Fix the Debt says Cutting Social Security is as American as…

What do you do when the vast majority of Americans, of all ages and political stripes, disagree with you? If you’re part of the well-financed anti-Social Security, Medicare lobby, you simply spend a portion of your billion dollar investment on a massive nationwide advertising campaign designed to convince Americans that cutting middle-class benefits is as American as…let’s see…McDonald’s hamburgers.

Burson-Marsteller subsidiary Proof Integrated Communications has launched a massive campaign for the Fix the Debt organization. The campaign includes images that are parody recreations of well-known advertising slogans with taglines like “I’m fixin’ it,” “Got debt?” and “Just fix it.” Johanna Schneider, MD of Burson’s DC office, said this is the biggest public policy campaign she has seen in some time.

This new campaign is in addition to the PR blitz already underway led by PR agencies DCI Group, Glover Park Group, and Dewey Square Group, which is also paid for by the same Pete Peterson funded anti-entitlement campaign.

How ironic that as Alan Simpson continues to attack seniors’ groups like ours for daring to represent their membership (and at $12 per year membership you can be sure we don’t have a billion dollars to spend) his big business and Wall Street funded “Fix the Debt” campaign is preparing an all-out advertising onslaught geared to buy the debate and silence the middle-class Americans who will actually pay the price for their failed fiscal policies. Representing seniors — BAD, representing big business — No problem!

The American people simply don’t believe cutting Social Security benefits for a senior living on an average $14,000 while lowering tax rates for corporations and the wealthy is fiscally responsible. They don’t believe the nation’s disabled, veterans, survivors and their families should pay the price for a deficit Social Security didn’t create.

However, as we’ve already seen, this Wall Street backed propaganda campaign has succeeded in convincing many on Capitol Hill that if millionaires lose even a penny of their tax cuts then the middle-class and poor must pay an even bigger price.

The question is will this massive ad blitz fool the American people into accepting massive benefit cuts with their fries?

Raising the Medicare Age is one of Washington’s Worst Ideas — Ever

And that’s saying something!

The weekend was buzzing with hints that President Obama might be open to trade a slightly higher tax rate for the wealthy for raising Medicare’s eligibility age. The New York Times’ Paul Krugman had the best summation of just how bad an idea this truly is:

First, raising the Medicare age is terrible policy. It would be terrible policy even if the Affordable Care Act were going to be there in full force for 65 and 66 year olds, because it would cost the public $2 for every dollar in federal funds saved. And in case you haven’t noticed, Republican governors are still fighting the ACA tooth and nail; if they block the Medicaid expansion, as some will, lower-income seniors will just be pitched into the abyss.

The Kaiser Family Foundation did a detailed analysis of the impact of raising the age of Medicare eligibility, taking into account the implementation of health care reform.

Seven million people age 65 or 66. 42 percent would turn to employer-sponsored plans for health insurance, either as active workers or retirees, 38 percent would enroll in the Exchange, and 20 percent would become covered under Medicare.

Two-thirds of adults ages 65 and 66 affected by the proposal are projected to pay more out-of- pocket, on average, in premiums and cost sharing under their new source of coverage than they would have paid under Medicare.

Premiums in the Exchange would rise for adults under age 65 by three percent (an additional ($141 per enrollee in 2014), on average, due to the shift of older adults from Medicare into the pool of lives covered by the Exchange.

Medicare Part B premiums would increase by three percent in 2014, as the deferred enrollment of relatively healthy, lower-cost beneficiaries would raise the average cost across remaining beneficiaries.

In addition, costs to employers are projected to increase by $4.5 billion in 2014 and costs to states are expected to increase by $0.7 billion.

Raising the age of eligibility to 67 in 2014 is projected to result in an estimated net increase of $3.7 billion in out-of-pocket costs for those ages 65 and 66 who would otherwise have been covered by Medicare.

In sum, raising Medicare’s eligibility age costs $2 for every $1 saved. Seniors, including those already in Medicare and those 65 & 66 years old who’d no longer qualify, would pay more. Businesses would pay more and states would pay more.

Sound like a good deal to you?

National Call In Day – Tell Congress No Cuts to Middle-Class Benefits

One Minute, One Call to Save Social Security, Medicare & Medicaid

The National Committee is joining advocates across the nation in a Congressional Call-In day on Wednesday, December 5th. Our goal is to flood Congress with calls reminding them that Americans of all ages and political parties do not support cutting middle-class benefits to pay for deficit reduction. Let’s shutdown the Capitol switchboard with thousands of calls delivering one simple message!

