Latest Social Security Website Crash a Symptom of Trump/DOGE Mismanagement

Seniors trying to access their earned benefit information hit a snag when the Social Security Administration’s (SSA) website crashed on Wednesday morning. These sorts of incidents have unfortunately become commonplace since the Trump administration took over, as DOGE’s crusade at SSA has left the agency in chaos.

“We continue to get reports of glitches on SSA’s website. It looks like this was one of them,” said NCPSSM President and CEO, Max Richtman.

At around 10 AM on Wednesday, My Social Security users faced “Online Service Not Available” errors. Advocates questioned whether the outage stemmed from SSA’s June login overhaul, which mandated Login.gov and ID.me as the sole sign-in options and scrapped traditional Social Security usernames and passwords. (Under new Trump administration rules, beneficiaries are no longer able to verify their identity over the phone.)

Thanks to Trump, Commissioner Frank Bisignano, and DOGE, staffing at SSA sits at historic lows, as the administration continues to force out experienced civil servants (including knowledgeable IT staff) in favor of a “technology agenda” better suited for the private sector, not an agency intended to serve the public. As a result, the website crashed five times in the month of March, and again during this latest incident. (Let’s not even get started on the AI bots that SSA has deployed to answer customer phone calls, which CNET called “maddening.”)

Trump’s Social Security Commissioner Frank Bisignano has presided over reckless cuts at SSA (AP Images)

Nancy Altman, President of Social Security Works, pointed out how Trump/DOGE cutbacks make tech outages “far more likely.” She told ThinkAdvisor, “This is especially concerning because Social Security leadership wants to reduce visitors to field offices by half, telling people to go online instead.”

“SSA is not a tech company to be gutted and sold to private equity. It is an agency that up until this year had nobly served the public, despite gross underfunding from Congress. On behalf of all Social Security beneficiaries, we lament the decline in service at SSA.” – Max Richtman, President and CEO, NCPSSM

SSA Commissioner Frank Bisignano has tried to disguise these reckless cuts as part of his “technology agenda,” using sketchy stats to cover up the fact that the administration has done nothing but kneecap the agency’s ability to function.

In an April edition of our podcast, former SSA Commissioner Martin O’Malley excoriated Trump and DOGE for taking a “meat cleaver” to what had been an improving agency under the Biden administration, despite chronic underfunding from Congress.

*************************************************************************************

Read our fact sheet on how seniors can protect themselves from chaos at SSA here

Read our fact check on Commissioner Frank Bisignano, aka “The Frankster” here

Listen to our “You Earned This” podcast here

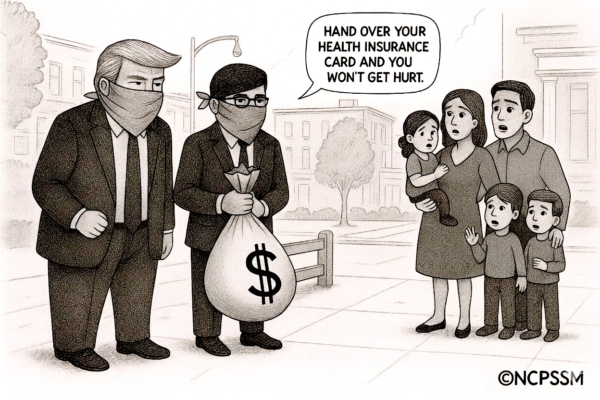

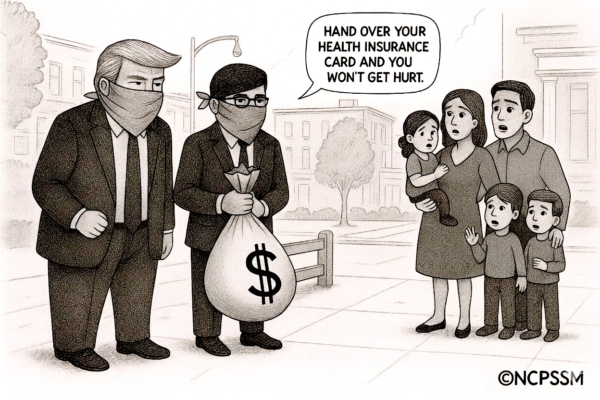

Senate Republicans Kill ACA Tax Credit Extension, Spike Health Care Premiums

Getty Images

Senate Republicans just voted to allow Americans’ health care premiums to spike in 2026, neglecting the needs of their own constituents. On Thursday, the Senate failed to reach the 60-vote threshold to extend crucial Affordable Care Act (ACA) tax credits, forcing the program’s nearly 24 million enrollees to navigate premiums that could double or even triple in 2026. In a Thursday news release, our President and CEO, Max Richtman called ACA marketplace coverage “a linchpin for older adults who often cannot get affordable health insurance any other way.”

