Will Democrats Promise No Cuts to Social Security?

NCPSSM’s Board Chair, Dr. Maya Rockeymoore, and Florida NCPSSM member Carol Berman testified to members of the Democratic National Committee platform drafting committee in Minneapolis this weekend. Here’s an excerpt of their comments:

Maya Rockeymoore, Ph.D., Chair of the Board of Directors

National Committee to Preserve Social Security and Medicare

Democrats can be proud of their long list of landmark accomplishments which enable seniors to live independent and dignified lives. It is Democrats who pulled seniors out of poverty through the creation of Social Security, Medicare, Medicaid and the Older Americans Act. During the 2012 campaign and beyond, the Democratic Party can honor the legacies of Presidents Franklin D. Roosevelt and Lyndon B. Johnson by standing up for seniors. Standing up for Social Security. And, standing up for Medicare and Medicaid. Unfortunately, too many Washington politicians are uncompromising in their belief that middle class benefits should be cut to pay for tax loopholes for the richest two percent and large profitable corporations who move American jobs overseas. However, rather than fight this intransigence, some of the traditional allies of Social Security, Medicare and Medicaid have said that “everything should be on the table.”

Everything, including benefit cuts that would harm seniors, people with disabilities and children and have a disproportionately negative affect on women and communities of color. Responding to the party of NO by being the party of MAYBE is not a winning formula and it won’t be persuasive for a majority of seniors. The polling is clear on that. Voters of all ages and political persuasions don’t support cutting benefits to middle-class Americans who depend on Social Security and Medicare (now or in the future) to repair our ailing economy.

There is no other issue that draws this level of nonpartisan support: 94 percent of Democrats, 82 percent of Independents and 64 percent of Republicans prefer raising taxes on the richest two percent of income earners rather than cutting benefits. Democrats have a historic opportunity in this year’s election to win over middle class seniors by drawing a clear line in the sand in defense of the core American values of hard work, fairness and compassion embodied in our nation’s most successful programs.

Towards that goal, the committee can reassure seniors that Democrats are fighting to protect their earned Social Security and Medicare benefits by using this testimony to draft the 2012 Democratic National Committee platform. In addition, we urge you to include language in the platform to defend and expand Medicaid for vulnerable seniors, people with disabilities and children who need health care and/or long-term services and supports.

By applying taxes more fairly to all workers, benefits do not have to be cut. Among the proposals we’ve recommended for inclusion in the Democratic platform:

– Eliminate the cap on Social Security payroll tax contributions.

– Gradual Increase in the Contribution Rate.

– Reform the Treatment of Salary Reduction Plans.

– Improving Survivor Benefits.

– Provide Social Security Credits for Caregivers.

– Enhance the Special Minimum Benefits.

– Equalize Rules for Disabled Widows.

– Benefit Equality for Working Widows.

– Strengthening the COLA.

– Restoring Student Benefits.

Carol Berman is a National Committee member and Social Security and Medicare beneficiary. She described to the platform committee the critical role Social Security and Medicare played after her husband became incapacitated due to Alzheimer’s and their long-term care costs drained their savings:

Carol Berman, NCPSSM Member and Social Security & Medicare Beneficiary

West Palm Beach, FL

“When it became clear that our funds would not last much longer and that my financial future was in serious jeopardy, I hired an elder care attorney who advised me to contact a state welfare worker. This person told me that when my funds ran out I would be eligible for Section 8 housing, food stamps, and other welfare programs. I could not believe that after working my whole life, this was my only option. It was not what I dreamed of in my retirement years.

Ultimately, the only way I could avoid impoverishment and taking welfare was to preserve my only remaining source of money — my 40lK. To do that, I had to divorce my husband. Thankfully, since my daily visits to the nursing home never wavered, my husband never knew the change in our marital status. He greeted me the same way every day during this terrible period with “here comes the pretty lady.I lived on the edge of financial disaster for a long time just because my husband needed long-term care.

Social Security and Medicare were the lifelines I needed to come through that very difficult time. They are lifelines future generations will also need and they should be protected and strengthened – not cut or privatized.”

You can see our full testimony to the Democratic Platform Committee here.

CBO Says Supreme Court Ruling on Health Care Reform Reduces Costs

CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period—for a net reduction of $84 billion. (Those figures do not include the budgetary impact of other provisions of the ACA, which in the aggregate reduce budget deficits.)

The projected net savings to the federal government resulting from the Supreme Court’s decision arise because the reductions in spending from lower Medicaid enrollment are expected to more than offset the increase in costs from greater participation in the newly established exchanges.

Unfortunately, the costs savings CBO projects is at the expense of millions of lower income uninsured Americans who won’t receive Medicaid benefits as originally envisioned in the Affordable Care Act.

The CBO also did an analysis of the cost of House Republican efforts to repeal health care reform. The CBO says that move would add $109 billion to federal deficits.