NO CUTS to Social Security, Medicare and Medicaid

The threat to Social Security, Medicare and Medicaid during this Lame Duck Congress is as serious as any time in these programs’ long and successful histories. Social Security, Medicare and Medicaid do not belong in this deficit debate and we must urge Congress to take these programs off the table.

Making your call couldn’t be easier. Just dial NCPSSM’s Legislative Hotline and you’ll be directed to your Congressional leaders from one toll-free number:

NCPSSM CONGRESSIONAL CALL IN DAY

(800) 998-0180

Send our flyer to 5 of your friends and tell them One Minute, One Call can make the difference in the fight to preserve America’s vital retirement and health security programs.

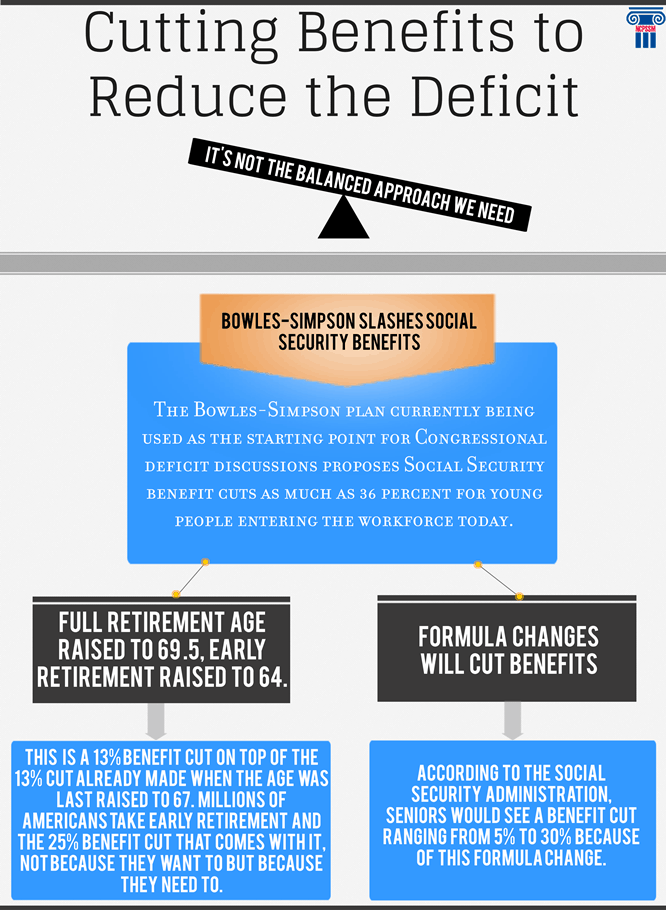

Breaking Down Plans to Cut Medicare & Social Security

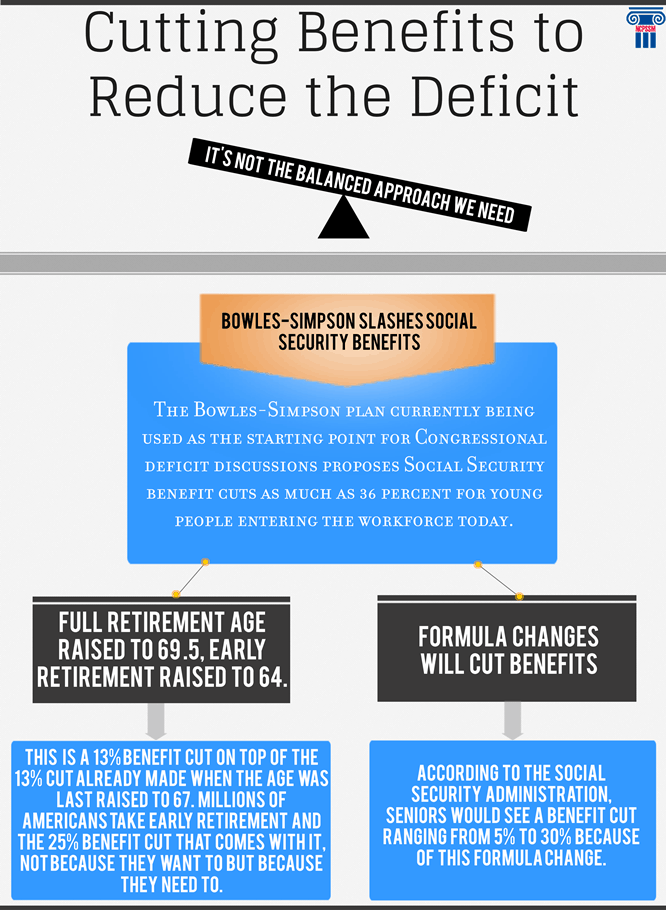

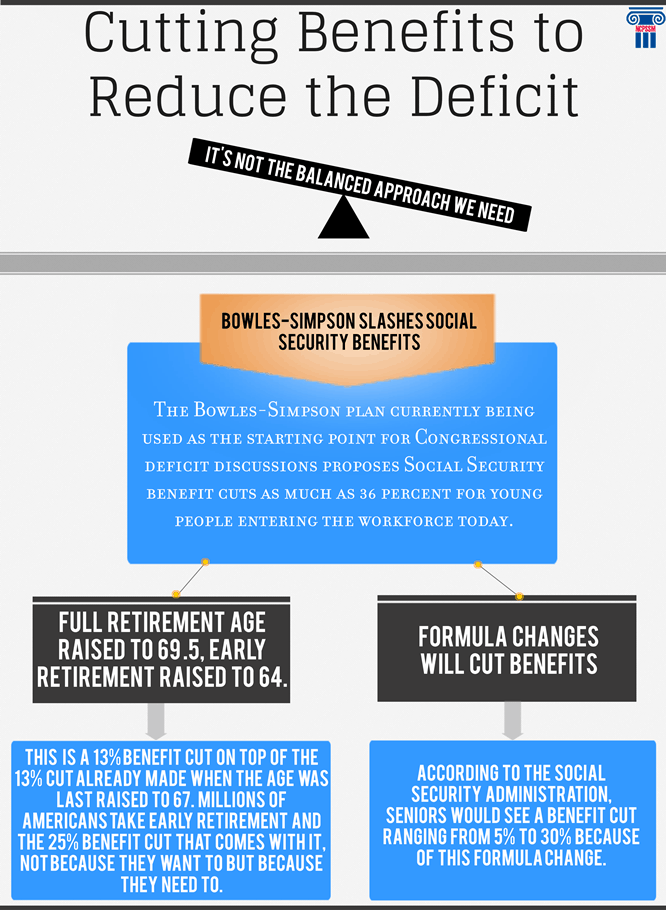

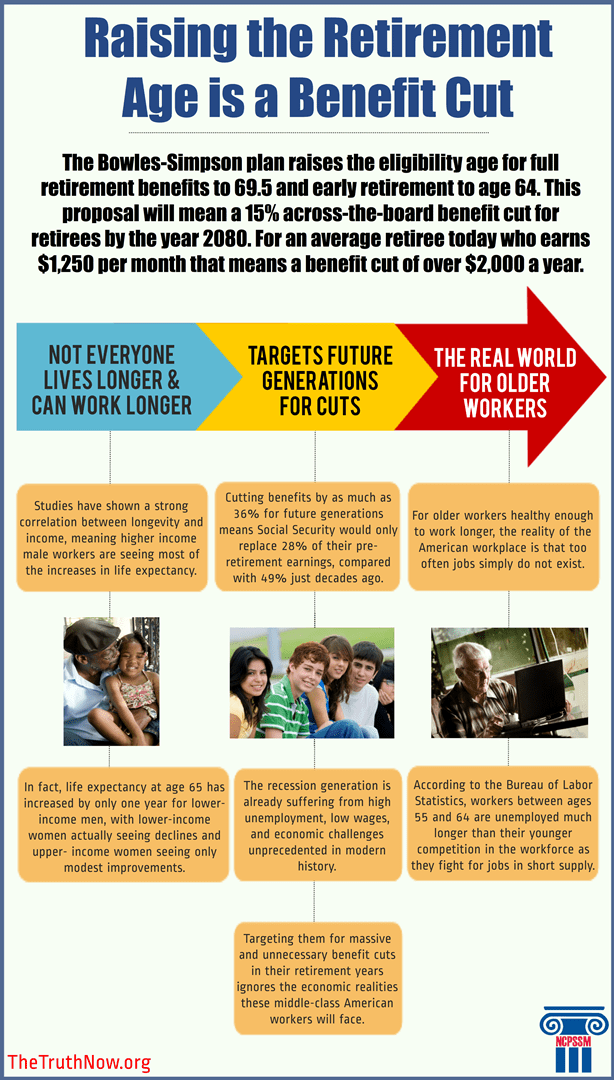

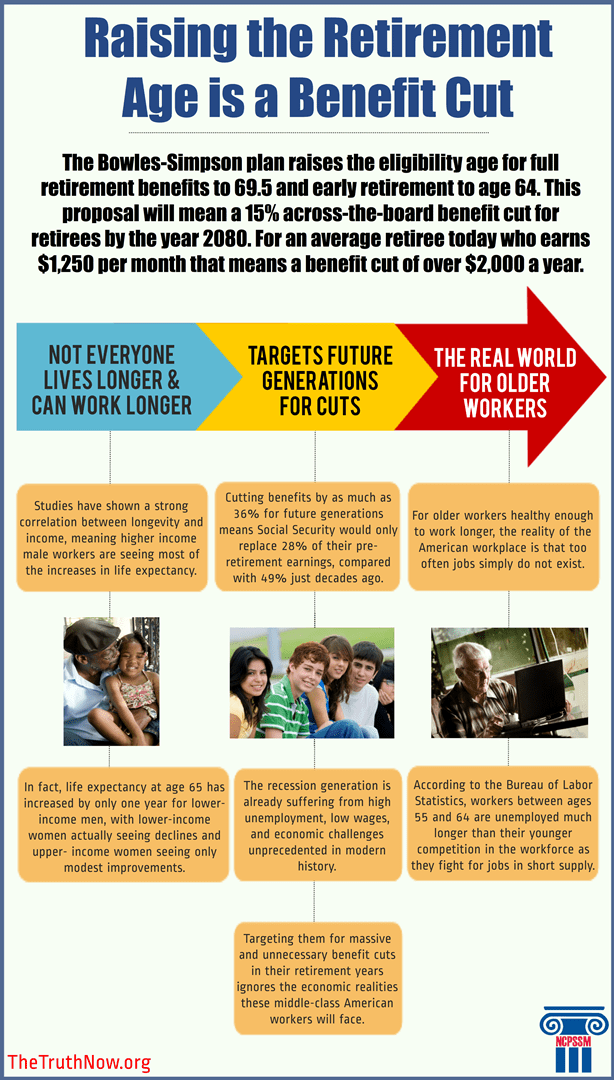

As we’ve reported here many, many times conservatives in Congress continue to demand cuts to Social Security, Medicare and Medicaid to reduce the deficit. There are a myriad of bad ideas that they’ve proposed to do this.

