Medicaid: The Forgotten Issue – Huffington Post

By Max Richtman

President and CEO, National Committee to Preserve Social Security and Medicare

10/22/12

Originally posted on Huffington Post

As we enter the final weeks of the 2012 campaign season, middle-class Americans are finally getting a glimpse of just how devastating Mitt Romney and Paul Ryan’s radical plans for Medicare and Social Security would be for generations of seniors and their families. In spite of repeated attempts to deflect attention from their proposals to cut benefits and privatize these programs, it’s clear that the more voters find out about the Romney/Ryan plan the less they like it. Unfortunately, Medicaid is not yet on the radar screen for most Americans. They don’t realize that the Romney/Ryan plan for the 62 million Americans helped by the Medicaid program is just as destructive.

No political candidate should get a pass on a plan that fundamentally changes the Medicaid program by shifting responsibility to states through block-grants while cutting $810 billion in federal funding during the first decade alone, with even more cuts to follow. When Chairman Ryan included a similar Medicaid block-grant proposal in his budget last year, the Kaiser Family Foundation and Urban Institute estimated it would lead states to drop between 14 million and 27 million people from Medicaid by 2021. An additional 13 million people would also lose Medicaid benefits because of the repeal of health care reform promised by Governor Romney.

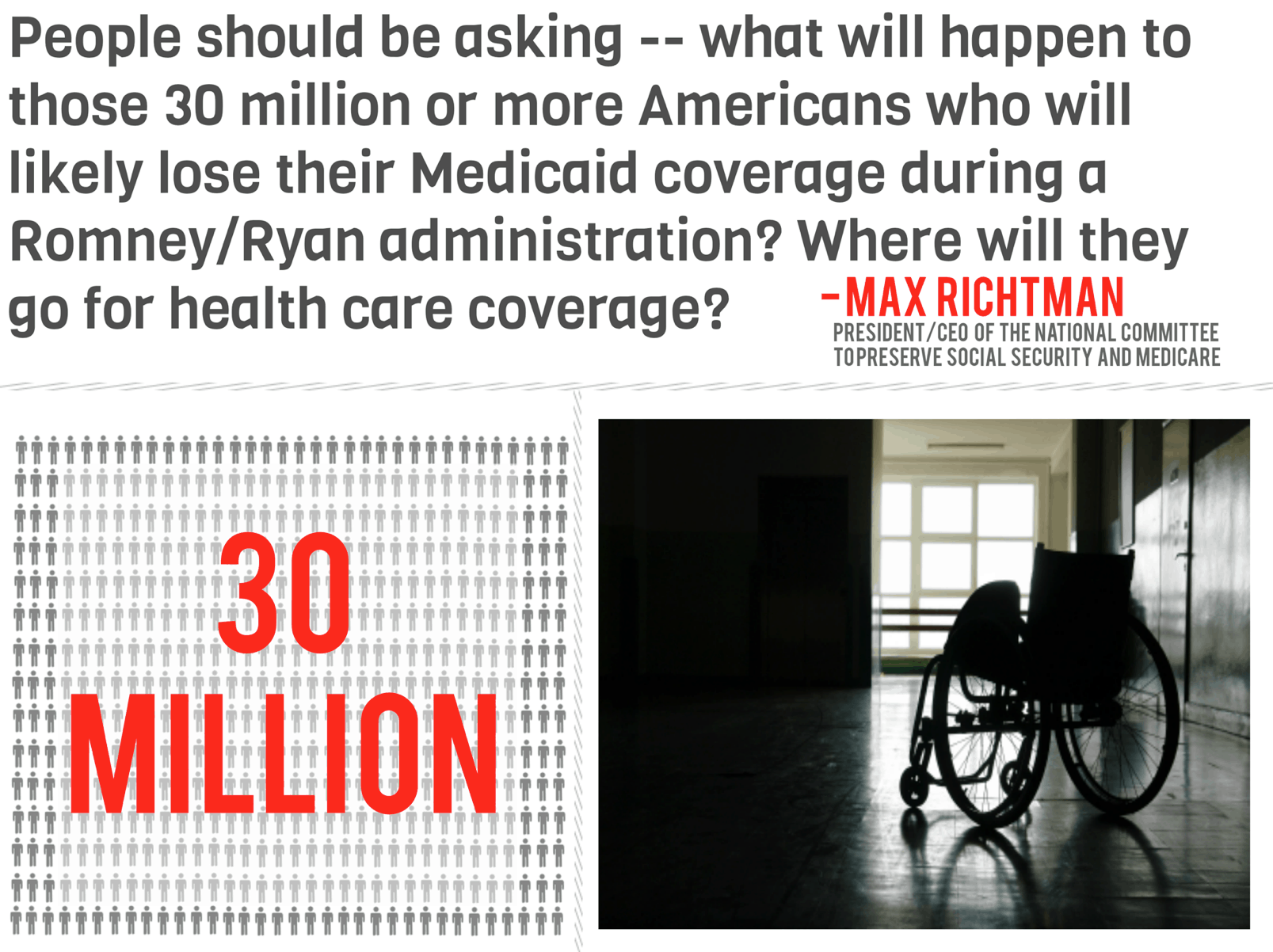

Many Americans don’t realize that the largest component of Medicaid is long-term care for America’s elderly followed by the disabled. People should be asking — what will happen to those 30 million or more Americans who will likely lose their Medicaid coverage during a Romney/Ryan administration? Where will they go for health care coverage? As is often the case, there are no answers to these critical questions because so few people even know to ask them.

