Robbing Medicare to Pay for the Trade Deal

Chances are if you’re a regular reader of this blog, the last issue you’d expect to see us write about is the hotly-debated and barely understood TPP  (Trans-Pacific Partnership) trade deal. After all, keeping up with and explaining policy issues impacting Social Security, Medicare and Medicaid is complicated enough, so yes, we really didn’t plan on wading too deep into the trade deal. (Although you can read NCPSSM’s take on TPP and drug prices here.)

(Trans-Pacific Partnership) trade deal. After all, keeping up with and explaining policy issues impacting Social Security, Medicare and Medicaid is complicated enough, so yes, we really didn’t plan on wading too deep into the trade deal. (Although you can read NCPSSM’s take on TPP and drug prices here.)

Unfortunately, that changed this week with news that Congress (with the White House running silent) intends to cut $700 million from the Medicare program to pay for a slice of the trade package. We talked to Michael Hiltzik the Los Angeles Times about this back-door attack on Medicare:

“The plan on Capitol Hill is to move the Trade Assistance Program expansion in tandem with fast-track approval of the Trans-Pacific Partnership trade deal, possibly as early as this week. We explained earlier the dangers of the fast-track approval of this immense and largely secret trade deal. But the linkage with the assistance program adds a new layer of political connivance: Congressional Democrats demanded the expansion of the Trade Assistance Program, Congressional Republicans apparently found the money in Medicare, and the Obama White House, which should be howling in protest, has remained silent.

Medicare advocates have taken up the slack by raising the alarm. “To take this cut and apply it to something completely unrelated sets a terrible precedent,” Max Richtman, head of the National Committee to Preserve Social Security and Medicare, told me.

The Medicare raid was so stealthy that critics in Congress, including members of the Congressional Progressive Caucus, are just now gearing up to oppose it. “It was sort of buried” in the bill, Rep. Keith Ellison (D-Minn.), the caucus co-chair, told me Monday.”

Funding the Trade Assistance Program is necessary to help Americans workers expected to lose their jobs because of this trade deal receive job training and assistance. However, telling American workers they have to trade away health care benefits in their retirement in order to get job training when they lose their job now is incredibly mercenary, even by Washington standards.

This isn’t the first time Medicare has been Congress’ piggy bank. This move follows last year’s vote to extend the Medicare sequester cuts into 2024 to cover a reversal of cost-of-living cuts to veterans’ pension benefits. Shifting Medicare funds to other programs seems to be Congress’ new go-to budget approach. That’s pretty ironic given that the GOP has spent millions of campaign dollars claiming Obamacare cut Medicare benefits (which is didn’t):

“This is different from the $700-billion cost reduction in Medicare enacted via the Affordable Care Act. That includes efforts to make the program more efficient by improving the incentives governing how doctors and hospitals deliver care to their patients, along with reductions in payments to Medicare Advantage plans. Richtman points out that much of this amounts to a reallocation within Medicare — “it’s piled back into the program by paying for improvements in preventive care, closing the ‘doughnut’ hole in Medicare Part D (the prescription drug benefit)” and other measures. In the broadest sense, the cost reductions in Medicare are netted against other healthcare costs within the Affordable Care Act.

By contrast, the new proposal would take $700 million out of Medicare, period. Nothing in the TAA will help Medicare function better, augment its services to members, or cover healthcare costs. Slicing into physician and hospital reimbursements may have the opposite effect, by reducing members’ access to care. “I’d characterize this as money stolen from Medicare,” Richtman says.”

We recommend you read Michael Hiltzik’s entire story at the Los Angeles Times

Social Security Privatization: Then and Now

by Max Richtman, NCPSSM President/CEO

About this time ten years ago it was becoming clear that President George Bush’s plan to forever change Social Security by turning the program over to Wall Street was on the ropes. Even though his Social Security privatization road tour still had two more months of scheduled stops, the more the President talked about his plan, the less people liked it. Gallup reported disapproval of privatizing Social Security rose by 16 points from 48 to 64 percent between the President’s State of the Union address and June. It was an incredibly risky and unpopular idea that rapidly flat-lined thanks to the overwhelming rejection by the public. Yet here we are a decade later and conservatives campaigning for Congress and the White House are resuscitating the Bush strategy by offering up approaches to Social Security which are stark reminders that the GOP playbook really hasn’t changed that much.

