NCPSSM Endorses Tim Kaine for Re-election to U.S. Senate

On behalf of our 28,000 members and supporters in Virginia, the National Committee to Preserve Social Security and Medicare today proudly endorsed Tim Kaine for re-election to the U.S. Senate in Fredericksburg, VA on Friday. Senator Kaine has proven himself time and again as a leader on issues affecting Virginia seniors. He earns a 100% rating on our legislative scorecard for his steadfast championing of Social Security, Medicare, and lower prescription drug prices.

“I have known Tim Kaine for over 15 years now, and I have been consistently impressed by his commitment to working families and seniors. He has always been close to his own elderly parents — and understands the importance of retirement and health security for all Virginia families. Underpinning all of this are the values of hard work, fairness, and family that he has demonstrated so well during his first two terms in Washington.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare

Senator Kaine accepted NCPSSM’s endorsement Friday morning at a town hall at Chancellor’s Village, a senior living facility in Fredericksburg. National Committee president and CEO Max Richtman handed the Senator a pair of NCPSSM’s signature boxing gloves to recognize his championing of seniors.

“I’m honored to receive the endorsement of the National Committee to Preserve Social Security and Medicare because I am determined to stand up for Virginia seniors and lower costs. Virginians should have access to affordable health care and be able to retire with dignity – which has been and will continue to be my priority in the U.S. Senate.” – Senator Tim Kaine

Virginians can continue to count on Senator Kaine to protect their hard-earned benefits. There are some 1.6 million Social Security beneficiaries in Virginia. The average benefit for Virginia retirees is nearly $1,900 per month, or about $23,000 a year. Senator Kaine knows that Virginians living on fixed incomes cannot afford cuts to their hard-earned benefits, which key Republicans (including contenders for the GOP presidential nomination) have proposed.

Senator Kaine greets supporters at town hall event in Fredericksburg, VA

Senator Kaine also will continue to fight prescription drug price gouging by Big Pharma, as he has during the 118th Congress. He supported the Inflation Reduction Act, which finally allows Medicare to negotiate drug prices with pharmaceutical companies — and caps seniors’ out-of-pocket drug costs under Medicare Part D at $2,000 per year. Virginians are now beginning to see those benefits realized, including a $35 cap on monthly insulin costs.

The Inflation Reduction Act passed the Senate by one vote. Without the vote of Senator Kaine, Virginians would not have the benefits of this historic drug pricing reform. There is plenty more work to be done in the next Congress — and that is why we need Tim Kaine in the Senate to fight for older Virginians and their families.

FDR Would Be “Fighting Mad” About Assaults on Social Security, Says Grandson on New Podcast

President Franklin D. Roosevelt would be “fighting mad” about conservative attempts to undermine Social Security, says his grandson, Jim Roosevelt on the first episode of our new podcast — released this week. Roosevelt says that FDR would not only be mad. “We’d see him actively pressuring Congress” to support Social Security — and working to elect lawmakers who champion his legacy program — in the face of myriad proposals to cut and privatize it.

The podcast, “You Earned This,” debuted on multiple platforms — including Spotify, Apple Podcasts, and Amazon/Audible. It is available to listen and download for free. Each episode covers a single topic with a single guest. Because we know that listeners have a limited amount of time, this podcast is designed to be “bite-sized.” Episodes are no longer than 15 minutes each, making for a brisk and brief listening experience!

In this episode, Jim Roosevelt says that the Social Security Administration (SSA), which is responsible for administering benefits for 71 million people, cannot be expected to service the public properly without adequate funding. Customers have experienced long wait times on the 800 phone line, field office closures, and extended delays in adjudication of disability claims hearings — all due to a 17% cut (adjusted for inflation) in operating budget since Tea Party Republicans took control of the House beginning in 2011.

“First of all the budget cuts that took place at the time of the Tea Party really devastated the workforce. (Employee morale has suffered) because if you tell people you have this huge amount of work to do and we’re not going to give you anybody to help you do it, they get very dissatisfied.”

Roosevelt expressed optimism that the putative new SSA Commissioner, former Maryland Governor Martin O’Malley, would advocate for more funding and make other improvements to shore up customer service. O’Malley is expected to be confirmed by the full Senate on December 18th.

Roosevelt criticizes Republicans who propose to raise the retirement age for Social Security to 69 or 70, including presidential candidate, Nikki Haley. Roosevelt says her intention to cut benefits for people now in their 20s and 30s — including her adult children — is plain “crazy.”

“Our kids (are) not going to have a lower cost of living than retirees do today. Social Security already is an adequate benefit, but not a generous benefit. In fact, if anything, it should be increased, not cut for future generations.” – Jim Roosevelt, 12/14/23

He also rails against Republican proposals for a fiscal commission to decide the fate of Social Security (and Medicare), including House Speaker Mike Johnson’s pledge to create such a commission. Those commissions, Roosevelt tells us, are “a black box” designed to let individual lawmakers off the hook for proposing to cut seniors’ earned benefits.

He also reminisced about conversations he had as a teenager with grandmother, Eleanor Roosevelt. (Jim Roosevelt was born after his grandfather, FDR, passed away.) He describes the former first lady as a passionate advocate for women’s rights, including women’s retirement security. Eleanor, he says, was equally dedicated to preserving Social Security so that, in the words of FDR, “no damn politician” could ever take it away.

Our next guest is NCPSSM senior health policy expert, Anne Montgomery, breaking down the Disadvantages of Medicare Advantage. That episode will be released on December 21st!

To listen to the “You Earned This” podcast, click here.

Sorry, Slate Magazine, We Don’t Need to ‘Radically Rethink’ Social Security

Conservative think tanks and publications have been very busy pumping out propaganda designed to undermine Social Security. Of course, the conservative movement has been working to weaken or eliminate the program since the 1980s, and its messaging seeps quite seamlessly into the mainstream media narrative about Social Security. A recent opinion piece in Slate magazine is the latest example of anti-Social Security propaganda from the political right. The unsubtly titled piece, Social Security Doesn’t Make Sense Anymore, is technically co-authored by Eric Boehm and Celeste Headlee, but it is mainly a transcript of an interview with Boehm on Headlee’s Slate podcast. Boehm is a reporter for the conservative magazine, Reason, who has praised Argentina’s new MAGA-like president, Javier Milei, as a champion of ‘smaller government.’

The Slate article is so rife with misleading statements that it’s hard to know where to begin correcting it. L.A. Times’ columnist Michael Hiltzik counted at least 30 such statements. We can’t even begin to rebut all of them in one Equal Time blog post. But we will correct some of the worst zingers (below), in hopes that by removing enough cards from the unstable house that the Slate authors built, the whole thing will rightfully come tumbling down.

