Last night Senate Republicans voted against the so-called ?Buffett Rule? killing this latest hope for tax fairness from Washington, once again. Seniors especially need to remember this vote when their elected leaders tell them that America ?can?t afford? Social Security and Medicare. During last night?s vote some GOP Senators even suggested the poor and middle-class aren?t suffering enough:

“The Joint Committee on Taxation estimates that 51 percent of all households, which includes both filers and nonfilers, had either zero or negative income tax liability in 2009,” Kyl said, suggesting it was the middle class and poor who were not sacrificing. “People who do not share in the sacrifice of paying taxes have little direct incentive to care whether the government is spending and taxing too much. Maybe that’s why the president has no problem with even more Americans getting a free ride.” Senator Jon Kyl (R-AZ)

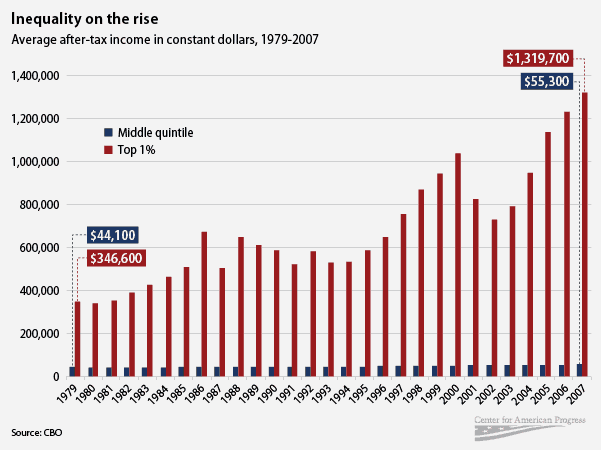

Most Americans understand that not earning enough income to have to pay income tax (even though they?re still paying plenty of other federal, state and local taxes) doesn’t mean working Americans are getting a free ride it just shows how much average Americans are suffering in this economy where unemployment, underemployment, and stagnant wages remain all-too-common. Nearly three-quarters of the American people support common-sense tax reform that returns some basic fairness to a system that has allows too many millionaires to pay a lower tax rate than middle class workers.However, conservatives in Washington, in vote after vote, have made it clear they will do whatever it takes to protect tax cuts for the wealthiest among us. In fact, they hope to persuade you that turning Medicare into Couponcare and privatizing Social Security is the kind of ?shared sacrifice? needed to preserve (and even expand) these tax cuts for the millionaires and corporations.Here are some graphs from Think Progress that clearly illustrate what?s at stake: