Paul Ryan’s Medicare Privatization Scheme Edging Closer to Reality

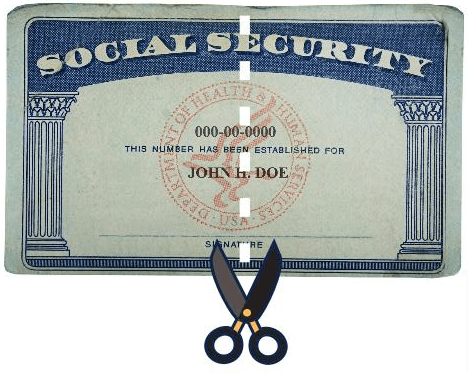

Paul Ryan’s dystopian dream of privatizing Medicare may soon come true. At least he seems to think so. In an interview with right-wing Wisconsin radio host Vicki McKenna, the House Speaker said that Medicare “reform” is coming to the Capitol this Spring. “I’m pretty sure the budget committee in the House will pass that on in the House Republican budget,” Ryan said. In fact, House Budget Committee Chair Diane Black (R-TN) has already promised to include Medicare privatization in the budget resolution next month. This is scary news for millions of current and future retirees.

To justify his Scrooge-like assault on Medicare, Ryan continues to perpetuate the myth that Medicare is an “entitlement.” In fact, it is a remarkably efficient social insurance program. Having paid into it their entire working lives, Americans are counting on having affordable health care coverage to protect them upon retirement. Why does Paul Ryan want to take that away, effectively reneging on the nation’s commitment to current and future retirees?

In the past, President Obama stood as an impenetrable barrier between Ryan and his privatization scheme. Though candidate Trump promised “not to touch” Medicare, the President has already broken that pledge by supporting the GOP healthcare plan, which shortens the solvency of the program. Despite Trump’s campaign promises, his budget director refused to publicly discourage Congress from privatizing Medicare. In fact, Speaker Ryan said in his radio interview that he and the Trump administration are having “an ongoing conversation” about it. Current and future retirees clearly cannot trust this White House to protect their Medicare benefits, which they have paid for during their entire working lives.

As we discussed on our “Behind the Headlines” Facebook Live broadcast Thursday, here is what Ryan’s insidious “reform” would do: Instead of receiving guaranteed benefits, all Medicare participants would be given vouchers to help pay premiums for traditional Medicare or private health insurance. In either case, the vouchers would not be able to keep up with rising health care costs, leaving seniors to cover the difference out of their own pockets. That’s why we call the voucher program “coupon care.”

Ryan’s plan would likely drive healthier, younger and wealthier seniors toward private insurance. Poorer and sicker seniors would remain in traditional Medicare, driving up costs until the program collapsed under its own weight. But that’s not all. Ryan also wants to hike the Medicare eligibility age from 65 to 67. This in itself is a massive benefit cut, as 65 and 66 year olds would have to buy private insurance on their own dime. Those who couldn’t afford it might go without health insurance entirely. In a recent National Committee poll, 65% of likely voters opposed raising the eligibility age. Among younger voters, the opposition was even stronger.

As Ryan predicts, Medicare privatization will likely pass the House as part of the Republican budget resolution. Its future in the Senate is less certain, but too close for comfort. Senate Republican leaders need only 50 votes to wreck Medicare. The National Committee is building a “firewall” of moderate GOP Senators who we believe can be convinced to protect Medicare. With an unpredictable President in the White House, that is the best way – along with vocal grassroots activism – to defend current and future retirees against the destruction of a program that has worked effectively for more than 50 years, and enjoys enduring public support.

***************************************

Subscribe for free to this blog today to stay informed about your health and retirement security!

The Best Mother’s Day Gift of All: Retirement Security

Let’s add something to the gift list for mom this Mother’s Day along with flowers and candy: financial security in retirement. Our nation’s mothers – indeed, all American women – are at greater risk of financial insecurity in their senior years than fathers (and other men). For myriad reasons, the women in our lives are less able to save for retirement than men, and their Social Security benefits are typically lower. At the same time, nearly half of elderly unmarried women rely on Social Security for 90% of their income. Working women who take time off to care for loved ones pay an especially steep price, losing an average $324,000 in wages and retirement benefits over their lifetimes.

As we discussed on Facebook Live from Capitol Hill on Thursday, the major factors contributing to women’s poorer retirement status include:

*Pay inequity, which means women can’t save as much as men during their working lives. (Women working full-time still earn only about 78 cents annually for every dollar earned by men doing the same job.)

*Loss of wages during time spent caring for children, parents and spouses. (Women make up 66% of unpaid caregivers).

