Where is Social Security in Coverage of Trump Payroll Tax Cut Proposal?

The mainstream media have given ample coverage to President Trump’s proposal to cut payroll taxes, but many news outlets have ignored the potential impact on Social Security. In fact, some of the coverage does not even mention Social Security – an odd omission considering that FICA payroll taxes fully fund the income security program! Cutting payroll taxes deprives Social Security of much-needed revenue. But consumers of mainstream news could be forgiven for not knowing that.

In fairness, major news sources — from Newsweek to the New York Times, from the Washington Post to the Associated Press, and from NBC to CNN — are by no means soft-pedaling the president’s proposal. They have chronicled objections from Democrats, Republicans, and economists that a payroll tax cut makes little macroeconomic sense. High earners would receive significantly more payroll tax relief than lower income workers. A payroll tax cut doesn’t help the unemployed. It would do nothing for contract workers in the gig economy.

“Trump’s coronavirus payroll tax cut has ‘important drawbacks’ and is ‘really inferior’ to other ideas, economists say.” – Newsweek

“Democrats… emerged to throw cold water on Mr. Trump’s payroll tax cut, saying it was not ‘what we need right now.’” – New York Times

“Senate Majority Leader Mitch McConnell views the idea with skepticism, privately making clear… that he ‘detests’ pursuing this particular policy, which probably would add to federal debt and deficits.” – Washington Post

No doubt this is valid reporting. But many media outlets failed to include the implications for Social Security itself, leaving it to progressive journalists and seniors’ advocates to warn the public. The National Committee has just sent a letter to Senators and House members warning about the perils of a payroll tax cut.

“It seems as though bad ideas never die in Washington. We do not believe that making cuts to or eliminating the Social Security payroll tax is an appropriate way to [provide financial relief to Americans during this crisis]. Any reductions to this vitally important revenue stream would threaten Social Security’s ability to continue paying benefits to the 63 million Americans who depend on [it].” – NCPSSM letter to the House and Senate

As we have argued in this space and in published opinion pieces, Social Security funds should not be used for unrelated purposes. Depriving Social Security of revenue could threaten retirees’ benefits, most of whom need every dollar of their monthly checks. With the Social Security trust fund facing insolvency in 2035 (if Congress doesn’t act to prevent it), cutting the program’s funding stream, even temporarily, could hasten the insolvency date.

Payroll tax cuts risk undermining the program’s fundamental design. When the Obama administration and Congress enacted a 2% payroll tax holiday during the Great Recession, Social Security funds were replenished using general funds. However, Social Security was designed to be self-funded by workers’ payroll contributions. That model has been successful for almost 85 years. Backfilling Social Security funds from other sources betrays the stability of the program’s worker-funded structure.

When Social Security ceases to become fully self-funded, it opens the door for “entitlement reformers” who seek to cut the program to reduce the deficit (even though Social Security does not contribute to federal debt). Using general funds to replace lost Social Security revenue is the “camel’s nose under the tent” toward cutting benefits. Most “entitlement reformers” insist that reducing future benefits is the only solution to Social Security’s fiscal challenges – while condemning proposals to bring needed revenue into the system. At the end of the Obama payroll tax holiday, fiscal hawks accused Democrats of “raising taxes” simply for restoring FICA contributions to their previous levels.

The news media unwittingly enable the “reformers” by omitting the broader implications for Social Security’s future in their coverage of a payroll tax cut. This is a disservice to the public, because workers and retirees need to be fully informed about the implications of any changes to the Social Security system. Responsible media coverage of a major change like reducing payroll taxes should include the impact on Social Security itself – and the 63 million retirees, disabled and their families who currently depend on it.

Stimulate the Economy, But Don’t Cut Payroll Tax

President Trump’s proposal to cut Social Security payroll taxes is a misguided attempt to stimulate the economy that will hurt the workers it is intended to help. The National Committee opposes interfering with the revenue stream that funds Americans’ retirement benefits. Social Security funds should not be used for an unrelated, short-term purpose — especially when common sense alternatives to boost the economy are available.

“First, President Trump promised never to cut Social Security. This proposal jeopardizes the strength of the program. Cutting the payroll tax is not an economic gift no matter how you wrap it. A payroll tax reduction would provide scant relief to working people while destabilizing the finances of Social Security. There are better ways to cushion the economic impact of the coronavirus than robbing Social Security of much-needed revenue.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare.

Contrary to the president’s claims, reducing the payroll tax would not put a significant amount of money in working people’s pockets. As Jason Furman pointed out in the Wall Street Journal, the payroll tax reduction would be “too slow and dispersed to substantially stimulate the economy” — and would favor higher earners. Furman calculates that a high-income couple might receive as much a $5,000 in relief from a one-year payroll tax reduction of 2%, while a single parent earning $25,000 per year only would reap an additional $500.

