While touted as a “new” plan by the mainstream media, the latest Bowles/Simpson (BS) deficit reduction proposal is really just more of the same — requiring middle-class benefit cuts and tax hikes to reduce the deficit.

“Their plan once again calls for cuts that are out of sync with middle class American’s priorities. Adopting the chained CPI, as Bowles Simpson propose, would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement. This chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts. That’s a lot of money…out of the pockets of those who can least afford to sacrifice even more. “…Max Richtman, President/CEO

While BS claims a goal of “shared sacrifice” let’s not forget that already 75% of deficit reduction has come from benefit cuts. Their latest version simply doubles-down on that formula asking for $2.4 trillion dollars more in savings, again largely from middle class Americans. Think Progress breaks it down:

Between the budget deals in the spring of 2011 and the Budget Control Act, which averted the debt ceiling crisis that same year, spending has been cut by $1.5 trillion and interest payments reduced by another $200 billion. Then the American Taxpayer Relief Act, which solved the impasse over the “fiscal cliff,” raised $600 billion in new tax revenue.

So if Simpson-Bowles are interested in “building upon” what lawmakers have already achieved, the logical thing to propose is another $1.4 trillion in spending cuts plus another $2 trillion in additional tax revenue. Or if they’re happy with their new $4.8 trillion target — rather than the original $6.3 trillion — their new proposal should heavily favor tax increases, since deficit reduction so far has favored spending cuts by three to one. Instead, Simpson and Bowles are proposing $1.8 trillion in new spending cuts and reduced interest payments, and only $600 billion in additional revenue.

It’s also worth noting that the additional revenue, once again, does not target those who’ve benefited most in this economy. Instead, BS will hit middle-class Americans with higher taxes while lowering tax rates for corporations and the wealthy:

“They’re still singing the gospel of revenue increases funded by “closing loopholes,” an amorphous plan that’s likely to hit the middle class with much more force than it would higher earners. They claim that the tax code is “riddled with well over $1 trillion of tax expenditures – which really are just spending by another name.”

And then they repeat their call for lowering tax rates for corporations and the highest-earning individuals.

Their $1-trillion-plus target for “tax expenditure” elimination can only be reached by targeting employer health plans, home mortgage interest deductions, and other policies that would disproportionately hit the already-beleaguered middle class.

Their approach would convert a social insurance program into a welfare program – but one which is solely funded on income below the payroll tax cap (roughly $110,000 at the moment). That plan targets everyone BUT the wealthy in the name of deficit reduction. That fact, coupled with Simpson and Bowles’ continued insistence on lowering tax rates for corporations and the wealthy, illustrates the right-wing thinking that underlies this supposedly “bipartisan” approach.” Richard Eskow, Our Future Blog

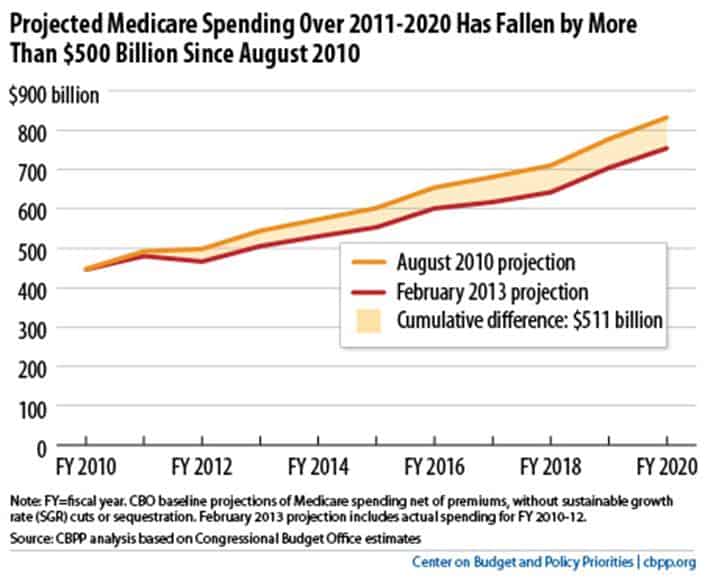

Once again, BS ignores the fact that according to the latest Congressional Budget Office (CBO) projections, Medicare spending over the 2011-2020 period has already fallen by more than $500 billion since late 2010. This inconvenient truth undermines the Bowles/Simpson meme that Medicare must be radically overhauled and seniors’ benefits slashed to lower costs. Allowing time for health care reform’s full implementation, given the lower spending costs already reported, is only reasonable. However, it simply doesn’t fit the BS frame that the only way to cut the deficit is to cut seniors’ benefits. The deficit reduction debate and Congress’ many self-induced fiscal crises provide anti-entitlement crusaders the best opportunity they’ve had in a lifetime to radically overhaul America’s retirement and health safety net. They know time is of the essence because reports of economic recovery and federal health savings undermine their campaign to blame our nation’s economic woes on Social Security, Medicare and Medicaid.

Once again, BS ignores the fact that according to the latest Congressional Budget Office (CBO) projections, Medicare spending over the 2011-2020 period has already fallen by more than $500 billion since late 2010. This inconvenient truth undermines the Bowles/Simpson meme that Medicare must be radically overhauled and seniors’ benefits slashed to lower costs. Allowing time for health care reform’s full implementation, given the lower spending costs already reported, is only reasonable. However, it simply doesn’t fit the BS frame that the only way to cut the deficit is to cut seniors’ benefits. The deficit reduction debate and Congress’ many self-induced fiscal crises provide anti-entitlement crusaders the best opportunity they’ve had in a lifetime to radically overhaul America’s retirement and health safety net. They know time is of the essence because reports of economic recovery and federal health savings undermine their campaign to blame our nation’s economic woes on Social Security, Medicare and Medicaid.

We don’t have to slash benefits to the middle-class and poor Americans to reduce the deficit. The BS plan to cut COLA’s and raise taxes through the chained-CPI, cutting Medicare benefits by further means testing and eliminating Medicare eligibility for millions of younger retirees is not shared sacrifice. It’s not fiscal responsibility and it’s certainly does not represent the economic priorities of the vast majority of Americans of all ages and political parties.