Too Old to Work, Too Young for Social Security

When someone tells you it?s no big deal for Americans to work until they?re 70, chances are that person:(a) has an office job (b) earns income in the top-half of American wage earners(c) has access to generous health care coverage This is exactly the demographic that the the Social Security Administration and CBOsays has benefited most from two decades of longevity increases that far exceed what the rest of America has seen. These demographics also explain why the idea is so popular among six-figure income Washington politicians, bureaucrats, and think-tankers, including some members of the President?s Fiscal Commission. Not so much— among the rest of America.While higher income Americans may indeed be ready, willing and able to extend their work-lives to age 70…what about your 56 year old uncle who?s a mechanic (bricklayer, plumber, truck driver, waiter…you get the idea) who?s knees (or high blood pressure, stroke, Alzheimer?s, diabetes) will force an early retirement at 62? Unfortunately, it?s these working Americans who will pay the price for years of fiscal irresponsibility in Washington, if we raise the retirement age to 70 to reduce a deficit that has nothing to do with workers or their Social Security benefits.This is the topic of the latest video in our 75th Anniversary Celebration series ?Keeping the Promise?. Take a moment to watch and then share it with your friends and family.

What Does Raising Your “Retirement Age” Really Mean?

Nancy Altman, Guest Blogger

NCPSSM Foundation Board member, Social Security Works Co-Director and Author, “The Battle for Social Security: From FDR?s Vision to Bush?s Gamble”

Despite its name, Social Security?s statutorily-defined ?Retirement Age? has nothing to do with when people must or can retire. It is most accurate to think of Social Security as having a band of retirement ages. Benefits are adjusted depending on the age a worker chooses to begin to receive benefits, whether that age is age 62, age 70, or some age in between.If there were no adjustment, benefits claimed at earlier ages would be more valuable because they would be received for a longer time. The adjustments are as close as the actuaries can come to ensuring that the benefits have the same overall value, taking into account when a worker begins to receive them.Because of these actuarial adjustments, raising the ?Retirement Age? is indistinguishable from a substantial across-the-board benefit cut. Currently, ?Retirement Age?, which until 2000 was age 65, is gradually being increased to age 67. If Minority Leader John Boehner has his way, the ?Retirement Age? will increase to age 70. The chart below illustrates the impact of the current-law increase to age 67, and the proposal to increasethe ?Retirement Age? to age 70.

(You can also see the full-size chart here)

As the chart reveals, theincrease in the?Retirement Age? from age 65 to age 67, by itself, amounts to about a 13 percent cut in monthly benefits A worker aged 62 who would be eligible for $800a month, if the ?Retirement Age? were age 65, will receive only $700 a month, once the ?Retirement Age? is age 67. That same worker who waited until age 70 would receive $1400 a month if the ?Retirement Age? were age 65, but only $1240 a month, once the ??Retirement Age? is age 67.If the statutory ?Retirement Age? were increased to age 70, that change would constitute another 19 percent cut in benefits, for a total of around 30 percent. That same worker who would have received $800 a month, if the ??Retirement Age?? were age 65, would receive only $565 a month, if the ?Retirement Age? were age 70. If that same worker chose to wait until age 70, he or she would receive $1400 a month if the ?Retirement Age? were age 65, but only $1000 a month, if the ?Retirement Age? were age 70.Instead of the misleading debate over what the ?Retirement Age? should be, I believe we should be debating what we think an appropriate and affordable benefit should be. The average monthly benefit received by all beneficiaries is $1054 or $12,648/year. Given how low Social Security?s average benefit is, and the trillions of dollars that have been lost in 401(k) plans and home equity, we should be discussing raising Social Security, not cutting it further!

On the Radio

Why is the President?s fiscal commission talking about cutting Social Security benefits to reduce the deficit when Social Security didn?t cause the problem?This is Barbara Kennelly.For 75 years Social Security has been a success. Millions count on receiving their modest benefit checks, now and in the future. Benefit cuts, including raising the retirement age, are the wrong solution for a fiscal mess Social Security never created.Go to the National Committee dot org to learn more.

