We’ve written a lot about how pay inequity has hurt generations of working women, not just while they’re on the job, but lasting throughout their retirement. The economic challenges facing American women in retirement is the heart of our “Eleanor’s Hope” project, designed to raise awareness and advocate for legislation to address the inequities threatening millions of retired women.

“Over a working woman’s career, that pay gap could accumulate to a half million dollars in lost income and even more for women of color. A comprehensive analysis of gender pay inequality, released by the Joint Economic Committee’s Democratic staff, shows how the gender pay gap grows over time. It’s not just an issue for working women because this inequality can also have a compounding and devastating impact on retired women.

The thought of running out of money in retirement keeps 57% of women awake at night. That’s not a surprise when you consider the many combined factors which make retirement especially challenging for American women. Women earn less than men even when doing the same jobs, they more often work part-time or in jobs that do not offer retirement savings plans, and they tend to spend more time out of the workforce as a consequence of their caregiving responsibilities. Women could lose $430,480 in earnings over the course of a 40-year career due to the wage gap alone.”…Max Richtman, NCPSSM President/CEO

That is a staggering number. But what does it really mean to you?

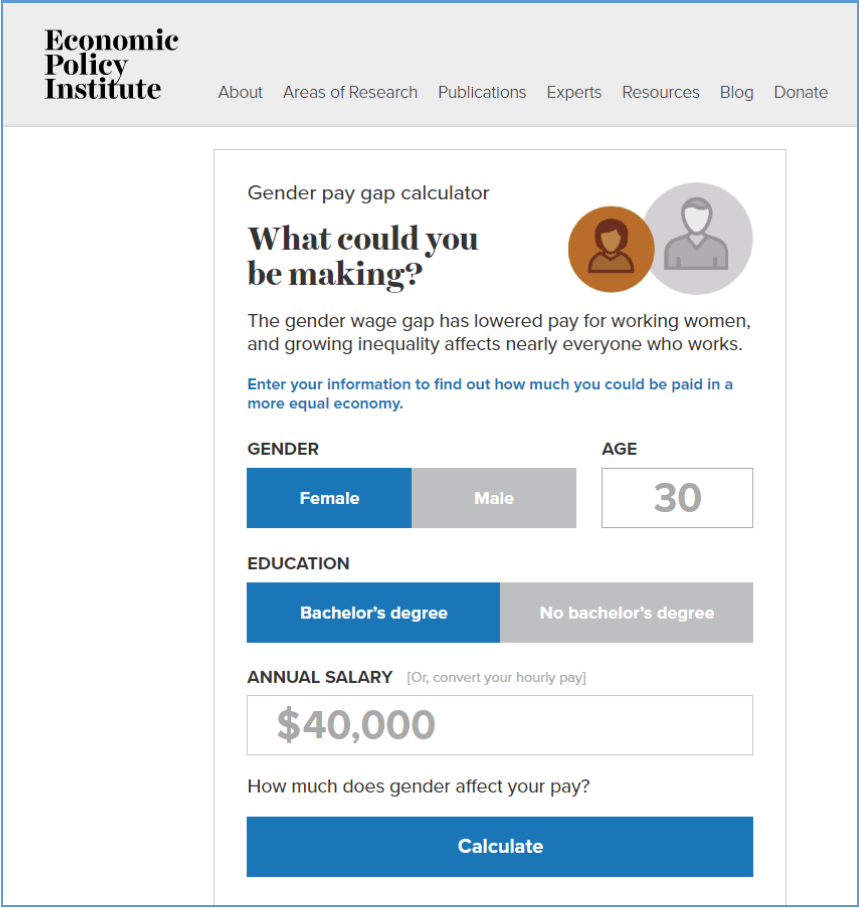

A new tool created by the Economic Policy Institute allows women workers to calculate how much you could be earning, in an equal pay world. Remember, that equal pay would have also meant a more equal retirement benefit.