*Women’s tendency to work part-time rather than full-time for family reasons. (26% of employed women work part time compared with only 13% for men.)

*Lack of retirement savings plans or pensions in jobs predominantly held by women.

*Women, on average, live longer than men, meaning their retirement savings are stretched thinner. (The average life expectancy for women in the U.S. is 81.2 years compared to 76.5 years for men.)

Even when women continue to work past 65, they face a startling wage gap. Women in this age group earn 25% less than men. By the age of 80, the gender wage gap widens to 44%!

Our founder’s son, James Roosevelt, Jr., reflected on his grandmother’s legacy during a recent “Behind the Headlines” Facebook Live interview:

“My grandmother would say many important things, but one was, ‘It’s up to the women.’ Eleanor would tell my female siblings and cousins, ‘You’ve got to get out, and you’ve got to be part of fighting for what’s been done already (Social Security) and moving things farther forward.’” – James Roosevelt, Jr. 3/23/17

We believe Eleanor Roosevelt would be dismayed by the retirement inequities plaguing today’s women. Fortunately, the solutions are intuitive, if too long in coming. Here are a just a few:

*Public policies to promote pay equity between the genders.

*Reforms to the employer-based system to encourage retirement plans that are universal, secure, and adequate – where financial risk is not borne entirely by workers.

*Spousal consent in defined contribution plans similar to those required for traditional pension plans.

To close the tremendous gap in women’s Social Security benefits, we support legislation to credit caregivers for time spent out of the workforce attending to loved ones. Such credits would count toward future Social Security benefits. Rep. Nita Lowey (D-NY) is reintroducing legislation to do just that. Her Social Security Caregiver Credit Act would “provide caregivers with a… credit when they take unpaid time off from their job to provide care.” For example, a full-time caregiver would receive a Social Security credit of about $22,000 per year, increasing her future benefits. Senator Sherrod Brown (D-OH) plans to introduce similar legislation based on the National Average Wage Index (currently, $48,099) to formulate caregiver credits. We at the National Committee feel these bills could go a long way toward equalizing women’s and men’s Social Security benefits.

Mother’s Day is a reminder of all we owe our mothers. They dried our tears and calmed our fears. One of the best things we can do for them – and all the other women in our lives – is make it possible to live out their retirement years without fear of financial strife.

Trump & GOP Should Do More than Pay Lip Service to Older Americans Month

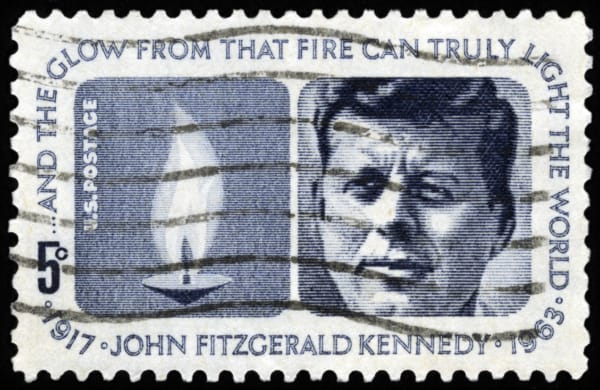

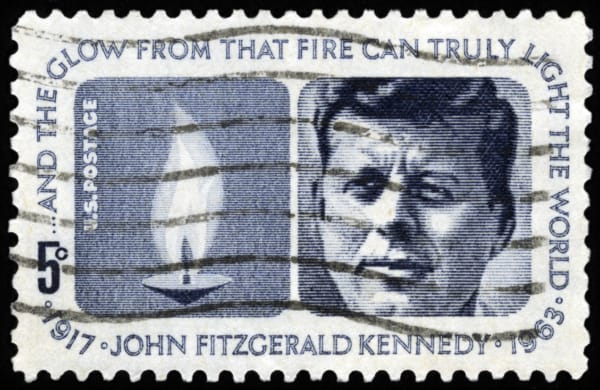

President John F. Kennedy created the original “Seniors Citizens Month” in 1963

May is Older Americans Month. It began in 1963 as “Senior Citizens Month” by proclamation of President John F. Kennedy. His proclamation half a century ago was not only an acknowledgment of seniors’ contributions to society, but an inspiring call to action:

“I urge all persons and public and private organizations to cooperate in its observance by increasing community awareness of the problems faced by older men and women, strengthening services and opportunities to meet their special needs… and making this special month the beginning of continuing interest and activity on their behalf.” – John F. Kennedy, April 18, 1963

