Whether or not President Trump understands the dangerous implications of “terminating payroll taxes,” his executive order on Saturday and accompanying remarks should alarm all Americans. The President’s exercising unilateral authority (of dubious legality) to cut the payroll taxes which fund Social Security proves that opponents of workers’ earned benefits have his ear. Earlier this month, conservative commentator and longtime antagonist of Social Security Stephen Moore implored the President to bypass Congress and order the I.R.S. to impose a “payroll tax holiday.” That’s exactly what the President’s executive order does. And that’s exactly what many on the right want: a back-door method to destroy Social Security under the guise of a “tax cut.”

“Beyond the attack on crucial earned benefits, this action does nothing to help unemployed and retired Americans survive this unprecedented crisis. Instead, the President is focused on undermining their financial security… This decree is a poorly disguised first step in an effort to fully dismantle this vital program by executive fiat.” – Rep. Richard Neal, Chairman of House Ways & Means Committee, 8/9/20

Simply put, the President’s action is a blatant betrayal of his promises “not to touch” Social Security. Rescinding workers’ payroll contributions – even temporarily – is harmful to Social Security, since the program’s funding depends on those taxes. But the President’s pronouncement that if re-elected he would “terminate FICA taxes” is even more chilling. No supporter of Social Security would permanently “terminate” the taxes that it relies on for funding, especially at a time when the program faces financial challenges that require more revenue, not less. Surrounding himself with “entitlement reformers” who want to cut, privatize, and obliterate the program – and then acting on their advice – is a strange way of honoring those promises.

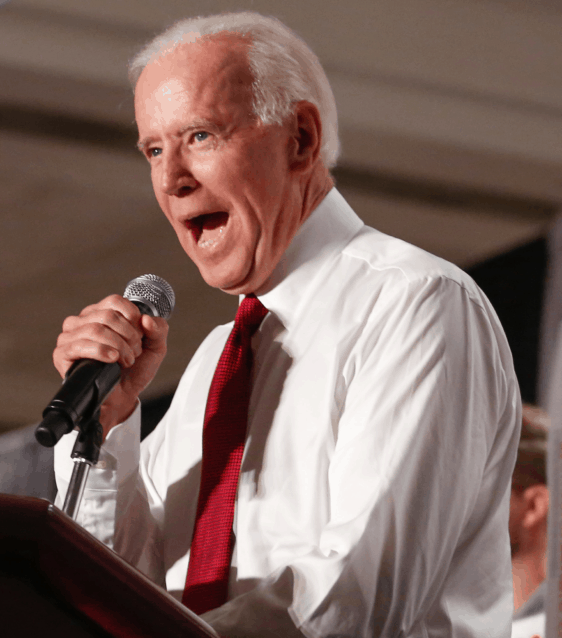

His opponent, Joe Biden, wasted no time calling the President’s action what it is – “the first shot in a reckless war on Social Security.”

“He is putting Social Security at grave risk at a time when seniors are suffering the overwhelming impact of a pandemic he failed to control. Our seniors are under enough stress without Trump putting their hard-earned benefits in doubt.” – Joe Biden, 8/8/20

Trump’s executive order is also an election-year ploy to offer financially struggling Americans fake relief during the COVID pandemic. Democrats and many Republicans in Congress opposed a payroll tax cut because it is an ineffective means of stimulus (and risky for Social Security), so the President simply did an end-run around them that may not even be legal. House Democratic leader Nancy Pelosi called the order “absurdly unconstitutional” and Republican Senator Ben Sasse labeled it “unconstitutional slop.”

So here we have an executive order that is an insidious attack on Social Security and likely unconstitutional, but also will not deliver the economic stimulus that the president promises, as senior contributor Rob Berger points out in Forbes.

“Experts seem to universally agree that a payroll tax holiday isn’t the type of relief we need. For starters, it does nothing for the unemployed. It only helps those with a job. It also doesn’t help those out of the workforce, such as retirees or stay-at-home parents. And the benefit is spread out over four months, rather than given to those in need of immediate relief.” – Rob Berger, Forbes, 8/9/20

Like many of his other executive orders and actions as President in general, Trump’s payroll tax cut is another con. He postures as a populist while doing the bidding of the corporate class, which has opposed Social Security from the very beginning. Any president who promises to “terminate” the funding source for America’s most popular and successful social insurance program if re-elected… deserves not to be.