H.R. 6079 would repeal the ACA (with the exception of one subsection that has no budgetary effect). This estimate reflects the spending and revenue projections in CBO’s March 2012 baseline as adjusted to take into account the effects of the recent Supreme Court decision.

Assuming that H.R. 6079 is enacted near the beginning of fiscal year 2013, CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting that legislation would cause a net increase in federal budget deficits of $109 billion over the 2013–2022 period. Specifically, we estimate that H.R. 6079 would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period.

Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012.

So, not only would the repeal of the Affordable Care Act add to our deficits it also cuts benefits to millions of Medicare beneficiaries. With repeal:

- The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

- The Part D coverage gap known as the ‘donut hole’ would return

- Annual wellness visits for beneficiaries would no longer be covered by Medicare

- Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

- Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

- The Medicare Trust Fund’s solvency would be shortened by 8 years

All this plus adding $109 billion to the deficit. So much for fiscal responsibility.

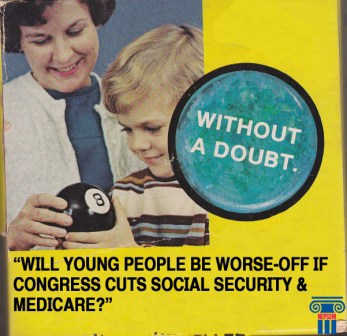

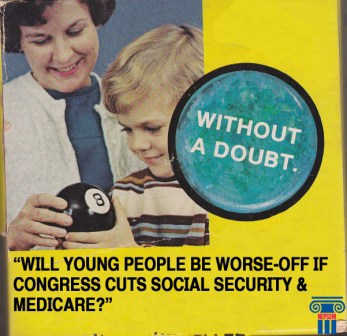

Young People – Don’t Buy the Lie about Social Security

That’s why it’s so encouraging to see that not all young workers are buying the lie about Social Security. The National Academy of Social Insurance’s new guide A Young Person’s Guide to Social Security, is written by and for America’s young workers and goes a long way to help provide some desperately needed Social Security myth-busting.

Don’t have time to read the report? OK…here’s the video. Watch it and share with your friends, no matter their age.