At the time, approximately 33 percent of seniors in America lived in poverty. Today that figure is down closer to 10 percent, thanks in no small part to federal programs designed to buttress the financial and health security of older Americans, including Medicare and Medicaid – signed into law by President Lyndon B. Johnson in 1965. LBJ also renamed Senior Citizens Month “Older Americans Month” that same year upon passage of the Older Americans Act. This legislation created new forms of federal assistance for seniors – including Meals on Wheels and home heating assistance. Every President since has issued proclamations honoring seniors during the month of May. President Trump is no exception. Today, the White House released a statement saying:

“We… recommit ourselves to ensuring that older Americans are not neglected or abused, receive the best healthcare available, live in suitable homes, have adequate income and economic opportunities, and enjoy freedom and independence in their golden years.” – White House proclamation, 5/8/17

These sentiments sound quite noble. But the Trump proclamation is an empty missive in light of the administration’s policies. National Committee President Max Richtman called out the President and his party in The Hill newspaper last week:

“May is Older Americans Month, but the Trump administration and Congressional Republicans are putting a serious damper on the celebration.” – Max Richtman, The Hill newspaper.

The Trump administration and its allies on Capitol Hill are engaged in a historic reversal of the promises of 54 years ago. In fact, not since President George W. Bush tried to privatize Social Security in 2005 have seniors’ programs been so much under siege. In a little more than 3 months in office, here is what the President and/or Republicans in Congress have done to undermine the economic and health security of older Americans:

*Passed the American Health Care Act (AHCA), which weakens Medicare, cuts $1 trillion from Medicaid, and makes private health insurance unaffordable for most older Americans.

*Created a budget plan which eliminates federal funding for Older Americans Act programs including Meals on Wheels, community service jobs, and home heating assistance, among others.

*Pledged to turn Medicare into a voucher program during the mark-up of the FY 2018 budget later this month.

*Introduced a House bill to raise the Social Security retirement age to 70 and slow the growth of Cost-of-Living adjustments (COLAs), effectively cutting benefits 30%.

*Repeatedly pushed the concept of “entitlement reform” and questioned the validity of Social Security Disability insurance.

Several of these break President Trump’s campaign promises “not to touch” Social Security, Medicare and Medicaid. Some in the administration and Congress have attempted to fudge the issue by saying that none of their policies will affect current retirees. But during this Older Americans Month, it’s wise to remember that all of us will be seniors some day. Attempts to cleave today’s and tomorrow’s seniors is a cynical ploy that cannot be allowed to undermine time-honored programs that have helped older Americans for decades. None of the actions of President Trump, his team, and his allies in Congress honor the spirit of Older Americans Month. Much more fitting are the words of President Obama last night as he accepted an honor named after the President who created Older Americans Month, the John F. Kennedy Profiles in Courage award.

“… It actually doesn’t take a lot of courage to aid those who are already powerful, already comfortable, already influential — but it does require some courage to champion the vulnerable and the sick and the infirm.” – President Obama, 5/7/17

Seniors citizens are among society’s most vulnerable and infirm members. We must demand that our current elected leaders do much more than pay lip service to the ideals of Older Americans Month.

House GOP Votes to Gut Medicaid, Weaken Medicare & Put Seniors’ healthcare at Risk

The National Committee strongly condemns the American Health Care Act (AHCA) just passed by the House, which needlessly puts the healthcare of millions of older Americans in jeopardy. “Despite the bill’s name, risking the health of our nation’s most vulnerable citizens to give the wealthy an $880 billion tax cut is tremendously uncaring — and does not reflect real American values,” says Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare. “In modifying the original AHCA bill to give reluctant Republicans political cover, the House leadership made a bad piece of legislation even worse.”

“Recent amendments to this cruel, ill-advised bill could put coverage for older Americans with pre-existing conditions like cancer and diabetes out of reach. The $8 billion (over 5 years) added to the legislation at the last minute to defray the cost of higher premiums is woefully inadequate. It’s a thin veil that covers a head of snakes.”

Paul Waldman of the Washington Post wrote a scathing, but accurate article about the human costs of the GOP healthcare bill – especially to patients with pre-existing conditions:

“Make no mistake, if you’re one of them and this bill passes, your life will become hugely more complicated, potentially more costly and possibly in danger if you’re unlucky.” – Paul Waldman, Washington Post 5/3/17

The bill contains several other poison pills for older Americans. It replaces Obamacare subsidies with meager tax credits which discriminate against older Americans. A $4,000 annual tax credit doesn’t come to close to covering premiums for seniors ages 60-64, meaning millions of older Americans will lose coverage altogether.

The bill cuts nearly $1 trillion from Medicaid by converting it into a block grant program or imposing per capita caps, which will make it harder for impoverished seniors to access long term skilled nursing care and community or home care. Overall, the Congressional Budget Office estimates that 14 million people will be kicked off the Medicaid rolls in the next 10 years if this bill becomes law.

The AHCA reduces Medicare’s solvency by repealing Obamacare’s 0.9% payroll tax on wages above $200,000. This could lead to cuts in Medicare, including privatizing the program — harming current and future beneficiaries.

Under the GOP bill, insurers can charge older enrollees five times more than younger ones. The Congressional Budget Office predicts that by 2026 this provision will substantially raise premiums for older people by as much as 25%.

“We can only hope that the Senate majority will kill this reckless legislation before it punishes seniors – and millions of other Americans – for the crime of needing and wanting affordable health care,” Richtman says.

***********************************************************

If you missed our “Behind the Headlines” analysis of the GOP healthcare bill on Facebook Live, you can watch it here.

Ryan’s Siren Song of Spring: Cut “Entitlements”

Along with Cherry Blossoms and the White House Easter Egg Roll, Spring has brought fresh talk of “entitlement reform” to the Nation’s Capital. Of course, Social Security and Medicare are not “entitlements.” They are earned benefits that Americans pay into during their working lives in exchange for retirement and health benefits during their senior years. Nevertheless, House Speaker Paul Ryan and other budget hawks prefer to perpetuate the “entitlement” myth. This week, Ryan said that fiscal responsibility means “reforming our entitlement programs.” “Reforming” is code for undermining Social Security and privatizing Medicare, two politically unpopular ideas that nonetheless seem to drive Ryan’s agenda. Never mind that Social Security and Medicare Part A are funded by workers’ payroll contributions and don’t contribute a penny to the deficit.

Meanwhile, House Budget Committee Chairwoman Diane Black (R-TN) is looking to end traditional Medicare through the budget reconciliation process in May, according to Congressional Quarterly.

“The coming fiscal 2018 plan is likely to include proposals to transform Medicare… into a premium support program. Under one House GOP model… people would be given a choice of traditional Medicare or insurer-run plans starting in 2024.” – Congressional Quarterly, 4/27/17

“Premium support” is an innocuous sounding term that could have dire consequences for seniors. What Diane Black means by “premium support” is converting Medicare into a voucher program. Seniors would be offered the option of leaving traditional Medicare to buy insurance in the private market using vouchers. These vouchers could never keep pace with rising premiums, meaning seniors would have to cover the difference or drop health insurance entirely. Older and sicker seniors would likely remain in conventional Medicare, causing the program’s cost to skyrocket, benefits to be cut, and eventually the death of Medicare itself.

The canard that Ryan and his party use to justify cutting benefits, reducing COLAs, and raising retirement ages is that Social Security and Medicare are going “bankrupt.” While it’s true that the trust funds for Social Security and Medicare Part A won’t be able to pay full benefits after 2034 and 2028 respectively without corrective action, there are modest and manageable solutions that won’t hurt the seniors who depend on them. Senator Bernie Sanders and Congressman John Larson (D-CT) have both offered common sense legislation to keep Social Security solvent for decades. Both bills ask the wealthy to pay their fair share by scrapping the income cap on payroll taxes. Larson’s legislation also increases the FICA tax by 1% over 25 years. (Larson says that for a worker earning $50,000 a year, the payroll tax bump equals one Starbucks coffee drink every 9 weeks). Instead of cutting benefits for our most vulnerable citizens – or raising the retirement age – these bills actually increase benefits and COLAs.

Medicare could be kept solvent well into this century by similarly modest and manageable means, if budget hawks like Ryan would stop insisting that privatization is the only fix. Congress could authorize Medicare to negotiate prescription drug prices (one of the biggest drivers of rising health care costs). Innovative methods for saving Medicare costs under the Affordable Care Act, many of which have already reduced healthcare expenditures, could be expanded instead of repealed. In fact, the Affordable Care Act itself extended the solvency of Medicare by four years. Repealing the ACA – as Ryan and President Trump are still struggling to do – hurts the long-term solvency of the program.

Ryan and many conservative Republicans ignore these alternatives because, at heart, they do not believe in federal programs that provide Americans with retirement and health security – which puts them at odds with the majority of voters. The latest National Committee poll indicates wide public support for progressive solutions for Social Security and Medicare – and significant opposition to the GOP approach. Seventy-nine percent favor increasing Social Security benefits by scrapping the payroll tax income cap. Sixty-five percent oppose raising the Medicare eligibility age. Ninety-three percent want Medicare to be able to negotiate prescription drug prices with pharmaceutical companies.

