CBO Says Supreme Court Ruling on Health Care Reform Reduces Costs

The Congressional Budget Office has released it’s assessment of how the Supreme Court’s Affordable Care Act decision will impact the law’s costs. Much to conservatives’ disappointment the price tag did not grow:

The Congressional Budget Office has released it’s assessment of how the Supreme Court’s Affordable Care Act decision will impact the law’s costs. Much to conservatives’ disappointment the price tag did not grow:

CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period—for a net reduction of $84 billion. (Those figures do not include the budgetary impact of other provisions of the ACA, which in the aggregate reduce budget deficits.)

The projected net savings to the federal government resulting from the Supreme Court’s decision arise because the reductions in spending from lower Medicaid enrollment are expected to more than offset the increase in costs from greater participation in the newly established exchanges.

Unfortunately, the costs savings CBO projects is at the expense of millions of lower income uninsured Americans who won’t receive Medicaid benefits as originally envisioned in the Affordable Care Act.

The CBO also did an analysis of the cost of House Republican efforts to repeal health care reform. The CBO says that move would add $109 billion to federal deficits.

H.R. 6079 would repeal the ACA (with the exception of one subsection that has no budgetary effect). This estimate reflects the spending and revenue projections in CBO’s March 2012 baseline as adjusted to take into account the effects of the recent Supreme Court decision.

Assuming that H.R. 6079 is enacted near the beginning of fiscal year 2013, CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting that legislation would cause a net increase in federal budget deficits of $109 billion over the 2013–2022 period. Specifically, we estimate that H.R. 6079 would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period.

Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012.

So, not only would the repeal of the Affordable Care Act add to our deficits it also cuts benefits to millions of Medicare beneficiaries. With repeal:

- The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

- The Part D coverage gap known as the ‘donut hole’ would return

- Annual wellness visits for beneficiaries would no longer be covered by Medicare

- Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

- Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

- The Medicare Trust Fund’s solvency would be shortened by 8 years

All this plus adding $109 billion to the deficit. So much for fiscal responsibility.

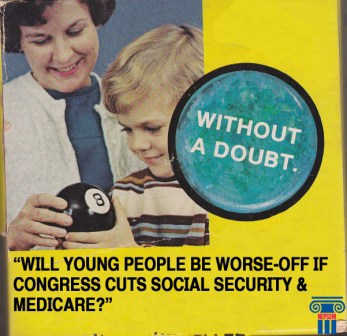

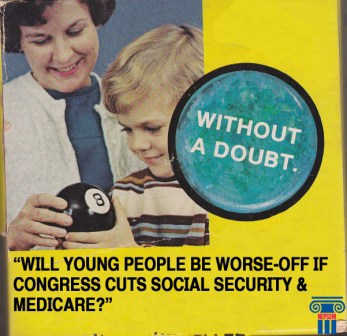

Young People – Don’t Buy the Lie about Social Security

That’s why it’s so encouraging to see that not all young workers are buying the lie about Social Security. The National Academy of Social Insurance’s new guide A Young Person’s Guide to Social Security, is written by and for America’s young workers and goes a long way to help provide some desperately needed Social Security myth-busting.

Don’t have time to read the report? OK…here’s the video. Watch it and share with your friends, no matter their age.

