Since before Social Security was created 81 years ago, the actuaries at the Social Security Administration have been tasked with making real-time analysis and long-term projections of the program’s health. Their record has been impressive. For example: in 1934, actuaries projected that the percentage of the U.S. population aged 65 and over would be 12.65 percent in 1990. It turned out to be 12.49 percent.

Given that 60 million Americans depend on Social Security, it’s obvious why accurate and consistent information on the program’s finances is vital to the economic health of so many families and our nation. That’s why it’s also disturbing to see the possibility that politics might be interjected into Social Security’s financial analysis and projections by the creation of dueling reports. Some background…

During the Bush administration, the Congressional Budget Office was tasked for the first time in its history to do its own analysis of Social Security. Now, CBO is staffed with economists who examine many federal programs but they’re not actuaries or Social Security experts. In fact, they’ve chosen different assumptions on mortality, interest rates, income inequality and disability rates for their Social Security calculations than the experts at SSA. Not surprisingly that means their predictions are also different.

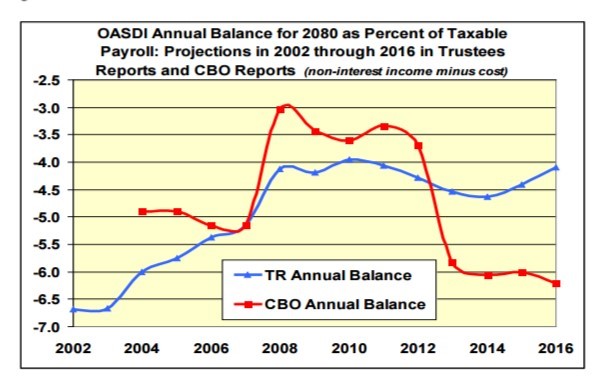

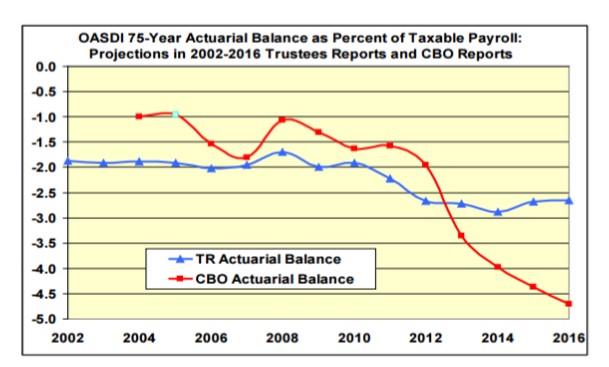

“When CBO first got into the act, it projected somewhat smaller shortfalls than the actuaries. Then, in 2013 – soon after Senator Elizabeth Warren and other prominent members of Congress began publicly advocating for expansion – CBO’s projected shortfall increased by 73 percent in just one year. It jumped again in 2014, and yet again in 2015. According to CBO’s non-actuaries, Social Security’s projected long-range shortfall more than doubled, increasing by a whopping 125 percent in just three years.

The smooth operation of Social Security oversight and policymaking depends on projections that are reliable and trustworthy. The actuaries spend all year long, every year, studying trends, perfecting techniques, and refining their projections. Their projections are steady and consistent, wavering only slightly from year to year.

Not so, CBO. Estimates that more than double the projected shortfall in the span of just three years should raise red flags in and of themselves. Not surprisingly, CBO’s underlying assumptions are highly questionable.”…Nancy Altman, Social Security Works

- CBO assumes 75 years of very low interest rates, far lower than we’ve seen over four decades.

- CBO predicts income inequality will grow substantially despite efforts in Congress to reverse that trend.

- While disability rates are slightly lower, CBO predicts they’ll increase.

- CBO assumes longevity rates will improve, even for the oldest Americans. Meaning a 95 year old will see the same longevity increase at a 55 year old?

With hundreds of assumptions to consider, it would be logical that some changes might balance the analysis; however, in CBO’s case, each of the assumptions they changed led to a significantly larger shortfall. Coincidence? These graphs, introduced in the House Ways and Means subcommittee hearing on this issue today illustrates that dramatic shift, which more than doubled the shortfall prediction in just three years.

Members of Congress asked the SSA and CBO today which prediction should they believe — the nation’s actuaries whose sole job is manage the Social Security program or economists at the CBO, who’ve taken a new and different path to come up with very different answers.

Unfortunately, this case of dueling reporting isn’t happening in a vacuum. Political pressure to exclude data on the size of Social Security’s benefit replacement rates in the annual Trustees Report (by those who’ve long claimed that benefits are much larger than can be proved) has been successful. This important data (which has been reported for decades) is no longer provided, meaning the public can no longer see the replacement rates which Social Security benefits provide its beneficiaries. This clears the way for those who hope to persuade Congress that benefits are more generous than the actual numbers would show.

Earlier this year, CBO also had to issue a correction for errors it made in a widely-reported brief on the exactly the same replacement rate issue. Once again, these errors played into the same political argument that seniors are getting more from Social Security than actuaries believe, that the retirement crisis is phony and that Social Security costs more and is more generous than the actuarial evidence demonstrates. As reported by economist Dean Baker at the Center for Economic and Policy Research, this is far from the first time CBO has made errors in its long-term analysis:

“While this was a serious error, unfortunately it was not the first time that CBO had made a major error in an authoritative publication. In 2010, in its annual long-term budget projections it grossly overstated the negative effect on the economy of budget deficits. The 2010 long-term projections showed a modest increase in future deficits relative to the 2009 projections, yet the impact on the economy was far worse.

The 2010 projections showed a drop in GDP of almost 18 percent by 2025, compared to a balanced budget scenario. This was more than twice as large as the impact shown in the prior year’s projections. The sharp projected drop in GDP could have been used to emphasize the urgency of deficit reduction. As was the case with the recent Social Security projections, CBO corrected its numbers after the error was exposed.”

The Social Security actuaries are universally respected for their straight-shooting and consistent approach to reporting and projecting on the program’s finances. These days, that type of bi-partisan respect is hard to come by. That’s why we say it’s time for outside influence-peddlers to quit creating confusion over a system which has served our nation well for more than three-quarters of a century.