The Romney/Ryan block-grant strategy is especially problematic for people who need nursing home level of care. The average annual nursing home cost is prohibitively expensive — over $75,000 for a semi-private room. No matter how hard they save for retirement, most middle-class families simply cannot afford the staggering costs of 24-hour skilled care and are forced to seek help from Medicaid. However, according to the Center for Medicare Advocacy, all too many nursing homes residents could lose their Medicaid coverage under the proposed Romney/Ryan plan.

States will also be able to change their Medicaid financial and eligibility rules, making residents and their relatives legally responsible for paying for a greater portion of nursing home expenses. To recover Medicaid costs, states could place a lien on the resident’s property even if the resident’s spouse or children continue to live in the home.

Likewise, the clock could be turned back on spousal impoverishment rules. Currently, nursing home residents’ spouses are allowed to retain some of their assets and income to live in their own homes and communities. However, if the law changes, spouses could be required to contribute even more of their income forcing many who are living on the edge into certain poverty. Americans already contribute $450 billion in uncompensated care with many being forced to quit their jobs and tap into their own retirement funds to help care for a family member. Passing along even more costs to cash-strapped families does not make sense for our nation.

As our nation’s population ages, we should be looking for ways to improve critical health care programs like Medicaid to protect our hardworking families. Medicaid is more efficient than private insurance (96 percent of funding goes directly to coverage) and provides a lifeline to young and old who are among the sickest, and most in need. The future of this program deserves close scrutiny during this election season and it is up to voters to ask the questions and demand straightforward answers.

Follow Max Richtman on Twitter: www.twitter.com/maxrichtman

Remembering George McGovern – Social Security & Medicare Champion

He also provided sound advice for Democrats toying with the idea of cutting those benefits away in a so-called “Grand Bargain” with Republicans who refuse to even talk about raising revenue. If only more lawmakers would take a page from George McGovern’s Social Security and Medicare playbook.

2013 Cola Demonstrates Why Proposed Social Security “Tweaks” Are Actually Benefit Cuts for Millions

“Seniors know all too well, their living costs often far outpace the COLA increase, yet incredibly many politicians are proposing a new formula that will erode this inflation protection even more. While they try to minimize this backdoor benefit cut, the truth is replacing the current COLA formula with the chained CPI will mean the typical 65 year-old, who filed for benefits at 62, would lose about $130 per year in benefits. By the time that senior reaches 95, the annual benefit cut will be almost $1,400, which is a 9.2 percent cut.

Given that the average senior currently receives just over $14,000 a year in Social Security, it’s hard to imagine how anyone can argue the current COLA is too generous. Yet this is exactly what is being proposed in closed door meetings on Capitol Hill and on the campaign trail nationwide. I’ve asked seniors at town hall meetings nationwide how many think the COLA is too large — laughter is always the response. Contrary to claims by those who hope to use Social Security benefits cuts as a bargaining chip in debt discussions, the Social Security COLA is clearly not too generous. Today’s announcement is even more proof of that fact.”…Max Richtman, President/CEO

The National Committee believes we should move to a COLA formula that takes a more accurate measure of seniors’ expenses, which is the CPI-E. It was developed in 1982 to reflect the different spending patterns of consumers age 62 and older. The CPI-E has reflected a rate 0.3 percentage points higher than inflation as measured under the current method.

The National Committee agrees it is critical that the COLA be calculated based on an accurate formula. But if accuracy is really the goal, Congress should adopt the CPI-E which factors in the large health care expenses most seniors face. Adopting a formula that cuts already modest benefits for generations of retirees, as does the proposed chained CPI, would be devastating for millions of middle-class Americans who can not afford this back-door benefit cut of $1,400 a year.