Skeptics in Congress are rightly wary of the president’s proposed payroll tax cut. They correctly observe that it would not help workers who lose their jobs during the epidemic, or who do not pay into Social Security, or retired seniors from whom the President proposes to take the funds. Many Congressional leaders speak of the need to target stimulus policy so that money gets into working people’s hands, instead of showering tax breaks on higher-wage earners and employers.

Meanwhile, Social Security provides more than $1.6 trillion in stimulus every year, as retirees spend their benefit checks in local and state economies. If the president wants to stimulate the economy, he should support legislation in Congress to boost Social Security benefits, especially Rep. John Larson’s Social Security 2100 Act. This bill would permanently increase the ongoing stimulus that Social Security provides by putting more money in the wallets of 63 million retirees, disabled and survivors.

“Payroll taxes are fundamental to the financial soundness of Social Security, and should not be leveraged for unrelated purposes. The Social Security trust fund will become exhausted by 2035 if Congress does not take pro-active steps to fortify the system. The system needs more – not less – revenue to meet the financial needs of future retirees, who will depend on their Social Security benefits even more than today’s seniors do.” – Max Richtman

There are other remedies for the current economic crisis, including federally guaranteed paid sick leave, infrastructure spending, and even granting adult citizens and taxpaying residents a $1,000 federal payout, an idea proposed by Jason Furman. While considering these measures, Congress must reject the president’s proposed payroll tax cut. Americans deserve better solutions that don’t put their Social Security program at risk.

Trump lets it slip again: He wants to cut ‘entitlements’

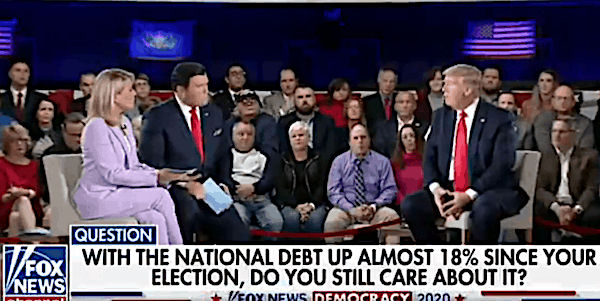

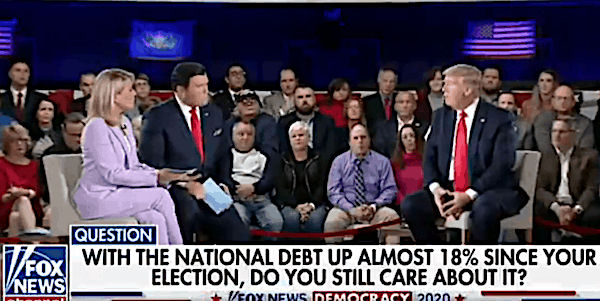

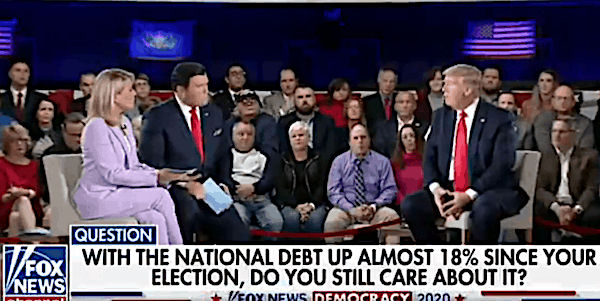

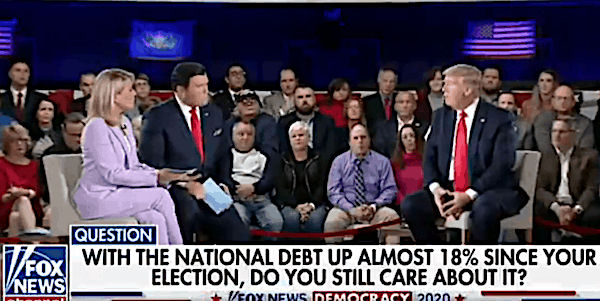

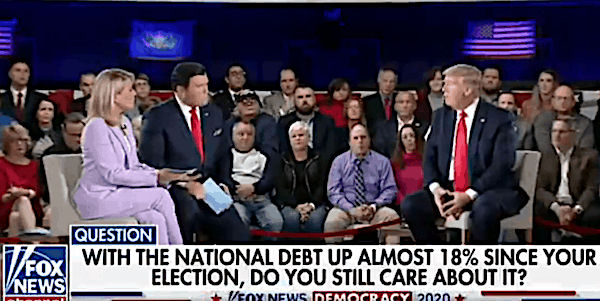

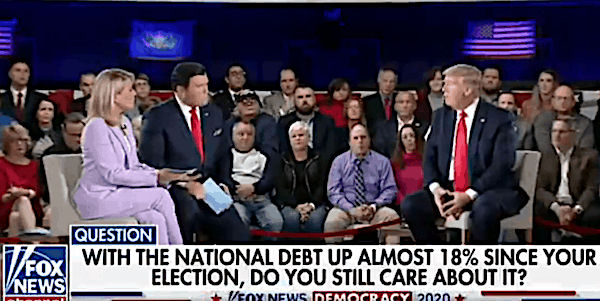

When it comes to Social Security and Medicare, President Trump can’t help saying the quiet part out loud: he would like to cut both programs, despite his campaign promises to protect them. During a town hall on Fox News last night, moderator Martha MacCallum asked the president whether he would cut ‘entitlements’ to reduce the soaring debt. Trump replied, “We’ll be cutting, but we’re also going to have (economic) growth like we’ve never seen before.”

