positions on each potential pay-for or budget cut. You can see NCPSSM’s Fall Legislative Update here.

They Never Learn. The GOP Threatens Cut Social Security & Medicare or Else

Senate Majority Leader Mitch McConnell has started budget and debt ceiling talks with the GOP’s favorite attack…cut Social Security or Medicare or else ______ (fill in the blank to fit the debate of the day). This time it’s… “or else we’ll shutdown the government.”

“Mitch McConnell privately wants the White House to pay this price to enact a major budget deal: Significant changes to Social Security and Medicare in exchange for raising the debt ceiling and funding the government.” CNN

“Chained CPI is off the table as an offset to pay for higher spending caps. One person with knowledge of the talks said Senate Majority Leader Mitch McConnell opened the negotiation with a proposal to offset higher discretionary spending with chained CPI and Medicare means testing, though McConnell’s office would not confirm that he made the request.” CQ News

“In a direct rebuke to his Republican counterpart, Senate Minority Leader Harry Reid (D-Nev.) said Tuesday that raising the debt limit is non-negotiable. Speaking hours before the first Democratic presidential debate, which is being held in his home state, Reid encouraged President Barack Obama not to enter into talks with congressional Republicans, who have plotted to use the debt limit as a means of extracting spending cuts.” Huffington Post

You’ll also note there is no talk of reversing trillions of dollars in tax breaks and loopholes for large corporations shipping jobs overseas. No talk of the billions more in tax breaks given to the ultra-wealthy. Instead, Republican leaders want to cut the whopping $1,291 average monthly Social Security retirement benefit. A benefit Americans have paid for throughout their working lives.

The debt limit expires November 5th so there’s not much time to make it clear…once again…that the American people are paying attention and you won’t stand by and watch as Social Security is used as a political bargaining chip. Make that call!

Two New Reports on Private Medicare Advantage Plans Reveal Real Problems for Seniors

“Federal investigators have found Medicare officials rarely enforce rules for private insurance plans intended to make sure beneficiaries will be able to see a doctor when they need care.

The U.S. Centers for Medicare and Medicaid Services, which oversees Medicare Advantage, requires the plans to have doctors in sufficient numbers and specialties who are near enough — in distance and travel time — so seniors can reach them.

But the GAO found CMS checked the provider networks of less than 1 percent of the plans since 2013 — serving just 2 percent of Medicare Advantage members — and only when the plans expanded to a new county.” … Kaiser Health News & Conn. Health I-Team

In 2013, United Healthcare, which is the nation’s biggest health insurance company and a provider of private Medicare Advantage in Connecticut, dropped hundreds of health care providers and 1,200 doctors. Medicare Advantage beneficiaries are restricted to a network of providers. If their provider leaves, they cannot change plans during the year. What happened in Connecticut is the perfect example of how MA plans have been allowed to skirt the rules, dropping providers thereby limiting coverage for seniors with little warning and leaving them with few options.

“The GAO report shows Medicare ‘was not verifying network adequacy. That’s their job and they abdicated that responsibility,’ said U.S. Rep. Rosa DeLauro, D-New Haven, who requested the investigation along with other members of the Connecticut congressional delegation.”

Also this week, a new Brown University study shows that once medical care becomes costly for seniors in Medicare Advantage and no longer meets their needs beneficiaries are leaving the private MA plans.

“Our results raise questions about whether current Medicare Advantage regulations and payment formulas are designed to meet the needs of Medicare Advantage members who use post-acute and long-term care,” wrote Momotazur Rahman, assistant professor (research) of health services, policy and practice in the Brown University School of Public Health, and colleagues in the October issue of the journal Health Affairs. “The unidirectional flow of these high-risk and often high-spending patients from Medicare Advantage to traditional Medicare appears to transfer responsibility to traditional Medicare just as patients enter a period of intensive health care needs.”

Private Medicare Advantage plans continue to see growth as they promise gym-memberships, limited optometric coverage or zero premium plans. However, as predicted by many healthcare experts and indicated in the Brown study, seniors find that once they actually need help with more costly care, MA plans aren’t providing the coverage they need.