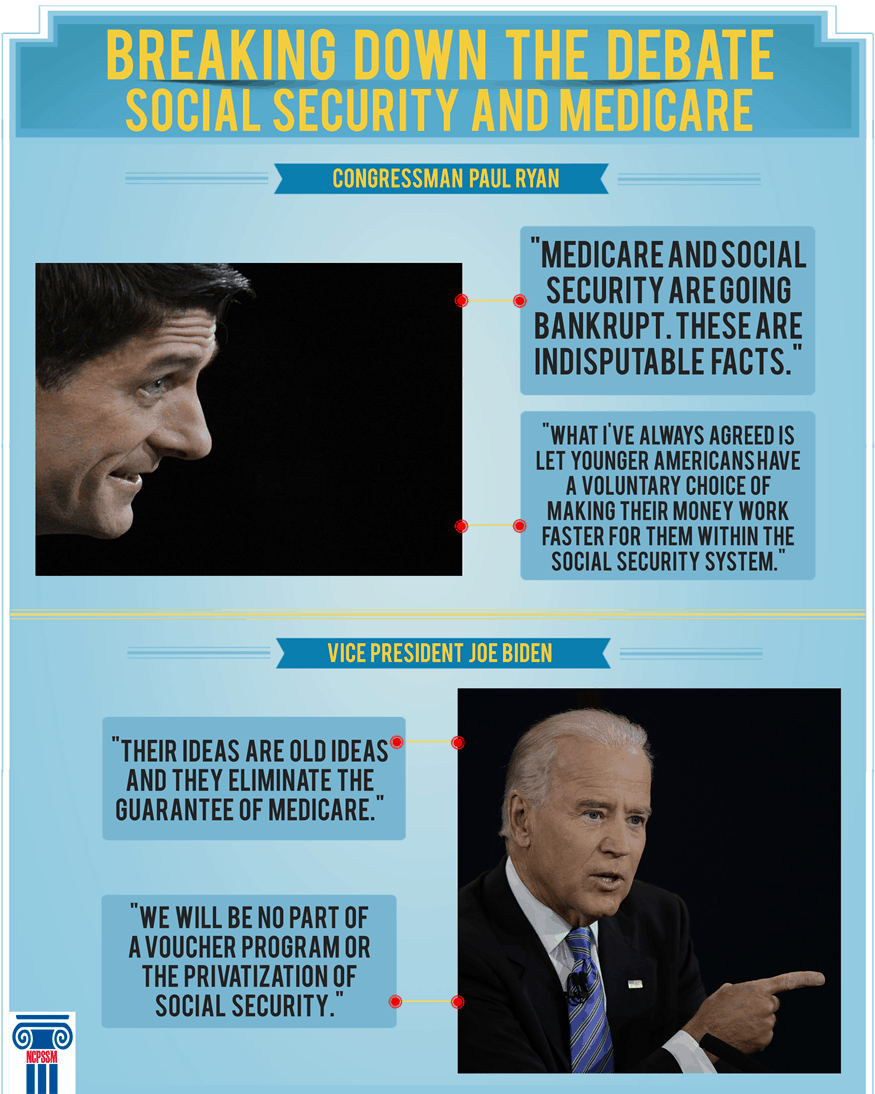

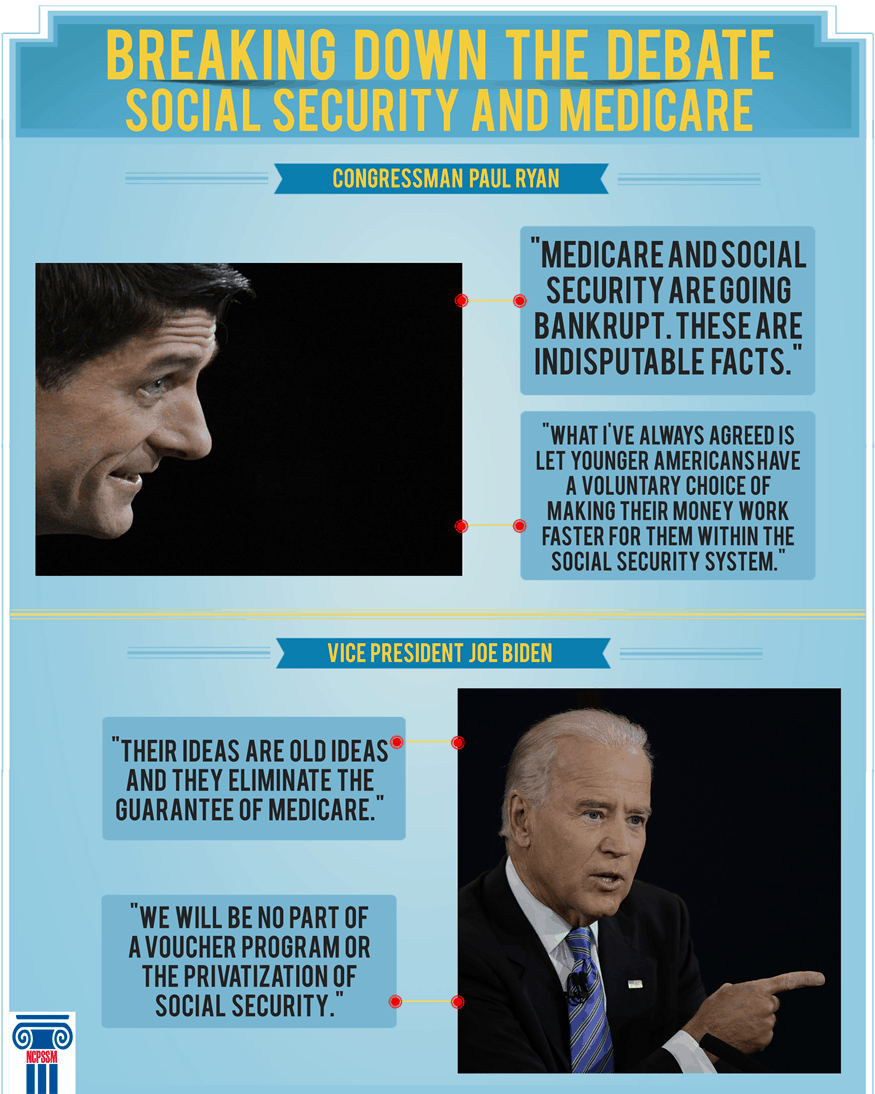

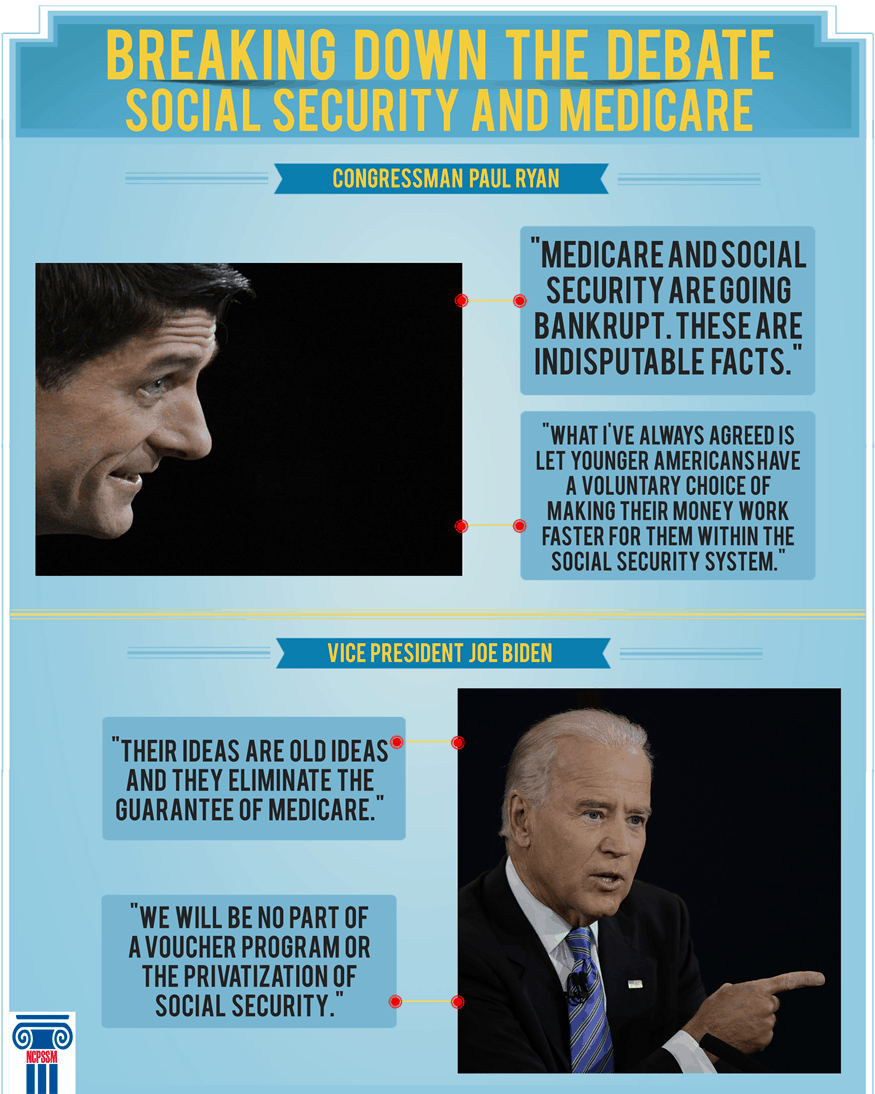

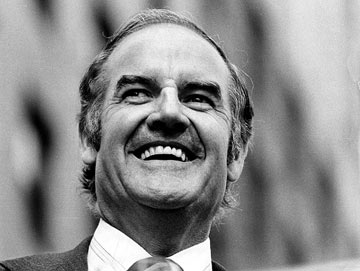

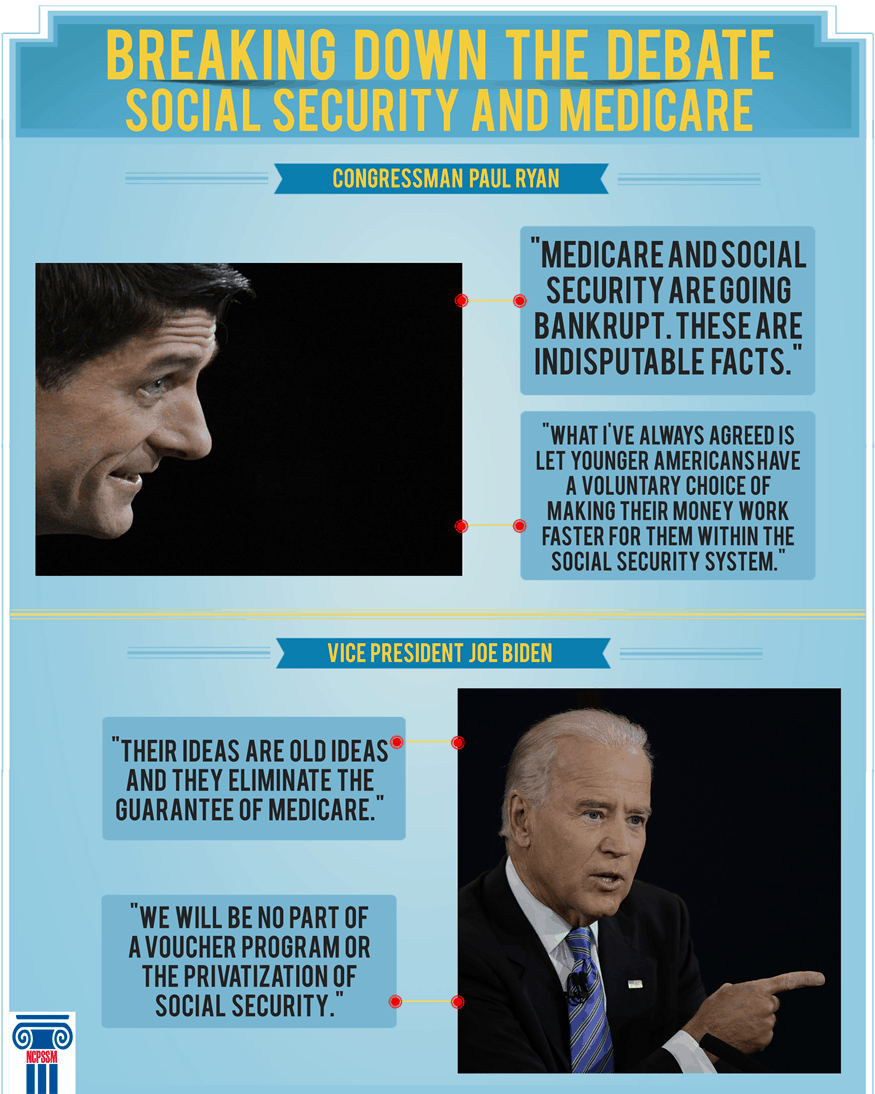

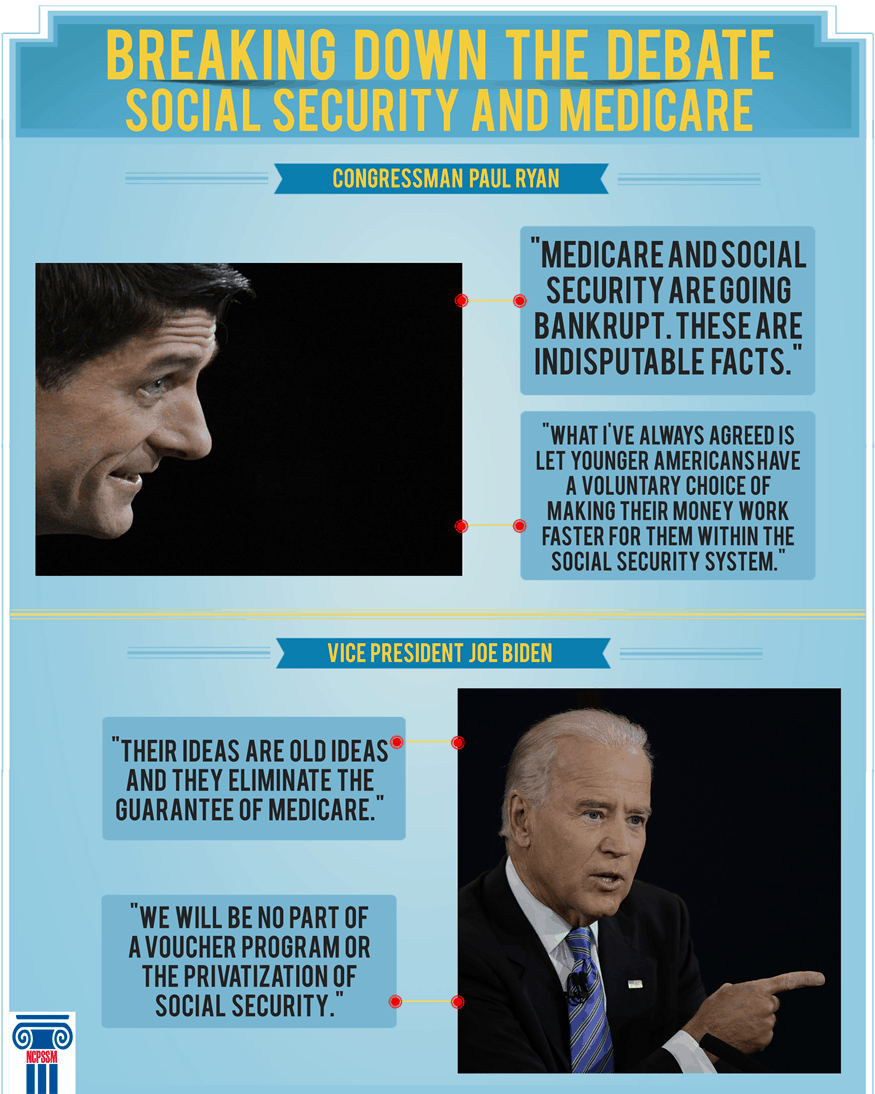

VP Debate Wrap Up: The Good, The Bad, and the Flat-Out Wrong

Rather than relive every minute of last night’s debate, we’ve decided to give you a collection of the best of the best Social Security and Medicare debate analysis, from a variety of sources. First, from NCPSSM’s President/CEO, Max Richtman:

“Finally, the American people were allowed a glimpse into what our Presidential tickets, represented by their Vice Presidential candidates in last night’s debate, have in mind for Social Security and Medicare. Their differences couldn’t be starker. However, what wasn’t said last night is the indisputable fact that Social