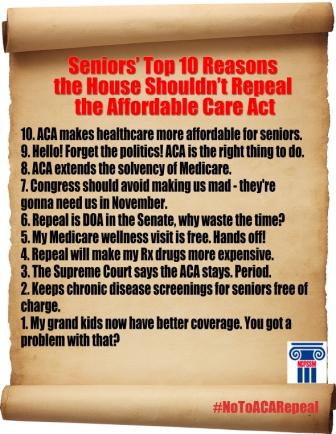

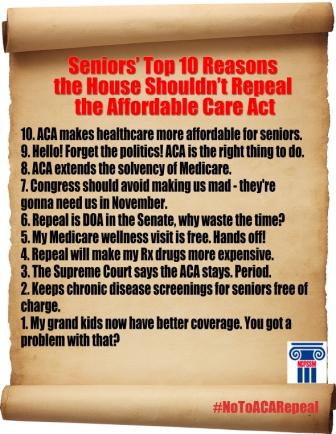

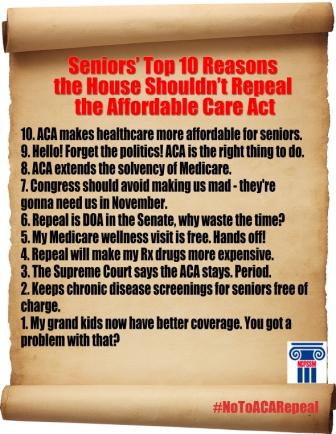

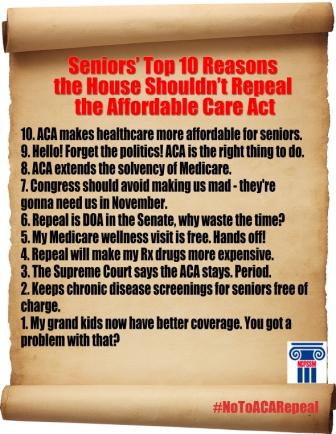

House Vote to Repeal the Affordable Care Act = Politics as Usual

“We are in this fight to keep Medicare benefits from being stripped away from millions of seniors by Members of Congress who vote to repeal the Affordable Care Act. The ACA will save lives, it will provide coverage to millions who lack insurance and it already provides improved benefits for less cost to seniors in Medicare. America’s health and economic security should take priority over election-year politics; however, this vote proves once again, politics trumps policy in the House. The Affordable Care Act is law, it’s working, and it’s long past time for Congress to start making economic growth a priority.” Max Richtman, President/CEO

While political rhetoric dominated much of today’s House repeal debate, the facts about the benefits provided to seniors in Medicare — which would be lost if health care reform was repealed — were largely ignored. Here are just a few of the benefits that would be lost if the Affordable Care Act was repealed:

· The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

· The Part D coverage gap known as the ‘donut hole’ would return

· Annual wellness visits for beneficiaries would no longer be covered by Medicare

· Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

· Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

· The Medicare Trust Fund’s solvency would be shortened by 8 years

A full analysis of the Medicare and Medicaid improvements that were preserved as a result of the recent Supreme Court ruling to uphold the Affordable Care Act can be found on the National Committee’s website.

Obamacare – Largest tax in history? Not.

Chances are you’ve heard this claim hundreds of times already and you’ll hear it repeatedly on Wednesday when the House casts it’s 31st vote to repeal the Affordable Care Act. But as Franklin Roosevelt said “Repetition does not transform a lie into truth”. So, here’s the truth about this latest anti-health care reform talking point:

The Affordable Care Act (ACA) includes a penalty for Americans who do not buy insurance. The Supreme Court ruled that penalty constitutional under Congress’ right to tax. However, when compared to the 15 significant tax increases since 1950, the Affordable Care Act, which amounts to an increase of 0.49 percent of GDP, comes in 10th. That’s even less than President Reagan’s tax increases in 1982. This chart is from the Incidental Economist.

Also, whether you call it a tax or a penalty; it’s important to know that hardly anyone will actually pay it. In Massachusetts, the only state with an insurance mandate (implemented by former Governor and GOP Presidential candidate Mitt Romney) less than 1 percent of the state’s residents paid the penalty in 2009. Not only will few people face this penalty, it’s also very small. According to Chief Justice John Roberts: “[F]or most Americans the amount due will be far less than the price of insurance, and, by statute, it can never be more.”

So, for perspective let’s compare this to the “hidden health tax” which will be eliminated thanks to the ACA’s insurance mandate. A study by Families USA found that the uninsured paid only 37 percent of the cost of their healthcare with government programs and charities footing 26 percent. The remaining 37 percent became a “hidden health tax” in the form of higher insurance premiums for all American businesses and families. That added up to $1,017 per family in 2008. A study by the Kaiser Family Foundation found similar results.