MISLEADING STATEMENT: “Social Security is a transfer of wealth from people who are young and working and productive, because it’s funded with payroll taxes.” – Slate

Social Security is not a federal transfer program. Transfer programs are funded by general tax revenue and tend to be one-way transactions, usually from wealthier to poorer groups (e.g., Medicaid, food stamps). Social Security payroll taxes are a dedicated income stream that can only be used for payment of Social Security benefits. Workers paying into Social Security are earning the right to collect benefits later — when they retire or become disabled.

MISLEADING STATEMENT: “Retirees are generally wealthier than the people who are funding their retirements through Social Security. So… we need a radical rethink of the program.” – Slate

While some retirees are well-off (Older billionaires like Warren Buffet skew the average), forty percent of seniors depend on Social Security for all their income. Ten percent of American seniors already live in poverty. Without Social Security, half of retirees would fall beneath the poverty line. Younger workers pay into the system in return for collecting benefits when they retire. This intergenerational compact has worked for nearly ninety years and there is no need to ‘radically rethink’ it now.

MISLEADING STATEMENT: “I’d love to reframe this debate away from the idea that those of us who are proposing reforms are somehow breaking a promise that was made to retirees.” – Slate

Of course Social Security is a promise — from the federal government to American workers, dating back to the enactment of the program in 1935. President Franklin D. Roosevelt pledged that Social Security would “give some measure of protection to the average citizen and family against poverty-ridden old age.” This is why, nearly 90 years later, President Biden referred to Social Security as a “sacred trust.” The fundamental promise is that when workers pay into the system, they are eligible for retirement benefits later.

MISLEADING STATEMENT: “That promise has been upended by decades of greater prosperity for Americans.” – Slate

While it’s true that fewer seniors are living in poverty than in 1935 – at the height of the Great Depression – prosperity is not equitably shared in 21st century America. Income inequality has mushroomed in the past 40 years. As Bloomberg reported, “middle class financial security has eroded in past decades.” In fact, as of 2021, the top 1% of U.S. earners now hold more wealth than all of the middle class. This includes millions of middle class seniors, Warren Buffett notwithstanding. Seniors need Social Security just as much as they did in 1935 — if not more.

MISLEADING STATEMENT: “(Social Security is) going to hit a brick wall in the 2030s.” – Slate

The Social Security Trustees project that the program’s trust fund will become depleted in 2034, without corrective action from Congress. Even if the trust fund does run dry, Social Security still could pay some 80% of benefits. So the program will not “hit a brick wall” and suddenly stop. That would only happen if we had 100% unemployment and no one was contributing payroll taxes. Congress can solve the trust fund shortfall largely by adjusting the payroll wage cap so that the wealthy begin paying their fair share into Social Security.

MISLEADING STATEMENT: “We have to borrow more money to pay Social Security benefits.” – Slate

First of all, Social Security is not legally allowed to borrow money. In fact, it provides the federal government with money because the trust fund is held in special Treasury notes. As we said above, the projected shortfall in the trust fund could be addressed by ensuring that high earners are contributing their fair share. Forty years ago, some 90% of eligible income was subject to Social Security payroll taxes. Thanks to rising income inequality (the rich getting richer while the rest tread water), today only about 80% of all eligible income goes toward Social Security payroll contributions, depriving the system of much-needed revenue. It’s time to correct that.

MISLEADING STATEMENT: “There’s not enough money to go around. So who gets paid first? Do we pay wealthy retirees first? Or do we pay needy working-class families and single moms with kids first? If you’re gonna pay wealthy seniors first, it means everything else has to go.” – Slate

First of all, Social Security benefits are progressive. Lower income retires receive proportionally higher benefits than wealthier ones do. Furthermore, eliminating Social Security benefits for higher earners wouldn’t significantly improve Social Security’s finances. Congress would have to slash benefits for the middle class, too, in order to have any impact on the bottom line.

In reality, if conservatives truly are concerned about “needy working-class families and single moms with kids,” they might want to rethink their crusade to slash federal safety net programs for those very people, including Medicaid, food stamps, or Temporary Assistance for Needy Families (TANF), to name a few. But then conservatives might have to let go out of those deficit-swelling Trump tax cuts that benefitted the wealthy and big corporations — along with corporate welfare and unchecked military spending. Blaming Social Security for the lack of spending on other segments of society is a huge red herring.

MISLEADING STATEMENT: “Life expectancy is more than 15 years higher now than when Social Security began.” – Slate

According to L.A. Times columnist Michael Hiltzik, Boehm’s life expectancy figures are misleading. Life expectancy in 1935 was about 63 years, but that figure was skewed by a high infant mortality rate at the time, when many children did not live beyond one year of age. “For Americans who made it to their first birthday back then, average life expectancy was nearly 66,” writes Hiltzik. “For those entering their working careers, say at age 20 — it was nearly 69.” With this analysis, Hiltzik takes the air of out Boehm’s argument that people were never intended to collect Social Security into their late 60s because they supposedly weren’t living that long.

Furthermore, while average life expectancy has increased since the 1930’s, life expectancy for some demographics is lagging behind. And even if some Americans are living longer than they did in 1935, that doesn’t mean they can continue working into their late 60s, which many conservatives demand by proposing to raise the Social Security retirement age.

**********************************************************************************************************************

For accurate information about Social Security, please visit ssa.gov and https://www.ncpssm.org/our-issues/social-security/

NY Times Op-ed Attempts to Divide the Generations to Undermine Social Security & Medicare

Way back in 1983, the Koch-seeded Cato Institute published a paper entitled, “Achieving A Leninist Strategy,” which mapped out a right-wing scheme to undermine Social Security by dividing the generations. The strategy was: convince young people that Social Security is a bad deal for them, because they have to pay into it while an undeserving older generation collects benefits. This, in turn, would weaken public support for the program, as the L.A. Times’ Michael Hiltzik explained:

“The authors… were anguished over President Reagan’s failure to exploit Social Security’s 1982 fiscal crisis to privatize the program. They concluded that the reason was the program’s strong support among the powerful voting bloc of seniors, compounded by the indifference of younger voters. The answer, they concluded, was to undermine confidence in Social Security among the young.’” – Michael Hiltzik, L.A. Times

It’s not that the conservative/libertarian movement suddenly cared about the welfare of young adults. Then, as now, they simply did not believe in social insurance, because they do not believe that the federal government has a legitimate role in providing basic financial and health security to working Americans. The conservative movement fundamentally opposes Social Security and Medicare as we know them — unless the programs are privatized so that Wall Street and Corporate America can get their hands on that money. (It has partially worked where Medicare is concerned, in the form of Medicare Advantage.)

Forty years after the CATO Institute paper, this strategy is still very much in effect. The New York Times ran not one – but two – conservative opinion pieces in the past week, attempting to convince readers that Social Security is unfair to younger adults.