Security is not in crisis, it’s not broke and it’s not bankrupt. The moderator’s incorrect premise followed by the candidates’ validating responses ignored the demonstrable facts that must be the starting point for any Social Security discussion. Social Security has $2.7 trillion in its trust fund; it will pay full benefits until 2033 and 75% of full benefits after that. By no definition can that be considered bankrupt or in crisis.

When it comes to Medicare, the differences have been laid out clearly—and Joe Biden is right. The Romney/Ryan “CouponCare” plan eliminates the guarantee of Medicare and takes us back to the days when seniors were at the mercy of private insurance companies for their health care. Seniors will pay more for less and while Rep. Ryan makes claims of increased choice, his privatized Medicare plan will actually make it much harder for seniors to choose their own doctor.

But with just two more debates and a few weeks until Election Day there’s only a short time left for candidates to finally ditch the political propaganda and mistruths and start giving it to us straight. The American people deserve the truth about Social Security and Medicare proposals which will impact the lives of millions of middle-class families for generations.” … Max Richtman, President/CEO, National Committee to Preserve Social Security and Medicare

Think Progress and Dean Baker at CEPR also picked up on how one really terrible question helped Paul Ryan mislead viewers :

“RADDATZ: Let’s talk about Medicare and entitlements. Both Medicare and Social Security are going broke and taking a larger share of the budget in the process. Will benefits for Americans under these programs have to change for the programs to survive? Mr. Ryan.