The National Committee’s social media community seems to agree. Comments on our Facebook posts over the past three months demonstrate deep skepticism about Republican talking points:

Bruce W. These programs are NOT “entitlements”–we have paid into them our entire working lives. If the income subject to SS fees was raised SS would be solvent for decades…

Suzanne S. Social Security has nothing to do with the deficit. It is a stand-alone program funded by workers. LEAVE IT ALONE.

Tom S. Social Security and Medicare are lifelines to millions of seniors; anyone who votes in favor of cutting or reducing benefits should be ashamed of themselves!

Adam R. Social Security has nothing to do with the general budget at all. FACT. It is not an entitlement, This is basically a Trust fund we have paid into all our working lives.

Americans intuitively understand that Social Security and Medicare are social insurance programs that they have already paid for through their hard-earned wages. For 82 years and 52 years respectively, these programs have worked efficiently to keep seniors healthy and out of poverty. Our Facebook commenter is perfectly correct to call them “lifelines to millions of seniors.” Yes, their finances need to be shored up. But asking beneficiaries to bear the burden is not the right way. It’s too bad that some of our most powerful political leaders do not seem to understand… or care.

Paul Ryan’s Medicare Privatization Scheme Edging Closer to Reality

Paul Ryan’s dystopian dream of privatizing Medicare may soon come true. At least he seems to think so. In an interview with right-wing Wisconsin radio host Vicki McKenna, the House Speaker said that Medicare “reform” is coming to the Capitol this Spring. “I’m pretty sure the budget committee in the House will pass that on in the House Republican budget,” Ryan said. In fact, House Budget Committee Chair Diane Black (R-TN) has already promised to include Medicare privatization in the budget resolution next month. This is scary news for millions of current and future retirees.

To justify his Scrooge-like assault on Medicare, Ryan continues to perpetuate the myth that Medicare is an “entitlement.” In fact, it is a remarkably efficient social insurance program. Having paid into it their entire working lives, Americans are counting on having affordable health care coverage to protect them upon retirement. Why does Paul Ryan want to take that away, effectively reneging on the nation’s commitment to current and future retirees?

In the past, President Obama stood as an impenetrable barrier between Ryan and his privatization scheme. Though candidate Trump promised “not to touch” Medicare, the President has already broken that pledge by supporting the GOP healthcare plan, which shortens the solvency of the program. Despite Trump’s campaign promises, his budget director refused to publicly discourage Congress from privatizing Medicare. In fact, Speaker Ryan said in his radio interview that he and the Trump administration are having “an ongoing conversation” about it. Current and future retirees clearly cannot trust this White House to protect their Medicare benefits, which they have paid for during their entire working lives.

As we discussed on our “Behind the Headlines” Facebook Live broadcast Thursday, here is what Ryan’s insidious “reform” would do: Instead of receiving guaranteed benefits, all Medicare participants would be given vouchers to help pay premiums for traditional Medicare or private health insurance. In either case, the vouchers would not be able to keep up with rising health care costs, leaving seniors to cover the difference out of their own pockets. That’s why we call the voucher program “coupon care.”

Ryan’s plan would likely drive healthier, younger and wealthier seniors toward private insurance. Poorer and sicker seniors would remain in traditional Medicare, driving up costs until the program collapsed under its own weight. But that’s not all. Ryan also wants to hike the Medicare eligibility age from 65 to 67. This in itself is a massive benefit cut, as 65 and 66 year olds would have to buy private insurance on their own dime. Those who couldn’t afford it might go without health insurance entirely. In a recent National Committee poll, 65% of likely voters opposed raising the eligibility age. Among younger voters, the opposition was even stronger.

As Ryan predicts, Medicare privatization will likely pass the House as part of the Republican budget resolution. Its future in the Senate is less certain, but too close for comfort. Senate Republican leaders need only 50 votes to wreck Medicare. The National Committee is building a “firewall” of moderate GOP Senators who we believe can be convinced to protect Medicare. With an unpredictable President in the White House, that is the best way – along with vocal grassroots activism – to defend current and future retirees against the destruction of a program that has worked effectively for more than 50 years, and enjoys enduring public support.

***************************************

Subscribe for free to this blog today to stay informed about your health and retirement security!

The Best Mother’s Day Gift of All: Retirement Security

Let’s add something to the gift list for mom this Mother’s Day along with flowers and candy: financial security in retirement. Our nation’s mothers – indeed, all American women – are at greater risk of financial insecurity in their senior years than fathers (and other men). For myriad reasons, the women in our lives are less able to save for retirement than men, and their Social Security benefits are typically lower. At the same time, nearly half of elderly unmarried women rely on Social Security for 90% of their income. Working women who take time off to care for loved ones pay an especially steep price, losing an average $324,000 in wages and retirement benefits over their lifetimes.