This is Trump’s second admission in less than two months of his true intentions regarding seniors’ earned benefits. In January, responding to a CNBC interviewer, the president said that he would “look at” cutting Medicare and Social Security because it’s “actually the easiest of all things, because it’s such a big percentage (of the debt).”

Through these statements, Trump indicates that he has bought into the fiscal conservatives’ fallacy that ‘entitlements’ are the biggest drivers of the debt and therefore must be cut to reduce it. In fact, ‘tax expenditures’ – revenue that the federal government forgoes through tax breaks (especially the Trump/GOP cuts of 2017) – are the number one contributors to the debt.

Social Security and Medicare Part A are fully self-financed through workers’ payroll contributions and do not add to the national debt. Medicare Parts B and D are financed, in part, by premiums. There are fairer ways to reduce the debt (including repealing those reckless 2017 tax cuts for the wealthy and big corporations) than cutting benefits for seniors living on fixed incomes. Tomorrow’s seniors will rely even more on their earned benefits to make ends meet.

Earlier this week, the president floated the idea of a temporary Social Security payroll tax cut in order to stimulate the economy amidst the coronavirus epidemic. A payroll tax cut, while providing a few extra dollars for workers in the short-term, would rob Social Security of much-needed revenue for the future. As NCPSSM president Max Richtman wrote this week in The Hill:

“If the president wants to use Social Security to stimulate the economy, why not boost benefits — instead of cutting payroll contributions? Social Security already provides more than $1.6 trillion in economic stimulus every year — as beneficiaries spend their benefit checks in their communities. Increasing benefits would provide even greater economic stimulus.” – National committee president Max Richtman, The Hill newspaper, 3/5/20

President Trump could honor his promises (most recently, in the State of the Union address) to protect Social Security and Medicare by supporting legislation like Rep. John Larson’s Social Security 2100 Act and the Lower Drug Costs Now Act (H.R. 3). But, of course, Trump does not support either measure – and neither do his GOP allies in Congress – because the bills challenge conservative orthodoxy that demands earned benefits be cut instead of boosted, even though both pieces of legislation can be paid for without burdening current and future seniors.

It’s ironic that a president who vowed to preserve Social Security, Medicare, and Medicaid has offered budgets that cut all three by more than a trillion dollars over ten years – most recently in his proposed 2021 spending plan:

“This budget would drastically cut programs that benefit America’s oldest — including many vulnerable — citizens. The president’s spending plan calls for deep reductions to Social Security Disability Insurance, breaking his promise not to touch Social Security. It also includes cuts in Medicare, another program he promised not to touch. By gutting Medicaid, the president’s budget jeopardizes access to the long-term care covered by the program — violating another Trump campaign pledge.” – National Committee ‘Viewpoint,’ 2/12/20

This election year, the president has postured as the savior of Social Security and Medicare – claiming Democrats seek to “destroy” both programs. This ‘opposite world’ narrative quickly dissipates by listening to the president’s own pronouncements. The words “cut entitlements’ come up an awful lot in his remarks, reinforced by his actual budget proposals. The words “expand and strengthen” workers’ earned benefits do not.

Sign our petition to Boost Social Security Now!

Trump Admin. Assault on SSDI Continues

A scant three months after introducing a rule to make Social Security disability benefit reviews more onerous, the Trump administration is at it again. On February 24, the Social Security Administration finalized another new rule that will make it harder for disabled workers to qualify for benefits. When the rule goes into effect at the end of April, the inability to speak English will no longer be a criterion for receiving benefits.

Up until now, the inability to speak English was one of various medical-vocational “grid factors” used to evaluate a claimant’s eligibility for Social Security Disability Insurance (SSDI). The rationale was: claimants who can’t speak English may have a harder time finding work that accommodates their disabilities, and therefore need SSDI benefits to survive. Disabled non-English speakers were not automatically awarded benefits based on their language abilities alone; it was simply a factor in evaluating claims.

“Claimants who are unable to communicate in English have fewer vocational opportunities than claimants with the same level of education who can communicate in English. Understanding and carrying out even simple instructions is harder or impossible when the instructions are conveyed in a language one does not speak.” – Consortium for Citizens with Disabilities, 4/2/19

With the stroke of a pen, the Trump administration has erased that criterion, claiming it will save SSDI millions of dollars – with a potentially steep human cost. The rule could deprive up to 10,000 workers of disability benefits every year, estimates Rep. John Larson (D-CT), chair of the House Ways & Means subcommittee on Social Security.