RYAN: Absolutely. Medicare and Social Security are going bankrupt. These are indisputable facts.

The media consistently fuel the misconception that Social Security is bankrupt or going broke, whipping itself into a frenzy of doomsday scenarios and asking politicians when they will deal with this supposedly grave threat to the U.S. budget. However, Social Security can pay full benefits until 2037, and nearly full benefits for years after that, even if literally nothing is done to change the program. Reporters would surely be shocked if infrastructure projects, child nutrition programs, or any other federal effort were fully funded for more than two decades, but no credit is given to lawmakers for achieving just that with Social Security.” Think Progress, October 12, 2012

“Polls consistently show that a majority of young people believe that they stand to get nothing back from Social Security when they retire. That is of course not true unless Congress were to vote to eliminate the program. Under the latest projections they would stand to get a larger benefit than current retirees even if nothing is ever done to change the program’s finances. It is unlikely that listeners would understand this to be the case based on Raddatz’s comment.

It is also unlikely that viewers would have realized that the changes put in place by the Affordable Care Act extended the date when Medicare is first projected to face a shortfall from 2016 to 2024 and reduced the projected shortfall over the program’s 75-year planning period by more than two thirds. The remaining gap could be filled by a tax increase that is less than 2 percent of projected wage growth over the next 30 years.” Beat the Press

Lastly, AFL-CIO Now describes the Romney/Ryan plan for Social Security and Medicare in frightening clear (and completely true) terms:

Last night, we learned vice presidential contender Rep. Paul Ryan (R-Wis.) and running mate Mitt Romney envision a pretty bleak future for working people. The Romney-Ryan future is one where seniors (part of the 47%) toil until age 70 when they can collect on a woefully inadequate privatized Social Security account—where people must wait until age 67 to receive a coupon (a.k.a. Medicare voucher) for health care. A future where millionaires and billionaires, the richest 2%, continue to receive massive tax cut giveaways at the expense of working people.

Besides Ryan’s support for partial Social Security privatization, we also learned Romney wants to raise the retirement age to 70 and cut Social Security benefits for middle-income workers using the progressive price indexing formula change, which is code for: cutting benefits. According to the Social Security chief actuary, a medium income earner, someone who made $43,000 in 2010, would see substantial benefit cuts under Romney’s plan. For a person retiring in 2030, the cut is $2,396. For a person retiring in 2050, the cut is $4,730.

The choices for middle-class seniors and their families couldn’t be clearer.

If You Can’t Cut Benefits: Cutting the Agency that Distributes Them Is the Next Best Thing

The latest news is that beginning on November 19th, the SSA will close field offices 30 minutes earlier. And starting in January, field offices will close at noon on Wednesdays. This is in addition to the 30 minute cut in operating hours announced just last year. In addition, the mailings of annual statements—which are the SSA’s most effective form of communication sent directly to beneficiaries about their earnings and benefits– will be cut off completely effective October 1st. It’s now up to each beneficiary to go to the SSA’s website to get that information.

Michael Hiltzik at the Los Angeles Times correctly points out the problem with that strategy:

But is that an adequate substitute? No way. For one thing, you have to know that your statement is available via the Internet, you have to know where to find it, and you have to be able to navigate a registration procedure that is not all that user-friendly — especially for someone not familiar with navigating the Web, and double-especially for someone without easy access to a computer. Despite a claim that we all live in the digital world today, those are not small groups.

Importantly, the Social Security Administration has made no discernible effort to proactively advise Americans that the paper statements are a thing of the past. In other words, what was once its most effective outreach to millions of people has disappeared without a trace, or a single word of warning.

Social Security says that if you have problems accessing the online service, you can get help at a Social Security office. Of course, those offices, which used to be open until 4 p.m., are now open only till 3:30. Starting in mid-November, they’ll only be open till 3. And starting Jan. 2, they’ll be closing at noon Wednesdays.

“There’s already an enormous amount of unhappiness for people who walk to their Social Security office and find a sign saying, ‘We closed at 3:30,'” says Webster Phillips, a former Social Security associate commissioner who now works with the National Committee to Preserve Social Security and Medicare.

Shorter hours, shrinking budgets to manage more beneficiaries, and limited communication with that growing constituency—this is not sound policy. But for conservatives who’ve long promised to allow middle-class programs to “wither on the vine” or shrink small enough “to drown in a bathtub” it is politics as usual. Unfortunately, generations of Americans will ultimately pay the price.

Medicaid: The Forgotten Issue – Huffington Post

By Max Richtman

President and CEO, National Committee to Preserve Social Security and Medicare

10/22/12

Originally posted on Huffington Post

As we enter the final weeks of the 2012 campaign season, middle-class Americans are finally getting a glimpse of just how devastating Mitt Romney and Paul Ryan’s radical plans for Medicare and Social Security would be for generations of seniors and their families. In spite of repeated attempts to deflect attention from their proposals to cut benefits and privatize these programs, it’s clear that the more voters find out about the Romney/Ryan plan the less they like it. Unfortunately, Medicaid is not yet on the radar screen for most Americans. They don’t realize that the Romney/Ryan plan for the 62 million Americans helped by the Medicaid program is just as destructive.