As we discussed on Facebook Live from Capitol Hill on Thursday, the major factors contributing to women’s poorer retirement status include:

*Pay inequity, which means women can’t save as much as men during their working lives. (Women working full-time still earn only about 78 cents annually for every dollar earned by men doing the same job.)

*Loss of wages during time spent caring for children, parents and spouses. (Women make up 66% of unpaid caregivers).

*Women’s tendency to work part-time rather than full-time for family reasons. (26% of employed women work part time compared with only 13% for men.)

*Lack of retirement savings plans or pensions in jobs predominantly held by women.

*Women, on average, live longer than men, meaning their retirement savings are stretched thinner. (The average life expectancy for women in the U.S. is 81.2 years compared to 76.5 years for men.)

Even when women continue to work past 65, they face a startling wage gap. Women in this age group earn 25% less than men. By the age of 80, the gender wage gap widens to 44%!

Our founder’s son, James Roosevelt, Jr., reflected on his grandmother’s legacy during a recent “Behind the Headlines” Facebook Live interview:

“My grandmother would say many important things, but one was, ‘It’s up to the women.’ Eleanor would tell my female siblings and cousins, ‘You’ve got to get out, and you’ve got to be part of fighting for what’s been done already (Social Security) and moving things farther forward.’” – James Roosevelt, Jr. 3/23/17

We believe Eleanor Roosevelt would be dismayed by the retirement inequities plaguing today’s women. Fortunately, the solutions are intuitive, if too long in coming. Here are a just a few:

*Public policies to promote pay equity between the genders.

*Reforms to the employer-based system to encourage retirement plans that are universal, secure, and adequate – where financial risk is not borne entirely by workers.

*Spousal consent in defined contribution plans similar to those required for traditional pension plans.

To close the tremendous gap in women’s Social Security benefits, we support legislation to credit caregivers for time spent out of the workforce attending to loved ones. Such credits would count toward future Social Security benefits. Rep. Nita Lowey (D-NY) is reintroducing legislation to do just that. Her Social Security Caregiver Credit Act would “provide caregivers with a… credit when they take unpaid time off from their job to provide care.” For example, a full-time caregiver would receive a Social Security credit of about $22,000 per year, increasing her future benefits. Senator Sherrod Brown (D-OH) plans to introduce similar legislation based on the National Average Wage Index (currently, $48,099) to formulate caregiver credits. We at the National Committee feel these bills could go a long way toward equalizing women’s and men’s Social Security benefits.

Mother’s Day is a reminder of all we owe our mothers. They dried our tears and calmed our fears. One of the best things we can do for them – and all the other women in our lives – is make it possible to live out their retirement years without fear of financial strife.

Trump & GOP Should Do More than Pay Lip Service to Older Americans Month

President John F. Kennedy created the original “Seniors Citizens Month” in 1963

May is Older Americans Month. It began in 1963 as “Senior Citizens Month” by proclamation of President John F. Kennedy. His proclamation half a century ago was not only an acknowledgment of seniors’ contributions to society, but an inspiring call to action:

“I urge all persons and public and private organizations to cooperate in its observance by increasing community awareness of the problems faced by older men and women, strengthening services and opportunities to meet their special needs… and making this special month the beginning of continuing interest and activity on their behalf.” – John F. Kennedy, April 18, 1963

At the time, approximately 33 percent of seniors in America lived in poverty. Today that figure is down closer to 10 percent, thanks in no small part to federal programs designed to buttress the financial and health security of older Americans, including Medicare and Medicaid – signed into law by President Lyndon B. Johnson in 1965. LBJ also renamed Senior Citizens Month “Older Americans Month” that same year upon passage of the Older Americans Act. This legislation created new forms of federal assistance for seniors – including Meals on Wheels and home heating assistance. Every President since has issued proclamations honoring seniors during the month of May. President Trump is no exception. Today, the White House released a statement saying:

“We… recommit ourselves to ensuring that older Americans are not neglected or abused, receive the best healthcare available, live in suitable homes, have adequate income and economic opportunities, and enjoy freedom and independence in their golden years.” – White House proclamation, 5/8/17

These sentiments sound quite noble. But the Trump proclamation is an empty missive in light of the administration’s policies. National Committee President Max Richtman called out the President and his party in The Hill newspaper last week:

“May is Older Americans Month, but the Trump administration and Congressional Republicans are putting a serious damper on the celebration.” – Max Richtman, The Hill newspaper.