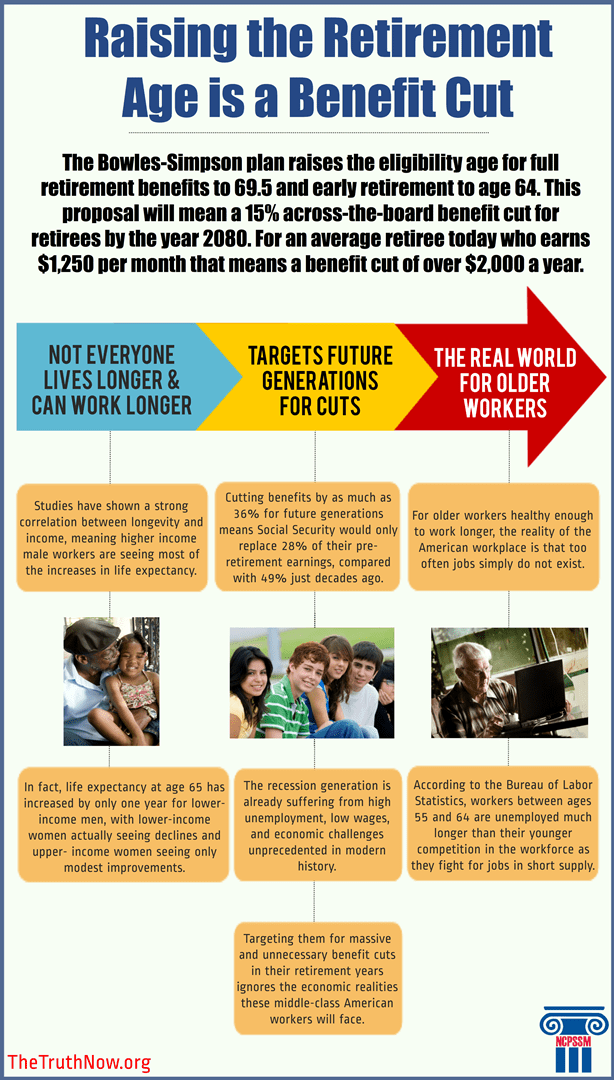

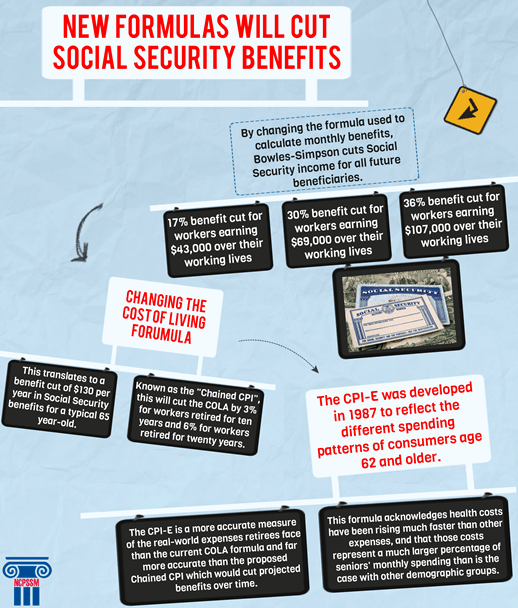

Here are some (hopefully) easy to understand infographics on some of the proposals currently being debated in closed-door Congressional deficit talks. You’ll note that many are based on the Bowles-Simpson (BS) report, which is the bible for corporate CEO’s and the well-funded fiscal hawk lobby. You can also find all of these on the National Committee’s Lame Duck website.

We’re also asking you to sign the online version of our “No Cuts” petition here. We will have more than 65,000 petitions to deliver to the Senate soon…please add your voice to the debate.

Americans Don’t Support Cutting Social Security & Medicare for Deficit Reduction: Even Wall Street-backed “Third Way” Agrees

We’ve said it before and we’ll say it again: Americans do not support cutting Social Security and Medicare to pay down the debt. This was confirmed, again, in a new poll released by Third Way, an organization backed by Wall Street which promotes cutting programs like Social Security and Medicare as the “centrist” option. Yet, they’ve chosen to bury that lead in favor of headlines that better fit its mission. Why? To convince Democratic members of Congress that voters will give them a pass if they cut these vital programs. While the Third Way polling memo headline states that voters want the President and Congress to “fix” Social Security and Medicare, you have to dig deep into their narrative to also find this line:

“voters indicate that they want these programs fixed to keep them solvent, but not pay down the debt.”

No kidding.

Unfortunately, Politico took the Third Way bait and reported that this survey was countering:

“surveys showing that Democrats don’t want lawmakers to touch entitlements, don’t view the debt and deficit as a top priority, and don’t favor Obama working with Republicans.”

The problem is…that’s just spin. It completely ignores what our poll (and several others) actually reported. For Third Way that type of “everyone else got it wrong” marketing is critical to their goal of persuading Democrats that the American people won’t punish them if Congress follows Wall Street’s economic prescription and cuts middle-class benefits in the name of deficit reduction. However, it also ignores that fact that the American people understand the difference between making reforms to improve Social Security and Medicare’s long-term solvency and cutting benefits to reduce the deficit. Using words like “fix” rather than what they really mean, benefit cuts, shows the fix was in on this polling.