“For years, Social Security’s rules recognized that for an older worker applying for disability benefits with severe health conditions, and with no or little transferable job skills, the inability to communicate in English poses an additional barrier to work.” – Rep. John Larson

The National Committee has joined the Consortium for Citizens with Disabilities (CCD) in condemning the new rule. As CCD wrote in a letter to the Social Security Administration:

“There is no justification for this proposed rule… SSA’s plan to implement these changes is flawed, will harm people with disabilities, and will lead to inefficiency in disability claims adjudication.” – Consortium for Citizens with Disabilities

Last fall, the Trump administration sought to make it harder for disabled workers to keep their SSDI benefits by adding a new layer of periodic disability reviews. As we pointed out in this space, disabled workers – many of whom live alone and do not have advocates to help them – will be required to collect medical records and other documentation every two years to prove that they are still disabled. This imposes a needless burden on some of society’s most vulnerable citizens.

The pattern is clear: the Trump administration is on a mission to discourage and punish disability claimants by taking advantage of a common misperception that disabled workers are somehow gaming the system. In fact, only 40% of disabled workers are approved for SSDI benefits. These beneficiaries have disabilities so serious that one in five men and one in six women die within five years of being approved for benefits. Here are just a few of the disabilities that can make a worker eligible for SSDI, none of them minor:

Cardiovascular disease

Respiratory diseases

Musculoskeletal disorders

Cancer

Severe Depression

This is not a population that should have to hurdle extra barriers, erected by an administration that pushed for trillions of dollars in tax cuts for the wealthy and big corporations — but shows no compassion for people it deems to be members of the ‘undeserving poor.’

Sign our petition to Boost Social Security Now!

Veterans Rely on Social Security and Medicare, Too

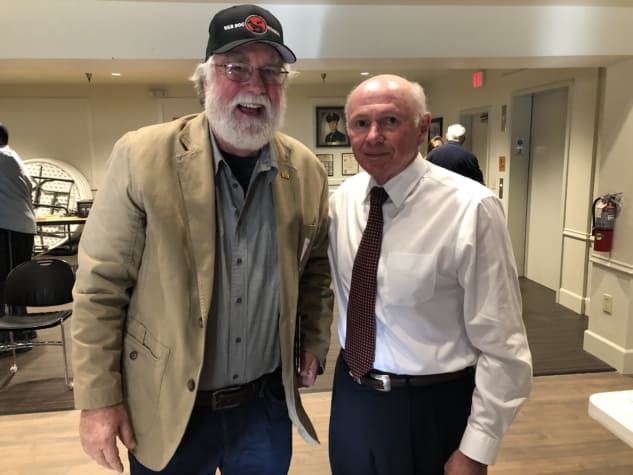

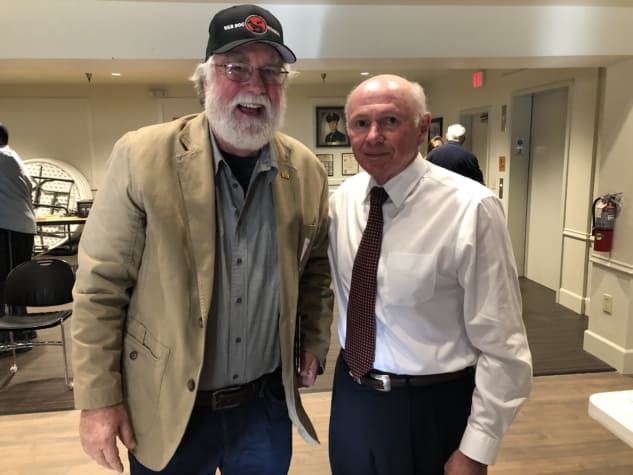

National Committee president Max Richtman speaks at veterans town hall in Vacaville, CA

National Committee president Max Richtman joined a true champion for seniors in Congress, Rep. John Garamendi (D-CA), for a town hall with local veterans in Vacaville, California on Monday. Though veterans do receive various benefits from the military and the V.A., most still are dependent on Medicare and Social Security for a healthy and secure retirement.

Richtman and Rep. Garamendi made the case that seniors’ earned benefits can be both expanded and strengthened, despite rhetoric from fiscal hawks who seek to cut what they call “entitlements.”

He told the audience that the National Committee has been fighting for legislation in Congress, co-sponsored by Rep. Garamendi, to boost Social Security. The Social Security 2100 Act includes an across-the-board benefit increase, a hike in the special minimum benefit, and a more accurate cost-of-living adjustment (COLA) formula that would put more income in seniors’ pockets — the Consumer Price Index for the Elderly (CPI-E). The expansion of benefits would be paid for, in large part, by adjusting the payroll wage tax cap so that the wealthy pay their fair share. Last week, millionaires stopped paying into Social Security for the rest of the calendar year.

“Right now, if you make more than $137,700 a year, you don’t pay any payroll tax beyond that. The legislation that the congressman supports would begin collecting payroll tax again at $400,000. That brings the program into financial balance until the end of the century, and allows benefits to be improved.” – National Committee president Max Richtman, 2/24/20

The National Committee also endorses a bill introduced by Rep. Garamendi to apply the CPI-E to veterans’ benefits (including military retirement) so that their COLAs would be larger.