What Else Has NOT Changed

Americans of all ages, political parties and income levels, continue to oppose cutting Social Security benefits through privatization or other means. They understand the retirement crisis is real. A recent Gallup poll reports more non-retirees believe Social Security will be a major source of income in their retirement now than at any point in the last 15 years. The National Academy of Social Insurance’s survey, “Americans Make Hard Choices on Social Security” shows that Americans’ support for Social Security is unparalleled and they are willing to pay more in taxes to stabilize the system’s finances and improve benefits. Seven out of 10 participants prefer a package that would eliminate Social Security’s long-term financing gap without cutting benefits.

Even though Americans clearly understand the value of Social Security and are willing to pay more to strengthen it, Republicans in Congress and GOP candidates for President continue to push for Social Security cuts and/or privatization plans. Governor Chris Christie may have hoped savaging the program would give him the attention and conservative credentials needed to revive his flagging poll numbers before announcing his Presidential campaign against a roster of other candidates who already offered their own plans to cut Social Security benefits. The GOP Presidential primary has become a race to see who can deny more benefits for seniors, people with disabilities, survivors and their families faster. While cutting benefits in Social Security, Medicare and Medicaid isn’t really new among conservatives, what has changed in the decade since the Democrats led the charge against Social Security privatization is how some Democrats are now talking about these vital programs in the language of the conservatives.

Why Opposing Privatization Isn’t Enough

During the last decade I’ve observed a growing willingness by some Democrats to buy into the conservative mythology that targeting average Americans for benefit cuts makes them more “honest” and “courageous” than other politicians. This Republican talking point is built on the false premise that supporting successful federal programs which keep millions of Americans economically and medically secure is “pandering to seniors” while supporting billionaire tax breaks and corporate giveaways costing the federal treasury billions of dollars is “fiscal responsibility.”

Ten years ago Democrats were united in their opposition to Social Security privatization. That’s still largely true today; however, given the lessons of the past decade, opposing privatization simply isn’t enough to convince constituents that their benefits are fully protected. The broader questions voters should ask incumbents and candidates alike include: Do they support benefit cuts in any other form such as the Chained CPI, raising the retirement age, and means testing? Do they support the failed Bowles-Simpson plan which would have done all of these things? Do they support the reallocation of trust fund monies to avoid a 20 percent cut to Social Security disability benefits? The answers to these questions can reveal the truth about a candidate’s vision for the future of Social Security and the generations of Americans who have earned their benefits. “I oppose privatization” was enough ten years ago but it doesn’t tell us whether an incumbent has been a Social Security defender or benefit cuts collaborator in the many battles since then.

While it’s safe for Democrats to declare their opposition to privatization, the bolder step they need to make in this politically charged benefit-cuts environment is to demand that any Social Security conversation must address benefit adequacy as well as long-term solvency. It’s clear that the majority in Congress has little interest in protecting this program even though our nation faces a retirement crisis leaving the average working household with virtually no retirement savings. The truth is Congress should Boost Social Security benefits not cut them. That’s a position that demonstrates true political leadership. Not because it’s unrealistic or opportunistic, as the billion dollar anti-Social Security lobby would like you to believe, but because it pushes back against a decade long quest to cut Social Security benefits as the next best thing to privatization. “Death by a thousand cuts” is a political goal the American people simply can not afford nor should they have to. We have Democratic and Independent leaders in Congress who understand this and they support legislation to improve Social Security benefits. The National Committee has endorsed numerous pieces of legislation that would enhance Social Security, boost benefits, lift the payroll tax cap and adopt the more accurate consumer price index for the elderly (CPI-E). Proposals like the Social Security 2100 Act not only improve benefits but also extend Social Security’s long-term solvency.

I believe the old truism that those who cannot remember the past are condemned to repeat it. When Democrats were unified in representing the American people’s views on Social Security they were on the correct side of the issue from both a policy and political perspective. Defeating the privatization of Social Security saved millions of Americans from an even worse economic fate than they already suffered through during the great recession. Current and future Democratic lawmakers now have an opportunity to do the right thing again by joining the growing Boost Social Security movement and supporting legislation which would improve benefits while also strengthening the program’s long-term outlook.

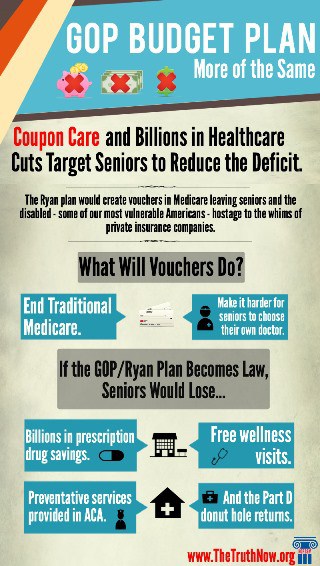

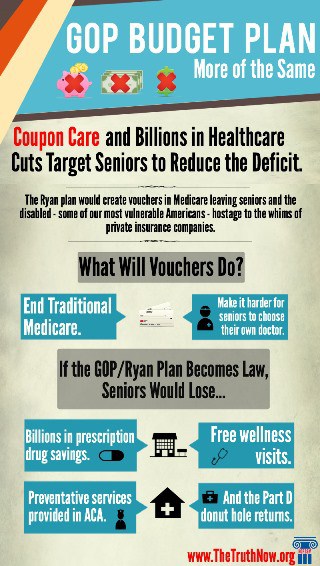

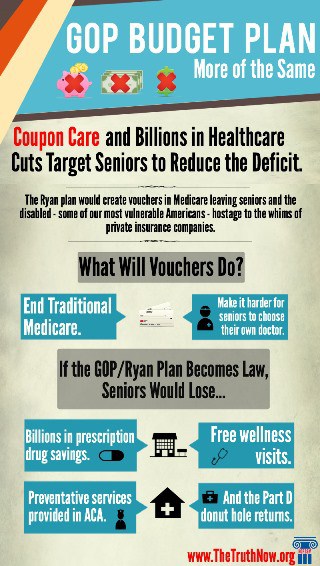

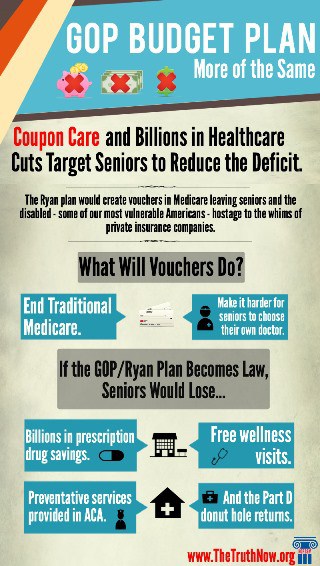

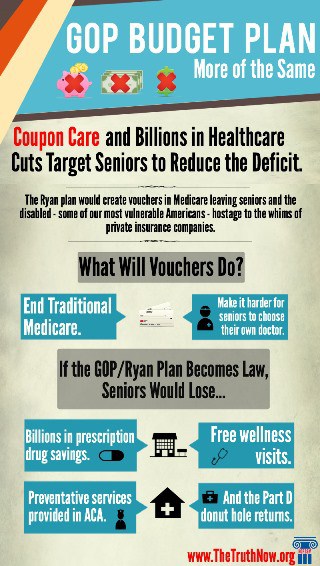

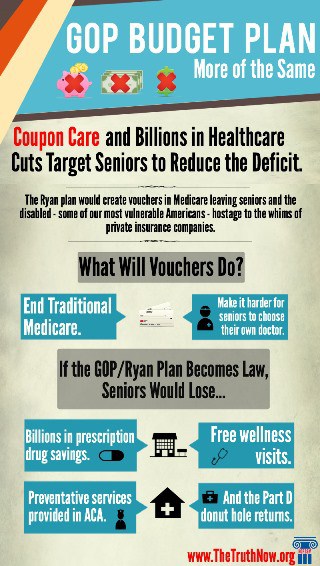

GOP Budget Plan: Even More Cuts for Seniors in Medicare

In keeping with every GOP budget passed over many years, benefit cuts for average Americans and tax cuts for the wealthy rule the day. The Senate this week will pass the Budget Conference Report (it only needs a majority, which the GOP now has) including massive benefit cuts for seniors in Medicare.

National Committee policy staff has laid out what this Budget bill means for seniors in our letter to the Senate:

The conference agreement would be devastating to today’s seniors and future retirees, people with disabilities and children due to the proposed changes it makes to Medicare, Medicaid and the Affordable Care Act. While it proposes huge cuts to our social insurance safety net, the conference report would give massive tax cuts to the very wealthy.The conference agreement assumes the privatization of Medicare and achieves savings by shifting costs to Medicare beneficiaries. Beginning in 2024, when people become eligible for Medicare they would not enroll in the current traditional Medicare program which provides guaranteed benefits. Rather they would receive a voucher, also referred to as a premium support payment, to be used to purchase private health insurance or traditional Medicare through a Medicare Exchange. The amount of the voucher would be determined each year when private health insurance plans and traditional Medicare participate in a competitive bidding process. Seniors choosing a plan costing more than the average amount determined through competitive bidding would be required to pay the difference between the voucher and the plan’s premium. In some geographic areas, traditional Medicare could be more expensive. This would make it harder for seniors, particularly lower-income beneficiaries, to choose their own doctors if their only affordable options are private plans that have limited provider networks. Wealthier Medicare beneficiaries would be required to pay a greater share of their premiums than lower-income seniors.

The plan to end traditional Medicare requires private plans participating in the Medicare Exchange to offer insurance to all Medicare beneficiaries. However, it is likely that plans could tailor their benefits to attract the youngest and healthiest seniors and still be at least actuarially equivalent to the benefit package provided by fee-for-service Medicare. This would leave traditional Medicare with older and sicker beneficiaries. Their higher health costs would lead to higher premiums that people would be unable or unwilling to pay, resulting in a death spiral for traditional Medicare. This would adversely impact people age 55 and older, including people currently enrolled in traditional Medicare, despite the conference agreement’s assertion that nothing will change for them.

The conference report threatens to shift costs to Medicare beneficiaries. S. Con. Res. 11 contains $431 billion over ten years in unnamed Medicare cuts. Over half of Medicare beneficiaries had incomes below $23,500 per year in 2013, and they are already paying 23 percent of their average Social Security check for Parts B and D cost-sharing in addition to paying for health services not covered by Medicare. When coupled with requirements to shift costs to beneficiaries in the Medicare Access and CHIP Reauthorization Act of 2015 (P.L. 114-10), the unspecified Medicare benefit cuts included in the conference agreement would be burdensome to millions of seniors and people with disabilities.

In addition, the conference agreement calls for repealing provisions in the Affordable Care Act (ACA), which would make health insurance inaccessible for seniors age 64 and younger. Without the guarantees in the ACA, such as requiring insurance companies to cover people with pre-existing medical conditions and to limit age rating, younger seniors may not be able to purchase or afford private health insurance.

Repealing the ACA would also take away improvements already in place for Medicare beneficiaries – closing the Medicare Part D coverage gap, known as the “donut hole”; providing preventive screenings and services without out-of-pocket costs; and providing annual wellness exams. The Centers for Medicare and Medicaid Services recently reported that since the passage of the ACA, over 9.4 million Medicare beneficiaries in the Medicare Part D donut hole have saved $15 billion on their prescription drugs, an average of $1,595 per person. An estimated 39 million people with Medicare took advantage of at least one preventive service with no cost sharing in 2014.

The agreement includes reductions to Medicaid funding that would affect low-income seniors. Medicaid provides funding for health care to help the most vulnerable Americans, including low-income seniors, people with disabilities, children and some families. The conference report would end the current joint federal/state financing partnership and replace it with fixed dollar amount block grants, giving states less money than they would receive under current law. In exchange, states would have additional flexibility to design and manage their Medicaid programs. The proposed block grants would cut federal Medicaid spending by $500 billion over the next 10 years. Giving states greater flexibility in managing and designing their programs in no way compensates for the significant reductions that beneficiaries, including nursing home residents and their families, could face by turning Medicaid into block grants.