Adults between the ages 45 and 64 account for 40 percent of ACA enrollees. Advocates worry that this group will lose their insurance and be compelled to rely on emergency room care, “a cost that gets passed on to all health care consumers,” noted Richtman. When today’s “near seniors” become eligible for Medicare at age 65, they will inevitably be in worse health than if they had been able to keep their ACA policies, putting additional strain on that program.

Following the vote, Congressman (and ‘‘You Earned This’ Podcast guest) Brendan Boyle (D-PA) excoriated Republicans for ‘kicking people off their coverage”:::

Instead of taking the commonsense step of extending the ACA tax credits, Republicans toyed with weak alternatives that would benefit big banking and insurance companies more than workers and families. The GOP alternative on offer Thursday would have replaced ACA tax credits (which have been working effectively to expand access to health insurance) with privatized Health Savings Accounts (HSA’s). According to a November 2025 report from Senate Finance Committee Democrats:::

“(The HSA) gambit would funnel funds necessary for health insurance to the nation’s largest banks and insurance companies through tax-preferred accounts, while raising premiums and decreasing payouts.” Senate Finance Committee, Minority Report

President Trump even tried to deflect this inconvenient truth during one of his signature late night tirades on Truth Social: “THE ONLY HEALTHCARE I WILL SUPPORT OR APPROVE IS SENDING THE MONEY DIRECTLY BACK TO THE PEOPLE, WITH NOTHING GOING TO THE BIG, FAT, RICH INSURANCE COMPANIES, WHO HAVE MADE $TRILLIONS, AND RIPPED OFF AMERICA LONG ENOUGH.”

Well, Mr. President, it seems as though the opposite has happened.

Rather than accept this insufficient “replacement” for expiring ACA credits, NCPSSM urges its readers to contact their representatives in Congress, and let them know you support our letter to Congress, which demands that members of the House sign a discharge petition that would bring these credits back under consideration by the chamber.

In response to consistent attacks on health coverage, progressive states have gotten creative and are trying their best to pick up the slack. In October, Maryland Governor Wes Moore unveiled the Premium Assistance Program, which will offset two-thirds of the projected ACA premium hikes.

Unfortunately, many states simply cannot make up the losses in coverage that will result from the GOP’s inaction on ACA tax credits.

“Extending these tax credits to keep Americans’ premiums from rising would have made simple common sense. Make no mistake: In 2026, older voters will remember who fought to protect their health coverage and who abdicated that responsibility.” – Max Richtman, President and CEO, NCPSSM

