No doubt you’ve already seen the Mitt Romney video in which he describes to a group of $50,000 per plate donors his view of almost half of America’s population:

“There are

47 percent who are with him, (Obama) who are dependent upon government, who believe that they are victims, who believe the government has a responsibility to care for them, who believe that they are entitled to health care, to food, to housing, to you-name-it. That that’s an entitlement. And the government should give it to them. And they will vote for this president no matter what…These are people who pay no income tax. “[M]y job is not to worry about those people. I’ll never convince them they should take personal responsibility and care for their lives.” Mitt Romney, Florida Fundraising Event

While Governor Romney later described his comments as “not elegantly stated”, he stands by his basic point that nearly half of America see themselves victims and believe they are entitled to something. So where does this 47% come from? Romney’s comments are an odd amalgam of two reports: one on the number of Americans who don’t pay income taxes (not all taxes) and the other on the number of Americans who receive some form of government benefit including: retirees, college students, veterans and farmers – just to name a few. Together these two reports are used to bolster the often-expressed GOP view that America is a nation of “makers vs. takers”.

America’s retirees need to listen up…you are among the “takers” Mitt Romney criticizes as “dependent” because of your tax status and that you dare to receive the Social Security and Medicare benefits you’ve earned. Ezra Klein describes how seniors work into the Romney tax argument:

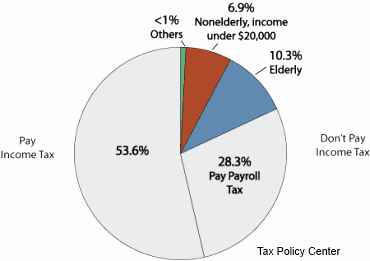

“The vast majority of households that don’t pay federal income taxes are either elderly or paying payroll taxes. As you can see below, 60 percent of those who don’t pay income tax are still working and paying taxes for Social Security and Medicare. Their tax liability is just too low to qualify for the income tax. Another 22 percent of non-payers are retirees. Only about 7.9 percent of households are not paying any federal taxes at all. That’s usually because they’re either unemployed or on disability or students or are very poor.”

So, targeted tax credits for the elderly puts retirees among the GOP “taker” class — regardless of the fact that most seniors paid a lifetime of income taxes while employed and continue to pay other taxes even into retirement. In addition, collecting the Social Security and Medicare benefits that you contributed to throughout your working lifetime also makes you “dependent” and “entitled” in the Romney/Ryan political perspective in which safety net programs are simply:

“…a hammock that lulls able-bodied people into lives of dependency and complacency, that drains them of their will and the intent to make the most of their lives.” Paul Ryan, March 2012

The Romney/Ryan economic strategy which claims our nation can’t afford tax cuts benefiting the poor and middle-class while at the same time proposing more tax cuts for the wealthy – to be paid for with benefit cuts for average Americans – has been laid out for all to see.

“Republicans have become outraged over the predictable effect of tax cuts they passed and are using that outrage as the justification for an agenda that further cuts taxes on the rich and pays for it by cutting social services for the non-rich. That’s why Romney’s theory here is more than merely impolitic. It’s actually core to his economic agenda.” Washington Post, Wonk Blog

“Romney’s message is that in order to lower taxes for his wealthy friends he will demand that retirees who worked hard, played by the rules, saved for retirement and counted on the promise of Social Security and Medicare, “take personal responsibility” and pay higher taxes, receive less in Social Security and trade in the promise of Medicare for Ryan’s Vouchercare, ending Medicare as we know it.” Daily Kos

Seniors need to ask themselves — Does this really sound like a President who will fight to preserve your economic security or your family’s? Because if you’re not Mitt Romney’s worry just 48 days before election day when will you be?