The conference report also would repeal the Medicaid expansion in the ACA. Beginning in 2014, states have had the option to receive federal funding to expand Medicaid coverage to uninsured adults with incomes up to 138 percent of the federal poverty level ($16,242 for an individual in 2015). Over half of the states have expanded their Medicaid programs, and some others will likely participate in the future. The conference agreement would hurt states and low-income individuals by repealing Medicaid expansion, taking away $900 billion from the program over 10 years. Altogether, S. Con. Res. 11 cuts the Medicaid program by more than $1.4 trillion over 10 years, compared to current law.

Moreover, the conference agreement puts 11 million severely disabled Social Security Disability Insurance (SSDI) beneficiaries at risk of a 20 percent benefit cut next year by reaffirming a House rule requiring legislation to address the financing of the SSDI program be accompanied by revenue increases or much more likely benefit cuts. That’s why the National Committee urges the Senate to reject the House’s SSDI recommendations in the conference report and instead make a modest reallocation of Social Security payroll taxes from the retirement trust fund to the Disability Insurance Trust Fund as has been done 11 times in the past on a bipartisan basis.

The National Committee urges you to oppose the Conference Report on the FY 2016 Budget Resolution, which would be harmful to seniors, people with disabilities and children.”

Social Security Numbers to be Removed from Medicare Cards

But it doesn’t come without a cost. The New York Times describes the funding:

Congress provided $320 million over four years to pay for the change. The money will come from Medicare trust funds that are financed with payroll and other taxes and with beneficiary premiums.

In his budget for 2016, Mr. Obama requested $50 million as a down payment “to support the removal of Social Security numbers from Medicare cards” — a step that federal auditors and investigators had been recommending for more than a decade.

More than 4,500 people a day sign up for Medicare. In the coming decade, 18 million more people are expected to qualify, bringing Medicare enrollment to 74 million people by 2025.

Medicare now has up to four years to start issuing new numbers on cards for new beneficiaries and four more years to reissue cards for those already in Medicare. Social Security numbers will be replaced with “a randomly generated Medicare beneficiary identifier.” The details are still being worked out.

Robbing Medicare to Pay for the Trade Deal

Chances are if you’re a regular reader of this blog, the last issue you’d expect to see us write about is the hotly-debated and barely understood TPP

Unfortunately, that changed this week with news that Congress (with the White House running silent) intends to cut $700 million from the Medicare program to pay for a slice of the trade package. We talked to Michael Hiltzik the Los Angeles Times about this back-door attack on Medicare:

“The plan on Capitol Hill is to move the Trade Assistance Program expansion in tandem with fast-track approval of the Trans-Pacific Partnership trade deal, possibly as early as this week. We explained earlier the dangers of the fast-track approval of this immense and largely secret trade deal. But the linkage with the assistance program adds a new layer of political connivance: Congressional Democrats demanded the expansion of the Trade Assistance Program, Congressional Republicans apparently found the money in Medicare, and the Obama White House, which should be howling in protest, has remained silent.

Medicare advocates have taken up the slack by raising the alarm. “To take this cut and apply it to something completely unrelated sets a terrible precedent,” Max Richtman, head of the National Committee to Preserve Social Security and Medicare, told me.

The Medicare raid was so stealthy that critics in Congress, including members of the Congressional Progressive Caucus, are just now gearing up to oppose it. “It was sort of buried” in the bill, Rep. Keith Ellison (D-Minn.), the caucus co-chair, told me Monday.”

Funding the Trade Assistance Program is necessary to help Americans workers expected to lose their jobs because of this trade deal receive job training and assistance. However, telling American workers they have to trade away health care benefits in their retirement in order to get job training when they lose their job now is incredibly mercenary, even by Washington standards.