When the Affordable Care Act becomes fully implemented in 2014 the mandate that everyone carry some form of health insurance means the “hidden health tax” paid by millions of insured Americans will disappear. Thanks to health care reform, millions Americans will no longer face huge hidden health care costs each year even though an estimated 1-3% of Americans who refuse to buy insurance might face a small penalty.

Whatever you call it – a penalty or a tax – that’s just common sense reform.

The Supreme Court Ruling and Seniors – Day Two Follow Up

Here are some highlights of the Supreme Court new coverage and our joint analysis prepared in partnership with the National Senior Citizens Law Center on the rulings impact on seniors.

Supreme Court Upholds Affordable Care Act – What Does This Mean for Seniors? – National Committee to Preserve Social Security & Medicare and the National Senior Citizens Law Center Analysis

What the Health Care Ruling Means for Medicare – New York Times New Oldage Blog

“This is great news for seniors on Medicare,” Paul Nathanson, executive director of the National Senior Citizens Law Center, a nonprofit advocacy group, said in a conference call on Thursday after the Supreme Court issued its ruling upholding the Affordable Care Act.

Because several key provisions involving Medicare kicked in soon after Congress passed the bill in 2010, many beneficiaries won’t see big changes in their coverage now. But those improvements could have evaporated had the law been overturned, so the ruling generated sighs of relief among advocacy organizations for older adults.

This means the annual free wellness exam will continue (about 2.2 million people took advantage of it last year, according to AARP), along with the first “Welcome to Medicare” visit, which will remain free, with no out-of-pocket costs.

A number of preventive services, including mammograms, bone scans and depression and diabetes screenings, used to involve deductibles and co-pays; under the Affordable Care Act, they no longer do.

And the gradual closing of the dread “doughnut hole” gap in Part D drug coverage by 2020 will proceed, bolstered by discounts that have already lowered drug costs. “The average Medicare beneficiary will continue to save an average $650 a year,” Max Richtman, who leads the National Committee to Preserve Social Security and Medicare, said in Thursday’s teleconference. “That’s real money, especially for seniors.”

States With Largest Uninsured Populations May Be More Likely to Opt Out of Medicaid – CQ Healthbeat

Max Richman, president and CEO of the National Committee to Preserve Social Security & Medicare, said that advocates will do “whatever we can” at the state and local level to persuade states to opt into the expansion. Others were not as sure.

“While we are pleased that the court’s ruling preserves existing Medicaid coverage, we are worried that the low-income people in any state that may reject the Medicaid expansion will bear the costs of that decision,” said Jane Perkins, legal director of the National Health Law Program. “If a state chooses not to participate in the expansion, poor people will suffer.”

Alan Weil, executive director for the National Academy for State Health Policy, declined to predict which states will opt out.“All that’s clear now is that states will have a debate over this issue they thought they didn’t have any choice on,” he said. “But it’s still a very attractive option for states.”A Senate GOP aide agreed with Weil’s assessment. “Congress threw a lot of money at the states in the expansion,” the aide said.“They may still take it.”

Supreme Court Gives America’s Senior Citizens Longer, Healthier Lives – Senior Journal

“Helpful in getting senior citizens who oppose Obamacare to take a second look are statements issued today by many well-informed senior advocates.

For seniors the legislation has already put in place lower drug costs, more free preventive health care screening and an annual consultation with a physician to discuss their personal health plan. And, for all Americans it should mean an end to out-of-control increases in medical costs.”

CBO Says Supreme Court Ruling on Health Care Reform Reduces Costs

CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period—for a net reduction of $84 billion. (Those figures do not include the budgetary impact of other provisions of the ACA, which in the aggregate reduce budget deficits.)

The projected net savings to the federal government resulting from the Supreme Court’s decision arise because the reductions in spending from lower Medicaid enrollment are expected to more than offset the increase in costs from greater participation in the newly established exchanges.

