Biden’s Speech: President Calls for Prescription Drug Price Reform, Defers White House Action

Seniors had their moment in the sun when President Biden unveiled his first infrastructure plan earlier this month. (The American Jobs Plan included an impressive $400 billion for improving senior care.) His new American Families Plan — dubbed “social infrastructure” by some — has less to offer seniors, focusing more on children and families. It includes more generous Affordable Care Act subsidies to help Americans afford Obamacare premiums, which would help near seniors (55-64) who are too young for Medicare. But the new plan does not include action on a crucial issue to older Americans: lowering the soaring cost of prescription drugs.

In his speech last night to a joint session of Congress, the President did make note of the prescription drug pricing issue:

“We all know how outrageously expensive drugs are in America. In fact, we pay the highest prescription drug prices of anywhere in the world right here in America… Let’s do what we talked about for all the years I was in Congress. Let’s give Medicare the power to save hundreds of billions of dollars by negotiating lower drug prescription prices.” – President Biden, 4/28/21

His acknowledgement and affirmation of the issue is important. Allowing Medicare to negotiate drug prices with Big Pharma is at the top of the list for Progressive Democrats and seniors’ advocates alike when it comes to drug pricing reform. But the White House has offered no specific plan.

Meanwhile, House Democrats have re-introduced the Elijah Cummings Lower Drug Costs Now Act (H.R. 3), which the Congressional Budget Office estimated would save the government some $400 billion in drug costs over ten years. (It also would expand Medicare to include coverage for basic hearing, vision, and dental care – a longtime priority for the National Committee and other seniors’ advocates.)

Advocates are understandably disappointed that the White House will not be pushing for prescription drug legislation right away. Exorbitant drug prices have a real impact on seniors living on fixed incomes, who cannot afford ever-rising costs at the pharmacy counter. According to Human Rights Watch:

Nearly 30 percent of adults in the US had not taken prescribed medication as recommended in the past year because of the cost. Instead of refilling expensive prescriptions, people skip doses or cut pills in half. – Human Rights Watch, 4/26/21

Skipping medications takes a staggering human toll. A 2020 study by West Health Policy Center estimated that the inability to fill prescriptions due to cost will result in 1.1 million premature deaths among Medicare beneficiaries over the next 10 years. That is an unacceptable result of Big Pharma price gouging.

The National Committee hopes that Congress can come together to support the inclusion of price negotiation in their version of the American Families Plan — and that they will respond to the desperate need for hearing, vision and dental services for seniors as part of traditional Medicare coverage. Seniors are an important part of the American family. They deserve our continued attention in this push to improve the nation’s “social infrastructure.”

Romney’s TRUST Act is Back (Again)

photo by George Skidmore/Wikimedia Commons

The TRUST Act is back again. Senator Mitt Romney (R-UT) reintroduced his bill on April 15th, after it went nowhere in the 116th Congress. The TRUST Act purports to protect federal trust funds, including Social Security and Medicare’s. But it would actually open the door to cutting both programs. The reintroduced TRUST Act is cosponsored by Republican members of the House and Senate and a handful of Democrats.

We urge them to reconsider their position — and to oppose the TRUST Act. Democrats must reject Republican attempts to undermine our nation’s most successful social insurance programs — crucial legacies of the New Deal and Great Society. Today’s workers and tomorrow’s retirees expect nothing less. – Former Senator Tom Harkin and NCPSSM president Max Ricthman, The Hill, 3/4/21

The bill would establish ‘Rescue Committees’ in Congress to draft legislation affecting the Social Security and Medicare – and fast track it for floor votes without going through the normal deliberative process. For example, members would not be able to offer amendments to legislation that comes out of the ‘Rescue Committees.’ “It leaves the skeleton of the legislative process in place, but nowhere along the line can you make changes or improvements,” explains Maria Freese, a Social Security and retirement expert at NCPSSM.

Given that fiscal hawks in Congress want to cut Americans’ earned benefits under the guise of protecting or “reforming” Social Security and Medicare, the TRUST Act is dangerous. It would open the door to slash both programs. Today’s seniors rely on their earned benefits to stay healthy and stay out of poverty. Research indicates that tomorrow’s retirees will rely on these programs even more. The last thing American workers need is to have their future benefits threatened. If anything, they should be expanded.

