The Congressional Budget Office has released it’s assessment of how the Supreme Court’s Affordable Care Act decision will impact the law’s costs. Much to conservatives’ disappointment the price tag did not grow:

The Congressional Budget Office has released it’s assessment of how the Supreme Court’s Affordable Care Act decision will impact the law’s costs. Much to conservatives’ disappointment the price tag did not grow:

CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period—for a net reduction of $84 billion. (Those figures do not include the budgetary impact of other provisions of the ACA, which in the aggregate reduce budget deficits.)

The projected net savings to the federal government resulting from the Supreme Court’s decision arise because the reductions in spending from lower Medicaid enrollment are expected to more than offset the increase in costs from greater participation in the newly established exchanges.

Unfortunately, the costs savings CBO projects is at the expense of millions of lower income uninsured Americans who won’t receive Medicaid benefits as originally envisioned in the Affordable Care Act.

The CBO also did an analysis of the cost of House Republican efforts to repeal health care reform. The CBO says that move would add $109 billion to federal deficits.

H.R. 6079 would repeal the ACA (with the exception of one subsection that has no budgetary effect). This estimate reflects the spending and revenue projections in CBO’s March 2012 baseline as adjusted to take into account the effects of the recent Supreme Court decision.

Assuming that H.R. 6079 is enacted near the beginning of fiscal year 2013, CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting that legislation would cause a net increase in federal budget deficits of $109 billion over the 2013–2022 period. Specifically, we estimate that H.R. 6079 would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period.

Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012.

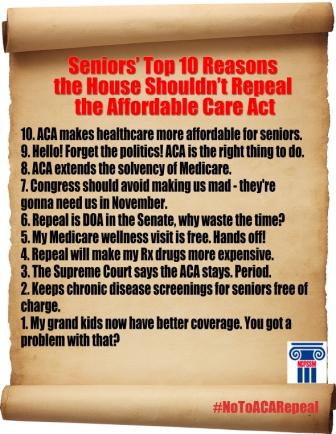

So, not only would the repeal of the Affordable Care Act add to our deficits it also cuts benefits to millions of Medicare beneficiaries. With repeal:

- The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

- The Part D coverage gap known as the ‘donut hole’ would return

- Annual wellness visits for beneficiaries would no longer be covered by Medicare

- Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

- Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

- The Medicare Trust Fund’s solvency would be shortened by 8 years

All this plus adding $109 billion to the deficit. So much for fiscal responsibility.