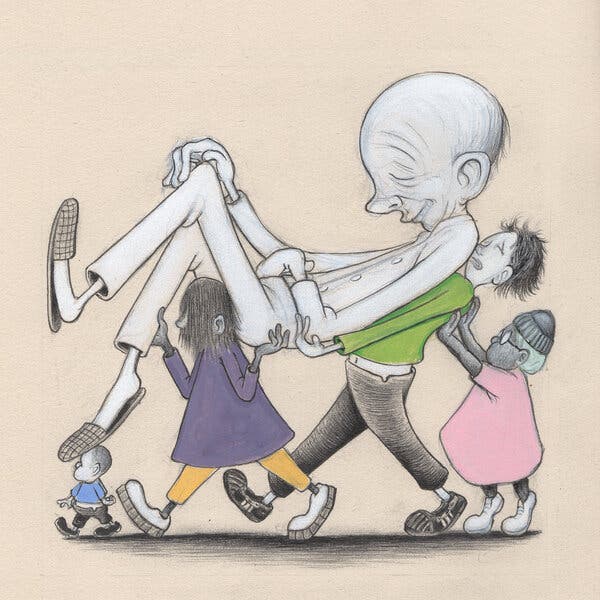

The first opinion piece (the one we will address here), “For the Good of the Country, Older Americans Should Work More and Take Less,” was written by Craig Seuerle (76) of the Urban-Brookings Tax Policy Center and Glenn Kramon (70), Assistant Managing Editor of the New York Times. Apparently speaking for all seniors, these two presumably well-compensated white collar professionals write, “We are consuming an ever larger share of our economy’s resources through programs like Social Security and Medicare, leaving younger Americans to foot growing bills for their parents’ and grandparents’ retirements.”

Their solution for this “problem” is not surprising: raise the retirement age for Social Security and do not allow people in their early 60’s to claim early. “Those in late middle age will need to work longer as they live longer,” they glibly proclaim. Medicare, which the authors say “discourages work after 64” must be “re-designed.” Translation: the eligibility age should be raised and benefits cut.

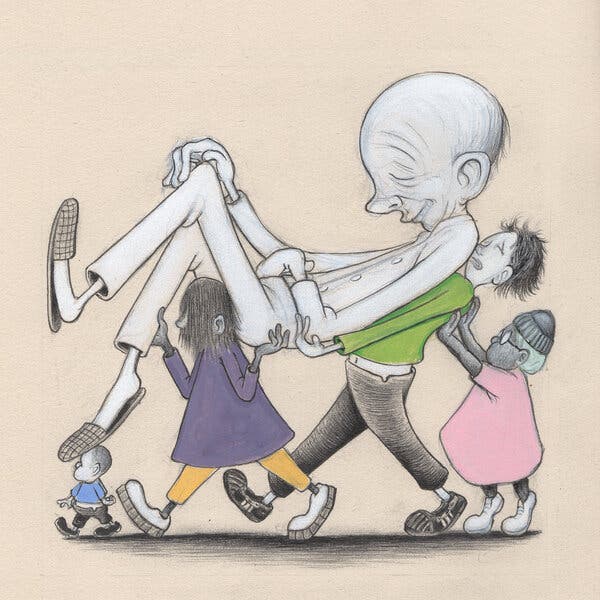

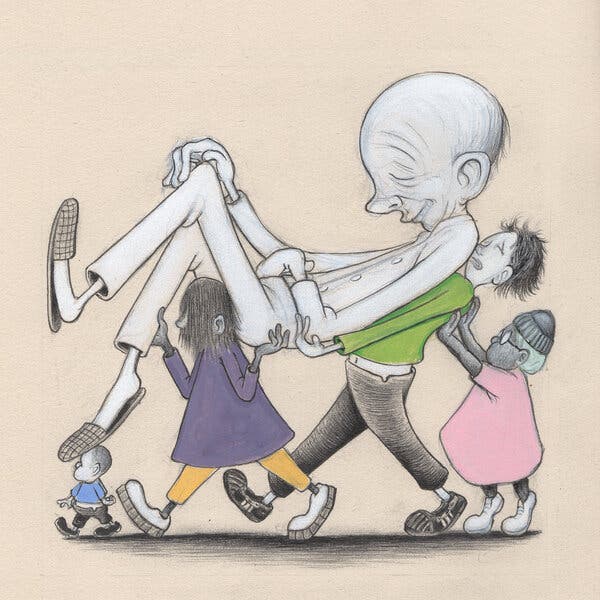

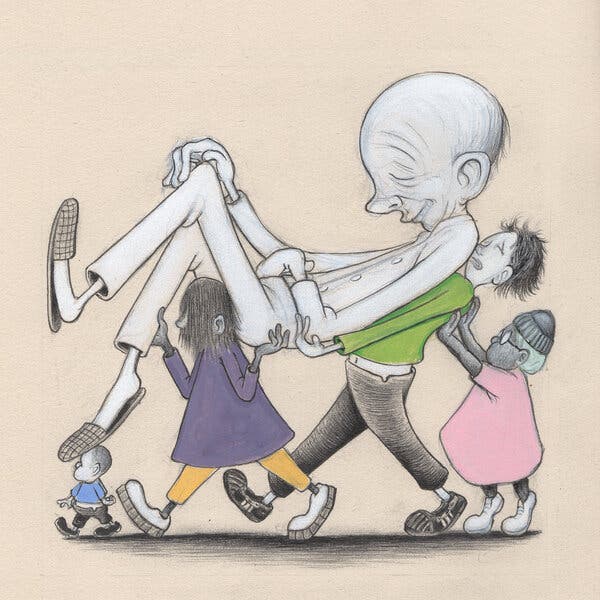

The blatantly ageist artwork accompanying the NY Times op-ed

Their justification for slashing Americans’ social insurance programs beyond recognition is that seniors, on average, are too prosperous and consume too much to need Social Security and Medicare as they exist today. Besides, people are living so much longer these days; they should work for a living in their 60s instead of collecting Social Security or getting health care from Medicare. Younger people, the authors say, shouldn’t have to foot the bill for seniors’ retirement.

How to begin untangling this disingenuous argument? First of all, while it’s true that some groups of Americans are living longer, other demographics aren’t. Longevity in 21st century America largely depends on socioeconomic status. For example, according to Kaiser Family Foundation, life expectancy for Black Americans was only 70.8 years compared to 76.4 years for white people.

The authors insist that people in their 60s should simply work longer. But they omit the fact that, while white collar professionals like themselves may be able to work through their 60s, many workers in physically-demanding jobs cannot. Not to mention: where are all these jobs for workers in their 60s? Many people in this age group face layoffs and job discrimination that make it difficult to continue holding a job.

Simply put, the Times piece is self-serving and misleading. Journalist Robert Kuttner debunked the authors’ claims quite tidily in the American Prospect:

The core fallacy in these arguments is the use of averages. On average, the elderly are richer, but that average includes Warren Buffett and the guy bagging groceries at your local supermarket because he can’t afford to retire.

On average, older homeowners have benefited from the run-up in housing values, but older renters spend more and more of their incomes on housing.