The Trump administration and its allies on Capitol Hill are engaged in a historic reversal of the promises of 54 years ago. In fact, not since President George W. Bush tried to privatize Social Security in 2005 have seniors’ programs been so much under siege. In a little more than 3 months in office, here is what the President and/or Republicans in Congress have done to undermine the economic and health security of older Americans:

*Passed the American Health Care Act (AHCA), which weakens Medicare, cuts $1 trillion from Medicaid, and makes private health insurance unaffordable for most older Americans.

*Created a budget plan which eliminates federal funding for Older Americans Act programs including Meals on Wheels, community service jobs, and home heating assistance, among others.

*Pledged to turn Medicare into a voucher program during the mark-up of the FY 2018 budget later this month.

*Introduced a House bill to raise the Social Security retirement age to 70 and slow the growth of Cost-of-Living adjustments (COLAs), effectively cutting benefits 30%.

*Repeatedly pushed the concept of “entitlement reform” and questioned the validity of Social Security Disability insurance.

Several of these break President Trump’s campaign promises “not to touch” Social Security, Medicare and Medicaid. Some in the administration and Congress have attempted to fudge the issue by saying that none of their policies will affect current retirees. But during this Older Americans Month, it’s wise to remember that all of us will be seniors some day. Attempts to cleave today’s and tomorrow’s seniors is a cynical ploy that cannot be allowed to undermine time-honored programs that have helped older Americans for decades. None of the actions of President Trump, his team, and his allies in Congress honor the spirit of Older Americans Month. Much more fitting are the words of President Obama last night as he accepted an honor named after the President who created Older Americans Month, the John F. Kennedy Profiles in Courage award.

“… It actually doesn’t take a lot of courage to aid those who are already powerful, already comfortable, already influential — but it does require some courage to champion the vulnerable and the sick and the infirm.” – President Obama, 5/7/17

Seniors citizens are among society’s most vulnerable and infirm members. We must demand that our current elected leaders do much more than pay lip service to the ideals of Older Americans Month.

House GOP Votes to Gut Medicaid, Weaken Medicare & Put Seniors’ healthcare at Risk

The National Committee strongly condemns the American Health Care Act (AHCA) just passed by the House, which needlessly puts the healthcare of millions of older Americans in jeopardy. “Despite the bill’s name, risking the health of our nation’s most vulnerable citizens to give the wealthy an $880 billion tax cut is tremendously uncaring — and does not reflect real American values,” says Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare. “In modifying the original AHCA bill to give reluctant Republicans political cover, the House leadership made a bad piece of legislation even worse.”

“Recent amendments to this cruel, ill-advised bill could put coverage for older Americans with pre-existing conditions like cancer and diabetes out of reach. The $8 billion (over 5 years) added to the legislation at the last minute to defray the cost of higher premiums is woefully inadequate. It’s a thin veil that covers a head of snakes.”

Paul Waldman of the Washington Post wrote a scathing, but accurate article about the human costs of the GOP healthcare bill – especially to patients with pre-existing conditions:

“Make no mistake, if you’re one of them and this bill passes, your life will become hugely more complicated, potentially more costly and possibly in danger if you’re unlucky.” – Paul Waldman, Washington Post 5/3/17

The bill contains several other poison pills for older Americans. It replaces Obamacare subsidies with meager tax credits which discriminate against older Americans. A $4,000 annual tax credit doesn’t come to close to covering premiums for seniors ages 60-64, meaning millions of older Americans will lose coverage altogether.

The bill cuts nearly $1 trillion from Medicaid by converting it into a block grant program or imposing per capita caps, which will make it harder for impoverished seniors to access long term skilled nursing care and community or home care. Overall, the Congressional Budget Office estimates that 14 million people will be kicked off the Medicaid rolls in the next 10 years if this bill becomes law.

The AHCA reduces Medicare’s solvency by repealing Obamacare’s 0.9% payroll tax on wages above $200,000. This could lead to cuts in Medicare, including privatizing the program — harming current and future beneficiaries.

Under the GOP bill, insurers can charge older enrollees five times more than younger ones. The Congressional Budget Office predicts that by 2026 this provision will substantially raise premiums for older people by as much as 25%.

“We can only hope that the Senate majority will kill this reckless legislation before it punishes seniors – and millions of other Americans – for the crime of needing and wanting affordable health care,” Richtman says.

***********************************************************

If you missed our “Behind the Headlines” analysis of the GOP healthcare bill on Facebook Live, you can watch it here.