Washington Disconnect

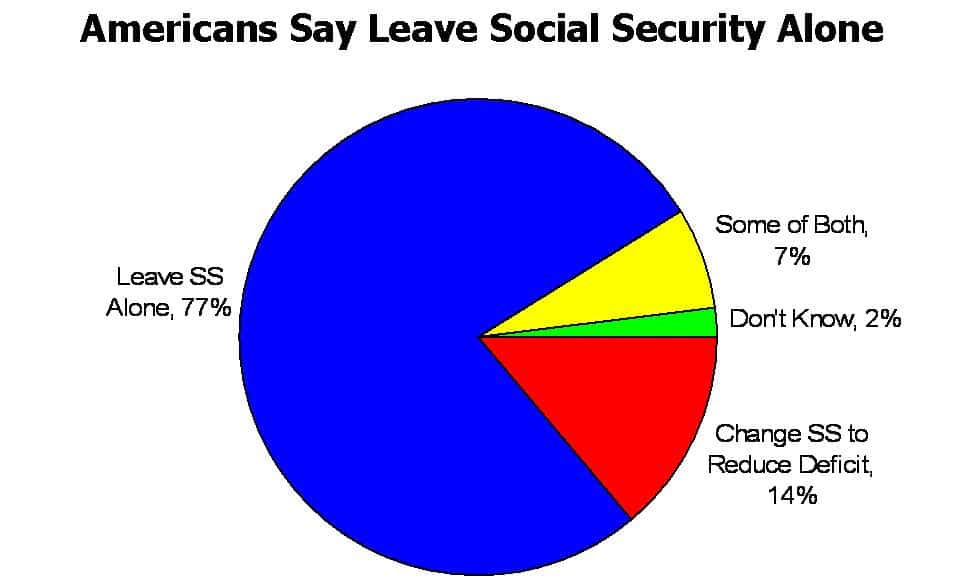

New National Poll Finds 78% of Americans Oppose Raising Social Security’s Retirement Age