Unfortunately, the costs savings CBO projects is at the expense of millions of lower income uninsured Americans who won’t receive Medicaid benefits as originally envisioned in the Affordable Care Act.

The CBO also did an analysis of the cost of House Republican efforts to repeal health care reform. The CBO says that move would add $109 billion to federal deficits.

H.R. 6079 would repeal the ACA (with the exception of one subsection that has no budgetary effect). This estimate reflects the spending and revenue projections in CBO’s March 2012 baseline as adjusted to take into account the effects of the recent Supreme Court decision.

Assuming that H.R. 6079 is enacted near the beginning of fiscal year 2013, CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting that legislation would cause a net increase in federal budget deficits of $109 billion over the 2013–2022 period. Specifically, we estimate that H.R. 6079 would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period.

Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012.

So, not only would the repeal of the Affordable Care Act add to our deficits it also cuts benefits to millions of Medicare beneficiaries. With repeal:

- The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

- The Part D coverage gap known as the ‘donut hole’ would return

- Annual wellness visits for beneficiaries would no longer be covered by Medicare

- Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

- Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

- The Medicare Trust Fund’s solvency would be shortened by 8 years

All this plus adding $109 billion to the deficit. So much for fiscal responsibility.

Young People – Don’t Buy the Lie about Social Security

That’s why it’s so encouraging to see that not all young workers are buying the lie about Social Security. The National Academy of Social Insurance’s new guide A Young Person’s Guide to Social Security, is written by and for America’s young workers and goes a long way to help provide some desperately needed Social Security myth-busting.

Don’t have time to read the report? OK…here’s the video. Watch it and share with your friends, no matter their age.

House Vote to Repeal the Affordable Care Act = Politics as Usual

“We are in this fight to keep Medicare benefits from being stripped away from millions of seniors by Members of Congress who vote to repeal the Affordable Care Act. The ACA will save lives, it will provide coverage to millions who lack insurance and it already provides improved benefits for less cost to seniors in Medicare. America’s health and economic security should take priority over election-year politics; however, this vote proves once again, politics trumps policy in the House. The Affordable Care Act is law, it’s working, and it’s long past time for Congress to start making economic growth a priority.” Max Richtman, President/CEO

While political rhetoric dominated much of today’s House repeal debate, the facts about the benefits provided to seniors in Medicare — which would be lost if health care reform was repealed — were largely ignored. Here are just a few of the benefits that would be lost if the Affordable Care Act was repealed:

· The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

· The Part D coverage gap known as the ‘donut hole’ would return

· Annual wellness visits for beneficiaries would no longer be covered by Medicare

· Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

· Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

· The Medicare Trust Fund’s solvency would be shortened by 8 years

A full analysis of the Medicare and Medicaid improvements that were preserved as a result of the recent Supreme Court ruling to uphold the Affordable Care Act can be found on the National Committee’s website.

Obamacare – Largest tax in history? Not.

Chances are you’ve heard this claim hundreds of times already and you’ll hear it repeatedly on Wednesday when the House casts it’s 31st vote to repeal the Affordable Care Act. But as Franklin Roosevelt said “Repetition does not transform a lie into truth”. So, here’s the truth about this latest anti-health care reform talking point:

The Affordable Care Act (ACA) includes a penalty for Americans who do not buy insurance. The Supreme Court ruled that penalty constitutional under Congress’ right to tax. However, when compared to the 15 significant tax increases since 1950, the Affordable Care Act, which amounts to an increase of 0.49 percent of GDP, comes in 10th. That’s even less than President Reagan’s tax increases in 1982. This chart is from the Incidental Economist.

Also, whether you call it a tax or a penalty; it’s important to know that hardly anyone will actually pay it. In Massachusetts, the only state with an insurance mandate (implemented by former Governor and GOP Presidential candidate Mitt Romney) less than 1 percent of the state’s residents paid the penalty in 2009. Not only will few people face this penalty, it’s also very small. According to Chief Justice John Roberts: “[F]or most Americans the amount due will be far less than the price of insurance, and, by statute, it can never be more.”