This isn’t the first time Medicare has been Congress’ piggy bank. This move follows last year’s vote to extend the Medicare sequester cuts into 2024 to cover a reversal of cost-of-living cuts to veterans’ pension benefits. Shifting Medicare funds to other programs seems to be Congress’ new go-to budget approach. That’s pretty ironic given that the GOP has spent millions of campaign dollars claiming Obamacare cut Medicare benefits (which is didn’t):

“This is different from the $700-billion cost reduction in Medicare enacted via the Affordable Care Act. That includes efforts to make the program more efficient by improving the incentives governing how doctors and hospitals deliver care to their patients, along with reductions in payments to Medicare Advantage plans. Richtman points out that much of this amounts to a reallocation within Medicare — “it’s piled back into the program by paying for improvements in preventive care, closing the ‘doughnut’ hole in Medicare Part D (the prescription drug benefit)” and other measures. In the broadest sense, the cost reductions in Medicare are netted against other healthcare costs within the Affordable Care Act.

By contrast, the new proposal would take $700 million out of Medicare, period. Nothing in the TAA will help Medicare function better, augment its services to members, or cover healthcare costs. Slicing into physician and hospital reimbursements may have the opposite effect, by reducing members’ access to care. “I’d characterize this as money stolen from Medicare,” Richtman says.”

We recommend you read Michael Hiltzik’s entire story at the Los Angeles Times

Social Security Privatization: Then and Now

by Max Richtman, NCPSSM President/CEO

About this time ten years ago it was becoming clear that President George Bush’s plan to forever change Social Security by turning the program over to Wall Street was on the ropes. Even though his Social Security privatization road tour still had two more months of scheduled stops, the more the President talked about his plan, the less people liked it. Gallup reported disapproval of privatizing Social Security rose by 16 points from 48 to 64 percent between the President’s State of the Union address and June. It was an incredibly risky and unpopular idea that rapidly flat-lined thanks to the overwhelming rejection by the public. Yet here we are a decade later and conservatives campaigning for Congress and the White House are resuscitating the Bush strategy by offering up approaches to Social Security which are stark reminders that the GOP playbook really hasn’t changed that much.

What Else Has NOT Changed

Americans of all ages, political parties and income levels, continue to oppose cutting Social Security benefits through privatization or other means. They understand the retirement crisis is real. A recent Gallup poll reports more non-retirees believe Social Security will be a major source of income in their retirement now than at any point in the last 15 years. The National Academy of Social Insurance’s survey, “Americans Make Hard Choices on Social Security” shows that Americans’ support for Social Security is unparalleled and they are willing to pay more in taxes to stabilize the system’s finances and improve benefits. Seven out of 10 participants prefer a package that would eliminate Social Security’s long-term financing gap without cutting benefits.

Even though Americans clearly understand the value of Social Security and are willing to pay more to strengthen it, Republicans in Congress and GOP candidates for President continue to push for Social Security cuts and/or privatization plans. Governor Chris Christie may have hoped savaging the program would give him the attention and conservative credentials needed to revive his flagging poll numbers before announcing his Presidential campaign against a roster of other candidates who already offered their own plans to cut Social Security benefits. The GOP Presidential primary has become a race to see who can deny more benefits for seniors, people with disabilities, survivors and their families faster. While cutting benefits in Social Security, Medicare and Medicaid isn’t really new among conservatives, what has changed in the decade since the Democrats led the charge against Social Security privatization is how some Democrats are now talking about these vital programs in the language of the conservatives.

Why Opposing Privatization Isn’t Enough

During the last decade I’ve observed a growing willingness by some Democrats to buy into the conservative mythology that targeting average Americans for benefit cuts makes them more “honest” and “courageous” than other politicians. This Republican talking point is built on the false premise that supporting successful federal programs which keep millions of Americans economically and medically secure is “pandering to seniors” while supporting billionaire tax breaks and corporate giveaways costing the federal treasury billions of dollars is “fiscal responsibility.”

Ten years ago Democrats were united in their opposition to Social Security privatization. That’s still largely true today; however, given the lessons of the past decade, opposing privatization simply isn’t enough to convince constituents that their benefits are fully protected. The broader questions voters should ask incumbents and candidates alike include: Do they support benefit cuts in any other form such as the Chained CPI, raising the retirement age, and means testing? Do they support the failed Bowles-Simpson plan which would have done all of these things? Do they support the reallocation of trust fund monies to avoid a 20 percent cut to Social Security disability benefits? The answers to these questions can reveal the truth about a candidate’s vision for the future of Social Security and the generations of Americans who have earned their benefits. “I oppose privatization” was enough ten years ago but it doesn’t tell us whether an incumbent has been a Social Security defender or benefit cuts collaborator in the many battles since then.