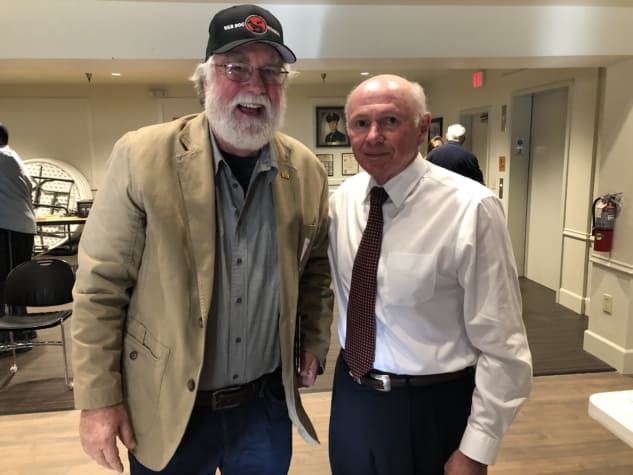

A veteran asks a question at town hall with Rep. John Garamendi (Right)

The town hall also touched on the pressing issue of prescription drug costs. Like other Americans, older veterans who do not receive medications through the V.A. health system are suffering from soaring prescription drug prices. Richtman said that the National Committee enthusiastically endorses a House-passed bill, The Lower Drug Costs Now Act (H.R. 3), which would finally allow Medicare to negotiate prescription drug prices directly with pharmaceutical companies. He pointed out that the Department of Veterans Affairs has been negotiating drug prices for more than two decades.

“The V.A.’s bulk volume prescription drug purchasing infrastructure could be the key to a sorely needed bipartisan pathway toward affordable prescription drugs for those in need.” – The Hill, 2/26/20

An analysis published by the Journal of the American Medical Association found that Medicare Part D could save 38-50% on prescription drugs if it negotiated prices as the V.A. does. Most of those savings would be passed on directly to patients.

Richtman spent some of the town hall dispelling myths about Social Security, including the falsehood that government is “stealing” from the program. (One audience member insisted that Social Security was being used to “pay for impeachment.”) “No one is ‘stealing’ from Social Security,” Richtman says. “Surplus revenue is invested in government bonds that earn interest and put more money back into the program. If you had a few trillion dollars, would you stick it under your mattress — or invest it someplace safe and earn interest? The same goes for Social Security.”

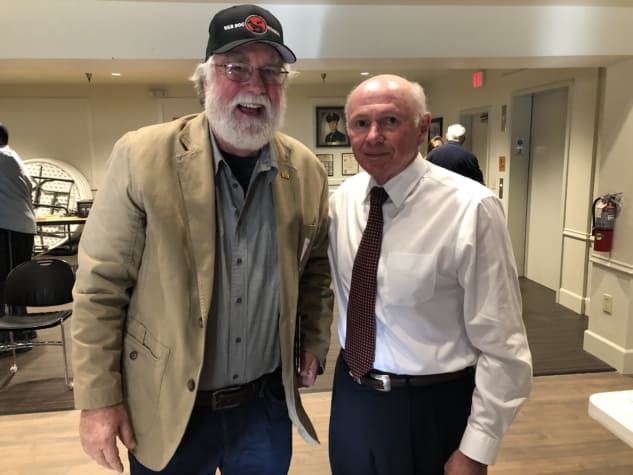

Town hall attendee/veteran (L) with NCPSSM president Max Richtman (R)

Richtman appeared at a previous town hall with Rep. Jared Huffman (D-CA) – another stalwart for senior citizens – on February 21st in Mill Valley, California, part of an effort to educate and inform voters about issues affecting older Americans in advance of the 2020 election.

Where is Social Security in Coverage of Trump Payroll Tax Cut Proposal?

The mainstream media have given ample coverage to President Trump’s proposal to cut payroll taxes, but many news outlets have ignored the potential impact on Social Security. In fact, some of the coverage does not even mention Social Security – an odd omission considering that FICA payroll taxes fully fund the income security program! Cutting payroll taxes deprives Social Security of much-needed revenue. But consumers of mainstream news could be forgiven for not knowing that.

In fairness, major news sources — from Newsweek to the New York Times, from the Washington Post to the Associated Press, and from NBC to CNN — are by no means soft-pedaling the president’s proposal. They have chronicled objections from Democrats, Republicans, and economists that a payroll tax cut makes little macroeconomic sense. High earners would receive significantly more payroll tax relief than lower income workers. A payroll tax cut doesn’t help the unemployed. It would do nothing for contract workers in the gig economy.