On average, older Americans are living longer and working longer. But affluent Americans tend to live longer than poorer ones. And well-off professionals tend to work well past retirement age because they love their work, while poorer Americans work at crappy jobs because they need the income. – Robert Kuttner, American Prospect, 10/31/23

In other words, not everyone is as comfortable as Seuerle and Kramon. The seniors that we meet tell us that they depend on every dollar of their Social Security benefits to pay the bills — and sometimes they still come up short and have to choose between essentials like rent and groceries. Social Security is especially crucial to communities of color. Some 50% of Black Americans would be living in poverty without Social Security.

Ditto with Medicare. We have heard poignant stories from seniors across the demographic spectrum who say they would not be alive without the life-saving medical care they received through Medicare.

And what about those younger adults who are supposedly so burdened by contributing a small percentage of their income to Social Security and Medicare so that they can collect benefits when they’re older? It’s likely that younger people would be much better off if their student debts were forgiven, if college were affordable, and if young families had affordable daycare. Most younger workers would probably rather have those things than compromise their future Social Security benefits.

Of course, most conservatives oppose those improvements for younger Americans, because they likely would require federal spending. The right’s default solution is always to cut benefits – in this case Social Security and Medicare.

Responding to the Times opinion piece, Dean Baker of the Center for Economic and Policy Research (CEPR) argues that growing wealth inequality – fostered by 40 years of Reaganomics – is far more burdensome to young Americans than paying Social Security and Medicare payroll taxes:

“In short, we have made a series of policy decisions that have led to a massive upward redistribution of income in the last half-century. The impact of this upward redistribution on the income of young workers dwarfs the impact of demographics. Unfortunately, our news outlets seem more interested in highlighting the demographic (young vs. old) issue than the causes of inequality.” – Dean Baker, CEPR, 10/29/23

Unfortunately, the conservative propaganda has been partially working. Young people still may support the Social Security program, but their confidence in it has been undermined by the ‘gloom and doom’ scenario that the right promulgates. As our President and CEO Max Richtman points out, some younger adults believe they are more likely to see a U.F.O. or Bigfoot than to receive a Social Security check when they retire.

In fact, younger adults are already covered by Social Security, though they may not realize it. For example, a 27 year-old with a spouse and two children has some $2 million worth of life and disability insurance from Social Security. The perpetrators of the ‘generational divide’ propaganda never seem to mention that. Nor do they mention that the average Millennial is on track to receive about $1 million in lifetime benefits.

In a 2021 poll, more than 60% of Millennials said that Social Security “should be enough to help me live comfortably in retirement.” That’s a good sign. NCPSSM and other advocates will continue to spread the word that Social Security is ‘a good deal’ for today’s younger adults and tomorrow’s retirees. For 88 years, it has worked as an inter-generational compact to provide workers with basic financial security. Let’s not allow well-funded and well-off conservatives to ‘divide and conquer’ the generations in order to kill or privatize two of our nation’s most effective and popular programs, Social Security and Medicare.

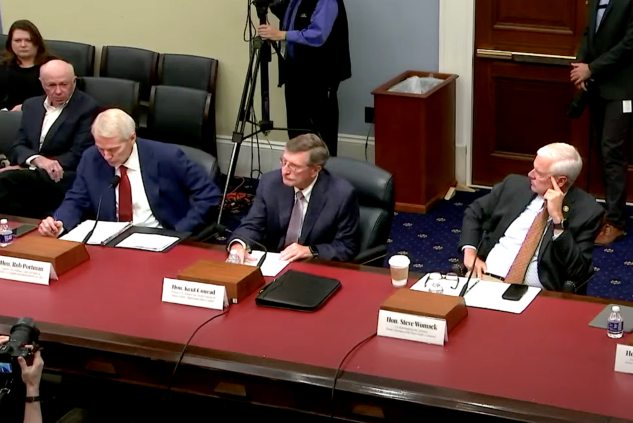

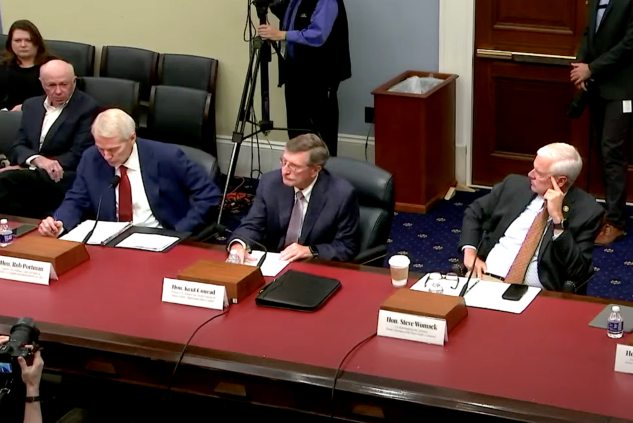

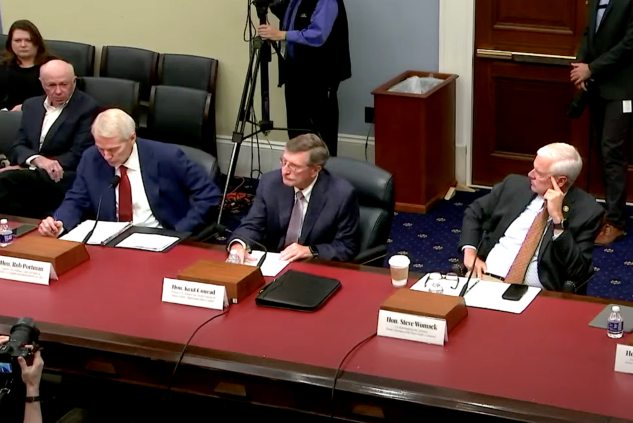

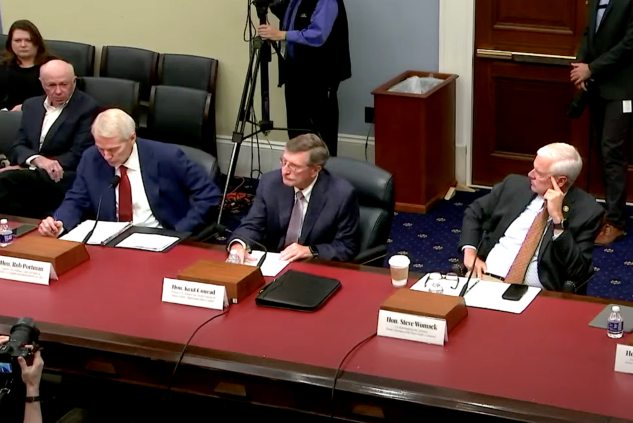

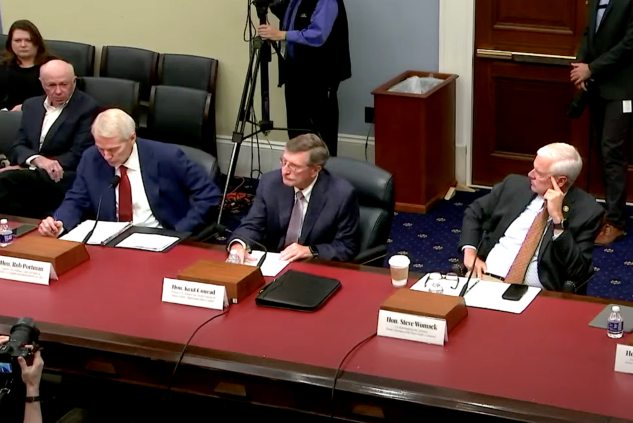

NCPSSM President Testifies Against Fiscal Commission Proposal

![]()

