Chained CPI Doesn’t Cut It

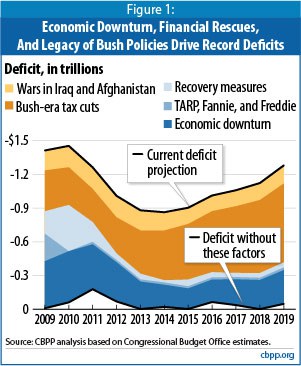

Normally we see eye to eye with the Center on Budget Policy and Priorities on Social Security and Medicare policy. However, we respectfully disagree with their recent position that the Chained CPI formula should be used to calculate Cost of Living Adjustments for Social Security recipients as part of a larger deficit reduction package.The Chained CPI is a benefit cut for Social Security beneficiaries, plain and simple. Since Social Security did notcause this deficit, why should we askbeneficiaries to pay for it through benefit cuts? This makes no sense and further emboldens anti-entitlement crusaders who have been desperately trying to cut Social Security for decades.  As CBPP itself has reported, there are other drivers of our deficit and those should be the focus of any debt debate. Cutting Social Security benefits by adopting the chained CPI is not the way to go if we want to protect the future financial stability of seniors.The Chained CPI cuts benefits because it produces lower estimates of inflation than the current CPI does, averaging about 0.3 percentage points lower than the increases in the current CPI since December 2000. The Chief Actuary estimates this reduced COLA would mean a benefit cut of about $130 per year (0.9 percent) for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1400, a 9.2 percent reduction from currently scheduled benefits. Social Security?s oldest beneficiaries will suffer the most under this formula while younger beneficiaries, who may have sources of income other than Social Security, could find themselves hit from another direction as well – increased taxes.We should not cut Social Security in the name of deficit reduction, period. If lawmakers want to strengthen Social Security?s benefits and improve the program?s long-term solvency, this should be accomplished solely from the perspective of what is best for this self-financed social insurance program. The Chained CPI is nothing more than a way to cut benefits that proponents hope will fly under the political radar so that beneficiaries won?t understand what?s happened to their benefits until it?s too late.

As CBPP itself has reported, there are other drivers of our deficit and those should be the focus of any debt debate. Cutting Social Security benefits by adopting the chained CPI is not the way to go if we want to protect the future financial stability of seniors.The Chained CPI cuts benefits because it produces lower estimates of inflation than the current CPI does, averaging about 0.3 percentage points lower than the increases in the current CPI since December 2000. The Chief Actuary estimates this reduced COLA would mean a benefit cut of about $130 per year (0.9 percent) for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1400, a 9.2 percent reduction from currently scheduled benefits. Social Security?s oldest beneficiaries will suffer the most under this formula while younger beneficiaries, who may have sources of income other than Social Security, could find themselves hit from another direction as well – increased taxes.We should not cut Social Security in the name of deficit reduction, period. If lawmakers want to strengthen Social Security?s benefits and improve the program?s long-term solvency, this should be accomplished solely from the perspective of what is best for this self-financed social insurance program. The Chained CPI is nothing more than a way to cut benefits that proponents hope will fly under the political radar so that beneficiaries won?t understand what?s happened to their benefits until it?s too late.

Santorum Describes Social Security & Medicare Beneficiaries as Drug Addicts Needing a “Dime Bag”