“Trump’s coronavirus payroll tax cut has ‘important drawbacks’ and is ‘really inferior’ to other ideas, economists say.” – Newsweek

“Democrats… emerged to throw cold water on Mr. Trump’s payroll tax cut, saying it was not ‘what we need right now.’” – New York Times

“Senate Majority Leader Mitch McConnell views the idea with skepticism, privately making clear… that he ‘detests’ pursuing this particular policy, which probably would add to federal debt and deficits.” – Washington Post

No doubt this is valid reporting. But many media outlets failed to include the implications for Social Security itself, leaving it to progressive journalists and seniors’ advocates to warn the public. The National Committee has just sent a letter to Senators and House members warning about the perils of a payroll tax cut.

“It seems as though bad ideas never die in Washington. We do not believe that making cuts to or eliminating the Social Security payroll tax is an appropriate way to [provide financial relief to Americans during this crisis]. Any reductions to this vitally important revenue stream would threaten Social Security’s ability to continue paying benefits to the 63 million Americans who depend on [it].” – NCPSSM letter to the House and Senate

As we have argued in this space and in published opinion pieces, Social Security funds should not be used for unrelated purposes. Depriving Social Security of revenue could threaten retirees’ benefits, most of whom need every dollar of their monthly checks. With the Social Security trust fund facing insolvency in 2035 (if Congress doesn’t act to prevent it), cutting the program’s funding stream, even temporarily, could hasten the insolvency date.

Payroll tax cuts risk undermining the program’s fundamental design. When the Obama administration and Congress enacted a 2% payroll tax holiday during the Great Recession, Social Security funds were replenished using general funds. However, Social Security was designed to be self-funded by workers’ payroll contributions. That model has been successful for almost 85 years. Backfilling Social Security funds from other sources betrays the stability of the program’s worker-funded structure.

When Social Security ceases to become fully self-funded, it opens the door for “entitlement reformers” who seek to cut the program to reduce the deficit (even though Social Security does not contribute to federal debt). Using general funds to replace lost Social Security revenue is the “camel’s nose under the tent” toward cutting benefits. Most “entitlement reformers” insist that reducing future benefits is the only solution to Social Security’s fiscal challenges – while condemning proposals to bring needed revenue into the system. At the end of the Obama payroll tax holiday, fiscal hawks accused Democrats of “raising taxes” simply for restoring FICA contributions to their previous levels.

The news media unwittingly enable the “reformers” by omitting the broader implications for Social Security’s future in their coverage of a payroll tax cut. This is a disservice to the public, because workers and retirees need to be fully informed about the implications of any changes to the Social Security system. Responsible media coverage of a major change like reducing payroll taxes should include the impact on Social Security itself – and the 63 million retirees, disabled and their families who currently depend on it.

Stimulate the Economy, But Don’t Cut Payroll Tax

President Trump’s proposal to cut Social Security payroll taxes is a misguided attempt to stimulate the economy that will hurt the workers it is intended to help. The National Committee opposes interfering with the revenue stream that funds Americans’ retirement benefits. Social Security funds should not be used for an unrelated, short-term purpose — especially when common sense alternatives to boost the economy are available.

“First, President Trump promised never to cut Social Security. This proposal jeopardizes the strength of the program. Cutting the payroll tax is not an economic gift no matter how you wrap it. A payroll tax reduction would provide scant relief to working people while destabilizing the finances of Social Security. There are better ways to cushion the economic impact of the coronavirus than robbing Social Security of much-needed revenue.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare.

Contrary to the president’s claims, reducing the payroll tax would not put a significant amount of money in working people’s pockets. As Jason Furman pointed out in the Wall Street Journal, the payroll tax reduction would be “too slow and dispersed to substantially stimulate the economy” — and would favor higher earners. Furman calculates that a high-income couple might receive as much a $5,000 in relief from a one-year payroll tax reduction of 2%, while a single parent earning $25,000 per year only would reap an additional $500.

Skeptics in Congress are rightly wary of the president’s proposed payroll tax cut. They correctly observe that it would not help workers who lose their jobs during the epidemic, or who do not pay into Social Security, or retired seniors from whom the President proposes to take the funds. Many Congressional leaders speak of the need to target stimulus policy so that money gets into working people’s hands, instead of showering tax breaks on higher-wage earners and employers.

Meanwhile, Social Security provides more than $1.6 trillion in stimulus every year, as retirees spend their benefit checks in local and state economies. If the president wants to stimulate the economy, he should support legislation in Congress to boost Social Security benefits, especially Rep. John Larson’s Social Security 2100 Act. This bill would permanently increase the ongoing stimulus that Social Security provides by putting more money in the wallets of 63 million retirees, disabled and survivors.

“Payroll taxes are fundamental to the financial soundness of Social Security, and should not be leveraged for unrelated purposes. The Social Security trust fund will become exhausted by 2035 if Congress does not take pro-active steps to fortify the system. The system needs more – not less – revenue to meet the financial needs of future retirees, who will depend on their Social Security benefits even more than today’s seniors do.” – Max Richtman

There are other remedies for the current economic crisis, including federally guaranteed paid sick leave, infrastructure spending, and even granting adult citizens and taxpaying residents a $1,000 federal payout, an idea proposed by Jason Furman. While considering these measures, Congress must reject the president’s proposed payroll tax cut. Americans deserve better solutions that don’t put their Social Security program at risk.