![]()

![]()

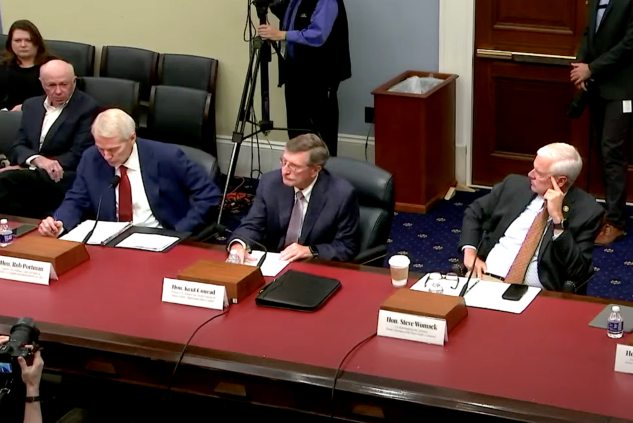

NCPSSM president Max Richtman offered testimony today to the U.S. House Budget Committee, warning that the creation of a fiscal commission to address the federal debt could jeopardize Social Security and Medicare benefits.

“As Congress grapples with the implications of a federal debt currently topping $33 trillion, pressure by fiscal conservatives inevitably turns to finding ‘savings’ in Social Security, even though this critical social insurance program for America’s workers does not contribute a single penny to the national debt,” said Richtman in his testimony.

As Laura Haltzel of the Century Foundation points out, “The simple fact is, Social Security is self-financed… and has accumulated massive surpluses… to pay current and future benefits. Further, it simply cannot add to the government’s publicly held debt, as it has no borrowing authority.” (Medicare Part A is also self-financed by workers’ payroll contributions.)

That has not stopped fiscal conservatives from coming after Social Security and Medicare in the name of debt reduction. Several of the Republican budget committee members at today’s hearing, including Rep. Steve Womack (R-AR), conflated Americans’ earned benefits with the federal debt, claiming that “fiscal dysfunction” in Washington is linked to Social Security and Medicare.

In point of fact, according to the Center on Budget and Policy Priorities, the number one driver of the debt is “tax expenditures” — giveaways to the wealthy and profitable corporations that forsake revenue that could help reduce red ink. Of course, fiscal conservatives seldom mention the Trump/GOP tax cuts, which swelled the debt by some $2 trillion. Many congressional Republicans want to make those tax cuts permanent.

Democrats in today’s hearing pointed out that there is no need for a fiscal commission, arguing that Congress should deliberate and pass legislation under “regular order” rather than relegate such important issues to an unelected panel. “When we have a functioning Congress, we have the tools to deal with all of this,” said Rep. Jan Schakowsky (D-IL), who noted that fiscal commissions “always seem to target Social Security and Medicare.”

One Republican on the committee seemed to agree. Rep. Tom McClintock (R-CA) said that the “ultimate bipartisan commission is called Congress” — and urged members not to “pass the buck” to a fiscal commission.

“Fiscal commissions always seem to target Social Security & Medicare,” says Rep. Jan Schakowsky

Opponents, including NCPSSM, have argued that such commissions traditionally emphasize cuts to social insurance programs while ignoring revenue-side solutions. “If revenue is not on the table, it is a commission to cut Social Security and Medicare,” said Rep. Lloyd Doggett (D-TX) at the hearing.

“Commissions are designed to squeeze every possible dollar of savings out of Social Security without consideration for the adequacy of benefits during their deliberations. They are intended as a vehicle for enacting deep cuts to Social Security and Medicare that could never pass Congress on their own because of their unpopularity with the voting public.” – Max Ricthman, NCPSSM President, Congressional testimony, 10/19/23

Advocates for a fiscal commission point to the Greenspan Commission, appointed by President Ronald Reagan and the Congress in 1981 to make recommendations on the short-term financing crisis that Social Security faced at that time, as a model for a new one. But the socioeconomic and political landscape has changed drastically in the past 42 years — and the Greenspan Commission was far from an unmitigated success.

“Robert Ball, a major player in the Greenspan Commission, famously wrote, ‘Nothing should obscure the fact that (it) was not an example of a successful bipartisan commission. The commission itself stalled after reaching agreement on the size of the problem that needed to be addressed. As a commission, that was as far as it got.’” – Laura Haltzel, Century Foundation, 10/18/23

Former House Budget Committee chairman John Yarmouth (D-KY) testified that “unelected commissions” do not have “superhuman powers.” And, he added, “They do not have souls.”

Read NCPSSM’s Viewpoint about the Greenspan Commission here.

NCPSSM Endorses Tim Kaine for Re-election to U.S. Senate

On behalf of our 28,000 members and supporters in Virginia, the National Committee to Preserve Social Security and Medicare today proudly endorsed Tim Kaine for re-election to the U.S. Senate in Fredericksburg, VA on Friday. Senator Kaine has proven himself time and again as a leader on issues affecting Virginia seniors. He earns a 100% rating on our legislative scorecard for his steadfast championing of Social Security, Medicare, and lower prescription drug prices.

“I have known Tim Kaine for over 15 years now, and I have been consistently impressed by his commitment to working families and seniors. He has always been close to his own elderly parents — and understands the importance of retirement and health security for all Virginia families. Underpinning all of this are the values of hard work, fairness, and family that he has demonstrated so well during his first two terms in Washington.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare

Senator Kaine accepted NCPSSM’s endorsement Friday morning at a town hall at Chancellor’s Village, a senior living facility in Fredericksburg. National Committee president and CEO Max Richtman handed the Senator a pair of NCPSSM’s signature boxing gloves to recognize his championing of seniors.

“I’m honored to receive the endorsement of the National Committee to Preserve Social Security and Medicare because I am determined to stand up for Virginia seniors and lower costs. Virginians should have access to affordable health care and be able to retire with dignity – which has been and will continue to be my priority in the U.S. Senate.” – Senator Tim Kaine

Virginians can continue to count on Senator Kaine to protect their hard-earned benefits. There are some 1.6 million Social Security beneficiaries in Virginia. The average benefit for Virginia retirees is nearly $1,900 per month, or about $23,000 a year. Senator Kaine knows that Virginians living on fixed incomes cannot afford cuts to their hard-earned benefits, which key Republicans (including contenders for the GOP presidential nomination) have proposed.