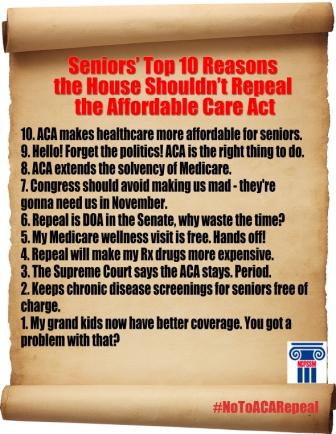

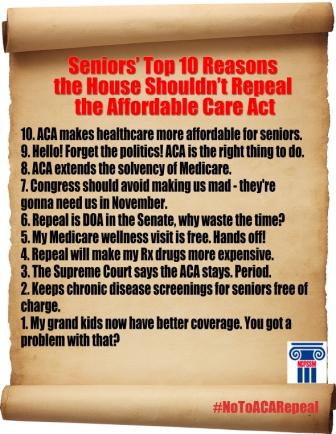

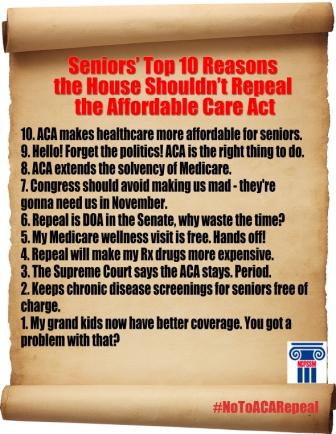

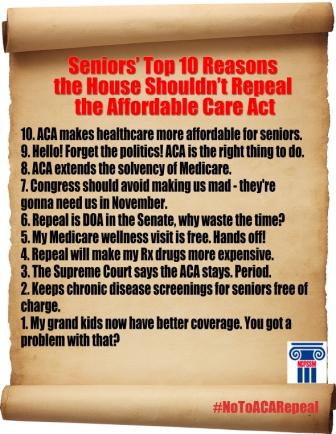

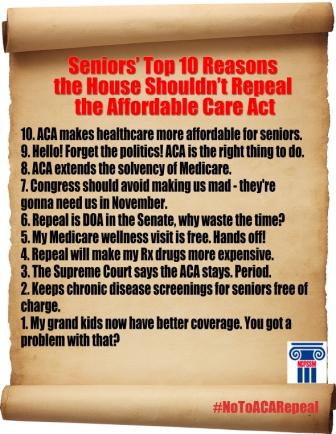

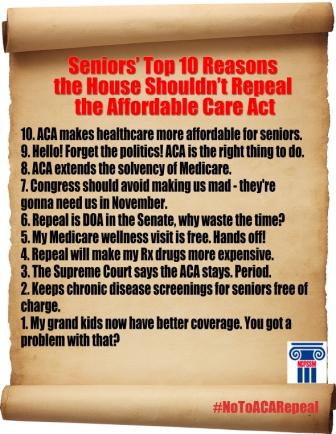

House Vote to Repeal the Affordable Care Act = Politics as Usual

“We are in this fight to keep Medicare benefits from being stripped away from millions of seniors by Members of Congress who vote to repeal the Affordable Care Act. The ACA will save lives, it will provide coverage to millions who lack insurance and it already provides improved benefits for less cost to seniors in Medicare. America’s health and economic security should take priority over election-year politics; however, this vote proves once again, politics trumps policy in the House. The Affordable Care Act is law, it’s working, and it’s long past time for Congress to start making economic growth a priority.” Max Richtman, President/CEO

While political rhetoric dominated much of today’s House repeal debate, the facts about the benefits provided to seniors in Medicare — which would be lost if health care reform was repealed — were largely ignored. Here are just a few of the benefits that would be lost if the Affordable Care Act was repealed:

· The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

· The Part D coverage gap known as the ‘donut hole’ would return

· Annual wellness visits for beneficiaries would no longer be covered by Medicare

· Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

· Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

· The Medicare Trust Fund’s solvency would be shortened by 8 years

A full analysis of the Medicare and Medicaid improvements that were preserved as a result of the recent Supreme Court ruling to uphold the Affordable Care Act can be found on the National Committee’s website.

Will Democrats Promise No Cuts to Social Security?

NCPSSM’s Board Chair, Dr. Maya Rockeymoore, and Florida NCPSSM member Carol Berman testified to members of the Democratic National Committee platform drafting committee in Minneapolis this weekend. Here’s an excerpt of their comments:

Maya Rockeymoore, Ph.D., Chair of the Board of Directors

National Committee to Preserve Social Security and Medicare

Democrats can be proud of their long list of landmark accomplishments which enable seniors to live independent and dignified lives. It is Democrats who pulled seniors out of poverty through the creation of Social Security, Medicare, Medicaid and the Older Americans Act. During the 2012 campaign and beyond, the Democratic Party can honor the legacies of Presidents Franklin D. Roosevelt and Lyndon B. Johnson by standing up for seniors. Standing up for Social Security. And, standing up for Medicare and Medicaid. Unfortunately, too many Washington politicians are uncompromising in their belief that middle class benefits should be cut to pay for tax loopholes for the richest two percent and large profitable corporations who move American jobs overseas. However, rather than fight this intransigence, some of the traditional allies of Social Security, Medicare and Medicaid have said that “everything should be on the table.”

Everything, including benefit cuts that would harm seniors, people with disabilities and children and have a disproportionately negative affect on women and communities of color. Responding to the party of NO by being the party of MAYBE is not a winning formula and it won’t be persuasive for a majority of seniors. The polling is clear on that. Voters of all ages and political persuasions don’t support cutting benefits to middle-class Americans who depend on Social Security and Medicare (now or in the future) to repair our ailing economy.

There is no other issue that draws this level of nonpartisan support: 94 percent of Democrats, 82 percent of Independents and 64 percent of Republicans prefer raising taxes on the richest two percent of income earners rather than cutting benefits. Democrats have a historic opportunity in this year’s election to win over middle class seniors by drawing a clear line in the sand in defense of the core American values of hard work, fairness and compassion embodied in our nation’s most successful programs.

Towards that goal, the committee can reassure seniors that Democrats are fighting to protect their earned Social Security and Medicare benefits by using this testimony to draft the 2012 Democratic National Committee platform. In addition, we urge you to include language in the platform to defend and expand Medicaid for vulnerable seniors, people with disabilities and children who need health care and/or long-term services and supports.

By applying taxes more fairly to all workers, benefits do not have to be cut. Among the proposals we’ve recommended for inclusion in the Democratic platform:

– Eliminate the cap on Social Security payroll tax contributions.

– Gradual Increase in the Contribution Rate.

– Reform the Treatment of Salary Reduction Plans.

– Improving Survivor Benefits.

– Provide Social Security Credits for Caregivers.

– Enhance the Special Minimum Benefits.

– Equalize Rules for Disabled Widows.

– Benefit Equality for Working Widows.

– Strengthening the COLA.

– Restoring Student Benefits.

Carol Berman is a National Committee member and Social Security and Medicare beneficiary. She described to the platform committee the critical role Social Security and Medicare played after her husband became incapacitated due to Alzheimer’s and their long-term care costs drained their savings:

Carol Berman, NCPSSM Member and Social Security & Medicare Beneficiary

West Palm Beach, FL

“When it became clear that our funds would not last much longer and that my financial future was in serious jeopardy, I hired an elder care attorney who advised me to contact a state welfare worker. This person told me that when my funds ran out I would be eligible for Section 8 housing, food stamps, and other welfare programs. I could not believe that after working my whole life, this was my only option. It was not what I dreamed of in my retirement years.