Trump lets it slip again: He wants to cut ‘entitlements’

When it comes to Social Security and Medicare, President Trump can’t help saying the quiet part out loud: he would like to cut both programs, despite his campaign promises to protect them. During a town hall on Fox News last night, moderator Martha MacCallum asked the president whether he would cut ‘entitlements’ to reduce the soaring debt. Trump replied, “We’ll be cutting, but we’re also going to have (economic) growth like we’ve never seen before.”

This is Trump’s second admission in less than two months of his true intentions regarding seniors’ earned benefits. In January, responding to a CNBC interviewer, the president said that he would “look at” cutting Medicare and Social Security because it’s “actually the easiest of all things, because it’s such a big percentage (of the debt).”

Through these statements, Trump indicates that he has bought into the fiscal conservatives’ fallacy that ‘entitlements’ are the biggest drivers of the debt and therefore must be cut to reduce it. In fact, ‘tax expenditures’ – revenue that the federal government forgoes through tax breaks (especially the Trump/GOP cuts of 2017) – are the number one contributors to the debt.

Social Security and Medicare Part A are fully self-financed through workers’ payroll contributions and do not add to the national debt. Medicare Parts B and D are financed, in part, by premiums. There are fairer ways to reduce the debt (including repealing those reckless 2017 tax cuts for the wealthy and big corporations) than cutting benefits for seniors living on fixed incomes. Tomorrow’s seniors will rely even more on their earned benefits to make ends meet.

Earlier this week, the president floated the idea of a temporary Social Security payroll tax cut in order to stimulate the economy amidst the coronavirus epidemic. A payroll tax cut, while providing a few extra dollars for workers in the short-term, would rob Social Security of much-needed revenue for the future. As NCPSSM president Max Richtman wrote this week in The Hill:

“If the president wants to use Social Security to stimulate the economy, why not boost benefits — instead of cutting payroll contributions? Social Security already provides more than $1.6 trillion in economic stimulus every year — as beneficiaries spend their benefit checks in their communities. Increasing benefits would provide even greater economic stimulus.” – National committee president Max Richtman, The Hill newspaper, 3/5/20

President Trump could honor his promises (most recently, in the State of the Union address) to protect Social Security and Medicare by supporting legislation like Rep. John Larson’s Social Security 2100 Act and the Lower Drug Costs Now Act (H.R. 3). But, of course, Trump does not support either measure – and neither do his GOP allies in Congress – because the bills challenge conservative orthodoxy that demands earned benefits be cut instead of boosted, even though both pieces of legislation can be paid for without burdening current and future seniors.

It’s ironic that a president who vowed to preserve Social Security, Medicare, and Medicaid has offered budgets that cut all three by more than a trillion dollars over ten years – most recently in his proposed 2021 spending plan:

“This budget would drastically cut programs that benefit America’s oldest — including many vulnerable — citizens. The president’s spending plan calls for deep reductions to Social Security Disability Insurance, breaking his promise not to touch Social Security. It also includes cuts in Medicare, another program he promised not to touch. By gutting Medicaid, the president’s budget jeopardizes access to the long-term care covered by the program — violating another Trump campaign pledge.” – National Committee ‘Viewpoint,’ 2/12/20

This election year, the president has postured as the savior of Social Security and Medicare – claiming Democrats seek to “destroy” both programs. This ‘opposite world’ narrative quickly dissipates by listening to the president’s own pronouncements. The words “cut entitlements’ come up an awful lot in his remarks, reinforced by his actual budget proposals. The words “expand and strengthen” workers’ earned benefits do not.

Sign our petition to Boost Social Security Now!

Trump Admin. Assault on SSDI Continues

A scant three months after introducing a rule to make Social Security disability benefit reviews more onerous, the Trump administration is at it again. On February 24, the Social Security Administration finalized another new rule that will make it harder for disabled workers to qualify for benefits. When the rule goes into effect at the end of April, the inability to speak English will no longer be a criterion for receiving benefits.

Up until now, the inability to speak English was one of various medical-vocational “grid factors” used to evaluate a claimant’s eligibility for Social Security Disability Insurance (SSDI). The rationale was: claimants who can’t speak English may have a harder time finding work that accommodates their disabilities, and therefore need SSDI benefits to survive. Disabled non-English speakers were not automatically awarded benefits based on their language abilities alone; it was simply a factor in evaluating claims.

“Claimants who are unable to communicate in English have fewer vocational opportunities than claimants with the same level of education who can communicate in English. Understanding and carrying out even simple instructions is harder or impossible when the instructions are conveyed in a language one does not speak.” – Consortium for Citizens with Disabilities, 4/2/19

With the stroke of a pen, the Trump administration has erased that criterion, claiming it will save SSDI millions of dollars – with a potentially steep human cost. The rule could deprive up to 10,000 workers of disability benefits every year, estimates Rep. John Larson (D-CT), chair of the House Ways & Means subcommittee on Social Security.