No political candidate should get a pass on a plan that fundamentally changes the Medicaid program by shifting responsibility to states through block-grants while cutting $810 billion in federal funding during the first decade alone, with even more cuts to follow. When Chairman Ryan included a similar Medicaid block-grant proposal in his budget last year, the Kaiser Family Foundation and Urban Institute estimated it would lead states to drop between 14 million and 27 million people from Medicaid by 2021. An additional 13 million people would also lose Medicaid benefits because of the repeal of health care reform promised by Governor Romney.

Many Americans don’t realize that the largest component of Medicaid is long-term care for America’s elderly followed by the disabled. People should be asking — what will happen to those 30 million or more Americans who will likely lose their Medicaid coverage during a Romney/Ryan administration? Where will they go for health care coverage? As is often the case, there are no answers to these critical questions because so few people even know to ask them.

The Romney/Ryan block-grant strategy is especially problematic for people who need nursing home level of care. The average annual nursing home cost is prohibitively expensive — over $75,000 for a semi-private room. No matter how hard they save for retirement, most middle-class families simply cannot afford the staggering costs of 24-hour skilled care and are forced to seek help from Medicaid. However, according to the Center for Medicare Advocacy, all too many nursing homes residents could lose their Medicaid coverage under the proposed Romney/Ryan plan.

States will also be able to change their Medicaid financial and eligibility rules, making residents and their relatives legally responsible for paying for a greater portion of nursing home expenses. To recover Medicaid costs, states could place a lien on the resident’s property even if the resident’s spouse or children continue to live in the home.

Likewise, the clock could be turned back on spousal impoverishment rules. Currently, nursing home residents’ spouses are allowed to retain some of their assets and income to live in their own homes and communities. However, if the law changes, spouses could be required to contribute even more of their income forcing many who are living on the edge into certain poverty. Americans already contribute $450 billion in uncompensated care with many being forced to quit their jobs and tap into their own retirement funds to help care for a family member. Passing along even more costs to cash-strapped families does not make sense for our nation.

As our nation’s population ages, we should be looking for ways to improve critical health care programs like Medicaid to protect our hardworking families. Medicaid is more efficient than private insurance (96 percent of funding goes directly to coverage) and provides a lifeline to young and old who are among the sickest, and most in need. The future of this program deserves close scrutiny during this election season and it is up to voters to ask the questions and demand straightforward answers.

Follow Max Richtman on Twitter: www.twitter.com/maxrichtman

Remembering George McGovern – Social Security & Medicare Champion

He also provided sound advice for Democrats toying with the idea of cutting those benefits away in a so-called “Grand Bargain” with Republicans who refuse to even talk about raising revenue. If only more lawmakers would take a page from George McGovern’s Social Security and Medicare playbook.

2013 Cola Demonstrates Why Proposed Social Security “Tweaks” Are Actually Benefit Cuts for Millions

“Seniors know all too well, their living costs often far outpace the COLA increase, yet incredibly many politicians are proposing a new formula that will erode this inflation protection even more. While they try to minimize this backdoor benefit cut, the truth is replacing the current COLA formula with the chained CPI will mean the typical 65 year-old, who filed for benefits at 62, would lose about $130 per year in benefits. By the time that senior reaches 95, the annual benefit cut will be almost $1,400, which is a 9.2 percent cut.

Given that the average senior currently receives just over $14,000 a year in Social Security, it’s hard to imagine how anyone can argue the current COLA is too generous. Yet this is exactly what is being proposed in closed door meetings on Capitol Hill and on the campaign trail nationwide. I’ve asked seniors at town hall meetings nationwide how many think the COLA is too large — laughter is always the response. Contrary to claims by those who hope to use Social Security benefits cuts as a bargaining chip in debt discussions, the Social Security COLA is clearly not too generous. Today’s announcement is even more proof of that fact.”…Max Richtman, President/CEO

The National Committee believes we should move to a COLA formula that takes a more accurate measure of seniors’ expenses, which is the CPI-E. It was developed in 1982 to reflect the different spending patterns of consumers age 62 and older. The CPI-E has reflected a rate 0.3 percentage points higher than inflation as measured under the current method.

The National Committee agrees it is critical that the COLA be calculated based on an accurate formula. But if accuracy is really the goal, Congress should adopt the CPI-E which factors in the large health care expenses most seniors face. Adopting a formula that cuts already modest benefits for generations of retirees, as does the proposed chained CPI, would be devastating for millions of middle-class Americans who can not afford this back-door benefit cut of $1,400 a year.

VP Debate Wrap Up: The Good, The Bad, and the Flat-Out Wrong

Rather than relive every minute of last night’s debate, we’ve decided to give you a collection of the best of the best Social Security and Medicare debate analysis, from a variety of sources. First, from NCPSSM’s President/CEO, Max Richtman:

“Finally, the American people were allowed a glimpse into what our Presidential tickets, represented by their Vice Presidential candidates in last night’s debate, have in mind for Social Security and Medicare. Their differences couldn’t be starker. However, what wasn’t said last night is the indisputable fact that Social Security is not in crisis, it’s not broke and it’s not bankrupt. The moderator’s incorrect premise followed by the candidates’ validating responses ignored the demonstrable facts that must be the starting point for any Social Security discussion. Social Security has $2.7 trillion in its trust fund; it will pay full benefits until 2033 and 75% of full benefits after that. By no definition can that be considered bankrupt or in crisis.

