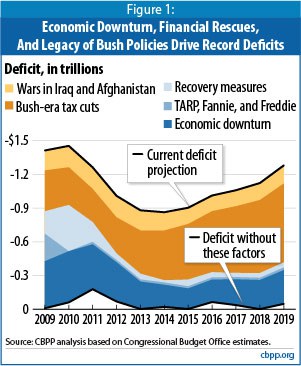

Normally we see eye to eye with the Center on Budget Policy and Priorities on Social Security and Medicare policy. However, we respectfully disagree with their recent position that the Chained CPI formula should be used to calculate Cost of Living Adjustments for Social Security recipients as part of a larger deficit reduction package.The Chained CPI is a benefit cut for Social Security beneficiaries, plain and simple. Since Social Security did notcause this deficit, why should we askbeneficiaries to pay for it through benefit cuts? This makes no sense and further emboldens anti-entitlement crusaders who have been desperately trying to cut Social Security for decades.  As CBPP itself has reported, there are other drivers of our deficit and those should be the focus of any debt debate. Cutting Social Security benefits by adopting the chained CPI is not the way to go if we want to protect the future financial stability of seniors.The Chained CPI cuts benefits because it produces lower estimates of inflation than the current CPI does, averaging about 0.3 percentage points lower than the increases in the current CPI since December 2000. The Chief Actuary estimates this reduced COLA would mean a benefit cut of about $130 per year (0.9 percent) for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1400, a 9.2 percent reduction from currently scheduled benefits. Social Security?s oldest beneficiaries will suffer the most under this formula while younger beneficiaries, who may have sources of income other than Social Security, could find themselves hit from another direction as well – increased taxes.We should not cut Social Security in the name of deficit reduction, period. If lawmakers want to strengthen Social Security?s benefits and improve the program?s long-term solvency, this should be accomplished solely from the perspective of what is best for this self-financed social insurance program. The Chained CPI is nothing more than a way to cut benefits that proponents hope will fly under the political radar so that beneficiaries won?t understand what?s happened to their benefits until it?s too late.

As CBPP itself has reported, there are other drivers of our deficit and those should be the focus of any debt debate. Cutting Social Security benefits by adopting the chained CPI is not the way to go if we want to protect the future financial stability of seniors.The Chained CPI cuts benefits because it produces lower estimates of inflation than the current CPI does, averaging about 0.3 percentage points lower than the increases in the current CPI since December 2000. The Chief Actuary estimates this reduced COLA would mean a benefit cut of about $130 per year (0.9 percent) for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1400, a 9.2 percent reduction from currently scheduled benefits. Social Security?s oldest beneficiaries will suffer the most under this formula while younger beneficiaries, who may have sources of income other than Social Security, could find themselves hit from another direction as well – increased taxes.We should not cut Social Security in the name of deficit reduction, period. If lawmakers want to strengthen Social Security?s benefits and improve the program?s long-term solvency, this should be accomplished solely from the perspective of what is best for this self-financed social insurance program. The Chained CPI is nothing more than a way to cut benefits that proponents hope will fly under the political radar so that beneficiaries won?t understand what?s happened to their benefits until it?s too late.