As we have said before, it?s long past time that primary voters start asking Presidential candidates very specific questions about their plans for Social Security and Medicare. So far, voters have been treated to a lot of Orwellian double-speak offered by candidates who say “reform” when they mean “cut” and “preserve” when they mean “privatize.”While GOP Presidential candidate Rick Santorum has made his views on Social Security and Medicare clearer than most–he wants to slash both– we found a video this week that offers a terrifying view of what Santorum really thinks about America?s seniors, the disabled, survivors and their families. He sees them as nothing more than drug addicts.In a 2010 speech at the Pennsylvania Republican State Committee’s annual dinner Santorum, in tones of hushed drama and fake theatrics, describes Democrats who support programs like Social Security and Medicare (including the President of the United States) as drug dealers pushing ?dime bags? to addicts — who in his worldview include middle class Americans who have the nerve to expect to collect the benefits they?ve paid for.Here?s the video followed by the full transcript.?I?ll tell you what Harry Reid, Nancy Pelosi and Barack Obama are telling me. What they?re telling me is that you may not like it now but Americans love their entitlements. And once we get you hooked on the entitlement you?ll never go back. Now I closed my eyes and thought, I?m standing in front of the school yard with a guy and a dime bag saying once I hook you, once I numb you, once I stop you from reaching great heights and protect you from falling?we got you. We?ll hook you.? former Senator Rick Santorum Shame on Rick Santorum. Political rhetoric is one thing but equating millions of hard-working Americans with drug addicts is indefensible and ridiculous. It?s also provides a frightening glimpse of his world-view, if he were elected President.

So Much Social Security/Medicare News – So Little Space

First off, Congress has predictably chosen politics over policy and extended the payroll tax cut.It?s no secret?there is no such thing as a temporary tax cut in Washington. Once the diversion of Social Security payroll taxes was renamed a ?middle class tax cut?, election year politics for both parties killed any hope of reversing this flawed stimulus approach.America?s seniors, disabled, survivors, and their families are fearful, and rightfully so, of Washington using their Social Security contributions as the nation?s piggy bank, and they will demand that Congress let this latest extension expire at the end of the year.Senator Tom Harkin made an eloquent floor statement last night summing up why this is such a flawed policy:Our President/CEO, Max Richtman also wrote an Oped that appeared in the Baltimore Sun today detailing why politicians, of both parties, need to wake up to the reality that Social Security and Medicare will play a vital role in this election–and the typical “campaign-speak” we’ve seen so far on what candidates plan for these vital programs in the future, really won’t cut it for voters this election cycle. Here’s just a sample of his comments:

Historically, the Democratic Party has been the party of Social Security and Medicare, and for decades its support among seniors and the middle class reflected that. However, that was then. The erosion of senior support for Democratic candidates has been steady, with Democrats winning seniors’ support by just 7 points in 1996 and losing it by 21 points in 2010, according to our polling. The party that created Social Security and Medicare has lost the confidence of many of those Americans who understand, firsthand, the value of these vital programs and who want elected leaders who will fight to strengthen them.Democrats are losing this battle because, simply put, some of them have signaled they are willing to bargain away earned benefits to pay for Washington’s economic mistakes. Democrats have an opportunity in this year’s election to regain lost ground by drawing a clear line in the sand in defense of the core American values of hard work, fairness and compassion embodied in our nation’s most successful programs. Will they take that stand?Over the years, some conservatives have also successfully co-opted the debate by promising Americans they’ll “preserve” and “strengthen” these vital programs ? while actually proposing benefit cuts, Social Security private accounts or vouchers for seniors in Medicare. We don’t have to destroy these programs to “save” them, yet that’s exactly the strategy wrapped in campaign-speak by candidates like Mitt Romney, who promised Florida seniors he’d “never go after Medicare.” Mr. Romney supports proposals like House Budget Committee Chairman Paul Ryan’s plan, which turns Medicare into a voucher program, destroying traditional Medicare as we know it and sending the bill to seniors. American voters expect more than the double-speak offered by political candidates who say “reform” when they mean “cut” and “preserve” when they mean “privatize.”Our nation’s leaders have an opportunity to regain the confidence of American voters by saying what they mean and meaning what they say in a full-throated defense against attacks on America’s social safety net. It’s a simple argument for fairness and economic reason. Voters are tired of false choices in which benefits for middle-class Americans are traded away in closed-door deals to protect tax breaks millionaires don’t need. America’s seniors want Washington to get its fiscal house in order, but they also know cutting benefits to those still struggling with skyrocketing health care costs, diminished home values, unemployment, decimated savings and a shaky economy is not shared sacrifice. While some in Washington continue to argue we can’t afford Social Security and Medicare, we can’t afford to lose these financial stabilization programs. Social Security alone provides $696 billion to our national economy each year through earned benefits provided to 54 million retirees, disabled workers, survivors and children. It’s fiscal folly to cut the very programs keeping millions of average Americans afloat while tax breaks for the wealthy, according to the National Priorities Project, drain $11.6 million from the Treasury every hour.

