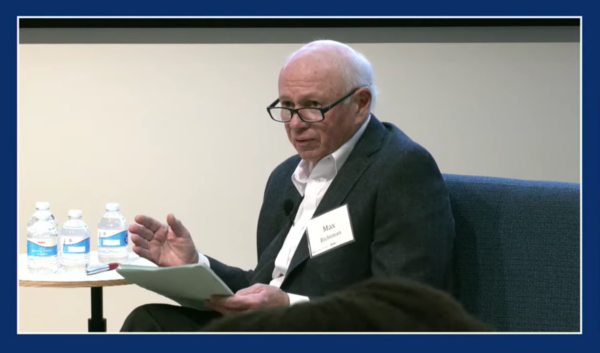

Some of the nation’s leading Social Security experts gathered in Des Moines, IA on Wednesday to discuss the future of a program buffeted by serious financial and political challenges. The forum, Roadmaps to Retirement, was presented by the Harkin Institute at Drake University and moderated by former U.S. Senator Tom Harkin (who also chairs the National Committee to Preserve Social Security and Medicare Advisory Board). NCPSSM President and CEO Max Richtman was among the experts on the panel, which also included Acting SSA Commissioner Kilolo Kijakazi and Assistant U.S. Labor Secretary Taryn Williams, among others.

During the forum, Senator Harkin asked Richtman to debunk several harmful myths which have undermined public perceptions of Social Security over the years – with many of these falsehoods perpetuated by conservative ideologues who have opposed the program from the beginning. Richtman told the audience that one of the most pernicious myths is that Social Security is “bankrupt” or “going broke”:

“While it’s true that the Social Security trust fund will become depleted in 2035 if Congress takes no preventative action, the program is not going bankrupt. Payroll taxes from workers will continue to cover 80% of benefits even if the trust fund is allowed to run dry. The only way Social Security could go “bankrupt” is if we had 100% unemployment and no one was working or paying into the program, which is unlikely to ever happen.” – Max Richtman, 12/7/22

Richtman also debunked the myth that the Social Security trust fund isn’t real — or that it consists of “worthless IOUs.” He explained that the $2.852 trillion in the trust fund is held in special interest-bearing Treasury bonds backed by “the full faith and credit of the United States of America.” He also pushed back on the notion that the government has been “stealing from Social Security” to pay for other expenses, a widespread belief which is patently untrue.

“Unfortunately, some of these myths have taken hold in the public’s mind. Many younger adults have bought into them and are cynical about the future of Social Security. Some young people believe that they are more likely to see Bigfoot or a U.F.O. than a Social Security check when they retire.” – Max Richtman, 12/7/22

Senator Harkin pointed out that, contrary to many younger adults’ perceptions, Social Security not only will be there for them when they retire, but the program provides insurance against disability and the loss of a family breadwinner to millions of young adults right now. In fact, workers have life insurance protection from Social Security worth over $725,000. Meanwhile, for a young disabled worker with a spouse and two children, the disability coverage they get through Social Security Disability Insurance (SSDI) is valued at over $580,000.

NCPSSM President Max Richtman: “The only way Social Security could go “bankrupt” is if we had 100% unemployment.”

Richtman and Senator Harkin agreed that more outreach to younger adults about Social Security is needed in order to maintain support for the program moving forward. “Hopefully there will be more education for young people as to how it works,” said Harkin. But the genesis of the forum was the Harkin Institute’s concern about financial security for current as well as future retirees. Experts have noted that the ‘three-legged stool’ of retirement security (retirement savings, employer provided pensions, and Social Security) is no longer strong enough for many workers to retire securely — mainly because it’s harder for working people to save for retirement and employers have largely stopped offering pensions.

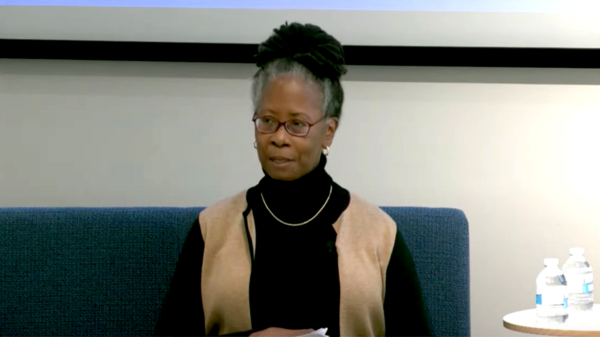

This new reality, says Harkin, makes it even more important to preserve and strengthen Social Security, noting that 40% of Americans aged 65 and over rely on the program for at least half of their total income. Social Security Acting Commissioner Kijakazi pointed out that even higher percentages of women and communities of color depend on Social Security as their main income source. “Social Security was supposed to be a ‘floor’ for retirement income. But it was never intended to be the sole source of retirement income,” says Kijakazi.

Acting Social Security Commissioner Kilolo Kijakazi

Harkin and Richtman called on Congress to strengthen the program and expand benefits to reflect the realities of retiring in America in the 20th century. They both favor adjusting the payroll wage cap (which will be about $160,000 in 2023) so that high earners begin paying their fair share into the system. This measure, which is included in Rep. John Larson’s Social Security 2100 act, would boost the solvency of the trust fund beyond the 2035 depletion date. These proposals are overwhelmingly popular among the public. Senator Harkin cited a survey by the National Academy of Social Insurance (NASI), indicating that 83% of Americans agree it is critical to preserve Social Security benefits for future generations, even if it means increasing taxes paid by wealthier earners.

Acting Commissioner Kijakazi called on lawmakers to shore up Social Security sooner than later. “Congress does need to act to ensure we will be able to pay all benefits beyond 2035,” she said. “And we believe congress will act to take the steps needed to maintain the long-term solvency of the program.”