USA Today has a must read analysis of the failure of 401K’s to provide retirement security. For baby boomers, promised that their 401K’s terrific returns would replace pensions which largely disappeared during their working lifetimes, the economic reality has been a disaster.

According to the Center for Retirement Research at Boston College, the median household retirement account balance in 2010 for workers between the ages of 55-64 was just $120,000. For people expecting to retire at around age 65, and to live for another 15 years or more, this will provide for only a trivial supplement to Social Security benefits.

And that’s for people who actually have a retirement account of some kind. A third of households do not. For these people, their sole retirement income, aside from potential aid from friends and family, comes from Social Security, for which the current average monthly benefit is $1,230.

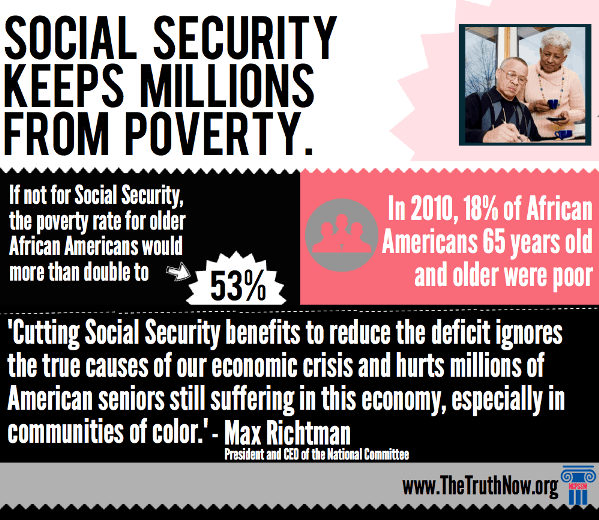

Which segues to those who don’t have any type of retirement account. Boston College’s Financial Security Project has an interesting blog post today touching on all of the reasons Social Security has become especially important to African American retirees. In addition to their average reduced longevity and lower incomes, as we’ve reported here before, the loss of the traditional retirement “3-legged stool” hits communities of color especially hard:

Social Security is now more critical than ever to whether retirees can make it financially, because traditional pensions are becoming rare. African-Americans and Latinos who are 65 or older were less likely to work for an employer that offered its employees a traditional pension, according to SSA data.

African-Americans and Latinos are behind the retirement 8 ball in another way that’s related to their income and their greater difficulty generating wealth: only about one in four African-Americans and Latinos over 65 receives income from investments, while more than half of whites do.

The Center on Budget and Policy Priorities’ Social Security fact sheet also provides 10 important facts about the program.