While it’s true that the Social Security and Medicare Part A trust funds will become depleted in 2035 and 2026 respectively if Congress takes no action, there are commonsense solutions that do not involve cutting benefits. But, too often, “entitlement reformers” use the canard that “no one in Washington has the courage” to address Social Security and Medicare’s financial challenges, which simply is not true. Representative John Larson introduced the Social Security 2100 Act, which would extend the life of the trust fund, partly by asking the wealthy to begin contributing their fair share of Social Security payroll taxes. Other members of Congress have offered their own solutions that do not ask future seniors to withstand benefit cuts.

“We agree that it’s important to address solvency,” said Dan Adcock, director of government relations and policy at the National Committee to Preserve Social Security & Medicare. “We also think it’s equally important to address benefit adequacy, because of the struggle that the middle class and working class have these days in saving for retirement.” – Dan Adcock, NCPSSM Director of Government Relations and Policy

In fact, the TRUST Act does not require its “rescue committees” to consider the adequacy of current benefits — or the human impact of potential cuts. Retirees would be relegated to the status of figures on a balance sheet. This is not an acceptable outcome for our parents, grandparents, and friends who depend on their earned benefits.

President’s Infrastructure Plan Builds Stronger Foundation for Seniors

The nation’s pre-eminent coalition representing older Americans supports President Biden’s American Jobs Plan “as a bold step in the right direction for seniors.” The Leadership Council of Aging Organizations (LCAO), currently chaired by NCPSSM, this week urged Congress to enact the President’s plan, “so that older Americans will feel the benefits across many areas of their lives — from housing to health to caregiving.” The plan includes $400 billion in new spending for long-term care for the elderly and disabled, the second highest allocation of funds after ‘Transportation.’

Support for seniors is part of President Biden’s expansive view of “infrastructure,” which he explains “has always evolved to meet the needs and aspirations of the American people.” Those needs and aspirations include older Americans who have contributed so much to our economy and enriched our lives.

The $400 billion in funding for older and disabled Americans goes toward home and community-based services (HCBS). It will help millions of seniors to receive long-term care in the comfort of their homes and communities instead of in nursing homes. The data show that HCBS is safer than nursing home care, with better mental and physical health outcomes. The American Jobs Act also will create new and better jobs for caregivers, predominantly women of color who have been “underpaid and undervalued for too long.”

“It’s expanded services for seniors. It’s for homecare workers who help seniors to stay in their homes… saving Medicaid hundreds of millions of dollars in the process.” – President Biden, 4/6/21

Seniors will benefit from the infrastructure plan in other life-changing ways. The American Jobs Plan contains $85 billion in sorely-needed funds to improve public transportation. Many seniors rely on public transit for shopping, banking, and medical appointments. Yet, one transportation advocacy group estimated that more than 15 million seniors live in communities where public transit is “poor or nonexistent.” We believe that some of the infrastructure funding for transportation should specifically benefit seniors under the Older Americans Act.

Housing is another crucial infrastructure issue for seniors. The American Jobs Act dedicates $213 billion to affordable housing. Some of that funding should go toward the Section 202 program, which finances supportive housing for low-income seniors – and provides much-needed rent subsidies, too.

The American Jobs Act includes $100 billion to expand Broadband internet access, which should benefit seniors lacking connectivity

Of course, 21st century seniors not only need roofs over their heads, but broadband internet access to connect their homes to the wider world. Seniors without reliable internet access can become disconnected from family and community, and unable to conduct crucial transactions online. Congress can ensure that some of this funding helps seniors better access the internet – including WiFi hotspots in underserved areas.

As the President’s plan is taken up by Congress, LCAO will continue to urge lawmakers to ensure that the American Jobs Act addresses the transportation, housing, broadband access, and caregiving needs of older people. As NCPSSM president and LCAO chairman Max Richtman said, “Just as the President’s American Jobs Plan will rebuild our nation’s crumbling infrastructure, it must build a better foundation for society as a whole by fortifying services for all of us as we age.”

March 22nd is an Important Anniversary for American Seniors

Today is the 49th anniversary of senior nutrition programs being added to the Older Americans Act (OAA), an important milestone in federal efforts to address food insecurity among the elderly. The original Older Americans Act was signed into law by President Lyndon B. Johnson as part of his vision for a Great Society. OAA senior nutrition programs include Congregate Meals (served in the community) and Home Delivered Meals (brought directly to seniors’ homes).

We talked to the National Committee’s director of government relations and policy, Dan Adcock, about this landmark anniversary, which roughly coincides with the first anniversary of the COVID pandemic.

As a former staffer on the U.S. House Committee on Education and Labor, Dan helped write an update of the Older Americans Act. In 2018, he rode along with Meals on Wheels to deliver meals to seniors in the San Diego, CA area. He told Entitled to Know, “The seniors who answered the door greeted us with huge smiles and ample gratitude, not only for bringing them lunch or dinner, but for their only social interaction all day.”

What does the 49th anniversary of senior nutrition programs being added to the OAA mean to American seniors?

ADCOCK: This year’s anniversary is especially timely given that local home-delivered meal programs throughout the country have risen to the occasion during the COVID pandemic by becoming the sole source of nutrition and social contact for millions of older Americans. That makes this a landmark year, of sorts.

How does the nutrition component of OAA fit into President Johnson’s vision of a Great Society?

ADCOCK: A Great Society doesn’t let its most vulnerable citizens live in poverty or go hungry. Adding a nutrition program to LBJ’s vision of the Older Americans Act was a compassionate step to make the program more fully serve the needs of seniors.

What are the main benefits of the Congregate Meals program? What does it give seniors that they otherwise wouldn’t have?

ADCOCK: The Congregate Meals program encourages seniors to get out of the house, socialize with other people, and get at least one nutritious meal a day. Unfortunately, many congregate meal centers are closed because of the pandemic. As soon as the pandemic is over, we want to encourage older Americans (who are able) to partake in congregate meals in their communities.

Why are home delivered meals (Meals on Wheels) so important to America’s seniors?

ADCOCK: Home delivered meals often provide seniors who can’t easily leave their homes with nutrition and social contact they wouldn’t otherwise have. Since it wasn’t safe for many seniors to leave their homes during the pandemic, the need for home delivered meals has become even more apparent. That’s why the home-delivered meals program needs to have the capacity to scale-up to handle future emergencies.

A Meals on Wheels delivery center in San Diego, CA

Which of your own personal or professional experiences informed your view of these programs?

ADCOCK: As a staffer on the House Committee on Education and Labor, I helped write an update of the Older Americans Act, including home delivered meals. While the committee heard testimony from many witnesses who ran senior nutrition programs, the experience of actually delivering meals to seniors as a volunteer gave me first-hand experience of how invaluable home delivered meals are to the people we visited. Every member of Congress should have the experience of seeing the smiling faces of seniors who receive a hot meal and much-needed social interaction.

How would you characterize funding levels for OAA nutrition programs today? Less than adequate? Just about adequate? And do we need better funding moving forward?

ADCOCK: Over the past 20 years, the OAA has lost ground due to our rapidly-increasing elderly population. Unfortunately, federal funding has not kept pace with either inflation and demographic changes. Eligible seniors face waiting periods for many OAA services, including home delivered meals, in most states. Fortunately, for Fiscal Year 2020, total OAA funding, including supplemental funding to respond to the needs of seniors during the COVID-19 pandemic, reached its highest level ($3.220 billion) in the Act’s 55-year history. This trend continued into Fiscal Year 2021 with an increase of $96 million. While it took a pandemic to finally provide adequate funding for the Older Americans Act, I am concerned that when things get back to normal, Congress may return to the usual practice of underfunding these vital programs, despite the needs of our growing elderly population.

How did the $750 million in additional funding for nutrition programs end up in the COVID bill and why is that significant?

ADCOCK: Congress recognized that seniors stuck at home would go without food during this emergency unless OAA nutrition programs, especially home-delivered meals, received additional funding.

What do we as an organization want to see on this issue moving forward? Will senior hunger/food insecurity continue to be a problem, and will the demand for these programs increase?

ADCOCK: The National Committee wants to ensure that lawmakers don’t slip back into the habit of neglecting senior nutrition programs. As 10,000 Americans turn 65 a day, the demand for all OAA services, including congregate and home delivered meals, will only grow.