While it’s safe for Democrats to declare their opposition to privatization, the bolder step they need to make in this politically charged benefit-cuts environment is to demand that any Social Security conversation must address benefit adequacy as well as long-term solvency. It’s clear that the majority in Congress has little interest in protecting this program even though our nation faces a retirement crisis leaving the average working household with virtually no retirement savings. The truth is Congress should Boost Social Security benefits not cut them. That’s a position that demonstrates true political leadership. Not because it’s unrealistic or opportunistic, as the billion dollar anti-Social Security lobby would like you to believe, but because it pushes back against a decade long quest to cut Social Security benefits as the next best thing to privatization. “Death by a thousand cuts” is a political goal the American people simply can not afford nor should they have to. We have Democratic and Independent leaders in Congress who understand this and they support legislation to improve Social Security benefits. The National Committee has endorsed numerous pieces of legislation that would enhance Social Security, boost benefits, lift the payroll tax cap and adopt the more accurate consumer price index for the elderly (CPI-E). Proposals like the Social Security 2100 Act not only improve benefits but also extend Social Security’s long-term solvency.

I believe the old truism that those who cannot remember the past are condemned to repeat it. When Democrats were unified in representing the American people’s views on Social Security they were on the correct side of the issue from both a policy and political perspective. Defeating the privatization of Social Security saved millions of Americans from an even worse economic fate than they already suffered through during the great recession. Current and future Democratic lawmakers now have an opportunity to do the right thing again by joining the growing Boost Social Security movement and supporting legislation which would improve benefits while also strengthening the program’s long-term outlook.

GOP Budget Plan: Even More Cuts for Seniors in Medicare

In keeping with every GOP budget passed over many years, benefit cuts for average Americans and tax cuts for the wealthy rule the day. The Senate this week will pass the Budget Conference Report (it only needs a majority, which the GOP now has) including massive benefit cuts for seniors in Medicare.

National Committee policy staff has laid out what this Budget bill means for seniors in our letter to the Senate:

The conference agreement would be devastating to today’s seniors and future retirees, people with disabilities and children due to the proposed changes it makes to Medicare, Medicaid and the Affordable Care Act. While it proposes huge cuts to our social insurance safety net, the conference report would give massive tax cuts to the very wealthy.The conference agreement assumes the privatization of Medicare and achieves savings by shifting costs to Medicare beneficiaries. Beginning in 2024, when people become eligible for Medicare they would not enroll in the current traditional Medicare program which provides guaranteed benefits. Rather they would receive a voucher, also referred to as a premium support payment, to be used to purchase private health insurance or traditional Medicare through a Medicare Exchange. The amount of the voucher would be determined each year when private health insurance plans and traditional Medicare participate in a competitive bidding process. Seniors choosing a plan costing more than the average amount determined through competitive bidding would be required to pay the difference between the voucher and the plan’s premium. In some geographic areas, traditional Medicare could be more expensive. This would make it harder for seniors, particularly lower-income beneficiaries, to choose their own doctors if their only affordable options are private plans that have limited provider networks. Wealthier Medicare beneficiaries would be required to pay a greater share of their premiums than lower-income seniors.

The plan to end traditional Medicare requires private plans participating in the Medicare Exchange to offer insurance to all Medicare beneficiaries. However, it is likely that plans could tailor their benefits to attract the youngest and healthiest seniors and still be at least actuarially equivalent to the benefit package provided by fee-for-service Medicare. This would leave traditional Medicare with older and sicker beneficiaries. Their higher health costs would lead to higher premiums that people would be unable or unwilling to pay, resulting in a death spiral for traditional Medicare. This would adversely impact people age 55 and older, including people currently enrolled in traditional Medicare, despite the conference agreement’s assertion that nothing will change for them.