So, for perspective let’s compare this to the “hidden health tax” which will be eliminated thanks to the ACA’s insurance mandate. A study by Families USA found that the uninsured paid only 37 percent of the cost of their healthcare with government programs and charities footing 26 percent. The remaining 37 percent became a “hidden health tax” in the form of higher insurance premiums for all American businesses and families. That added up to $1,017 per family in 2008. A study by the Kaiser Family Foundation found similar results.

When the Affordable Care Act becomes fully implemented in 2014 the mandate that everyone carry some form of health insurance means the “hidden health tax” paid by millions of insured Americans will disappear. Thanks to health care reform, millions Americans will no longer face huge hidden health care costs each year even though an estimated 1-3% of Americans who refuse to buy insurance might face a small penalty.

Whatever you call it – a penalty or a tax – that’s just common sense reform.

The Supreme Court Ruling and Seniors – Day Two Follow Up

Here are some highlights of the Supreme Court new coverage and our joint analysis prepared in partnership with the National Senior Citizens Law Center on the rulings impact on seniors.

Supreme Court Upholds Affordable Care Act – What Does This Mean for Seniors? – National Committee to Preserve Social Security & Medicare and the National Senior Citizens Law Center Analysis

What the Health Care Ruling Means for Medicare – New York Times New Oldage Blog

“This is great news for seniors on Medicare,” Paul Nathanson, executive director of the National Senior Citizens Law Center, a nonprofit advocacy group, said in a conference call on Thursday after the Supreme Court issued its ruling upholding the Affordable Care Act.

Because several key provisions involving Medicare kicked in soon after Congress passed the bill in 2010, many beneficiaries won’t see big changes in their coverage now. But those improvements could have evaporated had the law been overturned, so the ruling generated sighs of relief among advocacy organizations for older adults.

This means the annual free wellness exam will continue (about 2.2 million people took advantage of it last year, according to AARP), along with the first “Welcome to Medicare” visit, which will remain free, with no out-of-pocket costs.

A number of preventive services, including mammograms, bone scans and depression and diabetes screenings, used to involve deductibles and co-pays; under the Affordable Care Act, they no longer do.

And the gradual closing of the dread “doughnut hole” gap in Part D drug coverage by 2020 will proceed, bolstered by discounts that have already lowered drug costs. “The average Medicare beneficiary will continue to save an average $650 a year,” Max Richtman, who leads the National Committee to Preserve Social Security and Medicare, said in Thursday’s teleconference. “That’s real money, especially for seniors.”

States With Largest Uninsured Populations May Be More Likely to Opt Out of Medicaid – CQ Healthbeat

Max Richman, president and CEO of the National Committee to Preserve Social Security & Medicare, said that advocates will do “whatever we can” at the state and local level to persuade states to opt into the expansion. Others were not as sure.

“While we are pleased that the court’s ruling preserves existing Medicaid coverage, we are worried that the low-income people in any state that may reject the Medicaid expansion will bear the costs of that decision,” said Jane Perkins, legal director of the National Health Law Program. “If a state chooses not to participate in the expansion, poor people will suffer.”

Alan Weil, executive director for the National Academy for State Health Policy, declined to predict which states will opt out.“All that’s clear now is that states will have a debate over this issue they thought they didn’t have any choice on,” he said. “But it’s still a very attractive option for states.”A Senate GOP aide agreed with Weil’s assessment. “Congress threw a lot of money at the states in the expansion,” the aide said.“They may still take it.”

Supreme Court Gives America’s Senior Citizens Longer, Healthier Lives – Senior Journal

“Helpful in getting senior citizens who oppose Obamacare to take a second look are statements issued today by many well-informed senior advocates.

For seniors the legislation has already put in place lower drug costs, more free preventive health care screening and an annual consultation with a physician to discuss their personal health plan. And, for all Americans it should mean an end to out-of-control increases in medical costs.”