We also have to wonder, if the true goal was to prove that every poll ever taken in the past two years is wrong and the American people really do support cutting middle-class benefits, where is the critical polling question that gets to the heart of the Social Security/Medicare/Deficit issue: “Do you support cutting Social Security and Medicare benefits?” If it was asked it must be among the 52 of 81 questions which haven’t been released in this Third Way poll. Any bets as to why?

Let’s be really clear about what our NCPSSM/Lake Research poll showed. It showed Americans, of all ages and political parties, do not support cutting Social Security and Medicare as part of this deficit debate:

- Voters strongly oppose cutting Social Security benefits with 71% opposed to means-testing and 67% opposed to raising the retirement age

- 64% strongly oppose cutting Medicare benefits for future retirees and 59% oppose cutting payments to Medicare providers want voters support two Social Security and Medicare reforms by overwhelming margins:

Our poll also shows Americans support two Medicare and Social Security reforms by wide margins:

-

On Social Security, voters across party lines support lifting the cap on wages above the current level of $110,100. We know from focus groups that voters see this cap as an unfair loophole that they did not even know existed. Sixty-five (65) percent of voters favor gradually lifting this cap for both employees and employers, including 75 percent of Democrats, 63 percent of Independents, and 54 percent of Republicans.

-

On Medicare, overwhelming bi-partisan majorities support allowing Medicare to negotiate with drug companies to bring down the cost of prescription drugs. Eighty-six (86) percent of voters favor this, including 77 percent who strongly favor it. By party, 91 percent of Democrats favor allowing Medicare to negotiate with drug companies (81 percent strongly favor), as do 85 percent of Independents (75 percent strongly favor), and 81 percent of Republicans (75 percent strongly favor).

Lastly, our poll shows that 85% of those surveyed say Social Security and Medicare were important factors in casting their 2012 vote.

Ultimately, that is what makes Washington’s fiscal hawks and Wall Street backed groups like the Third Way nervous. Because even their own polls, no matter how they’re twisted and spun, show the American people do not support cutting Social Security and Medicare as part of this deficit debate.