Lastly, Richard Eskow has a terrific post at Huffington Post today describing the GOP’s latest Medicare privatization pitch in the Senate. Here’s an excerpt but we really recommend you read the entire piece here:

There’s a new “Medicare” proposal — sorta. It’s really the same old bait-and-switch we’ve seen a dozen times. Still, you gotta hand it to ’em: Republican Sens. Tom Coburn and Richard Burr have taken the usual right-wing think-tank-designed buzzwords, deceptive packaging, and sleights of hand to new heights.These foundation-forged assaults on the middle class may be old, battered ideas that have been debunked a dozen times, but still they just won’t die. Like the old Terminators, they keep coming back with the same mission: Must. Kill. Medicare.Coburn and Burr don’t even pretend to show how their anti-Medicare plan – excuse me, “choice” plan — will save money. They just say this:We do not yet have a concrete, specific amount of “savings” outlined, but we believe our proposal could save between $200 billion and $500 billion over a decade.Well, I do not yet have a concrete, specific schedule, but I believe that “monkeys” will fly out of my butt any moment now, and that there will be somewhere between two hundred and eight hundred of these aeronautical primates by the time the process concludes.Burr and Coburn want you to believe that they can raise the Medicare eligibility age, make you pay more in premiums, turn your health care over to the same insurers that are bankrupting you before you’re sixty-five (if you’re lucky enough to have insurance) — and that somehow you’ll save money!

Social Security Promise Quilt Campaign Unites Young and Old

All too often, the day-to-day reality of how Social Security touches the lives of virtually every American family is simply lost in this political debate. That?s why we?ve launched a new national campaign called Protect This Promise. Our goal is to bring generations together to share their stories about the vital role Social Security plays in their lives on our Social Security Promise Quilt. The Social Security Promise Quilt illustrates the interconnectivity of a program that touches virtually every American family whether the beneficiary is a future retiree, already retired, disabled or received survivor benefits as a child. Social Security is an American legacy ? not a partisan issue or a matter of age.

Please take just a moment and share your story — upload a family photo to our Promise Quilt and read the personal stories shared by hundreds of others throughout the nation. Americans understand the lasting value of Social Security and the Promise Quilt gives us an opportunity to stand together to remind Washington of the real life consequences of cutting benefits vital to millions of middle class Americans in every state of the nation.

The Good News and Bad News in the President’s Budget Plan

?While the President?s budget offers a balanced approach addressing revenue and spending, his plan shifts even more costs to seniors in Medicare through increased means-testing, premium hikes and co-pays. The real cost driver is not Medicare, as some have claimed, but rising healthcare costs system-wide. We need to tackle the true problem, not just pass more costs on to seniors. That?s why the National Committee supported health care reform as the best way to bring spending under control. We should be expanding on the progress made since the Affordable Care Act became law rather than finding new ways to send seniors the budget bill.? Max Richtman, NCPSSM President/CEO

However, we do not support the President?s plan to expand Medicare means-testing. While it may sound logical that so-called ?rich? seniors should pay more during tight budget times, the truth is that?s not what means testing will actually do:

?While some tout increasing means testing in Medicare as a way to insure ?rich? seniors pay their share, the truth is, the middle-class will take this hit too. Medicare has already been means tested since 2007 and the number of beneficiaries subject to higher premiums is already increasing. Proposals that target even more Medicare beneficiaries for increasing premiums will ultimately impact beneficiaries with modest incomes.? Max Richtman, President and CEO

Proposals that would subject even more Medicare beneficiaries to income-related premiums would impact beneficiaries who certainly would not be considered higher income. For example, beneficiaries with incomes of just $47,000 today, would face higher premiums by 2035 according to a report on means testing prepared by the Kaiser Family Foundation.