****************************************************************************

Find our letter to Congress supporting a discharge petition here

Find information to contact your representative in Congress here

Listen to our podcast here

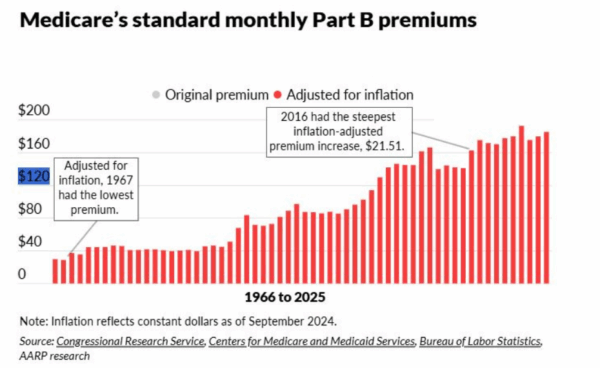

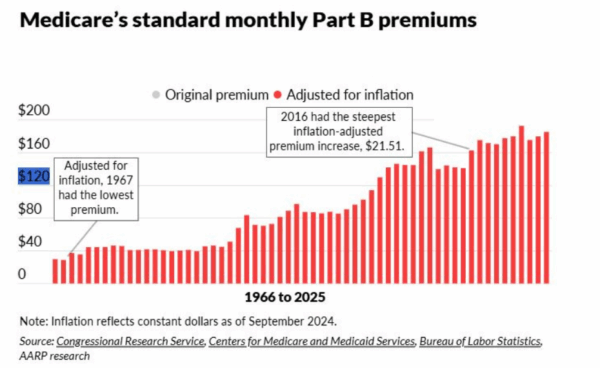

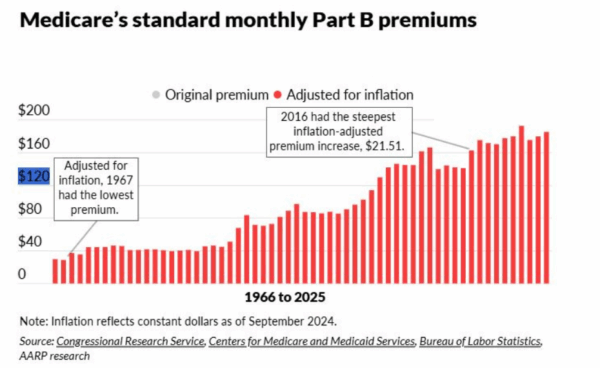

What’s Behind the Medicare Part B Premium Spike?

The nearly 67 million Americans who depend on Medicare will ring in the new year with an unwelcome cost increase. The Centers for Medicare and Medicaid Services (CMS) has announced that Part B premiums will rise to $203 per month from $185 in 2025. That $18 (or 10%) increase will consume about one-third of the average Social Security Cost-of-Living Adjustment (COLA).

“The average COLA will be $56 per month before the $18 Medicare Part B premium hike, leaving the average Social Security beneficiary with an effective monthly increase of $36 next year” noted our President and CEO Max Richtman in a news release.

Advocates and health care experts alike are worried about the impact on seniors’ ability to make ends meet. The meager COLA, less the Medicare Part B premium hike, leaves millions of seniors struggling to cover basic necessities like food, transportation, and utilities — let alone out‑of‑pocket health expenses.

“This premium jump will really pinch older Americans where it hurts,” says Anne Montgomery, our senior health policy expert. “An almost $18 premium increase may not sound huge on paper, but for people on fixed incomes, it’s a big chunk of their limited budgets.”

This one of the largest spikes in Part B premiums since 2016. While not entirely unexpected, it underscores deeper issues. As Montgomery points out, “Part B premiums are rising in part because of broader medical inflation and the cost of moving many treatments out of hospitals and into doctors’ offices and outpatient settings.”

At the same time, for–profit Medicare Advantage (MA) plans continue to exert cost pressures on the entire Medicare system. “We need to take a closer look at how Medicare Advantage is influencing overall spending,” Montgomery notes. “The way some MA plans game the system to boost profits drives up Medicare costs by billions, and those higher costs trickle down to beneficiaries in the form of higher premiums.”

A 2024 study from USC concluded that Medicare Advantage plans cost taxpayers an extra 22% per enrollee, to the tune of $83 billion a year.

We and other advocates have backed legislation to give seniors’ more relief from inflation by changing the outdated COLA formula, the CPI-W, which is based on the spending habits of urban wage earners. The current formula “undercounts the costs that weigh most heavily on older adults—especially health and prescription expenses,” says Anne Montgomery.

For years, NCPSSM has urged Congress to adopt the Consumer Price Index for the Elderly (CPI‑E) to calculate annual COLAs. The CPI‑E tracks how inflation uniquely affects Americans over 62, making it a more accurate reflection of retirees’ financial reality.

“The CPI‑E would base cost-of-living adjustments on the actual spending patterns of seniors,” says Montgomery. “An adjustment tied to the CPI‑E would more accurately protect seniors against rising healthcare costs year after year.”

“We support legislation that would adopt the CPI-E for determining COLAs, but Congress has yet to act on it. This would be a more than reasonable step toward expanding benefits to truly meet the needs of 21st century seniors.” -Max Richtman, President and CEO, NCPSSM

We urge our readers to contact their elected representatives and demand action: adopt the CPI-E formula for COLAs and curb Medicare Advantage abuses that continue to drive up health care costs for ourselves and our older loved ones.

What Does the End of the Shutdown Mean for Older Americans?

As the longest government shutdown in U.S. history finally ends, many of our readers are asking: what does this deal mean for older adults? We supported Democratic efforts to extend Affordable Care Act (ACA) premium subsidies. Without Congressional action to extend these subsidies, millions of “near seniors”— aged 54 to 65— are poised to face dramatically higher health insurance premiums in 2026.

In a statement issued when the Senate deal to end the shutdown was announced, our president and CEO, Max Richtman, warned: “Without those subsidies, ACA premiums could more than double in 2026, forcing people to endure unnecessary financial pain — or lose health coverage altogether.”