“For years, Social Security’s rules recognized that for an older worker applying for disability benefits with severe health conditions, and with no or little transferable job skills, the inability to communicate in English poses an additional barrier to work.” – Rep. John Larson

The National Committee has joined the Consortium for Citizens with Disabilities (CCD) in condemning the new rule. As CCD wrote in a letter to the Social Security Administration:

“There is no justification for this proposed rule… SSA’s plan to implement these changes is flawed, will harm people with disabilities, and will lead to inefficiency in disability claims adjudication.” – Consortium for Citizens with Disabilities

Last fall, the Trump administration sought to make it harder for disabled workers to keep their SSDI benefits by adding a new layer of periodic disability reviews. As we pointed out in this space, disabled workers – many of whom live alone and do not have advocates to help them – will be required to collect medical records and other documentation every two years to prove that they are still disabled. This imposes a needless burden on some of society’s most vulnerable citizens.

The pattern is clear: the Trump administration is on a mission to discourage and punish disability claimants by taking advantage of a common misperception that disabled workers are somehow gaming the system. In fact, only 40% of disabled workers are approved for SSDI benefits. These beneficiaries have disabilities so serious that one in five men and one in six women die within five years of being approved for benefits. Here are just a few of the disabilities that can make a worker eligible for SSDI, none of them minor:

Cardiovascular disease

Respiratory diseases

Musculoskeletal disorders

Cancer

Severe Depression

This is not a population that should have to hurdle extra barriers, erected by an administration that pushed for trillions of dollars in tax cuts for the wealthy and big corporations — but shows no compassion for people it deems to be members of the ‘undeserving poor.’

Sign our petition to Boost Social Security Now!

Veterans Rely on Social Security and Medicare, Too

National Committee president Max Richtman speaks at veterans town hall in Vacaville, CA

National Committee president Max Richtman joined a true champion for seniors in Congress, Rep. John Garamendi (D-CA), for a town hall with local veterans in Vacaville, California on Monday. Though veterans do receive various benefits from the military and the V.A., most still are dependent on Medicare and Social Security for a healthy and secure retirement.

Richtman and Rep. Garamendi made the case that seniors’ earned benefits can be both expanded and strengthened, despite rhetoric from fiscal hawks who seek to cut what they call “entitlements.”

He told the audience that the National Committee has been fighting for legislation in Congress, co-sponsored by Rep. Garamendi, to boost Social Security. The Social Security 2100 Act includes an across-the-board benefit increase, a hike in the special minimum benefit, and a more accurate cost-of-living adjustment (COLA) formula that would put more income in seniors’ pockets — the Consumer Price Index for the Elderly (CPI-E). The expansion of benefits would be paid for, in large part, by adjusting the payroll wage tax cap so that the wealthy pay their fair share. Last week, millionaires stopped paying into Social Security for the rest of the calendar year.

“Right now, if you make more than $137,700 a year, you don’t pay any payroll tax beyond that. The legislation that the congressman supports would begin collecting payroll tax again at $400,000. That brings the program into financial balance until the end of the century, and allows benefits to be improved.” – National Committee president Max Richtman, 2/24/20

The National Committee also endorses a bill introduced by Rep. Garamendi to apply the CPI-E to veterans’ benefits (including military retirement) so that their COLAs would be larger.

A veteran asks a question at town hall with Rep. John Garamendi (Right)

The town hall also touched on the pressing issue of prescription drug costs. Like other Americans, older veterans who do not receive medications through the V.A. health system are suffering from soaring prescription drug prices. Richtman said that the National Committee enthusiastically endorses a House-passed bill, The Lower Drug Costs Now Act (H.R. 3), which would finally allow Medicare to negotiate prescription drug prices directly with pharmaceutical companies. He pointed out that the Department of Veterans Affairs has been negotiating drug prices for more than two decades.

“The V.A.’s bulk volume prescription drug purchasing infrastructure could be the key to a sorely needed bipartisan pathway toward affordable prescription drugs for those in need.” – The Hill, 2/26/20

An analysis published by the Journal of the American Medical Association found that Medicare Part D could save 38-50% on prescription drugs if it negotiated prices as the V.A. does. Most of those savings would be passed on directly to patients.

Richtman spent some of the town hall dispelling myths about Social Security, including the falsehood that government is “stealing” from the program. (One audience member insisted that Social Security was being used to “pay for impeachment.”) “No one is ‘stealing’ from Social Security,” Richtman says. “Surplus revenue is invested in government bonds that earn interest and put more money back into the program. If you had a few trillion dollars, would you stick it under your mattress — or invest it someplace safe and earn interest? The same goes for Social Security.”

Town hall attendee/veteran (L) with NCPSSM president Max Richtman (R)

Richtman appeared at a previous town hall with Rep. Jared Huffman (D-CA) – another stalwart for senior citizens – on February 21st in Mill Valley, California, part of an effort to educate and inform voters about issues affecting older Americans in advance of the 2020 election.