Ultimately, the only way I could avoid impoverishment and taking welfare was to preserve my only remaining source of money — my 40lK. To do that, I had to divorce my husband. Thankfully, since my daily visits to the nursing home never wavered, my husband never knew the change in our marital status. He greeted me the same way every day during this terrible period with “here comes the pretty lady.I lived on the edge of financial disaster for a long time just because my husband needed long-term care.

Social Security and Medicare were the lifelines I needed to come through that very difficult time. They are lifelines future generations will also need and they should be protected and strengthened – not cut or privatized.”

You can see our full testimony to the Democratic Platform Committee here.

CBO Says Supreme Court Ruling on Health Care Reform Reduces Costs

CBO and JCT now estimate that the insurance coverage provisions of the ACA will have a net cost of $1,168 billion over the 2012–2022 period—compared with $1,252 billion projected in March 2012 for that 11-year period—for a net reduction of $84 billion. (Those figures do not include the budgetary impact of other provisions of the ACA, which in the aggregate reduce budget deficits.)

The projected net savings to the federal government resulting from the Supreme Court’s decision arise because the reductions in spending from lower Medicaid enrollment are expected to more than offset the increase in costs from greater participation in the newly established exchanges.

Unfortunately, the costs savings CBO projects is at the expense of millions of lower income uninsured Americans who won’t receive Medicaid benefits as originally envisioned in the Affordable Care Act.

The CBO also did an analysis of the cost of House Republican efforts to repeal health care reform. The CBO says that move would add $109 billion to federal deficits.

H.R. 6079 would repeal the ACA (with the exception of one subsection that has no budgetary effect). This estimate reflects the spending and revenue projections in CBO’s March 2012 baseline as adjusted to take into account the effects of the recent Supreme Court decision.

Assuming that H.R. 6079 is enacted near the beginning of fiscal year 2013, CBO and JCT estimate that, on balance, the direct spending and revenue effects of enacting that legislation would cause a net increase in federal budget deficits of $109 billion over the 2013–2022 period. Specifically, we estimate that H.R. 6079 would reduce direct spending by $890 billion and reduce revenues by $1 trillion between 2013 and 2022, thus adding $109 billion to federal budget deficits over that period.

Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act, as passed by the House of Representatives on July 11, 2012.

So, not only would the repeal of the Affordable Care Act add to our deficits it also cuts benefits to millions of Medicare beneficiaries. With repeal:

- The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

- The Part D coverage gap known as the ‘donut hole’ would return

- Annual wellness visits for beneficiaries would no longer be covered by Medicare

- Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

- Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

- The Medicare Trust Fund’s solvency would be shortened by 8 years

All this plus adding $109 billion to the deficit. So much for fiscal responsibility.

Young People – Don’t Buy the Lie about Social Security

That’s why it’s so encouraging to see that not all young workers are buying the lie about Social Security. The National Academy of Social Insurance’s new guide A Young Person’s Guide to Social Security, is written by and for America’s young workers and goes a long way to help provide some desperately needed Social Security myth-busting.

Don’t have time to read the report? OK…here’s the video. Watch it and share with your friends, no matter their age.

House Vote to Repeal the Affordable Care Act = Politics as Usual

“We are in this fight to keep Medicare benefits from being stripped away from millions of seniors by Members of Congress who vote to repeal the Affordable Care Act. The ACA will save lives, it will provide coverage to millions who lack insurance and it already provides improved benefits for less cost to seniors in Medicare. America’s health and economic security should take priority over election-year politics; however, this vote proves once again, politics trumps policy in the House. The Affordable Care Act is law, it’s working, and it’s long past time for Congress to start making economic growth a priority.” Max Richtman, President/CEO

While political rhetoric dominated much of today’s House repeal debate, the facts about the benefits provided to seniors in Medicare — which would be lost if health care reform was repealed — were largely ignored. Here are just a few of the benefits that would be lost if the Affordable Care Act was repealed:

· The typical senior would lose $4,200 over the next decade in prescription drug savings provided in the ACA

· The Part D coverage gap known as the ‘donut hole’ would return

· Annual wellness visits for beneficiaries would no longer be covered by Medicare

· Seniors will now pay more for preventive services. Medicare would no longer fully cover screenings like mammograms, pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings

· Almost 3.3 million uninsured Americans ages 50-64 who would have been insured under Medicaid will remain uninsured

· The Medicare Trust Fund’s solvency would be shortened by 8 years

A full analysis of the Medicare and Medicaid improvements that were preserved as a result of the recent Supreme Court ruling to uphold the Affordable Care Act can be found on the National Committee’s website.