Senator Kaine greets supporters at town hall event in Fredericksburg, VA

Senator Kaine also will continue to fight prescription drug price gouging by Big Pharma, as he has during the 118th Congress. He supported the Inflation Reduction Act, which finally allows Medicare to negotiate drug prices with pharmaceutical companies — and caps seniors’ out-of-pocket drug costs under Medicare Part D at $2,000 per year. Virginians are now beginning to see those benefits realized, including a $35 cap on monthly insulin costs.

The Inflation Reduction Act passed the Senate by one vote. Without the vote of Senator Kaine, Virginians would not have the benefits of this historic drug pricing reform. There is plenty more work to be done in the next Congress — and that is why we need Tim Kaine in the Senate to fight for older Virginians and their families.

FDR Would Be “Fighting Mad” About Assaults on Social Security, Says Grandson on New Podcast

President Franklin D. Roosevelt would be “fighting mad” about conservative attempts to undermine Social Security, says his grandson, Jim Roosevelt on the first episode of our new podcast — released this week. Roosevelt says that FDR would not only be mad. “We’d see him actively pressuring Congress” to support Social Security — and working to elect lawmakers who champion his legacy program — in the face of myriad proposals to cut and privatize it.

The podcast, “You Earned This,” debuted on multiple platforms — including Spotify, Apple Podcasts, and Amazon/Audible. It is available to listen and download for free. Each episode covers a single topic with a single guest. Because we know that listeners have a limited amount of time, this podcast is designed to be “bite-sized.” Episodes are no longer than 15 minutes each, making for a brisk and brief listening experience!

In this episode, Jim Roosevelt says that the Social Security Administration (SSA), which is responsible for administering benefits for 71 million people, cannot be expected to service the public properly without adequate funding. Customers have experienced long wait times on the 800 phone line, field office closures, and extended delays in adjudication of disability claims hearings — all due to a 17% cut (adjusted for inflation) in operating budget since Tea Party Republicans took control of the House beginning in 2011.

“First of all the budget cuts that took place at the time of the Tea Party really devastated the workforce. (Employee morale has suffered) because if you tell people you have this huge amount of work to do and we’re not going to give you anybody to help you do it, they get very dissatisfied.”

Roosevelt expressed optimism that the putative new SSA Commissioner, former Maryland Governor Martin O’Malley, would advocate for more funding and make other improvements to shore up customer service. O’Malley is expected to be confirmed by the full Senate on December 18th.

Roosevelt criticizes Republicans who propose to raise the retirement age for Social Security to 69 or 70, including presidential candidate, Nikki Haley. Roosevelt says her intention to cut benefits for people now in their 20s and 30s — including her adult children — is plain “crazy.”

“Our kids (are) not going to have a lower cost of living than retirees do today. Social Security already is an adequate benefit, but not a generous benefit. In fact, if anything, it should be increased, not cut for future generations.” – Jim Roosevelt, 12/14/23

He also rails against Republican proposals for a fiscal commission to decide the fate of Social Security (and Medicare), including House Speaker Mike Johnson’s pledge to create such a commission. Those commissions, Roosevelt tells us, are “a black box” designed to let individual lawmakers off the hook for proposing to cut seniors’ earned benefits.

He also reminisced about conversations he had as a teenager with grandmother, Eleanor Roosevelt. (Jim Roosevelt was born after his grandfather, FDR, passed away.) He describes the former first lady as a passionate advocate for women’s rights, including women’s retirement security. Eleanor, he says, was equally dedicated to preserving Social Security so that, in the words of FDR, “no damn politician” could ever take it away.

Our next guest is NCPSSM senior health policy expert, Anne Montgomery, breaking down the Disadvantages of Medicare Advantage. That episode will be released on December 21st!

To listen to the “You Earned This” podcast, click here.

Sorry, Slate Magazine, We Don’t Need to ‘Radically Rethink’ Social Security

Conservative think tanks and publications have been very busy pumping out propaganda designed to undermine Social Security. Of course, the conservative movement has been working to weaken or eliminate the program since the 1980s, and its messaging seeps quite seamlessly into the mainstream media narrative about Social Security. A recent opinion piece in Slate magazine is the latest example of anti-Social Security propaganda from the political right. The unsubtly titled piece, Social Security Doesn’t Make Sense Anymore, is technically co-authored by Eric Boehm and Celeste Headlee, but it is mainly a transcript of an interview with Boehm on Headlee’s Slate podcast. Boehm is a reporter for the conservative magazine, Reason, who has praised Argentina’s new MAGA-like president, Javier Milei, as a champion of ‘smaller government.’

The Slate article is so rife with misleading statements that it’s hard to know where to begin correcting it. L.A. Times’ columnist Michael Hiltzik counted at least 30 such statements. We can’t even begin to rebut all of them in one Equal Time blog post. But we will correct some of the worst zingers (below), in hopes that by removing enough cards from the unstable house that the Slate authors built, the whole thing will rightfully come tumbling down.

MISLEADING STATEMENT: “Social Security is a transfer of wealth from people who are young and working and productive, because it’s funded with payroll taxes.” – Slate

Social Security is not a federal transfer program. Transfer programs are funded by general tax revenue and tend to be one-way transactions, usually from wealthier to poorer groups (e.g., Medicaid, food stamps). Social Security payroll taxes are a dedicated income stream that can only be used for payment of Social Security benefits. Workers paying into Social Security are earning the right to collect benefits later — when they retire or become disabled.

MISLEADING STATEMENT: “Retirees are generally wealthier than the people who are funding their retirements through Social Security. So… we need a radical rethink of the program.” – Slate

While some retirees are well-off (Older billionaires like Warren Buffet skew the average), forty percent of seniors depend on Social Security for all their income. Ten percent of American seniors already live in poverty. Without Social Security, half of retirees would fall beneath the poverty line. Younger workers pay into the system in return for collecting benefits when they retire. This intergenerational compact has worked for nearly ninety years and there is no need to ‘radically rethink’ it now.

MISLEADING STATEMENT: “I’d love to reframe this debate away from the idea that those of us who are proposing reforms are somehow breaking a promise that was made to retirees.” – Slate

Of course Social Security is a promise — from the federal government to American workers, dating back to the enactment of the program in 1935. President Franklin D. Roosevelt pledged that Social Security would “give some measure of protection to the average citizen and family against poverty-ridden old age.” This is why, nearly 90 years later, President Biden referred to Social Security as a “sacred trust.” The fundamental promise is that when workers pay into the system, they are eligible for retirement benefits later.

MISLEADING STATEMENT: “That promise has been upended by decades of greater prosperity for Americans.” – Slate

While it’s true that fewer seniors are living in poverty than in 1935 – at the height of the Great Depression – prosperity is not equitably shared in 21st century America. Income inequality has mushroomed in the past 40 years. As Bloomberg reported, “middle class financial security has eroded in past decades.” In fact, as of 2021, the top 1% of U.S. earners now hold more wealth than all of the middle class. This includes millions of middle class seniors, Warren Buffett notwithstanding. Seniors need Social Security just as much as they did in 1935 — if not more.