Ultimately, this means that younger and healthier seniors are being lured into private insurers’ plans only to have to switch to traditional Medicare once they need coverage for more serious health issues (and isn’t that why we have health insurance in the first place – to cover when we get sick, not when we’re healthy?). Meanwhile, private insurance companies continue to reap the benefits of annual federal subsidies to provide this limited coverage for healthier seniors – which are tax dollars that could have been used in traditional Medicare to serve all beneficiaries.

What the GOP’s Sleight of Hand Budgeting and Deflection Politics Means for Social Security & Medicare

First pulished on Huffington Post by Max Richtman, NCPSSM President/CEO

Any good magician will tell you, the best tricks depend on misdirection. So while all eyes are on the spectacle of the House GOP’s in-fighting, its search for a new Speaker and the never-ending “who-insulted-who” shenanigans of the GOP Presidential primary, it’s easy to forget that Congress is now also quietly working on legislation that could impact virtually every American family, especially those that depend on Social Security, Medicare and Medicaid. The American people must not be distracted by the ongoing political show to the point that they miss the real action occurring behind the scenes.

Before leaving for recess in December, Congress faces legislative deadlines to avoid a government shutdown, a default, an extension for transportation funding and tax breaks. While the shutdown has been narrowly averted, the annual appropriations process continues as the President and Congressional Democrats push GOP leaders for a deal to mitigate automatic across-the-board cuts to defense and non-defense programs – also known as the “sequester.”

No amount of political magic can hide the fact that three years of sequester caps have had serious consequences for important seniors programs, including the Older Americans Act and the Low Income Home Energy Assistance Program, along with service reductions at Social Security Administration field offices. That’s why the National Committee supports the President’s plan to increase spending caps. However, some conservatives in Congress insist that relief for programs like the Older Americans Act be paid for by cutting Medicare and Medicaid. This budgetary sleight-of-hand could trade partial relief for some seniors’ programs by cutting other essential health security programs like Medicare and Medicaid, thus further eroding the tenuous economic situation many older Americans face.

It’s no mystery where these Medicare and Medicaid cuts are likely to come from. You have to look no further than the GOP Budget plan for a blueprint of the House leadership’s favorite benefit cut proposals, such as:

- Ending the Medicaid joint federal/state financing partnership and replacing it with fixed dollar amount block grants, giving states less money than they would receive under current law.

- Repealing Medicaid expansion. Since 2014, states have had the option to receive federal funding to expand Medicaid coverage. Over half of the states have expanded their Medicaid programs, and others will likely do so in the future. Repealing this option would result in at least 14 million people losing their Medicaid coverage and state Medicaid programs would lose a total of $900 billion over 10 years.

- Cutting Medicare by $431 billion over ten years. Over half of Medicare beneficiaries had incomes below $23,500 per year in 2013, and they are already paying 23 percent of their average Social Security check for Medicare cost-sharing in addition to out-of-pocket costs.

The National Committee to Preserve Social Security & Medicare has prepared a detailed look at the many policy options in our Fall Budget Outlook brief.

Legislation may need to be enacted by late November or early December to allow the government to continue borrowing and avoid a government default. Allowing a default would result in an economic catastrophe and jeopardize the payment of Social Security, Medicare and Medicaid benefits. In addition, default would jeopardize Medicare and Medicaid payments to doctors and hospitals and coverage for prescription drugs, which are critical to the health security of millions of Americans.

As if all of this isn’t enough, funding for the nation’s roads and public transit will also expire at the end of October. Because the Highway Trust Fund no longer takes in enough gasoline tax revenue to cover surface transportation costs, Congress must come up with more funding. When Congress passed a temporary funding fix this summer, House leaders proposed using Social Security funds to pay for it. This was the third time in little over a year that Congress has attempted to use Social Security and/or Medicare as an ATM to pay for a completely unrelated priority. Last year Congress voted to extend the Medicare sequester cuts into 2024 to cover a reversal of cost-of-living cuts to veterans’ pension benefits. This summer Medicare was cut again to help pay for the Trade bill. Rather than consider tax reform for huge corporate tax dodgers sending billions of profits oversee to avoid paying taxes, GOP leaders tried again (unsuccessfully this time) to cut benefits to seniors, people with disabilities and their families who depend on Social Security to pay for highways. Unfortunately, Congress could pull this outrageous strategy out of its hat once again. Need money for highways, to relieve sequester cuts, deficit reduction or anything at all? Voila! Let’s take if from Social Security and Medicare.