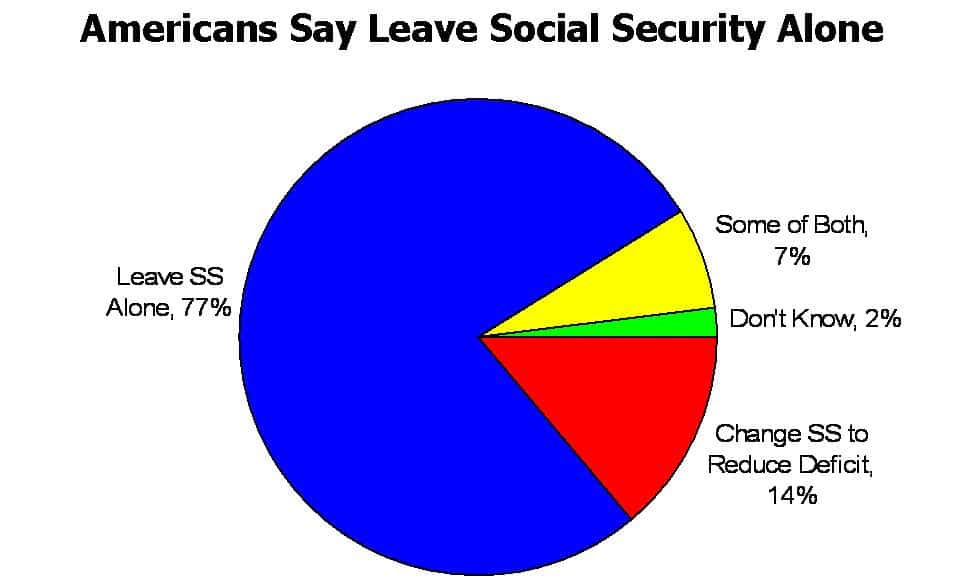

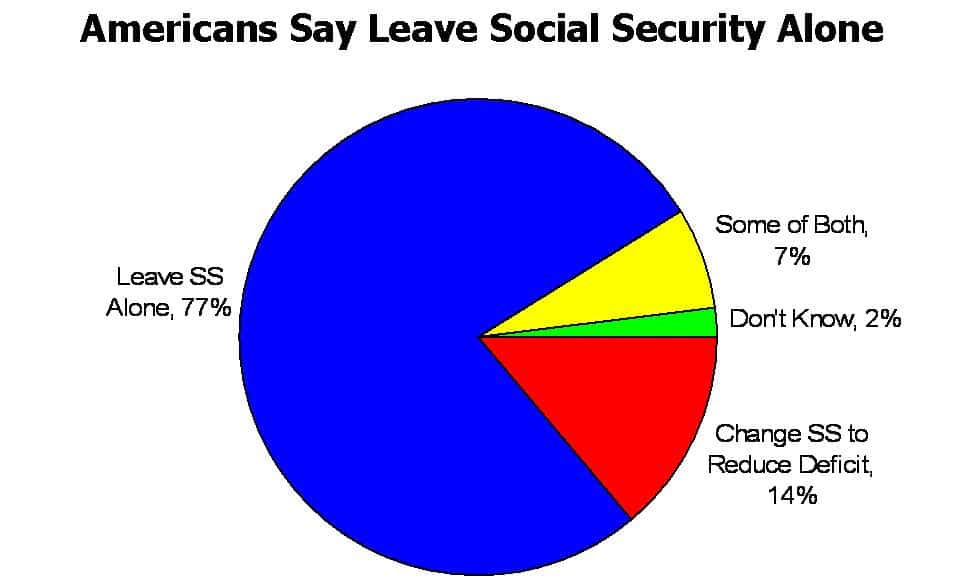

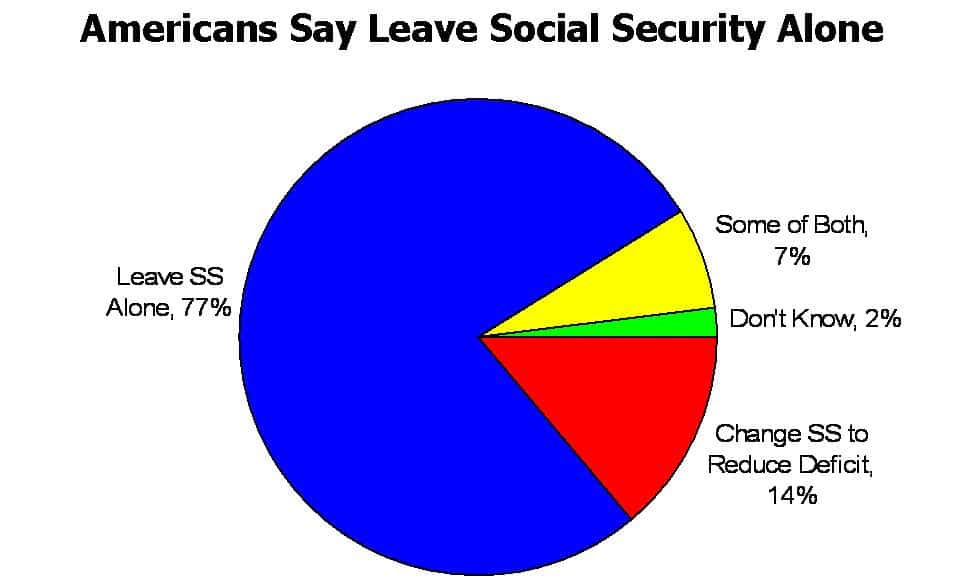

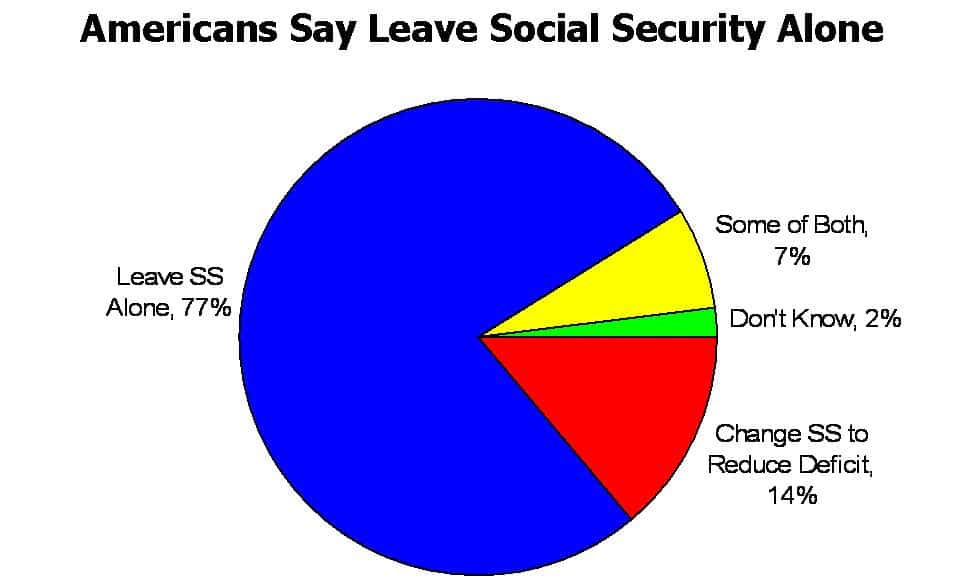

- Only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.

- Two out of three Americans (64%) think Social Security provides security and stability to our economy while only 20% see the program as a drain on the economy. 70% believe this recession underscores the critical role Social Security fills for families.

- Virtually all Americans polled (98%) believe Social Security funds belong to the people who contributed them and their beneficiaries and a majority (71%) say Social Security is a promise made to all generations that should not be broken.