MISLEADING STATEMENT: “(Social Security is) going to hit a brick wall in the 2030s.” – Slate

The Social Security Trustees project that the program’s trust fund will become depleted in 2034, without corrective action from Congress. Even if the trust fund does run dry, Social Security still could pay some 80% of benefits. So the program will not “hit a brick wall” and suddenly stop. That would only happen if we had 100% unemployment and no one was contributing payroll taxes. Congress can solve the trust fund shortfall largely by adjusting the payroll wage cap so that the wealthy begin paying their fair share into Social Security.

MISLEADING STATEMENT: “We have to borrow more money to pay Social Security benefits.” – Slate

First of all, Social Security is not legally allowed to borrow money. In fact, it provides the federal government with money because the trust fund is held in special Treasury notes. As we said above, the projected shortfall in the trust fund could be addressed by ensuring that high earners are contributing their fair share. Forty years ago, some 90% of eligible income was subject to Social Security payroll taxes. Thanks to rising income inequality (the rich getting richer while the rest tread water), today only about 80% of all eligible income goes toward Social Security payroll contributions, depriving the system of much-needed revenue. It’s time to correct that.

MISLEADING STATEMENT: “There’s not enough money to go around. So who gets paid first? Do we pay wealthy retirees first? Or do we pay needy working-class families and single moms with kids first? If you’re gonna pay wealthy seniors first, it means everything else has to go.” – Slate

First of all, Social Security benefits are progressive. Lower income retires receive proportionally higher benefits than wealthier ones do. Furthermore, eliminating Social Security benefits for higher earners wouldn’t significantly improve Social Security’s finances. Congress would have to slash benefits for the middle class, too, in order to have any impact on the bottom line.

In reality, if conservatives truly are concerned about “needy working-class families and single moms with kids,” they might want to rethink their crusade to slash federal safety net programs for those very people, including Medicaid, food stamps, or Temporary Assistance for Needy Families (TANF), to name a few. But then conservatives might have to let go out of those deficit-swelling Trump tax cuts that benefitted the wealthy and big corporations — along with corporate welfare and unchecked military spending. Blaming Social Security for the lack of spending on other segments of society is a huge red herring.

MISLEADING STATEMENT: “Life expectancy is more than 15 years higher now than when Social Security began.” – Slate

According to L.A. Times columnist Michael Hiltzik, Boehm’s life expectancy figures are misleading. Life expectancy in 1935 was about 63 years, but that figure was skewed by a high infant mortality rate at the time, when many children did not live beyond one year of age. “For Americans who made it to their first birthday back then, average life expectancy was nearly 66,” writes Hiltzik. “For those entering their working careers, say at age 20 — it was nearly 69.” With this analysis, Hiltzik takes the air of out Boehm’s argument that people were never intended to collect Social Security into their late 60s because they supposedly weren’t living that long.

Furthermore, while average life expectancy has increased since the 1930’s, life expectancy for some demographics is lagging behind. And even if some Americans are living longer than they did in 1935, that doesn’t mean they can continue working into their late 60s, which many conservatives demand by proposing to raise the Social Security retirement age.

**********************************************************************************************************************

For accurate information about Social Security, please visit ssa.gov and https://www.ncpssm.org/our-issues/social-security/

NY Times Op-ed Attempts to Divide the Generations to Undermine Social Security & Medicare

Way back in 1983, the Koch-seeded Cato Institute published a paper entitled, “Achieving A Leninist Strategy,” which mapped out a right-wing scheme to undermine Social Security by dividing the generations. The strategy was: convince young people that Social Security is a bad deal for them, because they have to pay into it while an undeserving older generation collects benefits. This, in turn, would weaken public support for the program, as the L.A. Times’ Michael Hiltzik explained:

“The authors… were anguished over President Reagan’s failure to exploit Social Security’s 1982 fiscal crisis to privatize the program. They concluded that the reason was the program’s strong support among the powerful voting bloc of seniors, compounded by the indifference of younger voters. The answer, they concluded, was to undermine confidence in Social Security among the young.’” – Michael Hiltzik, L.A. Times

It’s not that the conservative/libertarian movement suddenly cared about the welfare of young adults. Then, as now, they simply did not believe in social insurance, because they do not believe that the federal government has a legitimate role in providing basic financial and health security to working Americans. The conservative movement fundamentally opposes Social Security and Medicare as we know them — unless the programs are privatized so that Wall Street and Corporate America can get their hands on that money. (It has partially worked where Medicare is concerned, in the form of Medicare Advantage.)

Forty years after the CATO Institute paper, this strategy is still very much in effect. The New York Times ran not one – but two – conservative opinion pieces in the past week, attempting to convince readers that Social Security is unfair to younger adults.

The first opinion piece (the one we will address here), “For the Good of the Country, Older Americans Should Work More and Take Less,” was written by Craig Seuerle (76) of the Urban-Brookings Tax Policy Center and Glenn Kramon (70), Assistant Managing Editor of the New York Times. Apparently speaking for all seniors, these two presumably well-compensated white collar professionals write, “We are consuming an ever larger share of our economy’s resources through programs like Social Security and Medicare, leaving younger Americans to foot growing bills for their parents’ and grandparents’ retirements.”

Their solution for this “problem” is not surprising: raise the retirement age for Social Security and do not allow people in their early 60’s to claim early. “Those in late middle age will need to work longer as they live longer,” they glibly proclaim. Medicare, which the authors say “discourages work after 64” must be “re-designed.” Translation: the eligibility age should be raised and benefits cut.

The blatantly ageist artwork accompanying the NY Times op-ed

Their justification for slashing Americans’ social insurance programs beyond recognition is that seniors, on average, are too prosperous and consume too much to need Social Security and Medicare as they exist today. Besides, people are living so much longer these days; they should work for a living in their 60s instead of collecting Social Security or getting health care from Medicare. Younger people, the authors say, shouldn’t have to foot the bill for seniors’ retirement.

How to begin untangling this disingenuous argument? First of all, while it’s true that some groups of Americans are living longer, other demographics aren’t. Longevity in 21st century America largely depends on socioeconomic status. For example, according to Kaiser Family Foundation, life expectancy for Black Americans was only 70.8 years compared to 76.4 years for white people.

The authors insist that people in their 60s should simply work longer. But they omit the fact that, while white collar professionals like themselves may be able to work through their 60s, many workers in physically-demanding jobs cannot. Not to mention: where are all these jobs for workers in their 60s? Many people in this age group face layoffs and job discrimination that make it difficult to continue holding a job.