There’s no doubt about it — it will take more than legislative smoke and mirrors and political magic for Congress to get the job done right. But the American people also need to be more than an audience in this process. We need to pull back the curtain on this benefit cut agenda so the American people can avert any surprises Congressional leaders have up their sleeves for vital programs like Social Security, Medicare and Medicaid.

It’s Inequality, Stupid. Why Income Inequality, the Longevity Gap and Social Security are All Connected

One of the favored political tropes repeated often by the billion-dollar anti-Social Security lobby and its supporters in Congress as a justification to cut Social Security is: “Americans are living longer so they should just work longer.” That’s usually followed up with a personal anecdote like “Everyone I know plans to keep working into their 70’s.” Maybe that’s true for hedge-fund billionaires like Pete Peterson and politicians like Alan Simpson. Rich, white men live longer, healthier lives and no doubt it’s easier to consider working until 70 if the boardroom or committee room is where you spend your work day.

However, for the rest of America the “you can work until your 70” claim is built on the lie that “Americans are living longer.” Multiple studies have shown the opposite to be true. All Americans are definitely not living long. Yet another report from the National Academy of Science this week reports:

“Men at the top of the economic ladder saw an eight-year increase in life expectancy, while men at the bottom saw virtually no change.”

No change.

According to researchers, an increasing gap in life expectancy between the wealthy and the working class has come – and may even be caused by — the growing inequality of wealth and income in America. If you can afford the best healthcare, work in high income careers requiring less physical labor and have a higher education allowing you to navigate America’s complicated healthcare system, is it any surprise you might live longer? As more income goes to the richest Americans, our middle-class is shrinking leaving even more people vulnerable.

Teresa Ghilarducci is a labor economist who directs the Retirement Equity lab at The New School. She sums it up this way:

“The idea that everyone should work longer since everyone is living longer is one used to justify policy proposals such as cutting Social Security benefits. But that idea is a misleading oversimplification.

The Retirement Equity Lab at The New School (a project I direct) has pointed out that the growing class and racial gaps have dire implications for retirement policies. A cut to Social Security benefits—which raising the retirement age, an oft-suggested proposal, essentially is—would induce people without means to work in old age. This would produce an unseemly form of inequality: The people who live the longest will be able to retire, and the people who have to work longer will be the same people who are losing at longevity. The poorer will work and the richer will play in old age, a class divide we’ve already seen in the 19th and early 20th centuries. If post-work benefits are not shored up, this disparity will only get worse.”

Budget Squabbling and Its Potential Impact on Social Security & Medicare

With the clock ticking, Congress is scrambling to not only avoid a government shutdown and default but also pass an extension for transportation funding and tax breaks. Will the sequester continue or can Congress find a better way to manage our nation’s finances? This political gamesmanship and inability to get anything done impacts far more than one federal program. Seniors programs like Social Security and Medicare are also in the cross-hairs.

“America’s seniors have become especially weary of these Congressional dramas as they have learned, the hard way, that Social Security and Medicare have become the favored target for budget cuts or “pay-fors” for a host of Congressional programs that have nothing to do with providing the earned benefits seniors depend on. From highways to trade and beyond, Congress continues to try and use seniors’ programs as a national ATM. The next few weeks promises more of the same”… Max Richtman, NCPSSM President/CEO

The National Committee to Preserve Social Security and Medicare has prepared a detailed Fall Legislative Update mapping the current legislative minefield for programs which touch the lives of virtually every American family.

We’ve identified the numerous legislative hurdles still ahead, the possible threats to Social Security, Medicare and Medicaid and our positions on each potential pay-for or budget cut. You can see NCPSSM’s Fall Legislative Update here.