Ryan’s Siren Song of Spring: Cut “Entitlements”

Along with Cherry Blossoms and the White House Easter Egg Roll, Spring has brought fresh talk of “entitlement reform” to the Nation’s Capital. Of course, Social Security and Medicare are not “entitlements.” They are earned benefits that Americans pay into during their working lives in exchange for retirement and health benefits during their senior years. Nevertheless, House Speaker Paul Ryan and other budget hawks prefer to perpetuate the “entitlement” myth. This week, Ryan said that fiscal responsibility means “reforming our entitlement programs.” “Reforming” is code for undermining Social Security and privatizing Medicare, two politically unpopular ideas that nonetheless seem to drive Ryan’s agenda. Never mind that Social Security and Medicare Part A are funded by workers’ payroll contributions and don’t contribute a penny to the deficit.

Meanwhile, House Budget Committee Chairwoman Diane Black (R-TN) is looking to end traditional Medicare through the budget reconciliation process in May, according to Congressional Quarterly.

“The coming fiscal 2018 plan is likely to include proposals to transform Medicare… into a premium support program. Under one House GOP model… people would be given a choice of traditional Medicare or insurer-run plans starting in 2024.” – Congressional Quarterly, 4/27/17

“Premium support” is an innocuous sounding term that could have dire consequences for seniors. What Diane Black means by “premium support” is converting Medicare into a voucher program. Seniors would be offered the option of leaving traditional Medicare to buy insurance in the private market using vouchers. These vouchers could never keep pace with rising premiums, meaning seniors would have to cover the difference or drop health insurance entirely. Older and sicker seniors would likely remain in conventional Medicare, causing the program’s cost to skyrocket, benefits to be cut, and eventually the death of Medicare itself.

The canard that Ryan and his party use to justify cutting benefits, reducing COLAs, and raising retirement ages is that Social Security and Medicare are going “bankrupt.” While it’s true that the trust funds for Social Security and Medicare Part A won’t be able to pay full benefits after 2034 and 2028 respectively without corrective action, there are modest and manageable solutions that won’t hurt the seniors who depend on them. Senator Bernie Sanders and Congressman John Larson (D-CT) have both offered common sense legislation to keep Social Security solvent for decades. Both bills ask the wealthy to pay their fair share by scrapping the income cap on payroll taxes. Larson’s legislation also increases the FICA tax by 1% over 25 years. (Larson says that for a worker earning $50,000 a year, the payroll tax bump equals one Starbucks coffee drink every 9 weeks). Instead of cutting benefits for our most vulnerable citizens – or raising the retirement age – these bills actually increase benefits and COLAs.

Medicare could be kept solvent well into this century by similarly modest and manageable means, if budget hawks like Ryan would stop insisting that privatization is the only fix. Congress could authorize Medicare to negotiate prescription drug prices (one of the biggest drivers of rising health care costs). Innovative methods for saving Medicare costs under the Affordable Care Act, many of which have already reduced healthcare expenditures, could be expanded instead of repealed. In fact, the Affordable Care Act itself extended the solvency of Medicare by four years. Repealing the ACA – as Ryan and President Trump are still struggling to do – hurts the long-term solvency of the program.

Ryan and many conservative Republicans ignore these alternatives because, at heart, they do not believe in federal programs that provide Americans with retirement and health security – which puts them at odds with the majority of voters. The latest National Committee poll indicates wide public support for progressive solutions for Social Security and Medicare – and significant opposition to the GOP approach. Seventy-nine percent favor increasing Social Security benefits by scrapping the payroll tax income cap. Sixty-five percent oppose raising the Medicare eligibility age. Ninety-three percent want Medicare to be able to negotiate prescription drug prices with pharmaceutical companies.

The National Committee’s social media community seems to agree. Comments on our Facebook posts over the past three months demonstrate deep skepticism about Republican talking points:

Bruce W. These programs are NOT “entitlements”–we have paid into them our entire working lives. If the income subject to SS fees was raised SS would be solvent for decades…

Suzanne S. Social Security has nothing to do with the deficit. It is a stand-alone program funded by workers. LEAVE IT ALONE.

Tom S. Social Security and Medicare are lifelines to millions of seniors; anyone who votes in favor of cutting or reducing benefits should be ashamed of themselves!

Adam R. Social Security has nothing to do with the general budget at all. FACT. It is not an entitlement, This is basically a Trust fund we have paid into all our working lives.

Americans intuitively understand that Social Security and Medicare are social insurance programs that they have already paid for through their hard-earned wages. For 82 years and 52 years respectively, these programs have worked efficiently to keep seniors healthy and out of poverty. Our Facebook commenter is perfectly correct to call them “lifelines to millions of seniors.” Yes, their finances need to be shored up. But asking beneficiaries to bear the burden is not the right way. It’s too bad that some of our most powerful political leaders do not seem to understand… or care.