Older Americans, who already face higher premiums than younger adults, will have to navigate an even tougher road if these subsidies go by the wayside. “Their lives will be harder, and probably shorter,” says Richtman. “In addition, when those near seniors become eligible for Medicare at age 65, they will be sicker than if they had been able to keep their ACA policies, putting more of a strain on the Medicare program itself.”

As part of the deal to end the shutdown, Senate Democrats have been given a promise that the chamber will vote on a bill to extend the subsidies by the end of the second week of December. Of course, it remains to be seen whether Republicans hold up their end of the bargain. The GOP currently holds a 53-47 majority in the Senate, meaning any successful vote would require at least four GOP defections. Moderates Lisa Murkowski (R-AK), Susan Collins (R-ME), and Thom Tillis (R-NC) along with rural-state populists Josh Hawley (R-MO) and Jerry Moran (R-KS) may be potential ‘yes’ votes to extend the ACA subsidies if it comes to the floor.

Leader Jeffries & Congressional Democrats have not given up on extending ACA subsidies

There is a bit of good news in the shutdown deal for seniors on Medicare. It includes a much-needed extension of Medicare telehealth flexibilities through January 30, 2026, retroactively covering virtual visits from the shutdown period. This will provide critical relief for patients aged 65 and older, who have increasingly relied on telehealth to access care instead of burdensome, in-person doctor visits. Permanent telehealth provisions, such as those for mental health services, are also in effect — and are not impacted by this extension, notes HHS.

The deal also continues extra Medicare payments for hospitals with low patient volumes and disproportionate numbers of senior patients, and will also delay scheduled Medicare payment cuts, including for laboratory tests.

Older Americans’ lives “will be harder, and probably shorter” without ACA subsidies, says NCPSSM president Max Richtman

Unfortunately, the Medicare telehealth coverage extension is only temporary. And, of course, those crucial ACA subsidies remain in limbo for now.

“We must keep fighting to preserve those crucial ACA subsidies so that millions of the most vulnerable Americans don’t lose health coverage.” -Max Richtman, President and CEO, NCPSSM

These next few weeks present a crucial window for the health care status of ‘near seniors.’ It will be especially important for older Americans in red states and districts to make their voices heard, and let their representatives know just how important these premium subsidies are. The shutdown may be ending, but the fight for affordable health care for all Americans continues.

*******************************************************************************************************

Read about relevant policy updates from HHS here

Listen to our podcast here

Find information to contact your representative in congress here

Trump & GOP Intransigence Will Hike Health Care Premiums

Open enrollment season for Affordable Care Act (ACA) plans arrives amid a severe threat from Trump and congressional Republicans —- who continue to block the extension of crucial ACA premium subsidies. These subsidies have helped middle and lower-income Americans afford health coverage since they were enacted during the Covid pandemic.

This is what the government shutdown — now in its fifth week — is all about. Democrats insist that the subsidies be extended; Trump and the GOP have refused, despite the economic pain and health insecurity their actions will inflict on everyday Americans – including millions of MAGA voters. The president and his party won’t even negotiate with Democrats to end the shutdown.

The consequences couldn’t be more clear. If the subsidies aren’t extended, families with modest incomes will see their ACA premiums double, triple, or even quintuple. Senator Ruben Gallego (D-AZ) shared how premium hikes would affect his constituents. As the Senator posted on X, a family of four in Maricopa County, AZ currently paying $514 per month for an ACA plan will see their monthly premium skyrocket to $2,435 in 2026 without action from Congress.