?Next month, we will celebrate the 75th anniversary of Social Security, a national treasure that has only improved with age,? said Rep. Jan Schakowsky (D-IL), Co-Chair of the Congressional Seniors Task Force.?The poll released today shows that Social Security is cherished by the vast majority of Americans of all ages. They believe it is critical for their economic well-being and that its essential protections must not be reduced. I agree. The poll also made clear that the American public knows Social Security is not a contributor to today?s deficits. The program is not in crisis; while we will need to act ensure its solvency throughout this century and beyond, we can do so without making cuts in critical benefits.?Rep. Earl Pomeroy (D-ND) is Chairman of the Social Security Subcommittee and warned against efforts to cut or privatize Social Security benefits, ?There are those, even in the aftermath of the failed efforts by President Bush to privatize Social Security, who would take those changes right into the benefit structure today with a rationale of long term solvency without looking at other options. They never fully discuss that we are taking away the legacy of the program for our children.?Congressman Ron Klein (D-FL), a strong advocate for Social Security who represents over 130,000 seniors in South Florida said, ?Social Security is a contract we have with our seniors, and they have lived up to their end of the bargain. It?s essential that we live up to our end. That?s why I am here today to say that I will not stand for any attempts to weaken Social Security benefits for our seniors, or any reckless efforts to balance our nation?s books on the backs of our seniors.? The poll ?U.S. Attitudes Toward Social Security? is now available on the National Committee Foundation?s website.

Too Old to Work, Too Young for Social Security

When someone tells you it?s no big deal for Americans to work until they?re 70, chances are that person:(a) has an office job (b) earns income in the top-half of American wage earners(c) has access to generous health care coverage This is exactly the demographic that the the Social Security Administration and CBOsays has benefited most from two decades of longevity increases that far exceed what the rest of America has seen. These demographics also explain why the idea is so popular among six-figure income Washington politicians, bureaucrats, and think-tankers, including some members of the President?s Fiscal Commission. Not so much— among the rest of America.While higher income Americans may indeed be ready, willing and able to extend their work-lives to age 70…what about your 56 year old uncle who?s a mechanic (bricklayer, plumber, truck driver, waiter…you get the idea) who?s knees (or high blood pressure, stroke, Alzheimer?s, diabetes) will force an early retirement at 62? Unfortunately, it?s these working Americans who will pay the price for years of fiscal irresponsibility in Washington, if we raise the retirement age to 70 to reduce a deficit that has nothing to do with workers or their Social Security benefits.This is the topic of the latest video in our 75th Anniversary Celebration series ?Keeping the Promise?. Take a moment to watch and then share it with your friends and family.

What Does Raising Your “Retirement Age” Really Mean?

Nancy Altman, Guest Blogger

NCPSSM Foundation Board member, Social Security Works Co-Director and Author, “The Battle for Social Security: From FDR?s Vision to Bush?s Gamble”

Despite its name, Social Security?s statutorily-defined ?Retirement Age? has nothing to do with when people must or can retire. It is most accurate to think of Social Security as having a band of retirement ages. Benefits are adjusted depending on the age a worker chooses to begin to receive benefits, whether that age is age 62, age 70, or some age in between.If there were no adjustment, benefits claimed at earlier ages would be more valuable because they would be received for a longer time. The adjustments are as close as the actuaries can come to ensuring that the benefits have the same overall value, taking into account when a worker begins to receive them.Because of these actuarial adjustments, raising the ?Retirement Age? is indistinguishable from a substantial across-the-board benefit cut. Currently, ?Retirement Age?, which until 2000 was age 65, is gradually being increased to age 67. If Minority Leader John Boehner has his way, the ?Retirement Age? will increase to age 70. The chart below illustrates the impact of the current-law increase to age 67, and the proposal to increasethe ?Retirement Age? to age 70.

(You can also see the full-size chart here)

As the chart reveals, theincrease in the?Retirement Age? from age 65 to age 67, by itself, amounts to about a 13 percent cut in monthly benefits A worker aged 62 who would be eligible for $800a month, if the ?Retirement Age? were age 65, will receive only $700 a month, once the ?Retirement Age? is age 67. That same worker who waited until age 70 would receive $1400 a month if the ?Retirement Age? were age 65, but only $1240 a month, once the ??Retirement Age? is age 67.If the statutory ?Retirement Age? were increased to age 70, that change would constitute another 19 percent cut in benefits, for a total of around 30 percent. That same worker who would have received $800 a month, if the ??Retirement Age?? were age 65, would receive only $565 a month, if the ?Retirement Age? were age 70. If that same worker chose to wait until age 70, he or she would receive $1400 a month if the ?Retirement Age? were age 65, but only $1000 a month, if the ?Retirement Age? were age 70.Instead of the misleading debate over what the ?Retirement Age? should be, I believe we should be debating what we think an appropriate and affordable benefit should be. The average monthly benefit received by all beneficiaries is $1054 or $12,648/year. Given how low Social Security?s average benefit is, and the trillions of dollars that have been lost in 401(k) plans and home equity, we should be discussing raising Social Security, not cutting it further!