Simply put, the Times piece is self-serving and misleading. Journalist Robert Kuttner debunked the authors’ claims quite tidily in the American Prospect:

The core fallacy in these arguments is the use of averages. On average, the elderly are richer, but that average includes Warren Buffett and the guy bagging groceries at your local supermarket because he can’t afford to retire.

On average, older homeowners have benefited from the run-up in housing values, but older renters spend more and more of their incomes on housing.

On average, older Americans are living longer and working longer. But affluent Americans tend to live longer than poorer ones. And well-off professionals tend to work well past retirement age because they love their work, while poorer Americans work at crappy jobs because they need the income. – Robert Kuttner, American Prospect, 10/31/23

In other words, not everyone is as comfortable as Seuerle and Kramon. The seniors that we meet tell us that they depend on every dollar of their Social Security benefits to pay the bills — and sometimes they still come up short and have to choose between essentials like rent and groceries. Social Security is especially crucial to communities of color. Some 50% of Black Americans would be living in poverty without Social Security.

Ditto with Medicare. We have heard poignant stories from seniors across the demographic spectrum who say they would not be alive without the life-saving medical care they received through Medicare.

And what about those younger adults who are supposedly so burdened by contributing a small percentage of their income to Social Security and Medicare so that they can collect benefits when they’re older? It’s likely that younger people would be much better off if their student debts were forgiven, if college were affordable, and if young families had affordable daycare. Most younger workers would probably rather have those things than compromise their future Social Security benefits.

Of course, most conservatives oppose those improvements for younger Americans, because they likely would require federal spending. The right’s default solution is always to cut benefits – in this case Social Security and Medicare.

Responding to the Times opinion piece, Dean Baker of the Center for Economic and Policy Research (CEPR) argues that growing wealth inequality – fostered by 40 years of Reaganomics – is far more burdensome to young Americans than paying Social Security and Medicare payroll taxes:

“In short, we have made a series of policy decisions that have led to a massive upward redistribution of income in the last half-century. The impact of this upward redistribution on the income of young workers dwarfs the impact of demographics. Unfortunately, our news outlets seem more interested in highlighting the demographic (young vs. old) issue than the causes of inequality.” – Dean Baker, CEPR, 10/29/23

Unfortunately, the conservative propaganda has been partially working. Young people still may support the Social Security program, but their confidence in it has been undermined by the ‘gloom and doom’ scenario that the right promulgates. As our President and CEO Max Richtman points out, some younger adults believe they are more likely to see a U.F.O. or Bigfoot than to receive a Social Security check when they retire.

In fact, younger adults are already covered by Social Security, though they may not realize it. For example, a 27 year-old with a spouse and two children has some $2 million worth of life and disability insurance from Social Security. The perpetrators of the ‘generational divide’ propaganda never seem to mention that. Nor do they mention that the average Millennial is on track to receive about $1 million in lifetime benefits.

In a 2021 poll, more than 60% of Millennials said that Social Security “should be enough to help me live comfortably in retirement.” That’s a good sign. NCPSSM and other advocates will continue to spread the word that Social Security is ‘a good deal’ for today’s younger adults and tomorrow’s retirees. For 88 years, it has worked as an inter-generational compact to provide workers with basic financial security. Let’s not allow well-funded and well-off conservatives to ‘divide and conquer’ the generations in order to kill or privatize two of our nation’s most effective and popular programs, Social Security and Medicare.

NCPSSM President Testifies Against Fiscal Commission Proposal

![]()

![]()

![]()

NCPSSM president Max Richtman offered testimony today to the U.S. House Budget Committee, warning that the creation of a fiscal commission to address the federal debt could jeopardize Social Security and Medicare benefits.

“As Congress grapples with the implications of a federal debt currently topping $33 trillion, pressure by fiscal conservatives inevitably turns to finding ‘savings’ in Social Security, even though this critical social insurance program for America’s workers does not contribute a single penny to the national debt,” said Richtman in his testimony.

As Laura Haltzel of the Century Foundation points out, “The simple fact is, Social Security is self-financed… and has accumulated massive surpluses… to pay current and future benefits. Further, it simply cannot add to the government’s publicly held debt, as it has no borrowing authority.” (Medicare Part A is also self-financed by workers’ payroll contributions.)

That has not stopped fiscal conservatives from coming after Social Security and Medicare in the name of debt reduction. Several of the Republican budget committee members at today’s hearing, including Rep. Steve Womack (R-AR), conflated Americans’ earned benefits with the federal debt, claiming that “fiscal dysfunction” in Washington is linked to Social Security and Medicare.

In point of fact, according to the Center on Budget and Policy Priorities, the number one driver of the debt is “tax expenditures” — giveaways to the wealthy and profitable corporations that forsake revenue that could help reduce red ink. Of course, fiscal conservatives seldom mention the Trump/GOP tax cuts, which swelled the debt by some $2 trillion. Many congressional Republicans want to make those tax cuts permanent.

Democrats in today’s hearing pointed out that there is no need for a fiscal commission, arguing that Congress should deliberate and pass legislation under “regular order” rather than relegate such important issues to an unelected panel. “When we have a functioning Congress, we have the tools to deal with all of this,” said Rep. Jan Schakowsky (D-IL), who noted that fiscal commissions “always seem to target Social Security and Medicare.”

One Republican on the committee seemed to agree. Rep. Tom McClintock (R-CA) said that the “ultimate bipartisan commission is called Congress” — and urged members not to “pass the buck” to a fiscal commission.

“Fiscal commissions always seem to target Social Security & Medicare,” says Rep. Jan Schakowsky

Opponents, including NCPSSM, have argued that such commissions traditionally emphasize cuts to social insurance programs while ignoring revenue-side solutions. “If revenue is not on the table, it is a commission to cut Social Security and Medicare,” said Rep. Lloyd Doggett (D-TX) at the hearing.

“Commissions are designed to squeeze every possible dollar of savings out of Social Security without consideration for the adequacy of benefits during their deliberations. They are intended as a vehicle for enacting deep cuts to Social Security and Medicare that could never pass Congress on their own because of their unpopularity with the voting public.” – Max Ricthman, NCPSSM President, Congressional testimony, 10/19/23

Advocates for a fiscal commission point to the Greenspan Commission, appointed by President Ronald Reagan and the Congress in 1981 to make recommendations on the short-term financing crisis that Social Security faced at that time, as a model for a new one. But the socioeconomic and political landscape has changed drastically in the past 42 years — and the Greenspan Commission was far from an unmitigated success.

“Robert Ball, a major player in the Greenspan Commission, famously wrote, ‘Nothing should obscure the fact that (it) was not an example of a successful bipartisan commission. The commission itself stalled after reaching agreement on the size of the problem that needed to be addressed. As a commission, that was as far as it got.’” – Laura Haltzel, Century Foundation, 10/18/23

Former House Budget Committee chairman John Yarmouth (D-KY) testified that “unelected commissions” do not have “superhuman powers.” And, he added, “They do not have souls.”

Read NCPSSM’s Viewpoint about the Greenspan Commission here.