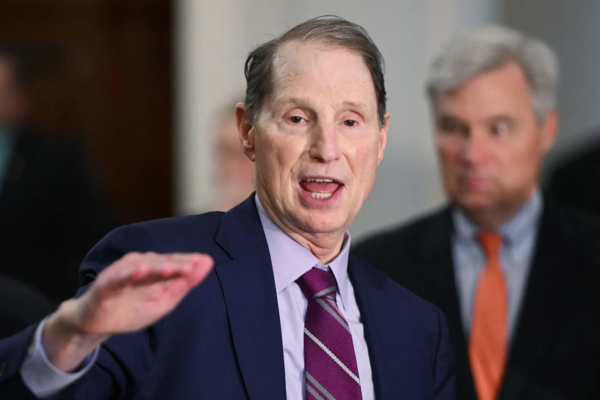

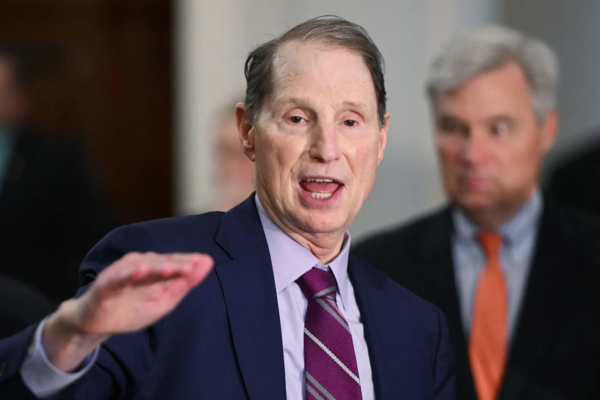

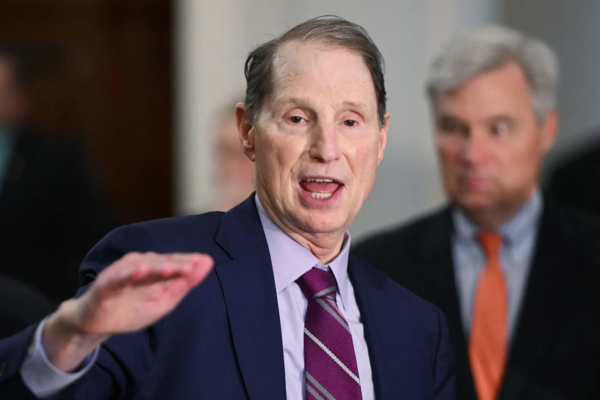

Senator Ron Wyden (D-OR), ranking Democrat on the Senate Finance Committee, excoriated Trump and Republicans for ignoring the health security of working Americans while showering the wealthy with favors.

“This is about a distorted set of values. They’re giving the tax breaks to the billionaires. Now Trump and the Republicans have decided to try to raise additional revenue for the insurance companies,” said Sen. Wyden on our podcast this week. “They’re using the shutdown as an ‘out’ from paying those subsidies.” – Senator Ron Wyden

Senator Ron Wyden: Trump & GOP values are “distorted”

Our senior health care policy expert, Anne Montgomery, points out that ‘near seniors’ (aged 54-65) will be hit hardest if the ACA subsidies disappear:

“It’s important to remember that many people in their 50s and early 60s are on fixed incomes, but not yet eligible for Medicare. As older folks, they already pay the highest premiums. We’re talking about thousands of dollars more out of pocket, just to keep basic health insurance. It’s an impossible choice: lose coverage, cut back on care, or take a huge financial hit.” – Anne Montgomery, NCPSSM senior health policy expert

A recent analysis from Kaiser Family Foundation demonstrates the hard reality:

-

-

A 60-year-old earning $62,700 (just above the threshold for subsidies if enhancements aren’t extended) would pay nearly $9,600 more per year in premiums.

-

A 64-year-old with that income might have to pay around $11,000 more annually.

-

Even 50-year-olds earning the same amount will pay $4,500 more per year if enhancements end.

-

Middle-income early retirees will especially feel the squeeze as the income threshold for premium assistance is set to drop back to 400% of the federal poverty level, reinstating the old “subsidy cliff.”

It’s also important to remember that President Biden’s Inflation Reduction Act (IRA) enabled more Americans to receive subsidies regardless of income. Currently, eligible households don’t pay more than 8.5% of their income for a benchmark silver plan while after-subsidy premiums could be as low as $10/month. That goes away if Trump and the GOP have their way.

Thanks to these improvements from the IRA, we saw marketplace enrollment hit a record 24.3 million. Without them, the Congressional Budget Office (CBO) projects ACA enrollment could drop by up to 4 million, dramatically increasing America’s uninsured rate.

“If you’re 50–64 and relying on ACA Marketplace coverage, this could be a pivotal year. Be prepared for premium increases and the return of the ‘subsidy cliff’ if Congress does not act. It’s important to shop for plans carefully and monitor policy changes as they happen.” – Anne Montgomery, NCPSSM

Zooming-out from the subsidy battle for a moment, it’s become increasingly obvious that Trump and the GOP are using the shutdown as a smoke screen for larger plans to cut social programs across the board, as part of an effort to destroy the safety net put in place during the New Deal and Great Society. NCPSSM urges Americans to protect themselves by speaking up and speaking out. Contact the White House and your elected representatives and tell them: no more breaks for billionaires, especially at the expense of working people struggling to afford basics like food and health care.

****************************************************

Listen to our podcast with Senator Ron Wyden, here.

Learn more about the ACA Marketplace here.

Read an informative analysis from Kaiser Family Foundation on the consequences of premium increases here.