On the Radio

Why is the President?s fiscal commission talking about cutting Social Security benefits to reduce the deficit when Social Security didn?t cause the problem?This is Barbara Kennelly.For 75 years Social Security has been a success. Millions count on receiving their modest benefit checks, now and in the future. Benefit cuts, including raising the retirement age, are the wrong solution for a fiscal mess Social Security never created.Go to the National Committee dot org to learn more.

Washington Disconnect

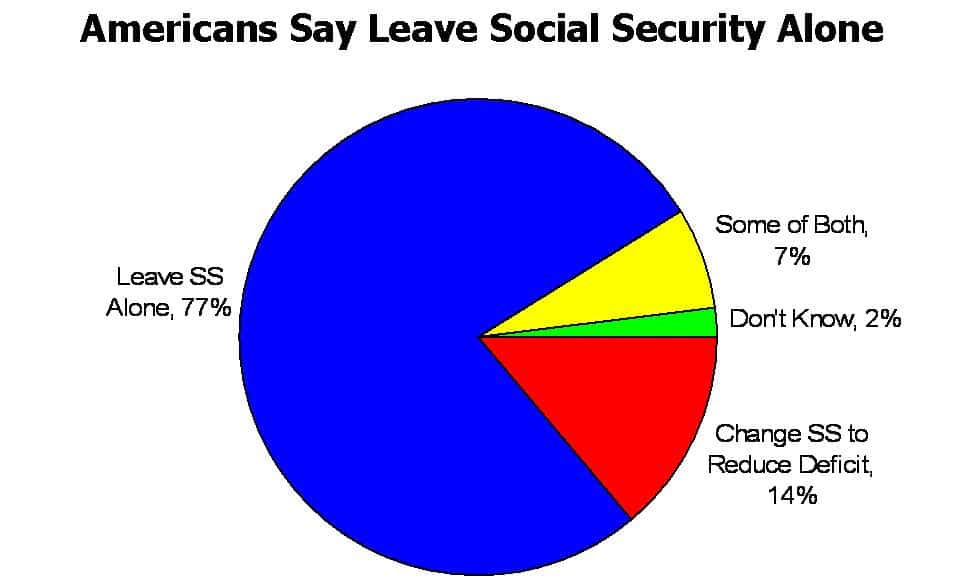

New National Poll Finds 78% of Americans Oppose Raising Social Security’s Retirement Age

- Only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.

- Two out of three Americans (64%) think Social Security provides security and stability to our economy while only 20% see the program as a drain on the economy. 70% believe this recession underscores the critical role Social Security fills for families.

- Virtually all Americans polled (98%) believe Social Security funds belong to the people who contributed them and their beneficiaries and a majority (71%) say Social Security is a promise made to all generations that should not be broken.

?Next month, we will celebrate the 75th anniversary of Social Security, a national treasure that has only improved with age,? said Rep. Jan Schakowsky (D-IL), Co-Chair of the Congressional Seniors Task Force.?The poll released today shows that Social Security is cherished by the vast majority of Americans of all ages. They believe it is critical for their economic well-being and that its essential protections must not be reduced. I agree. The poll also made clear that the American public knows Social Security is not a contributor to today?s deficits. The program is not in crisis; while we will need to act ensure its solvency throughout this century and beyond, we can do so without making cuts in critical benefits.?Rep. Earl Pomeroy (D-ND) is Chairman of the Social Security Subcommittee and warned against efforts to cut or privatize Social Security benefits, ?There are those, even in the aftermath of the failed efforts by President Bush to privatize Social Security, who would take those changes right into the benefit structure today with a rationale of long term solvency without looking at other options. They never fully discuss that we are taking away the legacy of the program for our children.?Congressman Ron Klein (D-FL), a strong advocate for Social Security who represents over 130,000 seniors in South Florida said, ?Social Security is a contract we have with our seniors, and they have lived up to their end of the bargain. It?s essential that we live up to our end. That?s why I am here today to say that I will not stand for any attempts to weaken Social Security benefits for our seniors, or any reckless efforts to balance our nation?s books on the backs of our seniors.? The poll ?U.S. Attitudes Toward Social Security? is now available on the National Committee Foundation?s website.