The conference report threatens to shift costs to Medicare beneficiaries. S. Con. Res. 11 contains $431 billion over ten years in unnamed Medicare cuts. Over half of Medicare beneficiaries had incomes below $23,500 per year in 2013, and they are already paying 23 percent of their average Social Security check for Parts B and D cost-sharing in addition to paying for health services not covered by Medicare. When coupled with requirements to shift costs to beneficiaries in the Medicare Access and CHIP Reauthorization Act of 2015 (P.L. 114-10), the unspecified Medicare benefit cuts included in the conference agreement would be burdensome to millions of seniors and people with disabilities.

In addition, the conference agreement calls for repealing provisions in the Affordable Care Act (ACA), which would make health insurance inaccessible for seniors age 64 and younger. Without the guarantees in the ACA, such as requiring insurance companies to cover people with pre-existing medical conditions and to limit age rating, younger seniors may not be able to purchase or afford private health insurance.

Repealing the ACA would also take away improvements already in place for Medicare beneficiaries – closing the Medicare Part D coverage gap, known as the “donut hole”; providing preventive screenings and services without out-of-pocket costs; and providing annual wellness exams. The Centers for Medicare and Medicaid Services recently reported that since the passage of the ACA, over 9.4 million Medicare beneficiaries in the Medicare Part D donut hole have saved $15 billion on their prescription drugs, an average of $1,595 per person. An estimated 39 million people with Medicare took advantage of at least one preventive service with no cost sharing in 2014.

The agreement includes reductions to Medicaid funding that would affect low-income seniors. Medicaid provides funding for health care to help the most vulnerable Americans, including low-income seniors, people with disabilities, children and some families. The conference report would end the current joint federal/state financing partnership and replace it with fixed dollar amount block grants, giving states less money than they would receive under current law. In exchange, states would have additional flexibility to design and manage their Medicaid programs. The proposed block grants would cut federal Medicaid spending by $500 billion over the next 10 years. Giving states greater flexibility in managing and designing their programs in no way compensates for the significant reductions that beneficiaries, including nursing home residents and their families, could face by turning Medicaid into block grants.

The conference report also would repeal the Medicaid expansion in the ACA. Beginning in 2014, states have had the option to receive federal funding to expand Medicaid coverage to uninsured adults with incomes up to 138 percent of the federal poverty level ($16,242 for an individual in 2015). Over half of the states have expanded their Medicaid programs, and some others will likely participate in the future. The conference agreement would hurt states and low-income individuals by repealing Medicaid expansion, taking away $900 billion from the program over 10 years. Altogether, S. Con. Res. 11 cuts the Medicaid program by more than $1.4 trillion over 10 years, compared to current law.

Moreover, the conference agreement puts 11 million severely disabled Social Security Disability Insurance (SSDI) beneficiaries at risk of a 20 percent benefit cut next year by reaffirming a House rule requiring legislation to address the financing of the SSDI program be accompanied by revenue increases or much more likely benefit cuts. That’s why the National Committee urges the Senate to reject the House’s SSDI recommendations in the conference report and instead make a modest reallocation of Social Security payroll taxes from the retirement trust fund to the Disability Insurance Trust Fund as has been done 11 times in the past on a bipartisan basis.

The National Committee urges you to oppose the Conference Report on the FY 2016 Budget Resolution, which would be harmful to seniors, people with disabilities and children.”

Social Security Numbers to be Removed from Medicare Cards

But it doesn’t come without a cost. The New York Times describes the funding:

Congress provided $320 million over four years to pay for the change. The money will come from Medicare trust funds that are financed with payroll and other taxes and with beneficiary premiums.

In his budget for 2016, Mr. Obama requested $50 million as a down payment “to support the removal of Social Security numbers from Medicare cards” — a step that federal auditors and investigators had been recommending for more than a decade.

More than 4,500 people a day sign up for Medicare. In the coming decade, 18 million more people are expected to qualify, bringing Medicare enrollment to 74 million people by 2025.

Medicare now has up to four years to start issuing new numbers on cards for new beneficiaries and four more years to reissue cards for those already in Medicare. Social Security numbers will be replaced with “a randomly generated Medicare beneficiary identifier.” The details are still being worked out.