Near retirees in Greater Baltimore are being beckoned by a billboard on wheels encouraging them to delay claiming Social Security. Baltimore is one of five U.S. cities where the National Committee has rolled out the “Delay and Gain” project, now in full swing. In addition to mobile billboards, the public education project is reaching out to older workers via radio ads, editorial content, and social media. The message is straightforward: workers who delay retirement can gain bigger Social Security benefits – extra income that they’ll need in old age.

One of the “Delay and Gain” mobile billboards visited Timonium, Maryland – just North of Baltimore – on Wednesday, eliciting supportive honks from motorists and curiosity from passersby. It’s one of the trucks spreading the message in cities like Baltimore, Pittsburgh, Detroit, and Louisville.

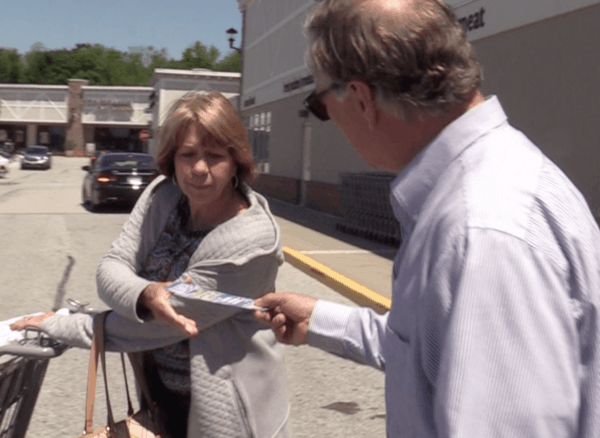

“Did you know that you can gain Social Security benefits by delaying retirement?” asked a National Committee volunteer passing out literature to shoppers and workers on lunch break in Timonium.

It’s a crucial message for today’s older workers. Nearly half of Americans surveyed did not know that they gain benefits by delaying claiming Social Security – or that they are penalized for claiming before the full retirement age of 66 (or 67 for those born after January 1, 1960). Even so, the average retirement age in Maryland is 64 — two years before Social Security’s full retirement age.

Workers’ monthly Social Security benefits are reduced by claiming at the earliest eligible age of 62 — and boosted up to 30% for waiting until the full retirement age of 66. Seniors who delay claiming until age 70 receive an even larger bump — up to 44% more than if they had filed for benefits early. For the average beneficiary, that can mean a difference of roughly $1,000 per month in extra income.

Maximizing Social Security benefits is important because the average monthly retirement benefit is about $1,460 or $17,500 annually. That’s only a few thousand dollars above the federal poverty line for individuals. Even with Social Security, some 8% of seniors under 70 live in poverty. (The poverty rate jumps to 12% for those over 85.) Older women are in greater peril than men, because they tend to live longer and have less retirement savings and lower Social Security benefits.

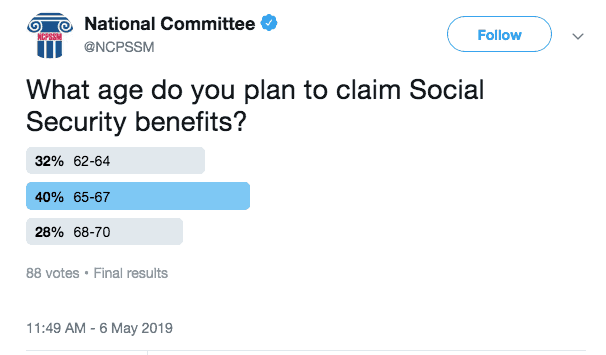

A recent Twitter poll by the National Committee tracks closely with previous data. A third of respondents say they plan to claim Social Security benefits between ages 62 and 64, despite the financial advantages of waiting.

Of course, older workers have their reasons for claiming early. Some cannot postpone retirement due to disability, age discrimination, or caring for family members. But others offer rationales that don’t make financial sense. Many near seniors say they’re sick and tired of working, not realizing they’ll be more sick and tired of not having enough money to pay the bills in old age. Others feel they must claim Social Security now, fearing it won’t be there for them in the future. And then there are those who try to calculate their “break even” point on lifetime benefits, thinking that they’ll receive a higher total payout over the years by claiming early.

The “Delay and Gain” project corrects these misguided notions by reminding workers that Social Security will be completely financially sound until 2035, and even then could still pay 80% of benefits – and only in the unlikely event that Congress takes no corrective action. To workers considering their “break even” points, the project reinforces that Social Security is income insurance, not an investment vehicle to be “gamed.” Workers should maximize their monthly benefits, which last their entire lives. People who reach age 65 today can expect to live nearly 20 more years – and will be happy to have the additional income in their elder years.

“We want seniors to be able to pursue a comfortable retirement, with the least amount of stress about paying the bills,” said Max Richtman, president and CEO of the National Committee. “This project will show older workers how to get there.”

***********************************************

Workers can use the Social Security Administration’s online calculator to determine benefit amounts at different ages.