When it comes to Medicare, the differences have been laid out clearly—and Joe Biden is right. The Romney/Ryan “CouponCare” plan eliminates the guarantee of Medicare and takes us back to the days when seniors were at the mercy of private insurance companies for their health care. Seniors will pay more for less and while Rep. Ryan makes claims of increased choice, his privatized Medicare plan will actually make it much harder for seniors to choose their own doctor.

But with just two more debates and a few weeks until Election Day there’s only a short time left for candidates to finally ditch the political propaganda and mistruths and start giving it to us straight. The American people deserve the truth about Social Security and Medicare proposals which will impact the lives of millions of middle-class families for generations.” … Max Richtman, President/CEO, National Committee to Preserve Social Security and Medicare

Think Progress and Dean Baker at CEPR also picked up on how one really terrible question helped Paul Ryan mislead viewers :

“RADDATZ: Let’s talk about Medicare and entitlements. Both Medicare and Social Security are going broke and taking a larger share of the budget in the process. Will benefits for Americans under these programs have to change for the programs to survive? Mr. Ryan.

RYAN: Absolutely. Medicare and Social Security are going bankrupt. These are indisputable facts.

The media consistently fuel the misconception that Social Security is bankrupt or going broke, whipping itself into a frenzy of doomsday scenarios and asking politicians when they will deal with this supposedly grave threat to the U.S. budget. However, Social Security can pay full benefits until 2037, and nearly full benefits for years after that, even if literally nothing is done to change the program. Reporters would surely be shocked if infrastructure projects, child nutrition programs, or any other federal effort were fully funded for more than two decades, but no credit is given to lawmakers for achieving just that with Social Security.” Think Progress, October 12, 2012

“Polls consistently show that a majority of young people believe that they stand to get nothing back from Social Security when they retire. That is of course not true unless Congress were to vote to eliminate the program. Under the latest projections they would stand to get a larger benefit than current retirees even if nothing is ever done to change the program’s finances. It is unlikely that listeners would understand this to be the case based on Raddatz’s comment.

It is also unlikely that viewers would have realized that the changes put in place by the Affordable Care Act extended the date when Medicare is first projected to face a shortfall from 2016 to 2024 and reduced the projected shortfall over the program’s 75-year planning period by more than two thirds. The remaining gap could be filled by a tax increase that is less than 2 percent of projected wage growth over the next 30 years.” Beat the Press

Lastly, AFL-CIO Now describes the Romney/Ryan plan for Social Security and Medicare in frightening clear (and completely true) terms:

Last night, we learned vice presidential contender Rep. Paul Ryan (R-Wis.) and running mate Mitt Romney envision a pretty bleak future for working people. The Romney-Ryan future is one where seniors (part of the 47%) toil until age 70 when they can collect on a woefully inadequate privatized Social Security account—where people must wait until age 67 to receive a coupon (a.k.a. Medicare voucher) for health care. A future where millionaires and billionaires, the richest 2%, continue to receive massive tax cut giveaways at the expense of working people.

Besides Ryan’s support for partial Social Security privatization, we also learned Romney wants to raise the retirement age to 70 and cut Social Security benefits for middle-income workers using the progressive price indexing formula change, which is code for: cutting benefits. According to the Social Security chief actuary, a medium income earner, someone who made $43,000 in 2010, would see substantial benefit cuts under Romney’s plan. For a person retiring in 2030, the cut is $2,396. For a person retiring in 2050, the cut is $4,730.

The choices for middle-class seniors and their families couldn’t be clearer.

If You Can’t Cut Benefits: Cutting the Agency that Distributes Them Is the Next Best Thing

The latest news is that beginning on November 19th, the SSA will close field offices 30 minutes earlier. And starting in January, field offices will close at noon on Wednesdays. This is in addition to the 30 minute cut in operating hours announced just last year. In addition, the mailings of annual statements—which are the SSA’s most effective form of communication sent directly to beneficiaries about their earnings and benefits– will be cut off completely effective October 1st. It’s now up to each beneficiary to go to the SSA’s website to get that information.

Michael Hiltzik at the Los Angeles Times correctly points out the problem with that strategy:

But is that an adequate substitute? No way. For one thing, you have to know that your statement is available via the Internet, you have to know where to find it, and you have to be able to navigate a registration procedure that is not all that user-friendly — especially for someone not familiar with navigating the Web, and double-especially for someone without easy access to a computer. Despite a claim that we all live in the digital world today, those are not small groups.

Importantly, the Social Security Administration has made no discernible effort to proactively advise Americans that the paper statements are a thing of the past. In other words, what was once its most effective outreach to millions of people has disappeared without a trace, or a single word of warning.

Social Security says that if you have problems accessing the online service, you can get help at a Social Security office. Of course, those offices, which used to be open until 4 p.m., are now open only till 3:30. Starting in mid-November, they’ll only be open till 3. And starting Jan. 2, they’ll be closing at noon Wednesdays.

“There’s already an enormous amount of unhappiness for people who walk to their Social Security office and find a sign saying, ‘We closed at 3:30,'” says Webster Phillips, a former Social Security associate commissioner who now works with the National Committee to Preserve Social Security and Medicare.

Shorter hours, shrinking budgets to manage more beneficiaries, and limited communication with that growing constituency—this is not sound policy. But for conservatives who’ve long promised to allow middle-class programs to “wither on the vine” or shrink small enough “to drown in a bathtub” it is politics as usual. Unfortunately, generations of Americans will ultimately pay the price.