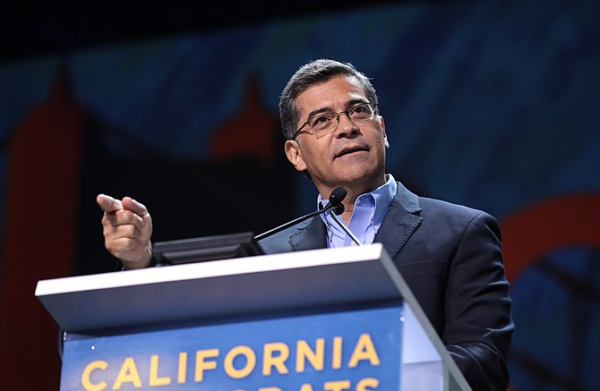

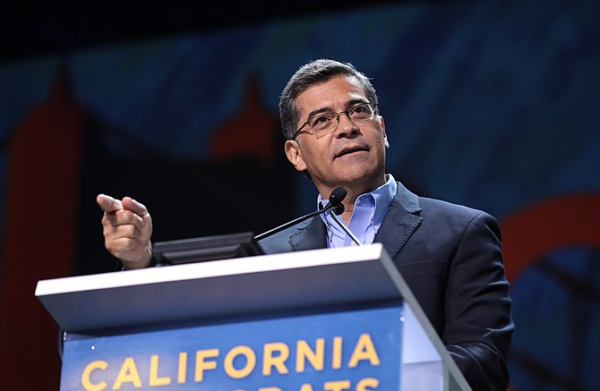

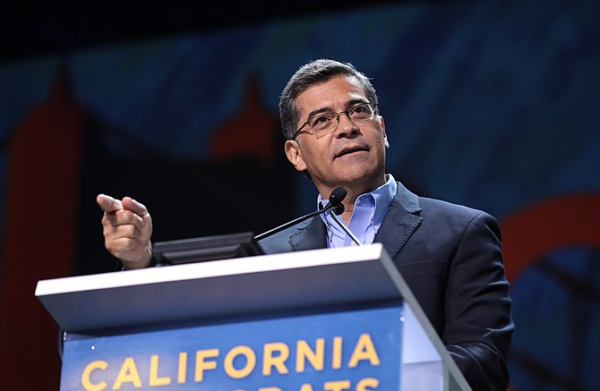

Senate Confirms Seniors’ Champion to Lead HHS

Seniors can rightly celebrate Thursday’s Senate confirmation of California attorney general Xavier Becerra to lead the U.S. Department of Health and Human Services (HHS). Few cabinet positions have as much impact on older Americans’ health and well-being as the Secretary of HHS, which oversees the administration of Medicare, Medicaid, and Older Americans Act programs. Throughout his long and distinguished career in public service, Xavier Becerra has demonstrated a commitment to older Americans’ health care.

“Attorney General Becerra’s experience as a legislator and executive leaves little doubt about his ability to help the Biden Administration successfully guide the country out of the COVID pandemic — and into a stronger era of health and human services delivery for seniors and all Americans.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare

As a Congressman, Becerra helped secure passage of the Affordable Care Act and later defended it in court. He knows the plight of those who lack access to affordable health care coverage and understands the government’s fundamental responsibility in this area. As HHS Secretary, he can direct the Centers for Medicare and Medicaid Services (CMS) to continue moving away from destructive Trump era policies, toward President Biden’s fairer and more expansive vision of both programs — and advocate for that vision with the Congress.

“Speaking at a Senate confirmation hearing last month, Becerra said he understands ‘the enormous challenges before us.’ He said he would work not only to contain the virus but also to boost access to affordable health care.” – CNBC, 3/18/21

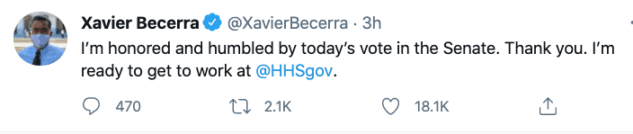

Thursday’s Senate vote was the closest for any of Biden’s cabinet nominations so far, with one Republican crossing the aisle to support Becerra.

“Maine Republican Susan Collins joined all of the Democrats present in the 50-49 vote — an unusually narrow margin for an HHS secretary. Becerra, who served in the House for more than two decades before becoming California’s Attorney General, will become the first Latino to head the sprawling federal health department.” – Politico, 3/18/21

National Committee President Max Richtman applauded the Democratic Senators who unanimously voted to confirm Becerra – and commended Senator Collins “for putting party politics aside to cast her vote for responsive, informed leadership at HHS.”

As the first Latino HHS Secretary, Xavier Becerra brings much-needed perspective and life experience to the job as an ever-diversifying country moves toward a more equitable health care system for all.